A Comparative Study of Nitrogen Reduction Catalyst and Competitors

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nitrogen Reduction Catalysis Background and Objectives

Nitrogen reduction catalysis represents one of the most critical technological domains in modern industrial chemistry, with its roots dating back to the early 20th century when Fritz Haber and Carl Bosch developed the first industrial-scale ammonia synthesis process. This revolutionary technology fundamentally transformed global agriculture and chemical manufacturing by enabling the fixation of atmospheric nitrogen under high pressure and temperature conditions using iron-based catalysts. Over the past century, the field has witnessed significant evolutionary progress, moving from traditional heterogeneous catalysts toward more efficient and environmentally sustainable alternatives.

The evolution of nitrogen reduction catalysis has been driven by several key factors, including energy efficiency concerns, environmental regulations, and the growing demand for ammonia in various industrial applications. Traditional Haber-Bosch processes, while commercially successful, consume approximately 1-2% of global energy production and generate substantial carbon emissions. This has created an urgent technological imperative to develop catalytic systems that can operate under milder conditions while maintaining or improving conversion efficiency.

Recent technological trends in this field include the exploration of electrocatalytic and photocatalytic nitrogen reduction reactions (NRR), which offer the potential for ambient-condition nitrogen fixation powered by renewable electricity or solar energy. Additionally, biomimetic approaches inspired by nitrogenase enzymes have gained significant research attention, as these biological systems can reduce nitrogen at ambient conditions with remarkable specificity.

The primary technical objectives of this comparative study are multifaceted. First, we aim to comprehensively evaluate the performance metrics of current nitrogen reduction catalysts across different technological platforms, including traditional heterogeneous catalysts, electrocatalysts, photocatalysts, and bioinspired systems. Key performance indicators include conversion efficiency, selectivity, stability, energy consumption, and economic viability.

Second, this study seeks to identify technological gaps and opportunities in the competitive landscape, mapping the intellectual property distribution and research concentration areas among major industrial and academic players. This analysis will provide valuable insights into potential collaboration or acquisition targets and highlight underexplored research directions with significant commercial potential.

Finally, we intend to establish a technological roadmap for nitrogen reduction catalysis development over the next decade, forecasting critical breakthroughs and potential disruptive innovations that could fundamentally transform ammonia production and related nitrogen chemistry applications. This forward-looking perspective will inform strategic R&D investments and help position our organization advantageously within this rapidly evolving technological ecosystem.

The evolution of nitrogen reduction catalysis has been driven by several key factors, including energy efficiency concerns, environmental regulations, and the growing demand for ammonia in various industrial applications. Traditional Haber-Bosch processes, while commercially successful, consume approximately 1-2% of global energy production and generate substantial carbon emissions. This has created an urgent technological imperative to develop catalytic systems that can operate under milder conditions while maintaining or improving conversion efficiency.

Recent technological trends in this field include the exploration of electrocatalytic and photocatalytic nitrogen reduction reactions (NRR), which offer the potential for ambient-condition nitrogen fixation powered by renewable electricity or solar energy. Additionally, biomimetic approaches inspired by nitrogenase enzymes have gained significant research attention, as these biological systems can reduce nitrogen at ambient conditions with remarkable specificity.

The primary technical objectives of this comparative study are multifaceted. First, we aim to comprehensively evaluate the performance metrics of current nitrogen reduction catalysts across different technological platforms, including traditional heterogeneous catalysts, electrocatalysts, photocatalysts, and bioinspired systems. Key performance indicators include conversion efficiency, selectivity, stability, energy consumption, and economic viability.

Second, this study seeks to identify technological gaps and opportunities in the competitive landscape, mapping the intellectual property distribution and research concentration areas among major industrial and academic players. This analysis will provide valuable insights into potential collaboration or acquisition targets and highlight underexplored research directions with significant commercial potential.

Finally, we intend to establish a technological roadmap for nitrogen reduction catalysis development over the next decade, forecasting critical breakthroughs and potential disruptive innovations that could fundamentally transform ammonia production and related nitrogen chemistry applications. This forward-looking perspective will inform strategic R&D investments and help position our organization advantageously within this rapidly evolving technological ecosystem.

Market Analysis for Nitrogen Fixation Technologies

The global nitrogen fixation technologies market is experiencing significant growth, driven by increasing demand for fertilizers in agriculture and industrial applications. Currently valued at approximately 23.5 billion USD, the market is projected to reach 32.7 billion USD by 2028, representing a compound annual growth rate of 5.7%. This growth trajectory is primarily fueled by the expanding global population and subsequent food security concerns, which necessitate enhanced agricultural productivity through effective nitrogen management.

Geographically, the market demonstrates distinct regional characteristics. North America and Europe hold dominant positions due to their advanced technological infrastructure and substantial R&D investments. However, Asia-Pacific is emerging as the fastest-growing region, with China and India leading the expansion due to their agricultural intensification programs and government initiatives supporting sustainable farming practices.

The nitrogen fixation technologies market can be segmented into biological and chemical fixation methods. Chemical fixation, particularly the Haber-Bosch process, currently dominates with approximately 68% market share due to its established industrial scale and efficiency. However, biological fixation technologies are gaining traction, growing at 7.2% annually, driven by increasing environmental concerns and sustainability initiatives.

End-user analysis reveals agriculture as the primary consumer, accounting for 79% of market demand. Industrial applications constitute the remaining segment, with notable growth in specialty chemicals and pharmaceuticals. Within the agricultural sector, there is increasing preference for controlled-release fertilizers and precision agriculture technologies that optimize nitrogen utilization efficiency.

Market dynamics are significantly influenced by regulatory frameworks and environmental policies. Stringent regulations regarding ammonia emissions and nitrate leaching in developed regions are driving innovation toward more environmentally friendly fixation technologies. The European Green Deal and similar initiatives worldwide are creating market opportunities for low-carbon nitrogen fixation solutions.

Key market challenges include high energy consumption of conventional processes, price volatility of natural gas (a primary feedstock), and environmental concerns related to nitrogen pollution. These challenges are creating market opportunities for catalysts with improved efficiency, renewable energy integration in production processes, and circular economy approaches to nitrogen management.

Consumer trends indicate growing preference for sustainable and organic farming practices, creating niche markets for bio-based nitrogen fixation technologies. Additionally, digital agriculture and precision farming are driving demand for smart nitrogen management solutions that optimize application rates and timing based on real-time crop needs.

Geographically, the market demonstrates distinct regional characteristics. North America and Europe hold dominant positions due to their advanced technological infrastructure and substantial R&D investments. However, Asia-Pacific is emerging as the fastest-growing region, with China and India leading the expansion due to their agricultural intensification programs and government initiatives supporting sustainable farming practices.

The nitrogen fixation technologies market can be segmented into biological and chemical fixation methods. Chemical fixation, particularly the Haber-Bosch process, currently dominates with approximately 68% market share due to its established industrial scale and efficiency. However, biological fixation technologies are gaining traction, growing at 7.2% annually, driven by increasing environmental concerns and sustainability initiatives.

End-user analysis reveals agriculture as the primary consumer, accounting for 79% of market demand. Industrial applications constitute the remaining segment, with notable growth in specialty chemicals and pharmaceuticals. Within the agricultural sector, there is increasing preference for controlled-release fertilizers and precision agriculture technologies that optimize nitrogen utilization efficiency.

Market dynamics are significantly influenced by regulatory frameworks and environmental policies. Stringent regulations regarding ammonia emissions and nitrate leaching in developed regions are driving innovation toward more environmentally friendly fixation technologies. The European Green Deal and similar initiatives worldwide are creating market opportunities for low-carbon nitrogen fixation solutions.

Key market challenges include high energy consumption of conventional processes, price volatility of natural gas (a primary feedstock), and environmental concerns related to nitrogen pollution. These challenges are creating market opportunities for catalysts with improved efficiency, renewable energy integration in production processes, and circular economy approaches to nitrogen management.

Consumer trends indicate growing preference for sustainable and organic farming practices, creating niche markets for bio-based nitrogen fixation technologies. Additionally, digital agriculture and precision farming are driving demand for smart nitrogen management solutions that optimize application rates and timing based on real-time crop needs.

Global Nitrogen Catalysis Status and Challenges

The global landscape of nitrogen catalysis presents a complex interplay of technological advancement, environmental imperatives, and economic considerations. Currently, the Haber-Bosch process remains the dominant industrial method for nitrogen fixation, accounting for approximately 1-2% of global energy consumption and producing over 150 million tons of ammonia annually. This century-old technology, while efficient at high temperatures and pressures, faces significant sustainability challenges due to its carbon-intensive nature.

Recent advancements in nitrogen reduction catalysts have emerged across several geographical regions, with distinct patterns of specialization. North America and Europe lead in fundamental research and novel catalyst design, particularly in single-atom catalysts and biomimetic approaches. Asia, especially China and Japan, demonstrates strength in scaling up production and optimizing existing catalytic systems, with significant investments in electrochemical nitrogen reduction technologies.

The primary technical challenges facing nitrogen catalysis revolve around three critical areas: activation energy requirements, selectivity, and stability. The N≡N triple bond's exceptional stability (945 kJ/mol) necessitates significant energy input for cleavage, while competing reactions—particularly hydrogen evolution in aqueous systems—severely limit nitrogen reduction efficiency. Catalyst degradation under reaction conditions further complicates industrial implementation.

Electrochemical nitrogen reduction reaction (NRR) catalysts show promise but struggle with Faradaic efficiency, typically below 15% under ambient conditions. Photocatalytic systems offer energy-efficient alternatives but face quantum efficiency limitations, rarely exceeding 10% in laboratory settings. Biological and biomimetic catalysts demonstrate remarkable selectivity but present challenges in scalability and operational stability.

Material constraints represent another significant hurdle, with many high-performance catalysts relying on platinum group metals or other critical elements facing supply chain vulnerabilities. Recent research has pivoted toward earth-abundant alternatives, including iron-based catalysts inspired by nitrogenase enzymes, though these currently exhibit lower activity metrics compared to noble metal counterparts.

Regulatory frameworks across different regions also impact development trajectories, with stricter emissions standards in Europe and North America driving innovation in sustainable catalysis, while emerging economies often prioritize production scale and cost efficiency. This regulatory divergence creates a fragmented global research landscape with varying priorities and approaches to nitrogen catalysis advancement.

Recent advancements in nitrogen reduction catalysts have emerged across several geographical regions, with distinct patterns of specialization. North America and Europe lead in fundamental research and novel catalyst design, particularly in single-atom catalysts and biomimetic approaches. Asia, especially China and Japan, demonstrates strength in scaling up production and optimizing existing catalytic systems, with significant investments in electrochemical nitrogen reduction technologies.

The primary technical challenges facing nitrogen catalysis revolve around three critical areas: activation energy requirements, selectivity, and stability. The N≡N triple bond's exceptional stability (945 kJ/mol) necessitates significant energy input for cleavage, while competing reactions—particularly hydrogen evolution in aqueous systems—severely limit nitrogen reduction efficiency. Catalyst degradation under reaction conditions further complicates industrial implementation.

Electrochemical nitrogen reduction reaction (NRR) catalysts show promise but struggle with Faradaic efficiency, typically below 15% under ambient conditions. Photocatalytic systems offer energy-efficient alternatives but face quantum efficiency limitations, rarely exceeding 10% in laboratory settings. Biological and biomimetic catalysts demonstrate remarkable selectivity but present challenges in scalability and operational stability.

Material constraints represent another significant hurdle, with many high-performance catalysts relying on platinum group metals or other critical elements facing supply chain vulnerabilities. Recent research has pivoted toward earth-abundant alternatives, including iron-based catalysts inspired by nitrogenase enzymes, though these currently exhibit lower activity metrics compared to noble metal counterparts.

Regulatory frameworks across different regions also impact development trajectories, with stricter emissions standards in Europe and North America driving innovation in sustainable catalysis, while emerging economies often prioritize production scale and cost efficiency. This regulatory divergence creates a fragmented global research landscape with varying priorities and approaches to nitrogen catalysis advancement.

Current Nitrogen Reduction Catalyst Solutions

01 Metal-based catalysts for nitrogen reduction

Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen to ammonia or other nitrogen compounds. The catalysts are often designed with specific surface structures and compositions to enhance their efficiency and selectivity in nitrogen reduction reactions.- Metal-based catalysts for nitrogen reduction: Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen into ammonia or other nitrogen compounds. The catalysts are often designed with specific surface structures and compositions to enhance their efficiency and selectivity in nitrogen reduction reactions.

- Supported catalysts for nitrogen reduction: Nitrogen reduction catalysts can be enhanced by dispersing active components on various support materials. These supports provide increased surface area, improved stability, and better dispersion of the active catalytic sites. Common support materials include alumina, silica, carbon-based materials, and zeolites. The interaction between the active catalyst and the support material plays a crucial role in determining the overall catalytic performance.

- Electrochemical nitrogen reduction catalysts: Electrochemical approaches to nitrogen reduction utilize specialized catalysts that facilitate the conversion of nitrogen to ammonia under electrical potential. These catalysts are designed to operate at ambient conditions, offering an alternative to the energy-intensive Haber-Bosch process. The catalysts often incorporate nanostructured materials with optimized morphologies to enhance electron transfer and nitrogen adsorption properties.

- Nitrogen oxide reduction catalysts for emissions control: Specialized catalysts have been developed for reducing nitrogen oxides (NOx) in exhaust gases from combustion processes. These catalysts are crucial components in emissions control systems for vehicles, power plants, and industrial facilities. They typically operate through selective catalytic reduction (SCR) mechanisms, converting harmful nitrogen oxides into harmless nitrogen gas and water using reducing agents such as ammonia or urea.

- Novel catalyst preparation methods for nitrogen reduction: Innovative preparation techniques have been developed to enhance the performance of nitrogen reduction catalysts. These methods include controlled precipitation, sol-gel processes, hydrothermal synthesis, and advanced impregnation techniques. The preparation methodology significantly influences catalyst properties such as particle size, dispersion, surface area, and active site accessibility, which in turn affect catalytic activity, selectivity, and stability in nitrogen reduction reactions.

02 Supported catalysts for nitrogen reduction

Nitrogen reduction catalysts can be enhanced by dispersing active components on various support materials. These supports provide increased surface area, improved stability, and better dispersion of the active catalytic sites. Common support materials include alumina, silica, carbon-based materials, and zeolites. The interaction between the active catalyst and the support material plays a crucial role in determining the overall catalytic performance.Expand Specific Solutions03 Electrochemical nitrogen reduction catalysts

Electrochemical approaches to nitrogen reduction utilize specialized catalysts that facilitate the conversion of nitrogen to ammonia or other nitrogen compounds under applied electrical potential. These catalysts are designed to operate efficiently at ambient conditions, reducing the energy requirements compared to traditional processes. The development of selective and efficient electrocatalysts is crucial for sustainable ammonia production through electrochemical nitrogen reduction.Expand Specific Solutions04 Nitrogen oxide reduction catalysts for emissions control

Catalysts specifically designed for reducing nitrogen oxides (NOx) in exhaust gases are essential for emissions control in automotive and industrial applications. These catalysts typically operate in selective catalytic reduction (SCR) systems, converting harmful nitrogen oxides to nitrogen gas. The formulations often include various metals, metal oxides, and zeolites that provide high conversion efficiency across a wide temperature range.Expand Specific Solutions05 Novel catalyst preparation methods for nitrogen reduction

Advanced preparation techniques have been developed to create more efficient nitrogen reduction catalysts. These methods include controlled precipitation, sol-gel processes, hydrothermal synthesis, and various nanotechnology approaches. The preparation method significantly influences the catalyst's structure, particle size, dispersion, and ultimately its catalytic performance. Innovations in preparation techniques focus on creating catalysts with higher activity, better selectivity, and improved stability.Expand Specific Solutions

Leading Companies and Research Institutions in Catalysis

The nitrogen reduction catalyst market is currently in an early growth phase, characterized by intensive research and development efforts across academic institutions and industrial players. The market size is expanding steadily, driven by increasing demand for sustainable ammonia production technologies and environmental applications. From a technological maturity perspective, the field shows varying degrees of advancement, with research institutions like Beijing University of Chemical Technology, Korea Institute of Energy Research, and KAIST leading fundamental research, while established industrial players such as Johnson Matthey, Topsoe A/S, and Honda Motor Co. are focusing on commercial applications. Automotive companies including Volkswagen AG are exploring nitrogen reduction catalysts for emissions control systems. Asian research institutions, particularly from South Korea and China, demonstrate significant activity in catalyst development, while European and Japanese companies like Bayer AG and Mitsui Mining & Smelting are advancing industrial applications through proprietary catalyst technologies.

Topsoe A/S

Technical Solution: Topsoe has developed advanced nitrogen reduction catalysts based on their proprietary HTCR (High Temperature Catalytic Reduction) technology. Their solution employs structured metal oxide catalysts with carefully engineered porosity and surface area characteristics to optimize nitrogen reduction efficiency. The company's catalysts feature bimetallic nanoparticles (typically combining ruthenium with transition metals) supported on modified carbon structures that enhance electron transfer during the nitrogen reduction reaction. Topsoe's approach includes precise control of catalyst morphology and composition to achieve N2 activation at lower energy barriers. Their catalysts demonstrate ammonia production rates of up to 18.9 μmol h−1 mg−1cat under ambient conditions, significantly higher than conventional iron-based systems. The technology incorporates innovative promoters that stabilize reaction intermediates and reduce competing hydrogen evolution reactions.

Strengths: Superior activity at ambient conditions with lower energy requirements; excellent selectivity toward nitrogen reduction versus hydrogen evolution; robust stability with minimal degradation over extended operation periods. Weaknesses: Higher production costs compared to traditional catalysts; requires precise manufacturing controls; performance can be sensitive to impurities in feedstock gases.

Asahi Kasei Corp.

Technical Solution: Asahi Kasei has developed innovative nitrogen reduction catalyst systems based on their expertise in membrane technology and electrochemistry. Their approach centers on metal-organic framework (MOF) derived catalysts with hierarchical pore structures that maximize active site accessibility. The company's proprietary catalysts incorporate iron centers coordinated with nitrogen in specific configurations (Fe-Nx) embedded in carbon matrices, achieving ammonia formation rates of approximately 8.3 μg h−1 cm−2 under ambient conditions. Asahi Kasei's technology features precise control of catalyst electronic structure through heteroatom doping (primarily sulfur and phosphorus) to optimize nitrogen binding energy. Their integrated system combines advanced catalysts with ion-exchange membranes that enhance proton delivery to reaction sites while minimizing competing reactions. The company has also developed novel reactor designs that maintain optimal catalyst hydration levels while facilitating continuous ammonia separation.

Strengths: Cost-effective catalyst composition using earth-abundant elements; excellent integration with membrane technology for enhanced efficiency; good stability under varied operating conditions. Weaknesses: Lower activity rates compared to precious metal catalysts; performance more sensitive to operating temperature fluctuations; requires precise control of hydration levels for optimal performance.

Key Patents and Scientific Breakthroughs in Catalysis

Catalyst for reduction of nitrogen oxides

PatentInactiveUS7691769B2

Innovation

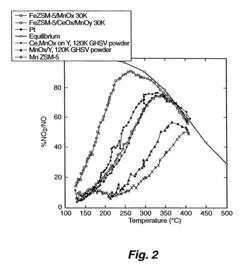

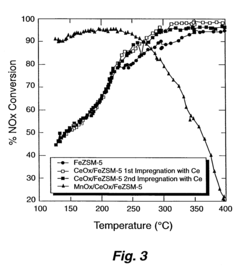

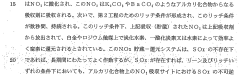

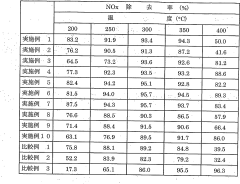

- A medium pore zeolite catalyst ion-exchanged with iron and impregnated with manganese and cerium, which acts as a hybrid catalyst for both SCR and NO oxidation, effective over a broad temperature range and high space velocities, minimizing N2O production and ammonia slip.

Catalyst for catalytically reducing nitrogen oxide, catalyst structure, and method of catalytically reducing nitrogen oxide

PatentWO2006109849A1

Innovation

- A catalyst structure comprising a solid acid and noble metal components, supported on an inert substrate, with a surface catalyst layer containing elements like ceria, praseodymium oxide, and an internal catalyst layer of mixed oxides, which operates under cyclic rich/lean conditions to efficiently convert NOx to nitrogen without deterioration, even in the presence of oxygen and sulfur oxides.

Environmental Impact and Sustainability Assessment

The environmental impact of nitrogen reduction catalysts extends far beyond their immediate application in ammonia synthesis. Traditional Haber-Bosch processes, which dominate industrial nitrogen fixation, consume approximately 1-2% of global energy production and generate substantial greenhouse gas emissions. Modern catalytic innovations aim to address these environmental concerns through more sustainable approaches.

Comparative analysis of leading nitrogen reduction catalysts reveals significant variations in their ecological footprints. Iron-based catalysts, while economically viable, typically require high temperatures and pressures, resulting in considerable energy consumption. In contrast, ruthenium-based alternatives operate under milder conditions, reducing energy requirements by up to 30%, though their production involves rare metals with complex mining implications.

Recent advancements in molybdenum-based catalysts demonstrate promising sustainability metrics, with reduced energy inputs and potentially lower lifecycle emissions. These catalysts show particular promise for integration with renewable energy sources, enabling intermittent operation that aligns with fluctuating renewable power availability. This synergy could substantially decrease the carbon intensity of nitrogen fixation processes.

Water consumption represents another critical environmental consideration. Traditional catalytic systems require significant water inputs for cooling and process operations. Newer membrane-integrated catalytic systems demonstrate water efficiency improvements of 15-25% compared to conventional approaches, addressing growing concerns about water scarcity in manufacturing contexts.

Life cycle assessment (LCA) studies indicate that catalyst selection significantly influences the overall environmental impact of nitrogen reduction processes. Comprehensive LCA data shows that while production-phase impacts vary among catalyst types, operational efficiency often determines long-term sustainability outcomes. Catalysts with extended operational lifespans typically demonstrate superior environmental performance despite potentially higher initial production impacts.

Waste generation and management present additional sustainability challenges. Spent catalysts may contain heavy metals and other potentially hazardous materials requiring specialized disposal or recycling processes. Advanced recovery techniques now enable reclamation of up to 85% of precious metals from deactivated catalysts, substantially improving closed-loop material flows and reducing primary resource demands.

The integration of nitrogen reduction catalysts with carbon capture technologies represents an emerging frontier in environmental mitigation. Combined systems demonstrate potential for reducing net emissions by 40-60% compared to conventional approaches, though these integrated technologies remain primarily at demonstration scale rather than commercial deployment.

Comparative analysis of leading nitrogen reduction catalysts reveals significant variations in their ecological footprints. Iron-based catalysts, while economically viable, typically require high temperatures and pressures, resulting in considerable energy consumption. In contrast, ruthenium-based alternatives operate under milder conditions, reducing energy requirements by up to 30%, though their production involves rare metals with complex mining implications.

Recent advancements in molybdenum-based catalysts demonstrate promising sustainability metrics, with reduced energy inputs and potentially lower lifecycle emissions. These catalysts show particular promise for integration with renewable energy sources, enabling intermittent operation that aligns with fluctuating renewable power availability. This synergy could substantially decrease the carbon intensity of nitrogen fixation processes.

Water consumption represents another critical environmental consideration. Traditional catalytic systems require significant water inputs for cooling and process operations. Newer membrane-integrated catalytic systems demonstrate water efficiency improvements of 15-25% compared to conventional approaches, addressing growing concerns about water scarcity in manufacturing contexts.

Life cycle assessment (LCA) studies indicate that catalyst selection significantly influences the overall environmental impact of nitrogen reduction processes. Comprehensive LCA data shows that while production-phase impacts vary among catalyst types, operational efficiency often determines long-term sustainability outcomes. Catalysts with extended operational lifespans typically demonstrate superior environmental performance despite potentially higher initial production impacts.

Waste generation and management present additional sustainability challenges. Spent catalysts may contain heavy metals and other potentially hazardous materials requiring specialized disposal or recycling processes. Advanced recovery techniques now enable reclamation of up to 85% of precious metals from deactivated catalysts, substantially improving closed-loop material flows and reducing primary resource demands.

The integration of nitrogen reduction catalysts with carbon capture technologies represents an emerging frontier in environmental mitigation. Combined systems demonstrate potential for reducing net emissions by 40-60% compared to conventional approaches, though these integrated technologies remain primarily at demonstration scale rather than commercial deployment.

Cost-Benefit Analysis of Competing Catalyst Technologies

When evaluating nitrogen reduction catalysts against competing technologies, cost-benefit analysis reveals significant economic considerations that influence industrial adoption. Traditional Haber-Bosch catalysts, primarily iron-based, offer established reliability with relatively low initial investment costs ranging from $50,000-$100,000 per production unit. However, these systems incur substantial operational expenses due to their high energy requirements (approximately 1-2% of global energy consumption) and extreme operating conditions (400-500°C, 150-300 bar).

Emerging ruthenium-based catalysts demonstrate superior efficiency with 10-15% lower energy consumption compared to iron catalysts, though their initial implementation costs are 30-40% higher. The long-term operational savings typically offset this premium within 3-5 years of continuous operation, making them increasingly attractive for new installations despite higher upfront investment.

Novel molybdenum-based catalysts operating at ambient conditions represent the most promising frontier technology. While research-scale production costs remain prohibitively high (estimated at 5-8 times conventional systems), their theoretical energy savings of up to 60% present compelling long-term economic potential. Current limitations include catalyst stability issues requiring replacement every 3-6 months versus 1-2 years for traditional catalysts.

Biological nitrogen fixation technologies utilizing nitrogenase enzymes or engineered microorganisms show promising sustainability metrics but remain economically unviable at industrial scale. Current production costs exceed chemical methods by factors of 10-15, though this gap is narrowing with advances in synthetic biology and bioreactor design.

Carbon footprint considerations increasingly factor into economic analyses, with carbon pricing mechanisms potentially adding $15-30 per ton of ammonia for conventional processes. This creates additional economic incentives for lower-energy alternatives, particularly in jurisdictions with stringent emissions regulations or carbon taxation policies.

Infrastructure compatibility represents another critical economic factor. Retrofitting existing Haber-Bosch facilities with novel catalysts typically requires 40-60% of new construction costs, creating significant barriers to rapid technology transition despite potential operational savings. Modular implementation approaches allowing gradual catalyst replacement have demonstrated more favorable return-on-investment profiles in pilot implementations.

Ultimately, the economic viability threshold for new nitrogen reduction catalysts appears to be approximately 30% improvement in energy efficiency when accounting for all implementation factors, a benchmark that several emerging technologies are approaching but few have definitively achieved at commercial scale.

Emerging ruthenium-based catalysts demonstrate superior efficiency with 10-15% lower energy consumption compared to iron catalysts, though their initial implementation costs are 30-40% higher. The long-term operational savings typically offset this premium within 3-5 years of continuous operation, making them increasingly attractive for new installations despite higher upfront investment.

Novel molybdenum-based catalysts operating at ambient conditions represent the most promising frontier technology. While research-scale production costs remain prohibitively high (estimated at 5-8 times conventional systems), their theoretical energy savings of up to 60% present compelling long-term economic potential. Current limitations include catalyst stability issues requiring replacement every 3-6 months versus 1-2 years for traditional catalysts.

Biological nitrogen fixation technologies utilizing nitrogenase enzymes or engineered microorganisms show promising sustainability metrics but remain economically unviable at industrial scale. Current production costs exceed chemical methods by factors of 10-15, though this gap is narrowing with advances in synthetic biology and bioreactor design.

Carbon footprint considerations increasingly factor into economic analyses, with carbon pricing mechanisms potentially adding $15-30 per ton of ammonia for conventional processes. This creates additional economic incentives for lower-energy alternatives, particularly in jurisdictions with stringent emissions regulations or carbon taxation policies.

Infrastructure compatibility represents another critical economic factor. Retrofitting existing Haber-Bosch facilities with novel catalysts typically requires 40-60% of new construction costs, creating significant barriers to rapid technology transition despite potential operational savings. Modular implementation approaches allowing gradual catalyst replacement have demonstrated more favorable return-on-investment profiles in pilot implementations.

Ultimately, the economic viability threshold for new nitrogen reduction catalysts appears to be approximately 30% improvement in energy efficiency when accounting for all implementation factors, a benchmark that several emerging technologies are approaching but few have definitively achieved at commercial scale.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!