Role of green hydrogen in aviation hydrogen-electric hybrid propulsion

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Hydrogen Aviation Background & Objectives

The aviation industry faces mounting pressure to reduce its carbon footprint, with commercial flights currently accounting for approximately 2.5% of global CO2 emissions. This figure is projected to increase significantly as air travel demand grows, potentially tripling by 2050. Traditional jet fuel-powered aircraft have reached efficiency plateaus, necessitating revolutionary propulsion technologies to achieve meaningful emissions reductions.

Green hydrogen has emerged as a promising solution for aviation decarbonization, particularly in hydrogen-electric hybrid propulsion systems. Unlike grey or blue hydrogen, green hydrogen is produced through electrolysis powered by renewable energy sources, resulting in near-zero lifecycle emissions. This aligns with the aviation industry's ambitious target of achieving net-zero carbon emissions by 2050, as outlined in the Air Transport Action Group's waypoint commitments.

The technological evolution of hydrogen applications in aviation dates back to experimental aircraft in the 1950s, but recent advancements in fuel cell efficiency, hydrogen storage, and electric propulsion systems have created new possibilities. Modern hydrogen-electric hybrid propulsion combines hydrogen fuel cells with battery systems to optimize performance across different flight phases while minimizing environmental impact.

The primary objective of green hydrogen integration in aviation propulsion is to develop commercially viable aircraft that can operate with significantly reduced or zero carbon emissions while maintaining competitive performance metrics. Secondary goals include reducing noise pollution, decreasing dependence on fossil fuels, and establishing sustainable aviation fuel ecosystems.

Technical objectives focus on overcoming key challenges: improving hydrogen storage density to increase range capabilities, enhancing fuel cell power density for weight reduction, developing efficient hybrid power management systems, and creating safe hydrogen handling infrastructure at airports. These advancements must meet stringent aviation safety standards while remaining economically feasible.

The trajectory of green hydrogen in aviation is shaped by international climate agreements and regulatory frameworks, including the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and various national hydrogen strategies. These policies are driving unprecedented investment in hydrogen technologies across the aviation value chain.

Success in this domain requires cross-industry collaboration between aircraft manufacturers, energy providers, airport operators, and regulatory bodies to establish standards and infrastructure for hydrogen-powered flight. The ultimate goal is creating a sustainable aviation ecosystem where green hydrogen serves as a primary energy carrier for next-generation aircraft.

Green hydrogen has emerged as a promising solution for aviation decarbonization, particularly in hydrogen-electric hybrid propulsion systems. Unlike grey or blue hydrogen, green hydrogen is produced through electrolysis powered by renewable energy sources, resulting in near-zero lifecycle emissions. This aligns with the aviation industry's ambitious target of achieving net-zero carbon emissions by 2050, as outlined in the Air Transport Action Group's waypoint commitments.

The technological evolution of hydrogen applications in aviation dates back to experimental aircraft in the 1950s, but recent advancements in fuel cell efficiency, hydrogen storage, and electric propulsion systems have created new possibilities. Modern hydrogen-electric hybrid propulsion combines hydrogen fuel cells with battery systems to optimize performance across different flight phases while minimizing environmental impact.

The primary objective of green hydrogen integration in aviation propulsion is to develop commercially viable aircraft that can operate with significantly reduced or zero carbon emissions while maintaining competitive performance metrics. Secondary goals include reducing noise pollution, decreasing dependence on fossil fuels, and establishing sustainable aviation fuel ecosystems.

Technical objectives focus on overcoming key challenges: improving hydrogen storage density to increase range capabilities, enhancing fuel cell power density for weight reduction, developing efficient hybrid power management systems, and creating safe hydrogen handling infrastructure at airports. These advancements must meet stringent aviation safety standards while remaining economically feasible.

The trajectory of green hydrogen in aviation is shaped by international climate agreements and regulatory frameworks, including the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and various national hydrogen strategies. These policies are driving unprecedented investment in hydrogen technologies across the aviation value chain.

Success in this domain requires cross-industry collaboration between aircraft manufacturers, energy providers, airport operators, and regulatory bodies to establish standards and infrastructure for hydrogen-powered flight. The ultimate goal is creating a sustainable aviation ecosystem where green hydrogen serves as a primary energy carrier for next-generation aircraft.

Market Analysis for Hydrogen-Electric Aviation

The global aviation industry is witnessing a significant shift towards sustainable propulsion technologies, with hydrogen-electric hybrid systems emerging as a promising solution for decarbonizing air travel. Current market projections indicate that the hydrogen-electric aviation market could reach $27 billion by 2040, with a compound annual growth rate of approximately 14% between 2025 and 2040.

The market demand is primarily driven by increasing regulatory pressure to reduce aviation emissions, which account for 2-3% of global CO2 emissions. The European Union's "Fit for 55" package aims to reduce net greenhouse gas emissions by at least 55% by 2030, while the International Air Transport Association (IATA) has committed to net-zero carbon emissions by 2050. These regulatory frameworks are creating a strong market pull for hydrogen-electric propulsion technologies.

Regional and short-haul aviation segments represent the most immediate market opportunity, with aircraft carrying 50-100 passengers over distances of 500-1000 kilometers showing the greatest potential for early adoption. Market research indicates that by 2035, hydrogen-electric propulsion could capture up to 40% of the regional aviation market, particularly in regions with well-developed hydrogen infrastructure such as Europe, Japan, and parts of North America.

Consumer sentiment is increasingly favorable toward sustainable aviation, with surveys showing that 65% of frequent flyers would choose a more environmentally friendly flight option if available at comparable cost. This shift in consumer preference is encouraging major airlines to invest in hydrogen technologies, with several flagship carriers announcing partnerships with hydrogen-electric propulsion developers.

The investment landscape for hydrogen-electric aviation is rapidly expanding, with venture capital funding exceeding $3 billion in 2022 alone. Major aerospace manufacturers are allocating significant R&D budgets to hydrogen propulsion, while government funding programs like the EU's Clean Hydrogen Partnership and the US Department of Energy's Hydrogen Shot initiative are providing additional financial support.

Market barriers include the high cost of green hydrogen production, currently 2-3 times more expensive than conventional jet fuel on an energy-equivalent basis. Infrastructure limitations present another challenge, with airports requiring substantial investments to support hydrogen storage, distribution, and refueling operations. However, economies of scale and technological advancements are expected to reduce green hydrogen costs by up to 60% by 2030, significantly improving market viability.

Competition in this emerging market is intensifying, with traditional aerospace companies, specialized startups, and energy corporations all vying for market share. Strategic partnerships between these stakeholders are becoming increasingly common, creating a complex but dynamic market ecosystem that is accelerating technology development and commercialization pathways.

The market demand is primarily driven by increasing regulatory pressure to reduce aviation emissions, which account for 2-3% of global CO2 emissions. The European Union's "Fit for 55" package aims to reduce net greenhouse gas emissions by at least 55% by 2030, while the International Air Transport Association (IATA) has committed to net-zero carbon emissions by 2050. These regulatory frameworks are creating a strong market pull for hydrogen-electric propulsion technologies.

Regional and short-haul aviation segments represent the most immediate market opportunity, with aircraft carrying 50-100 passengers over distances of 500-1000 kilometers showing the greatest potential for early adoption. Market research indicates that by 2035, hydrogen-electric propulsion could capture up to 40% of the regional aviation market, particularly in regions with well-developed hydrogen infrastructure such as Europe, Japan, and parts of North America.

Consumer sentiment is increasingly favorable toward sustainable aviation, with surveys showing that 65% of frequent flyers would choose a more environmentally friendly flight option if available at comparable cost. This shift in consumer preference is encouraging major airlines to invest in hydrogen technologies, with several flagship carriers announcing partnerships with hydrogen-electric propulsion developers.

The investment landscape for hydrogen-electric aviation is rapidly expanding, with venture capital funding exceeding $3 billion in 2022 alone. Major aerospace manufacturers are allocating significant R&D budgets to hydrogen propulsion, while government funding programs like the EU's Clean Hydrogen Partnership and the US Department of Energy's Hydrogen Shot initiative are providing additional financial support.

Market barriers include the high cost of green hydrogen production, currently 2-3 times more expensive than conventional jet fuel on an energy-equivalent basis. Infrastructure limitations present another challenge, with airports requiring substantial investments to support hydrogen storage, distribution, and refueling operations. However, economies of scale and technological advancements are expected to reduce green hydrogen costs by up to 60% by 2030, significantly improving market viability.

Competition in this emerging market is intensifying, with traditional aerospace companies, specialized startups, and energy corporations all vying for market share. Strategic partnerships between these stakeholders are becoming increasingly common, creating a complex but dynamic market ecosystem that is accelerating technology development and commercialization pathways.

Technical Challenges in Aviation Hydrogen Implementation

The implementation of hydrogen technologies in aviation faces significant technical hurdles that must be overcome before widespread adoption becomes feasible. One of the primary challenges is hydrogen storage, as liquid hydrogen requires cryogenic temperatures of approximately -253°C. This necessitates the development of specialized insulated tanks that can maintain these extreme temperatures while being lightweight enough for aircraft use. Current storage solutions add considerable weight penalties, reducing aircraft efficiency and range.

Fuel cell technology, while advancing rapidly, still presents limitations in power density compared to conventional jet engines. For hydrogen-electric hybrid propulsion systems to be viable in commercial aviation, significant improvements in power-to-weight ratios are essential. Current fuel cell systems deliver approximately 2-3 kW/kg, whereas commercial aviation applications may require 5-8 kW/kg or higher for practical implementation.

Distribution infrastructure represents another substantial barrier. Airports would need extensive modifications to accommodate hydrogen refueling capabilities, including cryogenic storage facilities, specialized handling equipment, and safety systems. The capital investment required for such infrastructure transformation is estimated to be in the billions of dollars globally.

Safety concerns present multifaceted challenges. Hydrogen's wide flammability range (4-75% concentration in air) and low ignition energy necessitate robust detection systems and stringent safety protocols. Additionally, the invisible flame of hydrogen fires complicates emergency response procedures, requiring specialized detection equipment and training for ground crews and flight personnel.

Material compatibility issues also pose significant technical obstacles. Hydrogen embrittlement—where hydrogen atoms diffuse into metal structures, causing them to become brittle—threatens the structural integrity of aircraft components. This necessitates the development of new materials or protective coatings that can withstand prolonged exposure to hydrogen without degradation.

Regulatory frameworks present another layer of complexity. Current aviation regulations were not designed with hydrogen propulsion in mind, creating a need for comprehensive updates to certification standards, operational procedures, and maintenance protocols. The development of these regulatory frameworks requires extensive testing and validation, which is both time-consuming and resource-intensive.

Energy efficiency across the entire hydrogen value chain remains problematic. While hydrogen-electric propulsion offers zero emissions at the point of use, the overall well-to-wake efficiency depends heavily on the production method. Green hydrogen production via electrolysis currently has efficiency losses of 30-35%, which must be improved to make the entire system environmentally and economically viable.

Fuel cell technology, while advancing rapidly, still presents limitations in power density compared to conventional jet engines. For hydrogen-electric hybrid propulsion systems to be viable in commercial aviation, significant improvements in power-to-weight ratios are essential. Current fuel cell systems deliver approximately 2-3 kW/kg, whereas commercial aviation applications may require 5-8 kW/kg or higher for practical implementation.

Distribution infrastructure represents another substantial barrier. Airports would need extensive modifications to accommodate hydrogen refueling capabilities, including cryogenic storage facilities, specialized handling equipment, and safety systems. The capital investment required for such infrastructure transformation is estimated to be in the billions of dollars globally.

Safety concerns present multifaceted challenges. Hydrogen's wide flammability range (4-75% concentration in air) and low ignition energy necessitate robust detection systems and stringent safety protocols. Additionally, the invisible flame of hydrogen fires complicates emergency response procedures, requiring specialized detection equipment and training for ground crews and flight personnel.

Material compatibility issues also pose significant technical obstacles. Hydrogen embrittlement—where hydrogen atoms diffuse into metal structures, causing them to become brittle—threatens the structural integrity of aircraft components. This necessitates the development of new materials or protective coatings that can withstand prolonged exposure to hydrogen without degradation.

Regulatory frameworks present another layer of complexity. Current aviation regulations were not designed with hydrogen propulsion in mind, creating a need for comprehensive updates to certification standards, operational procedures, and maintenance protocols. The development of these regulatory frameworks requires extensive testing and validation, which is both time-consuming and resource-intensive.

Energy efficiency across the entire hydrogen value chain remains problematic. While hydrogen-electric propulsion offers zero emissions at the point of use, the overall well-to-wake efficiency depends heavily on the production method. Green hydrogen production via electrolysis currently has efficiency losses of 30-35%, which must be improved to make the entire system environmentally and economically viable.

Current Hydrogen-Electric Hybrid Propulsion Solutions

01 Production methods for green hydrogen

Various methods for producing green hydrogen using renewable energy sources. These methods primarily involve water electrolysis powered by renewable electricity such as solar, wind, or hydroelectric power. The electrolysis process splits water molecules into hydrogen and oxygen without generating carbon emissions. Advanced electrolysis technologies including PEM (Proton Exchange Membrane), alkaline, and solid oxide electrolyzers are employed to improve efficiency and reduce production costs.- Production methods for green hydrogen: Various methods for producing green hydrogen using renewable energy sources. These methods primarily involve water electrolysis powered by renewable electricity from sources such as solar, wind, or hydroelectric power. The electrolysis process splits water molecules into hydrogen and oxygen without generating carbon emissions. Advanced electrolysis technologies including PEM (Proton Exchange Membrane), alkaline, and solid oxide electrolyzers are employed to optimize efficiency and production rates.

- Storage and transportation solutions: Technologies for efficient storage and transportation of green hydrogen. These include compression and liquefaction methods, chemical carriers like ammonia or liquid organic hydrogen carriers (LOHC), and advanced materials for hydrogen storage such as metal hydrides. Pipeline infrastructure adaptations and specialized containers for hydrogen transport are also covered, addressing the challenges of hydrogen's low volumetric energy density and potential for embrittlement of conventional materials.

- Integration with renewable energy systems: Systems and methods for integrating green hydrogen production with renewable energy sources. These innovations focus on coupling electrolyzers with intermittent renewable energy sources to provide grid balancing services and energy storage solutions. Smart control systems optimize hydrogen production based on renewable energy availability, grid demand, and hydrogen storage levels. Hybrid energy systems combining multiple renewable sources with hydrogen production and storage are designed to ensure reliable energy supply.

- Industrial applications and fuel cells: Applications of green hydrogen in industrial processes and fuel cell technologies. These include using green hydrogen as a feedstock for chemical production, as a reducing agent in steel manufacturing, and as a clean fuel for high-temperature industrial processes. Fuel cell technologies convert hydrogen back to electricity for various applications including transportation, stationary power generation, and portable devices. Advanced catalyst materials and membrane technologies improve fuel cell efficiency and durability.

- Catalyst and electrode materials: Development of advanced catalyst and electrode materials for improved hydrogen production efficiency. These innovations focus on non-precious metal catalysts to reduce costs, nanostructured materials with increased surface area for enhanced catalytic activity, and corrosion-resistant materials for extended operational lifetimes. Composite electrodes combining multiple functional materials optimize electron transfer and gas evolution processes. Surface modification techniques enhance the selectivity and stability of catalytic materials under various operating conditions.

02 Storage and transportation solutions

Innovative technologies for storing and transporting green hydrogen safely and efficiently. These include compression and liquefaction methods, chemical carriers like ammonia or liquid organic hydrogen carriers (LOHC), and advanced materials for hydrogen containment. Pipeline infrastructure adaptations and specialized vessels for maritime hydrogen transport are also being developed to enable the creation of a global green hydrogen supply chain.Expand Specific Solutions03 Integration with renewable energy systems

Systems and methods for integrating green hydrogen production with renewable energy sources. These technologies focus on optimizing the coupling between intermittent renewable energy generation and hydrogen production facilities. Smart grid solutions, energy management systems, and hybrid power plants that combine solar/wind generation with hydrogen production and storage are being developed to enhance grid stability and maximize renewable energy utilization.Expand Specific Solutions04 Industrial applications and fuel cells

Applications of green hydrogen in industrial processes and fuel cell technologies. These include using hydrogen as a clean reducing agent in steel manufacturing, as a feedstock for green ammonia and methanol production, and as a fuel for high-temperature industrial processes. Advanced fuel cell designs for stationary power generation, transportation, and portable applications are also being developed to efficiently convert hydrogen into electricity with only water as a byproduct.Expand Specific Solutions05 Catalysts and efficiency improvements

Novel catalysts and materials to improve the efficiency of green hydrogen production and utilization. These innovations include non-precious metal catalysts to replace platinum group metals, nanostructured materials with enhanced catalytic activity, and advanced membrane technologies for more efficient electrolysis. Developments also focus on reducing degradation rates, extending operational lifetimes, and lowering the overall cost of hydrogen production and conversion systems.Expand Specific Solutions

Key Industry Players in Hydrogen Aviation

The green hydrogen-electric hybrid propulsion market in aviation is in an early development stage, characterized by significant R&D investments but limited commercial deployment. Market size is projected to grow substantially as the aviation industry seeks decarbonization solutions, with estimates suggesting multi-billion dollar potential by 2035. Technologically, the field remains in nascent stages with varying maturity levels across key players. Boeing, Airbus, and RTX Corp. lead with substantial research programs, while specialized companies like ZeroAvia have made significant progress in hydrogen-electric propulsion systems. Traditional engine manufacturers including Rolls-Royce, GE, and Pratt & Whitney are developing complementary technologies. Chinese entities such as COMAC and AECC are also investing heavily, indicating a globally competitive landscape with both established aerospace giants and innovative startups driving development.

The Boeing Co.

Technical Solution: Boeing has developed a multi-faceted approach to hydrogen-electric hybrid propulsion for aviation, focusing on both near-term and long-term solutions. Their strategy includes the SUGAR (Subsonic Ultra Green Aircraft Research) Volt concept, which utilizes a hybrid electric architecture where hydrogen fuel cells provide supplementary power to conventional jet fuel engines during cruise phases, reducing emissions by an estimated 70%. Boeing has also invested in direct hydrogen combustion research through their partnership with the Clean Energy Research Centre at the University of British Columbia, exploring modified gas turbine designs that can efficiently burn hydrogen with minimal NOx emissions. The company's approach to hydrogen storage focuses on both compressed gas systems for smaller aircraft and advanced cryogenic liquid hydrogen tanks for larger commercial applications, with proprietary insulation technology to minimize boil-off. Boeing's ecoDemonstrator program has been used to test individual hydrogen-electric components in real flight conditions, and they've established partnerships with companies like Plug Power for fuel cell development and Shell for hydrogen infrastructure planning.

Strengths: Extensive aircraft integration expertise; balanced approach between near-term hybrid solutions and long-term full hydrogen systems; strong supply chain relationships; significant testing infrastructure. Weaknesses: More conservative approach than some competitors; less public commitment to specific hydrogen-electric timelines; challenges in retrofitting existing aircraft designs for hydrogen storage.

General Electric Company

Technical Solution: General Electric (GE) has developed an extensive hydrogen-electric hybrid propulsion program through its aviation division, focusing on both hydrogen combustion and fuel cell technologies. Their approach centers on a "building block" strategy that progressively introduces hydrogen technologies into aircraft propulsion systems. GE's hydrogen combustion research has demonstrated successful operation of modified turbofan engines with hydrogen-natural gas blends, with plans to test 100% hydrogen combustion. Their proprietary combustor designs address the unique challenges of hydrogen's higher flame speed and temperature. For fuel cell integration, GE is developing high-temperature solid oxide fuel cell (SOFC) systems that offer higher efficiency than traditional PEM fuel cells, though with greater weight penalties. Their hybrid architecture combines these technologies with advanced power electronics and electric motors from their existing electric propulsion portfolio. GE has established partnerships with NASA, the US Department of Energy, and European research institutions through the Clean Aviation program to accelerate development. Their timeline projects initial hydrogen-electric hybrid systems for regional aircraft by 2030, with technology for larger single-aisle aircraft available by 2035.

Strengths: Extensive experience in both aviation propulsion and power generation; strong capabilities in system integration; established relationships with major aircraft manufacturers; significant testing infrastructure. Weaknesses: Higher temperature SOFC technology presents thermal management challenges in aircraft applications; hydrogen storage integration requires substantial aircraft redesign; significant infrastructure development needed for hydrogen supply chain.

Critical Patents in Aviation Hydrogen Technologies

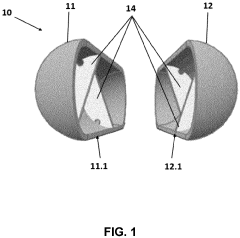

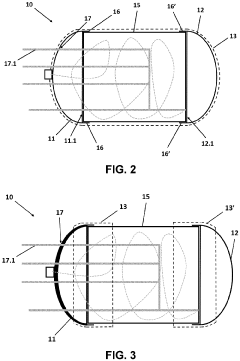

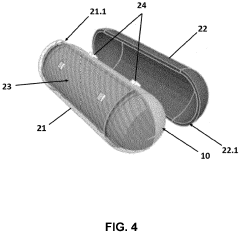

Method for manufacturing a vessel and a double-wall tank

PatentActiveEP4269859A1

Innovation

- A method for manufacturing a double-wall tank using partially cured Fiber Reinforced Polymer (FRP) structures that are coupled and then wrapped with additional FRP material, providing a lightweight and thermally insulated vessel with integrated systems and structural elements, and a double-wall tank design with an intermediate gap for thermal insulation.

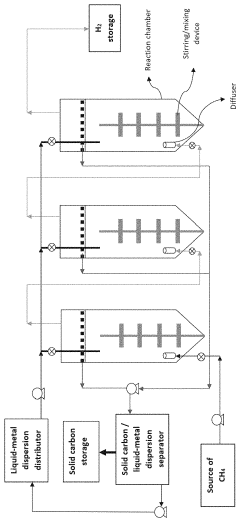

Using converted hydrogen and solid carbon from captured methane to power wellbore equipment

PatentActiveUS11548782B1

Innovation

- Converting captured methane into green hydrogen and solid carbon at lower temperatures using a reaction chamber with a liquid base fluid, carrier droplets, and a catalyst, where the methane reacts to form hydrogen gas and solid carbon without producing carbon dioxide as a by-product.

Regulatory Framework for Hydrogen Aircraft Development

The regulatory landscape for hydrogen aircraft development is evolving rapidly as aviation authorities worldwide recognize the potential of hydrogen-electric hybrid propulsion systems to reduce carbon emissions. Currently, the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) are developing certification frameworks specifically addressing hydrogen-powered aircraft, with preliminary guidelines expected by 2025.

Safety standards represent the most critical aspect of these regulations, focusing on hydrogen storage, fuel cell systems, and emergency protocols. Hydrogen's properties necessitate specialized containment systems and safety measures beyond those required for conventional jet fuel. Regulatory bodies are establishing new testing protocols for cryogenic liquid hydrogen tanks and pressurized gaseous hydrogen systems to ensure structural integrity under various flight conditions.

Emissions standards are being recalibrated to account for hydrogen-electric propulsion's unique environmental profile. While hydrogen combustion produces primarily water vapor, regulators are assessing potential non-CO2 impacts, including high-altitude water vapor emissions and their climate effects. The International Civil Aviation Organization (ICAO) is developing new metrics beyond traditional CO2 equivalents to properly evaluate hydrogen propulsion systems.

Infrastructure certification presents another regulatory challenge, as airports will require hydrogen refueling facilities meeting stringent safety standards. Current regulations for airport fuel systems must be extensively modified to accommodate hydrogen's specific handling requirements. The Airport Cooperative Research Program has initiated studies to develop standardized guidelines for hydrogen infrastructure implementation at commercial airports.

International harmonization of regulations remains a significant hurdle. Differences between regulatory approaches in North America, Europe, and Asia could potentially create barriers to global deployment of hydrogen aircraft. The ICAO's Committee on Aviation Environmental Protection is working to establish internationally recognized standards for hydrogen propulsion certification to prevent regulatory fragmentation.

Airworthiness directives for hydrogen-electric hybrid systems are being developed through collaborative efforts between regulators and industry stakeholders. These directives will address the integration of fuel cells, electric motors, and hydrogen storage systems, establishing performance requirements and acceptable means of compliance for certification.

Timeline considerations are also being incorporated into regulatory frameworks, with phased implementation allowing for progressive technology maturation. Initial regulations will likely focus on smaller regional aircraft before expanding to accommodate larger commercial airliners as hydrogen technology advances.

Safety standards represent the most critical aspect of these regulations, focusing on hydrogen storage, fuel cell systems, and emergency protocols. Hydrogen's properties necessitate specialized containment systems and safety measures beyond those required for conventional jet fuel. Regulatory bodies are establishing new testing protocols for cryogenic liquid hydrogen tanks and pressurized gaseous hydrogen systems to ensure structural integrity under various flight conditions.

Emissions standards are being recalibrated to account for hydrogen-electric propulsion's unique environmental profile. While hydrogen combustion produces primarily water vapor, regulators are assessing potential non-CO2 impacts, including high-altitude water vapor emissions and their climate effects. The International Civil Aviation Organization (ICAO) is developing new metrics beyond traditional CO2 equivalents to properly evaluate hydrogen propulsion systems.

Infrastructure certification presents another regulatory challenge, as airports will require hydrogen refueling facilities meeting stringent safety standards. Current regulations for airport fuel systems must be extensively modified to accommodate hydrogen's specific handling requirements. The Airport Cooperative Research Program has initiated studies to develop standardized guidelines for hydrogen infrastructure implementation at commercial airports.

International harmonization of regulations remains a significant hurdle. Differences between regulatory approaches in North America, Europe, and Asia could potentially create barriers to global deployment of hydrogen aircraft. The ICAO's Committee on Aviation Environmental Protection is working to establish internationally recognized standards for hydrogen propulsion certification to prevent regulatory fragmentation.

Airworthiness directives for hydrogen-electric hybrid systems are being developed through collaborative efforts between regulators and industry stakeholders. These directives will address the integration of fuel cells, electric motors, and hydrogen storage systems, establishing performance requirements and acceptable means of compliance for certification.

Timeline considerations are also being incorporated into regulatory frameworks, with phased implementation allowing for progressive technology maturation. Initial regulations will likely focus on smaller regional aircraft before expanding to accommodate larger commercial airliners as hydrogen technology advances.

Environmental Impact Assessment of Hydrogen Aviation

The environmental implications of hydrogen aviation represent a critical dimension in assessing the viability of hydrogen-electric hybrid propulsion systems. When examining greenhouse gas emissions, hydrogen-powered aircraft offer significant advantages over conventional jet fuel systems. Green hydrogen, produced through electrolysis powered by renewable energy sources, can potentially reduce aviation's carbon footprint by up to 90% compared to traditional kerosene-based operations. This dramatic reduction addresses one of the most pressing environmental challenges facing the aviation industry today.

Water vapor emissions present both benefits and concerns in hydrogen aviation. While hydrogen combustion primarily produces water vapor rather than carbon dioxide, these emissions at high altitudes can contribute to contrail formation and potential climate impacts. Research indicates that hydrogen combustion emits approximately 2.6 times more water vapor than conventional jet fuel per unit of energy. However, the absence of particulate matter in hydrogen combustion may reduce contrail persistence and radiative forcing effects, potentially mitigating some climate impacts.

Noise pollution considerations also favor hydrogen-electric hybrid systems. Electric motors used in hybrid configurations operate more quietly than conventional turbine engines, potentially reducing community noise exposure around airports. This advantage becomes particularly significant for urban air mobility applications and operations near densely populated areas, where noise restrictions often limit flight operations.

Life cycle assessment of hydrogen aviation reveals complex environmental trade-offs. While operational emissions decrease substantially, the environmental impact of hydrogen production, liquefaction, storage, and distribution infrastructure must be carefully evaluated. Current hydrogen production methods, particularly those relying on natural gas reforming, can generate significant upstream emissions. The transition to green hydrogen production pathways is therefore essential to realize the full environmental benefits of hydrogen aviation.

Land use and resource requirements for hydrogen infrastructure present additional environmental considerations. Hydrogen production facilities, especially those powered by renewable energy, require substantial land area. However, these impacts must be balanced against the environmental benefits of reduced aviation emissions and potential integration with broader hydrogen economy initiatives that serve multiple sectors beyond aviation.

Water vapor emissions present both benefits and concerns in hydrogen aviation. While hydrogen combustion primarily produces water vapor rather than carbon dioxide, these emissions at high altitudes can contribute to contrail formation and potential climate impacts. Research indicates that hydrogen combustion emits approximately 2.6 times more water vapor than conventional jet fuel per unit of energy. However, the absence of particulate matter in hydrogen combustion may reduce contrail persistence and radiative forcing effects, potentially mitigating some climate impacts.

Noise pollution considerations also favor hydrogen-electric hybrid systems. Electric motors used in hybrid configurations operate more quietly than conventional turbine engines, potentially reducing community noise exposure around airports. This advantage becomes particularly significant for urban air mobility applications and operations near densely populated areas, where noise restrictions often limit flight operations.

Life cycle assessment of hydrogen aviation reveals complex environmental trade-offs. While operational emissions decrease substantially, the environmental impact of hydrogen production, liquefaction, storage, and distribution infrastructure must be carefully evaluated. Current hydrogen production methods, particularly those relying on natural gas reforming, can generate significant upstream emissions. The transition to green hydrogen production pathways is therefore essential to realize the full environmental benefits of hydrogen aviation.

Land use and resource requirements for hydrogen infrastructure present additional environmental considerations. Hydrogen production facilities, especially those powered by renewable energy, require substantial land area. However, these impacts must be balanced against the environmental benefits of reduced aviation emissions and potential integration with broader hydrogen economy initiatives that serve multiple sectors beyond aviation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!