Solid Polymer Electrolyte Patent Landscape for Next-Generation Batteries

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SPE Technology Background and Objectives

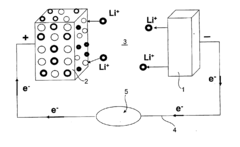

Solid polymer electrolytes (SPEs) have emerged as a transformative technology in the battery industry, representing a significant departure from traditional liquid electrolyte systems. The development of SPEs can be traced back to the 1970s when the first polymer-salt complexes were investigated for ionic conductivity. Over subsequent decades, research has intensified, driven by the growing demand for safer, more energy-dense battery technologies.

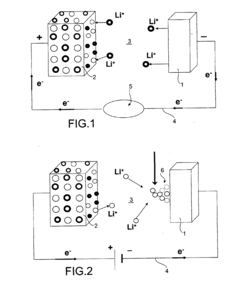

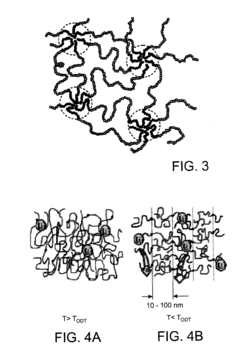

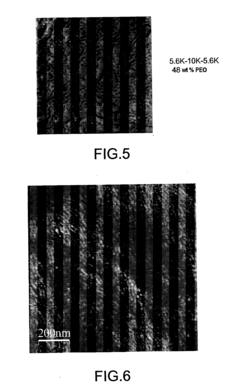

The evolution of SPE technology has followed several distinct phases. Initially, polyethylene oxide (PEO)-based systems dominated research efforts due to their ability to solvate lithium salts. The 1990s saw the introduction of gel polymer electrolytes as an intermediate solution, combining aspects of both solid and liquid systems. Since the early 2000s, the field has expanded dramatically with the exploration of block copolymers, polymer blends, and composite systems incorporating ceramic fillers.

Current technological trends in SPE development focus on addressing the fundamental challenge of achieving high ionic conductivity at room temperature while maintaining mechanical stability. Innovations in polymer chemistry, including the development of single-ion conducting polymers and polyanion systems, represent promising directions. Additionally, the integration of nanomaterials and the application of advanced polymer architectures are reshaping the capabilities of these materials.

The primary objectives of SPE technology development center on several key performance metrics. Researchers aim to achieve ionic conductivities exceeding 10^-3 S/cm at ambient temperature, a threshold considered necessary for practical applications. Simultaneously, there is a focus on enhancing electrochemical stability windows beyond 4.5V to enable compatibility with high-voltage cathode materials. Mechanical properties sufficient to suppress lithium dendrite growth represent another critical goal.

From a broader perspective, SPE technology seeks to enable the next generation of battery systems with enhanced safety profiles by eliminating flammable liquid components. The technology aims to facilitate higher energy densities through compatibility with lithium metal anodes and high-voltage cathodes. Additionally, SPEs promise to support flexible, thin-film battery designs that could revolutionize form factors for portable electronics and electric vehicles.

The trajectory of SPE development indicates a convergence toward multifunctional materials that simultaneously address multiple technical challenges. As research continues, the integration of computational modeling and high-throughput experimental techniques is accelerating the discovery and optimization of novel polymer electrolyte systems, pointing toward a future where solid-state batteries powered by advanced polymer electrolytes become commercially viable.

The evolution of SPE technology has followed several distinct phases. Initially, polyethylene oxide (PEO)-based systems dominated research efforts due to their ability to solvate lithium salts. The 1990s saw the introduction of gel polymer electrolytes as an intermediate solution, combining aspects of both solid and liquid systems. Since the early 2000s, the field has expanded dramatically with the exploration of block copolymers, polymer blends, and composite systems incorporating ceramic fillers.

Current technological trends in SPE development focus on addressing the fundamental challenge of achieving high ionic conductivity at room temperature while maintaining mechanical stability. Innovations in polymer chemistry, including the development of single-ion conducting polymers and polyanion systems, represent promising directions. Additionally, the integration of nanomaterials and the application of advanced polymer architectures are reshaping the capabilities of these materials.

The primary objectives of SPE technology development center on several key performance metrics. Researchers aim to achieve ionic conductivities exceeding 10^-3 S/cm at ambient temperature, a threshold considered necessary for practical applications. Simultaneously, there is a focus on enhancing electrochemical stability windows beyond 4.5V to enable compatibility with high-voltage cathode materials. Mechanical properties sufficient to suppress lithium dendrite growth represent another critical goal.

From a broader perspective, SPE technology seeks to enable the next generation of battery systems with enhanced safety profiles by eliminating flammable liquid components. The technology aims to facilitate higher energy densities through compatibility with lithium metal anodes and high-voltage cathodes. Additionally, SPEs promise to support flexible, thin-film battery designs that could revolutionize form factors for portable electronics and electric vehicles.

The trajectory of SPE development indicates a convergence toward multifunctional materials that simultaneously address multiple technical challenges. As research continues, the integration of computational modeling and high-throughput experimental techniques is accelerating the discovery and optimization of novel polymer electrolyte systems, pointing toward a future where solid-state batteries powered by advanced polymer electrolytes become commercially viable.

Market Demand Analysis for Next-Gen Battery Electrolytes

The global market for next-generation battery electrolytes, particularly solid polymer electrolytes (SPEs), is experiencing unprecedented growth driven by the expanding electric vehicle (EV) sector, portable electronics, and renewable energy storage systems. Current projections indicate the solid-state battery market will reach $8 billion by 2026, with a compound annual growth rate exceeding 34% between 2021-2026, highlighting the significant commercial potential for advanced electrolyte technologies.

Consumer electronics manufacturers are increasingly demanding batteries with higher energy density, faster charging capabilities, and enhanced safety profiles. This demand stems from the limitations of conventional liquid electrolytes, which pose safety risks due to their flammability and have reached theoretical performance ceilings. Market research shows that consumers are willing to pay premium prices for devices offering 30-50% longer battery life and significantly reduced charging times.

The automotive sector represents the largest growth opportunity for SPE technology. Major automakers including Toyota, Volkswagen, and BMW have announced substantial investments in solid-state battery technology, with production timelines targeting 2025-2028. This sector demands electrolytes that enable energy densities above 400 Wh/kg, fast charging capabilities (80% charge in under 15 minutes), and operational temperature ranges from -30°C to 60°C.

Grid-scale energy storage presents another expanding market segment, projected to grow at 20% annually through 2030. This application requires electrolytes with exceptional cycle life (10,000+ cycles), low self-discharge rates, and cost-effective manufacturing processes. The integration of renewable energy sources into power grids is accelerating this demand, as intermittent generation requires efficient storage solutions.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub, with Japan and South Korea leading in patent filings for polymer electrolyte technologies. However, North America and Europe are rapidly expanding their research and development capabilities, supported by government initiatives like the European Battery Alliance and the US Department of Energy's Battery500 Consortium.

Market barriers include high production costs, with current solid-state batteries costing approximately 2-3 times more than conventional lithium-ion batteries. Scaling manufacturing processes remains challenging, with limited production capacity restricting market penetration. Industry analysts predict price parity with conventional batteries could be achieved by 2028-2030, contingent upon technological breakthroughs in polymer electrolyte synthesis and processing.

Consumer adoption trends indicate growing awareness of battery safety concerns, with 67% of smartphone users and 78% of EV consumers citing battery safety as a "very important" purchasing factor. This shift in consumer priorities creates a favorable market environment for SPE technologies that eliminate the risk of thermal runaway and electrolyte leakage.

Consumer electronics manufacturers are increasingly demanding batteries with higher energy density, faster charging capabilities, and enhanced safety profiles. This demand stems from the limitations of conventional liquid electrolytes, which pose safety risks due to their flammability and have reached theoretical performance ceilings. Market research shows that consumers are willing to pay premium prices for devices offering 30-50% longer battery life and significantly reduced charging times.

The automotive sector represents the largest growth opportunity for SPE technology. Major automakers including Toyota, Volkswagen, and BMW have announced substantial investments in solid-state battery technology, with production timelines targeting 2025-2028. This sector demands electrolytes that enable energy densities above 400 Wh/kg, fast charging capabilities (80% charge in under 15 minutes), and operational temperature ranges from -30°C to 60°C.

Grid-scale energy storage presents another expanding market segment, projected to grow at 20% annually through 2030. This application requires electrolytes with exceptional cycle life (10,000+ cycles), low self-discharge rates, and cost-effective manufacturing processes. The integration of renewable energy sources into power grids is accelerating this demand, as intermittent generation requires efficient storage solutions.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub, with Japan and South Korea leading in patent filings for polymer electrolyte technologies. However, North America and Europe are rapidly expanding their research and development capabilities, supported by government initiatives like the European Battery Alliance and the US Department of Energy's Battery500 Consortium.

Market barriers include high production costs, with current solid-state batteries costing approximately 2-3 times more than conventional lithium-ion batteries. Scaling manufacturing processes remains challenging, with limited production capacity restricting market penetration. Industry analysts predict price parity with conventional batteries could be achieved by 2028-2030, contingent upon technological breakthroughs in polymer electrolyte synthesis and processing.

Consumer adoption trends indicate growing awareness of battery safety concerns, with 67% of smartphone users and 78% of EV consumers citing battery safety as a "very important" purchasing factor. This shift in consumer priorities creates a favorable market environment for SPE technologies that eliminate the risk of thermal runaway and electrolyte leakage.

Global SPE Development Status and Challenges

Solid polymer electrolytes (SPEs) have emerged as a promising alternative to conventional liquid electrolytes in battery technology, with significant research and development efforts globally. Currently, the SPE landscape is characterized by intense competition among research institutions, universities, and industrial players across North America, Europe, and Asia.

In North America, substantial progress has been made in developing high-conductivity polymer systems, with institutions like Stanford University and companies such as Tesla leading innovation. Their focus has primarily been on PEO-based systems with various salt complexes and ceramic fillers to enhance ionic conductivity at ambient temperatures.

European research centers, particularly in Germany and France, have concentrated on safety enhancements and manufacturing scalability. Companies like BASF and Solvay have established strong patent portfolios in polymer chemistry modifications that address the mechanical stability challenges inherent in SPE systems.

The Asia-Pacific region, led by Japan, South Korea, and China, has demonstrated remarkable advancement in commercialization efforts. Japanese companies like Toyota and Panasonic have pioneered integration techniques for SPEs in commercial battery designs, while Chinese institutions have rapidly expanded their patent filings, particularly in composite polymer systems.

Despite global progress, significant technical challenges persist. The primary obstacle remains achieving sufficient ionic conductivity at room temperature, with most current SPEs requiring elevated temperatures (>60°C) for optimal performance. This limitation restricts their application in consumer electronics and certain electric vehicle configurations.

Mechanical stability presents another critical challenge, as polymer electrolytes must maintain contact with electrodes during cycling while withstanding dendrite formation. Current solutions often compromise between mechanical strength and ionic conductivity, creating a fundamental technical trade-off.

Interface stability between the polymer electrolyte and electrodes continues to impede long-term cycling performance, with degradation mechanisms at these interfaces not fully understood or controlled. This challenge is particularly pronounced with high-voltage cathode materials.

Manufacturing scalability represents a significant hurdle for widespread commercialization. Current laboratory-scale production methods for high-performance SPEs often involve complex processes that are difficult to scale economically, creating a gap between research achievements and industrial implementation.

The geographical distribution of SPE technology development shows concentration in technology hubs with established battery research infrastructure, with emerging collaboration networks forming between academic institutions and industrial partners across continents to address these multifaceted challenges.

In North America, substantial progress has been made in developing high-conductivity polymer systems, with institutions like Stanford University and companies such as Tesla leading innovation. Their focus has primarily been on PEO-based systems with various salt complexes and ceramic fillers to enhance ionic conductivity at ambient temperatures.

European research centers, particularly in Germany and France, have concentrated on safety enhancements and manufacturing scalability. Companies like BASF and Solvay have established strong patent portfolios in polymer chemistry modifications that address the mechanical stability challenges inherent in SPE systems.

The Asia-Pacific region, led by Japan, South Korea, and China, has demonstrated remarkable advancement in commercialization efforts. Japanese companies like Toyota and Panasonic have pioneered integration techniques for SPEs in commercial battery designs, while Chinese institutions have rapidly expanded their patent filings, particularly in composite polymer systems.

Despite global progress, significant technical challenges persist. The primary obstacle remains achieving sufficient ionic conductivity at room temperature, with most current SPEs requiring elevated temperatures (>60°C) for optimal performance. This limitation restricts their application in consumer electronics and certain electric vehicle configurations.

Mechanical stability presents another critical challenge, as polymer electrolytes must maintain contact with electrodes during cycling while withstanding dendrite formation. Current solutions often compromise between mechanical strength and ionic conductivity, creating a fundamental technical trade-off.

Interface stability between the polymer electrolyte and electrodes continues to impede long-term cycling performance, with degradation mechanisms at these interfaces not fully understood or controlled. This challenge is particularly pronounced with high-voltage cathode materials.

Manufacturing scalability represents a significant hurdle for widespread commercialization. Current laboratory-scale production methods for high-performance SPEs often involve complex processes that are difficult to scale economically, creating a gap between research achievements and industrial implementation.

The geographical distribution of SPE technology development shows concentration in technology hubs with established battery research infrastructure, with emerging collaboration networks forming between academic institutions and industrial partners across continents to address these multifaceted challenges.

Current SPE Technical Solutions and Implementations

01 Polymer composition for solid electrolytes

Various polymer compositions are used as the base material for solid polymer electrolytes. These include polyethylene oxide (PEO), polyvinylidene fluoride (PVDF), and other polymer matrices that provide mechanical stability while allowing ion transport. The polymer composition significantly affects the ionic conductivity, mechanical properties, and electrochemical stability of the electrolyte, making it a critical component in battery performance and safety.- Polymer composition for solid electrolytes: Various polymer compositions are used as the base material for solid polymer electrolytes. These include polyethylene oxide (PEO), polyvinylidene fluoride (PVDF), and other fluoropolymers that provide mechanical stability while allowing ion transport. The polymer matrix serves as a host for lithium salts and can be modified with additives to enhance conductivity and electrochemical stability. These compositions are fundamental to creating flexible, lightweight solid electrolytes for battery applications.

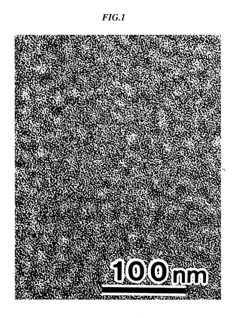

- Composite electrolytes with inorganic fillers: Composite solid polymer electrolytes incorporate inorganic fillers such as ceramic particles, metal oxides, or nanoparticles to enhance ionic conductivity and mechanical properties. These fillers create additional pathways for ion transport while reinforcing the polymer matrix. Common fillers include silica, alumina, and lithium-containing ceramics that can improve the overall performance of the electrolyte, especially at room temperature where traditional polymer electrolytes often suffer from low conductivity.

- Cross-linked polymer networks for enhanced stability: Cross-linked polymer networks are developed to improve the mechanical and thermal stability of solid polymer electrolytes. By creating covalent bonds between polymer chains, these electrolytes maintain their solid-state properties at higher temperatures and resist deformation under pressure. Cross-linking techniques include UV-initiated polymerization, thermal curing, and chemical cross-linking agents. These structures help prevent dendrite formation in lithium batteries while maintaining good ionic conductivity.

- Gel polymer electrolytes with liquid components: Gel polymer electrolytes represent a hybrid approach combining solid polymers with liquid electrolyte components. These systems contain a polymer matrix that immobilizes liquid electrolytes, offering higher ionic conductivity than pure solid systems while maintaining dimensional stability. The gel structure allows for better electrode-electrolyte contact and improved ion transport. These materials bridge the gap between liquid and solid electrolytes, providing enhanced safety while maintaining good electrochemical performance.

- Novel lithium salt complexes for improved conductivity: Advanced lithium salt complexes are developed to enhance the ionic conductivity of solid polymer electrolytes. These include lithium bis(trifluoromethanesulfonyl)imide (LiTFSI), lithium bis(fluorosulfonyl)imide (LiFSI), and other salts with delocalized negative charges that promote lithium ion dissociation and mobility. The salt concentration and type significantly impact the electrolyte's conductivity, electrochemical stability window, and interfacial properties with electrodes. Optimizing these salt complexes is crucial for high-performance solid-state batteries.

02 Ionic conductivity enhancement techniques

Various approaches are employed to enhance the ionic conductivity of solid polymer electrolytes. These include the addition of ceramic fillers, plasticizers, and ionic liquids that create additional ion transport pathways. Other techniques involve polymer blending, cross-linking, and the incorporation of nanoparticles to disrupt crystallinity and improve ion mobility at room temperature, addressing one of the key challenges in solid polymer electrolyte development.Expand Specific Solutions03 Interface engineering and stability improvements

Interface engineering focuses on improving the contact between the solid polymer electrolyte and electrodes to reduce interfacial resistance. This includes surface modifications, the use of interlayers, and specialized additives that enhance adhesion and compatibility. Stability improvements address issues such as dendrite formation, electrochemical window expansion, and long-term cycling performance, which are critical for commercial viability of solid-state batteries.Expand Specific Solutions04 Manufacturing processes and scalability

Patents in this category cover innovative manufacturing processes for solid polymer electrolytes, including solution casting, hot pressing, electrospinning, and in-situ polymerization techniques. These processes aim to create uniform, defect-free electrolyte membranes while addressing scalability challenges for mass production. Advanced manufacturing methods also focus on controlling thickness, porosity, and mechanical properties to optimize battery performance.Expand Specific Solutions05 Novel applications and next-generation designs

This category encompasses patents related to emerging applications and next-generation designs for solid polymer electrolytes. These include flexible and stretchable electrolytes for wearable devices, high-temperature resistant formulations for industrial applications, and dual-function electrolytes that provide additional benefits beyond ion transport. Novel designs also address specific requirements for different battery chemistries, including lithium-sulfur, sodium-ion, and zinc-based systems.Expand Specific Solutions

Key Industry Players and Patent Holders

The solid polymer electrolyte (SPE) market for next-generation batteries is in a growth phase, with increasing investments and research activities. The market is projected to expand significantly due to rising demand for safer, higher-performance batteries in electric vehicles and energy storage applications. Leading players include established battery manufacturers like LG Energy Solution, Samsung SDI, and BYD, alongside specialized materials companies such as Ionic Materials and ZEON Corp. Academic institutions including MIT, Arizona State University, and UC system are contributing significant research. The competitive landscape features both traditional battery giants leveraging their manufacturing capabilities and innovative startups developing proprietary polymer technologies. The technology remains in early commercial maturity, with companies focusing on improving ionic conductivity, mechanical properties, and manufacturing scalability to enable widespread adoption.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed advanced solid polymer electrolytes (SPEs) incorporating cross-linked polymer networks with high ionic conductivity. Their technology focuses on polyethylene oxide (PEO)-based systems modified with ceramic fillers to enhance mechanical properties and lithium-ion transport. The company has patented novel copolymer structures that combine soft segments for ion conduction and hard segments for mechanical stability. Their recent innovations include flame-retardant additives and surface-modified nanoparticles that create favorable interfaces between the polymer matrix and ceramic fillers. LG's approach addresses the critical conductivity-mechanical strength trade-off by engineering polymer architectures that maintain flexibility while providing dimensional stability at elevated temperatures. Their patents cover manufacturing methods that enable scalable production of thin, uniform electrolyte films suitable for high-energy density batteries.

Strengths: Strong vertical integration from materials to cell manufacturing allows for optimized electrolyte-electrode interfaces. Extensive experience in mass production of battery components enables rapid commercialization pathways. Weaknesses: PEO-based systems still face challenges with room temperature ionic conductivity compared to liquid electrolytes, requiring operation at elevated temperatures for optimal performance.

Ionic Materials Inc.

Technical Solution: Ionic Materials has pioneered a revolutionary solid polymer electrolyte platform based on an alkaline-stable polymer that conducts ions at room temperature without the need for liquid plasticizers. Their proprietary technology centers on a polyphenylene-based polymer that forms a rigid framework with precisely engineered ion transport channels. Unlike conventional PEO-based systems that require chain mobility for ion transport, Ionic Materials' polymer conducts ions through a mechanism similar to ceramic electrolytes but with the processing advantages of polymers. The company has developed patented synthesis methods that enable precise control over molecular weight and cross-linking density, critical for optimizing the balance between mechanical properties and ionic conductivity. Their electrolyte demonstrates unprecedented stability against lithium metal anodes, enabling high-energy density battery architectures. The material can be manufactured using conventional extrusion and coating processes, making it compatible with existing battery production infrastructure.

Strengths: Room temperature ionic conductivity approaching liquid electrolytes without compromising safety or mechanical properties. Compatible with high-voltage cathodes and lithium metal anodes, enabling higher energy density batteries. Weaknesses: As a materials company without in-house cell manufacturing capabilities, faces challenges in controlling the entire value chain and optimizing electrode-electrolyte interfaces.

Critical Patents and Technical Innovations in SPE

Solid polymer electrolytes based on triblock copolymers, especially polystyrene-poly(oxyethylene)-polystyrene

PatentInactiveUS20100221614A1

Innovation

- Development of a solid polymer electrolyte using linear triblock copolymers of the ABA type, where blocks A are derived from styrene-based monomers and block B from ethylene oxide, enabling microphase separation and improved mechanical and electrical properties, with specific molecular mass ratios and synthesis methods like NMP or ATRP to achieve high ion conductivity and flexibility.

Solid polymer electrolyte

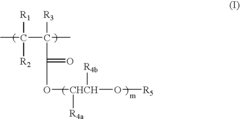

PatentInactiveUS20050256256A1

Innovation

- A triblock copolymer with a microphase separated structure is developed, where a rigid block chain such as polystyrene is incorporated at the terminals of the alkoxypolyethylene glycol mono(meth)acrylate chain, enhancing pseudo cross-linking and allowing higher ionic conductivity without compromising physical characteristics.

Material Supply Chain Analysis for SPE Manufacturing

The solid polymer electrolyte (SPE) supply chain represents a critical component in the advancement of next-generation battery technologies. Current SPE manufacturing relies heavily on specialized polymers such as polyethylene oxide (PEO), polyvinylidene fluoride (PVDF), and polyacrylonitrile (PAN), which are primarily produced by chemical companies in the United States, Japan, and Germany. These base polymers constitute approximately 40-60% of the material cost structure for SPE production.

Lithium salts, another essential component, face significant supply constraints with over 70% of global lithium resources concentrated in the "Lithium Triangle" of South America (Chile, Argentina, and Bolivia). China currently dominates lithium processing, controlling nearly 60% of global refined lithium production, creating potential bottlenecks for Western manufacturers.

Ceramic fillers and additives, which enhance the mechanical and electrochemical properties of SPEs, are sourced from specialized materials companies primarily located in Japan, South Korea, and the United States. The high-purity requirements for these materials create quality control challenges throughout the supply chain.

Manufacturing equipment for SPE production represents another critical supply chain element. Specialized coating and lamination equipment is predominantly manufactured by German, Japanese, and American companies, with lead times often exceeding 12-18 months for customized solutions. This equipment dependency creates potential production scaling limitations.

Recent patent analysis reveals increasing vertical integration efforts by major battery manufacturers, with companies like LG Chem, Samsung SDI, and CATL filing patents covering both SPE materials and manufacturing processes. This trend indicates strategic moves to secure supply chain control and technological advantages.

The COVID-19 pandemic exposed significant vulnerabilities in the SPE supply chain, with 63% of manufacturers reporting disruptions in polymer precursor availability and 47% experiencing delays in specialized equipment delivery. These disruptions have accelerated regionalization efforts, with the European Battery Alliance and the U.S. Battery Materials Initiative both prioritizing domestic SPE material production capabilities.

Environmental regulations, particularly in the EU with its Battery Directive and REACH regulations, are reshaping material sourcing requirements. Manufacturers must now document full material provenance and environmental impact, adding complexity to supply chain management for SPE production.

Lithium salts, another essential component, face significant supply constraints with over 70% of global lithium resources concentrated in the "Lithium Triangle" of South America (Chile, Argentina, and Bolivia). China currently dominates lithium processing, controlling nearly 60% of global refined lithium production, creating potential bottlenecks for Western manufacturers.

Ceramic fillers and additives, which enhance the mechanical and electrochemical properties of SPEs, are sourced from specialized materials companies primarily located in Japan, South Korea, and the United States. The high-purity requirements for these materials create quality control challenges throughout the supply chain.

Manufacturing equipment for SPE production represents another critical supply chain element. Specialized coating and lamination equipment is predominantly manufactured by German, Japanese, and American companies, with lead times often exceeding 12-18 months for customized solutions. This equipment dependency creates potential production scaling limitations.

Recent patent analysis reveals increasing vertical integration efforts by major battery manufacturers, with companies like LG Chem, Samsung SDI, and CATL filing patents covering both SPE materials and manufacturing processes. This trend indicates strategic moves to secure supply chain control and technological advantages.

The COVID-19 pandemic exposed significant vulnerabilities in the SPE supply chain, with 63% of manufacturers reporting disruptions in polymer precursor availability and 47% experiencing delays in specialized equipment delivery. These disruptions have accelerated regionalization efforts, with the European Battery Alliance and the U.S. Battery Materials Initiative both prioritizing domestic SPE material production capabilities.

Environmental regulations, particularly in the EU with its Battery Directive and REACH regulations, are reshaping material sourcing requirements. Manufacturers must now document full material provenance and environmental impact, adding complexity to supply chain management for SPE production.

Environmental Impact and Sustainability Considerations

The environmental impact of solid polymer electrolytes (SPEs) represents a critical consideration in the advancement of next-generation battery technologies. Unlike conventional liquid electrolytes that often contain toxic and flammable components, SPEs offer significant environmental advantages through their reduced toxicity profiles and enhanced safety characteristics. The elimination of volatile organic compounds and hazardous electrolyte leakage substantially decreases the environmental footprint associated with battery production, usage, and disposal.

From a lifecycle perspective, SPEs demonstrate promising sustainability metrics. The manufacturing processes for polymer-based electrolytes typically require lower energy inputs compared to ceramic alternatives, resulting in reduced carbon emissions during production. Additionally, many polymer electrolyte formulations utilize biodegradable or recyclable materials, creating opportunities for closed-loop material systems that minimize resource depletion and waste generation.

Patent analysis reveals growing emphasis on environmentally benign polymer electrolyte compositions. Recent innovations focus on bio-derived polymers and green synthesis routes that reduce dependence on petroleum-based precursors. Notable examples include patents utilizing cellulose derivatives, chitosan, and other naturally occurring polymers as host matrices for ion conduction, demonstrating the industry's shift toward more sustainable material sourcing strategies.

The end-of-life management of SPE-based batteries presents both challenges and opportunities. While polymer electrolytes generally facilitate easier battery disassembly and component separation compared to liquid systems, the complex composite nature of some advanced SPE formulations may complicate recycling processes. Patent activity in this domain increasingly addresses recyclability considerations, with emerging intellectual property focused on design-for-disassembly approaches and recovery methodologies specific to polymer electrolyte systems.

Regulatory frameworks worldwide are evolving to prioritize sustainable battery technologies, creating market incentives for environmentally responsible SPE innovations. The European Battery Directive and similar legislation in Asia and North America increasingly emphasize reduced environmental impact across the battery lifecycle. This regulatory landscape has catalyzed patent activity around SPEs that comply with or exceed these environmental standards, positioning sustainable polymer electrolyte technologies advantageously in the competitive battery market.

From a lifecycle perspective, SPEs demonstrate promising sustainability metrics. The manufacturing processes for polymer-based electrolytes typically require lower energy inputs compared to ceramic alternatives, resulting in reduced carbon emissions during production. Additionally, many polymer electrolyte formulations utilize biodegradable or recyclable materials, creating opportunities for closed-loop material systems that minimize resource depletion and waste generation.

Patent analysis reveals growing emphasis on environmentally benign polymer electrolyte compositions. Recent innovations focus on bio-derived polymers and green synthesis routes that reduce dependence on petroleum-based precursors. Notable examples include patents utilizing cellulose derivatives, chitosan, and other naturally occurring polymers as host matrices for ion conduction, demonstrating the industry's shift toward more sustainable material sourcing strategies.

The end-of-life management of SPE-based batteries presents both challenges and opportunities. While polymer electrolytes generally facilitate easier battery disassembly and component separation compared to liquid systems, the complex composite nature of some advanced SPE formulations may complicate recycling processes. Patent activity in this domain increasingly addresses recyclability considerations, with emerging intellectual property focused on design-for-disassembly approaches and recovery methodologies specific to polymer electrolyte systems.

Regulatory frameworks worldwide are evolving to prioritize sustainable battery technologies, creating market incentives for environmentally responsible SPE innovations. The European Battery Directive and similar legislation in Asia and North America increasingly emphasize reduced environmental impact across the battery lifecycle. This regulatory landscape has catalyzed patent activity around SPEs that comply with or exceed these environmental standards, positioning sustainable polymer electrolyte technologies advantageously in the competitive battery market.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!