What barriers limit adoption of green hydrogen in heavy industry

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Hydrogen Technology Background and Objectives

Green hydrogen represents a transformative energy carrier produced through water electrolysis powered by renewable electricity sources, resulting in zero carbon emissions during production. The concept has existed for decades but has gained significant momentum in recent years as nations and industries seek viable pathways to decarbonization, particularly for hard-to-abate sectors.

The evolution of green hydrogen technology has progressed through several key phases, beginning with early electrolysis demonstrations in the 19th century, followed by industrial applications in the mid-20th century, and now entering a renaissance period driven by climate imperatives. Current technological approaches primarily include alkaline electrolysis (AE), proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOEC), each with distinct operational characteristics and maturity levels.

Heavy industry sectors—including steel production, chemical manufacturing, cement production, and high-temperature industrial processes—represent approximately 20% of global carbon emissions. These sectors face unique decarbonization challenges due to their requirements for high-temperature heat, chemical feedstocks, and energy-dense fuels that electricity alone cannot efficiently provide.

The primary technical objective for green hydrogen adoption in heavy industry is achieving cost parity with conventional hydrogen production methods and traditional fossil fuels. Current production costs range from $3-8/kg, significantly higher than grey hydrogen's $1-2/kg. Industry targets aim to reduce costs to under $2/kg by 2030 through technological improvements, economies of scale, and supportive policy frameworks.

Secondary objectives include improving electrolysis efficiency (currently 60-80% depending on technology), extending equipment lifespans beyond current 60,000-90,000 operating hours, developing effective storage and transportation infrastructure, and establishing international standards for hydrogen purity, safety protocols, and carbon intensity certification.

The global trajectory indicates accelerating interest, with over 520 green hydrogen projects announced globally as of 2023, representing potential investments exceeding $500 billion. The International Energy Agency (IEA) and Hydrogen Council project that hydrogen could meet up to 18% of global energy demand by 2050, with green hydrogen comprising the majority of this supply in net-zero scenarios.

Technical innovation is progressing along multiple fronts, including advanced catalyst materials to reduce or eliminate precious metal requirements, high-pressure and high-temperature electrolysis systems, integration with variable renewable energy sources, and development of gigawatt-scale production facilities to capture economies of scale.

The evolution of green hydrogen technology has progressed through several key phases, beginning with early electrolysis demonstrations in the 19th century, followed by industrial applications in the mid-20th century, and now entering a renaissance period driven by climate imperatives. Current technological approaches primarily include alkaline electrolysis (AE), proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOEC), each with distinct operational characteristics and maturity levels.

Heavy industry sectors—including steel production, chemical manufacturing, cement production, and high-temperature industrial processes—represent approximately 20% of global carbon emissions. These sectors face unique decarbonization challenges due to their requirements for high-temperature heat, chemical feedstocks, and energy-dense fuels that electricity alone cannot efficiently provide.

The primary technical objective for green hydrogen adoption in heavy industry is achieving cost parity with conventional hydrogen production methods and traditional fossil fuels. Current production costs range from $3-8/kg, significantly higher than grey hydrogen's $1-2/kg. Industry targets aim to reduce costs to under $2/kg by 2030 through technological improvements, economies of scale, and supportive policy frameworks.

Secondary objectives include improving electrolysis efficiency (currently 60-80% depending on technology), extending equipment lifespans beyond current 60,000-90,000 operating hours, developing effective storage and transportation infrastructure, and establishing international standards for hydrogen purity, safety protocols, and carbon intensity certification.

The global trajectory indicates accelerating interest, with over 520 green hydrogen projects announced globally as of 2023, representing potential investments exceeding $500 billion. The International Energy Agency (IEA) and Hydrogen Council project that hydrogen could meet up to 18% of global energy demand by 2050, with green hydrogen comprising the majority of this supply in net-zero scenarios.

Technical innovation is progressing along multiple fronts, including advanced catalyst materials to reduce or eliminate precious metal requirements, high-pressure and high-temperature electrolysis systems, integration with variable renewable energy sources, and development of gigawatt-scale production facilities to capture economies of scale.

Market Demand Analysis for Industrial Decarbonization

The global industrial sector accounts for approximately 24% of total greenhouse gas emissions, making it a critical focus area for decarbonization efforts. Heavy industries such as steel, cement, chemicals, and refining face particular challenges in reducing their carbon footprint due to high-temperature heat requirements and process emissions that cannot be easily electrified. This creates a substantial market opportunity for green hydrogen as a zero-carbon energy carrier and feedstock.

Market analysis indicates that industrial hydrogen demand currently stands at around 70 million tonnes annually, with over 95% produced from fossil fuels without carbon capture. Projections suggest that hydrogen demand could increase threefold by 2050, with green hydrogen potentially capturing a significant market share as decarbonization pressures intensify.

The steel industry represents one of the largest potential markets for green hydrogen, as hydrogen-based direct reduction of iron offers a viable pathway to eliminate coal use in steelmaking. Several commercial-scale demonstration projects are underway globally, indicating growing market interest despite cost barriers.

Chemical manufacturing, particularly ammonia and methanol production, constitutes another substantial market segment. Green ammonia produced with renewable hydrogen could revolutionize both fertilizer production and serve as an energy carrier, with projected market growth exceeding traditional growth rates as decarbonization accelerates.

Refining operations present an immediate opportunity for green hydrogen adoption, as refineries already consume large quantities of hydrogen for desulfurization and hydrocracking processes. Regulatory pressures to reduce the carbon intensity of fuels are driving interest in substituting current gray hydrogen with green alternatives.

Market surveys indicate that 78% of heavy industry executives acknowledge the need to decarbonize operations, with 64% identifying hydrogen as a key technology in their long-term strategy. However, only 23% report having concrete implementation plans, highlighting the gap between recognition and action.

Regional analysis shows varying levels of market readiness. The European Union leads in policy support through its Hydrogen Strategy and carbon pricing mechanisms. East Asia shows strong interest driven by energy security concerns and industrial competitiveness, while North America demonstrates growing momentum through targeted incentives in recent legislation.

The total addressable market for green hydrogen in industrial applications is projected to reach substantial value by 2030, with compound annual growth rates exceeding 50% in optimistic scenarios. This growth trajectory is heavily dependent on continued cost reductions in renewable electricity and electrolyzer technologies, as well as supportive policy frameworks that recognize the higher costs of green production methods compared to conventional alternatives.

Market analysis indicates that industrial hydrogen demand currently stands at around 70 million tonnes annually, with over 95% produced from fossil fuels without carbon capture. Projections suggest that hydrogen demand could increase threefold by 2050, with green hydrogen potentially capturing a significant market share as decarbonization pressures intensify.

The steel industry represents one of the largest potential markets for green hydrogen, as hydrogen-based direct reduction of iron offers a viable pathway to eliminate coal use in steelmaking. Several commercial-scale demonstration projects are underway globally, indicating growing market interest despite cost barriers.

Chemical manufacturing, particularly ammonia and methanol production, constitutes another substantial market segment. Green ammonia produced with renewable hydrogen could revolutionize both fertilizer production and serve as an energy carrier, with projected market growth exceeding traditional growth rates as decarbonization accelerates.

Refining operations present an immediate opportunity for green hydrogen adoption, as refineries already consume large quantities of hydrogen for desulfurization and hydrocracking processes. Regulatory pressures to reduce the carbon intensity of fuels are driving interest in substituting current gray hydrogen with green alternatives.

Market surveys indicate that 78% of heavy industry executives acknowledge the need to decarbonize operations, with 64% identifying hydrogen as a key technology in their long-term strategy. However, only 23% report having concrete implementation plans, highlighting the gap between recognition and action.

Regional analysis shows varying levels of market readiness. The European Union leads in policy support through its Hydrogen Strategy and carbon pricing mechanisms. East Asia shows strong interest driven by energy security concerns and industrial competitiveness, while North America demonstrates growing momentum through targeted incentives in recent legislation.

The total addressable market for green hydrogen in industrial applications is projected to reach substantial value by 2030, with compound annual growth rates exceeding 50% in optimistic scenarios. This growth trajectory is heavily dependent on continued cost reductions in renewable electricity and electrolyzer technologies, as well as supportive policy frameworks that recognize the higher costs of green production methods compared to conventional alternatives.

Current State and Challenges of Green Hydrogen Implementation

Green hydrogen production currently represents less than 0.1% of global hydrogen production, with the vast majority still derived from fossil fuels. While pilot projects are emerging across Europe, Australia, and parts of Asia, commercial-scale implementation in heavy industries remains limited. Most existing projects are demonstration-scale, typically producing less than 10 MW of hydrogen capacity, whereas industrial applications would require facilities in the hundreds of megawatts range.

The primary technical challenge limiting adoption is the low efficiency of the electrolysis process, with current systems achieving only 60-80% efficiency. This inefficiency translates directly into higher production costs, as more renewable electricity is required per unit of hydrogen produced. Additionally, the durability of electrolyzer systems remains problematic, with most systems requiring significant maintenance after 60,000-90,000 operating hours, far below the industrial standard expectation of continuous operation.

Infrastructure constraints present another significant barrier. The existing natural gas pipeline network cannot be fully repurposed for hydrogen without substantial modifications due to hydrogen's propensity to cause embrittlement in certain metals and its different flow characteristics. Storage solutions for large volumes of hydrogen remain technically challenging and expensive, requiring either high-pressure tanks, cryogenic systems, or chemical carriers, all of which add substantial costs to the hydrogen value chain.

Economic barriers are perhaps the most immediate impediment to adoption. Green hydrogen currently costs between $3-8 per kilogram, compared to $1-2 for gray hydrogen produced from natural gas. This cost differential is prohibitive for industries operating on thin margins. The capital expenditure required for electrolyzers remains high at approximately $800-1,500 per kW of capacity, though this has decreased from over $2,000 per kW five years ago.

Regulatory frameworks across most jurisdictions lack clarity regarding hydrogen production, transport, and use. Safety standards and protocols for industrial-scale hydrogen handling are still evolving, creating uncertainty for potential adopters. Furthermore, carbon pricing mechanisms in many regions remain insufficient to bridge the cost gap between green hydrogen and fossil fuel alternatives.

Supply chain limitations also constrain adoption, with critical materials for advanced electrolyzers, such as platinum group metals and specialized membranes, facing potential shortages as production scales. The renewable electricity supply required for green hydrogen production exceeds current capacity in many industrial regions, necessitating significant grid upgrades or dedicated renewable installations.

The primary technical challenge limiting adoption is the low efficiency of the electrolysis process, with current systems achieving only 60-80% efficiency. This inefficiency translates directly into higher production costs, as more renewable electricity is required per unit of hydrogen produced. Additionally, the durability of electrolyzer systems remains problematic, with most systems requiring significant maintenance after 60,000-90,000 operating hours, far below the industrial standard expectation of continuous operation.

Infrastructure constraints present another significant barrier. The existing natural gas pipeline network cannot be fully repurposed for hydrogen without substantial modifications due to hydrogen's propensity to cause embrittlement in certain metals and its different flow characteristics. Storage solutions for large volumes of hydrogen remain technically challenging and expensive, requiring either high-pressure tanks, cryogenic systems, or chemical carriers, all of which add substantial costs to the hydrogen value chain.

Economic barriers are perhaps the most immediate impediment to adoption. Green hydrogen currently costs between $3-8 per kilogram, compared to $1-2 for gray hydrogen produced from natural gas. This cost differential is prohibitive for industries operating on thin margins. The capital expenditure required for electrolyzers remains high at approximately $800-1,500 per kW of capacity, though this has decreased from over $2,000 per kW five years ago.

Regulatory frameworks across most jurisdictions lack clarity regarding hydrogen production, transport, and use. Safety standards and protocols for industrial-scale hydrogen handling are still evolving, creating uncertainty for potential adopters. Furthermore, carbon pricing mechanisms in many regions remain insufficient to bridge the cost gap between green hydrogen and fossil fuel alternatives.

Supply chain limitations also constrain adoption, with critical materials for advanced electrolyzers, such as platinum group metals and specialized membranes, facing potential shortages as production scales. The renewable electricity supply required for green hydrogen production exceeds current capacity in many industrial regions, necessitating significant grid upgrades or dedicated renewable installations.

Current Green Hydrogen Production and Application Solutions

01 Economic barriers to green hydrogen adoption

Economic factors present significant barriers to green hydrogen adoption. These include high production costs compared to conventional hydrogen, substantial capital investment requirements for infrastructure development, and uncertain return on investment. The cost of electrolyzers, renewable energy sources, and storage facilities contribute to the economic challenges. Additionally, the lack of established market mechanisms and pricing structures for green hydrogen creates financial uncertainties for potential investors and adopters.- Economic barriers to green hydrogen adoption: Economic factors present significant barriers to green hydrogen adoption. These include high production costs compared to conventional hydrogen, substantial capital investment requirements for infrastructure development, and uncertain return on investment. The cost of electrolyzers, renewable energy sources, and hydrogen storage systems contribute to the economic challenges. Additionally, the lack of established market mechanisms and pricing structures for green hydrogen creates financial uncertainties for potential investors and adopters.

- Technical and infrastructure limitations: Technical challenges and infrastructure limitations hinder widespread green hydrogen adoption. These include inefficiencies in electrolysis processes, difficulties in hydrogen storage and transportation, and integration challenges with existing energy systems. The need for specialized materials resistant to hydrogen embrittlement, high-pressure storage solutions, and dedicated transportation networks represents significant technical barriers. Additionally, the lack of standardized technologies and compatible infrastructure across regions impedes seamless deployment and utilization of green hydrogen systems.

- Regulatory and policy challenges: Regulatory frameworks and policy environments significantly impact green hydrogen adoption. Inconsistent regulations across jurisdictions, lack of standardized certification schemes for green hydrogen, and insufficient policy incentives create barriers to market development. The absence of clear carbon pricing mechanisms that would favor green hydrogen over carbon-intensive alternatives further complicates adoption. Additionally, permitting processes for hydrogen production facilities and infrastructure can be complex and time-consuming, delaying project implementation and market growth.

- Safety and public perception concerns: Safety considerations and public perception issues present barriers to green hydrogen adoption. Hydrogen's flammability and potential explosion risks require stringent safety protocols and specialized handling procedures. Public concerns about hydrogen safety, particularly in densely populated areas, can lead to resistance against hydrogen infrastructure projects. Additionally, limited public awareness and understanding of hydrogen technologies contribute to skepticism and hesitation in embracing hydrogen-based solutions, affecting both consumer acceptance and community support for hydrogen initiatives.

- Supply chain and resource constraints: Supply chain limitations and resource constraints affect green hydrogen scaling. These include shortages of critical materials needed for electrolyzer manufacturing, limited availability of renewable energy sources in certain regions, and underdeveloped hydrogen distribution networks. The competition for rare earth elements and precious metals used in hydrogen technologies creates supply vulnerabilities. Additionally, water resource requirements for hydrogen production through electrolysis can present challenges in water-scarce regions, potentially limiting production capacity and geographical distribution of hydrogen facilities.

02 Technical and infrastructure limitations

Technical challenges and infrastructure limitations hinder widespread green hydrogen adoption. These include inefficiencies in electrolysis processes, difficulties in hydrogen storage and transportation, and integration challenges with existing energy systems. The need for specialized materials resistant to hydrogen embrittlement, high-pressure storage solutions, and dedicated transportation networks presents significant technical barriers. Additionally, the lack of standardized technologies and protocols for hydrogen production, storage, and utilization complicates implementation efforts.Expand Specific Solutions03 Regulatory and policy challenges

Regulatory frameworks and policy environments significantly impact green hydrogen adoption. Inconsistent or underdeveloped regulations regarding hydrogen production, transportation, and use create uncertainty for stakeholders. The lack of standardized safety protocols, certification schemes for green hydrogen, and clear permitting processes delays project implementation. Additionally, insufficient policy support mechanisms such as subsidies, tax incentives, or carbon pricing frameworks limit the economic viability of green hydrogen projects compared to conventional alternatives.Expand Specific Solutions04 Supply chain and resource constraints

Supply chain limitations and resource constraints affect green hydrogen deployment. These include shortages of critical materials needed for electrolyzer manufacturing, limited availability of renewable energy sources in certain regions, and underdeveloped supplier networks for hydrogen technologies. The competition for rare earth elements and other materials used in electrolyzers and fuel cells can lead to supply bottlenecks. Additionally, the geographical mismatch between optimal renewable energy production locations and hydrogen demand centers creates logistical challenges.Expand Specific Solutions05 Market and adoption barriers

Market-related barriers impede green hydrogen adoption across various sectors. These include limited awareness and understanding of hydrogen technologies among potential end-users, resistance to change from established energy systems, and lack of demonstrated commercial-scale applications. The chicken-and-egg problem between hydrogen supply infrastructure and demand development creates market uncertainty. Additionally, competition from other low-carbon alternatives and the absence of established value chains for hydrogen products complicate market development efforts.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The green hydrogen adoption in heavy industry faces significant barriers despite growing market interest. The industry is in an early development stage, with market size expanding but still limited by high production costs and infrastructure challenges. Technologically, companies like Joi Scientific, X Development, and Intelligent Energy are advancing extraction and fuel cell technologies, while traditional energy players such as China Petroleum & Chemical Corp and UOP LLC are exploring integration pathways. Academic institutions including Oxford University and Shanghai Jiao Tong University contribute research support. However, the technology remains in transition from demonstration to commercial scale, with cost competitiveness against conventional hydrogen production methods representing the primary adoption hurdle alongside regulatory uncertainties and supply chain limitations.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive green hydrogen strategy focusing on industrial decarbonization. Their approach includes large-scale electrolysis facilities powered by renewable energy sources, with several demonstration projects across China. Sinopec's Kuqa Green Hydrogen Plant in Xinjiang represents one of the world's largest green hydrogen production facilities, with 20,000 tons annual capacity using solar power for electrolysis. The company has invested significantly in proton exchange membrane (PEM) and alkaline electrolysis technologies, achieving efficiency improvements of approximately 10-15% compared to conventional systems. Sinopec is addressing cost barriers through vertical integration of their supply chain and economies of scale, while also developing specialized high-pressure storage solutions and pipeline infrastructure to overcome transportation challenges. Their technology roadmap includes plans for hydrogen blending in existing natural gas networks as a transitional solution.

Strengths: Sinopec leverages its extensive energy infrastructure and distribution networks to support hydrogen adoption. Their large-scale approach helps address cost barriers through economies of scale. Weaknesses: Despite progress, their green hydrogen production costs remain 2-3 times higher than conventional hydrogen. The company faces challenges in retrofitting existing industrial facilities for hydrogen compatibility.

Ford Global Technologies LLC

Technical Solution: Ford Global Technologies has developed a comprehensive approach to green hydrogen integration in heavy industrial manufacturing processes, particularly focused on automotive production facilities. Their technology solution addresses multiple barriers through a three-pronged strategy. First, they've created on-site hydrogen production systems using advanced PEM electrolyzers powered by renewable energy, reducing transportation costs and infrastructure dependencies. These systems achieve approximately 65% efficiency and are scalable from 0.5 to 10 MW to match facility requirements. Second, Ford has developed specialized hydrogen storage solutions using composite materials that reduce storage costs by approximately 30% compared to conventional high-pressure tanks. Third, they've engineered industrial process modifications for key manufacturing operations, particularly high-temperature processes like metal treatment and paint curing, to utilize hydrogen efficiently. Their system includes intelligent energy management software that optimizes hydrogen production, storage, and consumption based on renewable energy availability and production schedules, improving overall system economics by 15-20% compared to non-integrated approaches.

Strengths: Ford's integrated approach addresses multiple adoption barriers simultaneously, creating synergies between production, storage, and utilization. Their solutions are designed with manufacturing expertise, ensuring practical implementation in industrial settings. Weaknesses: The technology requires significant upfront capital investment, with payback periods currently exceeding 7-10 years without subsidies. Their approach is optimized for automotive manufacturing and may require substantial modifications for other heavy industries.

Core Technologies and Innovations in Green Hydrogen

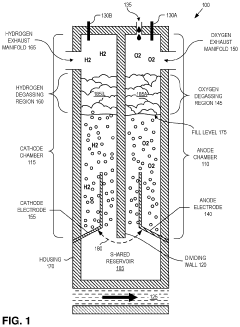

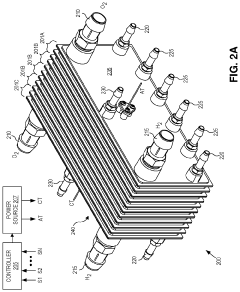

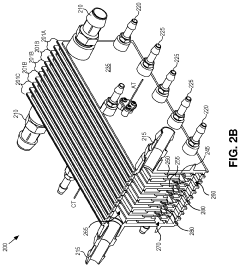

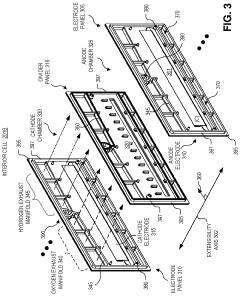

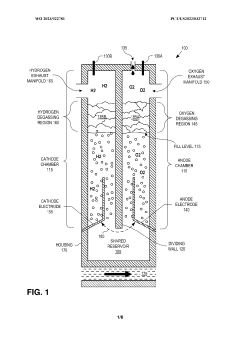

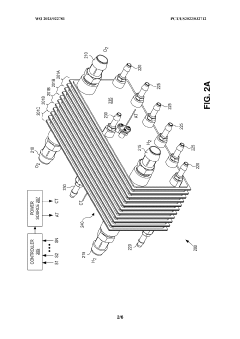

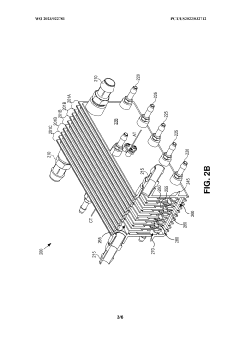

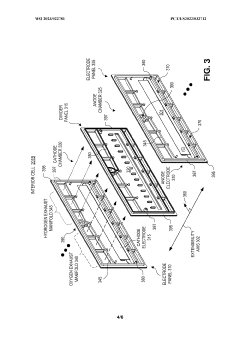

Membraneless hydrogen electrolyzer with static electrolyte

PatentInactiveUS20230054716A1

Innovation

- A low-cost hydrogen electrolyzer system with a modular and extensible design using injection molded thermoplastic for components like housing and electrodes, eliminating expensive components like gaskets and catalysts, and integrating heat exchange paths within the housing to reduce capital expenditures while maintaining efficiency.

Membraneless hydrogen electrolyzer with static electrolyte

PatentWO2023022781A1

Innovation

- A membraneless hydrogen electrolyzer design using a static electrolyte and injection molded thermoplastic components, eliminating the need for expensive catalysts and membranes, and integrating components into a modular, extensible structure to reduce costs and maintain efficiency.

Economic Feasibility and Cost Reduction Strategies

The economic feasibility of green hydrogen adoption in heavy industry remains a significant challenge, with production costs currently ranging from $3-8 per kilogram compared to $1-2 for conventional hydrogen. This cost disparity primarily stems from high capital expenditure requirements for electrolyzers, which can reach $1,000-1,500 per kW of capacity. Additionally, renewable electricity costs, which constitute 60-70% of green hydrogen production expenses, create substantial operational burdens despite recent price declines in solar and wind power.

Infrastructure development presents another major economic barrier, as transitioning to hydrogen requires extensive modifications to existing industrial facilities. For steel manufacturing, retrofitting blast furnaces or implementing direct reduction processes demands investments of hundreds of millions of dollars per facility, with uncertain returns on investment given the nascent market conditions.

Several promising cost reduction strategies are emerging to address these economic challenges. Scaling electrolyzer manufacturing could potentially reduce capital costs by 40-60% by 2030 through economies of scale and technological improvements. The implementation of policy mechanisms such as carbon pricing, production subsidies, and green procurement mandates can significantly improve the competitive position of green hydrogen against fossil fuel alternatives.

Public-private partnerships offer another viable approach, distributing financial risks across multiple stakeholders while accelerating technology deployment. The H2Global initiative in Europe exemplifies this strategy, creating a double auction system that bridges the cost gap between green hydrogen production and market demand through contract-for-difference mechanisms.

Technological innovation pathways present additional opportunities for cost reduction. Advanced electrolyzer designs utilizing novel materials could improve efficiency by 10-15%, while integration with variable renewable energy sources through smart grid technologies may optimize production schedules to capitalize on periods of low electricity prices, potentially reducing operational costs by 20-30%.

The development of hydrogen hubs represents a strategic approach to economic feasibility, concentrating production, storage, and end-use applications in industrial clusters to maximize infrastructure utilization and minimize transportation costs. These hubs enable shared investment in common infrastructure while facilitating knowledge transfer and creating economies of scope across the hydrogen value chain.

Infrastructure development presents another major economic barrier, as transitioning to hydrogen requires extensive modifications to existing industrial facilities. For steel manufacturing, retrofitting blast furnaces or implementing direct reduction processes demands investments of hundreds of millions of dollars per facility, with uncertain returns on investment given the nascent market conditions.

Several promising cost reduction strategies are emerging to address these economic challenges. Scaling electrolyzer manufacturing could potentially reduce capital costs by 40-60% by 2030 through economies of scale and technological improvements. The implementation of policy mechanisms such as carbon pricing, production subsidies, and green procurement mandates can significantly improve the competitive position of green hydrogen against fossil fuel alternatives.

Public-private partnerships offer another viable approach, distributing financial risks across multiple stakeholders while accelerating technology deployment. The H2Global initiative in Europe exemplifies this strategy, creating a double auction system that bridges the cost gap between green hydrogen production and market demand through contract-for-difference mechanisms.

Technological innovation pathways present additional opportunities for cost reduction. Advanced electrolyzer designs utilizing novel materials could improve efficiency by 10-15%, while integration with variable renewable energy sources through smart grid technologies may optimize production schedules to capitalize on periods of low electricity prices, potentially reducing operational costs by 20-30%.

The development of hydrogen hubs represents a strategic approach to economic feasibility, concentrating production, storage, and end-use applications in industrial clusters to maximize infrastructure utilization and minimize transportation costs. These hubs enable shared investment in common infrastructure while facilitating knowledge transfer and creating economies of scope across the hydrogen value chain.

Policy and Regulatory Framework for Green Hydrogen Adoption

The policy and regulatory landscape for green hydrogen adoption in heavy industry is currently characterized by a patchwork of approaches across different regions. Leading jurisdictions such as the European Union have established comprehensive hydrogen strategies with clear targets, funding mechanisms, and regulatory frameworks. The EU Hydrogen Strategy aims for 40GW of renewable hydrogen electrolyzer capacity by 2030, supported by the European Clean Hydrogen Alliance and various funding instruments.

In contrast, many developing economies lack coherent policy frameworks specifically addressing green hydrogen, creating significant market uncertainty for potential investors and industrial adopters. This regulatory gap represents a major barrier to widespread adoption, as industries require long-term policy stability to justify the substantial capital investments needed for hydrogen infrastructure.

Carbon pricing mechanisms vary widely across jurisdictions, with many regions implementing insufficient carbon prices to make green hydrogen economically competitive against fossil fuel alternatives. Studies indicate that carbon prices of €50-90 per tonne of CO2 would be necessary to create a level playing field, yet most existing schemes fall below this threshold.

Permitting and certification processes for hydrogen production facilities often involve complex, time-consuming procedures across multiple regulatory bodies. The lack of standardized permitting pathways specifically designed for hydrogen infrastructure creates administrative burdens that delay project implementation and increase costs. Additionally, the absence of internationally recognized certification schemes for "green" hydrogen creates market fragmentation and hinders cross-border trade.

Subsidies and incentives for green hydrogen production remain inconsistent globally. While some regions offer production subsidies (similar to the U.S. Inflation Reduction Act's production tax credits), investment grants, or preferential financing, many industrial hubs lack sufficient financial support mechanisms to bridge the cost gap between green hydrogen and conventional alternatives.

Technical standards and safety regulations for hydrogen use in industrial processes are still evolving, creating uncertainty for industrial adopters. The lack of harmonized international standards for hydrogen purity, storage specifications, and safety protocols increases compliance costs and technical barriers for multinational industrial operations considering hydrogen adoption.

Infrastructure planning frameworks often fail to adequately address the need for coordinated development of renewable energy capacity, hydrogen production facilities, and distribution networks. This regulatory disconnect creates chicken-and-egg problems where neither production nor consumption infrastructure develops at sufficient scale.

In contrast, many developing economies lack coherent policy frameworks specifically addressing green hydrogen, creating significant market uncertainty for potential investors and industrial adopters. This regulatory gap represents a major barrier to widespread adoption, as industries require long-term policy stability to justify the substantial capital investments needed for hydrogen infrastructure.

Carbon pricing mechanisms vary widely across jurisdictions, with many regions implementing insufficient carbon prices to make green hydrogen economically competitive against fossil fuel alternatives. Studies indicate that carbon prices of €50-90 per tonne of CO2 would be necessary to create a level playing field, yet most existing schemes fall below this threshold.

Permitting and certification processes for hydrogen production facilities often involve complex, time-consuming procedures across multiple regulatory bodies. The lack of standardized permitting pathways specifically designed for hydrogen infrastructure creates administrative burdens that delay project implementation and increase costs. Additionally, the absence of internationally recognized certification schemes for "green" hydrogen creates market fragmentation and hinders cross-border trade.

Subsidies and incentives for green hydrogen production remain inconsistent globally. While some regions offer production subsidies (similar to the U.S. Inflation Reduction Act's production tax credits), investment grants, or preferential financing, many industrial hubs lack sufficient financial support mechanisms to bridge the cost gap between green hydrogen and conventional alternatives.

Technical standards and safety regulations for hydrogen use in industrial processes are still evolving, creating uncertainty for industrial adopters. The lack of harmonized international standards for hydrogen purity, storage specifications, and safety protocols increases compliance costs and technical barriers for multinational industrial operations considering hydrogen adoption.

Infrastructure planning frameworks often fail to adequately address the need for coordinated development of renewable energy capacity, hydrogen production facilities, and distribution networks. This regulatory disconnect creates chicken-and-egg problems where neither production nor consumption infrastructure develops at sufficient scale.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!