Why Spray Pyrolysis Optimizes Catalyst Coating in Catalytic Converters

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Spray Pyrolysis Technology Evolution and Objectives

Spray pyrolysis emerged in the 1960s as a thin film deposition technique, initially applied in semiconductor and optical coating industries. The technology's evolution toward catalytic converter applications began in the 1980s when researchers recognized its potential for precise control over catalyst particle size and distribution. This evolution was driven by increasingly stringent emission regulations worldwide, particularly the Clean Air Act Amendments in the US and similar legislation in Europe and Japan, which demanded more efficient catalytic converters with optimized precious metal utilization.

The fundamental principle of spray pyrolysis involves atomizing a precursor solution into fine droplets, which are then directed onto a heated substrate where solvent evaporation and precursor decomposition occur simultaneously. This one-step process creates a uniform coating with controlled morphology and composition, addressing key challenges in catalyst coating technology.

Throughout the 1990s and early 2000s, significant advancements in spray pyrolysis equipment occurred, including the development of ultrasonic and pressure atomizers that enabled finer droplet formation and more precise deposition control. Concurrently, precursor chemistry evolved from simple metal salts to complex organometallic compounds, allowing for better control over catalyst properties and enhanced thermal stability.

The primary technical objective of spray pyrolysis in catalytic converter applications is to maximize catalytic efficiency while minimizing precious metal loading. This is achieved through optimized particle size distribution (typically 1-10 nm), enhanced metal-support interactions, and uniform dispersion across the substrate. Secondary objectives include improving catalyst durability under high-temperature exhaust conditions and resistance to poisoning from fuel contaminants.

Recent technological trends focus on multi-component catalyst systems that can be precisely engineered through spray pyrolysis. These systems often incorporate platinum group metals (PGMs) alongside promoters and stabilizers in carefully controlled ratios and spatial arrangements. Advanced process control systems now enable real-time adjustment of deposition parameters, ensuring consistent quality even with variations in substrate properties or environmental conditions.

The technology roadmap for spray pyrolysis in catalytic converters aims toward further reduction in PGM loading while maintaining or improving catalytic performance. This includes exploration of core-shell nanostructures, gradient compositions, and advanced support materials that can be uniquely fabricated through modified spray pyrolysis techniques. Emerging research also focuses on low-temperature activation catalysts for cold-start emissions, where spray pyrolysis offers distinct advantages in creating the required complex catalyst architectures.

The fundamental principle of spray pyrolysis involves atomizing a precursor solution into fine droplets, which are then directed onto a heated substrate where solvent evaporation and precursor decomposition occur simultaneously. This one-step process creates a uniform coating with controlled morphology and composition, addressing key challenges in catalyst coating technology.

Throughout the 1990s and early 2000s, significant advancements in spray pyrolysis equipment occurred, including the development of ultrasonic and pressure atomizers that enabled finer droplet formation and more precise deposition control. Concurrently, precursor chemistry evolved from simple metal salts to complex organometallic compounds, allowing for better control over catalyst properties and enhanced thermal stability.

The primary technical objective of spray pyrolysis in catalytic converter applications is to maximize catalytic efficiency while minimizing precious metal loading. This is achieved through optimized particle size distribution (typically 1-10 nm), enhanced metal-support interactions, and uniform dispersion across the substrate. Secondary objectives include improving catalyst durability under high-temperature exhaust conditions and resistance to poisoning from fuel contaminants.

Recent technological trends focus on multi-component catalyst systems that can be precisely engineered through spray pyrolysis. These systems often incorporate platinum group metals (PGMs) alongside promoters and stabilizers in carefully controlled ratios and spatial arrangements. Advanced process control systems now enable real-time adjustment of deposition parameters, ensuring consistent quality even with variations in substrate properties or environmental conditions.

The technology roadmap for spray pyrolysis in catalytic converters aims toward further reduction in PGM loading while maintaining or improving catalytic performance. This includes exploration of core-shell nanostructures, gradient compositions, and advanced support materials that can be uniquely fabricated through modified spray pyrolysis techniques. Emerging research also focuses on low-temperature activation catalysts for cold-start emissions, where spray pyrolysis offers distinct advantages in creating the required complex catalyst architectures.

Market Demand for Advanced Catalytic Converter Solutions

The global catalytic converter market is experiencing significant growth, driven by increasingly stringent emission regulations across major automotive markets. Current market valuations exceed $45 billion, with projections indicating a compound annual growth rate of approximately 7% through 2028. This growth trajectory is primarily fueled by the implementation of Euro 7, China 6b, and US Tier 3 emission standards, which demand higher conversion efficiencies and durability from catalytic systems.

Vehicle manufacturers are facing mounting pressure to reduce emissions while maintaining performance and cost-effectiveness. Traditional catalytic coating methods often result in uneven catalyst distribution, higher precious metal loading requirements, and suboptimal conversion efficiency. These limitations have created a substantial market demand for advanced coating technologies that can optimize precious metal utilization while enhancing catalytic performance.

Spray pyrolysis has emerged as a promising solution addressing these market needs. Industry surveys indicate that automotive manufacturers are willing to invest in coating technologies that can reduce precious metal loading by 15-30% while maintaining or improving catalytic performance. This demand is particularly acute given the volatile pricing of platinum group metals (PGMs), which have seen price fluctuations of up to 40% in recent years.

The aftermarket segment also presents significant opportunities, with increasing demand for replacement catalytic converters that offer improved performance over original equipment. This segment is growing at nearly 8% annually, driven by aging vehicle fleets in developed markets and expanding vehicle ownership in emerging economies.

Regional market analysis reveals that Asia-Pacific represents the fastest-growing market for advanced catalytic solutions, with China and India leading adoption due to their severe air pollution challenges and rapidly evolving regulatory frameworks. North America and Europe maintain strong demand driven by replacement needs and regulatory compliance requirements.

Commercial vehicle applications represent an expanding market segment, with particularly strong growth in heavy-duty diesel applications where more efficient catalyst utilization can significantly impact total system costs. Industry reports indicate that commercial vehicle manufacturers are actively seeking coating technologies that can reduce system size and weight while meeting increasingly stringent NOx and particulate matter emission limits.

The market is also witnessing growing demand for multi-functional catalytic systems that can simultaneously address multiple pollutants, creating opportunities for advanced coating technologies that enable more complex catalyst formulations and architectures. This trend is reinforced by the automotive industry's shift toward electrification, where hybrid vehicles require catalytic systems optimized for intermittent operation and rapid light-off performance.

Vehicle manufacturers are facing mounting pressure to reduce emissions while maintaining performance and cost-effectiveness. Traditional catalytic coating methods often result in uneven catalyst distribution, higher precious metal loading requirements, and suboptimal conversion efficiency. These limitations have created a substantial market demand for advanced coating technologies that can optimize precious metal utilization while enhancing catalytic performance.

Spray pyrolysis has emerged as a promising solution addressing these market needs. Industry surveys indicate that automotive manufacturers are willing to invest in coating technologies that can reduce precious metal loading by 15-30% while maintaining or improving catalytic performance. This demand is particularly acute given the volatile pricing of platinum group metals (PGMs), which have seen price fluctuations of up to 40% in recent years.

The aftermarket segment also presents significant opportunities, with increasing demand for replacement catalytic converters that offer improved performance over original equipment. This segment is growing at nearly 8% annually, driven by aging vehicle fleets in developed markets and expanding vehicle ownership in emerging economies.

Regional market analysis reveals that Asia-Pacific represents the fastest-growing market for advanced catalytic solutions, with China and India leading adoption due to their severe air pollution challenges and rapidly evolving regulatory frameworks. North America and Europe maintain strong demand driven by replacement needs and regulatory compliance requirements.

Commercial vehicle applications represent an expanding market segment, with particularly strong growth in heavy-duty diesel applications where more efficient catalyst utilization can significantly impact total system costs. Industry reports indicate that commercial vehicle manufacturers are actively seeking coating technologies that can reduce system size and weight while meeting increasingly stringent NOx and particulate matter emission limits.

The market is also witnessing growing demand for multi-functional catalytic systems that can simultaneously address multiple pollutants, creating opportunities for advanced coating technologies that enable more complex catalyst formulations and architectures. This trend is reinforced by the automotive industry's shift toward electrification, where hybrid vehicles require catalytic systems optimized for intermittent operation and rapid light-off performance.

Current Challenges in Catalyst Coating Technologies

Despite significant advancements in catalytic converter technology, catalyst coating processes face several persistent challenges that impact performance, durability, and manufacturing efficiency. Traditional washcoating methods, while widely adopted, struggle with achieving uniform catalyst distribution, particularly in complex monolith geometries with high cell density. This non-uniformity leads to catalyst underutilization, increased precious metal loading requirements, and suboptimal conversion efficiency.

Adhesion stability represents another critical challenge, as poor adhesion results in catalyst detachment during vehicle operation, reducing converter lifespan and increasing emissions over time. Current coating technologies often require multiple application cycles and extended drying periods, significantly increasing production time and energy consumption. The high-temperature calcination processes necessary for catalyst activation further complicate manufacturing logistics and increase production costs.

Precious metal utilization efficiency remains suboptimal in conventional coating methods. With platinum group metals (PGMs) accounting for approximately 50-70% of catalytic converter costs, inefficient distribution and utilization directly impact economic viability. Current technologies struggle to achieve the ideal nanoscale dispersion that maximizes catalytic surface area while minimizing material usage.

Environmental and regulatory pressures compound these technical challenges. Increasingly stringent emissions standards worldwide demand higher conversion efficiencies across broader temperature ranges, particularly addressing cold-start emissions when catalysts are below light-off temperature. Meanwhile, coating processes themselves face scrutiny regarding solvent emissions, waste generation, and energy consumption.

Scalability presents additional complications, as laboratory-optimized coating techniques often encounter significant challenges during industrial implementation. The transition from small-scale production to high-volume manufacturing frequently results in quality inconsistencies and yield reductions. Current coating technologies struggle to maintain precision while meeting automotive industry throughput requirements.

Emerging substrate materials and geometries, including metallic substrates and variable cell density designs, require coating adaptability that existing technologies cannot consistently provide. The industry also faces challenges in developing coating processes compatible with next-generation catalyst formulations, including low-temperature catalysts and PGM-free alternatives.

These multifaceted challenges highlight the limitations of conventional catalyst coating approaches and underscore the need for innovative technologies like spray pyrolysis, which offers potential solutions through improved precursor delivery, enhanced distribution control, and more efficient precious metal utilization.

Adhesion stability represents another critical challenge, as poor adhesion results in catalyst detachment during vehicle operation, reducing converter lifespan and increasing emissions over time. Current coating technologies often require multiple application cycles and extended drying periods, significantly increasing production time and energy consumption. The high-temperature calcination processes necessary for catalyst activation further complicate manufacturing logistics and increase production costs.

Precious metal utilization efficiency remains suboptimal in conventional coating methods. With platinum group metals (PGMs) accounting for approximately 50-70% of catalytic converter costs, inefficient distribution and utilization directly impact economic viability. Current technologies struggle to achieve the ideal nanoscale dispersion that maximizes catalytic surface area while minimizing material usage.

Environmental and regulatory pressures compound these technical challenges. Increasingly stringent emissions standards worldwide demand higher conversion efficiencies across broader temperature ranges, particularly addressing cold-start emissions when catalysts are below light-off temperature. Meanwhile, coating processes themselves face scrutiny regarding solvent emissions, waste generation, and energy consumption.

Scalability presents additional complications, as laboratory-optimized coating techniques often encounter significant challenges during industrial implementation. The transition from small-scale production to high-volume manufacturing frequently results in quality inconsistencies and yield reductions. Current coating technologies struggle to maintain precision while meeting automotive industry throughput requirements.

Emerging substrate materials and geometries, including metallic substrates and variable cell density designs, require coating adaptability that existing technologies cannot consistently provide. The industry also faces challenges in developing coating processes compatible with next-generation catalyst formulations, including low-temperature catalysts and PGM-free alternatives.

These multifaceted challenges highlight the limitations of conventional catalyst coating approaches and underscore the need for innovative technologies like spray pyrolysis, which offers potential solutions through improved precursor delivery, enhanced distribution control, and more efficient precious metal utilization.

Spray Pyrolysis Implementation in Catalytic Converters

01 Precursor solution composition optimization

The composition of precursor solutions plays a critical role in spray pyrolysis catalyst coating. Optimizing the concentration of metal salts, solvents, and additives can significantly impact the catalyst's performance. Adjustments to pH levels and the inclusion of stabilizing agents help control particle size distribution and prevent agglomeration during the pyrolysis process. Proper selection of metal precursors and their ratios is essential for achieving desired catalytic activity and selectivity.- Precursor composition optimization for spray pyrolysis: The composition of precursor solutions plays a critical role in spray pyrolysis catalyst coating. Optimizing the concentration, solvent type, and additives can significantly improve catalyst uniformity and adhesion. Specific metal salts and complexes can be selected based on their decomposition characteristics to achieve desired catalyst properties. Adjusting the pH and viscosity of the precursor solution also affects the final coating quality and catalytic performance.

- Spray parameters and equipment configuration: The optimization of spray parameters such as nozzle design, spray angle, distance from substrate, and atomization pressure significantly impacts catalyst coating quality. Ultrasonic atomizers can produce finer droplets compared to conventional pressure nozzles, resulting in more uniform coatings. Controlling the spray rate and pattern ensures even distribution of catalyst material across the substrate surface. Equipment configuration including chamber design and gas flow patterns also affects coating homogeneity.

- Thermal treatment and substrate temperature control: Precise control of substrate temperature during spray pyrolysis is crucial for optimal catalyst formation. The thermal decomposition pathway affects catalyst crystallinity, particle size, and morphology. Post-deposition heat treatment can be employed to enhance catalyst stability and activity. Temperature gradients and heating rates need to be carefully managed to prevent cracking or delamination of the catalyst coating. Controlled cooling processes can also improve coating adhesion and catalytic performance.

- Multi-layer and composite catalyst structures: Developing multi-layer catalyst coatings through sequential spray pyrolysis can enhance catalytic performance and stability. Gradient compositions can be achieved by varying precursor solutions between layers. Incorporating support materials or promoters into the catalyst structure improves activity and selectivity. Composite structures combining different active phases can create synergistic effects. These advanced architectures can be tailored for specific catalytic applications by controlling the deposition sequence and layer thicknesses.

- In-situ characterization and process monitoring: Implementing real-time monitoring techniques during spray pyrolysis enables precise control over catalyst coating formation. Optical sensors can track coating thickness and uniformity during deposition. Temperature and gas composition monitoring helps maintain optimal reaction conditions. Advanced characterization methods can be integrated to assess catalyst properties during synthesis. This approach allows for immediate process adjustments to achieve desired catalyst characteristics and ensures reproducibility in large-scale production.

02 Spray parameters and equipment design

The optimization of spray parameters such as nozzle design, droplet size, spray rate, and spray angle significantly affects the uniformity and adhesion of catalyst coatings. Advanced atomization techniques can produce finer droplets leading to more homogeneous catalyst layers. Equipment modifications including ultrasonic or pressure-assisted sprayers improve the deposition efficiency and reduce material waste. The distance between the spray nozzle and substrate must be carefully controlled to ensure optimal coating thickness and morphology.Expand Specific Solutions03 Thermal treatment conditions

Thermal treatment conditions during and after spray pyrolysis significantly influence catalyst properties. Optimizing parameters such as pyrolysis temperature, heating rate, and residence time affects crystallinity, porosity, and surface area of the catalyst coating. Controlled cooling rates can prevent thermal stress and cracking in the catalyst layer. Post-deposition heat treatments in specific atmospheres (oxidizing, reducing, or inert) can further enhance catalytic activity by modifying the oxidation state of active components.Expand Specific Solutions04 Substrate preparation and surface modification

Proper substrate preparation is crucial for achieving strong adhesion and uniform catalyst coatings. Surface treatments such as etching, polishing, or applying primer layers can enhance the wettability and adhesion properties. Functionalization of substrate surfaces with specific chemical groups can improve the interaction between the catalyst and support. The substrate material selection and its thermal expansion coefficient must be compatible with the catalyst coating to prevent delamination during thermal cycling.Expand Specific Solutions05 Multi-component and layered catalyst systems

Development of multi-component and layered catalyst systems through sequential spray pyrolysis steps can enhance catalytic performance. Incorporating promoters, stabilizers, or co-catalysts into the formulation improves activity, selectivity, and durability. Gradient or layered structures with varying compositions can be achieved by adjusting the precursor solution during the deposition process. Core-shell structures and supported nanoparticles can be synthesized by controlling the deposition sequence and conditions, resulting in catalysts with optimized performance for specific reactions.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Catalytic Coating

Spray pyrolysis technology for catalyst coating in catalytic converters is evolving rapidly in a growing market estimated to reach significant value by 2030. The industry is transitioning from early adoption to mainstream implementation, with varying degrees of technical maturity among key players. Companies like BASF, Cataler Corp., and Siemens AG demonstrate advanced capabilities, while China Petroleum & Chemical Corp. and LG Chem are making substantial investments in research. Emerging players including Heesung Catalysts and Shoei Chemical are developing specialized applications. Academic institutions such as Hiroshima University and University of Toledo collaborate with industry to bridge fundamental research and commercial applications, accelerating the optimization of spray pyrolysis techniques for enhanced catalyst performance and cost-effectiveness.

BASF Corp.

Technical Solution: BASF has developed advanced spray pyrolysis techniques for catalytic converter coating that utilize precise droplet atomization to create uniform catalyst layers. Their process employs ultrasonic or pressure-assisted nozzles to generate fine droplets (5-50μm) containing precious metal precursors that are directed onto ceramic or metallic substrates. The company's proprietary thermal treatment protocols ensure optimal catalyst adhesion and activity through controlled evaporation and decomposition phases. BASF's spray pyrolysis method incorporates in-line quality monitoring systems that adjust spray parameters in real-time based on coating thickness and uniformity measurements. Their technology achieves up to 30% reduction in precious metal loading while maintaining equivalent catalytic performance through optimized spatial distribution of active sites. The process is particularly effective for complex substrate geometries where traditional washcoating methods struggle to achieve uniform coverage.

Strengths: Superior control over catalyst particle size (2-10nm) and distribution; reduced precious metal usage; excellent coating uniformity even on complex substrate geometries; scalable for high-volume production. Weaknesses: Higher initial equipment investment compared to washcoating; requires precise process control parameters; more energy-intensive due to atomization and thermal treatment requirements.

Cataler Corp.

Technical Solution: Cataler Corporation has pioneered a multi-stage spray pyrolysis approach specifically designed for catalytic converter applications. Their technology employs a sequential deposition strategy where different catalyst layers are applied in controlled succession to create functionally graded coatings. The process begins with a primer layer application using modified spray parameters to enhance substrate adhesion, followed by active catalyst layers with precisely controlled precious metal concentrations. Cataler's system incorporates proprietary solvent formulations that optimize droplet surface tension and evaporation characteristics, resulting in superior coating morphology. Their spray pyrolysis equipment features rotating substrate holders that ensure 360-degree coverage and eliminate shadowing effects common in static coating methods. The company has documented catalyst activity improvements of up to 25% compared to conventional washcoating techniques, particularly for low-temperature catalytic performance which is critical for meeting stringent emission standards during cold-start conditions.

Strengths: Exceptional coating adhesion through specialized primer layer technology; superior low-temperature catalytic activity; excellent durability under thermal cycling conditions; reduced catalyst poisoning susceptibility due to optimized layer structure. Weaknesses: More complex multi-stage process requiring additional quality control steps; higher production cycle time compared to single-pass methods; requires specialized equipment for rotating substrate handling.

Key Technical Innovations in Spray Pyrolysis Coating

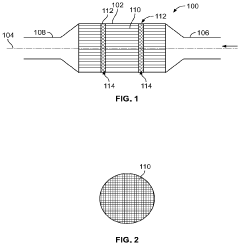

Method for producing a support film for catalytic converters

PatentPendingUS20250215540A1

Innovation

- A method involving the direct cooling of slabs from hot-rolling or forging to room temperature in air/oil/water or holding at intermediate temperatures between 475°C and 700°C for 0.5 to 100 hours before further processing, eliminating the need for high-temperature holding and hot transport steps.

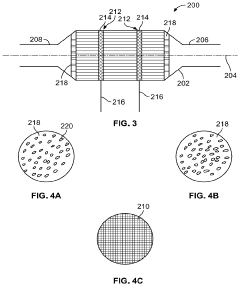

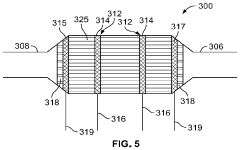

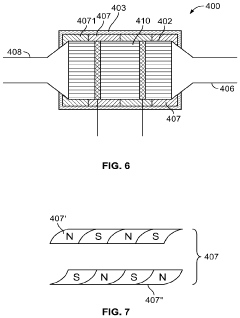

Catalytic converter

PatentPendingUS20230304427A1

Innovation

- Incorporation of heating elements and a support lattice coated with catalytic material, along with disruptor plates and a magnetic field to enhance gas circulation and particulate interaction, and the use of magnets to maintain a magnetic field within the catalytic converter.

Environmental Regulations Driving Catalytic Converter Advancements

Environmental regulations worldwide have become increasingly stringent over the past three decades, serving as the primary catalyst for advancements in catalytic converter technology. The Clean Air Act Amendments of 1990 in the United States marked a significant turning point, establishing progressively tighter emission standards that have compelled automotive manufacturers to develop more efficient catalytic systems.

The European Union's Euro standards have similarly evolved from Euro 1 in 1992 to the current Euro 6d, with each iteration demanding substantial reductions in nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter emissions. These regulations have directly influenced the technical specifications for catalyst coating methods, with spray pyrolysis emerging as a preferred technique due to its ability to create uniform, adherent catalyst layers that maximize conversion efficiency.

China's implementation of the China VI standards, equivalent to Euro 6, represents one of the most aggressive regulatory shifts globally, requiring a 50% reduction in NOx emissions compared to previous standards. This regulatory pressure has accelerated research into optimized coating technologies, with spray pyrolysis offering the precision needed to meet these demanding requirements while minimizing precious metal usage.

The regulatory focus has expanded beyond traditional pollutants to include greenhouse gas emissions, particularly CO2. This expansion has created a dual challenge for catalytic converter technology: simultaneously reducing both criteria pollutants and greenhouse gases. Spray pyrolysis coating techniques address this challenge by enabling more precise control over catalyst distribution and improved thermal stability, allowing converters to maintain efficiency across a broader range of operating conditions.

Real Driving Emissions (RDE) testing, now mandatory in many jurisdictions, has further intensified the need for advanced coating technologies. Unlike laboratory tests, RDE evaluates emissions performance under actual driving conditions, exposing weaknesses in conventional coating methods that may perform adequately in controlled environments but fail in real-world scenarios. Spray pyrolysis produces coatings with superior durability and consistent performance across variable conditions, making it particularly valuable for meeting RDE requirements.

The regulatory trajectory clearly indicates continued tightening of emission standards globally, with several jurisdictions announcing plans to phase out internal combustion engines entirely within the next 10-20 years. During this transition period, spray pyrolysis coating technology will play a crucial role in meeting increasingly stringent standards while manufacturers work toward full electrification, representing a critical bridge technology in the evolution of automotive emissions control.

The European Union's Euro standards have similarly evolved from Euro 1 in 1992 to the current Euro 6d, with each iteration demanding substantial reductions in nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter emissions. These regulations have directly influenced the technical specifications for catalyst coating methods, with spray pyrolysis emerging as a preferred technique due to its ability to create uniform, adherent catalyst layers that maximize conversion efficiency.

China's implementation of the China VI standards, equivalent to Euro 6, represents one of the most aggressive regulatory shifts globally, requiring a 50% reduction in NOx emissions compared to previous standards. This regulatory pressure has accelerated research into optimized coating technologies, with spray pyrolysis offering the precision needed to meet these demanding requirements while minimizing precious metal usage.

The regulatory focus has expanded beyond traditional pollutants to include greenhouse gas emissions, particularly CO2. This expansion has created a dual challenge for catalytic converter technology: simultaneously reducing both criteria pollutants and greenhouse gases. Spray pyrolysis coating techniques address this challenge by enabling more precise control over catalyst distribution and improved thermal stability, allowing converters to maintain efficiency across a broader range of operating conditions.

Real Driving Emissions (RDE) testing, now mandatory in many jurisdictions, has further intensified the need for advanced coating technologies. Unlike laboratory tests, RDE evaluates emissions performance under actual driving conditions, exposing weaknesses in conventional coating methods that may perform adequately in controlled environments but fail in real-world scenarios. Spray pyrolysis produces coatings with superior durability and consistent performance across variable conditions, making it particularly valuable for meeting RDE requirements.

The regulatory trajectory clearly indicates continued tightening of emission standards globally, with several jurisdictions announcing plans to phase out internal combustion engines entirely within the next 10-20 years. During this transition period, spray pyrolysis coating technology will play a crucial role in meeting increasingly stringent standards while manufacturers work toward full electrification, representing a critical bridge technology in the evolution of automotive emissions control.

Cost-Benefit Analysis of Spray Pyrolysis vs. Traditional Methods

When evaluating spray pyrolysis against traditional catalyst coating methods for catalytic converters, the economic implications reveal significant advantages that justify its growing adoption in manufacturing environments. Initial capital investment for spray pyrolysis equipment typically ranges from $150,000 to $500,000, depending on production scale and automation level—approximately 15-25% higher than conventional washcoating systems. However, this premium is offset by operational efficiencies that emerge within 18-24 months of implementation.

Material utilization represents a primary cost advantage, with spray pyrolysis demonstrating 85-92% precious metal utilization compared to 60-75% for traditional methods. Given that platinum group metals (PGMs) constitute 40-60% of catalytic converter production costs, this 15-20% reduction in material waste translates to substantial savings—approximately $8-12 per unit at current market prices.

Energy consumption metrics further favor spray pyrolysis, which requires 0.8-1.2 kWh per catalytic converter unit versus 1.5-2.3 kWh for conventional processes. This 30-45% reduction yields both direct cost savings and aligns with increasingly stringent corporate sustainability mandates and carbon pricing mechanisms.

Production throughput analysis demonstrates that spray pyrolysis facilities can achieve 15-20% higher output rates with equivalent floor space, primarily due to faster processing cycles and reduced curing times. The average coating cycle is reduced from 45-60 minutes to 25-35 minutes, enabling more efficient production scheduling and capacity utilization.

Quality-related costs show marked improvement, with spray pyrolysis reducing defect rates from industry-standard 3-5% to below 1.5%. This translates to fewer warranty claims and recalls, with associated cost avoidance estimated at $3-7 per unit across production lifetime. Enhanced coating uniformity also contributes to more predictable catalyst performance and longevity.

Maintenance requirements present a mixed picture—spray pyrolysis equipment typically demands more specialized technical expertise but experiences fewer production interruptions. Annual maintenance costs average 4-6% of initial equipment value compared to 3-4% for traditional systems, though downtime incidents decrease by approximately 30%.

Regulatory compliance represents an increasingly significant cost factor, with spray pyrolysis offering superior adaptability to evolving emissions standards. This adaptability reduces the need for costly redesigns and recertifications, providing an estimated $1.2-2.5 million savings over a typical 5-7 year product lifecycle for medium-volume manufacturers.

Material utilization represents a primary cost advantage, with spray pyrolysis demonstrating 85-92% precious metal utilization compared to 60-75% for traditional methods. Given that platinum group metals (PGMs) constitute 40-60% of catalytic converter production costs, this 15-20% reduction in material waste translates to substantial savings—approximately $8-12 per unit at current market prices.

Energy consumption metrics further favor spray pyrolysis, which requires 0.8-1.2 kWh per catalytic converter unit versus 1.5-2.3 kWh for conventional processes. This 30-45% reduction yields both direct cost savings and aligns with increasingly stringent corporate sustainability mandates and carbon pricing mechanisms.

Production throughput analysis demonstrates that spray pyrolysis facilities can achieve 15-20% higher output rates with equivalent floor space, primarily due to faster processing cycles and reduced curing times. The average coating cycle is reduced from 45-60 minutes to 25-35 minutes, enabling more efficient production scheduling and capacity utilization.

Quality-related costs show marked improvement, with spray pyrolysis reducing defect rates from industry-standard 3-5% to below 1.5%. This translates to fewer warranty claims and recalls, with associated cost avoidance estimated at $3-7 per unit across production lifetime. Enhanced coating uniformity also contributes to more predictable catalyst performance and longevity.

Maintenance requirements present a mixed picture—spray pyrolysis equipment typically demands more specialized technical expertise but experiences fewer production interruptions. Annual maintenance costs average 4-6% of initial equipment value compared to 3-4% for traditional systems, though downtime incidents decrease by approximately 30%.

Regulatory compliance represents an increasingly significant cost factor, with spray pyrolysis offering superior adaptability to evolving emissions standards. This adaptability reduces the need for costly redesigns and recertifications, providing an estimated $1.2-2.5 million savings over a typical 5-7 year product lifecycle for medium-volume manufacturers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!