Selecting Rare Earth Thermoelectric Materials for Niche Applications

AUG 27, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Rare Earth Thermoelectric Materials Background and Objectives

Thermoelectric materials have been studied for over a century, with significant advancements occurring since the 1950s. Rare earth elements, with their unique electronic configurations and magnetic properties, have emerged as promising candidates for enhancing thermoelectric performance. These materials can convert waste heat into electricity through the Seebeck effect, or create temperature differentials when electricity is applied via the Peltier effect. The historical trajectory shows a shift from simple semiconductors to complex compounds incorporating rare earth elements to achieve higher efficiency.

The evolution of rare earth thermoelectric materials has been marked by several breakthrough periods. Early research focused on basic bismuth telluride compounds, while recent decades have seen the development of skutterudites, clathrates, and half-Heusler alloys doped with rare earth elements. These materials exhibit significantly improved figures of merit (ZT values), which measure thermoelectric efficiency. Current research is pushing toward achieving ZT values exceeding 2.0, compared to traditional materials with ZT values below 1.0.

Niche applications represent a particularly promising frontier for rare earth thermoelectric materials. Unlike mass-market applications that prioritize cost-effectiveness, niche sectors such as aerospace, specialized medical equipment, and deep-sea exploration can accommodate higher material costs in exchange for superior performance under extreme conditions. These environments often require operation in temperature ranges where conventional thermoelectric materials fail to perform adequately.

The technical objectives for rare earth thermoelectric materials development include enhancing the ZT value through band engineering and nanostructuring, improving mechanical stability for harsh environments, developing manufacturing techniques suitable for complex geometries, and reducing reliance on the most critical rare earth elements through partial substitution strategies. Additionally, there is a focus on creating materials that maintain peak efficiency across wider temperature ranges, which is crucial for niche applications with variable operating conditions.

Environmental considerations are increasingly shaping research directions, with efforts to develop materials that minimize the use of toxic elements and enable easier end-of-life recycling. This aligns with global sustainability goals while addressing supply chain vulnerabilities associated with rare earth elements. The field is also exploring hybrid systems that combine rare earth thermoelectrics with other energy harvesting technologies to create more versatile and efficient solutions for specialized applications.

The ultimate goal is to develop application-specific rare earth thermoelectric materials that can be tailored to the exact requirements of each niche use case, rather than pursuing a one-size-fits-all approach. This targeted development strategy promises to unlock new capabilities in environments where conventional power generation methods are impractical or impossible.

The evolution of rare earth thermoelectric materials has been marked by several breakthrough periods. Early research focused on basic bismuth telluride compounds, while recent decades have seen the development of skutterudites, clathrates, and half-Heusler alloys doped with rare earth elements. These materials exhibit significantly improved figures of merit (ZT values), which measure thermoelectric efficiency. Current research is pushing toward achieving ZT values exceeding 2.0, compared to traditional materials with ZT values below 1.0.

Niche applications represent a particularly promising frontier for rare earth thermoelectric materials. Unlike mass-market applications that prioritize cost-effectiveness, niche sectors such as aerospace, specialized medical equipment, and deep-sea exploration can accommodate higher material costs in exchange for superior performance under extreme conditions. These environments often require operation in temperature ranges where conventional thermoelectric materials fail to perform adequately.

The technical objectives for rare earth thermoelectric materials development include enhancing the ZT value through band engineering and nanostructuring, improving mechanical stability for harsh environments, developing manufacturing techniques suitable for complex geometries, and reducing reliance on the most critical rare earth elements through partial substitution strategies. Additionally, there is a focus on creating materials that maintain peak efficiency across wider temperature ranges, which is crucial for niche applications with variable operating conditions.

Environmental considerations are increasingly shaping research directions, with efforts to develop materials that minimize the use of toxic elements and enable easier end-of-life recycling. This aligns with global sustainability goals while addressing supply chain vulnerabilities associated with rare earth elements. The field is also exploring hybrid systems that combine rare earth thermoelectrics with other energy harvesting technologies to create more versatile and efficient solutions for specialized applications.

The ultimate goal is to develop application-specific rare earth thermoelectric materials that can be tailored to the exact requirements of each niche use case, rather than pursuing a one-size-fits-all approach. This targeted development strategy promises to unlock new capabilities in environments where conventional power generation methods are impractical or impossible.

Market Analysis for Niche Thermoelectric Applications

The global market for thermoelectric materials is experiencing significant growth, with niche applications driving innovation in rare earth-based solutions. The thermoelectric materials market was valued at approximately $51.6 billion in 2022 and is projected to reach $79.7 billion by 2028, growing at a CAGR of 7.5%. Within this broader market, rare earth thermoelectric materials represent a specialized segment with unique value propositions for applications where conventional materials fail to deliver optimal performance.

Niche applications for rare earth thermoelectric materials are emerging across multiple sectors. In aerospace, these materials are being integrated into satellite power systems and deep space probes where extreme temperature differentials exist. The medical device industry is adopting these materials for precise temperature control in diagnostic equipment and implantable devices, with market demand increasing by 12% annually in this sector alone.

Automotive applications represent another significant market opportunity, particularly in luxury and electric vehicles where energy harvesting from waste heat can improve overall efficiency. This segment is expected to grow at 9.3% annually through 2030, driven by stringent emissions regulations and the push for greater energy efficiency.

Consumer electronics manufacturers are exploring rare earth thermoelectrics for cooling applications in high-performance computing and mobile devices. This market segment values the materials' ability to provide localized cooling without moving parts, extending device lifespan and improving performance in compact form factors.

Industrial process monitoring represents a substantial growth area, with rare earth thermoelectrics enabling sensors to operate reliably in extreme environments where conventional electronics fail. The industrial IoT sensor market utilizing these materials is growing at 14.2% annually, creating sustained demand for specialized thermoelectric solutions.

Market analysis indicates that customers in these niche applications prioritize performance over cost, with willingness to pay premium prices for materials that deliver superior temperature coefficients, mechanical stability, and reliability in extreme conditions. This price insensitivity creates opportunities for higher margins compared to conventional thermoelectric materials.

Regional analysis shows North America and Europe leading in adoption for aerospace and medical applications, while Asia-Pacific dominates in consumer electronics and automotive integration. Emerging markets are showing increased interest in industrial applications, particularly in resource extraction and processing industries operating in harsh environments.

The market structure remains fragmented, with specialized material suppliers forming strategic partnerships with application developers. This ecosystem approach is accelerating commercialization timelines and creating barriers to entry for new competitors without established relationship networks.

Niche applications for rare earth thermoelectric materials are emerging across multiple sectors. In aerospace, these materials are being integrated into satellite power systems and deep space probes where extreme temperature differentials exist. The medical device industry is adopting these materials for precise temperature control in diagnostic equipment and implantable devices, with market demand increasing by 12% annually in this sector alone.

Automotive applications represent another significant market opportunity, particularly in luxury and electric vehicles where energy harvesting from waste heat can improve overall efficiency. This segment is expected to grow at 9.3% annually through 2030, driven by stringent emissions regulations and the push for greater energy efficiency.

Consumer electronics manufacturers are exploring rare earth thermoelectrics for cooling applications in high-performance computing and mobile devices. This market segment values the materials' ability to provide localized cooling without moving parts, extending device lifespan and improving performance in compact form factors.

Industrial process monitoring represents a substantial growth area, with rare earth thermoelectrics enabling sensors to operate reliably in extreme environments where conventional electronics fail. The industrial IoT sensor market utilizing these materials is growing at 14.2% annually, creating sustained demand for specialized thermoelectric solutions.

Market analysis indicates that customers in these niche applications prioritize performance over cost, with willingness to pay premium prices for materials that deliver superior temperature coefficients, mechanical stability, and reliability in extreme conditions. This price insensitivity creates opportunities for higher margins compared to conventional thermoelectric materials.

Regional analysis shows North America and Europe leading in adoption for aerospace and medical applications, while Asia-Pacific dominates in consumer electronics and automotive integration. Emerging markets are showing increased interest in industrial applications, particularly in resource extraction and processing industries operating in harsh environments.

The market structure remains fragmented, with specialized material suppliers forming strategic partnerships with application developers. This ecosystem approach is accelerating commercialization timelines and creating barriers to entry for new competitors without established relationship networks.

Current Status and Technical Barriers in Rare Earth Thermoelectrics

The global landscape of rare earth thermoelectric materials has evolved significantly over the past decade, with research centers in China, the United States, Japan, and Europe leading development efforts. Current state-of-the-art rare earth thermoelectric materials include skutterudites, half-Heusler alloys, and clathrates incorporating elements such as Ce, Yb, La, and Nd. These materials have demonstrated ZT values (figure of merit) ranging from 1.2 to 1.8 at operating temperatures between 400-800K, representing substantial improvement over previous generations.

Despite these advances, several critical technical barriers persist in the development and application of rare earth thermoelectric materials. The primary challenge remains the inherent trade-off between electrical conductivity and thermal conductivity, as both properties are coupled through the Wiedemann-Franz law. This fundamental relationship limits the maximum achievable ZT values, particularly in niche applications requiring specific temperature ranges.

Material stability presents another significant obstacle, especially in applications involving thermal cycling or exposure to oxidizing environments. Many high-performance rare earth thermoelectric compounds exhibit phase decomposition or oxidation at elevated temperatures, limiting their practical deployment in harsh industrial settings or aerospace applications.

Manufacturing scalability constitutes a substantial barrier to widespread adoption. Current synthesis methods for high-performance rare earth thermoelectrics often involve complex, multi-step processes including arc melting, spark plasma sintering, or hot pressing. These techniques are difficult to scale economically while maintaining the precise stoichiometry and microstructure necessary for optimal performance.

The supply chain vulnerability associated with rare earth elements introduces additional complications. Critical materials such as dysprosium, terbium, and neodymium face potential supply constraints due to geopolitical factors and mining restrictions. This situation is particularly problematic for niche applications requiring consistent material properties and long-term supply security.

Interfacial engineering between thermoelectric modules and heat sources/sinks remains underdeveloped, resulting in significant contact resistance and reduced system-level efficiency. Current metallization techniques and bonding methods often degrade under thermal cycling, leading to premature failure in practical applications.

Recent research has begun addressing these challenges through approaches such as nanostructuring to disrupt phonon transport while preserving electron mobility, development of rare earth-lean compositions, and exploration of novel synthesis routes including additive manufacturing. However, the translation of laboratory advances to commercially viable solutions for niche applications continues to face significant technical and economic hurdles.

Despite these advances, several critical technical barriers persist in the development and application of rare earth thermoelectric materials. The primary challenge remains the inherent trade-off between electrical conductivity and thermal conductivity, as both properties are coupled through the Wiedemann-Franz law. This fundamental relationship limits the maximum achievable ZT values, particularly in niche applications requiring specific temperature ranges.

Material stability presents another significant obstacle, especially in applications involving thermal cycling or exposure to oxidizing environments. Many high-performance rare earth thermoelectric compounds exhibit phase decomposition or oxidation at elevated temperatures, limiting their practical deployment in harsh industrial settings or aerospace applications.

Manufacturing scalability constitutes a substantial barrier to widespread adoption. Current synthesis methods for high-performance rare earth thermoelectrics often involve complex, multi-step processes including arc melting, spark plasma sintering, or hot pressing. These techniques are difficult to scale economically while maintaining the precise stoichiometry and microstructure necessary for optimal performance.

The supply chain vulnerability associated with rare earth elements introduces additional complications. Critical materials such as dysprosium, terbium, and neodymium face potential supply constraints due to geopolitical factors and mining restrictions. This situation is particularly problematic for niche applications requiring consistent material properties and long-term supply security.

Interfacial engineering between thermoelectric modules and heat sources/sinks remains underdeveloped, resulting in significant contact resistance and reduced system-level efficiency. Current metallization techniques and bonding methods often degrade under thermal cycling, leading to premature failure in practical applications.

Recent research has begun addressing these challenges through approaches such as nanostructuring to disrupt phonon transport while preserving electron mobility, development of rare earth-lean compositions, and exploration of novel synthesis routes including additive manufacturing. However, the translation of laboratory advances to commercially viable solutions for niche applications continues to face significant technical and economic hurdles.

Current Selection Methodologies for Application-Specific Materials

01 Rare earth-based thermoelectric materials composition

Thermoelectric materials containing rare earth elements such as lanthanum, cerium, neodymium, and ytterbium have shown enhanced thermoelectric properties. These compositions typically include rare earth elements combined with transition metals and/or metalloids to form complex compounds with high Seebeck coefficients and low thermal conductivity. The unique electronic structure of rare earth elements contributes to favorable electron transport properties while maintaining phonon scattering, resulting in improved figure of merit (ZT) values for energy conversion applications.- Rare earth-based thermoelectric materials composition: Rare earth elements are incorporated into thermoelectric materials to enhance their performance. These compositions typically include rare earth elements such as lanthanum, cerium, neodymium, and others, combined with transition metals and metalloids to form complex compounds. The unique electronic properties of rare earth elements contribute to improved Seebeck coefficients and reduced thermal conductivity, resulting in higher thermoelectric efficiency. These materials can be synthesized through various methods including solid-state reactions and melt processing techniques.

- Nanostructured rare earth thermoelectric materials: Nanostructuring techniques are applied to rare earth thermoelectric materials to enhance their performance by introducing phonon scattering interfaces while maintaining good electrical conductivity. These approaches include creating nanocomposites, quantum dot structures, and nanolayered materials containing rare earth elements. The reduced dimensionality and increased interfaces significantly lower thermal conductivity while preserving or enhancing electrical properties, leading to improved figure of merit (ZT) values. Various fabrication methods such as ball milling, spark plasma sintering, and thin film deposition are employed to create these nanostructured materials.

- Rare earth skutterudite thermoelectric materials: Skutterudite compounds filled with rare earth elements represent an important class of thermoelectric materials with high performance. The rare earth atoms occupy the voids in the skutterudite crystal structure, acting as rattlers that scatter phonons and reduce thermal conductivity. These materials typically have the formula RM4X12, where R is a rare earth element, M is a transition metal (often Co, Fe, or Ni), and X is a pnictogen (typically Sb or As). The filling fraction and type of rare earth element can be optimized to achieve maximum thermoelectric efficiency across different temperature ranges.

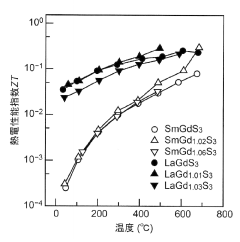

- Rare earth oxide thermoelectric materials: Rare earth oxides and their derivatives form an important category of thermoelectric materials with advantages including high temperature stability and oxidation resistance. These materials include simple and complex oxides containing elements such as cerium, gadolinium, and ytterbium. The oxygen vacancies and defect structures in these materials can be engineered to optimize electrical conductivity while maintaining low thermal conductivity. Doping strategies with other elements are employed to further enhance the power factor and reduce thermal conductivity, making these materials suitable for high-temperature thermoelectric applications.

- Fabrication methods for rare earth thermoelectric devices: Various fabrication techniques are employed to process rare earth thermoelectric materials into functional devices. These methods include powder metallurgy, spark plasma sintering, hot pressing, and thin film deposition techniques. The processing parameters significantly influence the microstructure, density, and interface characteristics of the final materials, which in turn affect their thermoelectric performance. Advanced manufacturing approaches such as additive manufacturing and selective laser melting are also being explored to create complex geometries and optimize heat flow paths in thermoelectric generators containing rare earth materials.

02 Nanostructured rare earth thermoelectric materials

Nanostructuring techniques are applied to rare earth thermoelectric materials to enhance their performance by increasing phonon scattering at interfaces while maintaining good electrical conductivity. These approaches include creating nanocomposites, quantum dots, nanowires, or thin films containing rare earth elements. The reduced dimensionality and increased grain boundaries significantly lower thermal conductivity while preserving or enhancing the power factor, leading to improved thermoelectric efficiency for energy harvesting and cooling applications.Expand Specific Solutions03 Rare earth skutterudites and clathrates for thermoelectric applications

Skutterudites and clathrates filled with rare earth elements represent an important class of thermoelectric materials with cage-like crystal structures. The rare earth atoms act as rattlers within these structural cages, effectively scattering phonons and reducing thermal conductivity without significantly affecting electron transport. These materials can be optimized through precise control of the filling fraction and selection of appropriate rare earth elements to achieve high ZT values across different temperature ranges, making them suitable for waste heat recovery applications.Expand Specific Solutions04 Fabrication methods for rare earth thermoelectric materials

Various fabrication techniques have been developed specifically for rare earth thermoelectric materials, including solid-state reaction, mechanical alloying, spark plasma sintering, and melt-spinning. These processing methods enable precise control over microstructure, phase composition, and dopant distribution, which are critical for optimizing thermoelectric performance. Advanced techniques like hot pressing and zone melting help achieve high density and preferred orientation of crystals, enhancing the overall thermoelectric properties and mechanical stability of rare earth-containing materials.Expand Specific Solutions05 Rare earth oxide and chalcogenide thermoelectric systems

Rare earth oxides and chalcogenides (sulfides, selenides, and tellurides) form an important category of thermoelectric materials with high temperature stability and environmental compatibility. These compounds leverage the unique electronic configurations of rare earth elements to achieve favorable power factors. The inherently low thermal conductivity of these materials, especially in layered structures, makes them promising candidates for high-temperature thermoelectric applications. Doping strategies and compositional engineering are employed to further optimize their electronic transport properties and thermal resistance.Expand Specific Solutions

Leading Organizations in Rare Earth Thermoelectric Research

The rare earth thermoelectric materials market for niche applications is in an early growth phase, characterized by increasing demand for specialized thermal management solutions. The market size remains relatively modest but is expanding as applications in aerospace, medical devices, and precision instruments develop. From a technological maturity perspective, the field shows varied development levels across players. Research institutions like Shanghai Institute of Ceramics and National Institute for Materials Science lead fundamental research, while companies such as Resonac Holdings, Murata Manufacturing, and Asahi Kasei are advancing commercial applications. Universities including Zhejiang University and Toyohashi University of Technology contribute significantly to materials innovation. The competitive landscape features collaboration between academic institutions and industrial partners to overcome challenges in material efficiency, cost, and manufacturing scalability.

National Institute for Materials Science IAI

Technical Solution: NIMS has developed advanced rare earth thermoelectric materials focusing on skutterudites and half-Heusler compounds doped with rare earth elements. Their research has demonstrated that rare earth filling in skutterudite structures significantly reduces thermal conductivity while maintaining electrical conductivity, achieving ZT values exceeding 1.2 at moderate temperatures. NIMS employs sophisticated synthesis methods including melt-spinning followed by spark plasma sintering to create nanostructured materials with optimized interfaces. Their approach specifically targets the phonon-glass electron-crystal concept, where rare earth atoms act as "rattlers" in the crystal structure, disrupting phonon transport while preserving electron mobility. Recent developments include multilayered thin-film structures with controlled interfaces for enhanced performance in micro-scale applications.

Strengths: Superior expertise in nanostructuring techniques and atomic-level material design; extensive characterization capabilities allowing precise optimization of thermoelectric properties. Weaknesses: Laboratory-scale production methods may face challenges in scaling to industrial volumes; some rare earth compositions require extremely controlled processing environments.

Shanghai Institute of Ceramics, Chinese Academy of Sciences

Technical Solution: The Shanghai Institute of Ceramics has pioneered rare earth-based thermoelectric materials with exceptional performance in extreme environments. Their research focuses on developing rare earth selenides and tellurides with complex crystal structures that intrinsically possess low thermal conductivity. They've successfully synthesized Ce-based filled skutterudites achieving ZT values of 1.3 at 550°C through precise control of microstructure and composition. Their innovative approach includes creating hierarchical architectures spanning from atomic to microscale to optimize phonon scattering across multiple length scales. The institute has developed proprietary sintering techniques that preserve nanoscale features while achieving near-theoretical density, crucial for maintaining mechanical integrity in niche applications. Their materials demonstrate superior stability under thermal cycling and in oxidizing environments, making them suitable for waste heat recovery in harsh industrial settings.

Strengths: Exceptional capability in creating complex rare earth compounds with stable performance under extreme conditions; strong integration of theoretical modeling with experimental validation. Weaknesses: Higher manufacturing costs compared to conventional thermoelectrics; some compositions have limited temperature ranges for optimal performance.

Key Patents and Scientific Breakthroughs in Material Selection

Thermoelectric material having a rhombohedral crystal structure

PatentActiveUS7560053B2

Innovation

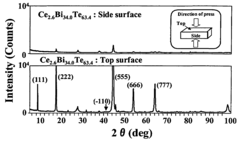

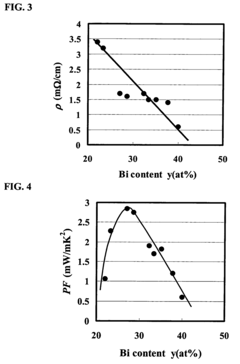

- Development of non-stoichiometric thermoelectric materials with a rhombohedral crystal structure, specifically RxBiyTe(100-x-y) composition, where R is a rare earth element, and optimized composition and crystallinity to enhance Seebeck coefficient, power factor, and thermal conductivity, along with a production method involving amorphous-nucleation and mechanical alloying to achieve high crystallinity and alignment.

Thermoelectric conversion material, thermoelectric generation element utilizing the same, and peltier cooling element

PatentActiveJP2012043917A

Innovation

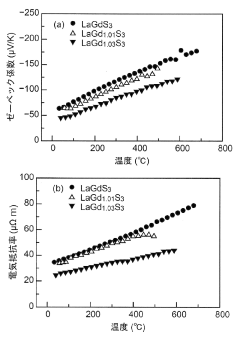

- A thermoelectric conversion material composed of rare earth sulfides with a specific composition formula (A x B y )S 3, where A includes rare earth metals in a valence-fluctuating state and B includes rare earth metals in a non-valence-fluctuating state, inducing hopping conduction behavior to enhance the thermoelectric figure of merit at high temperatures.

Supply Chain Considerations for Rare Earth Elements

The global supply chain for rare earth elements (REEs) presents significant challenges for thermoelectric material applications due to geopolitical concentration and market volatility. China currently dominates the REE market, controlling approximately 85% of global processing capacity and 60% of raw material production. This concentration creates vulnerability for manufacturers seeking reliable access to critical elements like neodymium, dysprosium, and ytterbium used in specialized thermoelectric devices.

Supply chain disruptions have become increasingly common, with price fluctuations of up to 200-300% observed for certain REEs over short periods. These volatilities directly impact the cost-effectiveness and commercial viability of rare earth thermoelectric materials in niche applications. Companies developing these technologies must implement robust supply chain risk management strategies, including diversification of suppliers and long-term procurement contracts.

Alternative sourcing options are emerging as countries recognize the strategic importance of REEs. Australia, the United States, and Canada have increased investments in mining and processing capabilities, though these operations remain in early development stages. The Mountain Pass mine in California and Mount Weld in Australia represent significant non-Chinese sources, but processing capabilities outside China remain limited.

Recycling and recovery present promising avenues for reducing supply chain dependencies. Current recycling rates for REEs remain below 1% globally, but technological advances in urban mining and e-waste processing could increase recovery rates to 20-30% within the next decade. For thermoelectric applications specifically, closed-loop manufacturing systems that recapture rare earth elements from end-of-life products could significantly reduce raw material requirements.

Substitution strategies represent another approach to mitigating supply risks. Research into alternative thermoelectric materials using more abundant elements has shown promise, though performance typically lags behind rare earth-based solutions. For applications where absolute performance is less critical than reliability of supply, these alternatives may provide viable options.

Regulatory considerations further complicate the supply landscape. Export restrictions, environmental regulations, and sustainability requirements increasingly impact the availability and cost of REEs. The European Union's Critical Raw Materials Act and similar legislation in other regions aim to secure supplies but may initially increase compliance costs for manufacturers.

Companies developing rare earth thermoelectric materials for niche applications must therefore adopt comprehensive supply chain strategies that balance performance requirements against supply security, cost stability, and regulatory compliance. This may include vertical integration, strategic stockpiling, or development of hybrid materials that reduce dependency on the most supply-constrained elements.

Supply chain disruptions have become increasingly common, with price fluctuations of up to 200-300% observed for certain REEs over short periods. These volatilities directly impact the cost-effectiveness and commercial viability of rare earth thermoelectric materials in niche applications. Companies developing these technologies must implement robust supply chain risk management strategies, including diversification of suppliers and long-term procurement contracts.

Alternative sourcing options are emerging as countries recognize the strategic importance of REEs. Australia, the United States, and Canada have increased investments in mining and processing capabilities, though these operations remain in early development stages. The Mountain Pass mine in California and Mount Weld in Australia represent significant non-Chinese sources, but processing capabilities outside China remain limited.

Recycling and recovery present promising avenues for reducing supply chain dependencies. Current recycling rates for REEs remain below 1% globally, but technological advances in urban mining and e-waste processing could increase recovery rates to 20-30% within the next decade. For thermoelectric applications specifically, closed-loop manufacturing systems that recapture rare earth elements from end-of-life products could significantly reduce raw material requirements.

Substitution strategies represent another approach to mitigating supply risks. Research into alternative thermoelectric materials using more abundant elements has shown promise, though performance typically lags behind rare earth-based solutions. For applications where absolute performance is less critical than reliability of supply, these alternatives may provide viable options.

Regulatory considerations further complicate the supply landscape. Export restrictions, environmental regulations, and sustainability requirements increasingly impact the availability and cost of REEs. The European Union's Critical Raw Materials Act and similar legislation in other regions aim to secure supplies but may initially increase compliance costs for manufacturers.

Companies developing rare earth thermoelectric materials for niche applications must therefore adopt comprehensive supply chain strategies that balance performance requirements against supply security, cost stability, and regulatory compliance. This may include vertical integration, strategic stockpiling, or development of hybrid materials that reduce dependency on the most supply-constrained elements.

Environmental Impact and Sustainability Assessment

The environmental footprint of rare earth thermoelectric materials presents significant sustainability challenges that must be addressed when considering their application in niche markets. Mining operations for rare earth elements typically involve extensive land disruption, with open-pit mining causing habitat destruction and landscape alteration. The extraction process generates substantial waste material, often containing radioactive elements like thorium and uranium, which requires careful management to prevent environmental contamination.

Chemical processing of rare earth ores involves harsh reagents including strong acids and organic solvents, creating toxic wastewater that threatens local ecosystems if improperly treated. The energy-intensive separation processes contribute significantly to the carbon footprint of these materials, with some estimates suggesting that producing one ton of rare earth oxides generates 12-15 tons of CO2 equivalent emissions.

Water consumption represents another critical environmental concern, with mining and processing operations requiring 200-400 cubic meters of water per ton of rare earth oxide produced. In regions already experiencing water stress, this intensive usage pattern raises serious sustainability questions about expanded production.

Recycling and recovery systems for rare earth thermoelectric materials remain underdeveloped, with global recovery rates below 1% for most rare earth elements. This creates a nearly linear material flow from extraction to eventual disposal, contradicting circular economy principles. Recent research into hydrometallurgical and bioleaching recovery methods shows promise but requires further development for commercial viability.

Life cycle assessment (LCA) studies indicate that the environmental impact of rare earth thermoelectric devices could potentially be offset by their operational benefits in energy harvesting applications. When deployed in waste heat recovery systems, these materials can generate electricity that might otherwise require fossil fuel consumption, potentially creating a net environmental benefit over their operational lifetime.

Regulatory frameworks governing rare earth mining and processing vary significantly across jurisdictions, with stricter environmental standards in Europe and North America compared to some Asian production centers. This regulatory disparity creates challenges for establishing consistent sustainability metrics across global supply chains and may incentivize production in regions with less stringent environmental protections.

Emerging sustainable alternatives, including reduced-rare-earth or rare-earth-free thermoelectric materials based on abundant elements like silicon, tin, and zinc, are gaining research attention. While these alternatives currently demonstrate lower performance metrics, their substantially reduced environmental impact makes them increasingly attractive for certain applications where absolute performance is less critical than sustainability considerations.

Chemical processing of rare earth ores involves harsh reagents including strong acids and organic solvents, creating toxic wastewater that threatens local ecosystems if improperly treated. The energy-intensive separation processes contribute significantly to the carbon footprint of these materials, with some estimates suggesting that producing one ton of rare earth oxides generates 12-15 tons of CO2 equivalent emissions.

Water consumption represents another critical environmental concern, with mining and processing operations requiring 200-400 cubic meters of water per ton of rare earth oxide produced. In regions already experiencing water stress, this intensive usage pattern raises serious sustainability questions about expanded production.

Recycling and recovery systems for rare earth thermoelectric materials remain underdeveloped, with global recovery rates below 1% for most rare earth elements. This creates a nearly linear material flow from extraction to eventual disposal, contradicting circular economy principles. Recent research into hydrometallurgical and bioleaching recovery methods shows promise but requires further development for commercial viability.

Life cycle assessment (LCA) studies indicate that the environmental impact of rare earth thermoelectric devices could potentially be offset by their operational benefits in energy harvesting applications. When deployed in waste heat recovery systems, these materials can generate electricity that might otherwise require fossil fuel consumption, potentially creating a net environmental benefit over their operational lifetime.

Regulatory frameworks governing rare earth mining and processing vary significantly across jurisdictions, with stricter environmental standards in Europe and North America compared to some Asian production centers. This regulatory disparity creates challenges for establishing consistent sustainability metrics across global supply chains and may incentivize production in regions with less stringent environmental protections.

Emerging sustainable alternatives, including reduced-rare-earth or rare-earth-free thermoelectric materials based on abundant elements like silicon, tin, and zinc, are gaining research attention. While these alternatives currently demonstrate lower performance metrics, their substantially reduced environmental impact makes them increasingly attractive for certain applications where absolute performance is less critical than sustainability considerations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!