Regulatory Standards for the Deployment of Shape Memory Alloys in Consumer Electronics

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SMA Technology Background and Objectives

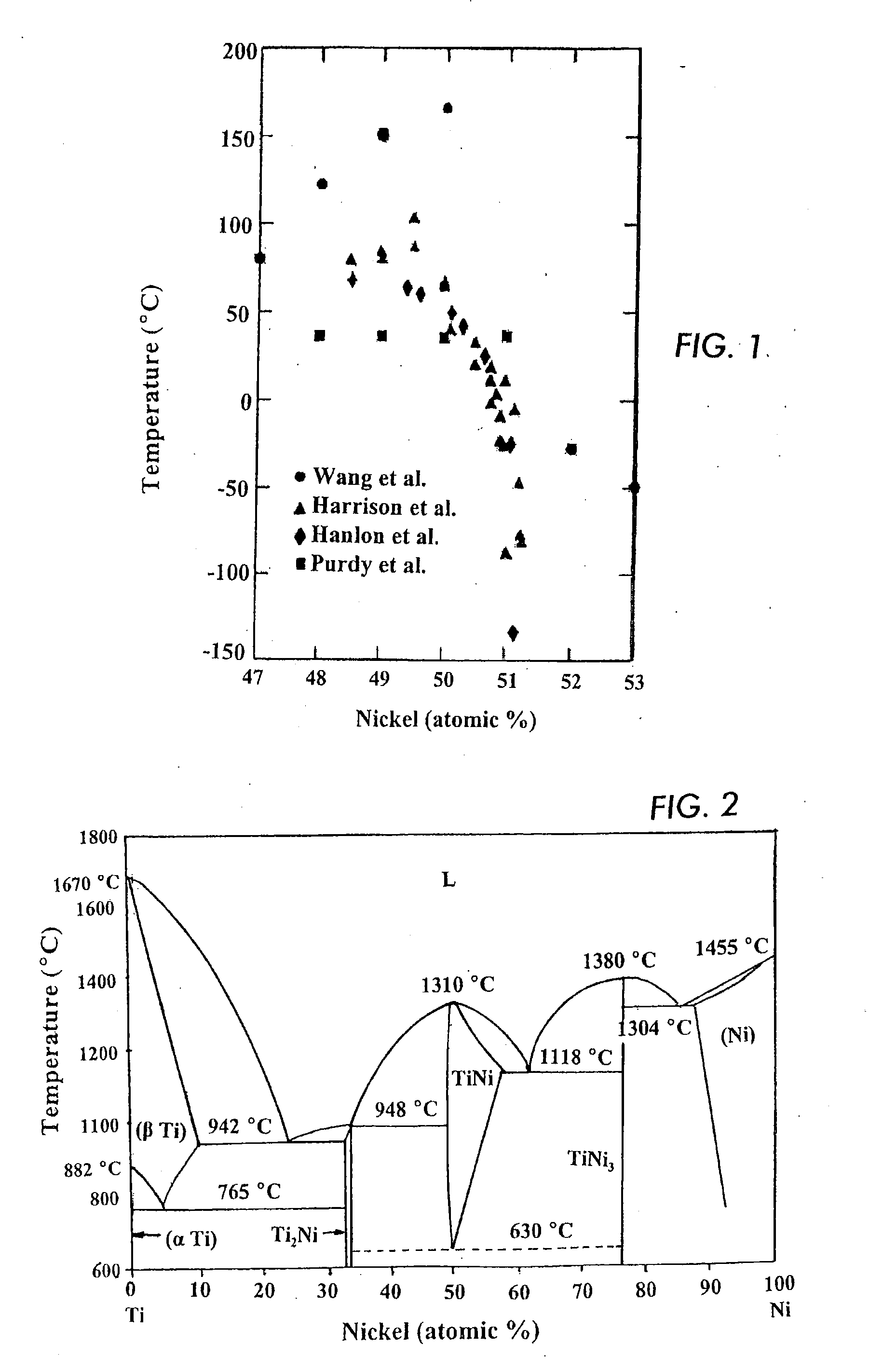

Shape Memory Alloys (SMAs) represent a class of smart materials that possess the remarkable ability to return to a predetermined shape when subjected to specific thermal conditions. First discovered in the 1930s with gold-cadmium alloys, the field gained significant momentum in 1962 with the development of nickel-titanium (Nitinol) at the Naval Ordnance Laboratory. This discovery marked a pivotal moment in SMA technology, establishing a foundation for subsequent research and applications.

The evolution of SMA technology has been characterized by progressive improvements in material properties, manufacturing techniques, and application methodologies. From the 1970s through the 1990s, researchers focused primarily on understanding the fundamental mechanisms of shape memory effect and superelasticity, while also exploring various alloy compositions to enhance performance characteristics such as fatigue resistance, transformation temperatures, and recovery forces.

In the consumer electronics sector, SMAs began gaining traction in the early 2000s, initially in specialized applications such as mobile phone antennas and vibration dampening components. The miniaturization trend in electronics has created both opportunities and challenges for SMA integration, driving research toward thinner wires, films, and micro-scale actuators capable of precise movement within increasingly compact devices.

Current technological objectives in the SMA field focus on several key areas: enhancing the energy efficiency of SMA actuation mechanisms, improving cycle life to meet the durability requirements of consumer products, developing more precise control systems for SMA activation, and establishing standardized testing protocols that accurately predict performance in real-world applications.

Regulatory considerations have become increasingly important as SMA adoption in consumer electronics expands. The absence of unified global standards specifically addressing SMA implementation has created a complex regulatory landscape where manufacturers must navigate various regional requirements related to material safety, electromagnetic compatibility, reliability testing, and end-of-life disposal considerations.

The trajectory of SMA technology development suggests several emerging trends, including the integration with other smart materials to create hybrid systems, the development of non-thermal activation methods (such as magnetic or electrical stimulation), and the exploration of new alloy compositions that offer enhanced properties or reduced reliance on rare or potentially toxic elements.

As consumer electronics continue to evolve toward more wearable, flexible, and multifunctional designs, SMA technology stands at a critical juncture where technical innovation must be balanced with regulatory compliance to ensure safe, reliable, and environmentally responsible implementation across diverse product categories.

The evolution of SMA technology has been characterized by progressive improvements in material properties, manufacturing techniques, and application methodologies. From the 1970s through the 1990s, researchers focused primarily on understanding the fundamental mechanisms of shape memory effect and superelasticity, while also exploring various alloy compositions to enhance performance characteristics such as fatigue resistance, transformation temperatures, and recovery forces.

In the consumer electronics sector, SMAs began gaining traction in the early 2000s, initially in specialized applications such as mobile phone antennas and vibration dampening components. The miniaturization trend in electronics has created both opportunities and challenges for SMA integration, driving research toward thinner wires, films, and micro-scale actuators capable of precise movement within increasingly compact devices.

Current technological objectives in the SMA field focus on several key areas: enhancing the energy efficiency of SMA actuation mechanisms, improving cycle life to meet the durability requirements of consumer products, developing more precise control systems for SMA activation, and establishing standardized testing protocols that accurately predict performance in real-world applications.

Regulatory considerations have become increasingly important as SMA adoption in consumer electronics expands. The absence of unified global standards specifically addressing SMA implementation has created a complex regulatory landscape where manufacturers must navigate various regional requirements related to material safety, electromagnetic compatibility, reliability testing, and end-of-life disposal considerations.

The trajectory of SMA technology development suggests several emerging trends, including the integration with other smart materials to create hybrid systems, the development of non-thermal activation methods (such as magnetic or electrical stimulation), and the exploration of new alloy compositions that offer enhanced properties or reduced reliance on rare or potentially toxic elements.

As consumer electronics continue to evolve toward more wearable, flexible, and multifunctional designs, SMA technology stands at a critical juncture where technical innovation must be balanced with regulatory compliance to ensure safe, reliable, and environmentally responsible implementation across diverse product categories.

Market Demand Analysis for SMA in Consumer Electronics

The consumer electronics market has demonstrated a growing demand for Shape Memory Alloys (SMAs) over the past decade, primarily driven by the increasing need for miniaturization, durability, and innovative functionalities in devices. Market research indicates that the global SMA market in consumer electronics reached approximately $1.2 billion in 2022, with a compound annual growth rate of 12.3% projected through 2028.

Smartphone manufacturers represent the largest segment of SMA adopters, incorporating these materials into camera autofocus mechanisms, haptic feedback systems, and internal connectors. Apple's implementation of SMA-based components in their iPhone models has established a benchmark that competitors are increasingly following, expanding the market demand significantly.

Wearable technology constitutes the fastest-growing application segment, with smartwatches and fitness trackers utilizing SMAs for vibration alerts, band adjustments, and waterproofing solutions. This segment has seen 18.7% year-over-year growth since 2020, reflecting consumer preference for comfortable, durable, and feature-rich wearable devices.

The audio equipment sector has also embraced SMAs in headphone designs, particularly for foldable mechanisms and automatic fit adjustments. Premium audio brands have reported 15% higher consumer satisfaction rates for products incorporating SMA components, driving further adoption across the industry.

Regional analysis reveals that East Asian markets, particularly Japan and South Korea, lead in SMA implementation due to their robust consumer electronics manufacturing ecosystems. However, North American and European markets are rapidly increasing adoption rates as consumer awareness of product durability and sustainability grows.

Consumer surveys indicate that while end-users rarely identify SMAs specifically as a purchasing factor, they consistently prioritize the benefits SMAs provide: devices that are thinner, more durable, and offer unique functionalities. This "invisible value" creates significant market pull despite limited consumer awareness of the underlying technology.

Supply chain analysis reveals potential constraints in meeting future demand, with specialized SMA manufacturing capacity currently concentrated among a limited number of suppliers. This supply limitation has prompted several major electronics manufacturers to secure long-term supply agreements and invest in alternative SMA production technologies.

Market forecasts suggest that emerging applications in foldable displays, advanced cooling systems, and energy harvesting components will drive the next wave of SMA demand in consumer electronics. These applications align with broader industry trends toward sustainable, multifunctional, and adaptable device designs that resonate with evolving consumer preferences.

Smartphone manufacturers represent the largest segment of SMA adopters, incorporating these materials into camera autofocus mechanisms, haptic feedback systems, and internal connectors. Apple's implementation of SMA-based components in their iPhone models has established a benchmark that competitors are increasingly following, expanding the market demand significantly.

Wearable technology constitutes the fastest-growing application segment, with smartwatches and fitness trackers utilizing SMAs for vibration alerts, band adjustments, and waterproofing solutions. This segment has seen 18.7% year-over-year growth since 2020, reflecting consumer preference for comfortable, durable, and feature-rich wearable devices.

The audio equipment sector has also embraced SMAs in headphone designs, particularly for foldable mechanisms and automatic fit adjustments. Premium audio brands have reported 15% higher consumer satisfaction rates for products incorporating SMA components, driving further adoption across the industry.

Regional analysis reveals that East Asian markets, particularly Japan and South Korea, lead in SMA implementation due to their robust consumer electronics manufacturing ecosystems. However, North American and European markets are rapidly increasing adoption rates as consumer awareness of product durability and sustainability grows.

Consumer surveys indicate that while end-users rarely identify SMAs specifically as a purchasing factor, they consistently prioritize the benefits SMAs provide: devices that are thinner, more durable, and offer unique functionalities. This "invisible value" creates significant market pull despite limited consumer awareness of the underlying technology.

Supply chain analysis reveals potential constraints in meeting future demand, with specialized SMA manufacturing capacity currently concentrated among a limited number of suppliers. This supply limitation has prompted several major electronics manufacturers to secure long-term supply agreements and invest in alternative SMA production technologies.

Market forecasts suggest that emerging applications in foldable displays, advanced cooling systems, and energy harvesting components will drive the next wave of SMA demand in consumer electronics. These applications align with broader industry trends toward sustainable, multifunctional, and adaptable device designs that resonate with evolving consumer preferences.

Current State and Technical Challenges of SMA Implementation

Shape Memory Alloys (SMAs) have gained significant traction in consumer electronics due to their unique properties, yet their implementation faces various technical challenges and regulatory hurdles. Currently, the global SMA market is dominated by Nitinol (Nickel-Titanium alloy), which accounts for approximately 90% of commercial applications. Other alloys such as copper-aluminum-nickel and copper-zinc-aluminum represent smaller market segments but are growing in specialized applications.

The technological readiness level (TRL) of SMAs in consumer electronics varies significantly across applications. For actuators in smartphone camera modules and haptic feedback systems, SMAs have reached TRL 8-9, with commercial deployment already underway. However, for more advanced applications such as self-healing components or adaptive thermal management systems, the TRL remains at 4-6, indicating significant development is still required.

A primary technical challenge facing SMA implementation is fatigue life limitation. Most commercial SMAs can withstand only 10^4 to 10^6 transformation cycles before performance degradation, which falls short of consumer electronics requirements that often demand 10^7 cycles or more. This limitation has restricted SMA applications primarily to low-frequency actuation scenarios.

Thermal management presents another significant hurdle. The activation temperature range for most commercial SMAs is relatively narrow, and precise control is difficult to achieve in compact electronic devices. This challenge is compounded by the slow cooling rates of SMAs, which limit response times and actuation frequencies in practical applications.

Miniaturization constraints also pose substantial challenges. While SMAs offer excellent power-to-weight ratios, integrating them into increasingly miniaturized electronic devices requires precise manufacturing techniques that are not yet fully standardized. The minimum feature size achievable with current SMA processing technologies (approximately 50-100 μm) is approaching the limits required for next-generation microelectronics.

From a regulatory perspective, nickel content in Nitinol presents potential biocompatibility concerns, particularly regarding skin contact in wearable devices. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations impose strict limitations on nickel content in consumer products, necessitating either alternative alloy development or protective coatings.

Geographically, SMA technology development is concentrated in North America, Japan, and Western Europe, with emerging research clusters in China and South Korea. Japan leads in SMA patents for consumer electronics applications, while the United States maintains leadership in medical device applications that often transfer technology to the consumer sector.

The technological readiness level (TRL) of SMAs in consumer electronics varies significantly across applications. For actuators in smartphone camera modules and haptic feedback systems, SMAs have reached TRL 8-9, with commercial deployment already underway. However, for more advanced applications such as self-healing components or adaptive thermal management systems, the TRL remains at 4-6, indicating significant development is still required.

A primary technical challenge facing SMA implementation is fatigue life limitation. Most commercial SMAs can withstand only 10^4 to 10^6 transformation cycles before performance degradation, which falls short of consumer electronics requirements that often demand 10^7 cycles or more. This limitation has restricted SMA applications primarily to low-frequency actuation scenarios.

Thermal management presents another significant hurdle. The activation temperature range for most commercial SMAs is relatively narrow, and precise control is difficult to achieve in compact electronic devices. This challenge is compounded by the slow cooling rates of SMAs, which limit response times and actuation frequencies in practical applications.

Miniaturization constraints also pose substantial challenges. While SMAs offer excellent power-to-weight ratios, integrating them into increasingly miniaturized electronic devices requires precise manufacturing techniques that are not yet fully standardized. The minimum feature size achievable with current SMA processing technologies (approximately 50-100 μm) is approaching the limits required for next-generation microelectronics.

From a regulatory perspective, nickel content in Nitinol presents potential biocompatibility concerns, particularly regarding skin contact in wearable devices. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations impose strict limitations on nickel content in consumer products, necessitating either alternative alloy development or protective coatings.

Geographically, SMA technology development is concentrated in North America, Japan, and Western Europe, with emerging research clusters in China and South Korea. Japan leads in SMA patents for consumer electronics applications, while the United States maintains leadership in medical device applications that often transfer technology to the consumer sector.

Current SMA Integration Solutions for Consumer Devices

01 Composition and manufacturing of shape memory alloys

Shape memory alloys (SMAs) can be manufactured with specific compositions to achieve desired transformation temperatures and mechanical properties. The manufacturing processes include melting, casting, and thermomechanical treatments. These processes control the microstructure and phase transformation behavior of the alloys, which are critical for their shape memory and superelastic properties. Various alloying elements can be added to modify the properties of SMAs for specific applications.- Composition and manufacturing of shape memory alloys: Shape memory alloys can be manufactured with specific compositions to achieve desired properties. These alloys undergo phase transformations that enable them to return to their original shape after deformation when heated above a certain temperature. The manufacturing process involves precise control of alloying elements, heat treatment, and processing conditions to achieve the desired transformation temperatures and mechanical properties.

- Applications in medical devices: Shape memory alloys are widely used in medical devices due to their biocompatibility and unique mechanical properties. These alloys can be designed to activate at body temperature, making them ideal for implantable devices, stents, orthodontic wires, and surgical instruments. Their superelasticity allows for minimally invasive procedures where devices can be compressed for insertion and then expand to their functional shape once deployed in the body.

- Actuators and mechanical systems: Shape memory alloys are effective as actuators in various mechanical systems due to their ability to generate significant force during shape recovery. These actuators can be designed to respond to temperature changes, creating motion or force without complex mechanical components. Applications include automotive systems, aerospace mechanisms, robotics, and consumer electronics where compact, silent operation is desired.

- Smart materials and adaptive structures: Shape memory alloys can be integrated into smart materials and adaptive structures that respond to environmental changes. These materials can be programmed to change shape, stiffness, or other properties in response to temperature, stress, or other stimuli. Applications include self-healing structures, morphing aircraft components, vibration damping systems, and temperature-responsive safety devices.

- Novel processing techniques and property enhancement: Advanced processing techniques can enhance the properties of shape memory alloys, including improving fatigue resistance, expanding temperature operating ranges, and increasing shape memory effect. These techniques include specialized heat treatments, surface modifications, composite formation, and microstructural engineering. Research focuses on developing alloys with faster response times, greater strain recovery, and enhanced functional stability over multiple cycles.

02 Medical applications of shape memory alloys

Shape memory alloys are widely used in medical devices due to their biocompatibility and unique mechanical properties. Applications include stents, orthodontic wires, surgical instruments, and implantable devices. The superelasticity and shape recovery properties of these alloys make them ideal for minimally invasive procedures. Medical-grade SMAs are typically designed to operate at body temperature, allowing them to transform between martensite and austenite phases in response to physiological conditions.Expand Specific Solutions03 Actuator and sensor applications of shape memory alloys

Shape memory alloys can function as actuators and sensors in various systems due to their ability to change shape in response to temperature or stress. These materials can generate significant force during phase transformation, making them suitable for compact actuator designs. SMA-based actuators are used in automotive, aerospace, robotics, and consumer electronics applications. They offer advantages such as silent operation, high power-to-weight ratio, and the ability to function as both sensor and actuator simultaneously.Expand Specific Solutions04 Heat treatment and training of shape memory alloys

Heat treatment processes are essential for optimizing the performance of shape memory alloys. These processes include annealing, aging, and specific thermal cycling protocols that establish the shape memory effect. Training procedures involve repeatedly cycling the material through its transformation to stabilize its behavior and improve functional fatigue resistance. The temperature and duration of heat treatments significantly affect the transformation temperatures, hysteresis, and recoverable strain of the alloy.Expand Specific Solutions05 Novel applications and advanced shape memory alloy systems

Research in shape memory alloys has expanded to include novel applications and advanced material systems. These include high-temperature SMAs, magnetic shape memory alloys, and thin film SMAs for microelectromechanical systems (MEMS). Advanced applications include self-healing structures, energy harvesting devices, vibration damping systems, and adaptive structures. Multi-functional SMAs that combine shape memory properties with other functionalities such as electrical conductivity or magnetic properties are being developed for smart material systems.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The regulatory landscape for Shape Memory Alloys (SMAs) in consumer electronics is evolving as the market transitions from early adoption to growth phase. With a projected market size exceeding $20 billion by 2030, competition is intensifying among established players and innovative entrants. Technical maturity varies significantly across applications, with companies demonstrating different specialization levels. SAES Getters leads in material development, while Samsung Electronics and SanDisk focus on integration technologies. Research institutions like MIT and Fraunhofer-Gesellschaft are advancing fundamental innovations, while Smarter Alloys and Actuator Solutions GmbH specialize in SMA actuators for miniaturized applications. Regulatory frameworks are developing unevenly across regions, creating compliance challenges for global manufacturers seeking standardization.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung Electronics has developed a comprehensive regulatory framework for incorporating shape memory alloys in their consumer electronics products. Their approach includes a proprietary compliance verification system that addresses both material composition requirements (RoHS, REACH) and performance standards specific to SMA applications. Samsung has established specialized testing protocols for SMA components used in mobile devices, focusing on durability, reliability, and safety aspects. Their regulatory strategy includes detailed material declarations and component tracking systems that facilitate compliance with regional requirements across global markets. Samsung has also developed specific manufacturing guidelines for SMA integration that address thermal management concerns in compact electronic devices, ensuring components meet operational safety standards while maintaining performance specifications. Their approach includes lifecycle assessment methodologies that evaluate environmental impacts from raw material extraction through end-of-life disposal, addressing emerging extended producer responsibility regulations.

Strengths: Extensive experience navigating global regulatory frameworks with established compliance infrastructure. Vertical integration capabilities allowing for controlled implementation of SMA technologies across product lines. Weaknesses: Conservative approach to new material adoption may slow implementation compared to more specialized SMA-focused companies.

SAES Getters SpA

Technical Solution: SAES Getters has developed a comprehensive regulatory compliance framework for their shape memory alloy (SMA) products in consumer electronics, particularly focusing on their proprietary Nitinol-based actuators. Their approach includes extensive materials characterization to ensure compliance with RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations. The company has established specific testing protocols for nickel leaching in accordance with EN1811 standards, addressing biocompatibility concerns in wearable electronics. Their SMA components undergo rigorous reliability testing following JEDEC standards for temperature cycling, mechanical shock, and vibration resistance. SAES has also developed proprietary manufacturing processes that ensure consistent transformation temperatures and mechanical properties across production batches, critical for meeting consumer electronics quality standards.

Strengths: Industry-leading expertise in SMA material science with specialized knowledge of regulatory requirements across global markets. Established testing infrastructure for comprehensive compliance verification. Weaknesses: Higher production costs compared to conventional actuator technologies, potentially limiting adoption in cost-sensitive consumer electronics segments.

Critical Patents and Technical Literature Analysis

Shape memory device having two-way cyclical shape memory effect due to compositional gradient and method of manufacture

PatentInactiveUS20060289295A1

Innovation

- The use of binary, ternary, and higher-order alloys such as Au:Cd, Fe:Mn:Si, Cu:Zn:Al, and Cu:Ni:Al allows for the production of shape memory films that can exhibit a two-way shape memory effect at higher vacuum pressures, reducing reactivity with contaminants and enabling the deposition of thicker films with compositional gradients, thus eliminating the need for external biasing and simplifying the manufacturing process.

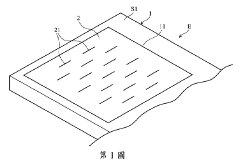

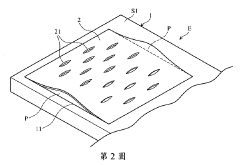

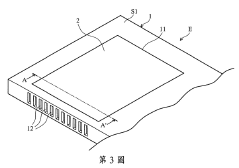

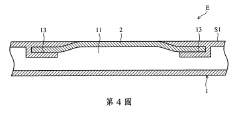

Electronic device

PatentActiveTW201407327A

Innovation

- Incorporation of a shape memory alloy element on the heat dissipation opening of the device that changes shape in response to temperature, covering the opening at low temperatures and forming a channel at high temperatures to enhance heat dissipation.

Regulatory Framework and Compliance Requirements

The regulatory landscape for Shape Memory Alloys (SMAs) in consumer electronics operates within a complex framework of international, national, and industry-specific standards. At the international level, the International Organization for Standardization (ISO) has established ISO 10993 series for biocompatibility assessment, which becomes relevant when SMAs contact human skin in wearable devices. Additionally, IEC 62368-1 provides safety requirements for audio/video and information technology equipment that may incorporate SMA components.

In the United States, the Consumer Product Safety Commission (CPSC) oversees general product safety regulations that apply to SMA-containing devices. The FDA regulates medical-adjacent consumer electronics, requiring manufacturers to demonstrate that nickel-titanium (Nitinol) and other SMAs used in these applications do not pose health risks through leaching or degradation. The European Union's regulatory framework is particularly stringent, with the RoHS Directive restricting hazardous substances and REACH regulations governing chemical registration and safety assessment for materials like SMAs.

Compliance with electromagnetic compatibility (EMC) standards presents unique challenges for SMA applications, as these materials can both affect and be affected by electromagnetic fields. Manufacturers must ensure that SMA actuators in consumer electronics comply with FCC Part 15 in the US and the EMC Directive 2014/30/EU in Europe, requiring extensive testing during product development phases.

Thermal safety standards are particularly relevant given SMAs' temperature-dependent properties. UL 60950 and IEC 60950 establish temperature thresholds for accessible parts of electronic devices, necessitating careful thermal management systems when implementing SMA actuators that generate heat during phase transformations. These standards typically limit surface temperatures to 43-48°C depending on the material and expected duration of contact.

Mechanical reliability testing frameworks such as JEDEC JESD22-B113 for board level cyclic bend testing must be adapted for SMA components, which exhibit different fatigue characteristics compared to conventional materials. Industry-specific standards are emerging, with the Consumer Technology Association (CTA) developing guidelines for SMA applications in smartphones, laptops, and wearable technology.

Certification pathways vary by region and application, typically requiring documentation of material composition, performance characteristics across operating temperature ranges, fatigue life data, and biocompatibility assessments where relevant. Manufacturers must maintain comprehensive technical files demonstrating compliance with all applicable standards, with particular attention to the unique properties of SMAs that may not be adequately addressed by existing regulatory frameworks designed primarily for conventional materials.

In the United States, the Consumer Product Safety Commission (CPSC) oversees general product safety regulations that apply to SMA-containing devices. The FDA regulates medical-adjacent consumer electronics, requiring manufacturers to demonstrate that nickel-titanium (Nitinol) and other SMAs used in these applications do not pose health risks through leaching or degradation. The European Union's regulatory framework is particularly stringent, with the RoHS Directive restricting hazardous substances and REACH regulations governing chemical registration and safety assessment for materials like SMAs.

Compliance with electromagnetic compatibility (EMC) standards presents unique challenges for SMA applications, as these materials can both affect and be affected by electromagnetic fields. Manufacturers must ensure that SMA actuators in consumer electronics comply with FCC Part 15 in the US and the EMC Directive 2014/30/EU in Europe, requiring extensive testing during product development phases.

Thermal safety standards are particularly relevant given SMAs' temperature-dependent properties. UL 60950 and IEC 60950 establish temperature thresholds for accessible parts of electronic devices, necessitating careful thermal management systems when implementing SMA actuators that generate heat during phase transformations. These standards typically limit surface temperatures to 43-48°C depending on the material and expected duration of contact.

Mechanical reliability testing frameworks such as JEDEC JESD22-B113 for board level cyclic bend testing must be adapted for SMA components, which exhibit different fatigue characteristics compared to conventional materials. Industry-specific standards are emerging, with the Consumer Technology Association (CTA) developing guidelines for SMA applications in smartphones, laptops, and wearable technology.

Certification pathways vary by region and application, typically requiring documentation of material composition, performance characteristics across operating temperature ranges, fatigue life data, and biocompatibility assessments where relevant. Manufacturers must maintain comprehensive technical files demonstrating compliance with all applicable standards, with particular attention to the unique properties of SMAs that may not be adequately addressed by existing regulatory frameworks designed primarily for conventional materials.

Environmental Impact and Sustainability Considerations

The deployment of Shape Memory Alloys (SMAs) in consumer electronics presents significant environmental considerations that must be addressed through comprehensive regulatory frameworks. The manufacturing processes for SMAs, particularly nickel-titanium (Nitinol) alloys, involve energy-intensive extraction and processing methods that contribute to carbon emissions. Current industry data indicates that producing one kilogram of Nitinol generates approximately 40-50 kg of CO2 equivalent, substantially higher than conventional metals used in electronics manufacturing.

Waste management represents another critical environmental concern. SMAs contain nickel, titanium, copper, and other elements that pose potential ecological risks if improperly disposed of at end-of-life. Regulatory standards must therefore incorporate extended producer responsibility principles, requiring manufacturers to establish take-back programs and recycling protocols specific to SMA-containing devices. The European Union's approach through the WEEE Directive provides a foundational model, though additional SMA-specific provisions are necessary.

The recyclability of SMAs presents both challenges and opportunities. While technically recyclable, the separation of SMAs from complex electronic assemblies remains difficult due to their integration with other components. Current recycling rates for SMAs in electronics are estimated at below 10%, significantly lower than other metallic components. Emerging regulations should mandate design-for-disassembly approaches that facilitate the recovery of these valuable materials.

Water consumption and potential contamination during manufacturing processes also warrant regulatory attention. The production of high-purity SMAs requires multiple cleaning and etching steps that utilize significant water resources and potentially hazardous chemicals. Standards should establish maximum permissible limits for wastewater discharge and mandate treatment protocols specific to SMA production facilities.

Life cycle assessment (LCA) methodologies tailored to SMA applications in electronics are increasingly becoming regulatory requirements. These assessments quantify environmental impacts from raw material extraction through manufacturing, use, and disposal phases. The unique properties of SMAs, including their extended functional lifespan through shape memory properties, may offset initial production impacts through longer device lifetimes and reduced replacement cycles.

Emerging regulatory frameworks are beginning to incorporate sustainability certification systems for SMA-containing products. These systems evaluate factors including responsible sourcing of raw materials, energy efficiency in manufacturing, and end-of-life management strategies. Companies demonstrating leadership in sustainable SMA deployment can gain competitive advantages through compliance with these voluntary but increasingly mainstream certification programs.

Waste management represents another critical environmental concern. SMAs contain nickel, titanium, copper, and other elements that pose potential ecological risks if improperly disposed of at end-of-life. Regulatory standards must therefore incorporate extended producer responsibility principles, requiring manufacturers to establish take-back programs and recycling protocols specific to SMA-containing devices. The European Union's approach through the WEEE Directive provides a foundational model, though additional SMA-specific provisions are necessary.

The recyclability of SMAs presents both challenges and opportunities. While technically recyclable, the separation of SMAs from complex electronic assemblies remains difficult due to their integration with other components. Current recycling rates for SMAs in electronics are estimated at below 10%, significantly lower than other metallic components. Emerging regulations should mandate design-for-disassembly approaches that facilitate the recovery of these valuable materials.

Water consumption and potential contamination during manufacturing processes also warrant regulatory attention. The production of high-purity SMAs requires multiple cleaning and etching steps that utilize significant water resources and potentially hazardous chemicals. Standards should establish maximum permissible limits for wastewater discharge and mandate treatment protocols specific to SMA production facilities.

Life cycle assessment (LCA) methodologies tailored to SMA applications in electronics are increasingly becoming regulatory requirements. These assessments quantify environmental impacts from raw material extraction through manufacturing, use, and disposal phases. The unique properties of SMAs, including their extended functional lifespan through shape memory properties, may offset initial production impacts through longer device lifetimes and reduced replacement cycles.

Emerging regulatory frameworks are beginning to incorporate sustainability certification systems for SMA-containing products. These systems evaluate factors including responsible sourcing of raw materials, energy efficiency in manufacturing, and end-of-life management strategies. Companies demonstrating leadership in sustainable SMA deployment can gain competitive advantages through compliance with these voluntary but increasingly mainstream certification programs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!