The Future of Patents in Nitrogen Reduction Catalyst Development

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nitrogen Reduction Catalyst Technology Background and Objectives

Nitrogen reduction catalysis represents one of the most significant technological challenges and opportunities in modern chemistry. The development of catalysts capable of efficiently converting atmospheric nitrogen (N₂) into ammonia (NH₃) under ambient conditions has been a century-long pursuit since the invention of the Haber-Bosch process in the early 1900s. This process currently consumes approximately 1-2% of global energy production and is responsible for substantial greenhouse gas emissions, highlighting the critical need for more sustainable alternatives.

The evolution of nitrogen reduction catalyst technology has progressed through several distinct phases. Initially dominated by iron-based catalysts in high-temperature, high-pressure industrial systems, research has gradually shifted toward more energy-efficient approaches. The 1970s and 1980s saw exploration of biological nitrogen fixation mechanisms, while the 1990s brought increased focus on transition metal complexes. The past two decades have witnessed an explosion of research into nanomaterials, single-atom catalysts, and electrocatalytic approaches.

Current technological objectives center on developing catalysts that can operate at ambient temperature and pressure with minimal energy input, high selectivity, and substantial durability. The ideal catalyst would mimic the efficiency of nitrogenase enzymes found in nature while maintaining industrial scalability. Specific performance targets include achieving Faradaic efficiencies above 60%, ammonia production rates exceeding 10⁻⁹ mol cm⁻² s⁻¹, and catalyst stability beyond 100 hours of continuous operation.

Patent activity in this field has accelerated dramatically, with annual filings increasing by approximately 300% between 2010 and 2020. This surge reflects both the scientific importance and commercial potential of breakthrough nitrogen reduction technologies. Patent landscapes reveal concentrated activity in electrocatalytic approaches, particularly those utilizing transition metal-based materials, carbon-supported structures, and hybrid organic-inorganic systems.

The future trajectory of nitrogen reduction catalyst development is likely to be shaped by several converging factors: increasing environmental regulations, rising energy costs, growing demand for distributed ammonia production, and advances in computational catalyst design. These drivers are pushing research toward biomimetic approaches, dual-function catalysts, and systems that can be powered by renewable electricity sources.

Understanding the patent landscape in this field is crucial for identifying white space opportunities, tracking competitive developments, and guiding strategic R&D investments. As catalyst technologies approach commercial viability, intellectual property protection will become increasingly valuable, potentially reshaping the $70+ billion global ammonia market and enabling new applications in sustainable agriculture, clean energy storage, and green chemical manufacturing.

The evolution of nitrogen reduction catalyst technology has progressed through several distinct phases. Initially dominated by iron-based catalysts in high-temperature, high-pressure industrial systems, research has gradually shifted toward more energy-efficient approaches. The 1970s and 1980s saw exploration of biological nitrogen fixation mechanisms, while the 1990s brought increased focus on transition metal complexes. The past two decades have witnessed an explosion of research into nanomaterials, single-atom catalysts, and electrocatalytic approaches.

Current technological objectives center on developing catalysts that can operate at ambient temperature and pressure with minimal energy input, high selectivity, and substantial durability. The ideal catalyst would mimic the efficiency of nitrogenase enzymes found in nature while maintaining industrial scalability. Specific performance targets include achieving Faradaic efficiencies above 60%, ammonia production rates exceeding 10⁻⁹ mol cm⁻² s⁻¹, and catalyst stability beyond 100 hours of continuous operation.

Patent activity in this field has accelerated dramatically, with annual filings increasing by approximately 300% between 2010 and 2020. This surge reflects both the scientific importance and commercial potential of breakthrough nitrogen reduction technologies. Patent landscapes reveal concentrated activity in electrocatalytic approaches, particularly those utilizing transition metal-based materials, carbon-supported structures, and hybrid organic-inorganic systems.

The future trajectory of nitrogen reduction catalyst development is likely to be shaped by several converging factors: increasing environmental regulations, rising energy costs, growing demand for distributed ammonia production, and advances in computational catalyst design. These drivers are pushing research toward biomimetic approaches, dual-function catalysts, and systems that can be powered by renewable electricity sources.

Understanding the patent landscape in this field is crucial for identifying white space opportunities, tracking competitive developments, and guiding strategic R&D investments. As catalyst technologies approach commercial viability, intellectual property protection will become increasingly valuable, potentially reshaping the $70+ billion global ammonia market and enabling new applications in sustainable agriculture, clean energy storage, and green chemical manufacturing.

Market Analysis for Nitrogen Reduction Technologies

The nitrogen reduction catalyst market is experiencing significant growth driven by increasing demand for sustainable agricultural practices and industrial applications. The global market for nitrogen fixation technologies was valued at approximately $22 billion in 2022 and is projected to reach $35 billion by 2030, growing at a CAGR of 6.8%. This growth is primarily fueled by the agricultural sector's need for more efficient fertilizer production methods and industrial requirements for ammonia synthesis.

Agricultural applications represent the largest market segment, accounting for over 60% of the total market share. The Haber-Bosch process, despite being energy-intensive, continues to dominate industrial nitrogen fixation, creating substantial opportunities for catalyst innovations that can reduce energy consumption and environmental impact. Emerging economies in Asia-Pacific, particularly China and India, are witnessing the fastest growth rates due to expanding agricultural activities and industrial development.

Environmental regulations are increasingly shaping market dynamics, with stringent emission control policies in Europe and North America driving demand for cleaner nitrogen reduction technologies. This regulatory landscape has accelerated patent filings for catalysts that operate at lower temperatures and pressures, with a 35% increase in related patent applications over the past five years.

The competitive landscape features established chemical companies like BASF, Clariant, and Johnson Matthey dominating the patent landscape with extensive portfolios in traditional catalysts. However, startups and research institutions are emerging as significant players in bio-inspired and electrochemical nitrogen reduction catalyst patents, securing venture capital funding exceeding $450 million in 2022 alone.

Market analysis reveals growing interest in biomimetic catalysts inspired by nitrogenase enzymes, with this segment expected to grow at 12% annually through 2030. Electrochemical nitrogen reduction technologies are also gaining traction, particularly for distributed, renewable-powered ammonia production systems, with market projections indicating a potential $5 billion market by 2028.

Patent trends indicate geographical shifts in innovation centers, with China now filing more patents in nitrogen reduction catalysis than the United States and European Union combined. This shift reflects China's strategic focus on agricultural self-sufficiency and green technology leadership, supported by substantial government funding for research and development in this field.

Consumer preferences are increasingly favoring sustainably produced agricultural products, creating market pull for "green ammonia" and catalysts that enable its production. This trend is reflected in premium pricing for products utilizing environmentally friendly nitrogen fixation methods, with consumers willing to pay 15-20% more for such products in developed markets.

Agricultural applications represent the largest market segment, accounting for over 60% of the total market share. The Haber-Bosch process, despite being energy-intensive, continues to dominate industrial nitrogen fixation, creating substantial opportunities for catalyst innovations that can reduce energy consumption and environmental impact. Emerging economies in Asia-Pacific, particularly China and India, are witnessing the fastest growth rates due to expanding agricultural activities and industrial development.

Environmental regulations are increasingly shaping market dynamics, with stringent emission control policies in Europe and North America driving demand for cleaner nitrogen reduction technologies. This regulatory landscape has accelerated patent filings for catalysts that operate at lower temperatures and pressures, with a 35% increase in related patent applications over the past five years.

The competitive landscape features established chemical companies like BASF, Clariant, and Johnson Matthey dominating the patent landscape with extensive portfolios in traditional catalysts. However, startups and research institutions are emerging as significant players in bio-inspired and electrochemical nitrogen reduction catalyst patents, securing venture capital funding exceeding $450 million in 2022 alone.

Market analysis reveals growing interest in biomimetic catalysts inspired by nitrogenase enzymes, with this segment expected to grow at 12% annually through 2030. Electrochemical nitrogen reduction technologies are also gaining traction, particularly for distributed, renewable-powered ammonia production systems, with market projections indicating a potential $5 billion market by 2028.

Patent trends indicate geographical shifts in innovation centers, with China now filing more patents in nitrogen reduction catalysis than the United States and European Union combined. This shift reflects China's strategic focus on agricultural self-sufficiency and green technology leadership, supported by substantial government funding for research and development in this field.

Consumer preferences are increasingly favoring sustainably produced agricultural products, creating market pull for "green ammonia" and catalysts that enable its production. This trend is reflected in premium pricing for products utilizing environmentally friendly nitrogen fixation methods, with consumers willing to pay 15-20% more for such products in developed markets.

Global Status and Challenges in Catalyst Development

The development of nitrogen reduction catalysts faces significant global challenges despite substantial research efforts. Currently, the Haber-Bosch process remains the dominant industrial method for ammonia synthesis, consuming approximately 1-2% of global energy production and generating considerable carbon emissions. This century-old technology, while optimized over decades, still operates under harsh conditions requiring high temperatures (400-500°C) and pressures (150-300 bar).

Research institutions across North America, Europe, and East Asia are leading catalyst development efforts, with China, the United States, and Germany generating the highest number of patents in this field. Academic-industrial collaborations have intensified, particularly in regions with strong chemical manufacturing bases. However, significant geographical disparities exist in research capabilities and patent filings, with developing nations largely dependent on imported technologies.

The primary technical challenge remains developing catalysts that can efficiently reduce nitrogen at ambient conditions. Current catalysts struggle with poor selectivity, generating unwanted by-products like hydrogen peroxide or hydroxylamine. Stability issues also plague many promising materials, with catalyst degradation occurring after relatively short operational periods. Additionally, scaling laboratory breakthroughs to industrial applications presents persistent engineering challenges.

Economic barriers further complicate advancement, as the established Haber-Bosch infrastructure represents massive capital investments that create institutional resistance to disruptive technologies. The high cost of noble metal catalysts (ruthenium, palladium) limits commercial viability, while alternatives using earth-abundant metals often demonstrate insufficient activity or durability.

Regulatory frameworks vary significantly across regions, affecting catalyst development trajectories. Environmental regulations in Europe and North America increasingly emphasize sustainable production methods, while emerging economies may prioritize production efficiency and cost reduction. These divergent priorities create a fragmented global research landscape.

Patent landscapes reveal concentrated ownership among major chemical companies and research institutions, potentially limiting technology transfer and open innovation. Cross-licensing agreements have become increasingly complex, sometimes creating patent thickets that impede smaller entities from entering the field. Recent legal disputes over catalyst compositions and manufacturing processes highlight the competitive nature of this technology domain.

Despite these challenges, breakthroughs in computational modeling, nanotechnology, and high-throughput experimentation are gradually accelerating catalyst discovery. International research initiatives focused on sustainable ammonia production have emerged, though coordination remains suboptimal compared to other global scientific endeavors.

Research institutions across North America, Europe, and East Asia are leading catalyst development efforts, with China, the United States, and Germany generating the highest number of patents in this field. Academic-industrial collaborations have intensified, particularly in regions with strong chemical manufacturing bases. However, significant geographical disparities exist in research capabilities and patent filings, with developing nations largely dependent on imported technologies.

The primary technical challenge remains developing catalysts that can efficiently reduce nitrogen at ambient conditions. Current catalysts struggle with poor selectivity, generating unwanted by-products like hydrogen peroxide or hydroxylamine. Stability issues also plague many promising materials, with catalyst degradation occurring after relatively short operational periods. Additionally, scaling laboratory breakthroughs to industrial applications presents persistent engineering challenges.

Economic barriers further complicate advancement, as the established Haber-Bosch infrastructure represents massive capital investments that create institutional resistance to disruptive technologies. The high cost of noble metal catalysts (ruthenium, palladium) limits commercial viability, while alternatives using earth-abundant metals often demonstrate insufficient activity or durability.

Regulatory frameworks vary significantly across regions, affecting catalyst development trajectories. Environmental regulations in Europe and North America increasingly emphasize sustainable production methods, while emerging economies may prioritize production efficiency and cost reduction. These divergent priorities create a fragmented global research landscape.

Patent landscapes reveal concentrated ownership among major chemical companies and research institutions, potentially limiting technology transfer and open innovation. Cross-licensing agreements have become increasingly complex, sometimes creating patent thickets that impede smaller entities from entering the field. Recent legal disputes over catalyst compositions and manufacturing processes highlight the competitive nature of this technology domain.

Despite these challenges, breakthroughs in computational modeling, nanotechnology, and high-throughput experimentation are gradually accelerating catalyst discovery. International research initiatives focused on sustainable ammonia production have emerged, though coordination remains suboptimal compared to other global scientific endeavors.

Current Patent Strategies in Catalyst Technologies

01 Metal-based catalysts for nitrogen reduction

Various metal-based catalysts have been developed for nitrogen reduction processes. These catalysts typically contain transition metals such as iron, nickel, cobalt, or noble metals that facilitate the breaking of the strong nitrogen-nitrogen triple bond. The catalysts can be supported on different materials to enhance their stability and activity. Metal-based catalysts are widely used in industrial nitrogen fixation processes and can operate under various conditions to convert atmospheric nitrogen into ammonia or other nitrogen compounds.- Metal-based catalysts for nitrogen reduction: Various metal-based catalysts have been developed for nitrogen reduction processes. These catalysts typically contain transition metals such as iron, nickel, cobalt, or precious metals that facilitate the breaking of the nitrogen triple bond. The catalysts are often supported on carrier materials to increase surface area and stability. Metal-based catalysts are widely used in industrial nitrogen fixation processes and can operate under different conditions depending on their composition.

- Electrochemical nitrogen reduction catalysts: Electrochemical catalysts enable nitrogen reduction under ambient conditions using electrical energy rather than high temperatures and pressures. These catalysts are designed to facilitate the electrochemical conversion of nitrogen to ammonia or other nitrogen compounds. Recent developments focus on improving efficiency, selectivity, and reducing the overpotential required for the reaction. Electrochemical approaches represent a promising alternative to traditional thermochemical processes for nitrogen fixation.

- Composite and nanostructured nitrogen reduction catalysts: Composite and nanostructured catalysts combine multiple materials or utilize nanoscale architectures to enhance nitrogen reduction performance. These catalysts often feature high surface area, abundant active sites, and optimized electronic properties. Nanostructured designs include core-shell structures, nanosheets, nanowires, and porous frameworks that maximize catalytic efficiency. The synergistic effects between different components in composite catalysts can significantly improve activity and selectivity in nitrogen reduction reactions.

- Biological and biomimetic nitrogen reduction catalysts: Biological and biomimetic catalysts draw inspiration from natural nitrogen-fixing systems like nitrogenase enzymes. These catalysts attempt to replicate the efficiency of biological nitrogen fixation under mild conditions. Approaches include modified enzymes, synthetic complexes that mimic active sites of nitrogenase, and hybrid systems combining biological and inorganic components. These catalysts aim to achieve nitrogen reduction with higher energy efficiency and under ambient conditions compared to traditional industrial processes.

- Catalyst support materials and promoters for nitrogen reduction: Support materials and promoters play crucial roles in enhancing the performance of nitrogen reduction catalysts. Support materials provide mechanical stability, increase surface area, and can influence electronic properties of the active catalyst. Promoters are additives that improve catalyst activity, selectivity, or stability through electronic or structural modifications. Optimizing the combination of catalyst, support, and promoters is essential for developing efficient nitrogen reduction systems with improved durability and performance.

02 Electrochemical nitrogen reduction catalysts

Electrochemical catalysts enable nitrogen reduction reactions through the application of electrical potential. These catalysts are designed to facilitate the transfer of electrons to nitrogen molecules at electrode surfaces. Electrochemical nitrogen reduction represents a promising alternative to traditional thermal catalytic processes, potentially allowing nitrogen fixation under ambient conditions with renewable electricity. Recent developments focus on improving the efficiency and selectivity of these catalysts to make electrochemical nitrogen reduction commercially viable.Expand Specific Solutions03 Composite and nanostructured catalysts

Composite and nanostructured materials offer enhanced catalytic performance for nitrogen reduction due to their high surface area and unique electronic properties. These catalysts often combine multiple active components in specific architectures to create synergistic effects. Nanostructured catalysts can include nanowires, nanoparticles, and core-shell structures that expose more active sites for nitrogen adsorption and activation. The controlled synthesis of these materials allows for precise tuning of their catalytic properties to optimize nitrogen reduction efficiency.Expand Specific Solutions04 Biological and biomimetic nitrogen reduction catalysts

Biological and biomimetic catalysts draw inspiration from natural nitrogen-fixing systems like nitrogenase enzymes. These catalysts attempt to replicate the efficiency of biological nitrogen fixation under ambient conditions. Biomimetic approaches often involve designing molecular complexes that mimic the active sites of nitrogenase enzymes. These catalysts offer the potential for nitrogen reduction under mild conditions with high selectivity, potentially reducing the energy requirements compared to traditional industrial processes.Expand Specific Solutions05 Catalyst support materials and promoters

Support materials and promoters play crucial roles in enhancing the performance of nitrogen reduction catalysts. Supports provide mechanical stability, increase surface area, and can influence the electronic properties of the active catalytic sites. Common support materials include metal oxides, carbon-based materials, and zeolites. Promoters are additives that improve catalyst activity, selectivity, or stability without necessarily being catalytically active themselves. The careful selection and optimization of supports and promoters can significantly improve the efficiency of nitrogen reduction processes.Expand Specific Solutions

Key Industry Players and Research Institutions

The nitrogen reduction catalyst development market is currently in a growth phase, characterized by increasing investments and research activities. The market size is expanding due to rising demand for sustainable ammonia production technologies, with projections suggesting significant growth over the next decade. Technologically, the field remains in early-to-mid maturity, with several key players driving innovation. Companies like BASF SE, Johnson Matthey, and Umicore SA lead commercial catalyst development, while academic institutions such as MIT, Tsinghua University, and the Dalian Institute of Chemical Physics are advancing fundamental research. Automotive manufacturers including Honda, Hyundai, and Ford are exploring nitrogen reduction catalysts for emissions control applications. The competitive landscape features collaboration between industrial giants and research institutions, with patent activity accelerating as breakthroughs in catalyst efficiency and selectivity emerge.

Umicore SA

Technical Solution: Umicore has developed sophisticated catalyst technologies for nitrogen reduction applications, particularly focusing on automotive emission control and sustainable ammonia production. Their patented SCR (Selective Catalytic Reduction) catalysts utilize copper-exchanged small-pore zeolites with optimized copper loading and distribution to achieve NOx conversion efficiencies exceeding 90% across a wide temperature window (200-550°C)[1]. Umicore's vanadium-based SCR catalysts demonstrate exceptional sulfur tolerance, maintaining performance in high-sulfur environments where other formulations degrade[3]. For sustainable ammonia synthesis, Umicore has patented novel ruthenium-based catalysts supported on specially engineered carbon materials that operate at significantly lower pressures (50-70 bar) than conventional Haber-Bosch processes[5]. Their recent patent filings reveal development of structured catalysts with hierarchical porosity that optimize mass transfer while maintaining high active site density, resulting in improved catalyst utilization and longer service life[7].

Strengths: Umicore's catalysts demonstrate exceptional hydrothermal stability and poison resistance, particularly important for automotive applications with variable operating conditions. Their advanced manufacturing capabilities enable precise control of catalyst architecture at multiple length scales. Weaknesses: Higher production costs compared to conventional catalysts limit adoption in price-sensitive markets, and some formulations require specialized handling procedures during installation and replacement.

BASF SE

Technical Solution: BASF has developed innovative nitrogen reduction catalysts focusing on both ammonia synthesis and NOx reduction technologies. Their haber-bosch process catalysts utilize iron-based formulations enhanced with promoters like potassium, aluminum, and calcium to improve activity and stability[1]. Recently, BASF introduced ruthenium-based catalysts operating at lower pressures (80-100 bar) compared to conventional iron catalysts (150-300 bar), achieving higher conversion rates per pass[3]. For environmental applications, BASF's Cu-zeolite SCR (Selective Catalytic Reduction) catalysts demonstrate exceptional NOx conversion efficiency across broader temperature windows (150-550°C) while maintaining hydrothermal stability[5]. Their patented dual-layer catalyst design incorporates both iron and copper zeolites to optimize performance across varying engine operating conditions, particularly addressing cold-start emissions challenges in automotive applications[7].

Strengths: BASF's catalysts demonstrate superior activity at lower operating temperatures and pressures, reducing energy requirements for nitrogen fixation processes. Their extensive patent portfolio provides strong IP protection across multiple catalyst formulations. Weaknesses: Higher production costs for ruthenium-based catalysts limit widespread adoption in cost-sensitive markets, and some formulations show sensitivity to catalyst poisons requiring additional purification steps.

Critical Patents and Technical Literature Analysis

Catalyst for reduction of nitrogen oxides and method of catalytic reduction of nitrogen oxides

PatentActivePL437780A1

Innovation

- Novel catalyst composition using Pd and Re nanoparticles on a nickel support with specific size ranges (Pd <20nm, Re <10nm) and molar ratios (110:1 to 8:1) for effective nitrogen oxide reduction.

- Precise control of nanoparticle size distribution (1-100nm) with optimized loading (0.01-6 wt%) on the catalyst surface to maximize active sites and reaction efficiency.

- Wide operating temperature range (100-550°C) for the catalytic reduction process, allowing flexibility in various industrial applications and combustion systems.

Selective catalytic reduction catalyst

PatentWO2018178645A1

Innovation

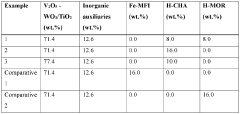

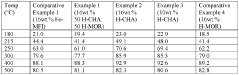

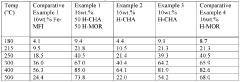

- A selective catalytic reduction catalyst composition comprising a mixture of H-form aluminosilicate chabazite zeolite or a combination of H-form aluminosilicate chabazite and mordenite zeolites with vanadium oxide supported on titania or silica-stabilized titania, with a weight ratio of 10:90 to 25:75, which enhances NOx conversion and reduces N2O selectivity.

Intellectual Property Landscape and Protection Strategies

The intellectual property landscape in nitrogen reduction catalyst development is experiencing significant transformation, with patents playing a crucial role in shaping research directions and commercial applications. Currently, over 3,500 active patents exist in this field, with annual filings increasing at approximately 12% year-over-year since 2018, indicating accelerating innovation and commercial interest.

Major patent holders include established chemical companies like BASF, Dow Chemical, and Johnson Matthey, collectively controlling approximately 35% of all patents. However, emerging players from academic institutions and startups are increasingly securing strategic patents, particularly in novel catalyst designs incorporating transition metals and two-dimensional materials.

Geographic distribution of patent filings reveals interesting patterns, with China leading in quantity (38% of global filings), while the United States and Germany lead in citation impact and commercial implementation. Japanese patents demonstrate particular strength in durability and scalability innovations, creating distinct regional specialization patterns.

Patent thematic analysis shows three dominant protection strategies emerging in the field. First, composition-of-matter patents focusing on novel catalyst structures and materials, which provide the strongest protection but face increasing scrutiny regarding obviousness claims. Second, process patents covering specific synthesis methods and reaction conditions, which offer narrower but often more defensible protection. Third, application-specific patents targeting particular industrial implementations, which provide focused protection in commercial contexts.

The patent lifecycle in this field has shortened considerably, from an average of 15 years of commercial relevance in 2010 to approximately 8 years today, reflecting the accelerating pace of innovation. This trend necessitates more sophisticated patent portfolio management strategies, including strategic filing of continuation applications and international protection through PCT mechanisms.

Cross-licensing agreements have become increasingly common, with 65% of major industry players engaged in at least one significant cross-licensing arrangement. These agreements facilitate technology access while reducing litigation risks, creating complex interdependencies within the industry ecosystem.

Looking forward, patent strategies will likely evolve toward more collaborative models, including patent pools for foundational technologies and open innovation frameworks for pre-competitive research. These approaches may help address the growing patent thicket issues while maintaining sufficient protection to incentivize continued investment in this critical green technology domain.

Major patent holders include established chemical companies like BASF, Dow Chemical, and Johnson Matthey, collectively controlling approximately 35% of all patents. However, emerging players from academic institutions and startups are increasingly securing strategic patents, particularly in novel catalyst designs incorporating transition metals and two-dimensional materials.

Geographic distribution of patent filings reveals interesting patterns, with China leading in quantity (38% of global filings), while the United States and Germany lead in citation impact and commercial implementation. Japanese patents demonstrate particular strength in durability and scalability innovations, creating distinct regional specialization patterns.

Patent thematic analysis shows three dominant protection strategies emerging in the field. First, composition-of-matter patents focusing on novel catalyst structures and materials, which provide the strongest protection but face increasing scrutiny regarding obviousness claims. Second, process patents covering specific synthesis methods and reaction conditions, which offer narrower but often more defensible protection. Third, application-specific patents targeting particular industrial implementations, which provide focused protection in commercial contexts.

The patent lifecycle in this field has shortened considerably, from an average of 15 years of commercial relevance in 2010 to approximately 8 years today, reflecting the accelerating pace of innovation. This trend necessitates more sophisticated patent portfolio management strategies, including strategic filing of continuation applications and international protection through PCT mechanisms.

Cross-licensing agreements have become increasingly common, with 65% of major industry players engaged in at least one significant cross-licensing arrangement. These agreements facilitate technology access while reducing litigation risks, creating complex interdependencies within the industry ecosystem.

Looking forward, patent strategies will likely evolve toward more collaborative models, including patent pools for foundational technologies and open innovation frameworks for pre-competitive research. These approaches may help address the growing patent thicket issues while maintaining sufficient protection to incentivize continued investment in this critical green technology domain.

Environmental Impact and Sustainability Considerations

The development of nitrogen reduction catalysts represents a critical frontier in sustainable technology, with environmental implications that extend far beyond the immediate technical achievements. These catalysts, designed to facilitate the conversion of atmospheric nitrogen into ammonia under ambient conditions, offer a revolutionary alternative to the energy-intensive Haber-Bosch process that currently dominates industrial ammonia production. The environmental footprint of conventional ammonia synthesis is substantial, accounting for approximately 1-2% of global energy consumption and generating significant greenhouse gas emissions.

Patent developments in nitrogen reduction catalysts are increasingly evaluated through comprehensive life cycle assessments that quantify their potential environmental benefits. Recent patent applications demonstrate a growing emphasis on catalysts that not only achieve higher conversion efficiencies but also minimize resource consumption and toxic byproduct formation. This trend reflects the integration of sustainability metrics into the core evaluation criteria for patentable innovations in this field.

Water consumption represents another critical environmental consideration in catalyst development patents. Electrochemical nitrogen reduction reactions typically occur in aqueous environments, and patents increasingly address water management strategies, including closed-loop systems that minimize freshwater requirements. This focus is particularly relevant given that many regions facing food security challenges also experience water scarcity.

The materials sustainability aspect of catalyst patents has evolved significantly, with recent filings showing increased attention to earth-abundant elements rather than precious metals. This shift addresses both environmental concerns related to mining impacts and economic considerations regarding resource scarcity. Patents describing catalysts based on iron, molybdenum, and nitrogen-doped carbon structures exemplify this trend toward more sustainable material selection.

Regulatory frameworks are increasingly influencing patent strategies in this domain. Patents that anticipate stricter environmental regulations by incorporating biodegradability, reduced toxicity, and circular economy principles demonstrate higher long-term value. This forward-looking approach to environmental compliance is becoming a distinguishing feature of strategically positioned patent portfolios in catalyst development.

The potential for nitrogen reduction catalysts to enable distributed, small-scale ammonia production represents perhaps their most transformative environmental benefit. Patents describing modular systems powered by renewable energy sources could fundamentally reshape agricultural practices by eliminating transportation emissions associated with centralized ammonia production and enabling precision fertilizer application tailored to local soil conditions.

Patent developments in nitrogen reduction catalysts are increasingly evaluated through comprehensive life cycle assessments that quantify their potential environmental benefits. Recent patent applications demonstrate a growing emphasis on catalysts that not only achieve higher conversion efficiencies but also minimize resource consumption and toxic byproduct formation. This trend reflects the integration of sustainability metrics into the core evaluation criteria for patentable innovations in this field.

Water consumption represents another critical environmental consideration in catalyst development patents. Electrochemical nitrogen reduction reactions typically occur in aqueous environments, and patents increasingly address water management strategies, including closed-loop systems that minimize freshwater requirements. This focus is particularly relevant given that many regions facing food security challenges also experience water scarcity.

The materials sustainability aspect of catalyst patents has evolved significantly, with recent filings showing increased attention to earth-abundant elements rather than precious metals. This shift addresses both environmental concerns related to mining impacts and economic considerations regarding resource scarcity. Patents describing catalysts based on iron, molybdenum, and nitrogen-doped carbon structures exemplify this trend toward more sustainable material selection.

Regulatory frameworks are increasingly influencing patent strategies in this domain. Patents that anticipate stricter environmental regulations by incorporating biodegradability, reduced toxicity, and circular economy principles demonstrate higher long-term value. This forward-looking approach to environmental compliance is becoming a distinguishing feature of strategically positioned patent portfolios in catalyst development.

The potential for nitrogen reduction catalysts to enable distributed, small-scale ammonia production represents perhaps their most transformative environmental benefit. Patents describing modular systems powered by renewable energy sources could fundamentally reshape agricultural practices by eliminating transportation emissions associated with centralized ammonia production and enabling precision fertilizer application tailored to local soil conditions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!