Techno-economic modeling of hydrogen export from renewable hubs

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hydrogen Export Technology Background and Objectives

Hydrogen has emerged as a promising energy carrier in the global transition towards decarbonization, with renewable hydrogen export representing a significant opportunity for countries with abundant renewable resources. The concept of hydrogen export from renewable hubs has evolved over the past decade, driven by increasing recognition of hydrogen's potential to address climate change challenges while creating new economic opportunities in the energy sector.

The evolution of hydrogen export technology has progressed through several key phases, beginning with early conceptual studies in the 2010s to the current development of commercial-scale projects. Initially focused on grey hydrogen produced from natural gas, the industry has rapidly shifted toward green hydrogen produced via electrolysis powered by renewable energy sources such as solar, wind, and hydroelectric power.

The primary objective of techno-economic modeling for hydrogen export is to establish economically viable pathways for transporting renewable energy from regions with abundant resources to markets with high energy demand but limited renewable generation capacity. This modeling aims to identify optimal configurations of production facilities, conversion technologies, transportation methods, and end-use applications that maximize economic returns while minimizing environmental impacts.

Technical objectives include determining the most efficient hydrogen carriers for long-distance transport, with options including liquid hydrogen (LH2), ammonia (NH3), liquid organic hydrogen carriers (LOHCs), and methanol. Each carrier presents unique challenges related to energy density, conversion efficiency, storage stability, and reconversion requirements at destination markets.

Economic modeling objectives focus on quantifying capital and operational expenditures across the entire value chain, from renewable electricity generation to final delivery at import terminals. This includes assessing the levelized cost of hydrogen (LCOH) at various stages, identifying cost reduction pathways, and determining price points necessary for commercial viability against conventional energy sources.

The strategic objectives extend to evaluating potential market structures, regulatory frameworks, and international partnerships required to establish global hydrogen trade routes. This includes assessing infrastructure requirements, standardization needs, and certification systems to verify the renewable origin of exported hydrogen.

As renewable hydrogen export technology continues to mature, techno-economic modeling will play an increasingly critical role in guiding investment decisions, policy development, and international collaboration to establish a global hydrogen economy that contributes meaningfully to climate goals while creating sustainable economic value.

The evolution of hydrogen export technology has progressed through several key phases, beginning with early conceptual studies in the 2010s to the current development of commercial-scale projects. Initially focused on grey hydrogen produced from natural gas, the industry has rapidly shifted toward green hydrogen produced via electrolysis powered by renewable energy sources such as solar, wind, and hydroelectric power.

The primary objective of techno-economic modeling for hydrogen export is to establish economically viable pathways for transporting renewable energy from regions with abundant resources to markets with high energy demand but limited renewable generation capacity. This modeling aims to identify optimal configurations of production facilities, conversion technologies, transportation methods, and end-use applications that maximize economic returns while minimizing environmental impacts.

Technical objectives include determining the most efficient hydrogen carriers for long-distance transport, with options including liquid hydrogen (LH2), ammonia (NH3), liquid organic hydrogen carriers (LOHCs), and methanol. Each carrier presents unique challenges related to energy density, conversion efficiency, storage stability, and reconversion requirements at destination markets.

Economic modeling objectives focus on quantifying capital and operational expenditures across the entire value chain, from renewable electricity generation to final delivery at import terminals. This includes assessing the levelized cost of hydrogen (LCOH) at various stages, identifying cost reduction pathways, and determining price points necessary for commercial viability against conventional energy sources.

The strategic objectives extend to evaluating potential market structures, regulatory frameworks, and international partnerships required to establish global hydrogen trade routes. This includes assessing infrastructure requirements, standardization needs, and certification systems to verify the renewable origin of exported hydrogen.

As renewable hydrogen export technology continues to mature, techno-economic modeling will play an increasingly critical role in guiding investment decisions, policy development, and international collaboration to establish a global hydrogen economy that contributes meaningfully to climate goals while creating sustainable economic value.

Global Market Analysis for Renewable Hydrogen

The global hydrogen market is experiencing unprecedented growth, driven by the urgent need for decarbonization across various sectors. Current estimates value the global hydrogen market at approximately 150 billion USD, with projections suggesting expansion to 600 billion USD by 2050. Renewable hydrogen, specifically green hydrogen produced through electrolysis powered by renewable energy sources, represents the fastest-growing segment within this market, with annual growth rates exceeding 50% in some regions.

Geographically, Europe leads in renewable hydrogen adoption, with Germany, the Netherlands, and the Nordic countries establishing ambitious national hydrogen strategies. The European Union's Hydrogen Strategy targets 40 GW of electrolyzer capacity by 2030, representing a twenty-fold increase from current levels. Asia-Pacific follows closely, with Japan, South Korea, and Australia making significant investments in hydrogen infrastructure and export capabilities.

Demand drivers vary significantly across regions. In Europe and East Asia, industrial decarbonization and energy security concerns predominate, while Australia, Chile, and Middle Eastern nations focus on export opportunities leveraging abundant renewable resources. The transportation sector represents another significant demand center, particularly for heavy-duty vehicles, shipping, and aviation where direct electrification proves challenging.

Price dynamics remain a critical factor influencing market development. Current renewable hydrogen production costs range between 4-6 USD/kg, significantly higher than conventional hydrogen derived from natural gas (1-2 USD/kg). However, technological advancements and economies of scale are expected to drive renewable hydrogen costs below 2 USD/kg by 2030 in optimal locations, achieving cost parity with conventional hydrogen in many markets.

Regulatory frameworks are evolving rapidly to support market growth. Carbon pricing mechanisms, renewable energy mandates, and direct hydrogen subsidies are being implemented across major economies. The European Union's Carbon Border Adjustment Mechanism and various national hydrogen certification schemes are creating structured market conditions that favor renewable hydrogen development.

Investment trends indicate strong confidence in the sector's growth potential. Venture capital and private equity investments in hydrogen technologies exceeded 25 billion USD in 2022, while government commitments across G20 nations surpassed 70 billion USD. Major energy companies are redirecting significant portions of their capital expenditure toward renewable hydrogen projects, with several multi-billion dollar export-oriented projects announced in Australia, Chile, Namibia, and Saudi Arabia.

Geographically, Europe leads in renewable hydrogen adoption, with Germany, the Netherlands, and the Nordic countries establishing ambitious national hydrogen strategies. The European Union's Hydrogen Strategy targets 40 GW of electrolyzer capacity by 2030, representing a twenty-fold increase from current levels. Asia-Pacific follows closely, with Japan, South Korea, and Australia making significant investments in hydrogen infrastructure and export capabilities.

Demand drivers vary significantly across regions. In Europe and East Asia, industrial decarbonization and energy security concerns predominate, while Australia, Chile, and Middle Eastern nations focus on export opportunities leveraging abundant renewable resources. The transportation sector represents another significant demand center, particularly for heavy-duty vehicles, shipping, and aviation where direct electrification proves challenging.

Price dynamics remain a critical factor influencing market development. Current renewable hydrogen production costs range between 4-6 USD/kg, significantly higher than conventional hydrogen derived from natural gas (1-2 USD/kg). However, technological advancements and economies of scale are expected to drive renewable hydrogen costs below 2 USD/kg by 2030 in optimal locations, achieving cost parity with conventional hydrogen in many markets.

Regulatory frameworks are evolving rapidly to support market growth. Carbon pricing mechanisms, renewable energy mandates, and direct hydrogen subsidies are being implemented across major economies. The European Union's Carbon Border Adjustment Mechanism and various national hydrogen certification schemes are creating structured market conditions that favor renewable hydrogen development.

Investment trends indicate strong confidence in the sector's growth potential. Venture capital and private equity investments in hydrogen technologies exceeded 25 billion USD in 2022, while government commitments across G20 nations surpassed 70 billion USD. Major energy companies are redirecting significant portions of their capital expenditure toward renewable hydrogen projects, with several multi-billion dollar export-oriented projects announced in Australia, Chile, Namibia, and Saudi Arabia.

Technical Barriers and Regional Development Status

Despite significant advancements in hydrogen production technologies, several technical barriers continue to impede the large-scale development of renewable hydrogen export hubs. Electrolysis efficiency remains a primary challenge, with current commercial electrolyzers operating at 65-75% efficiency, resulting in substantial energy losses during hydrogen production. This inefficiency directly impacts the economic viability of renewable hydrogen projects, particularly when considering the already high costs of renewable electricity generation in many regions.

Storage and transportation present formidable technical hurdles for hydrogen export. Hydrogen's low volumetric energy density necessitates compression to 350-700 bar or liquefaction at -253°C, both processes consuming approximately 30% of the energy content of the hydrogen itself. Materials compatibility issues further complicate matters, as hydrogen embrittlement affects many conventional metals used in storage and transportation infrastructure.

Conversion technologies for carrier substances like ammonia or liquid organic hydrogen carriers (LOHC) face efficiency challenges, with round-trip efficiency losses of 25-35% during conversion and reconversion processes. These losses significantly impact the delivered cost of hydrogen at destination markets.

Regional development status varies considerably across potential hydrogen export hubs. Australia has made substantial progress, with multiple demonstration projects underway in Western Australia and Queensland, supported by bilateral agreements with Japan and South Korea. The country's National Hydrogen Strategy aims to position Australia as a major hydrogen exporter by 2030.

Middle Eastern nations, particularly Saudi Arabia and the United Arab Emirates, are leveraging their existing energy export infrastructure and abundant solar resources. The NEOM project in Saudi Arabia represents one of the world's largest green hydrogen initiatives, targeting 4 GW of electrolysis capacity.

Chile has emerged as a promising Southern Hemisphere hub due to exceptional wind resources in Patagonia and established trade relationships with Asian markets. The country's National Green Hydrogen Strategy targets 5 GW of electrolysis capacity by 2025.

North Africa, particularly Morocco and Egypt, is developing significant renewable hydrogen capacity aimed at European markets, benefiting from geographic proximity and existing natural gas pipeline infrastructure that could potentially be repurposed for hydrogen transport.

Technical readiness levels differ markedly across regions, with Australia and the Middle East demonstrating more advanced project development and regulatory frameworks compared to emerging players in South America and Africa.

Storage and transportation present formidable technical hurdles for hydrogen export. Hydrogen's low volumetric energy density necessitates compression to 350-700 bar or liquefaction at -253°C, both processes consuming approximately 30% of the energy content of the hydrogen itself. Materials compatibility issues further complicate matters, as hydrogen embrittlement affects many conventional metals used in storage and transportation infrastructure.

Conversion technologies for carrier substances like ammonia or liquid organic hydrogen carriers (LOHC) face efficiency challenges, with round-trip efficiency losses of 25-35% during conversion and reconversion processes. These losses significantly impact the delivered cost of hydrogen at destination markets.

Regional development status varies considerably across potential hydrogen export hubs. Australia has made substantial progress, with multiple demonstration projects underway in Western Australia and Queensland, supported by bilateral agreements with Japan and South Korea. The country's National Hydrogen Strategy aims to position Australia as a major hydrogen exporter by 2030.

Middle Eastern nations, particularly Saudi Arabia and the United Arab Emirates, are leveraging their existing energy export infrastructure and abundant solar resources. The NEOM project in Saudi Arabia represents one of the world's largest green hydrogen initiatives, targeting 4 GW of electrolysis capacity.

Chile has emerged as a promising Southern Hemisphere hub due to exceptional wind resources in Patagonia and established trade relationships with Asian markets. The country's National Green Hydrogen Strategy targets 5 GW of electrolysis capacity by 2025.

North Africa, particularly Morocco and Egypt, is developing significant renewable hydrogen capacity aimed at European markets, benefiting from geographic proximity and existing natural gas pipeline infrastructure that could potentially be repurposed for hydrogen transport.

Technical readiness levels differ markedly across regions, with Australia and the Middle East demonstrating more advanced project development and regulatory frameworks compared to emerging players in South America and Africa.

Current Techno-economic Models for Hydrogen Export

01 Renewable hydrogen production technologies

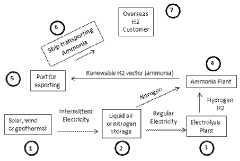

Various technologies for producing hydrogen from renewable energy sources are discussed in these patents. These include electrolysis powered by renewable electricity, biomass gasification, and solar-driven processes. The patents cover innovations in efficiency improvements, catalyst development, and system integration that make renewable hydrogen production more economically viable for export hubs.- Renewable hydrogen production technologies: Various technologies for producing hydrogen from renewable energy sources are discussed, including electrolysis powered by solar, wind, or other renewable sources. These technologies form the foundation of renewable hydrogen hubs, enabling the conversion of intermittent renewable energy into storable hydrogen. The efficiency, scalability, and integration of these production methods are critical factors in techno-economic modeling of hydrogen export systems.

- Hydrogen storage and transportation solutions: Different methods for storing and transporting hydrogen from renewable hubs to export destinations are examined, including compression, liquefaction, chemical carriers (like ammonia or LOHC), and pipeline infrastructure. Each method presents different cost structures, energy requirements, and technical challenges that significantly impact the overall economics of hydrogen export. The choice of carrier technology affects both capital expenditure and operational costs in the export value chain.

- Economic modeling frameworks for hydrogen export: Comprehensive economic modeling approaches for evaluating the viability of hydrogen export from renewable hubs are presented. These frameworks incorporate capital costs, operational expenses, revenue projections, and risk assessments. The models account for variables such as renewable energy costs, conversion efficiencies, transportation expenses, and market prices at destination. Sensitivity analyses help identify key economic drivers and potential optimization strategies for hydrogen export projects.

- Integration of renewable energy systems with hydrogen production: Methods for optimally integrating variable renewable energy sources with hydrogen production systems are explored. This includes grid connection strategies, hybrid renewable systems, energy management algorithms, and buffer storage solutions. The integration approach significantly impacts the capacity factor of electrolyzers and overall system efficiency, which are crucial parameters in techno-economic modeling. Advanced control systems can help maximize renewable energy utilization while maintaining stable hydrogen production.

- Policy frameworks and market analysis for hydrogen export: Analysis of policy mechanisms, regulatory frameworks, and market conditions that influence the economics of hydrogen export from renewable hubs. This includes carbon pricing, renewable energy incentives, international trade agreements, and certification schemes for clean hydrogen. The modeling approaches incorporate policy scenarios to evaluate how different regulatory environments affect project viability. Market analysis components assess demand projections, price forecasts, and competition from alternative energy carriers in target export markets.

02 Hydrogen storage and transportation solutions

These patents address the challenges of storing and transporting hydrogen from renewable hubs to export markets. Solutions include conversion to liquid carriers like ammonia or methanol, compression and liquefaction technologies, and novel materials for hydrogen storage. The techno-economic aspects of different carrier options are analyzed to optimize the export value chain.Expand Specific Solutions03 Economic modeling and optimization frameworks

These patents focus on techno-economic modeling frameworks specifically designed for hydrogen export projects. They include methodologies for cost analysis, risk assessment, and optimization of renewable hydrogen supply chains. The models account for variables such as renewable resource availability, production scale, transportation distance, and market demand to determine economic viability.Expand Specific Solutions04 Integration of renewable energy sources with hydrogen production

These patents describe systems and methods for integrating variable renewable energy sources with hydrogen production facilities. They address challenges such as intermittency management, grid balancing, and hybrid power systems. Solutions include smart control systems, energy storage integration, and flexible operation strategies to maximize renewable energy utilization in hydrogen export hubs.Expand Specific Solutions05 Policy frameworks and carbon accounting for hydrogen exports

These patents cover methodologies for carbon accounting, certification schemes, and policy frameworks relevant to renewable hydrogen exports. They include systems for tracking the carbon intensity of hydrogen across the supply chain, mechanisms for carbon credits or guarantees of origin, and approaches to ensure compliance with international standards and regulations for clean hydrogen trade.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The hydrogen export market from renewable hubs is currently in an early growth phase, characterized by increasing investments but limited commercial-scale deployments. The global market size is projected to expand significantly, driven by decarbonization goals and energy security concerns. Technologically, the field remains in development with varying maturity levels across the value chain. Leading players demonstrate different strategic approaches: established energy companies like Air Products, Toshiba Energy Systems, and Saudi Aramco leverage existing infrastructure and capital; technology specialists such as Hydrogenics (Cummins) and H2 Clipper focus on specific innovations; while research institutions including Virginia Tech, Oxford University Innovation, and IIT Madras contribute fundamental research. Chinese state-owned enterprises like State Grid and Sinopec are rapidly scaling up capabilities, positioning for leadership in this emerging market.

Air Products & Chemicals, Inc.

Technical Solution: Air Products has developed a comprehensive techno-economic model for hydrogen export from renewable hubs that integrates production, liquefaction, and transportation systems. Their NEOM green hydrogen project in Saudi Arabia represents a $7 billion investment to produce 650 tons of hydrogen daily using 4GW of renewable power. The model incorporates advanced electrolysis technology with efficiency rates of 70-80%, coupled with proprietary liquefaction processes that reduce energy consumption by approximately 30% compared to conventional methods. Their approach includes detailed cost modeling across the entire value chain, from renewable electricity generation (primarily wind and solar) to final delivery, with sensitivity analysis for key variables including electricity costs, capital expenditure, and carbon pricing. Air Products' model accounts for regional variations in renewable resource availability, infrastructure requirements, and market demand patterns, enabling optimization of hub locations and export pathways. The company has implemented machine learning algorithms to continuously refine cost projections based on operational data from existing facilities, creating a dynamic modeling framework that adapts to technological improvements and market changes.

Strengths: Industry-leading expertise in hydrogen production and liquefaction with proven large-scale implementation capability; extensive global distribution infrastructure; proprietary technologies that improve efficiency across the value chain. Weaknesses: Heavy reliance on capital-intensive infrastructure requiring significant upfront investment; sensitivity to renewable electricity price fluctuations; potential challenges in scaling to meet projected demand growth.

Cummins, Inc.

Technical Solution: Cummins has developed a modular techno-economic modeling framework for hydrogen export from renewable hubs that focuses on scalability and flexibility. Their approach centers on electrolyzer technology acquired through their purchase of Hydrogenics, featuring PEM (Proton Exchange Membrane) systems that achieve 65-75% efficiency and can rapidly respond to variable renewable inputs. Cummins' model incorporates detailed capital and operational expenditure analysis across multiple production scales (from 1MW to 100+MW installations) and evaluates various compression, storage, and transportation pathways including pipeline, trucking, and shipping options. Their framework includes sophisticated risk assessment tools that quantify uncertainties in renewable resource availability, policy environments, and market development across different geographies. The company has implemented this modeling approach in projects across Australia, Europe, and North America, with particular focus on optimizing the balance between production capacity, storage requirements, and transportation infrastructure to minimize levelized cost of hydrogen (LCOH). Cummins' model incorporates learning curve effects, projecting cost reductions of 40-60% by 2030 as deployment scales, and includes detailed analysis of potential revenue streams including grid balancing services that can be provided by flexible electrolyzer operation.

Strengths: Extensive experience in hydrogen production equipment manufacturing with proven electrolyzer technology; modular approach allows for phased deployment and reduced initial capital requirements; strong integration capabilities with various renewable energy sources. Weaknesses: Less vertical integration in the hydrogen value chain compared to some competitors; higher production costs at smaller scales; limited experience with maritime hydrogen transport solutions for long-distance export.

Critical Patents and Innovations in Hydrogen Transport

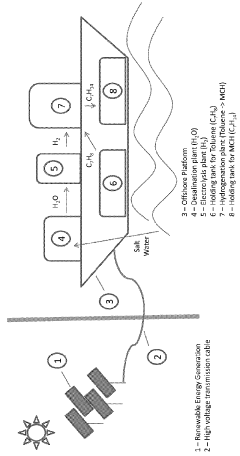

Exporting renewable hydrogen via offshore MCH platform

PatentInactiveAU2014101317A4

Innovation

- An offshore MCH production platform is used to generate, store, and offload methylcyclohexane (MCH) using renewable energy, which combines a water desalination unit, electrolysis plant, and hydrogenation plant, enabling the transportation of hydrogen via existing infrastructure and recycling Toluene to create a closed carbon loop.

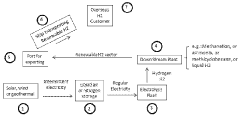

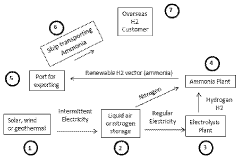

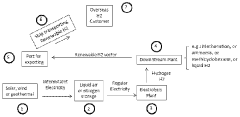

Liquid air facilitating renewable hydrogen exports

PatentInactiveAU2014100315A4

Innovation

- Storing renewable energy in the form of liquid air or liquid nitrogen, allowing for its efficient conversion back into electricity to power electrolysis plants, thereby smoothing out energy usage patterns and enhancing plant utilization, and using this stored energy to produce hydrogen for export via various carriers such as liquefied hydrogen, ammonia, or methane.

Policy Frameworks and International Trade Regulations

The global hydrogen economy is significantly shaped by diverse policy frameworks and international trade regulations that vary across regions. Currently, countries like Japan, South Korea, and Germany have established comprehensive hydrogen strategies with clear regulatory pathways for imports, while others are still developing their approaches. These frameworks typically address safety standards, certification requirements, and import/export procedures specific to hydrogen as an energy carrier.

International trade of hydrogen faces unique regulatory challenges due to its classification across multiple categories - as an industrial gas, fuel, and potential commodity. The World Trade Organization's rules on technical barriers to trade and sanitary measures become particularly relevant when countries establish hydrogen purity standards or safety regulations that could potentially restrict market access.

Carbon border adjustment mechanisms (CBAMs) are emerging as critical policy instruments that will influence hydrogen trade flows. These mechanisms aim to price the carbon content of imported goods, potentially creating competitive advantages for low-carbon hydrogen production pathways. The European Union's CBAM implementation timeline will significantly impact hydrogen exporters targeting European markets.

Certification schemes for hydrogen, particularly those distinguishing between "green," "blue," and "gray" hydrogen based on production methods and carbon intensity, are developing rapidly but lack global harmonization. This creates potential trade barriers as exporters may need to comply with multiple certification systems to access different markets. The International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE) is working toward standardized methodologies for determining hydrogen's greenhouse gas intensity.

Bilateral and multilateral hydrogen trade agreements are becoming increasingly common, with countries like Australia establishing hydrogen export partnerships with Japan, Singapore, and Germany. These agreements often include provisions for technology transfer, infrastructure development, and regulatory alignment to facilitate future trade flows.

Subsidies and incentives for hydrogen production and export vary significantly across jurisdictions, creating complex trade dynamics. The US Inflation Reduction Act provides substantial production tax credits for clean hydrogen, while the EU's Innovation Fund supports hydrogen projects throughout the value chain. These policy differences create both opportunities and challenges for establishing renewable hydrogen export hubs.

Customs classifications and tariff structures for hydrogen and hydrogen carriers (such as ammonia or liquid organic hydrogen carriers) remain inconsistent globally, adding complexity to international trade modeling. Harmonized System (HS) codes specific to hydrogen by production method are still evolving, creating potential for trade disputes or misclassification.

International trade of hydrogen faces unique regulatory challenges due to its classification across multiple categories - as an industrial gas, fuel, and potential commodity. The World Trade Organization's rules on technical barriers to trade and sanitary measures become particularly relevant when countries establish hydrogen purity standards or safety regulations that could potentially restrict market access.

Carbon border adjustment mechanisms (CBAMs) are emerging as critical policy instruments that will influence hydrogen trade flows. These mechanisms aim to price the carbon content of imported goods, potentially creating competitive advantages for low-carbon hydrogen production pathways. The European Union's CBAM implementation timeline will significantly impact hydrogen exporters targeting European markets.

Certification schemes for hydrogen, particularly those distinguishing between "green," "blue," and "gray" hydrogen based on production methods and carbon intensity, are developing rapidly but lack global harmonization. This creates potential trade barriers as exporters may need to comply with multiple certification systems to access different markets. The International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE) is working toward standardized methodologies for determining hydrogen's greenhouse gas intensity.

Bilateral and multilateral hydrogen trade agreements are becoming increasingly common, with countries like Australia establishing hydrogen export partnerships with Japan, Singapore, and Germany. These agreements often include provisions for technology transfer, infrastructure development, and regulatory alignment to facilitate future trade flows.

Subsidies and incentives for hydrogen production and export vary significantly across jurisdictions, creating complex trade dynamics. The US Inflation Reduction Act provides substantial production tax credits for clean hydrogen, while the EU's Innovation Fund supports hydrogen projects throughout the value chain. These policy differences create both opportunities and challenges for establishing renewable hydrogen export hubs.

Customs classifications and tariff structures for hydrogen and hydrogen carriers (such as ammonia or liquid organic hydrogen carriers) remain inconsistent globally, adding complexity to international trade modeling. Harmonized System (HS) codes specific to hydrogen by production method are still evolving, creating potential for trade disputes or misclassification.

Environmental Impact Assessment of Export Pathways

The environmental impact assessment of hydrogen export pathways reveals significant variations across different transport methods. Maritime shipping of hydrogen, whether in liquid form, as ammonia, or through liquid organic hydrogen carriers (LOHCs), generates substantial carbon emissions primarily from energy-intensive liquefaction processes and refrigeration requirements. These processes can account for up to 30% of the total energy content of the hydrogen being transported, resulting in considerable indirect emissions when powered by non-renewable sources.

Pipeline transport presents a lower environmental footprint for regional distribution, with emissions primarily stemming from compression energy requirements and potential fugitive hydrogen leakage. Recent studies indicate that pipeline transport produces approximately 0.2-0.5 kg CO2-eq per kg of hydrogen transported over 1000 km, significantly lower than maritime alternatives which can range from 1.2-3.5 kg CO2-eq depending on the carrier medium and distance.

Ammonia as a hydrogen carrier offers improved energy density but introduces additional environmental considerations including potential ammonia leakage, which has 300 times the global warming potential of CO2 over a 100-year period. Conversion and reconversion processes for ammonia also generate nitrogen oxide emissions that contribute to air pollution and acid rain formation.

Water consumption represents another critical environmental factor, particularly for green hydrogen production in water-scarce regions. Electrolysis requires approximately 9 kg of water per kg of hydrogen produced, with additional water needed for cooling systems. This creates potential competition with agricultural and municipal water needs in export hub locations.

Land use impacts vary significantly between export pathways, with pipeline infrastructure requiring continuous land corridors that may fragment ecosystems, while maritime terminals concentrate environmental disruption in coastal areas but may affect sensitive marine ecosystems through construction and operational activities.

Life cycle assessments indicate that the environmental benefits of hydrogen export are highly dependent on the renewable energy penetration throughout the supply chain. When renewable energy powers production, conversion, and transport processes, lifecycle emissions can be reduced by up to 90% compared to fossil-based hydrogen pathways, making the integration of renewable energy into export infrastructure a critical factor in achieving sustainability goals.

Pipeline transport presents a lower environmental footprint for regional distribution, with emissions primarily stemming from compression energy requirements and potential fugitive hydrogen leakage. Recent studies indicate that pipeline transport produces approximately 0.2-0.5 kg CO2-eq per kg of hydrogen transported over 1000 km, significantly lower than maritime alternatives which can range from 1.2-3.5 kg CO2-eq depending on the carrier medium and distance.

Ammonia as a hydrogen carrier offers improved energy density but introduces additional environmental considerations including potential ammonia leakage, which has 300 times the global warming potential of CO2 over a 100-year period. Conversion and reconversion processes for ammonia also generate nitrogen oxide emissions that contribute to air pollution and acid rain formation.

Water consumption represents another critical environmental factor, particularly for green hydrogen production in water-scarce regions. Electrolysis requires approximately 9 kg of water per kg of hydrogen produced, with additional water needed for cooling systems. This creates potential competition with agricultural and municipal water needs in export hub locations.

Land use impacts vary significantly between export pathways, with pipeline infrastructure requiring continuous land corridors that may fragment ecosystems, while maritime terminals concentrate environmental disruption in coastal areas but may affect sensitive marine ecosystems through construction and operational activities.

Life cycle assessments indicate that the environmental benefits of hydrogen export are highly dependent on the renewable energy penetration throughout the supply chain. When renewable energy powers production, conversion, and transport processes, lifecycle emissions can be reduced by up to 90% compared to fossil-based hydrogen pathways, making the integration of renewable energy into export infrastructure a critical factor in achieving sustainability goals.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!