Solid Polymer Electrolyte Patent Analysis for Global Lithium Battery Market

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SPE Technology Background and Objectives

Solid polymer electrolytes (SPEs) represent a transformative technology in the lithium battery industry, offering a potential solution to the safety and performance limitations of conventional liquid electrolytes. The development of SPEs dates back to the 1970s when the first polymer-salt complexes were investigated for ionic conductivity. Over subsequent decades, research has intensified significantly, with major breakthroughs occurring in the early 2000s as the demand for safer and higher energy density batteries accelerated.

The evolution of SPE technology has been characterized by persistent efforts to overcome the fundamental challenge of achieving sufficient ionic conductivity at ambient temperatures while maintaining mechanical stability. Early polymer systems like polyethylene oxide (PEO) demonstrated promising complexation with lithium salts but suffered from poor room temperature conductivity due to their semi-crystalline nature. This limitation sparked diverse research pathways including copolymerization strategies, cross-linking techniques, and the incorporation of ceramic fillers to create composite systems.

Recent technological trends show a convergence toward hybrid approaches that combine the benefits of different material classes. These include block copolymer architectures that separate ion conduction and mechanical support functions, single-ion conducting polymers that address concentration polarization issues, and polymer-in-ceramic composites that leverage interfacial conductivity enhancement effects.

The primary technical objectives for SPE development center on achieving room temperature ionic conductivity exceeding 10^-4 S/cm while maintaining a lithium transference number above 0.5. Additionally, electrochemical stability windows wider than 4.5V, mechanical properties sufficient to suppress lithium dendrite growth, and long-term interfacial stability with electrode materials represent critical targets for commercial viability.

Global research efforts are increasingly focused on scalable manufacturing processes that can transition SPE technology from laboratory demonstrations to mass production. This includes addressing challenges in polymer synthesis consistency, composite material dispersion, and thin-film fabrication techniques compatible with existing battery manufacturing infrastructure.

The strategic importance of SPE technology extends beyond performance metrics to geopolitical considerations, as it offers pathways to reduce dependence on critical liquid electrolyte components and potentially simplify battery design. As the global lithium battery market continues its exponential growth trajectory, driven by electric vehicle adoption and renewable energy storage demands, SPE technology represents a critical innovation frontier with potential to reshape industry standards for safety, energy density, and operational lifetime.

The evolution of SPE technology has been characterized by persistent efforts to overcome the fundamental challenge of achieving sufficient ionic conductivity at ambient temperatures while maintaining mechanical stability. Early polymer systems like polyethylene oxide (PEO) demonstrated promising complexation with lithium salts but suffered from poor room temperature conductivity due to their semi-crystalline nature. This limitation sparked diverse research pathways including copolymerization strategies, cross-linking techniques, and the incorporation of ceramic fillers to create composite systems.

Recent technological trends show a convergence toward hybrid approaches that combine the benefits of different material classes. These include block copolymer architectures that separate ion conduction and mechanical support functions, single-ion conducting polymers that address concentration polarization issues, and polymer-in-ceramic composites that leverage interfacial conductivity enhancement effects.

The primary technical objectives for SPE development center on achieving room temperature ionic conductivity exceeding 10^-4 S/cm while maintaining a lithium transference number above 0.5. Additionally, electrochemical stability windows wider than 4.5V, mechanical properties sufficient to suppress lithium dendrite growth, and long-term interfacial stability with electrode materials represent critical targets for commercial viability.

Global research efforts are increasingly focused on scalable manufacturing processes that can transition SPE technology from laboratory demonstrations to mass production. This includes addressing challenges in polymer synthesis consistency, composite material dispersion, and thin-film fabrication techniques compatible with existing battery manufacturing infrastructure.

The strategic importance of SPE technology extends beyond performance metrics to geopolitical considerations, as it offers pathways to reduce dependence on critical liquid electrolyte components and potentially simplify battery design. As the global lithium battery market continues its exponential growth trajectory, driven by electric vehicle adoption and renewable energy storage demands, SPE technology represents a critical innovation frontier with potential to reshape industry standards for safety, energy density, and operational lifetime.

Global Lithium Battery Market Demand Analysis

The global lithium battery market has experienced unprecedented growth over the past decade, primarily driven by the rapid expansion of electric vehicles (EVs), portable electronics, and energy storage systems. Market research indicates that the global lithium battery market was valued at approximately 46.2 billion USD in 2021 and is projected to reach 193.7 billion USD by 2030, growing at a CAGR of 17.3% during the forecast period.

Electric vehicle adoption represents the most significant demand driver, accounting for over 40% of the total lithium battery market. This segment is expected to maintain its dominant position as governments worldwide implement stringent emission regulations and offer incentives for EV adoption. Countries like Norway, China, and Germany have established ambitious targets to phase out internal combustion engines, further accelerating demand for lithium batteries.

Consumer electronics constitute the second-largest application segment, representing approximately 25% of market demand. The proliferation of smartphones, laptops, wearable devices, and other portable electronics continues to fuel steady growth in this sector, though at a more moderate pace compared to automotive applications.

Energy storage systems (ESS) represent the fastest-growing segment, with an estimated CAGR of 24% through 2030. The increasing integration of renewable energy sources into power grids necessitates advanced energy storage solutions, creating substantial opportunities for lithium battery manufacturers. Utility-scale projects in Australia, the United States, and China demonstrate the expanding role of lithium batteries in grid stabilization and peak shaving applications.

Geographically, Asia Pacific dominates the market with over 55% share, led by China, Japan, and South Korea. These countries host major battery manufacturers and have established robust supply chains. North America and Europe follow, with rapidly growing demand driven by EV adoption and renewable energy integration.

The solid polymer electrolyte (SPE) segment specifically is gaining significant attention due to its potential to address safety concerns associated with conventional liquid electrolytes. Market analysis suggests that SPE technology could capture up to 15% of the total lithium battery market by 2030, representing a substantial opportunity for innovation and commercialization.

Customer requirements are evolving toward higher energy density, faster charging capabilities, enhanced safety, and longer cycle life. For solid polymer electrolytes specifically, the market demands improvements in ionic conductivity at room temperature, mechanical stability, and compatibility with high-voltage cathode materials. These performance parameters are critical for widespread adoption across various applications.

Electric vehicle adoption represents the most significant demand driver, accounting for over 40% of the total lithium battery market. This segment is expected to maintain its dominant position as governments worldwide implement stringent emission regulations and offer incentives for EV adoption. Countries like Norway, China, and Germany have established ambitious targets to phase out internal combustion engines, further accelerating demand for lithium batteries.

Consumer electronics constitute the second-largest application segment, representing approximately 25% of market demand. The proliferation of smartphones, laptops, wearable devices, and other portable electronics continues to fuel steady growth in this sector, though at a more moderate pace compared to automotive applications.

Energy storage systems (ESS) represent the fastest-growing segment, with an estimated CAGR of 24% through 2030. The increasing integration of renewable energy sources into power grids necessitates advanced energy storage solutions, creating substantial opportunities for lithium battery manufacturers. Utility-scale projects in Australia, the United States, and China demonstrate the expanding role of lithium batteries in grid stabilization and peak shaving applications.

Geographically, Asia Pacific dominates the market with over 55% share, led by China, Japan, and South Korea. These countries host major battery manufacturers and have established robust supply chains. North America and Europe follow, with rapidly growing demand driven by EV adoption and renewable energy integration.

The solid polymer electrolyte (SPE) segment specifically is gaining significant attention due to its potential to address safety concerns associated with conventional liquid electrolytes. Market analysis suggests that SPE technology could capture up to 15% of the total lithium battery market by 2030, representing a substantial opportunity for innovation and commercialization.

Customer requirements are evolving toward higher energy density, faster charging capabilities, enhanced safety, and longer cycle life. For solid polymer electrolytes specifically, the market demands improvements in ionic conductivity at room temperature, mechanical stability, and compatibility with high-voltage cathode materials. These performance parameters are critical for widespread adoption across various applications.

Current SPE Development Status and Challenges

Solid polymer electrolytes (SPEs) have emerged as a promising alternative to conventional liquid electrolytes in lithium battery applications. Currently, the global development of SPE technology demonstrates significant regional disparities, with major research hubs concentrated in East Asia, North America, and Europe. Japan, South Korea, and China lead in patent filings, while the United States and Germany contribute substantial research publications in this domain.

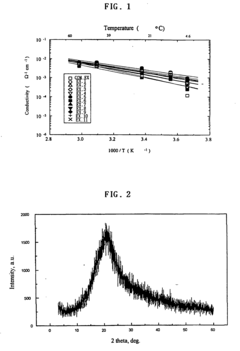

The primary technical challenges facing SPE development center around ionic conductivity limitations. Most polymer electrolytes exhibit conductivity values between 10^-5 and 10^-4 S/cm at room temperature, significantly lower than the 10^-3 S/cm threshold required for practical applications. This conductivity gap represents the most critical technical barrier to widespread commercial adoption.

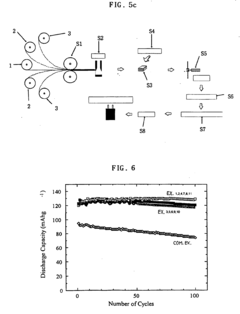

Mechanical stability presents another substantial challenge. Current SPE formulations struggle to maintain structural integrity during repeated charge-discharge cycles, leading to performance degradation over time. The interface between the polymer electrolyte and electrodes often develops resistance issues, further compromising battery efficiency and lifespan.

Chemical compatibility with high-voltage cathode materials remains problematic. Many promising SPE compositions demonstrate degradation when exposed to operating voltages above 4.5V, limiting their application in high-energy density battery systems. This voltage stability constraint restricts the energy density potential of SPE-based batteries.

Manufacturing scalability constitutes a significant industrial challenge. Current laboratory-scale production methods for high-performance SPEs often involve complex synthesis procedures that prove difficult to scale for mass production. The precision required for consistent polymer chain length, crystallinity control, and additive distribution presents formidable manufacturing hurdles.

Temperature sensitivity further complicates SPE implementation. Most polymer electrolytes exhibit dramatic performance variations across operating temperature ranges, with particularly poor conductivity at lower temperatures. This temperature dependence limits their practical application in regions with variable climates.

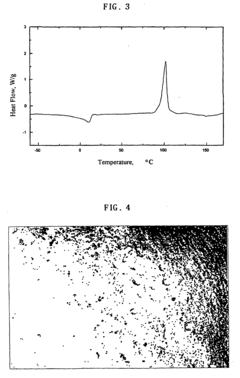

Recent research has focused on composite approaches, incorporating inorganic fillers such as ceramic nanoparticles to enhance conductivity and mechanical properties. While promising, these composite systems introduce new challenges in achieving homogeneous dispersion and maintaining interfacial stability between organic and inorganic components.

The patent landscape reveals increasing activity in cross-linking strategies and block copolymer architectures designed to simultaneously address multiple performance parameters. However, these advanced molecular engineering approaches often increase production complexity and cost, creating additional barriers to commercialization.

The primary technical challenges facing SPE development center around ionic conductivity limitations. Most polymer electrolytes exhibit conductivity values between 10^-5 and 10^-4 S/cm at room temperature, significantly lower than the 10^-3 S/cm threshold required for practical applications. This conductivity gap represents the most critical technical barrier to widespread commercial adoption.

Mechanical stability presents another substantial challenge. Current SPE formulations struggle to maintain structural integrity during repeated charge-discharge cycles, leading to performance degradation over time. The interface between the polymer electrolyte and electrodes often develops resistance issues, further compromising battery efficiency and lifespan.

Chemical compatibility with high-voltage cathode materials remains problematic. Many promising SPE compositions demonstrate degradation when exposed to operating voltages above 4.5V, limiting their application in high-energy density battery systems. This voltage stability constraint restricts the energy density potential of SPE-based batteries.

Manufacturing scalability constitutes a significant industrial challenge. Current laboratory-scale production methods for high-performance SPEs often involve complex synthesis procedures that prove difficult to scale for mass production. The precision required for consistent polymer chain length, crystallinity control, and additive distribution presents formidable manufacturing hurdles.

Temperature sensitivity further complicates SPE implementation. Most polymer electrolytes exhibit dramatic performance variations across operating temperature ranges, with particularly poor conductivity at lower temperatures. This temperature dependence limits their practical application in regions with variable climates.

Recent research has focused on composite approaches, incorporating inorganic fillers such as ceramic nanoparticles to enhance conductivity and mechanical properties. While promising, these composite systems introduce new challenges in achieving homogeneous dispersion and maintaining interfacial stability between organic and inorganic components.

The patent landscape reveals increasing activity in cross-linking strategies and block copolymer architectures designed to simultaneously address multiple performance parameters. However, these advanced molecular engineering approaches often increase production complexity and cost, creating additional barriers to commercialization.

Current SPE Technical Solutions and Implementations

01 Polymer matrix compositions for solid electrolytes

Various polymer matrices are used as the foundation for solid polymer electrolytes, providing mechanical stability and ion transport pathways. Common polymers include polyethylene oxide (PEO), polyvinylidene fluoride (PVDF), and their copolymers. These matrices can be modified with additives to enhance their ionic conductivity, mechanical properties, and electrochemical stability for battery applications.- Polymer-based electrolyte compositions: Solid polymer electrolytes can be formulated with various polymer matrices to enhance ionic conductivity and mechanical stability. These compositions typically include polymers such as polyethylene oxide (PEO), polyvinylidene fluoride (PVDF), or polyacrylonitrile (PAN) as the host material. The polymer matrix provides structural integrity while allowing for ion transport through the electrolyte. These formulations can be optimized by adjusting the polymer molecular weight, crystallinity, and cross-linking density to achieve desired electrochemical properties.

- Lithium salt additives for improved conductivity: The incorporation of lithium salts into solid polymer electrolytes significantly enhances ionic conductivity. Common lithium salts include lithium hexafluorophosphate (LiPF6), lithium bis(trifluoromethanesulfonyl)imide (LiTFSI), and lithium perchlorate (LiClO4). These salts dissociate within the polymer matrix, providing mobile lithium ions for charge transport. The concentration and type of lithium salt can be optimized to achieve the desired balance between conductivity and electrochemical stability, which is crucial for battery performance.

- Ceramic fillers and nanocomposite electrolytes: The addition of ceramic fillers or nanoparticles to polymer electrolytes creates composite systems with enhanced properties. Materials such as alumina (Al2O3), silica (SiO2), titanium dioxide (TiO2), and various metal oxides are commonly used as fillers. These nanocomposite electrolytes exhibit improved mechanical strength, thermal stability, and ionic conductivity compared to pure polymer electrolytes. The ceramic particles can create additional pathways for ion transport and help suppress polymer crystallization, leading to better overall performance in battery applications.

- Gel polymer electrolytes and plasticizers: Gel polymer electrolytes incorporate plasticizers into the polymer matrix to enhance ionic conductivity while maintaining solid-like mechanical properties. Common plasticizers include organic carbonates, polyethylene glycol, and ionic liquids. These additives reduce the crystallinity of the polymer and increase the free volume, facilitating ion transport through the electrolyte. Gel polymer electrolytes offer a compromise between the high conductivity of liquid electrolytes and the mechanical stability and safety advantages of solid electrolytes, making them suitable for various electrochemical devices.

- Cross-linked and block copolymer electrolytes: Advanced solid polymer electrolytes utilize cross-linking techniques and block copolymer architectures to optimize both mechanical and electrochemical properties. Cross-linked polymer networks provide enhanced dimensional stability and resistance to deformation while maintaining ionic pathways. Block copolymers with distinct functional segments can self-assemble into nanostructured morphologies that simultaneously provide mechanical strength and efficient ion transport channels. These sophisticated polymer designs allow for tailoring of electrolyte properties to meet specific requirements for different battery technologies and operating conditions.

02 Ionic conductivity enhancement techniques

Various methods are employed to enhance the ionic conductivity of solid polymer electrolytes, which is crucial for their performance in energy storage devices. These techniques include incorporating ceramic fillers, plasticizers, and ionic liquids into the polymer matrix. Additionally, the use of lithium salts with large anions and the creation of cross-linked polymer networks can significantly improve ion transport properties while maintaining mechanical integrity.Expand Specific Solutions03 Composite and gel polymer electrolytes

Composite and gel polymer electrolytes represent advanced formulations that combine the benefits of solid polymers with enhanced ionic conductivity. These systems typically incorporate inorganic fillers such as silica, alumina, or lithium-containing ceramics into the polymer matrix. Gel polymer electrolytes contain liquid electrolyte components trapped within a polymer network, offering higher conductivity while maintaining solid-like mechanical properties.Expand Specific Solutions04 Interface engineering and stability improvements

Interface engineering focuses on improving the contact between solid polymer electrolytes and electrodes to enhance electrochemical performance and stability. Techniques include surface modifications of electrodes, incorporation of interfacial layers, and development of additives that suppress dendrite formation. These approaches aim to reduce interfacial resistance, prevent side reactions, and extend the cycle life of batteries using solid polymer electrolytes.Expand Specific Solutions05 Manufacturing processes and applications

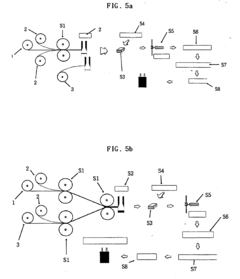

Various manufacturing processes are employed to produce solid polymer electrolytes with optimized properties for specific applications. These include solution casting, hot pressing, electrospinning, and in-situ polymerization techniques. Solid polymer electrolytes find applications in lithium-ion batteries, lithium metal batteries, fuel cells, supercapacitors, and electrochromic devices, where they offer advantages in terms of safety, form factor flexibility, and energy density.Expand Specific Solutions

Key Industry Players in SPE Technology

The solid polymer electrolyte (SPE) market for lithium batteries is in a growth phase, with increasing adoption driven by safety and performance advantages over liquid electrolytes. The global market is projected to expand significantly as electric vehicle adoption accelerates. Technologically, SPEs are advancing from early-stage development toward commercial viability, with key players demonstrating varying levels of maturity. Leading companies like LG Energy Solution, Samsung SDI, and Toyota are investing heavily in SPE R&D, while BYD and CATL are rapidly advancing their technologies. Academic institutions including MIT, University of Maryland, and CNRS are contributing fundamental research. Specialized firms like Ionic Materials and PolyPlus Battery are developing proprietary SPE technologies, creating a competitive landscape balanced between established battery manufacturers and innovative startups focused on next-generation solutions.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed advanced solid polymer electrolytes (SPEs) incorporating cross-linked polymer networks with high ionic conductivity. Their proprietary technology combines polyethylene oxide (PEO) matrices with lithium salts and ceramic fillers to create composite polymer electrolytes that operate efficiently at room temperature. The company has implemented a unique surface modification technique for the ceramic fillers that enhances the interfacial stability between the electrolyte and electrodes. Their patents cover multi-layered SPE structures that effectively suppress lithium dendrite growth while maintaining mechanical flexibility. LG has also developed manufacturing processes that enable large-scale production of these SPEs with consistent quality and performance characteristics, positioning them as a leader in commercial solid-state battery technology.

Strengths: Superior ionic conductivity at room temperature compared to traditional PEO-based systems; excellent mechanical properties that prevent dendrite penetration; established manufacturing infrastructure for scale-up. Weaknesses: Higher production costs compared to liquid electrolytes; potential challenges with long-term cycling stability at elevated temperatures; interface resistance issues that may affect power performance.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered a hybrid solid polymer electrolyte system that combines sulfide-based inorganic materials with flexible polymer matrices to create a composite electrolyte with superior mechanical properties and ionic conductivity. Their patented technology incorporates specialized polymer chains with functional groups that coordinate with lithium ions, creating efficient ion transport pathways. Toyota's approach includes a gradient electrolyte structure where the composition varies across the thickness to optimize both electrode interfaces simultaneously. The company has developed proprietary processing techniques that enable the formation of thin, defect-free electrolyte layers (under 20 μm) that significantly reduce internal resistance. Toyota has also created self-healing polymer electrolyte formulations that can repair microcracks during battery operation, extending cycle life and enhancing safety performance in automotive applications.

Strengths: Excellent mechanical stability preventing short circuits; high voltage stability (>4.5V) enabling high-energy cathode materials; proven scalability for automotive applications. Weaknesses: Complex manufacturing process requiring precise control of multiple components; temperature sensitivity affecting cold-weather performance; higher material costs compared to conventional liquid electrolyte systems.

Critical SPE Patent Analysis and Innovation Assessment

Solid polymer electrolyte

PatentInactiveUS20050256256A1

Innovation

- A triblock copolymer with a microphase separated structure is developed, where a rigid block chain such as polystyrene is incorporated at the terminals of the alkoxypolyethylene glycol mono(meth)acrylate chain, enhancing pseudo cross-linking and allowing higher ionic conductivity without compromising physical characteristics.

Solid polymer alloy electrolyte in homogeneous state and manufacturing method therefor, and composite electrode, lithium polymer battery and lithium ion polymer battery using the same and manufacturing methods therefor

PatentInactiveEP1114481B1

Innovation

- A homogeneous solid polymer alloy electrolyte is developed by blending specific polymers such as polyacrylonitrile, poly(methyl methacrylate), polyvinylidene fluoride, and poly(vinyl chloride) with organic solvent electrolytes and additives like SiO2 or Al2O3, enhancing ion conductivity, adhesion, and mechanical strength, and simplifying the manufacturing process.

Regulatory Framework for Battery Materials

The regulatory landscape for solid polymer electrolytes (SPEs) in lithium battery applications is complex and varies significantly across global markets. In the United States, the Department of Energy has established specific safety standards for battery materials through the Battery500 Consortium, which aims to develop lithium-metal batteries with specific energies of 500 Wh/kg. These regulations focus on thermal stability, non-flammability, and environmental impact of polymer electrolytes.

The European Union has implemented more stringent regulatory frameworks through the Battery Directive (2006/66/EC) and its recent update, the Battery Regulation (2023), which specifically addresses advanced battery materials including solid-state components. These regulations emphasize sustainability, requiring manufacturers to document the carbon footprint of battery materials and establish recycling protocols for polymer-based components.

In Asia, regulatory approaches differ markedly. China's Energy-Saving and New Energy Vehicle Technology Roadmap (Version 2.0) outlines specific requirements for solid-state battery materials, including polymer electrolytes, with emphasis on performance standards rather than environmental considerations. Japan's regulatory framework, administered by METI (Ministry of Economy, Trade and Industry), focuses on safety certification for new battery materials through the JIS (Japanese Industrial Standards).

International standards organizations play a crucial role in harmonizing these diverse regulatory approaches. The International Electrotechnical Commission (IEC) has developed IEC 62660 for lithium-ion batteries, which is being expanded to address solid-state technologies. Similarly, ISO/TC 197 is developing standards specifically for solid electrolyte materials, including polymers.

Patent protection for SPEs must navigate these regulatory frameworks, with significant implications for market entry strategies. Intellectual property rights must be secured while ensuring compliance with regional safety standards, which can substantially impact the commercialization timeline. For instance, UL 1642 certification in the United States requires extensive safety testing that can delay market entry by 12-18 months.

Emerging regulations are increasingly focusing on end-of-life management for advanced battery materials. The EU's proposed Battery Passport system will require detailed documentation of material composition and recyclability for all battery components, including solid polymer electrolytes. This trend toward circular economy principles is expected to influence patent strategies, with increasing emphasis on recyclable polymer formulations and environmentally benign processing methods.

The European Union has implemented more stringent regulatory frameworks through the Battery Directive (2006/66/EC) and its recent update, the Battery Regulation (2023), which specifically addresses advanced battery materials including solid-state components. These regulations emphasize sustainability, requiring manufacturers to document the carbon footprint of battery materials and establish recycling protocols for polymer-based components.

In Asia, regulatory approaches differ markedly. China's Energy-Saving and New Energy Vehicle Technology Roadmap (Version 2.0) outlines specific requirements for solid-state battery materials, including polymer electrolytes, with emphasis on performance standards rather than environmental considerations. Japan's regulatory framework, administered by METI (Ministry of Economy, Trade and Industry), focuses on safety certification for new battery materials through the JIS (Japanese Industrial Standards).

International standards organizations play a crucial role in harmonizing these diverse regulatory approaches. The International Electrotechnical Commission (IEC) has developed IEC 62660 for lithium-ion batteries, which is being expanded to address solid-state technologies. Similarly, ISO/TC 197 is developing standards specifically for solid electrolyte materials, including polymers.

Patent protection for SPEs must navigate these regulatory frameworks, with significant implications for market entry strategies. Intellectual property rights must be secured while ensuring compliance with regional safety standards, which can substantially impact the commercialization timeline. For instance, UL 1642 certification in the United States requires extensive safety testing that can delay market entry by 12-18 months.

Emerging regulations are increasingly focusing on end-of-life management for advanced battery materials. The EU's proposed Battery Passport system will require detailed documentation of material composition and recyclability for all battery components, including solid polymer electrolytes. This trend toward circular economy principles is expected to influence patent strategies, with increasing emphasis on recyclable polymer formulations and environmentally benign processing methods.

Environmental Impact and Sustainability of SPE Technology

Solid Polymer Electrolyte (SPE) technology represents a significant advancement in lithium battery development with notable environmental and sustainability advantages over conventional liquid electrolyte systems. The elimination of volatile organic solvents in SPEs substantially reduces the risk of toxic chemical leakage and flammability issues, enhancing both environmental safety and reducing hazardous waste management requirements throughout the battery lifecycle.

From a manufacturing perspective, SPE production processes typically consume less energy compared to liquid electrolyte systems, resulting in a lower carbon footprint. Many polymer electrolyte formulations can be produced using environmentally benign methods, with some advanced manufacturing techniques enabling solvent-free processing that further minimizes environmental impact and reduces industrial waste generation.

The extended cycle life and improved stability of SPE-based batteries directly contribute to sustainability by reducing the frequency of battery replacement and associated resource consumption. This longevity effect translates to fewer batteries entering the waste stream over time, addressing a critical environmental challenge in the rapidly expanding global battery market.

Recyclability represents another significant environmental advantage of SPE technology. The solid-state nature of these batteries facilitates more efficient end-of-life material recovery compared to liquid systems. Patent analysis reveals increasing innovation focus on designing SPEs with recyclable polymers and recovery-optimized structures, potentially enabling closed-loop material cycles that align with circular economy principles.

Recent patent filings demonstrate growing interest in bio-derived and biodegradable polymer electrolytes, with several major battery manufacturers securing intellectual property around naturally sourced polymers. These developments could significantly reduce dependence on petroleum-based materials while offering end-of-life biodegradability advantages.

Life Cycle Assessment (LCA) studies referenced in patent documentation indicate that SPE-based batteries generally demonstrate lower environmental impact scores across multiple categories including global warming potential, resource depletion, and ecotoxicity. However, challenges remain in scaling sustainable production methods and ensuring consistent environmental performance across diverse SPE formulations.

The regulatory landscape is increasingly favorable toward SPE technology, with several jurisdictions implementing policies that incentivize lower-impact battery technologies. Patent activity suggests companies are strategically positioning their SPE innovations to capitalize on these regulatory trends, particularly in regions with stringent environmental compliance requirements for battery manufacturing and disposal.

From a manufacturing perspective, SPE production processes typically consume less energy compared to liquid electrolyte systems, resulting in a lower carbon footprint. Many polymer electrolyte formulations can be produced using environmentally benign methods, with some advanced manufacturing techniques enabling solvent-free processing that further minimizes environmental impact and reduces industrial waste generation.

The extended cycle life and improved stability of SPE-based batteries directly contribute to sustainability by reducing the frequency of battery replacement and associated resource consumption. This longevity effect translates to fewer batteries entering the waste stream over time, addressing a critical environmental challenge in the rapidly expanding global battery market.

Recyclability represents another significant environmental advantage of SPE technology. The solid-state nature of these batteries facilitates more efficient end-of-life material recovery compared to liquid systems. Patent analysis reveals increasing innovation focus on designing SPEs with recyclable polymers and recovery-optimized structures, potentially enabling closed-loop material cycles that align with circular economy principles.

Recent patent filings demonstrate growing interest in bio-derived and biodegradable polymer electrolytes, with several major battery manufacturers securing intellectual property around naturally sourced polymers. These developments could significantly reduce dependence on petroleum-based materials while offering end-of-life biodegradability advantages.

Life Cycle Assessment (LCA) studies referenced in patent documentation indicate that SPE-based batteries generally demonstrate lower environmental impact scores across multiple categories including global warming potential, resource depletion, and ecotoxicity. However, challenges remain in scaling sustainable production methods and ensuring consistent environmental performance across diverse SPE formulations.

The regulatory landscape is increasingly favorable toward SPE technology, with several jurisdictions implementing policies that incentivize lower-impact battery technologies. Patent activity suggests companies are strategically positioning their SPE innovations to capitalize on these regulatory trends, particularly in regions with stringent environmental compliance requirements for battery manufacturing and disposal.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!