How green hydrogen facilitates industrial carbon capture utilization

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Hydrogen Technology Background and Objectives

Green hydrogen represents a revolutionary approach to clean energy production, derived from water electrolysis powered by renewable energy sources such as wind, solar, and hydroelectric power. Unlike conventional "gray" hydrogen produced from fossil fuels, green hydrogen generates zero carbon emissions during its production process, positioning it as a critical component in the global transition toward carbon neutrality.

The evolution of hydrogen technology spans over two centuries, beginning with its discovery in the late 18th century. However, the specific focus on green hydrogen has gained significant momentum only in the past decade, driven by urgent climate change concerns and technological advancements in renewable energy. The declining costs of renewable electricity generation, coupled with improvements in electrolyzer technology, have created a favorable environment for green hydrogen development.

Current technological trajectories indicate that green hydrogen is approaching an inflection point where economic viability meets environmental necessity. Industry projections suggest that production costs could decrease by up to 60% by 2030, potentially making green hydrogen competitive with fossil fuel-based alternatives without subsidies.

In the context of industrial carbon capture utilization (CCU), green hydrogen serves multiple transformative functions. It acts as a clean reducing agent in various industrial processes, provides a carbon-neutral energy carrier for high-temperature applications, and serves as a critical feedstock for synthesizing sustainable fuels and chemicals from captured carbon dioxide. This synergistic relationship between hydrogen production and carbon utilization creates a circular carbon economy where emissions become valuable resources.

The primary objective of green hydrogen technology in industrial CCU is to establish economically viable pathways for decarbonizing hard-to-abate sectors such as steel production, cement manufacturing, and chemical synthesis. These industries collectively account for approximately 20% of global CO2 emissions and present significant technical challenges for direct electrification.

Secondary objectives include developing scalable infrastructure for hydrogen transport and storage, optimizing integration with existing industrial processes, and creating standardized frameworks for measuring and verifying emissions reductions. The ultimate goal is to transform industrial carbon capture from a cost center into a value-generating opportunity through hydrogen-enabled utilization pathways.

As nations worldwide commit to ambitious climate targets, green hydrogen's role in industrial carbon management has become increasingly central to long-term decarbonization strategies. The technology represents not merely an incremental improvement but a fundamental paradigm shift in how industries approach both energy consumption and carbon emissions.

The evolution of hydrogen technology spans over two centuries, beginning with its discovery in the late 18th century. However, the specific focus on green hydrogen has gained significant momentum only in the past decade, driven by urgent climate change concerns and technological advancements in renewable energy. The declining costs of renewable electricity generation, coupled with improvements in electrolyzer technology, have created a favorable environment for green hydrogen development.

Current technological trajectories indicate that green hydrogen is approaching an inflection point where economic viability meets environmental necessity. Industry projections suggest that production costs could decrease by up to 60% by 2030, potentially making green hydrogen competitive with fossil fuel-based alternatives without subsidies.

In the context of industrial carbon capture utilization (CCU), green hydrogen serves multiple transformative functions. It acts as a clean reducing agent in various industrial processes, provides a carbon-neutral energy carrier for high-temperature applications, and serves as a critical feedstock for synthesizing sustainable fuels and chemicals from captured carbon dioxide. This synergistic relationship between hydrogen production and carbon utilization creates a circular carbon economy where emissions become valuable resources.

The primary objective of green hydrogen technology in industrial CCU is to establish economically viable pathways for decarbonizing hard-to-abate sectors such as steel production, cement manufacturing, and chemical synthesis. These industries collectively account for approximately 20% of global CO2 emissions and present significant technical challenges for direct electrification.

Secondary objectives include developing scalable infrastructure for hydrogen transport and storage, optimizing integration with existing industrial processes, and creating standardized frameworks for measuring and verifying emissions reductions. The ultimate goal is to transform industrial carbon capture from a cost center into a value-generating opportunity through hydrogen-enabled utilization pathways.

As nations worldwide commit to ambitious climate targets, green hydrogen's role in industrial carbon management has become increasingly central to long-term decarbonization strategies. The technology represents not merely an incremental improvement but a fundamental paradigm shift in how industries approach both energy consumption and carbon emissions.

Market Analysis for Green Hydrogen in Carbon Capture

The global market for green hydrogen in carbon capture applications is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. Current market size estimates place the green hydrogen for CCU (Carbon Capture and Utilization) sector at approximately $2.5 billion in 2023, with projections indicating a compound annual growth rate of 14-16% through 2030. This growth trajectory is substantially higher than traditional hydrogen production methods, reflecting the strategic shift toward decarbonization technologies.

Regional analysis reveals distinct market characteristics across different geographies. Europe leads in market adoption, with Germany, Netherlands, and Denmark establishing comprehensive hydrogen strategies that specifically target carbon capture applications. The European Union's Green Deal and subsequent hydrogen strategy have allocated €470 billion for green hydrogen development through 2050, with approximately 30% directed toward carbon capture integration.

North America represents the second-largest market, with the United States Inflation Reduction Act providing substantial tax credits for clean hydrogen production and carbon capture projects. These incentives have catalyzed over $15 billion in announced investments for green hydrogen facilities with integrated carbon capture capabilities since 2022.

Asia-Pacific demonstrates the highest growth potential, particularly in China, Japan, and South Korea, where government initiatives are actively promoting hydrogen-based industrial decarbonization. China's latest Five-Year Plan specifically targets green hydrogen production capacity of 100,000 tons annually by 2025, with significant portions allocated to carbon capture applications.

Demand segmentation analysis indicates that the chemical sector currently represents the largest end-use market (38%), followed by refining (27%), steel production (18%), and cement manufacturing (12%). These hard-to-abate sectors are increasingly viewing green hydrogen as a critical pathway for reducing emissions while maintaining production capabilities.

Market barriers remain significant, primarily centered around cost differentials. Green hydrogen production costs currently range from $3-6/kg compared to $1-2/kg for conventional gray hydrogen. However, this gap is narrowing rapidly due to declining renewable energy costs and economies of scale in electrolyzer manufacturing. Industry analysts project cost parity in select markets by 2028, which would substantially accelerate adoption rates.

Customer willingness-to-pay surveys indicate growing acceptance of premium pricing for green hydrogen solutions, particularly among companies with established net-zero commitments. This trend is reinforced by the increasing implementation of carbon pricing mechanisms globally, which improves the economic case for green hydrogen in carbon capture applications.

Regional analysis reveals distinct market characteristics across different geographies. Europe leads in market adoption, with Germany, Netherlands, and Denmark establishing comprehensive hydrogen strategies that specifically target carbon capture applications. The European Union's Green Deal and subsequent hydrogen strategy have allocated €470 billion for green hydrogen development through 2050, with approximately 30% directed toward carbon capture integration.

North America represents the second-largest market, with the United States Inflation Reduction Act providing substantial tax credits for clean hydrogen production and carbon capture projects. These incentives have catalyzed over $15 billion in announced investments for green hydrogen facilities with integrated carbon capture capabilities since 2022.

Asia-Pacific demonstrates the highest growth potential, particularly in China, Japan, and South Korea, where government initiatives are actively promoting hydrogen-based industrial decarbonization. China's latest Five-Year Plan specifically targets green hydrogen production capacity of 100,000 tons annually by 2025, with significant portions allocated to carbon capture applications.

Demand segmentation analysis indicates that the chemical sector currently represents the largest end-use market (38%), followed by refining (27%), steel production (18%), and cement manufacturing (12%). These hard-to-abate sectors are increasingly viewing green hydrogen as a critical pathway for reducing emissions while maintaining production capabilities.

Market barriers remain significant, primarily centered around cost differentials. Green hydrogen production costs currently range from $3-6/kg compared to $1-2/kg for conventional gray hydrogen. However, this gap is narrowing rapidly due to declining renewable energy costs and economies of scale in electrolyzer manufacturing. Industry analysts project cost parity in select markets by 2028, which would substantially accelerate adoption rates.

Customer willingness-to-pay surveys indicate growing acceptance of premium pricing for green hydrogen solutions, particularly among companies with established net-zero commitments. This trend is reinforced by the increasing implementation of carbon pricing mechanisms globally, which improves the economic case for green hydrogen in carbon capture applications.

Current Status and Challenges in Green Hydrogen Production

Green hydrogen production has witnessed significant advancements in recent years, with global installed electrolyzer capacity reaching approximately 300 MW by the end of 2022. This represents a substantial increase from just 70 MW in 2020, indicating accelerating market growth. However, this capacity remains insufficient to meet the projected demand for industrial decarbonization applications, particularly in carbon capture utilization contexts.

The predominant technologies for green hydrogen production currently include alkaline electrolysis (AE), proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOEC). Alkaline electrolysis represents the most mature technology with system efficiencies of 65-70% and costs ranging from $800-1,400/kW. PEM systems offer faster response times and higher current densities but at increased costs of $1,100-1,800/kW. SOEC technology, while promising higher efficiencies of up to 85%, remains largely in demonstration phases.

Despite these technological advances, green hydrogen production faces several critical challenges. Cost competitiveness remains the foremost barrier, with green hydrogen production costs ranging between $3-8/kg compared to $1-2/kg for conventional grey hydrogen. This cost differential significantly impedes widespread adoption in industrial carbon capture utilization applications where economic viability is essential.

Energy efficiency presents another substantial challenge. Current electrolysis technologies convert only 65-75% of electrical energy into hydrogen, with significant energy losses occurring as heat. When considering the entire value chain from renewable electricity generation to hydrogen utilization in carbon capture processes, system-wide efficiencies can drop below 30%.

Infrastructure limitations further constrain green hydrogen deployment. The intermittent nature of renewable energy sources necessitates either substantial storage capacity or grid connectivity, both adding significant costs. Additionally, the geographical disconnect between optimal renewable energy production sites and industrial carbon capture facilities creates logistical challenges for hydrogen transport and storage.

Technological maturity varies significantly across different production methods. While alkaline electrolysis has reached commercial scale, newer technologies like anion exchange membrane (AEM) electrolysis and photocatalytic water splitting remain in early development stages. This technological fragmentation complicates standardization efforts and slows industry-wide cost reductions through economies of scale.

Regulatory frameworks and certification standards for green hydrogen production remain underdeveloped in many regions, creating market uncertainty. The lack of internationally recognized guarantees of origin systems complicates the verification of hydrogen's carbon intensity, particularly important when used in carbon capture utilization applications where emissions accounting is critical.

The predominant technologies for green hydrogen production currently include alkaline electrolysis (AE), proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOEC). Alkaline electrolysis represents the most mature technology with system efficiencies of 65-70% and costs ranging from $800-1,400/kW. PEM systems offer faster response times and higher current densities but at increased costs of $1,100-1,800/kW. SOEC technology, while promising higher efficiencies of up to 85%, remains largely in demonstration phases.

Despite these technological advances, green hydrogen production faces several critical challenges. Cost competitiveness remains the foremost barrier, with green hydrogen production costs ranging between $3-8/kg compared to $1-2/kg for conventional grey hydrogen. This cost differential significantly impedes widespread adoption in industrial carbon capture utilization applications where economic viability is essential.

Energy efficiency presents another substantial challenge. Current electrolysis technologies convert only 65-75% of electrical energy into hydrogen, with significant energy losses occurring as heat. When considering the entire value chain from renewable electricity generation to hydrogen utilization in carbon capture processes, system-wide efficiencies can drop below 30%.

Infrastructure limitations further constrain green hydrogen deployment. The intermittent nature of renewable energy sources necessitates either substantial storage capacity or grid connectivity, both adding significant costs. Additionally, the geographical disconnect between optimal renewable energy production sites and industrial carbon capture facilities creates logistical challenges for hydrogen transport and storage.

Technological maturity varies significantly across different production methods. While alkaline electrolysis has reached commercial scale, newer technologies like anion exchange membrane (AEM) electrolysis and photocatalytic water splitting remain in early development stages. This technological fragmentation complicates standardization efforts and slows industry-wide cost reductions through economies of scale.

Regulatory frameworks and certification standards for green hydrogen production remain underdeveloped in many regions, creating market uncertainty. The lack of internationally recognized guarantees of origin systems complicates the verification of hydrogen's carbon intensity, particularly important when used in carbon capture utilization applications where emissions accounting is critical.

Current Green Hydrogen Integration Solutions for CCUS

01 Hydrogen production systems with carbon capture

Systems that integrate hydrogen production with carbon capture technologies to reduce greenhouse gas emissions. These systems typically involve processes for producing hydrogen from fossil fuels or biomass while simultaneously capturing the CO2 generated during production. The captured carbon can then be stored or utilized in various applications, making the hydrogen production more environmentally friendly.- Green hydrogen production systems: Systems for producing green hydrogen through electrolysis powered by renewable energy sources. These systems typically include electrolyzers that split water into hydrogen and oxygen using electricity from renewable sources such as solar or wind power. The produced hydrogen is considered 'green' as the process generates minimal carbon emissions, making it a sustainable alternative to conventional hydrogen production methods.

- Carbon capture technologies integrated with hydrogen production: Technologies that combine hydrogen production with carbon capture processes to reduce overall emissions. These systems capture CO2 emissions from industrial processes or directly from the atmosphere while simultaneously producing hydrogen. The integration of these technologies creates more environmentally friendly energy systems by addressing both clean energy production and carbon reduction goals.

- Carbon utilization for value-added products: Methods for converting captured carbon dioxide into valuable products while using hydrogen as a reactant. These processes transform CO2 into chemicals, fuels, or materials such as methanol, synthetic fuels, or polymers. By utilizing captured carbon and green hydrogen, these technologies create circular economy solutions that reduce net carbon emissions while producing commercially viable products.

- Integrated energy systems combining hydrogen and carbon management: Comprehensive energy systems that integrate hydrogen production, carbon capture, and utilization technologies into unified platforms. These systems often incorporate renewable energy sources, energy storage solutions, and smart grid technologies to optimize efficiency and minimize emissions. The integrated approach allows for better resource management and creates synergies between different components of clean energy infrastructure.

- Industrial applications of hydrogen and carbon capture: Specific industrial implementations of green hydrogen production and carbon capture technologies in sectors such as manufacturing, chemical processing, and power generation. These applications focus on decarbonizing industrial processes by replacing fossil fuels with green hydrogen and implementing carbon capture to reduce emissions from existing operations. The technologies are adapted to meet the specific requirements of different industries while maximizing environmental benefits.

02 Carbon utilization in hydrogen production facilities

Technologies that focus on utilizing captured carbon dioxide in hydrogen production facilities. These approaches transform CO2 from a waste product into a valuable resource by incorporating it into various industrial processes or products. This can include converting CO2 into synthetic fuels, chemicals, building materials, or using it for enhanced oil recovery, thereby creating a circular economy approach to hydrogen production.Expand Specific Solutions03 Integrated renewable energy and hydrogen systems

Systems that combine renewable energy sources with hydrogen production and carbon capture technologies. These integrated systems use renewable electricity (such as solar or wind) to power electrolysis for green hydrogen production, while also incorporating carbon capture components. This approach maximizes environmental benefits by using clean energy for hydrogen production and managing carbon emissions simultaneously.Expand Specific Solutions04 Novel catalysts and materials for hydrogen production and carbon capture

Advanced materials and catalysts designed specifically for improving the efficiency of hydrogen production while enabling better carbon capture. These innovations include specialized membranes, adsorbents, and catalytic materials that can enhance hydrogen yield, reduce energy requirements, and increase carbon capture rates. Such materials are crucial for making green hydrogen production and carbon capture economically viable.Expand Specific Solutions05 Process optimization and system integration for hydrogen and carbon management

Methods and technologies focused on optimizing the entire process chain of hydrogen production, carbon capture, and utilization. These approaches involve innovative system designs, heat integration, process intensification, and digital control systems to maximize efficiency and minimize waste. By optimizing the integration of various components, these technologies reduce costs and improve the overall sustainability of green hydrogen production with carbon management.Expand Specific Solutions

Key Industry Players in Green Hydrogen and CCUS Sectors

The green hydrogen-carbon capture utilization market is in an early growth phase, characterized by increasing investments and technological advancements. The global market size is projected to expand significantly, driven by industrial decarbonization initiatives and supportive government policies. Technologically, the field shows varying maturity levels, with companies like Air Liquide, Air Products & Chemicals, and Saudi Aramco leading commercial-scale implementations. Research institutions including KAUST and X Development are advancing novel integration approaches, while specialized firms like Capture6 and Kiverdi focus on innovative carbon utilization pathways. Chinese entities such as Sinopec and Shanghai Electric are rapidly scaling up capabilities, positioning themselves as significant players in this emerging ecosystem that bridges renewable energy and industrial carbon management.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed an integrated green hydrogen-carbon capture utilization platform called "HyCCU" (Hydrogen-Carbon Coupling Utilization). This system leverages Sinopec's extensive refining and petrochemical infrastructure to implement carbon capture from industrial processes while utilizing green hydrogen as both a process agent and feedstock. Their approach begins with large-scale alkaline electrolysis powered by renewable energy sources, producing hydrogen with carbon intensities below 2kg CO2e/kg H2[3]. The captured carbon dioxide undergoes catalytic hydrogenation using Sinopec's proprietary metal-organic framework catalysts, which demonstrate conversion efficiencies exceeding 90% for transforming CO2 into methanol, dimethyl ether, and synthetic hydrocarbons[6]. Sinopec has implemented this technology at their Qilu Petrochemical facility, where green hydrogen facilitates carbon capture from refinery operations and converts the CO2 into methanol with a production capacity of 100,000 tons annually. The system incorporates advanced process integration that reduces energy consumption by approximately 30% compared to conventional carbon capture methods[8], as hydrogen is utilized in multiple process steps.

Strengths: Extensive existing industrial infrastructure that can be retrofitted; vertical integration from hydrogen production to end-product manufacturing; significant R&D capabilities and proprietary catalyst technology; large-scale implementation experience. Weaknesses: Still heavily invested in fossil fuel operations creating potential strategic conflicts; high capital requirements for full-scale deployment; technology optimization still ongoing for certain industrial applications.

Capture6 Corp.

Technical Solution: Capture6 has developed an innovative green hydrogen-integrated carbon capture and utilization system called "HyCapture". Their approach centers on a novel direct air capture (DAC) technology that uses green hydrogen both as an energy source and as a key reactant in their carbon conversion processes. The system begins with renewable-powered electrolysis producing green hydrogen, which then powers their proprietary sorbent-based direct air capture units. These units achieve remarkably low energy consumption of approximately 5GJ per ton of CO2 captured[4], significantly below industry averages. The captured CO2 is then channeled into Capture6's catalytic conversion system where green hydrogen facilitates the production of sustainable aviation fuels and specialty chemicals. Their proprietary catalyst technology enables conversion efficiencies exceeding 85% when transforming CO2 into longer-chain hydrocarbons[6]. A distinctive feature of Capture6's approach is their modular system design, allowing for distributed deployment near renewable energy sources and industrial facilities. The company has deployed demonstration units in California and Texas, showing the ability to produce carbon-negative fuels with carbon intensities below -50 gCO2e/MJ according to lifecycle analyses[9].

Strengths: Purpose-built integration of hydrogen and carbon capture technologies; innovative direct air capture approach with lower energy requirements; modular design enabling flexible deployment; focus on high-value products like sustainable aviation fuel. Weaknesses: Limited commercial-scale deployment history compared to larger industrial players; requires significant capital for scaling operations; technology still optimizing for cost reduction at larger scales.

Key Technical Innovations in Hydrogen-Based Carbon Capture

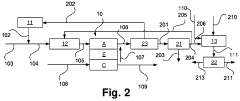

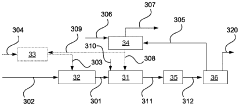

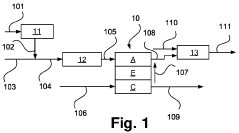

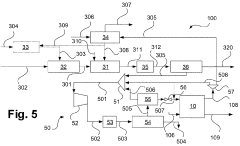

Process and system for producing a hydrogen product

PatentWO2024074221A1

Innovation

- A method and system combining reforming, water gas shift, adsorptive separation, and solid oxide fuel cells for efficient hydrogen production, incorporating cryogenic separation and pressure swing adsorption to achieve nearly emission-free hydrogen production while recovering carbon dioxide.

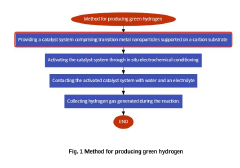

Green hydrogen production catalyst: design and methodology

PatentPendingIN202421033524A

Innovation

- A novel catalyst system is designed with strategically positioned active sites, synthesized using earth-abundant materials through precise methodologies like sol-gel processes and atomic layer deposition, and activated to enhance surface reactivity and stability, optimizing hydrogen production efficiency and selectivity.

Economic Viability and Cost Reduction Strategies

The economic viability of green hydrogen in industrial carbon capture utilization (CCU) remains a significant challenge despite its environmental benefits. Current production costs for green hydrogen range from $3-8 per kilogram, substantially higher than gray hydrogen's $1-2 per kilogram. This cost differential creates a substantial barrier to widespread adoption in carbon capture applications, where economic considerations often drive industrial decision-making.

Several cost reduction pathways are emerging to address this challenge. Economies of scale represent the most immediate opportunity, with projections suggesting that increasing electrolyzer manufacturing capacity could reduce capital costs by 40-60% by 2030. The International Energy Agency estimates that green hydrogen costs could fall to $1.5-3.5 per kilogram within this decade if production scales appropriately.

Technological innovations are simultaneously driving efficiency improvements. Advanced electrolyzer designs, including proton exchange membrane (PEM) and solid oxide electrolyzer cells (SOEC), are achieving higher conversion efficiencies—approaching 80-85% compared to traditional alkaline electrolyzers' 60-70%. These efficiency gains directly translate to lower production costs and enhanced economic viability for CCU applications.

Integration strategies that combine renewable energy generation with hydrogen production facilities offer another cost reduction avenue. Co-location reduces transmission losses and enables more efficient utilization of intermittent renewable resources. Analysis from Bloomberg NEF indicates that such integration could reduce overall system costs by 15-25% compared to separate facilities.

Policy support mechanisms remain crucial for bridging the current cost gap. Carbon pricing, production tax credits, and regulatory frameworks that value decarbonization create economic incentives that can make green hydrogen-based CCU financially viable even before technological cost parity is achieved. The EU's hydrogen strategy exemplifies this approach, targeting 40GW of electrolyzer capacity by 2030 supported by various financial instruments.

Industrial symbiosis presents additional economic opportunities, where hydrogen production, carbon capture, and utilization processes are integrated into existing industrial clusters. This approach reduces infrastructure costs and creates value-added product streams that improve overall economics. Studies indicate that such integrated systems could achieve carbon abatement costs below $100 per ton of CO₂, approaching economic viability in regions with strong carbon pricing.

Several cost reduction pathways are emerging to address this challenge. Economies of scale represent the most immediate opportunity, with projections suggesting that increasing electrolyzer manufacturing capacity could reduce capital costs by 40-60% by 2030. The International Energy Agency estimates that green hydrogen costs could fall to $1.5-3.5 per kilogram within this decade if production scales appropriately.

Technological innovations are simultaneously driving efficiency improvements. Advanced electrolyzer designs, including proton exchange membrane (PEM) and solid oxide electrolyzer cells (SOEC), are achieving higher conversion efficiencies—approaching 80-85% compared to traditional alkaline electrolyzers' 60-70%. These efficiency gains directly translate to lower production costs and enhanced economic viability for CCU applications.

Integration strategies that combine renewable energy generation with hydrogen production facilities offer another cost reduction avenue. Co-location reduces transmission losses and enables more efficient utilization of intermittent renewable resources. Analysis from Bloomberg NEF indicates that such integration could reduce overall system costs by 15-25% compared to separate facilities.

Policy support mechanisms remain crucial for bridging the current cost gap. Carbon pricing, production tax credits, and regulatory frameworks that value decarbonization create economic incentives that can make green hydrogen-based CCU financially viable even before technological cost parity is achieved. The EU's hydrogen strategy exemplifies this approach, targeting 40GW of electrolyzer capacity by 2030 supported by various financial instruments.

Industrial symbiosis presents additional economic opportunities, where hydrogen production, carbon capture, and utilization processes are integrated into existing industrial clusters. This approach reduces infrastructure costs and creates value-added product streams that improve overall economics. Studies indicate that such integrated systems could achieve carbon abatement costs below $100 per ton of CO₂, approaching economic viability in regions with strong carbon pricing.

Policy Frameworks and International Collaboration Opportunities

The global transition to green hydrogen as a carbon capture facilitator requires robust policy frameworks and international cooperation. Currently, several major economies have established comprehensive hydrogen strategies with specific provisions for carbon capture utilization (CCU) integration. The European Union's Hydrogen Strategy explicitly connects green hydrogen production with industrial decarbonization efforts, offering financial incentives through the Innovation Fund and Horizon Europe programs for projects combining these technologies. Similarly, the United States' Inflation Reduction Act provides significant tax credits (45V and 45Q) for clean hydrogen production when paired with carbon capture systems.

Japan and South Korea have pioneered international collaboration models through their respective hydrogen roadmaps, emphasizing technology transfer and joint development projects with resource-rich countries. These bilateral agreements typically include provisions for shared intellectual property and standardized certification systems for hydrogen-CCU integrated solutions.

International organizations are increasingly coordinating cross-border initiatives. The International Renewable Energy Agency (IRENA) has established the Green Hydrogen Catapult, bringing together industry leaders to scale up production while the Clean Energy Ministerial's Hydrogen Initiative facilitates knowledge sharing on regulatory frameworks. The Mission Innovation platform has dedicated innovation challenges specifically targeting hydrogen-CCU integration technologies.

Standardization efforts represent another critical dimension of international collaboration. The International Organization for Standardization (ISO) Technical Committee 197 is developing unified standards for hydrogen technologies, while the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE) works on harmonizing regulations across jurisdictions. These efforts are essential for creating interoperable systems and enabling global trade in hydrogen and captured carbon products.

Emerging economies are increasingly included in these collaborative frameworks. The Green Hydrogen Alliance between European and African nations focuses on technology transfer and capacity building, while China's Belt and Road Initiative now incorporates green hydrogen infrastructure development with partner countries. These partnerships often include provisions for shared carbon accounting methodologies and mutual recognition of environmental certificates.

Financial mechanisms supporting international collaboration include the World Bank's Climate Investment Funds, which has established dedicated funding windows for green hydrogen-CCU projects in developing economies, and the Green Climate Fund's targeted programs for industrial decarbonization technologies. These mechanisms help address the significant capital requirements for integrated hydrogen-CCU infrastructure development across borders.

Japan and South Korea have pioneered international collaboration models through their respective hydrogen roadmaps, emphasizing technology transfer and joint development projects with resource-rich countries. These bilateral agreements typically include provisions for shared intellectual property and standardized certification systems for hydrogen-CCU integrated solutions.

International organizations are increasingly coordinating cross-border initiatives. The International Renewable Energy Agency (IRENA) has established the Green Hydrogen Catapult, bringing together industry leaders to scale up production while the Clean Energy Ministerial's Hydrogen Initiative facilitates knowledge sharing on regulatory frameworks. The Mission Innovation platform has dedicated innovation challenges specifically targeting hydrogen-CCU integration technologies.

Standardization efforts represent another critical dimension of international collaboration. The International Organization for Standardization (ISO) Technical Committee 197 is developing unified standards for hydrogen technologies, while the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE) works on harmonizing regulations across jurisdictions. These efforts are essential for creating interoperable systems and enabling global trade in hydrogen and captured carbon products.

Emerging economies are increasingly included in these collaborative frameworks. The Green Hydrogen Alliance between European and African nations focuses on technology transfer and capacity building, while China's Belt and Road Initiative now incorporates green hydrogen infrastructure development with partner countries. These partnerships often include provisions for shared carbon accounting methodologies and mutual recognition of environmental certificates.

Financial mechanisms supporting international collaboration include the World Bank's Climate Investment Funds, which has established dedicated funding windows for green hydrogen-CCU projects in developing economies, and the Green Climate Fund's targeted programs for industrial decarbonization technologies. These mechanisms help address the significant capital requirements for integrated hydrogen-CCU infrastructure development across borders.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!