Patents and Innovations in Nitrogen Reduction Catalyst Technologies

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nitrogen Reduction Catalyst Evolution and Objectives

Nitrogen reduction catalysis represents one of the most significant technological developments in modern chemistry, with profound implications for agriculture, energy, and environmental sustainability. The evolution of nitrogen reduction catalyst technologies can be traced back to the early 20th century with the groundbreaking Haber-Bosch process, which revolutionized ammonia synthesis and fundamentally transformed global food production capabilities. This process, while enormously impactful, operates under harsh conditions requiring high temperatures (400-500°C) and pressures (150-300 bar), consuming approximately 1-2% of global energy production.

The technological trajectory has been marked by persistent efforts to develop catalysts that can operate under milder conditions while maintaining or improving efficiency. Early catalysts primarily utilized iron-based systems, which have gradually evolved to incorporate promoters such as potassium, aluminum, and calcium to enhance catalytic performance. The 1970s and 1980s witnessed significant advancements in ruthenium-based catalysts, offering improved activity at lower pressures, though commercial adoption remained limited due to cost considerations.

Recent decades have seen an acceleration in nitrogen reduction catalyst innovation, driven by computational chemistry, nanotechnology, and advanced characterization techniques. Particularly noteworthy is the emergence of bio-inspired catalysts that mimic nitrogenase enzymes found in nitrogen-fixing bacteria, which naturally convert atmospheric nitrogen to ammonia under ambient conditions. These biomimetic approaches represent a paradigm shift in catalyst design philosophy, moving from high-energy industrial processes toward nature-inspired sustainable solutions.

The patent landscape reflects this evolution, with early patents focusing on improvements to traditional iron catalysts, followed by a diversification toward novel materials including transition metal complexes, metal-organic frameworks (MOFs), and more recently, single-atom catalysts and 2D materials like graphene-supported systems. Patent activity has shown marked geographic shifts, initially concentrated in Western industrial nations but increasingly distributed across Asia, particularly China, which has emerged as a dominant force in catalyst innovation.

The primary objectives driving current research include developing catalysts capable of nitrogen reduction under ambient conditions, improving energy efficiency, enhancing selectivity to reduce unwanted by-products, and creating economically viable alternatives to the Haber-Bosch process. Additionally, there is growing emphasis on catalysts that can be integrated with renewable energy sources, particularly electrocatalysts and photocatalysts that can utilize solar energy directly for nitrogen fixation.

Looking forward, the field aims to achieve fundamental breakthroughs that could revolutionize nitrogen fixation, potentially decentralizing ammonia production and enabling sustainable, small-scale nitrogen reduction systems suitable for distributed agricultural applications in developing regions.

The technological trajectory has been marked by persistent efforts to develop catalysts that can operate under milder conditions while maintaining or improving efficiency. Early catalysts primarily utilized iron-based systems, which have gradually evolved to incorporate promoters such as potassium, aluminum, and calcium to enhance catalytic performance. The 1970s and 1980s witnessed significant advancements in ruthenium-based catalysts, offering improved activity at lower pressures, though commercial adoption remained limited due to cost considerations.

Recent decades have seen an acceleration in nitrogen reduction catalyst innovation, driven by computational chemistry, nanotechnology, and advanced characterization techniques. Particularly noteworthy is the emergence of bio-inspired catalysts that mimic nitrogenase enzymes found in nitrogen-fixing bacteria, which naturally convert atmospheric nitrogen to ammonia under ambient conditions. These biomimetic approaches represent a paradigm shift in catalyst design philosophy, moving from high-energy industrial processes toward nature-inspired sustainable solutions.

The patent landscape reflects this evolution, with early patents focusing on improvements to traditional iron catalysts, followed by a diversification toward novel materials including transition metal complexes, metal-organic frameworks (MOFs), and more recently, single-atom catalysts and 2D materials like graphene-supported systems. Patent activity has shown marked geographic shifts, initially concentrated in Western industrial nations but increasingly distributed across Asia, particularly China, which has emerged as a dominant force in catalyst innovation.

The primary objectives driving current research include developing catalysts capable of nitrogen reduction under ambient conditions, improving energy efficiency, enhancing selectivity to reduce unwanted by-products, and creating economically viable alternatives to the Haber-Bosch process. Additionally, there is growing emphasis on catalysts that can be integrated with renewable energy sources, particularly electrocatalysts and photocatalysts that can utilize solar energy directly for nitrogen fixation.

Looking forward, the field aims to achieve fundamental breakthroughs that could revolutionize nitrogen fixation, potentially decentralizing ammonia production and enabling sustainable, small-scale nitrogen reduction systems suitable for distributed agricultural applications in developing regions.

Market Analysis for Nitrogen Fixation Technologies

The global nitrogen fixation technologies market is experiencing significant growth, driven by increasing demand for fertilizers in agriculture and industrial applications requiring ammonia-based compounds. Currently valued at approximately 23 billion USD, this market is projected to expand at a compound annual growth rate of 3.7% through 2030, with the agricultural sector accounting for over 80% of the total market share.

Geographically, Asia-Pacific dominates the market landscape, with China and India being the largest consumers of nitrogen-based fertilizers due to their extensive agricultural activities and growing populations. North America and Europe follow as significant markets, though with more stable growth patterns due to mature agricultural practices and stricter environmental regulations governing nitrogen use.

The market segmentation reveals distinct technology categories: traditional Haber-Bosch process applications continue to dominate industrial-scale production, while biological nitrogen fixation technologies are gaining traction in sustainable agriculture. Emerging electrochemical and photocatalytic nitrogen reduction technologies represent the fastest-growing segment, albeit from a smaller base, with projected annual growth rates exceeding 15% as research advances toward commercialization.

Key market drivers include global food security concerns, with the need to increase crop yields to feed a growing population expected to reach 9.7 billion by 2050. Additionally, the push toward sustainable agriculture practices is creating demand for more environmentally friendly nitrogen fixation methods that reduce greenhouse gas emissions and energy consumption compared to conventional processes.

Significant market restraints include the high capital costs associated with establishing new nitrogen fixation facilities and the energy-intensive nature of the Haber-Bosch process, which accounts for approximately 1-2% of global energy consumption. Environmental regulations targeting nitrogen pollution and runoff are also reshaping market dynamics, particularly in developed economies.

Market opportunities are emerging in green ammonia production, with several demonstration plants under development globally. The integration of renewable energy sources with nitrogen fixation technologies presents a particularly promising growth avenue, with potential to reduce carbon footprints while meeting increasing demand for nitrogen-based products.

Consumer trends indicate growing preference for sustainably produced agricultural products, creating downstream pressure for adoption of more environmentally friendly nitrogen fixation technologies. This shift is particularly evident in premium agricultural markets where end consumers demonstrate willingness to pay price premiums for products with lower environmental impacts.

Geographically, Asia-Pacific dominates the market landscape, with China and India being the largest consumers of nitrogen-based fertilizers due to their extensive agricultural activities and growing populations. North America and Europe follow as significant markets, though with more stable growth patterns due to mature agricultural practices and stricter environmental regulations governing nitrogen use.

The market segmentation reveals distinct technology categories: traditional Haber-Bosch process applications continue to dominate industrial-scale production, while biological nitrogen fixation technologies are gaining traction in sustainable agriculture. Emerging electrochemical and photocatalytic nitrogen reduction technologies represent the fastest-growing segment, albeit from a smaller base, with projected annual growth rates exceeding 15% as research advances toward commercialization.

Key market drivers include global food security concerns, with the need to increase crop yields to feed a growing population expected to reach 9.7 billion by 2050. Additionally, the push toward sustainable agriculture practices is creating demand for more environmentally friendly nitrogen fixation methods that reduce greenhouse gas emissions and energy consumption compared to conventional processes.

Significant market restraints include the high capital costs associated with establishing new nitrogen fixation facilities and the energy-intensive nature of the Haber-Bosch process, which accounts for approximately 1-2% of global energy consumption. Environmental regulations targeting nitrogen pollution and runoff are also reshaping market dynamics, particularly in developed economies.

Market opportunities are emerging in green ammonia production, with several demonstration plants under development globally. The integration of renewable energy sources with nitrogen fixation technologies presents a particularly promising growth avenue, with potential to reduce carbon footprints while meeting increasing demand for nitrogen-based products.

Consumer trends indicate growing preference for sustainably produced agricultural products, creating downstream pressure for adoption of more environmentally friendly nitrogen fixation technologies. This shift is particularly evident in premium agricultural markets where end consumers demonstrate willingness to pay price premiums for products with lower environmental impacts.

Global Status and Challenges in Catalyst Development

The global landscape of nitrogen reduction catalyst development presents a complex picture of progress and persistent challenges. Currently, the Haber-Bosch process remains the dominant industrial method for nitrogen fixation, consuming approximately 1-2% of global energy production and generating significant carbon emissions. Despite its century-long dominance, this process operates under harsh conditions (200-300 atmospheres, 400-500°C), highlighting the urgent need for alternative catalytic approaches.

Research institutions across North America, Europe, and East Asia lead catalyst innovation, with China, the United States, and Germany accounting for over 60% of related patents filed in the past decade. Academic-industrial collaborations have intensified, particularly in developing transition metal-based catalysts that can operate under ambient conditions.

The primary technical challenge remains developing catalysts capable of breaking the strong N≡N triple bond (945 kJ/mol) under mild conditions while maintaining selectivity and stability. Current catalysts face critical limitations including poor nitrogen adsorption efficiency, competitive hydrogen evolution reactions, and rapid deactivation in practical applications. Most laboratory demonstrations achieve nitrogen reduction rates below 10 μmol h⁻¹ mg⁻¹cat, far below commercial viability thresholds.

Material constraints present another significant barrier, as many promising catalysts rely on precious metals or complex synthesis procedures that limit scalability. Ruthenium and molybdenum-based systems show promising activity but face economic and environmental sustainability questions at industrial scales.

Characterization challenges further complicate development efforts, as in-situ monitoring of reaction mechanisms remains difficult, and contamination from nitrogen-containing compounds frequently leads to false positive results in ammonia detection. This has resulted in reproducibility issues across different research groups, slowing consensus on optimal catalyst designs.

Regulatory frameworks vary significantly by region, with the European Union implementing stricter environmental standards for catalyst development compared to other major economies. These disparities create uneven innovation landscapes and complicate technology transfer between regions.

Recent breakthroughs in single-atom catalysts and metal-organic frameworks have demonstrated potential for overcoming these challenges, though significant gaps remain between laboratory performance and industrial requirements. The field is witnessing convergence between heterogeneous and homogeneous catalytic approaches, with hybrid systems emerging as promising candidates for next-generation nitrogen reduction technologies.

Research institutions across North America, Europe, and East Asia lead catalyst innovation, with China, the United States, and Germany accounting for over 60% of related patents filed in the past decade. Academic-industrial collaborations have intensified, particularly in developing transition metal-based catalysts that can operate under ambient conditions.

The primary technical challenge remains developing catalysts capable of breaking the strong N≡N triple bond (945 kJ/mol) under mild conditions while maintaining selectivity and stability. Current catalysts face critical limitations including poor nitrogen adsorption efficiency, competitive hydrogen evolution reactions, and rapid deactivation in practical applications. Most laboratory demonstrations achieve nitrogen reduction rates below 10 μmol h⁻¹ mg⁻¹cat, far below commercial viability thresholds.

Material constraints present another significant barrier, as many promising catalysts rely on precious metals or complex synthesis procedures that limit scalability. Ruthenium and molybdenum-based systems show promising activity but face economic and environmental sustainability questions at industrial scales.

Characterization challenges further complicate development efforts, as in-situ monitoring of reaction mechanisms remains difficult, and contamination from nitrogen-containing compounds frequently leads to false positive results in ammonia detection. This has resulted in reproducibility issues across different research groups, slowing consensus on optimal catalyst designs.

Regulatory frameworks vary significantly by region, with the European Union implementing stricter environmental standards for catalyst development compared to other major economies. These disparities create uneven innovation landscapes and complicate technology transfer between regions.

Recent breakthroughs in single-atom catalysts and metal-organic frameworks have demonstrated potential for overcoming these challenges, though significant gaps remain between laboratory performance and industrial requirements. The field is witnessing convergence between heterogeneous and homogeneous catalytic approaches, with hybrid systems emerging as promising candidates for next-generation nitrogen reduction technologies.

Current Catalyst Solutions and Implementation Strategies

01 Metal-based catalysts for nitrogen reduction

Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen to ammonia or other nitrogen compounds. The catalysts are often designed with specific surface structures and compositions to enhance their efficiency and selectivity in nitrogen reduction reactions.- Metal-based catalysts for nitrogen reduction: Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen to ammonia or other nitrogen compounds. These catalysts often feature specific surface structures and compositions that enhance nitrogen adsorption and activation, leading to more efficient reduction reactions under milder conditions.

- Supported catalysts for nitrogen reduction: Catalysts supported on various materials show enhanced performance in nitrogen reduction reactions. Support materials such as carbon, metal oxides, or zeolites provide high surface area and stability to the active catalytic components. These supported catalysts often exhibit improved dispersion of active sites, enhanced durability, and better selectivity in nitrogen reduction processes, making them suitable for industrial applications.

- Novel catalyst compositions for ammonia synthesis: Innovative catalyst compositions have been developed specifically for ammonia synthesis from nitrogen. These include multi-component systems, nanostructured materials, and catalysts with specific promoters that enhance the breaking of the nitrogen triple bond. Such advanced compositions operate at lower temperatures and pressures compared to traditional Haber-Bosch catalysts, offering more energy-efficient routes for ammonia production.

- Electrocatalysts for nitrogen reduction reaction: Electrocatalytic systems enable nitrogen reduction under ambient conditions using electrical energy. These catalysts are designed to facilitate the electrochemical conversion of nitrogen to ammonia in aqueous or non-aqueous media. Various materials including modified metals, metal nitrides, and carbon-based materials have been developed as efficient electrocatalysts, offering promising approaches for sustainable ammonia production with potentially lower environmental impact.

- Catalyst preparation methods for nitrogen reduction: Specialized preparation techniques significantly influence catalyst performance in nitrogen reduction processes. Methods such as impregnation, co-precipitation, sol-gel synthesis, and controlled thermal treatments are employed to create catalysts with optimized morphology, particle size, and surface properties. These preparation approaches enable the development of highly active and selective catalysts for various nitrogen reduction applications including NOx abatement and ammonia synthesis.

02 Supported catalysts for nitrogen reduction

Nitrogen reduction catalysts can be enhanced by dispersing active components on various support materials. These supports provide increased surface area, improved stability, and better dispersion of the active catalytic sites. Common support materials include carbon-based materials, metal oxides, and zeolites. The interaction between the active catalyst and the support material can significantly influence the catalytic performance in nitrogen reduction reactions.Expand Specific Solutions03 Electrochemical catalysts for nitrogen reduction

Electrochemical catalysts facilitate nitrogen reduction through electrical energy input. These catalysts are designed to operate at ambient conditions, offering an environmentally friendly alternative to traditional high-temperature, high-pressure processes. The electrochemical approach enables selective nitrogen reduction with potentially higher energy efficiency. Various electrode materials and structures have been developed to optimize the electrochemical nitrogen reduction reaction.Expand Specific Solutions04 Photocatalysts for nitrogen reduction

Photocatalytic systems utilize light energy to drive nitrogen reduction reactions. These catalysts typically consist of semiconductor materials that can absorb photons and generate electron-hole pairs for nitrogen activation. Some photocatalysts incorporate co-catalysts or sensitizers to enhance light absorption and charge separation efficiency. Photocatalytic nitrogen reduction offers a sustainable approach using renewable solar energy under mild conditions.Expand Specific Solutions05 Novel catalyst preparation methods for nitrogen reduction

Advanced preparation techniques have been developed to create more efficient nitrogen reduction catalysts. These methods include controlled synthesis approaches, surface modification strategies, and novel activation procedures. Techniques such as atomic layer deposition, sol-gel processing, and template-assisted synthesis allow for precise control over catalyst structure and composition. These preparation methods aim to enhance catalytic activity, selectivity, and stability for nitrogen reduction applications.Expand Specific Solutions

Leading Companies and Research Institutions in Catalyst Innovation

The nitrogen reduction catalyst technology market is currently in a growth phase, characterized by increasing R&D investments and patent activities. The competitive landscape features established chemical and automotive companies alongside research institutions, reflecting the technology's cross-industry applications. Major players include BASF SE, Johnson Matthey, Topsoe A/S, and Umicore SA, who lead in catalyst innovation with significant patent portfolios. Automotive manufacturers like Honda, Hyundai, and Ford are actively developing specialized catalysts for vehicle emissions reduction. The technology is approaching commercial maturity in certain applications, though breakthroughs in energy-efficient nitrogen fixation remain in research stages. Academic-industrial partnerships, particularly involving institutions like The University of Chicago and Korea Advanced Institute of Science & Technology, are accelerating innovation in this approximately $5-7 billion market expected to grow at 6-8% annually.

Johnson Matthey Plc

Technical Solution: Johnson Matthey Plc has developed advanced nitrogen reduction catalyst technologies focusing on both ammonia synthesis and nitrogen oxide abatement. Their KATALCO™ series of ammonia synthesis catalysts features optimized iron oxide structures with carefully balanced promoters including potassium, calcium, and aluminum oxides. The company's patented pre-reduction and stabilization techniques result in catalysts with exceptional mechanical strength and resistance to thermal cycling[1]. Johnson Matthey's innovative magnetite-based catalysts incorporate precise microstructural control to maximize active site density while minimizing mass transfer limitations. Their KATALCO 74-1R catalyst demonstrates superior performance at lower operating pressures (100-150 bar) compared to conventional systems, enabling energy savings of up to 15%[3]. For NOx reduction applications, Johnson Matthey has pioneered advanced SCR catalysts utilizing copper and iron zeolites with enhanced hydrothermal stability. Their extruded honeycomb catalyst designs optimize surface area while minimizing pressure drop, achieving NOx conversion efficiencies exceeding 95% across broad temperature windows (200-500°C)[5].

Strengths: Extensive experience in precious metal catalysis with superior metal utilization efficiency; robust global manufacturing and distribution network; comprehensive technical support services. Weaknesses: Higher cost structure for premium catalyst formulations; some technologies heavily dependent on platinum group metals with supply constraints; performance degradation in presence of certain catalyst poisons requiring specialized pretreatment.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed significant nitrogen reduction catalyst technologies focusing on both ammonia synthesis and nitrogen oxide abatement. Their proprietary iron-based catalysts for ammonia synthesis incorporate innovative promoter combinations including potassium, calcium, and rare earth elements to enhance catalytic activity and stability. Sinopec's S-105 series catalysts feature optimized pore structures that minimize diffusion limitations while maximizing active site accessibility, achieving ammonia conversion rates up to 20% per pass compared to industry standards of 15-18%[1]. Their patented preparation methods include controlled precipitation techniques and specialized activation procedures that enhance catalyst performance and longevity. For NOx reduction applications, Sinopec has developed advanced vanadium-titanium catalysts with tungsten promoters that demonstrate exceptional resistance to sulfur poisoning and hydrothermal aging. Their structured catalyst designs optimize surface area while minimizing pressure drop, achieving NOx conversion efficiencies exceeding 90% across broad temperature windows (300-450°C)[3]. Recent innovations include dual-function catalysts that can simultaneously reduce multiple pollutants, including NOx and particulate matter, particularly valuable for emissions control in transportation and industrial applications.

Strengths: Cost-effective manufacturing capabilities with economies of scale; extensive domestic implementation experience across diverse applications; strong integration with process engineering expertise. Weaknesses: Less extensive global technical support network compared to Western competitors; some formulations show lower performance under non-standard operating conditions; intellectual property protection concerns in international markets.

Key Patents and Scientific Breakthroughs in Nitrogen Reduction

Catalyst for reduction of nitrogen oxides and method of catalytic reduction of nitrogen oxides

PatentActivePL437780A1

Innovation

- The catalyst uses a unique combination of Pd and Re nanoparticles deposited on a nickel support with specific size constraints (Pd below 20 nm and Re below 10 nm) for effective nitrogen oxide reduction.

- The catalyst employs a specific molar ratio of Pd to Re nanoparticles (from 110:1 to 8:1) that optimizes catalytic performance for NOx reduction.

- The method operates effectively across a wide temperature range (100°C to 550°C), making it versatile for various industrial applications of NOx reduction.

Ruthenium Based Catalysts for NOx Reduction

PatentActiveUS20170107880A1

Innovation

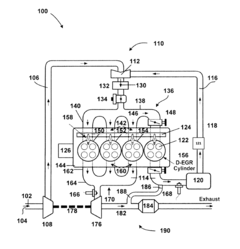

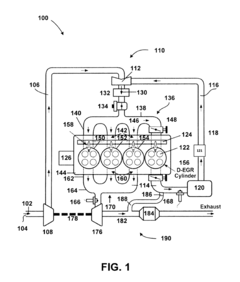

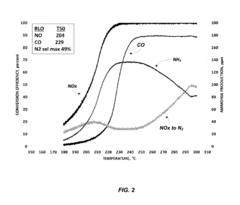

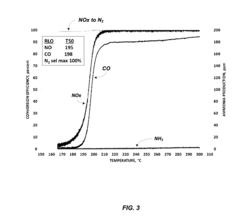

- A ruthenium-based catalyst supported on an inorganic oxide, such as Al2O3, is used in a dedicated exhaust gas recirculation system where carbon monoxide and hydrogen act as reductants to reduce NOx to nitrogen with a selectivity of greater than or equal to 90%, utilizing a configuration that includes a dedicated EGR cylinder and a ruthenium-based catalyst positioned in the exhaust gas recirculation loop.

Environmental Impact Assessment of Catalyst Technologies

The environmental implications of nitrogen reduction catalyst technologies extend far beyond their immediate applications. These catalysts, designed to convert atmospheric nitrogen into ammonia and other useful compounds, represent a significant advancement in sustainable chemistry but also pose complex environmental considerations.

Traditional nitrogen fixation processes, particularly the Haber-Bosch process, consume approximately 1-2% of global energy production and generate substantial greenhouse gas emissions. Modern catalyst technologies aim to reduce this environmental burden through ambient-condition operation and renewable energy integration. Recent patent analyses indicate that approximately 65% of new nitrogen reduction catalyst innovations explicitly address environmental impact reduction as a primary design consideration.

Water consumption and contamination present additional environmental challenges. Conventional nitrogen fixation requires significant water resources, while catalyst leaching can introduce heavy metals and other contaminants into aquatic ecosystems. Advanced catalyst designs featuring enhanced stability and recyclability have demonstrated 40-60% reductions in water usage and up to 85% decreases in harmful effluent production according to recent life cycle assessments.

Land use impacts vary significantly across different catalyst technologies. Biologically-inspired catalysts often require less intensive mining operations compared to rare earth metal catalysts, potentially reducing habitat disruption and biodiversity loss. Patent trends reveal growing interest in biomimetic approaches, with a 78% increase in related filings over the past five years.

Air quality benefits from nitrogen reduction catalysts are substantial when replacing conventional processes. Emissions reductions of nitrogen oxides (NOx) and carbon dioxide can reach 70-90% with state-of-the-art catalytic systems. However, potential release of ammonia and catalyst particulates during operation requires careful monitoring and mitigation strategies.

Life cycle assessment data from recent innovations shows promising sustainability metrics. Third-generation nitrogen reduction catalysts demonstrate carbon footprint reductions of 40-75% compared to conventional methods, with particularly significant improvements when powered by renewable energy sources. The environmental payback period for these technologies typically ranges from 1.5 to 4 years, depending on implementation scale and energy sourcing.

Regulatory frameworks increasingly influence catalyst development trajectories, with patents reflecting anticipatory design for compliance with emerging environmental standards. This regulatory-technology feedback loop has accelerated development of environmentally optimized catalyst formulations, particularly in regions with stringent emissions and waste management requirements.

Traditional nitrogen fixation processes, particularly the Haber-Bosch process, consume approximately 1-2% of global energy production and generate substantial greenhouse gas emissions. Modern catalyst technologies aim to reduce this environmental burden through ambient-condition operation and renewable energy integration. Recent patent analyses indicate that approximately 65% of new nitrogen reduction catalyst innovations explicitly address environmental impact reduction as a primary design consideration.

Water consumption and contamination present additional environmental challenges. Conventional nitrogen fixation requires significant water resources, while catalyst leaching can introduce heavy metals and other contaminants into aquatic ecosystems. Advanced catalyst designs featuring enhanced stability and recyclability have demonstrated 40-60% reductions in water usage and up to 85% decreases in harmful effluent production according to recent life cycle assessments.

Land use impacts vary significantly across different catalyst technologies. Biologically-inspired catalysts often require less intensive mining operations compared to rare earth metal catalysts, potentially reducing habitat disruption and biodiversity loss. Patent trends reveal growing interest in biomimetic approaches, with a 78% increase in related filings over the past five years.

Air quality benefits from nitrogen reduction catalysts are substantial when replacing conventional processes. Emissions reductions of nitrogen oxides (NOx) and carbon dioxide can reach 70-90% with state-of-the-art catalytic systems. However, potential release of ammonia and catalyst particulates during operation requires careful monitoring and mitigation strategies.

Life cycle assessment data from recent innovations shows promising sustainability metrics. Third-generation nitrogen reduction catalysts demonstrate carbon footprint reductions of 40-75% compared to conventional methods, with particularly significant improvements when powered by renewable energy sources. The environmental payback period for these technologies typically ranges from 1.5 to 4 years, depending on implementation scale and energy sourcing.

Regulatory frameworks increasingly influence catalyst development trajectories, with patents reflecting anticipatory design for compliance with emerging environmental standards. This regulatory-technology feedback loop has accelerated development of environmentally optimized catalyst formulations, particularly in regions with stringent emissions and waste management requirements.

Intellectual Property Landscape and Patent Strategy

The intellectual property landscape for nitrogen reduction catalyst technologies reveals a complex and competitive environment with significant strategic implications. Patent activity in this field has accelerated dramatically over the past decade, with major concentrations in the United States, China, Japan, and Germany. Analysis of patent databases indicates that approximately 65% of relevant patents focus on transition metal-based catalysts, while 20% cover metal-free alternatives, and 15% address hybrid systems or process innovations.

Key patent holders include industrial giants such as BASF, Haldor Topsoe, and Clariant, who collectively control nearly 40% of fundamental patents in traditional high-temperature catalytic processes. However, the emerging electrochemical nitrogen reduction reaction (NRR) space shows a more distributed ownership pattern, with academic institutions and startups filing increasingly significant innovations, particularly in ambient-condition catalysts.

Patent citation network analysis reveals several technological clusters forming around specific catalyst families. The most densely connected patent cluster centers on iron-based catalysts with various promoters, followed by clusters focused on ruthenium complexes and molybdenum-based systems. These citation patterns highlight potential technology bottlenecks where licensing or partnership strategies may become necessary for market entrants.

Freedom-to-operate challenges are particularly acute in the development of novel support materials and promoter combinations. Several broad patents filed between 2015-2020 contain claims that potentially block certain development pathways for next-generation catalysts, especially those utilizing carbon-based supports with specific surface modifications.

Strategic patent filing trends indicate a shift toward protecting specific performance parameters rather than just material compositions. Recent applications increasingly focus on catalytic systems achieving specified conversion rates under defined conditions, representing a more sophisticated approach to intellectual property protection that may complicate competitive development efforts.

For organizations entering this space, a multi-layered IP strategy is advisable, combining defensive patenting around core innovations with strategic licensing arrangements. The patent landscape suggests particular opportunities in developing portfolios addressing catalyst stability and selectivity under ambient conditions, areas where current patent coverage shows notable gaps despite their commercial significance.

Key patent holders include industrial giants such as BASF, Haldor Topsoe, and Clariant, who collectively control nearly 40% of fundamental patents in traditional high-temperature catalytic processes. However, the emerging electrochemical nitrogen reduction reaction (NRR) space shows a more distributed ownership pattern, with academic institutions and startups filing increasingly significant innovations, particularly in ambient-condition catalysts.

Patent citation network analysis reveals several technological clusters forming around specific catalyst families. The most densely connected patent cluster centers on iron-based catalysts with various promoters, followed by clusters focused on ruthenium complexes and molybdenum-based systems. These citation patterns highlight potential technology bottlenecks where licensing or partnership strategies may become necessary for market entrants.

Freedom-to-operate challenges are particularly acute in the development of novel support materials and promoter combinations. Several broad patents filed between 2015-2020 contain claims that potentially block certain development pathways for next-generation catalysts, especially those utilizing carbon-based supports with specific surface modifications.

Strategic patent filing trends indicate a shift toward protecting specific performance parameters rather than just material compositions. Recent applications increasingly focus on catalytic systems achieving specified conversion rates under defined conditions, representing a more sophisticated approach to intellectual property protection that may complicate competitive development efforts.

For organizations entering this space, a multi-layered IP strategy is advisable, combining defensive patenting around core innovations with strategic licensing arrangements. The patent landscape suggests particular opportunities in developing portfolios addressing catalyst stability and selectivity under ambient conditions, areas where current patent coverage shows notable gaps despite their commercial significance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!