Shape Memory Alloys: Patent Landscape and Intellectual Property Challenges

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SMA Technology Background and Objectives

Shape Memory Alloys (SMAs) represent a unique class of functional materials that possess the remarkable ability to "remember" and return to their original shape after deformation when subjected to specific thermal, mechanical, or magnetic stimuli. First discovered in the 1930s with gold-cadmium alloys, the field gained significant momentum in the 1960s with the discovery of nickel-titanium (Nitinol) by the Naval Ordnance Laboratory, marking a pivotal moment in SMA development.

The evolution of SMA technology has progressed through several distinct phases, beginning with fundamental material discovery, advancing through characterization of mechanical properties, and now focusing on specialized applications and novel compositions. Current research trends indicate growing interest in high-temperature SMAs, magnetic shape memory alloys, and thin-film SMA technologies for micro-electromechanical systems (MEMS).

Global patent activity in SMA technology has shown exponential growth over the past two decades, with particularly intense filing activity in medical devices, aerospace components, and automotive applications. This surge reflects the expanding commercial potential of these materials across diverse industrial sectors. The intellectual property landscape has become increasingly complex, with overlapping patent claims and cross-licensing agreements becoming common in mature application areas.

The primary technical objectives in contemporary SMA research include enhancing transformation temperature ranges, improving fatigue resistance, increasing actuation speed, and developing cost-effective manufacturing processes. Researchers are particularly focused on overcoming the inherent limitations of traditional SMAs, such as relatively slow response times, limited strain recovery, and susceptibility to functional fatigue after repeated cycling.

From an intellectual property perspective, the field faces several challenges, including the maturation of foundational patents for Nitinol applications, increasing competition from emerging economies with growing SMA research capabilities, and the complex interplay between material composition patents and application-specific patents. The strategic management of SMA intellectual property has become crucial for companies seeking competitive advantage in this space.

The convergence of SMA technology with other emerging fields, such as additive manufacturing, nanotechnology, and artificial intelligence for materials design, presents new frontiers for innovation and corresponding intellectual property opportunities. These intersections are expected to drive the next wave of technological breakthroughs and patent activity in the SMA domain.

The evolution of SMA technology has progressed through several distinct phases, beginning with fundamental material discovery, advancing through characterization of mechanical properties, and now focusing on specialized applications and novel compositions. Current research trends indicate growing interest in high-temperature SMAs, magnetic shape memory alloys, and thin-film SMA technologies for micro-electromechanical systems (MEMS).

Global patent activity in SMA technology has shown exponential growth over the past two decades, with particularly intense filing activity in medical devices, aerospace components, and automotive applications. This surge reflects the expanding commercial potential of these materials across diverse industrial sectors. The intellectual property landscape has become increasingly complex, with overlapping patent claims and cross-licensing agreements becoming common in mature application areas.

The primary technical objectives in contemporary SMA research include enhancing transformation temperature ranges, improving fatigue resistance, increasing actuation speed, and developing cost-effective manufacturing processes. Researchers are particularly focused on overcoming the inherent limitations of traditional SMAs, such as relatively slow response times, limited strain recovery, and susceptibility to functional fatigue after repeated cycling.

From an intellectual property perspective, the field faces several challenges, including the maturation of foundational patents for Nitinol applications, increasing competition from emerging economies with growing SMA research capabilities, and the complex interplay between material composition patents and application-specific patents. The strategic management of SMA intellectual property has become crucial for companies seeking competitive advantage in this space.

The convergence of SMA technology with other emerging fields, such as additive manufacturing, nanotechnology, and artificial intelligence for materials design, presents new frontiers for innovation and corresponding intellectual property opportunities. These intersections are expected to drive the next wave of technological breakthroughs and patent activity in the SMA domain.

Market Applications and Demand Analysis

The global market for Shape Memory Alloys (SMAs) has been experiencing significant growth, driven by their unique properties of shape recovery and superelasticity. The market was valued at approximately $10.6 billion in 2020 and is projected to reach $19.5 billion by 2027, growing at a CAGR of around 9.2% during this period. This growth trajectory underscores the increasing adoption of SMAs across various industries.

The medical sector represents the largest application segment for SMAs, accounting for over 40% of the total market share. Within healthcare, these alloys are extensively used in orthopedic implants, stents, surgical instruments, and dental applications. The demand is particularly strong for Nitinol (Nickel-Titanium alloy) due to its biocompatibility and mechanical properties that closely mimic human tissues.

Aerospace and automotive industries collectively constitute the second-largest market segment. In aerospace, SMAs are utilized in adaptive wing structures, vibration damping systems, and actuators. The automotive sector employs these materials in safety mechanisms, engine components, and increasingly in electric vehicle thermal management systems. The push toward lightweight materials in both industries is expected to further accelerate SMA adoption.

Consumer electronics represents an emerging high-growth application area, with SMAs being incorporated into smartphones, wearable devices, and haptic feedback systems. This segment is projected to grow at the highest rate among all applications, driven by miniaturization trends and the need for durable, space-efficient components.

Regional analysis indicates that North America currently leads the global SMA market with approximately 35% share, followed closely by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to witness the fastest growth rate due to rapid industrialization, increasing healthcare expenditure, and expanding manufacturing capabilities in countries like China, Japan, and South Korea.

Market challenges include the high cost of raw materials, complex manufacturing processes, and limited awareness about SMA capabilities among potential end-users. Additionally, there exists a significant gap between laboratory research and commercial applications, with many innovative SMA applications still confined to academic settings.

Customer demand analysis reveals growing interest in SMAs with enhanced functional properties, including wider transformation temperature ranges, improved fatigue resistance, and faster response times. There is also increasing demand for SMAs that can be processed using conventional manufacturing techniques to reduce production costs and increase accessibility.

The medical sector represents the largest application segment for SMAs, accounting for over 40% of the total market share. Within healthcare, these alloys are extensively used in orthopedic implants, stents, surgical instruments, and dental applications. The demand is particularly strong for Nitinol (Nickel-Titanium alloy) due to its biocompatibility and mechanical properties that closely mimic human tissues.

Aerospace and automotive industries collectively constitute the second-largest market segment. In aerospace, SMAs are utilized in adaptive wing structures, vibration damping systems, and actuators. The automotive sector employs these materials in safety mechanisms, engine components, and increasingly in electric vehicle thermal management systems. The push toward lightweight materials in both industries is expected to further accelerate SMA adoption.

Consumer electronics represents an emerging high-growth application area, with SMAs being incorporated into smartphones, wearable devices, and haptic feedback systems. This segment is projected to grow at the highest rate among all applications, driven by miniaturization trends and the need for durable, space-efficient components.

Regional analysis indicates that North America currently leads the global SMA market with approximately 35% share, followed closely by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to witness the fastest growth rate due to rapid industrialization, increasing healthcare expenditure, and expanding manufacturing capabilities in countries like China, Japan, and South Korea.

Market challenges include the high cost of raw materials, complex manufacturing processes, and limited awareness about SMA capabilities among potential end-users. Additionally, there exists a significant gap between laboratory research and commercial applications, with many innovative SMA applications still confined to academic settings.

Customer demand analysis reveals growing interest in SMAs with enhanced functional properties, including wider transformation temperature ranges, improved fatigue resistance, and faster response times. There is also increasing demand for SMAs that can be processed using conventional manufacturing techniques to reduce production costs and increase accessibility.

Global SMA Development Status and Barriers

Shape Memory Alloys (SMAs) have witnessed significant global development over the past decades, with varying levels of research intensity and commercial application across different regions. The United States, Japan, China, and several European countries currently lead in SMA research and development. The U.S. maintains a strong position in aerospace and biomedical applications, while Japan excels in consumer electronics and automotive implementations. China has rapidly expanded its SMA manufacturing capabilities, focusing on cost-effective production methods for various industrial applications.

Despite this progress, several critical barriers impede the widespread adoption of SMAs across industries. Technical challenges remain prominent, particularly in improving the fatigue life of these materials under cyclic loading conditions. Most commercial SMAs can withstand only 10^4 to 10^6 transformation cycles before failure, which limits their application in high-cycle scenarios. Additionally, the narrow temperature window for transformation in many SMAs restricts their operational environments.

Manufacturing scalability presents another significant barrier. Current production methods for high-quality SMAs often involve complex thermomechanical processing that is difficult to standardize across large production volumes. This results in batch-to-batch variability that complicates quality control and certification processes, especially for critical applications in aerospace and medical devices.

Cost factors continue to constrain market expansion, with high-purity nickel-titanium alloys commanding premium prices that make them prohibitive for many potential applications. Alternative SMAs based on copper or iron systems offer lower costs but typically exhibit inferior performance characteristics, creating a persistent performance-cost tradeoff that limits market penetration.

Regulatory hurdles further complicate global SMA development, particularly in biomedical applications where extensive clinical trials and certification processes are required. The lack of standardized testing protocols and material specifications across different jurisdictions creates additional barriers to international commercialization efforts.

Knowledge gaps in fundamental material science also persist. The complex microstructural evolution during thermomechanical cycling is not fully understood, making it difficult to predict long-term material behavior accurately. This scientific uncertainty translates into engineering conservatism, where designers apply large safety factors that often negate the weight and space advantages that SMAs potentially offer.

Intellectual property fragmentation represents another significant barrier, with patent thickets forming around specific compositions and processing techniques. This complex IP landscape forces new market entrants to navigate a challenging legal environment or invest in developing entirely novel approaches to avoid infringement issues.

Despite this progress, several critical barriers impede the widespread adoption of SMAs across industries. Technical challenges remain prominent, particularly in improving the fatigue life of these materials under cyclic loading conditions. Most commercial SMAs can withstand only 10^4 to 10^6 transformation cycles before failure, which limits their application in high-cycle scenarios. Additionally, the narrow temperature window for transformation in many SMAs restricts their operational environments.

Manufacturing scalability presents another significant barrier. Current production methods for high-quality SMAs often involve complex thermomechanical processing that is difficult to standardize across large production volumes. This results in batch-to-batch variability that complicates quality control and certification processes, especially for critical applications in aerospace and medical devices.

Cost factors continue to constrain market expansion, with high-purity nickel-titanium alloys commanding premium prices that make them prohibitive for many potential applications. Alternative SMAs based on copper or iron systems offer lower costs but typically exhibit inferior performance characteristics, creating a persistent performance-cost tradeoff that limits market penetration.

Regulatory hurdles further complicate global SMA development, particularly in biomedical applications where extensive clinical trials and certification processes are required. The lack of standardized testing protocols and material specifications across different jurisdictions creates additional barriers to international commercialization efforts.

Knowledge gaps in fundamental material science also persist. The complex microstructural evolution during thermomechanical cycling is not fully understood, making it difficult to predict long-term material behavior accurately. This scientific uncertainty translates into engineering conservatism, where designers apply large safety factors that often negate the weight and space advantages that SMAs potentially offer.

Intellectual property fragmentation represents another significant barrier, with patent thickets forming around specific compositions and processing techniques. This complex IP landscape forces new market entrants to navigate a challenging legal environment or invest in developing entirely novel approaches to avoid infringement issues.

Current SMA Patent Solutions and Approaches

01 Composition and manufacturing of shape memory alloys

Shape memory alloys (SMAs) can be manufactured with specific compositions to achieve desired properties. These alloys undergo phase transformations that enable them to return to their original shape after deformation when heated. Manufacturing processes include precise control of alloying elements, heat treatments, and processing techniques to optimize the shape memory effect and superelasticity. Advanced production methods ensure consistent quality and performance characteristics for various applications.- Composition and manufacturing of shape memory alloys: Various methods and compositions for manufacturing shape memory alloys with specific properties. These include techniques for processing alloys to achieve desired transformation temperatures, mechanical properties, and shape memory effects. The manufacturing processes involve specific heat treatments, mechanical working, and composition control to enhance the functional properties of these materials.

- Medical applications of shape memory alloys: Shape memory alloys are extensively used in medical devices and implants due to their biocompatibility and unique mechanical properties. Applications include stents, orthodontic wires, surgical instruments, and implantable devices that can change shape at body temperature. These materials enable minimally invasive procedures and self-adjusting implants that respond to physiological conditions.

- Actuators and mechanical systems using shape memory alloys: Shape memory alloys are utilized in various actuator systems and mechanical devices that require controlled movement or force generation. These include micro-actuators, valves, switches, and motion control systems that leverage the temperature-dependent shape recovery properties of these materials. The technology enables compact, silent operation with high force-to-weight ratios in applications ranging from automotive to aerospace systems.

- Advanced processing techniques for shape memory alloys: Innovative processing methods to enhance the performance characteristics of shape memory alloys, including specialized heat treatments, surface modifications, and microstructural engineering. These techniques aim to improve fatigue resistance, functional stability, and response time of the alloys. Advanced processing includes laser treatment, powder metallurgy, and novel thermomechanical processing routes to achieve specific functional properties.

- Novel applications and emerging technologies: Emerging applications and innovative uses of shape memory alloys in fields such as robotics, smart textiles, energy harvesting, and adaptive structures. These include self-healing materials, reconfigurable structures, and responsive systems that can adapt to environmental changes. The technologies leverage the unique properties of shape memory alloys to create smart systems with programmable responses to external stimuli.

02 Medical applications of shape memory alloys

Shape memory alloys are extensively used in medical devices due to their biocompatibility and unique mechanical properties. Applications include stents, orthodontic wires, surgical instruments, and implantable devices. The superelastic behavior of these alloys allows for minimally invasive procedures, as devices can be compressed for insertion and then expand to their functional shape when deployed in the body. These materials provide advantages in terms of flexibility, durability, and adaptability to anatomical structures.Expand Specific Solutions03 Actuators and mechanical systems using shape memory alloys

Shape memory alloys are utilized in actuator systems that convert thermal energy into mechanical motion. These actuators can generate significant force and displacement when heated, making them suitable for applications requiring compact, silent operation. They are implemented in various mechanical systems including automotive components, aerospace mechanisms, robotics, and consumer electronics. The temperature-dependent actuation provides advantages in systems where traditional motors or hydraulics would be impractical.Expand Specific Solutions04 Advanced processing techniques for shape memory alloys

Innovative processing techniques have been developed to enhance the properties and performance of shape memory alloys. These include specialized heat treatments, thermomechanical processing, surface modifications, and microstructural engineering. Advanced manufacturing methods such as powder metallurgy, additive manufacturing, and precision forming enable the production of complex geometries with optimized shape memory characteristics. These techniques allow for customization of transformation temperatures, fatigue resistance, and response times.Expand Specific Solutions05 Smart materials and systems incorporating shape memory alloys

Shape memory alloys are integrated into smart material systems that can respond to environmental changes. These intelligent systems combine SMAs with sensors, control electronics, and other functional materials to create adaptive structures and self-regulating mechanisms. Applications include self-healing components, reconfigurable structures, vibration damping systems, and temperature-responsive devices. The integration of shape memory alloys enables the development of multifunctional materials with programmable responses to external stimuli.Expand Specific Solutions

Key Industry Players and Competition Landscape

Shape Memory Alloys (SMAs) are currently in a growth phase, with the global market expected to reach significant expansion due to increasing applications in aerospace, automotive, and medical sectors. The technology has matured considerably, with major players like Boeing, Honeywell International, and 3M Innovative Properties leading commercial applications. Academic institutions such as Northwestern University, University of Connecticut, and University of Florida are driving fundamental research advancements. Chinese universities including Zhejiang University and Harbin Institute of Technology are rapidly increasing their patent portfolios, while companies like Smarter Alloys are developing specialized applications. The competitive landscape shows a balance between established industrial players focusing on practical applications and academic institutions pursuing novel compositions and manufacturing techniques.

University of Connecticut

Technical Solution: The University of Connecticut has developed advanced shape memory alloy (SMA) technologies focusing on high-temperature applications and biomedical devices. Their research includes novel NiTiHf and NiTiZr alloys with transformation temperatures exceeding 100°C, addressing limitations of conventional NiTi alloys[1]. Their patented processing techniques enhance functional stability through targeted precipitation strengthening and thermomechanical treatments. The university has pioneered microstructural engineering approaches that significantly improve cyclic stability and work output of SMAs[3]. Their biomedical research includes developing biocompatible porous NiTi scaffolds with controlled transformation properties for orthopedic implants, and thin-film SMA actuators for minimally invasive surgical tools[5]. They've also established comprehensive characterization protocols for evaluating SMA fatigue life and functional degradation under complex loading conditions.

Strengths: Strong expertise in high-temperature SMAs and biomedical applications with superior functional stability and fatigue resistance. Weaknesses: Some technologies remain in laboratory phase with challenges in scaling to commercial production, and potential regulatory hurdles for biomedical applications.

The Boeing Co.

Technical Solution: Boeing has developed proprietary shape memory alloy (SMA) technologies for aerospace applications, focusing on adaptive structures and morphing aircraft components. Their patented SMA-based actuator systems enable aircraft wings to change shape during flight, optimizing aerodynamic performance across different flight regimes[2]. Boeing's SMA technology includes specialized NiTi-based alloys with customized transformation temperatures suitable for aerospace operating environments (-65°C to 125°C). They've pioneered hybrid composite-SMA structures where embedded SMA elements provide controlled deformation capabilities while maintaining structural integrity[4]. Boeing has also developed unique training and conditioning processes for SMAs that enhance cyclic stability and functional fatigue resistance in aerospace applications. Their intellectual property portfolio includes SMA-powered deployment mechanisms for space structures that eliminate traditional mechanical complexity and reduce weight by approximately 40% compared to conventional systems[7].

Strengths: Extensive aerospace application expertise with flight-certified SMA systems and integration with existing aircraft structures. Weaknesses: Technologies primarily optimized for aerospace conditions with limited transferability to other sectors, and high development costs associated with aviation certification requirements.

Critical SMA Intellectual Property Analysis

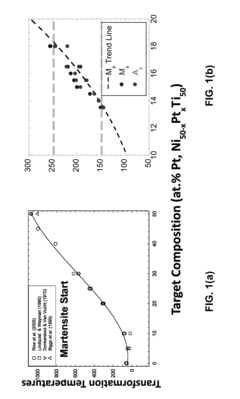

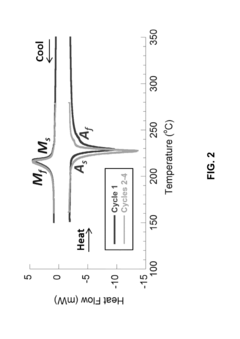

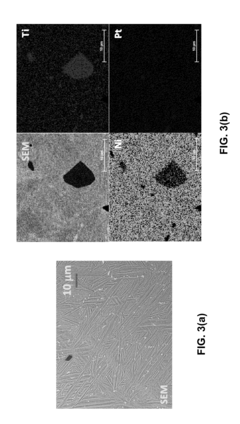

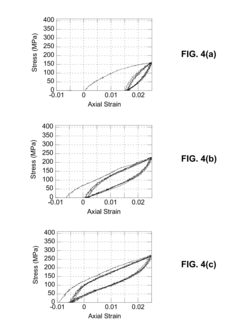

Nickel-Titanium-Based Superelastic High-Temperature Shape Memory Alloys

PatentInactiveUS20150354033A1

Innovation

- NiTi-based ternary alloys with specific compositions, such as Ni, Ti, and Pt or Ni, Ti, and Pd, exhibiting superelastic behavior in the 210-280°C temperature range, achieved through arc-melting and homogenization heat treatment, allowing for significant strain recovery and hysteresis in stress-strain responses.

Patent Litigation and Legal Challenges

The patent landscape for Shape Memory Alloys (SMAs) has become increasingly complex, leading to numerous legal disputes across various jurisdictions. Major litigation cases have emerged between industry leaders such as Nitinol Devices & Components (NDC), Johnson & Johnson, Medtronic, and Boston Scientific, particularly in the medical device sector where SMA applications hold significant commercial value. These disputes typically center around method patents covering specific processing techniques, composition patents related to unique alloy formulations, and application patents for novel uses of SMAs in various devices.

Courts have struggled with the technical complexity of SMA patents, often requiring specialized expertise to interpret claims related to phase transformation mechanisms, superelasticity properties, and thermomechanical processing methods. This complexity has led to inconsistent rulings across different jurisdictions, creating uncertainty for industry stakeholders and investors. The specialized nature of SMA technology frequently necessitates expert witnesses with metallurgical backgrounds to explain critical technical distinctions during litigation proceedings.

International patent enforcement presents additional challenges, with significant disparities in how different countries interpret and protect SMA innovations. While the United States and Europe maintain robust protection frameworks, emerging markets with growing SMA industries often have less developed intellectual property systems, creating enforcement difficulties for patent holders. Cross-border litigation has become increasingly common as companies seek to protect their global market positions.

Patent thickets have emerged in certain SMA application areas, particularly in medical devices and automotive systems, where overlapping claims create navigation difficulties for new market entrants. Defensive patenting strategies have become prevalent, with established companies building extensive portfolios to create freedom-to-operate barriers. This environment has led to increased licensing activity, with cross-licensing agreements becoming a common resolution to potential litigation.

Recent legal trends show courts increasingly scrutinizing the non-obviousness of incremental SMA innovations, particularly for well-established alloy systems like Nitinol. The evolving legal landscape has prompted companies to focus on more disruptive innovations rather than minor improvements to existing technologies. Additionally, standard-essential patents related to testing methods and characterization protocols for SMAs have become litigation hotspots, raising questions about fair, reasonable, and non-discriminatory (FRAND) licensing terms in the industry.

Courts have struggled with the technical complexity of SMA patents, often requiring specialized expertise to interpret claims related to phase transformation mechanisms, superelasticity properties, and thermomechanical processing methods. This complexity has led to inconsistent rulings across different jurisdictions, creating uncertainty for industry stakeholders and investors. The specialized nature of SMA technology frequently necessitates expert witnesses with metallurgical backgrounds to explain critical technical distinctions during litigation proceedings.

International patent enforcement presents additional challenges, with significant disparities in how different countries interpret and protect SMA innovations. While the United States and Europe maintain robust protection frameworks, emerging markets with growing SMA industries often have less developed intellectual property systems, creating enforcement difficulties for patent holders. Cross-border litigation has become increasingly common as companies seek to protect their global market positions.

Patent thickets have emerged in certain SMA application areas, particularly in medical devices and automotive systems, where overlapping claims create navigation difficulties for new market entrants. Defensive patenting strategies have become prevalent, with established companies building extensive portfolios to create freedom-to-operate barriers. This environment has led to increased licensing activity, with cross-licensing agreements becoming a common resolution to potential litigation.

Recent legal trends show courts increasingly scrutinizing the non-obviousness of incremental SMA innovations, particularly for well-established alloy systems like Nitinol. The evolving legal landscape has prompted companies to focus on more disruptive innovations rather than minor improvements to existing technologies. Additionally, standard-essential patents related to testing methods and characterization protocols for SMAs have become litigation hotspots, raising questions about fair, reasonable, and non-discriminatory (FRAND) licensing terms in the industry.

Cross-Industry SMA Licensing Strategies

Cross-industry licensing strategies for Shape Memory Alloys (SMAs) have evolved significantly as these materials find applications across diverse sectors. The unique properties of SMAs—particularly their ability to return to a predetermined shape when subjected to temperature change—create valuable intellectual property assets that can be monetized through strategic licensing arrangements. Currently, the most successful SMA licensing models employ tiered approaches that differentiate between core technology patents and application-specific implementations.

In the medical device sector, companies like Medtronic and Boston Scientific have established licensing frameworks that separate fundamental NiTi alloy composition patents from specific device designs. This approach allows them to maintain control over core technology while enabling innovation in specialized applications through non-exclusive licensing agreements with smaller medical device manufacturers.

Aerospace and automotive industries demonstrate contrasting licensing strategies. Aerospace companies typically prefer exclusive licensing arrangements with stringent quality control provisions due to safety-critical applications. Boeing and Airbus have developed joint licensing programs with material suppliers that include technology transfer components to ensure manufacturing consistency. Automotive manufacturers, conversely, favor broader non-exclusive licensing models that promote wider adoption of SMA technologies in non-critical components like actuators and damping systems.

The consumer electronics sector has pioneered cross-industry patent pools for SMA technologies. Apple and Samsung have independently developed extensive SMA patent portfolios but participate in industry-wide licensing consortiums that facilitate technology sharing while reducing litigation risks. These arrangements typically include field-of-use restrictions that prevent direct competitive applications while encouraging innovation in adjacent markets.

Emerging licensing trends include performance-based royalty structures that link compensation to the actual value delivered by SMA implementations rather than fixed per-unit fees. This approach has gained traction particularly in energy and infrastructure applications where SMA-based solutions provide quantifiable efficiency improvements or extended service life.

Cross-border licensing presents significant challenges due to varying patent enforcement regimes. Companies with global operations increasingly adopt region-specific licensing strategies, with differentiated terms for markets with strong IP protection versus those with weaker enforcement mechanisms. This geographic segmentation allows for maximizing returns while managing infringement risks in developing markets where SMA technologies are increasingly being adopted.

In the medical device sector, companies like Medtronic and Boston Scientific have established licensing frameworks that separate fundamental NiTi alloy composition patents from specific device designs. This approach allows them to maintain control over core technology while enabling innovation in specialized applications through non-exclusive licensing agreements with smaller medical device manufacturers.

Aerospace and automotive industries demonstrate contrasting licensing strategies. Aerospace companies typically prefer exclusive licensing arrangements with stringent quality control provisions due to safety-critical applications. Boeing and Airbus have developed joint licensing programs with material suppliers that include technology transfer components to ensure manufacturing consistency. Automotive manufacturers, conversely, favor broader non-exclusive licensing models that promote wider adoption of SMA technologies in non-critical components like actuators and damping systems.

The consumer electronics sector has pioneered cross-industry patent pools for SMA technologies. Apple and Samsung have independently developed extensive SMA patent portfolios but participate in industry-wide licensing consortiums that facilitate technology sharing while reducing litigation risks. These arrangements typically include field-of-use restrictions that prevent direct competitive applications while encouraging innovation in adjacent markets.

Emerging licensing trends include performance-based royalty structures that link compensation to the actual value delivered by SMA implementations rather than fixed per-unit fees. This approach has gained traction particularly in energy and infrastructure applications where SMA-based solutions provide quantifiable efficiency improvements or extended service life.

Cross-border licensing presents significant challenges due to varying patent enforcement regimes. Companies with global operations increasingly adopt region-specific licensing strategies, with differentiated terms for markets with strong IP protection versus those with weaker enforcement mechanisms. This geographic segmentation allows for maximizing returns while managing infringement risks in developing markets where SMA technologies are increasingly being adopted.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!