Role of green hydrogen in district heating decarbonization

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Hydrogen Background and Decarbonization Goals

Green hydrogen represents a revolutionary energy carrier produced through water electrolysis powered by renewable electricity sources such as wind, solar, and hydroelectric power. Unlike conventional hydrogen production methods that rely on fossil fuels, green hydrogen generates zero carbon emissions during its production cycle, positioning it as a critical component in the global transition toward carbon neutrality.

The evolution of hydrogen technology has progressed significantly over recent decades, with electrolyzer efficiency improvements and declining renewable energy costs creating a viable pathway for green hydrogen implementation. Historical applications of hydrogen have primarily focused on industrial processes, but its potential as a heating solution represents an emerging frontier with substantial decarbonization implications.

District heating systems, which provide centralized heat generation and distribution to multiple buildings, currently account for approximately 12% of heating demand across Europe, with significantly higher penetration in Northern European countries. These systems have traditionally relied on fossil fuels, contributing substantially to urban carbon emissions and air pollution. The European Union's commitment to achieve carbon neutrality by 2050 necessitates a fundamental transformation of these heating networks.

The integration of green hydrogen into district heating aligns with several key decarbonization objectives. Primary among these is the reduction of greenhouse gas emissions from the heating sector, which represents approximately 40% of global energy-related CO2 emissions. Green hydrogen offers a solution for heat generation that can utilize existing gas infrastructure with modifications, potentially reducing transition costs compared to complete system overhauls.

Additionally, green hydrogen provides a seasonal energy storage mechanism, addressing one of renewable energy's fundamental challenges. Excess renewable electricity during high-production periods can be converted to hydrogen, stored, and later used for heating during peak demand seasons, enhancing grid stability and renewable integration capacity.

The technical goal for green hydrogen in district heating involves developing efficient, scalable, and economically viable systems that can either directly utilize hydrogen or blend it with natural gas in existing infrastructure. This includes advancing high-temperature heat pumps, hydrogen boilers, and fuel cell technologies specifically optimized for district heating applications.

Several pioneering projects across Europe, including HyDeploy in the UK and H2District in Denmark, are demonstrating the feasibility of hydrogen integration in heating networks at various scales. These initiatives aim to establish technical parameters, safety protocols, and operational frameworks necessary for widespread adoption.

The evolution of hydrogen technology has progressed significantly over recent decades, with electrolyzer efficiency improvements and declining renewable energy costs creating a viable pathway for green hydrogen implementation. Historical applications of hydrogen have primarily focused on industrial processes, but its potential as a heating solution represents an emerging frontier with substantial decarbonization implications.

District heating systems, which provide centralized heat generation and distribution to multiple buildings, currently account for approximately 12% of heating demand across Europe, with significantly higher penetration in Northern European countries. These systems have traditionally relied on fossil fuels, contributing substantially to urban carbon emissions and air pollution. The European Union's commitment to achieve carbon neutrality by 2050 necessitates a fundamental transformation of these heating networks.

The integration of green hydrogen into district heating aligns with several key decarbonization objectives. Primary among these is the reduction of greenhouse gas emissions from the heating sector, which represents approximately 40% of global energy-related CO2 emissions. Green hydrogen offers a solution for heat generation that can utilize existing gas infrastructure with modifications, potentially reducing transition costs compared to complete system overhauls.

Additionally, green hydrogen provides a seasonal energy storage mechanism, addressing one of renewable energy's fundamental challenges. Excess renewable electricity during high-production periods can be converted to hydrogen, stored, and later used for heating during peak demand seasons, enhancing grid stability and renewable integration capacity.

The technical goal for green hydrogen in district heating involves developing efficient, scalable, and economically viable systems that can either directly utilize hydrogen or blend it with natural gas in existing infrastructure. This includes advancing high-temperature heat pumps, hydrogen boilers, and fuel cell technologies specifically optimized for district heating applications.

Several pioneering projects across Europe, including HyDeploy in the UK and H2District in Denmark, are demonstrating the feasibility of hydrogen integration in heating networks at various scales. These initiatives aim to establish technical parameters, safety protocols, and operational frameworks necessary for widespread adoption.

Market Analysis for Hydrogen-Based District Heating

The global hydrogen-based district heating market is experiencing significant growth, driven by increasing decarbonization initiatives and the urgent need to reduce greenhouse gas emissions in the heating sector. Currently valued at approximately $2.3 billion, this market is projected to grow at a compound annual growth rate of 12.7% through 2030, potentially reaching $5.4 billion by the end of the decade. This growth trajectory is supported by substantial government investments, particularly in Europe where the EU Hydrogen Strategy has allocated €470 billion for green hydrogen development by 2050.

Market segmentation reveals distinct regional patterns in hydrogen-based district heating adoption. Europe leads the market with countries like Germany, Denmark, and the Netherlands implementing pilot projects and developing hydrogen valleys. The European market accounts for nearly 58% of global hydrogen heating initiatives, followed by Asia-Pacific at 22%, with China and South Korea making significant investments. North America represents about 15% of the market, with concentrated development in Canada and the northeastern United States.

Consumer demand analysis indicates growing acceptance of hydrogen heating solutions, particularly in environmentally conscious urban centers. A recent industry survey showed that 67% of district heating operators are considering hydrogen integration within their five-year strategic plans. The primary market drivers include stringent carbon reduction targets, volatile fossil fuel prices, and increasing carbon taxation mechanisms that improve the economic competitiveness of hydrogen solutions.

The competitive landscape features both traditional energy companies pivoting toward hydrogen and specialized hydrogen technology providers. Major players include Siemens Energy, Ørsted, Engie, and Vattenfall, who are developing integrated hydrogen production and district heating solutions. Additionally, specialized technology providers like McPhy Energy, ITM Power, and Nel Hydrogen are gaining market share by focusing on electrolysis technology optimization for heating applications.

Market barriers remain significant, with cost being the primary challenge. Green hydrogen production costs currently range from $3-6/kg, making it 2-3 times more expensive than natural gas heating on an energy-equivalent basis. Infrastructure adaptation requirements represent another substantial barrier, as existing gas networks typically require significant modifications to safely transport hydrogen blends above 20% concentration.

Future market growth will likely be driven by technological advancements in electrolysis efficiency, regulatory support mechanisms including carbon pricing, and the development of hydrogen storage solutions that address seasonal heating demand fluctuations. The market is expected to reach commercial viability in progressive stages, beginning with hydrogen blending in existing networks before transitioning to dedicated hydrogen heating systems in newly developed districts.

Market segmentation reveals distinct regional patterns in hydrogen-based district heating adoption. Europe leads the market with countries like Germany, Denmark, and the Netherlands implementing pilot projects and developing hydrogen valleys. The European market accounts for nearly 58% of global hydrogen heating initiatives, followed by Asia-Pacific at 22%, with China and South Korea making significant investments. North America represents about 15% of the market, with concentrated development in Canada and the northeastern United States.

Consumer demand analysis indicates growing acceptance of hydrogen heating solutions, particularly in environmentally conscious urban centers. A recent industry survey showed that 67% of district heating operators are considering hydrogen integration within their five-year strategic plans. The primary market drivers include stringent carbon reduction targets, volatile fossil fuel prices, and increasing carbon taxation mechanisms that improve the economic competitiveness of hydrogen solutions.

The competitive landscape features both traditional energy companies pivoting toward hydrogen and specialized hydrogen technology providers. Major players include Siemens Energy, Ørsted, Engie, and Vattenfall, who are developing integrated hydrogen production and district heating solutions. Additionally, specialized technology providers like McPhy Energy, ITM Power, and Nel Hydrogen are gaining market share by focusing on electrolysis technology optimization for heating applications.

Market barriers remain significant, with cost being the primary challenge. Green hydrogen production costs currently range from $3-6/kg, making it 2-3 times more expensive than natural gas heating on an energy-equivalent basis. Infrastructure adaptation requirements represent another substantial barrier, as existing gas networks typically require significant modifications to safely transport hydrogen blends above 20% concentration.

Future market growth will likely be driven by technological advancements in electrolysis efficiency, regulatory support mechanisms including carbon pricing, and the development of hydrogen storage solutions that address seasonal heating demand fluctuations. The market is expected to reach commercial viability in progressive stages, beginning with hydrogen blending in existing networks before transitioning to dedicated hydrogen heating systems in newly developed districts.

Current Status and Barriers in Green Hydrogen Implementation

Green hydrogen implementation in district heating systems is currently in its early stages, with several pilot projects and demonstrations emerging across Europe and other regions. Countries like Denmark, Germany, and the Netherlands are leading with innovative projects that integrate hydrogen into existing heating infrastructure. These projects typically involve either blending hydrogen with natural gas in existing networks or developing dedicated hydrogen pipelines for pure hydrogen delivery to heating systems.

The technological readiness level varies significantly across different components of the hydrogen heating value chain. While hydrogen production through electrolysis has reached commercial maturity, particularly for alkaline and PEM electrolyzers, the integration of these systems with district heating infrastructure remains largely experimental. Most implementations are operating at small scales, typically serving limited geographic areas or specific building clusters.

Significant barriers impede widespread adoption of green hydrogen in district heating decarbonization. Cost remains the foremost challenge, with green hydrogen production still 2-3 times more expensive than natural gas heating on an energy-equivalent basis. The levelized cost of hydrogen heating currently ranges from €70-120/MWh compared to €30-50/MWh for conventional natural gas systems, making economic viability difficult without substantial subsidies or carbon pricing mechanisms.

Infrastructure limitations present another major obstacle. Existing natural gas pipelines can typically accommodate only 10-20% hydrogen blending without significant modifications, while pure hydrogen transport requires entirely new infrastructure or extensive retrofitting. The capital expenditure required for such transitions is substantial, estimated at €300-500 per meter for pipeline conversion.

Regulatory frameworks remain underdeveloped in most jurisdictions, creating uncertainty for potential investors and project developers. Issues such as hydrogen purity standards, safety regulations, and grid access rules are still evolving, complicating planning and implementation processes.

Technical challenges persist in areas such as hydrogen storage, which is crucial for managing the intermittency of renewable energy sources used for electrolysis. Current storage solutions are either expensive (pressurized tanks) or geographically constrained (salt caverns), limiting deployment flexibility.

Public acceptance and awareness represent additional barriers, with concerns about safety and limited understanding of hydrogen technologies among consumers and local authorities. The perception of hydrogen as a potentially dangerous gas requires comprehensive education and engagement strategies to overcome.

The technological readiness level varies significantly across different components of the hydrogen heating value chain. While hydrogen production through electrolysis has reached commercial maturity, particularly for alkaline and PEM electrolyzers, the integration of these systems with district heating infrastructure remains largely experimental. Most implementations are operating at small scales, typically serving limited geographic areas or specific building clusters.

Significant barriers impede widespread adoption of green hydrogen in district heating decarbonization. Cost remains the foremost challenge, with green hydrogen production still 2-3 times more expensive than natural gas heating on an energy-equivalent basis. The levelized cost of hydrogen heating currently ranges from €70-120/MWh compared to €30-50/MWh for conventional natural gas systems, making economic viability difficult without substantial subsidies or carbon pricing mechanisms.

Infrastructure limitations present another major obstacle. Existing natural gas pipelines can typically accommodate only 10-20% hydrogen blending without significant modifications, while pure hydrogen transport requires entirely new infrastructure or extensive retrofitting. The capital expenditure required for such transitions is substantial, estimated at €300-500 per meter for pipeline conversion.

Regulatory frameworks remain underdeveloped in most jurisdictions, creating uncertainty for potential investors and project developers. Issues such as hydrogen purity standards, safety regulations, and grid access rules are still evolving, complicating planning and implementation processes.

Technical challenges persist in areas such as hydrogen storage, which is crucial for managing the intermittency of renewable energy sources used for electrolysis. Current storage solutions are either expensive (pressurized tanks) or geographically constrained (salt caverns), limiting deployment flexibility.

Public acceptance and awareness represent additional barriers, with concerns about safety and limited understanding of hydrogen technologies among consumers and local authorities. The perception of hydrogen as a potentially dangerous gas requires comprehensive education and engagement strategies to overcome.

Existing Green Hydrogen District Heating Solutions

01 Hydrogen production technologies for decarbonization

Various technologies are being developed for green hydrogen production to support decarbonization efforts. These include advanced electrolysis systems, renewable energy integration methods, and innovative catalysts that improve efficiency and reduce costs. These technologies aim to produce hydrogen with minimal or zero carbon emissions, making it a viable alternative to fossil fuels in various industrial applications.- Hydrogen production methods for decarbonization: Various methods for producing green hydrogen are employed to achieve decarbonization goals. These methods include water electrolysis powered by renewable energy sources, such as solar and wind power. Advanced electrolysis technologies like proton exchange membrane (PEM) electrolyzers and alkaline electrolyzers are utilized to split water into hydrogen and oxygen with zero carbon emissions. These production methods are crucial for establishing a sustainable hydrogen economy and reducing dependence on fossil fuels.

- Integration of green hydrogen in industrial processes: Green hydrogen is being integrated into various industrial processes to reduce carbon emissions. It serves as a clean alternative to fossil fuels in energy-intensive industries such as steel manufacturing, chemical production, and refining. By replacing traditional carbon-intensive feedstocks with green hydrogen, these industries can significantly reduce their carbon footprint. The integration often involves retrofitting existing infrastructure or developing new processes specifically designed to utilize hydrogen as a clean energy carrier.

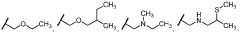

- Storage and transportation solutions for hydrogen: Effective storage and transportation solutions are essential for the widespread adoption of green hydrogen in decarbonization efforts. Innovations include advanced compression technologies, liquid hydrogen systems, metal hydrides, and chemical carriers like ammonia or liquid organic hydrogen carriers (LOHC). These solutions address the challenges associated with hydrogen's low volumetric energy density and ensure safe, efficient delivery from production sites to end-users across various sectors of the economy.

- Hydrogen fuel cell applications for transportation: Hydrogen fuel cells are being developed and deployed in various transportation applications to reduce carbon emissions. These applications include passenger vehicles, heavy-duty trucks, buses, trains, and maritime vessels. Fuel cells convert hydrogen into electricity through an electrochemical reaction, producing only water vapor as a byproduct. This technology offers advantages such as quick refueling times and longer ranges compared to battery electric vehicles, making it particularly suitable for certain transportation segments in a decarbonized economy.

- Green hydrogen infrastructure and ecosystem development: Developing comprehensive infrastructure and ecosystems is crucial for scaling up green hydrogen as a decarbonization solution. This includes establishing hydrogen hubs that integrate production, storage, distribution, and end-use applications. Smart grid integration enables efficient use of renewable energy for hydrogen production, while policy frameworks and market mechanisms support investment in hydrogen technologies. These ecosystem approaches create synergies between different sectors and facilitate the transition to a hydrogen-based low-carbon economy.

02 Industrial applications of green hydrogen

Green hydrogen is being implemented across various industrial sectors to reduce carbon footprints. Applications include steel manufacturing, chemical production, transportation, and power generation. By replacing fossil fuel-based processes with hydrogen-based alternatives, these industries can significantly reduce their greenhouse gas emissions while maintaining or improving production efficiency.Expand Specific Solutions03 Storage and distribution systems for hydrogen

Innovative storage and distribution systems are essential for the widespread adoption of green hydrogen. These include advanced compression technologies, novel materials for hydrogen storage, pipeline infrastructure adaptations, and specialized transportation solutions. These systems address the challenges of hydrogen's low volumetric energy density and ensure safe, efficient delivery to end-users.Expand Specific Solutions04 Integration of green hydrogen with renewable energy sources

Effective integration of hydrogen production with renewable energy sources is crucial for true decarbonization. This includes systems that utilize excess renewable electricity for hydrogen production, smart grid technologies that optimize energy flows, and hybrid power plants that combine multiple renewable sources with hydrogen production and storage capabilities. These integrated systems help address the intermittency issues of renewable energy while providing a stable, carbon-free energy carrier.Expand Specific Solutions05 Carbon capture and utilization in hydrogen production

Carbon capture technologies are being combined with hydrogen production processes to further reduce emissions. These include systems that capture CO2 during hydrogen production from fossil fuels, as well as technologies that utilize captured carbon in combination with hydrogen to produce valuable chemicals or fuels. This approach provides a transition pathway to fully green hydrogen while still achieving significant emissions reductions.Expand Specific Solutions

Key Industry Players in Green Hydrogen Production and Heating

Green hydrogen is emerging as a crucial component in district heating decarbonization, with the market currently in early development but showing significant growth potential. The global market size is expanding rapidly, driven by increasing policy support and technological advancements. Companies like Air Liquide, Siemens Energy, and SINOPEC are leading technological innovation, while organizations such as Ormat Technologies and Siemens AG are developing integrated solutions combining hydrogen with existing heating infrastructure. The technology is approaching commercial viability, with pilot projects demonstrating feasibility, though challenges remain in cost reduction and infrastructure development. Research institutions like Riga Technical University and Penn State Research Foundation are contributing to technological advancement, while energy giants including Saudi Aramco and TotalEnergies are investing in large-scale implementation strategies.

Air Liquide SA

Technical Solution: Air Liquide has developed a comprehensive green hydrogen integration system for district heating decarbonization. Their approach centers on electrolytic hydrogen production using renewable electricity sources, primarily wind and solar power. The company has implemented a modular electrolyzer design that can scale from small community-level installations (1-5 MW) to large industrial-scale operations (20+ MW). Their system incorporates advanced PEM (Proton Exchange Membrane) electrolysis technology that achieves 70-75% efficiency in converting electricity to hydrogen[1]. For district heating applications, Air Liquide employs both direct hydrogen combustion in modified boilers and fuel cell technologies that can generate both heat and electricity with overall system efficiencies of up to 90%[3]. The company has pioneered hydrogen blending techniques allowing for gradual integration into existing natural gas district heating infrastructure, with blending ratios of up to 20% hydrogen without significant modifications to end-user equipment[5]. Their solutions include comprehensive hydrogen storage systems using both pressurized tanks and underground cavern storage to address seasonal demand fluctuations in district heating requirements.

Strengths: Industry-leading electrolyzer efficiency and scalability; extensive experience in hydrogen production and handling; established infrastructure for hydrogen distribution. Weaknesses: Higher initial capital costs compared to conventional heating solutions; requires significant renewable electricity capacity to achieve full decarbonization benefits; storage solutions for seasonal demand still face economic challenges.

Siemens Energy Global GmbH & Co. KG

Technical Solution: Siemens Energy has developed an integrated green hydrogen solution for district heating decarbonization called "HyFlex Heat." This system combines their Silyzer electrolyzer technology with specialized hydrogen-ready heat generation equipment. The Silyzer 300 PEM electrolyzer forms the core of their solution, offering modular capacity from 1.25 MW to multi-hundred MW installations with efficiency rates reaching 75%[2]. For district heating applications, Siemens Energy has engineered hydrogen-compatible combined heat and power (CHP) units that can operate on variable hydrogen blends up to 100% pure hydrogen. Their system incorporates smart grid integration technology that enables dynamic operation based on renewable energy availability, optimizing electrolyzer operation during periods of excess renewable generation. The HyFlex Heat platform includes thermal storage components that work alongside hydrogen production, allowing the system to decouple energy production from consumption patterns. Siemens has implemented advanced control systems that optimize the economics of hydrogen production by responding to electricity price signals and heating demand forecasts[4]. Their district heating solution includes heat recovery systems that capture waste heat from the electrolysis process, improving overall system efficiency by up to 15% compared to standalone hydrogen production and combustion[7].

Strengths: Highly integrated system approach combining power generation, hydrogen production and heating in one platform; advanced control systems for optimizing economics; strong experience in grid-scale energy systems. Weaknesses: Higher upfront capital costs compared to conventional heating solutions; requires significant grid infrastructure upgrades for large-scale implementation; technology still being proven at commercial scale for district heating applications.

Critical Technologies for Hydrogen-Based Heat Generation

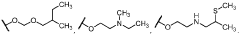

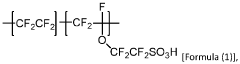

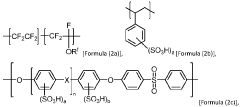

Improved ionomer blends, high-temperature polymer electrolyte membranes and electrode assemblies

PatentWO2024049680A2

Innovation

- Development of improved ionomer blends and high-temperature polymer electrolyte membranes, including polysulfonic and polyphosphonic acid-based ionomers blended with Aquivion, which enhance proton conductivity and reduce gas crossover, combined with advanced electrode binder materials to create more efficient membrane electrode assemblies for electrochemical hydrogen pumps.

Economic Feasibility and Cost Reduction Strategies

The economic feasibility of green hydrogen in district heating decarbonization remains a significant challenge despite its environmental benefits. Current production costs range from $3-8 per kilogram, substantially higher than natural gas alternatives, creating a considerable economic barrier to widespread adoption. This cost disparity is primarily driven by high electrolyzer capital expenditures, renewable electricity prices, and limited economies of scale in the nascent hydrogen economy.

Several cost reduction strategies are emerging to address these challenges. Technological improvements in electrolyzer efficiency and durability could reduce capital costs by 40-60% by 2030, according to industry projections. Manufacturers are focusing on increasing production volumes and standardizing designs to achieve economies of scale, potentially reducing unit costs by 30-50% over the next decade.

Policy interventions play a crucial role in bridging the economic gap. Carbon pricing mechanisms, targeted subsidies for green hydrogen production, and regulatory frameworks that value decarbonization can significantly improve the competitive position of hydrogen-based heating solutions. The European Union's hydrogen strategy, for instance, includes funding mechanisms and regulatory support aimed at reducing production costs to €1.5-2 per kilogram by 2030.

Hybrid system approaches offer another pathway to economic viability. Integrating green hydrogen with existing district heating infrastructure in a phased manner allows for gradual transition while optimizing system costs. Pilot projects in Denmark and Germany demonstrate that blending hydrogen with natural gas in existing networks can reduce initial investment requirements while still achieving meaningful emissions reductions.

Energy system integration represents a promising cost reduction strategy. Using excess renewable electricity during low-demand periods for hydrogen production can significantly reduce input costs. Additionally, capturing and utilizing waste heat from the electrolysis process can improve overall system efficiency by 10-15%, enhancing economic performance.

Long-term economic assessments must consider the full value chain and externalities. When accounting for avoided carbon emissions, reduced air pollution, and energy security benefits, the total economic case for green hydrogen strengthens considerably. Analysis from the International Energy Agency suggests that with appropriate policy support and continued technological development, green hydrogen could reach cost parity with fossil alternatives in district heating applications by 2035-2040 in regions with favorable renewable energy resources.

Several cost reduction strategies are emerging to address these challenges. Technological improvements in electrolyzer efficiency and durability could reduce capital costs by 40-60% by 2030, according to industry projections. Manufacturers are focusing on increasing production volumes and standardizing designs to achieve economies of scale, potentially reducing unit costs by 30-50% over the next decade.

Policy interventions play a crucial role in bridging the economic gap. Carbon pricing mechanisms, targeted subsidies for green hydrogen production, and regulatory frameworks that value decarbonization can significantly improve the competitive position of hydrogen-based heating solutions. The European Union's hydrogen strategy, for instance, includes funding mechanisms and regulatory support aimed at reducing production costs to €1.5-2 per kilogram by 2030.

Hybrid system approaches offer another pathway to economic viability. Integrating green hydrogen with existing district heating infrastructure in a phased manner allows for gradual transition while optimizing system costs. Pilot projects in Denmark and Germany demonstrate that blending hydrogen with natural gas in existing networks can reduce initial investment requirements while still achieving meaningful emissions reductions.

Energy system integration represents a promising cost reduction strategy. Using excess renewable electricity during low-demand periods for hydrogen production can significantly reduce input costs. Additionally, capturing and utilizing waste heat from the electrolysis process can improve overall system efficiency by 10-15%, enhancing economic performance.

Long-term economic assessments must consider the full value chain and externalities. When accounting for avoided carbon emissions, reduced air pollution, and energy security benefits, the total economic case for green hydrogen strengthens considerably. Analysis from the International Energy Agency suggests that with appropriate policy support and continued technological development, green hydrogen could reach cost parity with fossil alternatives in district heating applications by 2035-2040 in regions with favorable renewable energy resources.

Policy Frameworks Supporting Hydrogen Heating Transition

The development of effective policy frameworks is crucial for enabling the transition to hydrogen-based district heating systems. Currently, several pioneering countries have established comprehensive policies that support green hydrogen integration into heating infrastructure. The European Union's Hydrogen Strategy provides a foundation through targeted funding mechanisms, regulatory incentives, and clear decarbonization targets specifically addressing district heating networks.

National-level policies demonstrate varying approaches to hydrogen heating adoption. Germany's National Hydrogen Strategy allocates €9 billion for hydrogen projects, with specific provisions for heating applications and district energy systems. The UK's Hydrogen Strategy includes regulatory sandboxes allowing controlled testing of hydrogen blending in existing heating networks, while Denmark has implemented carbon taxation structures that inherently favor green hydrogen solutions over fossil fuel alternatives.

Regional policy innovations have emerged as particularly effective catalysts. Several European municipalities have established hydrogen valleys - integrated ecosystems where production, distribution, and heating applications are supported through coordinated policy instruments. These zones typically feature streamlined permitting processes, local tax incentives, and public-private partnership frameworks specifically designed for district heating applications.

Financial support mechanisms represent a critical policy component. Green hydrogen heating projects benefit from various instruments including capital grants covering 20-40% of infrastructure costs, operational subsidies addressing the price gap between natural gas and hydrogen, and low-interest financing through green bonds specifically targeting district heating decarbonization. The EU Innovation Fund and various national green investment banks have created dedicated funding windows for hydrogen heating demonstration projects.

Regulatory harmonization remains an ongoing challenge. Technical standards for hydrogen blending in heating systems vary significantly across jurisdictions, creating barriers to technology transfer and market scaling. Progressive policy frameworks are addressing this through international standardization efforts and the development of hydrogen-ready certification schemes for heating equipment and infrastructure components.

Forward-looking policies increasingly focus on demand creation through public procurement requirements, building codes mandating low-carbon heating solutions, and emissions performance standards that indirectly favor hydrogen adoption. Several jurisdictions have implemented carbon intensity thresholds for district heating that tighten progressively, creating predictable market signals for hydrogen technology deployment while allowing flexibility in implementation approaches.

National-level policies demonstrate varying approaches to hydrogen heating adoption. Germany's National Hydrogen Strategy allocates €9 billion for hydrogen projects, with specific provisions for heating applications and district energy systems. The UK's Hydrogen Strategy includes regulatory sandboxes allowing controlled testing of hydrogen blending in existing heating networks, while Denmark has implemented carbon taxation structures that inherently favor green hydrogen solutions over fossil fuel alternatives.

Regional policy innovations have emerged as particularly effective catalysts. Several European municipalities have established hydrogen valleys - integrated ecosystems where production, distribution, and heating applications are supported through coordinated policy instruments. These zones typically feature streamlined permitting processes, local tax incentives, and public-private partnership frameworks specifically designed for district heating applications.

Financial support mechanisms represent a critical policy component. Green hydrogen heating projects benefit from various instruments including capital grants covering 20-40% of infrastructure costs, operational subsidies addressing the price gap between natural gas and hydrogen, and low-interest financing through green bonds specifically targeting district heating decarbonization. The EU Innovation Fund and various national green investment banks have created dedicated funding windows for hydrogen heating demonstration projects.

Regulatory harmonization remains an ongoing challenge. Technical standards for hydrogen blending in heating systems vary significantly across jurisdictions, creating barriers to technology transfer and market scaling. Progressive policy frameworks are addressing this through international standardization efforts and the development of hydrogen-ready certification schemes for heating equipment and infrastructure components.

Forward-looking policies increasingly focus on demand creation through public procurement requirements, building codes mandating low-carbon heating solutions, and emissions performance standards that indirectly favor hydrogen adoption. Several jurisdictions have implemented carbon intensity thresholds for district heating that tighten progressively, creating predictable market signals for hydrogen technology deployment while allowing flexibility in implementation approaches.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!