What role green hydrogen plays in heavy-duty vehicle decarbonization

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Hydrogen Technology Background and Objectives

Green hydrogen has emerged as a promising solution for decarbonizing sectors that are difficult to electrify, particularly heavy-duty transportation. The concept of hydrogen as an energy carrier dates back to the early 20th century, but its application as a clean fuel has gained significant momentum only in the past decade. Green hydrogen specifically refers to hydrogen produced through electrolysis powered by renewable energy sources, resulting in minimal carbon emissions throughout its production lifecycle.

The evolution of hydrogen technology has progressed through several distinct phases. Initially, hydrogen was primarily used in industrial applications such as ammonia production and petroleum refining. The oil crises of the 1970s sparked interest in hydrogen as an alternative fuel, though technological limitations and high costs prevented widespread adoption. Recent advancements in electrolysis technology, coupled with the declining cost of renewable energy, have revitalized interest in green hydrogen as a viable decarbonization strategy.

Current technological trends indicate a rapid acceleration in green hydrogen development. Electrolysis efficiency has improved substantially, with modern systems achieving conversion rates of 70-80%, compared to 50-60% a decade ago. Simultaneously, the cost of electrolyzers has decreased by approximately 60% since 2010, with projections suggesting further reductions of 40-60% by 2030 as manufacturing scales up.

For heavy-duty vehicle applications, the primary objective is to develop hydrogen solutions that can match or exceed the performance characteristics of diesel engines while eliminating carbon emissions. This includes achieving comparable range (800+ kilometers), refueling times (under 15 minutes), payload capacity, and operational reliability under various conditions. Additionally, the technology must be economically viable without permanent subsidies to enable market-driven adoption.

Secondary objectives include establishing the necessary infrastructure for hydrogen production, distribution, and refueling to support fleet operations. This encompasses developing high-capacity refueling stations capable of servicing multiple vehicles simultaneously, as well as creating efficient hydrogen storage and transportation systems to connect production sites with consumption points.

The ultimate goal is to position green hydrogen as a cornerstone technology in achieving net-zero emissions in the heavy-duty transportation sector by 2050, in alignment with global climate objectives. This requires not only technological advancement but also supportive policy frameworks, industry collaboration, and significant investment in both research and infrastructure development to overcome the current barriers to widespread adoption.

The evolution of hydrogen technology has progressed through several distinct phases. Initially, hydrogen was primarily used in industrial applications such as ammonia production and petroleum refining. The oil crises of the 1970s sparked interest in hydrogen as an alternative fuel, though technological limitations and high costs prevented widespread adoption. Recent advancements in electrolysis technology, coupled with the declining cost of renewable energy, have revitalized interest in green hydrogen as a viable decarbonization strategy.

Current technological trends indicate a rapid acceleration in green hydrogen development. Electrolysis efficiency has improved substantially, with modern systems achieving conversion rates of 70-80%, compared to 50-60% a decade ago. Simultaneously, the cost of electrolyzers has decreased by approximately 60% since 2010, with projections suggesting further reductions of 40-60% by 2030 as manufacturing scales up.

For heavy-duty vehicle applications, the primary objective is to develop hydrogen solutions that can match or exceed the performance characteristics of diesel engines while eliminating carbon emissions. This includes achieving comparable range (800+ kilometers), refueling times (under 15 minutes), payload capacity, and operational reliability under various conditions. Additionally, the technology must be economically viable without permanent subsidies to enable market-driven adoption.

Secondary objectives include establishing the necessary infrastructure for hydrogen production, distribution, and refueling to support fleet operations. This encompasses developing high-capacity refueling stations capable of servicing multiple vehicles simultaneously, as well as creating efficient hydrogen storage and transportation systems to connect production sites with consumption points.

The ultimate goal is to position green hydrogen as a cornerstone technology in achieving net-zero emissions in the heavy-duty transportation sector by 2050, in alignment with global climate objectives. This requires not only technological advancement but also supportive policy frameworks, industry collaboration, and significant investment in both research and infrastructure development to overcome the current barriers to widespread adoption.

Market Analysis for Hydrogen-Powered Heavy-Duty Vehicles

The global market for hydrogen-powered heavy-duty vehicles is experiencing significant growth, driven by increasing environmental regulations and the push for decarbonization in the transportation sector. Currently, the market size for hydrogen fuel cell trucks is estimated at $1.5 billion, with projections indicating a compound annual growth rate of 40% through 2030, potentially reaching $15 billion by that time.

Demand patterns vary significantly across regions. Europe leads in adoption rates, particularly in countries like Germany, Switzerland, and the Netherlands, where government incentives and strict emission regulations have accelerated market development. The European market accounts for approximately 45% of global hydrogen truck deployments, with over 500 vehicles currently in operation or on order.

Asia-Pacific represents the fastest-growing market, with China investing heavily in hydrogen infrastructure and manufacturing capabilities. Japan and South Korea are also making substantial investments, focusing on both vehicle development and hydrogen production technologies. The region is expected to surpass Europe in market share by 2028.

North America has been slower to adopt hydrogen for heavy-duty applications, with most deployments concentrated in California and Canadian provinces with carbon pricing mechanisms. However, recent federal initiatives suggest accelerated growth in the coming years.

Customer segments for hydrogen-powered heavy-duty vehicles include long-haul freight operators, drayage operations at ports, municipal waste management fleets, and mining operations. Long-haul transportation represents the largest potential segment due to hydrogen's advantages in range and refueling time compared to battery electric alternatives.

Market barriers remain significant, with high vehicle acquisition costs being the primary obstacle. Hydrogen fuel cell trucks currently cost 2-3 times more than diesel equivalents, though this premium is expected to decrease as production scales. Limited refueling infrastructure also constrains adoption, with fewer than 200 hydrogen refueling stations globally capable of serving heavy-duty vehicles.

Fuel costs represent another challenge, with green hydrogen currently priced at $5-10 per kilogram in most markets, making operational costs higher than diesel in regions without substantial subsidies. However, production scale economies and technological improvements are projected to reduce costs to competitive levels by 2025-2027.

Despite these challenges, market forecasts remain optimistic, with fleet operators increasingly including hydrogen vehicles in their decarbonization strategies, particularly for applications where battery electric vehicles face limitations in range, payload capacity, or refueling time.

Demand patterns vary significantly across regions. Europe leads in adoption rates, particularly in countries like Germany, Switzerland, and the Netherlands, where government incentives and strict emission regulations have accelerated market development. The European market accounts for approximately 45% of global hydrogen truck deployments, with over 500 vehicles currently in operation or on order.

Asia-Pacific represents the fastest-growing market, with China investing heavily in hydrogen infrastructure and manufacturing capabilities. Japan and South Korea are also making substantial investments, focusing on both vehicle development and hydrogen production technologies. The region is expected to surpass Europe in market share by 2028.

North America has been slower to adopt hydrogen for heavy-duty applications, with most deployments concentrated in California and Canadian provinces with carbon pricing mechanisms. However, recent federal initiatives suggest accelerated growth in the coming years.

Customer segments for hydrogen-powered heavy-duty vehicles include long-haul freight operators, drayage operations at ports, municipal waste management fleets, and mining operations. Long-haul transportation represents the largest potential segment due to hydrogen's advantages in range and refueling time compared to battery electric alternatives.

Market barriers remain significant, with high vehicle acquisition costs being the primary obstacle. Hydrogen fuel cell trucks currently cost 2-3 times more than diesel equivalents, though this premium is expected to decrease as production scales. Limited refueling infrastructure also constrains adoption, with fewer than 200 hydrogen refueling stations globally capable of serving heavy-duty vehicles.

Fuel costs represent another challenge, with green hydrogen currently priced at $5-10 per kilogram in most markets, making operational costs higher than diesel in regions without substantial subsidies. However, production scale economies and technological improvements are projected to reduce costs to competitive levels by 2025-2027.

Despite these challenges, market forecasts remain optimistic, with fleet operators increasingly including hydrogen vehicles in their decarbonization strategies, particularly for applications where battery electric vehicles face limitations in range, payload capacity, or refueling time.

Technical Challenges in Green Hydrogen Implementation

Despite the promising potential of green hydrogen in decarbonizing heavy-duty transportation, several significant technical challenges impede its widespread implementation. The production of green hydrogen through water electrolysis remains energy-intensive, with current electrolyzers operating at efficiency levels of 60-80%. This inefficiency translates to higher production costs, estimated at $3-8 per kilogram, substantially exceeding the $1-2 per kilogram target needed for competitive market adoption.

Storage and distribution infrastructure presents another formidable barrier. Hydrogen's low volumetric energy density necessitates compression to 350-700 bar or liquefaction at -253°C for practical storage, both processes consuming 10-30% of the energy content. The existing pipeline infrastructure is largely incompatible with hydrogen due to material embrittlement concerns, while establishing a dedicated hydrogen distribution network requires massive capital investment estimated at $200-500 billion globally.

On-board vehicle storage systems face significant weight and volume constraints. Current compressed hydrogen tanks (Type IV) occupy 6-8 times more volume than equivalent diesel tanks, severely impacting vehicle payload capacity and range. Liquid hydrogen storage offers higher density but suffers from boil-off losses of 1-3% daily and requires sophisticated cryogenic systems that add complexity and cost to vehicle design.

Fuel cell durability and performance in heavy-duty applications remain problematic. While light-duty fuel cells have achieved 30,000-hour lifespans, heavy-duty applications require 50,000+ hours of operation under more demanding conditions. Current systems experience performance degradation of 10-15% over 5,000 operating hours, falling short of commercial viability thresholds.

The refueling infrastructure for hydrogen vehicles is severely underdeveloped, with fewer than 600 stations worldwide as of 2023. Each station costs $1-2 million to construct, and standardization issues persist regarding pressure levels, nozzle designs, and safety protocols. The refueling process itself presents technical challenges, with cooling requirements during fast-fill operations and the need for specialized compressors capable of delivering hydrogen at 700 bar.

Material compatibility issues extend beyond pipelines to vehicle components. Hydrogen embrittlement affects various metals used in engines, storage systems, and fuel delivery components. Additionally, detecting hydrogen leaks poses unique challenges due to its colorless, odorless nature and wide flammability range (4-75% concentration in air), necessitating sophisticated sensor systems throughout the hydrogen supply chain and vehicle systems.

Storage and distribution infrastructure presents another formidable barrier. Hydrogen's low volumetric energy density necessitates compression to 350-700 bar or liquefaction at -253°C for practical storage, both processes consuming 10-30% of the energy content. The existing pipeline infrastructure is largely incompatible with hydrogen due to material embrittlement concerns, while establishing a dedicated hydrogen distribution network requires massive capital investment estimated at $200-500 billion globally.

On-board vehicle storage systems face significant weight and volume constraints. Current compressed hydrogen tanks (Type IV) occupy 6-8 times more volume than equivalent diesel tanks, severely impacting vehicle payload capacity and range. Liquid hydrogen storage offers higher density but suffers from boil-off losses of 1-3% daily and requires sophisticated cryogenic systems that add complexity and cost to vehicle design.

Fuel cell durability and performance in heavy-duty applications remain problematic. While light-duty fuel cells have achieved 30,000-hour lifespans, heavy-duty applications require 50,000+ hours of operation under more demanding conditions. Current systems experience performance degradation of 10-15% over 5,000 operating hours, falling short of commercial viability thresholds.

The refueling infrastructure for hydrogen vehicles is severely underdeveloped, with fewer than 600 stations worldwide as of 2023. Each station costs $1-2 million to construct, and standardization issues persist regarding pressure levels, nozzle designs, and safety protocols. The refueling process itself presents technical challenges, with cooling requirements during fast-fill operations and the need for specialized compressors capable of delivering hydrogen at 700 bar.

Material compatibility issues extend beyond pipelines to vehicle components. Hydrogen embrittlement affects various metals used in engines, storage systems, and fuel delivery components. Additionally, detecting hydrogen leaks poses unique challenges due to its colorless, odorless nature and wide flammability range (4-75% concentration in air), necessitating sophisticated sensor systems throughout the hydrogen supply chain and vehicle systems.

Current Green Hydrogen Solutions for Heavy Transport

01 Hydrogen production technologies for decarbonization

Various technologies are being developed for producing green hydrogen to support decarbonization efforts. These include advanced electrolysis systems that use renewable energy sources to split water into hydrogen and oxygen with minimal carbon emissions. Innovations in catalyst materials and cell designs are improving efficiency and reducing costs of hydrogen production, making it more viable as a clean energy carrier for industrial applications.- Hydrogen production methods for decarbonization: Various methods for producing green hydrogen are employed to reduce carbon emissions. These include electrolysis powered by renewable energy sources, which splits water into hydrogen and oxygen without carbon emissions. Advanced catalysts and innovative reactor designs improve efficiency and reduce costs of hydrogen production, making it more viable for industrial decarbonization applications.

- Integration of green hydrogen in industrial processes: Green hydrogen can be integrated into existing industrial processes to reduce carbon footprints. This includes using hydrogen as a clean fuel in manufacturing, as a reducing agent in steel production, and as a feedstock in chemical industries. These applications help industries transition away from fossil fuels while maintaining production capabilities, significantly contributing to decarbonization efforts.

- Storage and transportation solutions for hydrogen: Effective storage and transportation systems are crucial for the widespread adoption of green hydrogen. Technologies include compressed gas storage, liquid hydrogen systems, and chemical carriers like ammonia or organic compounds. These solutions address the challenges of hydrogen's low volumetric energy density and enable its use in various applications across different sectors.

- Hydrogen utilization in energy systems: Green hydrogen can be utilized in various energy systems to replace fossil fuels. Applications include fuel cells for electricity generation, hydrogen-powered vehicles, and blending with natural gas in existing infrastructure. These implementations provide clean energy alternatives while leveraging existing distribution networks, facilitating a smoother transition to low-carbon energy systems.

- Economic and policy frameworks for hydrogen adoption: Successful implementation of green hydrogen for decarbonization requires supportive economic models and policy frameworks. This includes carbon pricing mechanisms, subsidies for clean hydrogen production, regulatory standards, and international cooperation. These frameworks help overcome cost barriers, stimulate investment in hydrogen infrastructure, and accelerate the transition to hydrogen-based decarbonization strategies.

02 Integration of renewable energy with hydrogen systems

Combining renewable energy sources with hydrogen production systems creates synergistic solutions for decarbonization. These integrated systems utilize surplus renewable electricity to produce hydrogen during peak generation periods, which can then be stored and used when renewable generation is low. This approach addresses intermittency issues of renewable energy while providing a stable, carbon-free energy source that can replace fossil fuels in various applications.Expand Specific Solutions03 Industrial applications of green hydrogen

Green hydrogen is being implemented across various industrial sectors to reduce carbon emissions. It serves as both a clean energy carrier and a feedstock for chemical processes, replacing fossil fuel-based hydrogen in industries such as steel manufacturing, ammonia production, and refining. The integration of green hydrogen into these hard-to-abate sectors represents a significant pathway for industrial decarbonization and meeting climate goals.Expand Specific Solutions04 Hydrogen storage and transportation solutions

Innovative methods for storing and transporting hydrogen are critical for establishing a viable hydrogen economy for decarbonization. These include advanced compression technologies, liquid hydrogen systems, metal hydrides, and chemical carriers like ammonia or liquid organic hydrogen carriers. These solutions address the challenges of hydrogen's low volumetric energy density and enable its efficient distribution from production sites to end-use applications.Expand Specific Solutions05 Hydrogen utilization in transportation and power generation

Green hydrogen offers significant decarbonization potential in transportation and power generation sectors. Fuel cell technologies convert hydrogen into electricity with only water as a byproduct, providing zero-emission power for vehicles ranging from passenger cars to heavy-duty trucks and maritime vessels. Hydrogen can also be used in gas turbines or combined cycle power plants, either pure or blended with natural gas, to reduce carbon emissions while providing dispatchable power generation capacity.Expand Specific Solutions

Key Industry Players in Hydrogen Mobility Ecosystem

The green hydrogen market for heavy-duty vehicle decarbonization is in its early growth phase, with an expanding market projected to reach $2.5-3.5 billion by 2030. The technology is advancing from pilot to commercial scale, with varying maturity levels across applications. Air Products & Chemicals and Air Liquide lead in hydrogen production infrastructure, while Sinopec and Saudi Aramco are leveraging their energy expertise to develop large-scale hydrogen projects. Vehicle manufacturers like Kubota are integrating hydrogen technologies, and specialized firms such as Midrex Technologies and LanzaTech are developing innovative hydrogen production methods. Research institutions including IIT Madras and Indian Institute of Science are advancing fundamental technologies, creating a competitive landscape spanning traditional energy companies, technology specialists, and research organizations.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive green hydrogen strategy for heavy-duty transportation decarbonization centered around their "Hydrogen into Ten Thousand Homes" demonstration project. Their technical approach integrates large-scale electrolysis facilities powered by dedicated renewable energy installations, primarily solar and wind farms with capacities exceeding 300 MW. Sinopec's solution includes advanced alkaline electrolyzers achieving 80%+ efficiency rates and proprietary hydrogen purification systems ensuring 99.999% purity levels required for fuel cell applications. The company has established an integrated hydrogen supply chain with production facilities strategically located near industrial clusters and transportation corridors, supported by a growing network of hydrogen refueling stations (100+ operational stations with plans for 1,000 by 2025)[3]. Their heavy-duty vehicle focus includes partnerships with leading Chinese truck manufacturers to deploy hydrogen fuel cell vehicles with 400-600 km ranges and refueling times under 15 minutes. Sinopec's Ordos green hydrogen facility in Inner Mongolia represents their flagship project, producing over 10,000 tons of green hydrogen annually using 270 MW of solar and wind power[4].

Strengths: Massive scale and financial resources enabling rapid infrastructure deployment; Existing nationwide fuel distribution network that can be leveraged for hydrogen; Strong government policy support and alignment with China's carbon neutrality goals. Weaknesses: Current heavy reliance on coal-based hydrogen production alongside green initiatives; Geographic concentration primarily within China limiting global market access; Relatively early stage of fuel cell vehicle deployment compared to battery electric alternatives.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has developed a comprehensive green hydrogen strategy for heavy-duty transportation decarbonization leveraging Saudi Arabia's abundant solar resources. Their technical approach combines massive-scale solar PV installations (multi-gigawatt capacity) with advanced electrolysis technologies, including both PEM and alkaline systems optimized for desert conditions. The company's NEOM project, developed in partnership with Air Products and ACWA Power, represents one of the world's largest green hydrogen initiatives with 4 GW of dedicated renewable power producing 650 tons of hydrogen daily, specifically targeting heavy transport applications[7]. Saudi Aramco's solution includes integrated hydrogen production, conversion to ammonia for efficient transport, and reconversion facilities at destination markets. Their technical infrastructure encompasses specialized high-temperature electrolyzers achieving efficiency rates above 75%, advanced compression and storage systems (350-700 bar), and dedicated export terminals with cryogenic storage capabilities. For heavy-duty vehicles, Saudi Aramco has developed hydrogen refueling protocols enabling 10-15 minute refill times for trucks with 500+ km range capabilities. Their approach also includes carbon capture technologies to produce blue hydrogen during the transition period, with carbon storage capacities exceeding 800,000 tons annually[8].

Strengths: Unparalleled access to low-cost solar resources enabling competitive green hydrogen production; Massive financial resources supporting large-scale infrastructure development; Strategic geographic position for hydrogen/ammonia export to key markets in Europe and Asia. Weaknesses: Limited domestic market for hydrogen vehicles requiring heavy reliance on export markets; Significant water constraints in Saudi Arabia requiring desalination for electrolysis; Early stage of development in hydrogen-specific technologies compared to established industrial gas companies.

Core Innovations in Hydrogen Fuel Cell Technology

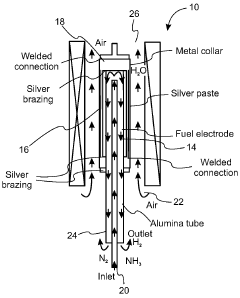

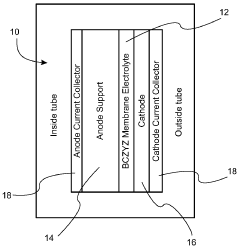

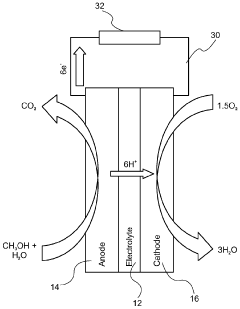

Proton-conductive solid oxide fuel cell and method of operation

PatentWO2024095010A1

Innovation

- A proton conductive solid oxide fuel cell design using a BaCe1-xYxZrxYyO3-6 (BCZY) electrolyte with 4% Zinc doping, combined with a nickel oxide anode and LSCF cathode, operating at temperatures between 300°C to 800°C, allowing for direct fueling with ammonia or methanol and reducing nitrogen oxide production, while providing improved catalytic activity and structural integrity.

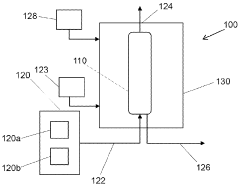

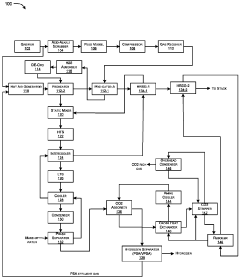

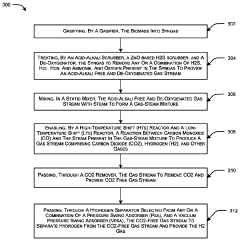

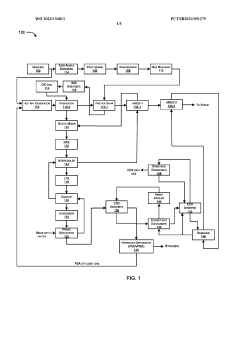

A modular system and method for generating hydrogen from biomass

PatentWO2023194811A1

Innovation

- A modular system comprising a gasifier, acid-alkali scrubber, de-oxygenator, high-temperature and low-temperature shift reactors, CO2 remover, and hydrogen separator, which converts biomass into syngas, removes impurities, and produces high-purity hydrogen while reutilizing heat and flue gas in a carbon-neutral manner, with an automated control mechanism for efficient operation.

Infrastructure Requirements for Hydrogen Refueling

The development of a robust hydrogen refueling infrastructure represents a critical prerequisite for the widespread adoption of hydrogen-powered heavy-duty vehicles. Current infrastructure remains severely limited, with fewer than 500 hydrogen refueling stations globally as of 2023, concentrated primarily in Japan, Germany, California, and South Korea. This scarcity creates a classic "chicken-and-egg" dilemma where fleet operators hesitate to invest in hydrogen vehicles without adequate refueling options, while infrastructure developers await sufficient vehicle demand to justify investment.

Hydrogen refueling stations for heavy-duty applications require significantly different specifications compared to light-duty counterparts. These stations must deliver hydrogen at 700 bar pressure, with substantially higher daily capacity (1,000-2,000 kg/day versus 200-400 kg/day for light-duty stations) to accommodate the larger fuel tanks and operational demands of commercial fleets. The capital expenditure for such stations ranges between $2-5 million, representing a substantial barrier to rapid deployment.

Technical challenges further complicate infrastructure development. Hydrogen's low volumetric energy density necessitates specialized high-pressure storage systems and cryogenic equipment for liquid hydrogen. Compression, storage, and dispensing technologies must be optimized for safety, efficiency, and speed to achieve refueling times comparable to diesel (under 15 minutes for complete refill). Additionally, the infrastructure must incorporate sophisticated leak detection systems and safety protocols due to hydrogen's flammability characteristics.

Location optimization presents another critical consideration. Strategic placement along major freight corridors and logistics hubs is essential to maximize utilization and economic viability. The "corridor approach" has emerged as a leading deployment strategy, establishing hydrogen stations along key transportation routes to enable long-haul operations while minimizing initial infrastructure investment.

Standardization remains a pressing concern for infrastructure development. Currently, multiple competing standards exist for connectors, pressure levels, and refueling protocols. Industry stakeholders and regulatory bodies are working toward harmonized global standards to ensure interoperability and reduce manufacturing costs through economies of scale.

Financing models for hydrogen infrastructure are evolving beyond traditional approaches. Public-private partnerships, consortium-based investments, and anchor fleet agreements have emerged as promising mechanisms to distribute risk and ensure sufficient utilization rates. Government support through direct subsidies, tax incentives, and regulatory frameworks plays a crucial role in bridging the economic gap during early deployment phases.

Hydrogen refueling stations for heavy-duty applications require significantly different specifications compared to light-duty counterparts. These stations must deliver hydrogen at 700 bar pressure, with substantially higher daily capacity (1,000-2,000 kg/day versus 200-400 kg/day for light-duty stations) to accommodate the larger fuel tanks and operational demands of commercial fleets. The capital expenditure for such stations ranges between $2-5 million, representing a substantial barrier to rapid deployment.

Technical challenges further complicate infrastructure development. Hydrogen's low volumetric energy density necessitates specialized high-pressure storage systems and cryogenic equipment for liquid hydrogen. Compression, storage, and dispensing technologies must be optimized for safety, efficiency, and speed to achieve refueling times comparable to diesel (under 15 minutes for complete refill). Additionally, the infrastructure must incorporate sophisticated leak detection systems and safety protocols due to hydrogen's flammability characteristics.

Location optimization presents another critical consideration. Strategic placement along major freight corridors and logistics hubs is essential to maximize utilization and economic viability. The "corridor approach" has emerged as a leading deployment strategy, establishing hydrogen stations along key transportation routes to enable long-haul operations while minimizing initial infrastructure investment.

Standardization remains a pressing concern for infrastructure development. Currently, multiple competing standards exist for connectors, pressure levels, and refueling protocols. Industry stakeholders and regulatory bodies are working toward harmonized global standards to ensure interoperability and reduce manufacturing costs through economies of scale.

Financing models for hydrogen infrastructure are evolving beyond traditional approaches. Public-private partnerships, consortium-based investments, and anchor fleet agreements have emerged as promising mechanisms to distribute risk and ensure sufficient utilization rates. Government support through direct subsidies, tax incentives, and regulatory frameworks plays a crucial role in bridging the economic gap during early deployment phases.

Policy Frameworks Supporting Clean Transportation

Policy frameworks across the globe are increasingly recognizing the critical role of clean transportation in achieving climate goals. These frameworks typically combine regulatory measures, financial incentives, and infrastructure development strategies to accelerate the transition to low-carbon mobility solutions, including green hydrogen for heavy-duty vehicles.

The European Union has established comprehensive policies through its Green Deal and Fit for 55 package, which include stringent CO2 emission standards for heavy-duty vehicles and targets for alternative fueling infrastructure deployment. The Alternative Fuels Infrastructure Regulation (AFIR) specifically mandates the installation of hydrogen refueling stations along major transportation corridors, creating a backbone for hydrogen mobility.

In the United States, the Inflation Reduction Act (IRA) provides substantial tax credits for clean hydrogen production, with higher incentives for hydrogen with lower carbon intensity. The Bipartisan Infrastructure Law complements this by allocating $8 billion for regional clean hydrogen hubs, several of which focus on transportation applications. California's Advanced Clean Trucks regulation further mandates increasing sales percentages of zero-emission trucks, creating market pull for hydrogen solutions.

Asian economies are also implementing supportive policies. Japan's Strategic Roadmap for Hydrogen and Fuel Cells includes specific targets for fuel cell trucks and hydrogen refueling infrastructure. China has incorporated hydrogen vehicles into its New Energy Vehicle (NEV) strategy, offering subsidies and preferential policies for hydrogen fuel cell vehicles, particularly in freight transport.

Financial mechanisms play a crucial role in these frameworks. These include purchase subsidies, tax exemptions, and reduced road tolls for zero-emission vehicles. More innovative approaches include contracts for difference for hydrogen production and carbon pricing mechanisms that improve the competitiveness of clean transportation solutions against conventional diesel.

Regulatory standards are equally important, with increasingly stringent emission regulations for heavy-duty vehicles driving the transition to cleaner alternatives. Low and zero-emission zones in urban areas further incentivize the adoption of hydrogen vehicles for last-mile delivery and urban logistics.

Cross-sectoral policy coordination represents an emerging trend, with governments increasingly recognizing the need to align transportation, energy, and industrial policies to create viable ecosystems for hydrogen mobility. This includes coordinated approaches to renewable energy deployment, hydrogen production, and transportation infrastructure development.

The European Union has established comprehensive policies through its Green Deal and Fit for 55 package, which include stringent CO2 emission standards for heavy-duty vehicles and targets for alternative fueling infrastructure deployment. The Alternative Fuels Infrastructure Regulation (AFIR) specifically mandates the installation of hydrogen refueling stations along major transportation corridors, creating a backbone for hydrogen mobility.

In the United States, the Inflation Reduction Act (IRA) provides substantial tax credits for clean hydrogen production, with higher incentives for hydrogen with lower carbon intensity. The Bipartisan Infrastructure Law complements this by allocating $8 billion for regional clean hydrogen hubs, several of which focus on transportation applications. California's Advanced Clean Trucks regulation further mandates increasing sales percentages of zero-emission trucks, creating market pull for hydrogen solutions.

Asian economies are also implementing supportive policies. Japan's Strategic Roadmap for Hydrogen and Fuel Cells includes specific targets for fuel cell trucks and hydrogen refueling infrastructure. China has incorporated hydrogen vehicles into its New Energy Vehicle (NEV) strategy, offering subsidies and preferential policies for hydrogen fuel cell vehicles, particularly in freight transport.

Financial mechanisms play a crucial role in these frameworks. These include purchase subsidies, tax exemptions, and reduced road tolls for zero-emission vehicles. More innovative approaches include contracts for difference for hydrogen production and carbon pricing mechanisms that improve the competitiveness of clean transportation solutions against conventional diesel.

Regulatory standards are equally important, with increasingly stringent emission regulations for heavy-duty vehicles driving the transition to cleaner alternatives. Low and zero-emission zones in urban areas further incentivize the adoption of hydrogen vehicles for last-mile delivery and urban logistics.

Cross-sectoral policy coordination represents an emerging trend, with governments increasingly recognizing the need to align transportation, energy, and industrial policies to create viable ecosystems for hydrogen mobility. This includes coordinated approaches to renewable energy deployment, hydrogen production, and transportation infrastructure development.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!