Tailoring FTIR for Efficient Gas Emissions Monitoring

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

FTIR Gas Monitoring Technology Background and Objectives

Fourier Transform Infrared Spectroscopy (FTIR) has evolved significantly since its inception in the mid-20th century, transforming from laboratory equipment to versatile environmental monitoring tools. The technology leverages the principle that different gas molecules absorb infrared radiation at specific wavelengths, creating unique spectral fingerprints that enable precise identification and quantification of various gases simultaneously.

The evolution of FTIR for gas monitoring has been driven by increasing environmental regulations and industrial needs for more accurate emissions data. Early systems were bulky, expensive, and primarily confined to laboratory settings. However, technological advancements in optics, detectors, and computational capabilities have progressively enhanced FTIR's field applicability, sensitivity, and cost-effectiveness.

Recent developments have focused on miniaturization, ruggedization, and automation to make FTIR systems more suitable for continuous emissions monitoring systems (CEMS) and fence-line monitoring applications. The integration of advanced algorithms and machine learning techniques has further improved the accuracy of gas concentration measurements and the ability to identify complex gas mixtures in real-time.

The primary objective of tailoring FTIR for efficient gas emissions monitoring is to develop systems that combine high sensitivity, selectivity, and reliability with practical field deployment capabilities. This includes enhancing detection limits to parts-per-billion levels for critical pollutants while maintaining measurement accuracy under varying environmental conditions such as temperature fluctuations, humidity changes, and the presence of interfering compounds.

Another key goal is to reduce the size, power consumption, and maintenance requirements of FTIR systems without compromising analytical performance. This would enable more widespread deployment across industrial facilities, urban environments, and remote locations for comprehensive emissions monitoring networks.

Real-time data processing and integration with wireless communication technologies represent additional objectives, allowing for immediate reporting of emissions data to regulatory authorities and facilitating rapid response to potential environmental hazards. The development of user-friendly interfaces and automated calibration procedures aims to make FTIR technology accessible to operators with varying levels of technical expertise.

Long-term reliability under harsh industrial conditions remains a significant challenge, with research efforts directed toward developing more robust optical components, improved sample handling systems, and self-diagnostic capabilities to ensure measurement integrity over extended periods without frequent maintenance interventions.

The ultimate technological trajectory points toward fully autonomous FTIR monitoring systems capable of continuous operation in diverse environments, providing accurate, real-time emissions data while requiring minimal human intervention. This evolution aligns with broader industry trends toward smart manufacturing and environmental management systems that leverage advanced sensing technologies and data analytics for improved operational and environmental performance.

The evolution of FTIR for gas monitoring has been driven by increasing environmental regulations and industrial needs for more accurate emissions data. Early systems were bulky, expensive, and primarily confined to laboratory settings. However, technological advancements in optics, detectors, and computational capabilities have progressively enhanced FTIR's field applicability, sensitivity, and cost-effectiveness.

Recent developments have focused on miniaturization, ruggedization, and automation to make FTIR systems more suitable for continuous emissions monitoring systems (CEMS) and fence-line monitoring applications. The integration of advanced algorithms and machine learning techniques has further improved the accuracy of gas concentration measurements and the ability to identify complex gas mixtures in real-time.

The primary objective of tailoring FTIR for efficient gas emissions monitoring is to develop systems that combine high sensitivity, selectivity, and reliability with practical field deployment capabilities. This includes enhancing detection limits to parts-per-billion levels for critical pollutants while maintaining measurement accuracy under varying environmental conditions such as temperature fluctuations, humidity changes, and the presence of interfering compounds.

Another key goal is to reduce the size, power consumption, and maintenance requirements of FTIR systems without compromising analytical performance. This would enable more widespread deployment across industrial facilities, urban environments, and remote locations for comprehensive emissions monitoring networks.

Real-time data processing and integration with wireless communication technologies represent additional objectives, allowing for immediate reporting of emissions data to regulatory authorities and facilitating rapid response to potential environmental hazards. The development of user-friendly interfaces and automated calibration procedures aims to make FTIR technology accessible to operators with varying levels of technical expertise.

Long-term reliability under harsh industrial conditions remains a significant challenge, with research efforts directed toward developing more robust optical components, improved sample handling systems, and self-diagnostic capabilities to ensure measurement integrity over extended periods without frequent maintenance interventions.

The ultimate technological trajectory points toward fully autonomous FTIR monitoring systems capable of continuous operation in diverse environments, providing accurate, real-time emissions data while requiring minimal human intervention. This evolution aligns with broader industry trends toward smart manufacturing and environmental management systems that leverage advanced sensing technologies and data analytics for improved operational and environmental performance.

Market Analysis for FTIR Gas Emissions Monitoring Solutions

The global market for FTIR gas emissions monitoring solutions has experienced significant growth in recent years, driven by increasingly stringent environmental regulations and growing awareness of air quality issues. The market size was valued at approximately 1.2 billion USD in 2022 and is projected to reach 1.8 billion USD by 2027, representing a compound annual growth rate of 8.5%.

Environmental regulations across major economies have been a primary driver for this market expansion. The European Union's Industrial Emissions Directive, the U.S. EPA's Clean Air Act amendments, and China's strengthened environmental protection laws have all contributed to increased demand for precise emissions monitoring technologies. These regulatory frameworks require industries to monitor and report various pollutants, creating a sustained demand for advanced monitoring solutions.

The industrial sector represents the largest market segment, accounting for nearly 45% of the total market share. Power generation, chemical processing, and petroleum refining industries are particularly significant consumers of FTIR gas monitoring systems due to their complex emission profiles and regulatory requirements. The automotive sector is also emerging as a growth area, with manufacturers seeking more efficient ways to test and validate emission control systems.

Geographically, North America and Europe currently dominate the market with a combined share of approximately 60%. However, the Asia-Pacific region is witnessing the fastest growth rate at 10.2% annually, primarily driven by rapid industrialization in China and India, coupled with strengthening environmental regulations in these countries.

Customer requirements are increasingly focused on system portability, real-time monitoring capabilities, and integration with digital platforms for remote access and data analytics. There is a growing demand for solutions that can simultaneously monitor multiple gas species with high accuracy while maintaining operational simplicity.

Price sensitivity varies significantly across market segments. While large industrial operations prioritize accuracy and reliability over cost, smaller facilities and emerging markets show greater price sensitivity, creating opportunities for tiered product offerings.

The competitive landscape features established analytical instrument manufacturers alongside specialized environmental monitoring companies. Recent market consolidation through mergers and acquisitions indicates a trend toward integrated solution providers who can offer comprehensive emissions monitoring packages rather than standalone instruments.

Future market growth is expected to be driven by the expansion of emissions trading schemes, carbon pricing mechanisms, and the increasing focus on greenhouse gas reduction targets following international climate agreements. Additionally, the growing adoption of industrial Internet of Things (IIoT) platforms is creating new opportunities for connected FTIR monitoring systems with enhanced data analytics capabilities.

Environmental regulations across major economies have been a primary driver for this market expansion. The European Union's Industrial Emissions Directive, the U.S. EPA's Clean Air Act amendments, and China's strengthened environmental protection laws have all contributed to increased demand for precise emissions monitoring technologies. These regulatory frameworks require industries to monitor and report various pollutants, creating a sustained demand for advanced monitoring solutions.

The industrial sector represents the largest market segment, accounting for nearly 45% of the total market share. Power generation, chemical processing, and petroleum refining industries are particularly significant consumers of FTIR gas monitoring systems due to their complex emission profiles and regulatory requirements. The automotive sector is also emerging as a growth area, with manufacturers seeking more efficient ways to test and validate emission control systems.

Geographically, North America and Europe currently dominate the market with a combined share of approximately 60%. However, the Asia-Pacific region is witnessing the fastest growth rate at 10.2% annually, primarily driven by rapid industrialization in China and India, coupled with strengthening environmental regulations in these countries.

Customer requirements are increasingly focused on system portability, real-time monitoring capabilities, and integration with digital platforms for remote access and data analytics. There is a growing demand for solutions that can simultaneously monitor multiple gas species with high accuracy while maintaining operational simplicity.

Price sensitivity varies significantly across market segments. While large industrial operations prioritize accuracy and reliability over cost, smaller facilities and emerging markets show greater price sensitivity, creating opportunities for tiered product offerings.

The competitive landscape features established analytical instrument manufacturers alongside specialized environmental monitoring companies. Recent market consolidation through mergers and acquisitions indicates a trend toward integrated solution providers who can offer comprehensive emissions monitoring packages rather than standalone instruments.

Future market growth is expected to be driven by the expansion of emissions trading schemes, carbon pricing mechanisms, and the increasing focus on greenhouse gas reduction targets following international climate agreements. Additionally, the growing adoption of industrial Internet of Things (IIoT) platforms is creating new opportunities for connected FTIR monitoring systems with enhanced data analytics capabilities.

Current FTIR Technology Landscape and Challenges

Fourier Transform Infrared (FTIR) spectroscopy has evolved significantly over the past decades, establishing itself as a cornerstone technology for gas emissions monitoring across various industries. The current landscape reveals a mature yet rapidly advancing field, with several key technological configurations dominating the market. Traditional benchtop FTIR systems offer high resolution and sensitivity but remain bulky and primarily laboratory-confined. Portable FTIR analyzers have gained traction in recent years, though they often sacrifice some performance metrics for mobility.

The global FTIR gas analysis market is currently segmented between high-end research-grade instruments and more accessible industrial monitoring solutions. Leading manufacturers have developed specialized systems for emissions monitoring that incorporate heated sampling lines, automated calibration routines, and multi-component analysis capabilities. These systems typically operate in the mid-infrared region (400-4000 cm⁻¹) where most gas molecules exhibit characteristic absorption patterns.

Despite significant advancements, FTIR technology faces several persistent challenges in gas emissions monitoring applications. Sensitivity limitations remain problematic for trace gas detection, particularly when monitoring compounds at sub-ppm levels in complex gas mixtures. Current detection limits typically range from 0.1-5 ppm depending on the target gas and sampling conditions, which proves insufficient for certain environmental and regulatory requirements.

Interference management represents another substantial hurdle. Water vapor and CO₂ absorption bands overlap with many target gases, necessitating complex spectral processing algorithms. Current deconvolution methods often struggle with highly variable background compositions, leading to measurement uncertainties. Cross-sensitivity between similar molecular structures further complicates accurate quantification in multi-component gas streams.

Field deployment presents additional challenges, with temperature fluctuations, vibration, and dust significantly affecting instrument performance. Most existing FTIR systems require controlled environments to maintain optical alignment and spectral resolution. Miniaturization efforts have yielded more compact instruments but often at the cost of reduced spectral range or resolution, creating a persistent trade-off between portability and analytical performance.

Data processing capabilities represent both a challenge and opportunity. Current systems generate massive spectral datasets that require sophisticated chemometric approaches for real-time analysis. Edge computing integration remains limited, with most systems still relying on centralized data processing that introduces latency in monitoring applications requiring immediate feedback.

Cost barriers continue to restrict widespread adoption, with comprehensive FTIR monitoring systems typically ranging from $50,000 to $150,000, placing them beyond reach for many potential users, particularly in developing regions where emissions monitoring is increasingly critical.

The global FTIR gas analysis market is currently segmented between high-end research-grade instruments and more accessible industrial monitoring solutions. Leading manufacturers have developed specialized systems for emissions monitoring that incorporate heated sampling lines, automated calibration routines, and multi-component analysis capabilities. These systems typically operate in the mid-infrared region (400-4000 cm⁻¹) where most gas molecules exhibit characteristic absorption patterns.

Despite significant advancements, FTIR technology faces several persistent challenges in gas emissions monitoring applications. Sensitivity limitations remain problematic for trace gas detection, particularly when monitoring compounds at sub-ppm levels in complex gas mixtures. Current detection limits typically range from 0.1-5 ppm depending on the target gas and sampling conditions, which proves insufficient for certain environmental and regulatory requirements.

Interference management represents another substantial hurdle. Water vapor and CO₂ absorption bands overlap with many target gases, necessitating complex spectral processing algorithms. Current deconvolution methods often struggle with highly variable background compositions, leading to measurement uncertainties. Cross-sensitivity between similar molecular structures further complicates accurate quantification in multi-component gas streams.

Field deployment presents additional challenges, with temperature fluctuations, vibration, and dust significantly affecting instrument performance. Most existing FTIR systems require controlled environments to maintain optical alignment and spectral resolution. Miniaturization efforts have yielded more compact instruments but often at the cost of reduced spectral range or resolution, creating a persistent trade-off between portability and analytical performance.

Data processing capabilities represent both a challenge and opportunity. Current systems generate massive spectral datasets that require sophisticated chemometric approaches for real-time analysis. Edge computing integration remains limited, with most systems still relying on centralized data processing that introduces latency in monitoring applications requiring immediate feedback.

Cost barriers continue to restrict widespread adoption, with comprehensive FTIR monitoring systems typically ranging from $50,000 to $150,000, placing them beyond reach for many potential users, particularly in developing regions where emissions monitoring is increasingly critical.

Current FTIR Gas Detection Methodologies

01 Advanced FTIR system designs for improved efficiency

Modern FTIR spectroscopy systems incorporate innovative designs to enhance measurement efficiency. These include optimized optical configurations, improved interferometer designs, and advanced signal processing algorithms. Such enhancements allow for faster scan rates, higher resolution, and better signal-to-noise ratios, ultimately improving the overall efficiency of FTIR analysis.- Advanced FTIR system designs for improved efficiency: Modern FTIR spectroscopy systems incorporate innovative designs to enhance measurement efficiency. These include optimized optical configurations, improved interferometer designs, and integrated data processing capabilities. Such advancements allow for faster scan rates, higher resolution, and better signal-to-noise ratios, ultimately improving the overall efficiency of spectroscopic analysis.

- Sample handling and preparation techniques: Efficient sample handling and preparation methods significantly impact FTIR analysis performance. Specialized sample holders, automated sample introduction systems, and preparation protocols are developed to minimize contamination and ensure reproducible results. These techniques reduce analysis time and improve the accuracy of spectral data collection, contributing to overall FTIR efficiency.

- Software and algorithm enhancements for FTIR data processing: Advanced software solutions and computational algorithms have been developed to improve FTIR data processing efficiency. These include automated baseline correction, spectral deconvolution, and chemometric analysis tools. Machine learning and artificial intelligence approaches are increasingly being integrated to enhance spectral interpretation and reduce analysis time, making FTIR more efficient for various applications.

- Miniaturization and portable FTIR systems: Compact and portable FTIR systems have been developed to improve operational efficiency in field applications. These systems feature reduced size and power requirements while maintaining analytical performance. Miniaturized components, including interferometers and detectors, enable on-site analysis without sample transport to laboratories, significantly improving workflow efficiency and enabling real-time decision making.

- Specialized FTIR techniques for specific applications: Application-specific FTIR techniques have been developed to enhance efficiency in particular fields. These include attenuated total reflection (ATR) for surface analysis, diffuse reflectance for powder samples, and hyphenated techniques combining FTIR with other analytical methods. Such specialized approaches optimize the efficiency of FTIR analysis for specific sample types and research questions, reducing analysis time and improving data quality.

02 Sample preparation and handling techniques

Efficient sample preparation and handling methods significantly impact FTIR spectroscopy performance. Specialized sample holders, automated sample introduction systems, and preparation protocols optimize the interaction between the infrared beam and the sample. These techniques minimize contamination, reduce analysis time, and improve reproducibility, thereby enhancing the overall efficiency of FTIR analysis.Expand Specific Solutions03 Miniaturization and portable FTIR solutions

Compact and portable FTIR systems have been developed to enable field analysis and point-of-use applications. These miniaturized systems maintain analytical performance while reducing size, weight, and power requirements. Innovations in component design and integration allow for efficient operation outside traditional laboratory settings, expanding the utility and efficiency of FTIR technology in various applications.Expand Specific Solutions04 Data processing and analysis algorithms

Advanced computational methods enhance FTIR data processing efficiency. Machine learning algorithms, automated spectral interpretation, and specialized software tools improve the speed and accuracy of analysis. These computational approaches enable rapid identification of spectral features, automated quality control, and efficient handling of large datasets, significantly reducing analysis time while maintaining or improving analytical quality.Expand Specific Solutions05 Application-specific FTIR optimization

FTIR systems can be optimized for specific applications to maximize efficiency in particular analytical contexts. Customized hardware configurations, specialized accessories, and application-specific calibration methods enhance performance for targeted analyses. These optimizations may include specific wavelength ranges, detector types, or sampling interfaces designed to improve efficiency for particular sample types or analytical requirements.Expand Specific Solutions

Leading FTIR Manufacturers and Research Institutions

The FTIR gas emissions monitoring market is currently in a growth phase, with increasing demand driven by environmental regulations and industrial needs. The market size is expanding as industries adopt more sophisticated monitoring solutions, with projections indicating significant growth over the next decade. Technologically, FTIR for gas monitoring has reached moderate maturity, with established players like Horiba Ltd., MKS Inc., and Thermo Fisher Scientific offering commercial solutions. Innovation leaders include research institutions such as Hefei Institutes of Physical Science, Industrial Technology Research Institute, and Heriot-Watt University, which are developing tailored FTIR technologies with enhanced sensitivity and specificity. Companies like NEO Monitors AS and GRANDPERSPECTIVE GmbH are bringing specialized applications to market, while industrial giants including ABB AG and Saudi Aramco are integrating these technologies into comprehensive environmental monitoring systems.

Horiba Ltd.

Technical Solution: Horiba has developed advanced FTIR gas analysis systems specifically tailored for emissions monitoring applications. Their MEXA series incorporates multi-gas analyzers with optimized optical paths and specialized sampling systems designed to handle the complex matrix of automotive and industrial emissions. Horiba's approach focuses on miniaturization of traditional FTIR components while maintaining high sensitivity, achieving detection limits in the sub-ppm range for key pollutants. Their systems employ temperature-controlled gas cells with gold-coated mirrors to maximize infrared signal throughput and minimize interference. Horiba has also developed proprietary algorithms for spectral analysis that can differentiate between overlapping absorption bands of different gases, enabling simultaneous quantification of multiple components in real-time. Their latest systems incorporate automated calibration routines and drift compensation to ensure measurement stability in continuous monitoring applications.

Strengths: Industry-leading sensitivity and specificity for automotive emissions testing; robust design suitable for both laboratory and field deployment; comprehensive software suite for regulatory compliance. Weaknesses: Higher cost compared to simpler monitoring technologies; requires regular maintenance of optical components; sampling system complexity can introduce measurement delays.

MKS, Inc.

Technical Solution: MKS has pioneered portable FTIR solutions for gas emissions monitoring through their Airgard series. Their approach centers on reducing the traditional FTIR footprint while maintaining analytical performance through innovative optical designs. MKS systems utilize a folded optical path configuration that significantly reduces instrument size while providing effective pathlengths of up to 10 meters, enhancing sensitivity for trace gas detection. Their systems incorporate proprietary interferometer designs that are resistant to vibration and temperature fluctuations, making them suitable for harsh industrial environments. MKS has developed specialized gas cells with optimized flow dynamics to reduce sample residence time and improve response rates. Their systems feature advanced chemometric algorithms that can process complex spectra in real-time, allowing for the simultaneous quantification of over 30 gas species. MKS has also implemented automated validation procedures that comply with regulatory requirements for continuous emissions monitoring systems (CEMS).

Strengths: Compact and portable design suitable for field deployment; excellent vibration resistance for industrial environments; fast response time for process control applications. Weaknesses: Lower sensitivity for certain compounds compared to laboratory systems; higher maintenance requirements in dusty environments; more limited dynamic range than some competitors.

Key FTIR Spectral Analysis Innovations

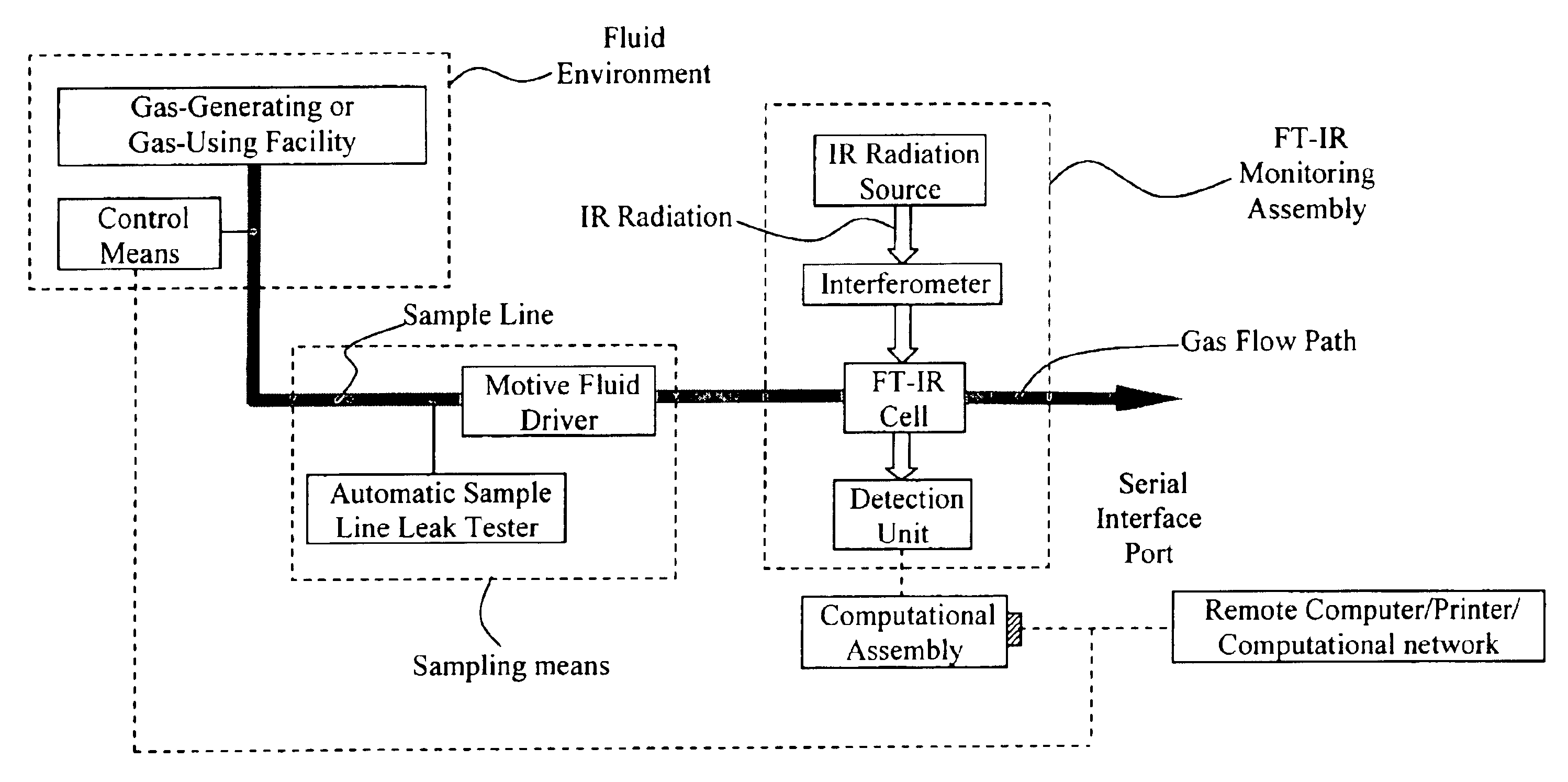

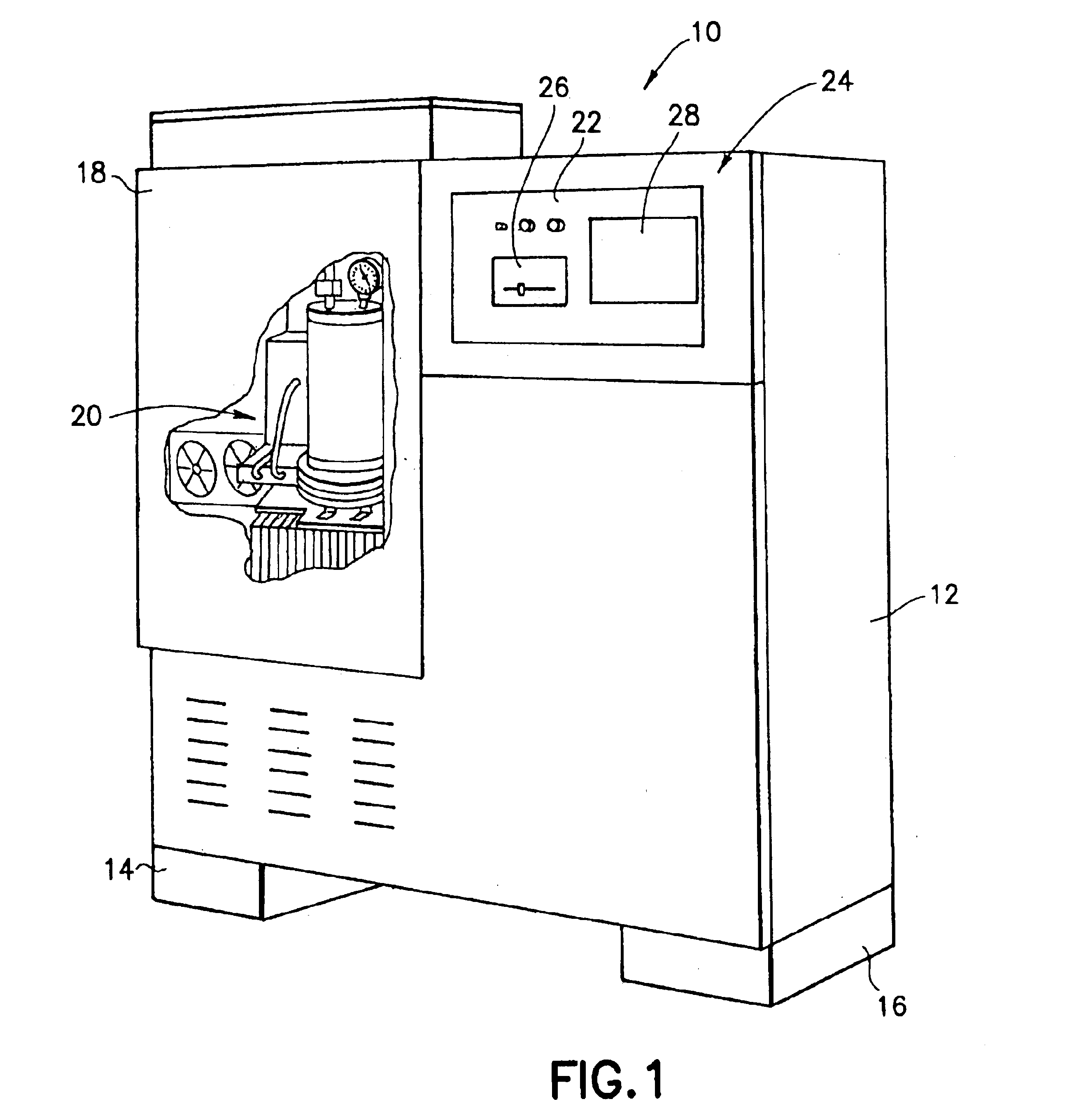

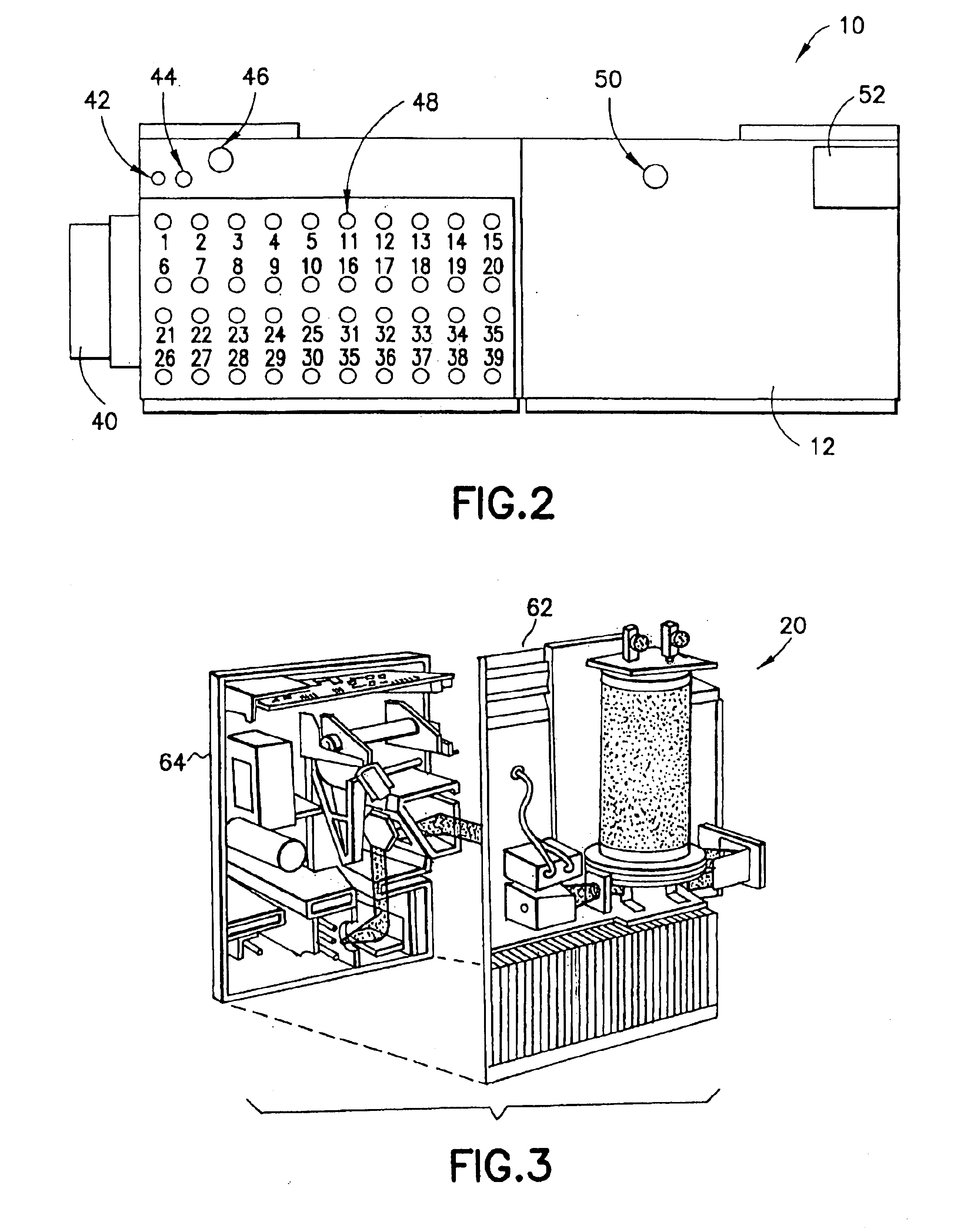

Fourier transform infrared (FTIR) spectrometric toxic gas monitoring system, and method of detecting toxic gas species in a fluid environment containing or susceptible to the presence of such toxic gas species

PatentInactiveUS6862535B2

Innovation

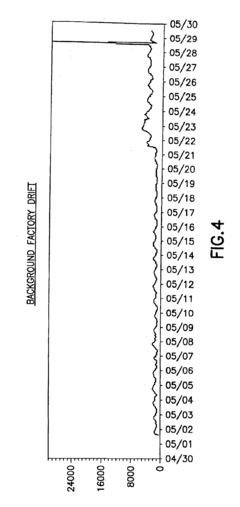

- An FTIR toxic gas monitoring system that includes a computational assembly for continuous measurement and analysis of the background spectrum, determining signal-to-noise ratio, background spectrum deviation, and zero path difference, with setpoint alerts for maintenance, using a stored signal-to-noise ratio reference and background spectrum to detect toxic gas species in a fluid environment.

Patent

Innovation

- Integration of advanced spectral analysis algorithms with FTIR systems to enhance sensitivity and selectivity for specific gas emissions detection in complex environments.

- Implementation of automated calibration and drift correction mechanisms to ensure long-term stability and reliability of FTIR gas monitoring systems in continuous operation scenarios.

- Development of specialized sampling interfaces tailored for different industrial environments to optimize gas collection efficiency and minimize interference from particulates and moisture.

Environmental Regulations Impact on FTIR Development

Environmental regulations have become a significant driving force in the development and adaptation of Fourier Transform Infrared (FTIR) spectroscopy technologies for gas emissions monitoring. Since the early 2000s, increasingly stringent emission standards across global markets have necessitated more precise, reliable, and cost-effective monitoring solutions. The European Union's Industrial Emissions Directive (IED) and the United States Environmental Protection Agency's (EPA) regulations have established progressively lower permissible limits for greenhouse gases and air pollutants, directly influencing FTIR system specifications and capabilities.

These regulatory frameworks have created a tiered compliance structure that varies by industry sector, emission type, and facility size. For instance, power generation facilities face different monitoring requirements compared to chemical manufacturing plants or waste incineration facilities. This regulatory diversity has pushed FTIR manufacturers to develop more versatile and adaptable systems capable of monitoring multiple gas species simultaneously while maintaining compliance with sector-specific standards.

The Paris Agreement of 2015 marked a pivotal moment in environmental regulation, establishing global commitments to reduce greenhouse gas emissions. This international framework has accelerated the adoption of continuous emissions monitoring systems (CEMS) incorporating FTIR technology, particularly in emerging economies where industrial growth is rapidly expanding. Countries like China and India have implemented their own emissions standards, often modeled after European or American frameworks but adapted to local industrial conditions.

Regulatory compliance has also driven significant innovations in FTIR calibration protocols and quality assurance procedures. Standards organizations such as ISO, CEN, and ASTM have developed specific methodologies for FTIR deployment in emissions monitoring, ensuring measurement traceability and data reliability. These standards have become increasingly harmonized across jurisdictions, reducing market fragmentation and enabling more consistent technology development pathways.

Looking forward, upcoming regulatory changes will continue to shape FTIR technology evolution. The European Green Deal and similar initiatives worldwide are setting more ambitious emission reduction targets for 2030 and beyond. These will likely require enhanced detection limits, greater measurement stability under varying field conditions, and improved integration with digital reporting systems. Additionally, regulations are expanding to cover previously unregulated pollutants, creating new market opportunities for advanced FTIR solutions capable of identifying and quantifying these emerging compounds.

These regulatory frameworks have created a tiered compliance structure that varies by industry sector, emission type, and facility size. For instance, power generation facilities face different monitoring requirements compared to chemical manufacturing plants or waste incineration facilities. This regulatory diversity has pushed FTIR manufacturers to develop more versatile and adaptable systems capable of monitoring multiple gas species simultaneously while maintaining compliance with sector-specific standards.

The Paris Agreement of 2015 marked a pivotal moment in environmental regulation, establishing global commitments to reduce greenhouse gas emissions. This international framework has accelerated the adoption of continuous emissions monitoring systems (CEMS) incorporating FTIR technology, particularly in emerging economies where industrial growth is rapidly expanding. Countries like China and India have implemented their own emissions standards, often modeled after European or American frameworks but adapted to local industrial conditions.

Regulatory compliance has also driven significant innovations in FTIR calibration protocols and quality assurance procedures. Standards organizations such as ISO, CEN, and ASTM have developed specific methodologies for FTIR deployment in emissions monitoring, ensuring measurement traceability and data reliability. These standards have become increasingly harmonized across jurisdictions, reducing market fragmentation and enabling more consistent technology development pathways.

Looking forward, upcoming regulatory changes will continue to shape FTIR technology evolution. The European Green Deal and similar initiatives worldwide are setting more ambitious emission reduction targets for 2030 and beyond. These will likely require enhanced detection limits, greater measurement stability under varying field conditions, and improved integration with digital reporting systems. Additionally, regulations are expanding to cover previously unregulated pollutants, creating new market opportunities for advanced FTIR solutions capable of identifying and quantifying these emerging compounds.

Cost-Benefit Analysis of FTIR Implementation

The implementation of Fourier Transform Infrared (FTIR) spectroscopy for gas emissions monitoring represents a significant investment that requires thorough financial analysis. Initial capital expenditure for FTIR systems ranges from $50,000 to $250,000 depending on resolution capabilities, sampling interfaces, and software sophistication. Organizations must also consider installation costs, which typically add 15-20% to the base equipment price, covering site preparation, calibration, and integration with existing monitoring infrastructure.

Operational expenses constitute another critical dimension, including maintenance contracts ($5,000-$15,000 annually), consumables such as reference gases, and specialized technician training. Energy consumption, while relatively modest compared to some alternative technologies, adds approximately $1,000-$2,500 to annual operating costs depending on system configuration and duty cycle.

Against these expenses, FTIR implementation offers substantial quantifiable benefits. Most notably, regulatory compliance avoidance costs can range from $10,000 to $1,000,000+ annually depending on industry and jurisdiction, making this a primary financial driver for implementation. Enhanced process optimization enabled by real-time multi-gas monitoring typically yields 3-7% efficiency improvements in affected operations, translating to significant energy and material savings.

The return on investment timeline varies considerably by application. Industrial process control implementations generally achieve ROI within 12-24 months, while environmental monitoring applications may require 24-36 months to reach break-even. Facilities with existing violations or operating in stringently regulated environments often see accelerated returns due to immediate compliance benefits.

Sensitivity analysis reveals that FTIR systems' financial performance is most affected by regulatory landscape changes, with each 10% increase in emissions penalties typically improving ROI timelines by 15-20%. Conversely, maintenance cost increases of 20% generally extend payback periods by only 3-6 months, indicating relatively low sensitivity to this variable.

When compared to alternative technologies, FTIR demonstrates superior lifetime value in multi-component monitoring scenarios. While technologies like NDIR or electrochemical sensors offer lower initial investments ($5,000-$30,000), their limited gas coverage, cross-interference issues, and higher long-term calibration requirements result in 30-50% higher total cost of ownership over a typical 10-year deployment period for complex monitoring applications.

Operational expenses constitute another critical dimension, including maintenance contracts ($5,000-$15,000 annually), consumables such as reference gases, and specialized technician training. Energy consumption, while relatively modest compared to some alternative technologies, adds approximately $1,000-$2,500 to annual operating costs depending on system configuration and duty cycle.

Against these expenses, FTIR implementation offers substantial quantifiable benefits. Most notably, regulatory compliance avoidance costs can range from $10,000 to $1,000,000+ annually depending on industry and jurisdiction, making this a primary financial driver for implementation. Enhanced process optimization enabled by real-time multi-gas monitoring typically yields 3-7% efficiency improvements in affected operations, translating to significant energy and material savings.

The return on investment timeline varies considerably by application. Industrial process control implementations generally achieve ROI within 12-24 months, while environmental monitoring applications may require 24-36 months to reach break-even. Facilities with existing violations or operating in stringently regulated environments often see accelerated returns due to immediate compliance benefits.

Sensitivity analysis reveals that FTIR systems' financial performance is most affected by regulatory landscape changes, with each 10% increase in emissions penalties typically improving ROI timelines by 15-20%. Conversely, maintenance cost increases of 20% generally extend payback periods by only 3-6 months, indicating relatively low sensitivity to this variable.

When compared to alternative technologies, FTIR demonstrates superior lifetime value in multi-component monitoring scenarios. While technologies like NDIR or electrochemical sensors offer lower initial investments ($5,000-$30,000), their limited gas coverage, cross-interference issues, and higher long-term calibration requirements result in 30-50% higher total cost of ownership over a typical 10-year deployment period for complex monitoring applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!