Regulatory Compliance of Spray Pyrolysis in Coating Industries

SEP 25, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Spray Pyrolysis Technology Evolution and Objectives

Spray pyrolysis technology has evolved significantly since its inception in the 1960s as a simple method for producing thin films. Initially developed for academic research purposes, this technology has transformed into a sophisticated industrial process widely utilized in various coating applications. The evolution trajectory shows a clear shift from laboratory-scale experimentation to large-scale manufacturing implementation, particularly accelerating in the 1990s when commercial viability became evident.

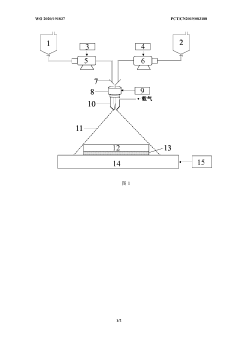

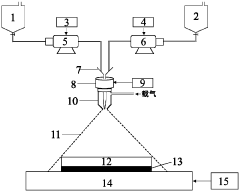

The fundamental principle of spray pyrolysis—converting a liquid precursor into solid-state coating through thermal decomposition—has remained consistent, while significant advancements have occurred in precursor chemistry, atomization techniques, and process control systems. Early systems relied on simple pneumatic atomizers with limited control capabilities, whereas modern configurations incorporate ultrasonic or electrostatic atomization with precise digital control systems that ensure coating uniformity and reproducibility.

A pivotal development in the technology's evolution was the introduction of computer-controlled spray parameters in the early 2000s, which dramatically improved coating quality consistency and reduced material waste. Subsequently, the integration of in-situ monitoring systems enabled real-time quality control, representing another significant milestone in the technology's maturation process.

The regulatory landscape surrounding spray pyrolysis has similarly evolved from minimal oversight to comprehensive frameworks addressing environmental impact, worker safety, and product quality standards. This regulatory evolution has directly influenced technical development, pushing innovation toward more environmentally sustainable processes with reduced volatile organic compound (VOC) emissions and improved energy efficiency.

The primary objectives of contemporary spray pyrolysis technology in coating industries center around four key areas: regulatory compliance, process efficiency, coating performance, and environmental sustainability. Regulatory compliance objectives specifically focus on developing systems and methodologies that inherently meet increasingly stringent global regulations regarding emissions control, workplace exposure limits, and hazardous material handling.

Additional technical objectives include enhancing precursor utilization efficiency to minimize waste generation, improving atomization consistency for superior coating uniformity, and developing closed-loop systems that capture and treat process emissions. The industry is also pursuing objectives related to energy optimization, seeking to reduce the thermal energy requirements of pyrolysis processes through catalytic assistance and alternative energy sources.

Looking forward, the technology roadmap aims to achieve fully automated, zero-emission spray pyrolysis systems that maintain perfect regulatory compliance while delivering superior coating performance. This vision guides current research and development efforts across the industry, with particular emphasis on smart control systems that can adapt to regulatory requirements across different jurisdictions.

The fundamental principle of spray pyrolysis—converting a liquid precursor into solid-state coating through thermal decomposition—has remained consistent, while significant advancements have occurred in precursor chemistry, atomization techniques, and process control systems. Early systems relied on simple pneumatic atomizers with limited control capabilities, whereas modern configurations incorporate ultrasonic or electrostatic atomization with precise digital control systems that ensure coating uniformity and reproducibility.

A pivotal development in the technology's evolution was the introduction of computer-controlled spray parameters in the early 2000s, which dramatically improved coating quality consistency and reduced material waste. Subsequently, the integration of in-situ monitoring systems enabled real-time quality control, representing another significant milestone in the technology's maturation process.

The regulatory landscape surrounding spray pyrolysis has similarly evolved from minimal oversight to comprehensive frameworks addressing environmental impact, worker safety, and product quality standards. This regulatory evolution has directly influenced technical development, pushing innovation toward more environmentally sustainable processes with reduced volatile organic compound (VOC) emissions and improved energy efficiency.

The primary objectives of contemporary spray pyrolysis technology in coating industries center around four key areas: regulatory compliance, process efficiency, coating performance, and environmental sustainability. Regulatory compliance objectives specifically focus on developing systems and methodologies that inherently meet increasingly stringent global regulations regarding emissions control, workplace exposure limits, and hazardous material handling.

Additional technical objectives include enhancing precursor utilization efficiency to minimize waste generation, improving atomization consistency for superior coating uniformity, and developing closed-loop systems that capture and treat process emissions. The industry is also pursuing objectives related to energy optimization, seeking to reduce the thermal energy requirements of pyrolysis processes through catalytic assistance and alternative energy sources.

Looking forward, the technology roadmap aims to achieve fully automated, zero-emission spray pyrolysis systems that maintain perfect regulatory compliance while delivering superior coating performance. This vision guides current research and development efforts across the industry, with particular emphasis on smart control systems that can adapt to regulatory requirements across different jurisdictions.

Market Analysis for Spray Pyrolysis Coating Applications

The spray pyrolysis coating market has experienced significant growth in recent years, driven by increasing demand across multiple industries including electronics, automotive, energy, and healthcare. The global market value for spray pyrolysis coatings reached approximately $2.3 billion in 2022, with projections indicating a compound annual growth rate of 6.8% through 2028. This growth trajectory is primarily fueled by the expanding applications in semiconductor manufacturing, solar cell production, and advanced optical coatings.

The electronics sector represents the largest market segment, accounting for roughly 35% of the total spray pyrolysis coating applications. This dominance stems from the technology's ability to create uniform, thin-film coatings essential for modern electronic components. The solar energy sector follows closely, comprising about 28% of the market share, where spray pyrolysis enables cost-effective production of transparent conductive oxide (TCO) layers critical for photovoltaic cells.

Regional analysis reveals Asia-Pacific as the leading market, controlling approximately 45% of global demand. This regional dominance is attributed to the high concentration of electronics manufacturing facilities in countries like China, South Korea, and Taiwan. North America and Europe collectively account for about 40% of the market, with particular strength in high-value applications such as medical devices and aerospace components.

Customer demand patterns indicate a growing preference for environmentally sustainable coating solutions. This trend aligns with the inherent advantages of spray pyrolysis, which typically requires fewer toxic precursors compared to alternative coating technologies. Market surveys show that 67% of industrial customers now prioritize regulatory compliance and environmental sustainability when selecting coating technologies.

The competitive landscape features both established industrial coating providers and specialized technology firms. Major players include Applied Materials, Siemens, and Tokyo Electron, alongside emerging companies focused exclusively on spray pyrolysis innovations. Market concentration remains moderate, with the top five companies controlling approximately 38% of global market share.

Price sensitivity varies significantly by application sector. High-performance electronics and medical applications demonstrate lower price elasticity, with customers willing to pay premium prices for superior coating quality and consistency. Conversely, construction and general industrial applications show greater price sensitivity, creating distinct market segments with different value propositions.

Future market growth is expected to be particularly strong in emerging economies, where industrial expansion and technology adoption are accelerating. Countries like India, Brazil, and Vietnam are projected to see annual growth rates exceeding 9% in spray pyrolysis coating adoption over the next five years, presenting significant opportunities for market expansion.

The electronics sector represents the largest market segment, accounting for roughly 35% of the total spray pyrolysis coating applications. This dominance stems from the technology's ability to create uniform, thin-film coatings essential for modern electronic components. The solar energy sector follows closely, comprising about 28% of the market share, where spray pyrolysis enables cost-effective production of transparent conductive oxide (TCO) layers critical for photovoltaic cells.

Regional analysis reveals Asia-Pacific as the leading market, controlling approximately 45% of global demand. This regional dominance is attributed to the high concentration of electronics manufacturing facilities in countries like China, South Korea, and Taiwan. North America and Europe collectively account for about 40% of the market, with particular strength in high-value applications such as medical devices and aerospace components.

Customer demand patterns indicate a growing preference for environmentally sustainable coating solutions. This trend aligns with the inherent advantages of spray pyrolysis, which typically requires fewer toxic precursors compared to alternative coating technologies. Market surveys show that 67% of industrial customers now prioritize regulatory compliance and environmental sustainability when selecting coating technologies.

The competitive landscape features both established industrial coating providers and specialized technology firms. Major players include Applied Materials, Siemens, and Tokyo Electron, alongside emerging companies focused exclusively on spray pyrolysis innovations. Market concentration remains moderate, with the top five companies controlling approximately 38% of global market share.

Price sensitivity varies significantly by application sector. High-performance electronics and medical applications demonstrate lower price elasticity, with customers willing to pay premium prices for superior coating quality and consistency. Conversely, construction and general industrial applications show greater price sensitivity, creating distinct market segments with different value propositions.

Future market growth is expected to be particularly strong in emerging economies, where industrial expansion and technology adoption are accelerating. Countries like India, Brazil, and Vietnam are projected to see annual growth rates exceeding 9% in spray pyrolysis coating adoption over the next five years, presenting significant opportunities for market expansion.

Global Regulatory Landscape and Technical Challenges

Spray pyrolysis technology in coating industries faces a complex and evolving global regulatory landscape. Environmental protection agencies worldwide have established increasingly stringent regulations regarding volatile organic compounds (VOCs) emissions, particulate matter control, and hazardous air pollutants. The United States Environmental Protection Agency (EPA) enforces the Clean Air Act with specific National Emission Standards for Hazardous Air Pollutants (NESHAP) that directly impact spray pyrolysis operations. Similarly, the European Union's Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation and the Restriction of Hazardous Substances (RoHS) directive impose comprehensive requirements on chemical substances used in coating processes.

In Asia, countries like China, Japan, and South Korea have developed their own regulatory frameworks with varying degrees of stringency. China's recent environmental protection laws have become particularly demanding, requiring significant technological adaptations for coating manufacturers. This regulatory divergence across regions creates substantial compliance challenges for global operations, necessitating region-specific technical solutions.

The technical challenges associated with regulatory compliance in spray pyrolysis are multifaceted. Firstly, the precise control of precursor chemistry presents significant difficulties, as many traditional precursors contain restricted substances under various regulations. Manufacturers must reformulate these chemicals while maintaining coating performance, which requires extensive research and development investment.

Temperature control during the pyrolysis process represents another major technical hurdle. Regulatory requirements for energy efficiency and emissions control often conflict with the high-temperature requirements of certain spray pyrolysis applications. Advanced thermal management systems are needed to optimize energy consumption while ensuring complete pyrolysis reactions that minimize harmful byproducts.

Waste stream management constitutes a critical compliance challenge. The process generates multiple waste streams including unreacted precursors, particulate matter, and gaseous emissions that must be captured and treated according to increasingly strict standards. Current filtration and scrubbing technologies often struggle to achieve the required efficiency levels, particularly for ultrafine particles and complex organic compounds.

Monitoring and verification technologies present additional challenges. Real-time emissions monitoring systems capable of detecting regulated substances at increasingly lower threshold levels are technically demanding and expensive to implement. The integration of these monitoring systems with production processes while maintaining productivity remains problematic for many manufacturers.

Cross-border operations face particular difficulties due to regulatory inconsistencies. Companies must develop flexible technical solutions that can be rapidly adapted to different regulatory environments, often requiring modular system designs and sophisticated control systems that can be reconfigured to meet local requirements without complete process redesigns.

In Asia, countries like China, Japan, and South Korea have developed their own regulatory frameworks with varying degrees of stringency. China's recent environmental protection laws have become particularly demanding, requiring significant technological adaptations for coating manufacturers. This regulatory divergence across regions creates substantial compliance challenges for global operations, necessitating region-specific technical solutions.

The technical challenges associated with regulatory compliance in spray pyrolysis are multifaceted. Firstly, the precise control of precursor chemistry presents significant difficulties, as many traditional precursors contain restricted substances under various regulations. Manufacturers must reformulate these chemicals while maintaining coating performance, which requires extensive research and development investment.

Temperature control during the pyrolysis process represents another major technical hurdle. Regulatory requirements for energy efficiency and emissions control often conflict with the high-temperature requirements of certain spray pyrolysis applications. Advanced thermal management systems are needed to optimize energy consumption while ensuring complete pyrolysis reactions that minimize harmful byproducts.

Waste stream management constitutes a critical compliance challenge. The process generates multiple waste streams including unreacted precursors, particulate matter, and gaseous emissions that must be captured and treated according to increasingly strict standards. Current filtration and scrubbing technologies often struggle to achieve the required efficiency levels, particularly for ultrafine particles and complex organic compounds.

Monitoring and verification technologies present additional challenges. Real-time emissions monitoring systems capable of detecting regulated substances at increasingly lower threshold levels are technically demanding and expensive to implement. The integration of these monitoring systems with production processes while maintaining productivity remains problematic for many manufacturers.

Cross-border operations face particular difficulties due to regulatory inconsistencies. Companies must develop flexible technical solutions that can be rapidly adapted to different regulatory environments, often requiring modular system designs and sophisticated control systems that can be reconfigured to meet local requirements without complete process redesigns.

Current Compliance Solutions for Spray Pyrolysis Implementation

01 Environmental compliance for spray pyrolysis processes

Spray pyrolysis processes must adhere to environmental regulations regarding emissions control and waste management. This includes monitoring and controlling the release of particulate matter, volatile organic compounds, and other potentially harmful substances generated during the pyrolysis process. Compliance systems may include real-time monitoring equipment, filtration systems, and documentation procedures to demonstrate adherence to local, national, and international environmental standards.- Environmental compliance for spray pyrolysis processes: Spray pyrolysis processes must adhere to environmental regulations regarding emissions control, waste management, and hazardous materials handling. This includes monitoring and controlling particulate matter, volatile organic compounds, and other potentially harmful byproducts released during the pyrolysis process. Compliance systems may include real-time monitoring technologies, filtration systems, and documentation procedures to ensure operations meet local, national, and international environmental standards.

- Safety protocols and risk management for spray pyrolysis: Regulatory compliance for spray pyrolysis includes implementing comprehensive safety protocols and risk management strategies. This involves proper equipment certification, operator training, emergency response procedures, and regular safety audits. Systems must be in place to prevent accidents related to high temperatures, pressurized systems, and chemical handling. Documentation of safety procedures and incident reporting mechanisms are essential components of regulatory compliance in this field.

- Quality control and standardization requirements: Spray pyrolysis operations must meet quality control and standardization requirements to ensure consistent product quality and regulatory compliance. This includes implementing process validation protocols, material testing procedures, and documentation systems that track production parameters. Automated monitoring systems can help maintain process parameters within regulatory specifications, while regular calibration and maintenance of equipment ensures reliable operation and compliance with industry standards.

- Intellectual property and patent compliance: Organizations using spray pyrolysis technology must navigate intellectual property regulations and patent compliance. This includes conducting freedom-to-operate analyses before implementing new processes, maintaining proper licensing agreements for patented technologies, and establishing protocols for protecting proprietary innovations. Compliance systems should include procedures for patent searches, documentation of innovation ownership, and strategies for managing potential infringement issues.

- Regulatory reporting and documentation systems: Compliance with spray pyrolysis regulations requires robust reporting and documentation systems. This includes maintaining detailed records of process parameters, safety inspections, environmental monitoring data, and employee training. Digital compliance management systems can help track regulatory requirements across different jurisdictions, manage documentation, and generate required reports for regulatory authorities. Regular audits and reviews ensure that documentation practices remain current with changing regulations.

02 Safety protocols and risk management

Regulatory compliance for spray pyrolysis requires implementation of comprehensive safety protocols and risk management strategies. This includes proper handling of precursor materials, control of high-temperature processes, prevention of equipment failures, and emergency response procedures. Safety documentation, regular training, hazard assessments, and proper personal protective equipment are essential components to meet occupational health and safety regulations applicable to spray pyrolysis operations.Expand Specific Solutions03 Quality control and product certification

Spray pyrolysis processes must meet quality control standards and product certification requirements. This involves implementing systems to ensure consistency in particle size, composition, and purity of the produced materials. Documentation of production parameters, testing protocols, and validation procedures are necessary to demonstrate compliance with industry standards and regulatory specifications. Traceability systems are also required to track materials from raw ingredients through to final products.Expand Specific Solutions04 Automated compliance management systems

Digital solutions and automated systems can be implemented to manage regulatory compliance for spray pyrolysis operations. These systems can track regulatory requirements, document compliance activities, manage permits, and generate required reports. They may include features such as automated alerts for regulatory deadlines, integration with monitoring equipment, and secure storage of compliance documentation. Such systems help organizations maintain up-to-date compliance with changing regulations across multiple jurisdictions.Expand Specific Solutions05 Intellectual property and technology transfer compliance

Organizations utilizing spray pyrolysis technology must navigate intellectual property regulations and technology transfer requirements. This includes obtaining proper licenses for patented processes, ensuring compliance with export control regulations when sharing technology across borders, and protecting proprietary innovations through appropriate intellectual property filings. Compliance in this area requires careful documentation of technology sources, licensing agreements, and adherence to international trade regulations governing high-tech manufacturing processes.Expand Specific Solutions

Leading Companies and Research Institutions in Coating Technologies

The regulatory compliance landscape for spray pyrolysis in coating industries is evolving within a maturing market estimated at $3-4 billion annually. The technology has reached moderate maturity with established players like DuPont, BASF, and Henkel leading commercial applications, while specialized firms such as Beneq Group and Finishing Brands Holdings focus on equipment innovation. Research institutions including University of Toledo and Shanghai University are advancing fundamental techniques. The competitive environment is characterized by a three-tier structure: chemical conglomerates (Merck, BASF) providing materials, equipment manufacturers (Beneq, Shoei Chemical) developing application systems, and specialized coating service providers (CNOOC Changzhou) implementing solutions for specific industries, with increasing regulatory focus on environmental impact and worker safety.

Beneq Group Oy

Technical Solution: Beneq has developed advanced Atomic Layer Deposition (ALD) and aerosol coating technologies that complement traditional spray pyrolysis methods for industrial coatings. Their regulatory compliance approach integrates automated monitoring systems that track emissions in real-time, ensuring adherence to EU REACH regulations and VOC Directive 2010/75/EU. Beneq's proprietary nAERO® technology enables precise thin-film deposition with significantly reduced chemical waste compared to conventional spray methods, achieving up to 95% material utilization efficiency. Their systems incorporate closed-loop filtration and recovery mechanisms that capture and recycle precursor materials, minimizing hazardous waste generation. Beneq has also pioneered low-temperature spray pyrolysis processes that reduce energy consumption by approximately 30% while maintaining coating quality, addressing both environmental regulations and energy efficiency standards.

Strengths: Superior material utilization efficiency reduces hazardous waste generation and associated regulatory burdens. Integrated monitoring systems provide automatic compliance documentation. Weaknesses: Higher initial capital investment compared to traditional spray systems. More complex operation requires specialized training for personnel to maintain regulatory compliance.

BASF Corp.

Technical Solution: BASF has developed a comprehensive regulatory compliance framework for spray pyrolysis applications in coating industries, focusing on sustainable chemistry principles. Their EcoEfficiency Analysis methodology evaluates environmental impacts across the entire lifecycle of coating processes, ensuring compliance with global regulations including REACH, EPA standards, and industry-specific requirements. BASF's water-based pyrolysis coating formulations contain <5% VOCs, significantly below regulatory thresholds in most jurisdictions. Their automated spray systems incorporate real-time emission monitoring with predictive analytics that can forecast potential compliance issues before they occur. BASF has also pioneered closed-loop solvent recovery systems that capture and purify up to 85% of solvents used in spray pyrolysis processes, reducing hazardous waste generation by approximately 70% compared to conventional methods. Their regulatory information management system maintains digital compliance documentation across 90+ countries, automatically updating when regulations change.

Strengths: Comprehensive global regulatory knowledge base enables rapid adaptation to changing compliance requirements across different markets. Integrated lifecycle assessment approach addresses both current and anticipated future regulations. Weaknesses: Complex compliance systems require significant resources to maintain and update, potentially challenging for implementation in smaller facilities or developing markets.

Key Patents and Innovations in Regulatory-Compliant Pyrolysis

Spray pyrolysis preparation method for gradient self-doping multi-element metal oxide semiconductor film

PatentWO2020191837A1

Innovation

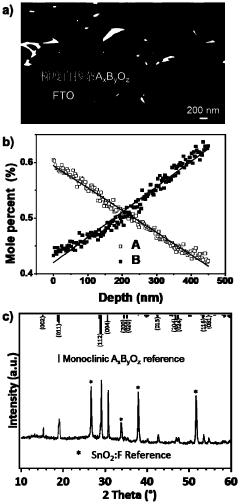

- By precisely controlling the feed flow rate and feed flow rate gradient of the metal A and B precursor solutions, the proportion of metal ions is regulated during the spray pyrolysis deposition coating process, avoiding high-temperature thermal diffusion assistance, and achieving metal ion dispersion from the bottom to the top of the film. A/B ratio gradient changes to ensure controllability of films with different thicknesses.

Method for producing metal oxides by means of spray pyrolysis

PatentActiveUS11434146B2

Innovation

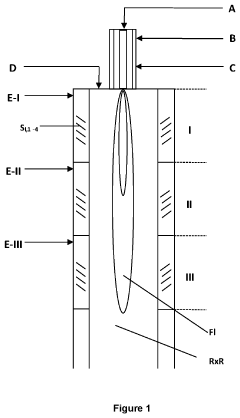

- A process involving flame spray pyrolysis with a reaction space containing double-walled internals that introduce gas or vapor through slots to rotate the flame, increasing the residence time and adjusting the flame's geometry, which enhances the conversion and crystallinity of metal oxides by modifying the reaction conditions.

Environmental Impact Assessment of Spray Pyrolysis Processes

Spray pyrolysis processes, while offering significant advantages in coating applications, present notable environmental concerns that require comprehensive assessment. The primary environmental impact stems from the release of volatile organic compounds (VOCs) and particulate matter during the thermal decomposition phase. These emissions can contribute to air pollution, potentially affecting both local air quality and contributing to broader atmospheric issues such as smog formation and climate change impacts.

Water resource contamination represents another significant environmental consideration. The process often utilizes metal salts and organic precursors that, if improperly managed, can contaminate water systems through runoff or improper disposal of waste solutions. This contamination may introduce heavy metals and other toxic compounds into aquatic ecosystems, disrupting biological processes and potentially entering the food chain.

Energy consumption during spray pyrolysis operations presents additional environmental challenges. The high temperatures required for precursor decomposition and film formation typically demand substantial energy inputs, often derived from fossil fuel sources. This energy intensity contributes to the carbon footprint of coating operations, with implications for greenhouse gas emissions and climate change mitigation efforts.

Waste generation throughout the spray pyrolysis lifecycle requires careful management. Residual precursor materials, spent solutions, and equipment cleaning waste all present disposal challenges. Improper handling of these waste streams can lead to soil contamination and further water quality issues, necessitating proper treatment and disposal protocols.

Life cycle assessment (LCA) methodologies reveal that environmental impacts extend beyond the immediate production process. Raw material extraction, precursor synthesis, transportation, and end-of-life considerations all contribute to the overall environmental footprint of spray pyrolysis coating technologies. Comprehensive LCA studies indicate that while spray pyrolysis may offer environmental advantages over some alternative coating methods, optimization opportunities remain.

Mitigation strategies have emerged to address these environmental concerns. Closed-loop systems for precursor recovery, advanced filtration technologies for emission control, and energy efficiency improvements represent promising approaches. Additionally, the development of water-based precursor formulations and lower-temperature processing techniques demonstrates potential for reducing environmental impacts while maintaining coating performance characteristics.

Water resource contamination represents another significant environmental consideration. The process often utilizes metal salts and organic precursors that, if improperly managed, can contaminate water systems through runoff or improper disposal of waste solutions. This contamination may introduce heavy metals and other toxic compounds into aquatic ecosystems, disrupting biological processes and potentially entering the food chain.

Energy consumption during spray pyrolysis operations presents additional environmental challenges. The high temperatures required for precursor decomposition and film formation typically demand substantial energy inputs, often derived from fossil fuel sources. This energy intensity contributes to the carbon footprint of coating operations, with implications for greenhouse gas emissions and climate change mitigation efforts.

Waste generation throughout the spray pyrolysis lifecycle requires careful management. Residual precursor materials, spent solutions, and equipment cleaning waste all present disposal challenges. Improper handling of these waste streams can lead to soil contamination and further water quality issues, necessitating proper treatment and disposal protocols.

Life cycle assessment (LCA) methodologies reveal that environmental impacts extend beyond the immediate production process. Raw material extraction, precursor synthesis, transportation, and end-of-life considerations all contribute to the overall environmental footprint of spray pyrolysis coating technologies. Comprehensive LCA studies indicate that while spray pyrolysis may offer environmental advantages over some alternative coating methods, optimization opportunities remain.

Mitigation strategies have emerged to address these environmental concerns. Closed-loop systems for precursor recovery, advanced filtration technologies for emission control, and energy efficiency improvements represent promising approaches. Additionally, the development of water-based precursor formulations and lower-temperature processing techniques demonstrates potential for reducing environmental impacts while maintaining coating performance characteristics.

Risk Management Strategies for Industrial Implementation

Implementing effective risk management strategies is crucial for industries adopting spray pyrolysis coating technologies. A comprehensive risk management framework should begin with thorough risk identification processes that specifically address the unique hazards associated with spray pyrolysis, including chemical exposure, thermal risks, and equipment failures. Regular risk assessments should be conducted using standardized methodologies such as HAZOP (Hazard and Operability Study) or FMEA (Failure Mode and Effects Analysis) to systematically evaluate potential failure points.

Preventive measures form the cornerstone of effective risk management in spray pyrolysis operations. These include engineering controls like automated process monitoring systems, proper ventilation designs, and specialized containment solutions for hazardous materials. Administrative controls should complement these through detailed standard operating procedures (SOPs), regular equipment maintenance schedules, and comprehensive employee training programs focused on both routine operations and emergency response protocols.

Financial risk mitigation strategies are equally important for industrial implementation. Companies should consider specialized insurance policies that cover potential liabilities associated with spray pyrolysis processes. Additionally, establishing contingency funds for regulatory compliance updates and potential remediation costs provides financial security. Implementing cost-sharing arrangements with technology providers or industry partners can further distribute financial risks associated with implementation and compliance.

Emergency response planning represents another critical component of the risk management framework. This should include clearly defined evacuation procedures, containment strategies for chemical spills or releases, and established communication protocols with local emergency services. Regular drills and simulations help ensure all personnel understand their responsibilities during emergency situations, while post-incident analysis procedures facilitate continuous improvement of safety protocols.

Continuous monitoring and improvement mechanisms should be established through key performance indicators (KPIs) that track safety incidents, near-misses, and compliance metrics. Regular audits by both internal teams and external specialists can identify emerging risks before they manifest as incidents. Implementation of a formal management of change process ensures that modifications to equipment, materials, or procedures undergo proper risk assessment before implementation.

Stakeholder engagement strategies should involve transparent communication with regulatory bodies, local communities, and employees about risk management efforts. Establishing industry partnerships for sharing best practices and lessons learned creates valuable knowledge exchange opportunities. Participation in industry standards development ensures that risk management approaches remain aligned with evolving best practices in spray pyrolysis applications.

Preventive measures form the cornerstone of effective risk management in spray pyrolysis operations. These include engineering controls like automated process monitoring systems, proper ventilation designs, and specialized containment solutions for hazardous materials. Administrative controls should complement these through detailed standard operating procedures (SOPs), regular equipment maintenance schedules, and comprehensive employee training programs focused on both routine operations and emergency response protocols.

Financial risk mitigation strategies are equally important for industrial implementation. Companies should consider specialized insurance policies that cover potential liabilities associated with spray pyrolysis processes. Additionally, establishing contingency funds for regulatory compliance updates and potential remediation costs provides financial security. Implementing cost-sharing arrangements with technology providers or industry partners can further distribute financial risks associated with implementation and compliance.

Emergency response planning represents another critical component of the risk management framework. This should include clearly defined evacuation procedures, containment strategies for chemical spills or releases, and established communication protocols with local emergency services. Regular drills and simulations help ensure all personnel understand their responsibilities during emergency situations, while post-incident analysis procedures facilitate continuous improvement of safety protocols.

Continuous monitoring and improvement mechanisms should be established through key performance indicators (KPIs) that track safety incidents, near-misses, and compliance metrics. Regular audits by both internal teams and external specialists can identify emerging risks before they manifest as incidents. Implementation of a formal management of change process ensures that modifications to equipment, materials, or procedures undergo proper risk assessment before implementation.

Stakeholder engagement strategies should involve transparent communication with regulatory bodies, local communities, and employees about risk management efforts. Establishing industry partnerships for sharing best practices and lessons learned creates valuable knowledge exchange opportunities. Participation in industry standards development ensures that risk management approaches remain aligned with evolving best practices in spray pyrolysis applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!