How Regulations Impact the Use of Nitrogen Reduction Catalyst

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nitrogen Reduction Catalyst Development History and Objectives

Nitrogen reduction catalysts have evolved significantly since their initial development in the early 20th century. The Haber-Bosch process, developed between 1908 and 1913, marked the first major breakthrough in nitrogen fixation technology, enabling the industrial production of ammonia from atmospheric nitrogen. This revolutionary process utilized iron-based catalysts operating under high pressure and temperature conditions, fundamentally transforming agricultural practices through increased fertilizer production.

The 1960s and 1970s witnessed substantial advancements with the introduction of ruthenium-based catalysts, which demonstrated superior activity compared to traditional iron catalysts. This period also saw the emergence of regulatory frameworks addressing industrial emissions, particularly in developed nations, initiating the relationship between catalyst technology and environmental regulation.

The 1980s brought a paradigm shift with the development of selective catalytic reduction (SCR) technology for nitrogen oxide (NOx) emissions control. Initially implemented in power plants, these catalysts typically contained vanadium pentoxide, tungsten oxide, or titanium dioxide. This technological advancement coincided with increasingly stringent air quality regulations in North America, Europe, and Japan, establishing a clear correlation between regulatory pressure and catalyst innovation.

The 1990s and early 2000s saw the expansion of nitrogen reduction catalyst applications to automotive emissions control, driven by progressively stricter vehicle emission standards worldwide. This period featured the development of three-way catalytic converters and specialized SCR systems for diesel engines, utilizing zeolite-based catalysts and requiring urea-based reducing agents.

Recent developments have focused on enhancing catalyst efficiency, reducing precious metal content, and expanding temperature operating windows. Research has increasingly targeted low-temperature catalyst performance, crucial for meeting cold-start emission requirements in modern vehicles. Additionally, significant efforts have been directed toward developing catalysts resistant to sulfur poisoning and thermal degradation, extending operational lifespans in industrial applications.

The primary objectives in nitrogen reduction catalyst development now center on meeting increasingly stringent regulatory standards while minimizing economic impact. Key goals include developing catalysts that function effectively at lower temperatures, reducing the energy requirements of nitrogen fixation processes, and creating more durable catalysts capable of maintaining performance under variable operating conditions. Additionally, research aims to reduce or eliminate precious metal components, addressing cost and resource sustainability concerns.

Another critical objective involves developing catalysts compatible with renewable energy systems, particularly for green ammonia production using hydrogen derived from electrolysis powered by renewable electricity, aligning with global decarbonization efforts and circular economy principles.

The 1960s and 1970s witnessed substantial advancements with the introduction of ruthenium-based catalysts, which demonstrated superior activity compared to traditional iron catalysts. This period also saw the emergence of regulatory frameworks addressing industrial emissions, particularly in developed nations, initiating the relationship between catalyst technology and environmental regulation.

The 1980s brought a paradigm shift with the development of selective catalytic reduction (SCR) technology for nitrogen oxide (NOx) emissions control. Initially implemented in power plants, these catalysts typically contained vanadium pentoxide, tungsten oxide, or titanium dioxide. This technological advancement coincided with increasingly stringent air quality regulations in North America, Europe, and Japan, establishing a clear correlation between regulatory pressure and catalyst innovation.

The 1990s and early 2000s saw the expansion of nitrogen reduction catalyst applications to automotive emissions control, driven by progressively stricter vehicle emission standards worldwide. This period featured the development of three-way catalytic converters and specialized SCR systems for diesel engines, utilizing zeolite-based catalysts and requiring urea-based reducing agents.

Recent developments have focused on enhancing catalyst efficiency, reducing precious metal content, and expanding temperature operating windows. Research has increasingly targeted low-temperature catalyst performance, crucial for meeting cold-start emission requirements in modern vehicles. Additionally, significant efforts have been directed toward developing catalysts resistant to sulfur poisoning and thermal degradation, extending operational lifespans in industrial applications.

The primary objectives in nitrogen reduction catalyst development now center on meeting increasingly stringent regulatory standards while minimizing economic impact. Key goals include developing catalysts that function effectively at lower temperatures, reducing the energy requirements of nitrogen fixation processes, and creating more durable catalysts capable of maintaining performance under variable operating conditions. Additionally, research aims to reduce or eliminate precious metal components, addressing cost and resource sustainability concerns.

Another critical objective involves developing catalysts compatible with renewable energy systems, particularly for green ammonia production using hydrogen derived from electrolysis powered by renewable electricity, aligning with global decarbonization efforts and circular economy principles.

Market Analysis of Nitrogen Reduction Technologies

The global market for nitrogen reduction technologies has experienced significant growth in recent years, driven primarily by stringent environmental regulations aimed at reducing harmful emissions. The market size was valued at approximately $5.2 billion in 2022 and is projected to reach $8.7 billion by 2030, representing a compound annual growth rate (CAGR) of 6.7%. This growth trajectory is largely attributed to the increasing implementation of emission control regulations across various industries worldwide.

The automotive sector remains the largest consumer of nitrogen reduction catalysts, accounting for nearly 40% of the total market share. This dominance is expected to continue as vehicle emission standards become increasingly stringent in major markets including Europe, North America, and Asia. The Euro 7 standards in Europe and China VI standards in Asia are particularly influential in driving demand for advanced SCR (Selective Catalytic Reduction) systems.

Industrial applications represent the second-largest market segment, with power plants, chemical manufacturing facilities, and industrial boilers collectively accounting for approximately 35% of market demand. This segment is experiencing rapid growth due to tightening NOx emission limits for industrial facilities, particularly in developed economies.

Regionally, Europe leads the market with a 38% share, followed by North America (27%) and Asia-Pacific (25%). However, the Asia-Pacific region is expected to witness the fastest growth rate of 8.3% annually through 2030, primarily due to China and India implementing stricter emission regulations while simultaneously expanding their industrial and automotive sectors.

The market is characterized by varying technology adoption rates across different regions, directly correlating with regulatory stringency. Countries with the most stringent NOx regulations, such as Germany, Japan, and the United States, show the highest penetration rates of advanced catalyst technologies, while emerging economies typically exhibit lower adoption rates but higher growth potential.

Price sensitivity varies significantly by application sector. The automotive industry demonstrates moderate price sensitivity due to competitive pressures and high production volumes, while industrial applications often prioritize performance and durability over initial cost considerations, particularly in regions with strict compliance requirements and substantial non-compliance penalties.

Future market growth is expected to be driven by regulatory developments in emerging economies, technological advancements improving catalyst efficiency and reducing costs, and the expansion of regulations to previously unregulated sectors. The increasing focus on ammonia as a potential clean energy carrier may also create new market opportunities for nitrogen reduction technologies beyond traditional emission control applications.

The automotive sector remains the largest consumer of nitrogen reduction catalysts, accounting for nearly 40% of the total market share. This dominance is expected to continue as vehicle emission standards become increasingly stringent in major markets including Europe, North America, and Asia. The Euro 7 standards in Europe and China VI standards in Asia are particularly influential in driving demand for advanced SCR (Selective Catalytic Reduction) systems.

Industrial applications represent the second-largest market segment, with power plants, chemical manufacturing facilities, and industrial boilers collectively accounting for approximately 35% of market demand. This segment is experiencing rapid growth due to tightening NOx emission limits for industrial facilities, particularly in developed economies.

Regionally, Europe leads the market with a 38% share, followed by North America (27%) and Asia-Pacific (25%). However, the Asia-Pacific region is expected to witness the fastest growth rate of 8.3% annually through 2030, primarily due to China and India implementing stricter emission regulations while simultaneously expanding their industrial and automotive sectors.

The market is characterized by varying technology adoption rates across different regions, directly correlating with regulatory stringency. Countries with the most stringent NOx regulations, such as Germany, Japan, and the United States, show the highest penetration rates of advanced catalyst technologies, while emerging economies typically exhibit lower adoption rates but higher growth potential.

Price sensitivity varies significantly by application sector. The automotive industry demonstrates moderate price sensitivity due to competitive pressures and high production volumes, while industrial applications often prioritize performance and durability over initial cost considerations, particularly in regions with strict compliance requirements and substantial non-compliance penalties.

Future market growth is expected to be driven by regulatory developments in emerging economies, technological advancements improving catalyst efficiency and reducing costs, and the expansion of regulations to previously unregulated sectors. The increasing focus on ammonia as a potential clean energy carrier may also create new market opportunities for nitrogen reduction technologies beyond traditional emission control applications.

Global Regulatory Landscape and Technical Challenges

The global regulatory landscape for nitrogen reduction catalysts has evolved significantly over the past three decades, driven primarily by increasing environmental concerns and the recognition of nitrogen oxides (NOx) as major contributors to air pollution and climate change. Regulations have progressively become more stringent across different regions, with the European Union, United States, and China leading the implementation of comprehensive emission control frameworks.

In the European Union, the Euro standards (Euro 1 through Euro 6) have systematically reduced permissible NOx emissions from vehicles, with Euro 6d imposing limits as low as 80 mg/km for diesel passenger cars. This regulatory pressure has accelerated the development and adoption of advanced Selective Catalytic Reduction (SCR) systems and Lean NOx Trap (LNT) technologies.

The United States has implemented tiered emission standards through the Environmental Protection Agency (EPA), with Tier 3 standards requiring fleet-wide average NOx emissions of 30 mg/mile by 2025. California's more stringent regulations, particularly the Low Emission Vehicle (LEV) and Zero Emission Vehicle (ZEV) programs, have created a dual regulatory system that presents significant compliance challenges for manufacturers.

China has rapidly strengthened its regulatory framework with the China VI standards for vehicles and ultra-low emission standards for power plants, which now rival or exceed the stringency of regulations in Western markets. This regulatory convergence has created a more unified global market for nitrogen reduction technologies, though regional variations in implementation timelines and testing procedures remain significant.

The technical challenges arising from these regulatory frameworks are multifaceted. Catalyst manufacturers face the challenge of developing systems that maintain high NOx conversion efficiency across a wider temperature range, particularly at the lower temperatures characteristic of modern, more efficient engines. The "cold-start" problem—achieving catalytic activity before the system reaches optimal operating temperature—remains a significant hurdle.

Durability requirements have also intensified, with regulations now mandating that emission control systems maintain performance for up to 700,000 kilometers in heavy-duty applications. This necessitates catalyst formulations resistant to thermal aging, poisoning, and mechanical stress over extended periods.

The integration of real-world driving emissions (RDE) testing in regulatory frameworks has exposed the limitations of laboratory-optimized catalyst systems. Manufacturers must now ensure performance across highly variable operating conditions, including different driving styles, ambient temperatures, and altitudes.

Additionally, the regulatory push toward zero-emission vehicles is creating uncertainty about the long-term market for traditional catalyst technologies, complicating investment decisions in research and development. This transition period requires manufacturers to simultaneously improve conventional catalyst systems while preparing for potential paradigm shifts in propulsion technologies.

In the European Union, the Euro standards (Euro 1 through Euro 6) have systematically reduced permissible NOx emissions from vehicles, with Euro 6d imposing limits as low as 80 mg/km for diesel passenger cars. This regulatory pressure has accelerated the development and adoption of advanced Selective Catalytic Reduction (SCR) systems and Lean NOx Trap (LNT) technologies.

The United States has implemented tiered emission standards through the Environmental Protection Agency (EPA), with Tier 3 standards requiring fleet-wide average NOx emissions of 30 mg/mile by 2025. California's more stringent regulations, particularly the Low Emission Vehicle (LEV) and Zero Emission Vehicle (ZEV) programs, have created a dual regulatory system that presents significant compliance challenges for manufacturers.

China has rapidly strengthened its regulatory framework with the China VI standards for vehicles and ultra-low emission standards for power plants, which now rival or exceed the stringency of regulations in Western markets. This regulatory convergence has created a more unified global market for nitrogen reduction technologies, though regional variations in implementation timelines and testing procedures remain significant.

The technical challenges arising from these regulatory frameworks are multifaceted. Catalyst manufacturers face the challenge of developing systems that maintain high NOx conversion efficiency across a wider temperature range, particularly at the lower temperatures characteristic of modern, more efficient engines. The "cold-start" problem—achieving catalytic activity before the system reaches optimal operating temperature—remains a significant hurdle.

Durability requirements have also intensified, with regulations now mandating that emission control systems maintain performance for up to 700,000 kilometers in heavy-duty applications. This necessitates catalyst formulations resistant to thermal aging, poisoning, and mechanical stress over extended periods.

The integration of real-world driving emissions (RDE) testing in regulatory frameworks has exposed the limitations of laboratory-optimized catalyst systems. Manufacturers must now ensure performance across highly variable operating conditions, including different driving styles, ambient temperatures, and altitudes.

Additionally, the regulatory push toward zero-emission vehicles is creating uncertainty about the long-term market for traditional catalyst technologies, complicating investment decisions in research and development. This transition period requires manufacturers to simultaneously improve conventional catalyst systems while preparing for potential paradigm shifts in propulsion technologies.

Current Catalyst Solutions and Compliance Strategies

01 Metal-based catalysts for nitrogen reduction

Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen compounds. These catalysts often feature specific surface structures and compositions that enhance their selectivity and efficiency in nitrogen reduction reactions, particularly in environmental applications and industrial processes.- Metal-based catalysts for nitrogen reduction: Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen to ammonia or other reduced nitrogen compounds. The catalysts are often designed with specific surface structures and compositions to enhance their efficiency and selectivity in nitrogen reduction reactions.

- Supported catalysts for nitrogen reduction: Nitrogen reduction catalysts can be enhanced by dispersing active components on various support materials. These supports provide increased surface area, improved stability, and better dispersion of the active catalytic sites. Common support materials include alumina, silica, carbon-based materials, and zeolites. The interaction between the active catalyst and the support material can significantly influence the catalytic performance in nitrogen reduction reactions.

- Novel catalyst compositions for enhanced nitrogen reduction: Advanced catalyst compositions have been developed specifically for nitrogen reduction applications. These include multi-component systems, doped materials, and novel structures designed to improve catalytic activity and selectivity. Some compositions incorporate promoters or modifiers to enhance the performance of the primary catalytic component. These novel compositions aim to overcome limitations of traditional catalysts by providing better activity under milder conditions.

- Catalyst preparation methods for nitrogen reduction: Various preparation methods have been developed to synthesize effective nitrogen reduction catalysts with controlled properties. These methods include precipitation, impregnation, sol-gel processes, and hydrothermal synthesis. The preparation technique significantly influences the catalyst's physical and chemical properties, such as particle size, dispersion, and surface area, which in turn affect its catalytic performance in nitrogen reduction reactions.

- Catalyst systems for selective catalytic reduction (SCR) of nitrogen oxides: Specialized catalyst systems have been developed for the selective catalytic reduction (SCR) of nitrogen oxides in exhaust gases. These systems typically use ammonia or urea as reducing agents and incorporate catalysts that promote the conversion of nitrogen oxides to nitrogen gas. The catalysts are designed to operate effectively within specific temperature ranges and in the presence of various gas compositions found in industrial or automotive exhaust streams.

02 Zeolite and molecular sieve catalysts

Zeolites and molecular sieves serve as effective catalysts for nitrogen reduction due to their unique porous structures and ion-exchange capabilities. These materials provide selective reaction sites and can be modified with various metals to enhance their catalytic performance. Their high thermal stability and resistance to poisoning make them particularly valuable in applications such as NOx reduction in exhaust gas treatment systems.Expand Specific Solutions03 Supported catalysts for nitrogen reduction

Catalysts supported on various substrates show enhanced performance in nitrogen reduction reactions. The support materials, including alumina, silica, and carbon-based materials, provide high surface area and stability to the active catalytic components. These supported catalysts demonstrate improved dispersion of active sites, enhanced durability, and better resistance to deactivation, making them suitable for continuous operation in industrial settings.Expand Specific Solutions04 Novel catalyst preparation methods

Innovative preparation techniques have been developed to create more efficient nitrogen reduction catalysts. These methods include sol-gel processes, impregnation techniques, co-precipitation, and hydrothermal synthesis. Advanced manufacturing approaches enable precise control over catalyst morphology, particle size, and composition, resulting in catalysts with enhanced activity, selectivity, and longevity for nitrogen reduction applications.Expand Specific Solutions05 Catalysts for specific nitrogen reduction applications

Specialized catalysts have been designed for specific nitrogen reduction processes, including ammonia synthesis, NOx abatement, and wastewater treatment. These application-specific catalysts are tailored to operate under particular conditions such as high pressure, elevated temperature, or in the presence of certain contaminants. Their formulations are optimized to achieve maximum conversion efficiency while minimizing energy consumption and catalyst degradation in their target applications.Expand Specific Solutions

Key Industry Players and Competitive Analysis

The nitrogen reduction catalyst market is currently in a growth phase, characterized by increasing regulatory pressures driving adoption across industries. The global market size is expanding significantly as environmental regulations become more stringent worldwide, particularly in automotive and industrial sectors. From a technological maturity perspective, established players like Topsoe A/S, Umicore SA, and China Petroleum & Chemical Corp. lead with advanced catalyst solutions, while companies such as Toyota, Hyundai, and Ford are actively developing application-specific technologies. Research institutions including CSIC and KIST are advancing next-generation catalysts. The competitive landscape shows a mix of chemical specialists (Topsoe, Umicore), energy companies (Sinopec), and end-users (automotive manufacturers) collaborating and competing to meet increasingly strict emissions standards across different regulatory environments.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced Selective Catalytic Reduction (SCR) systems utilizing vanadium-based catalysts optimized for high NOx conversion efficiency across varied temperature ranges (300-400°C). Their proprietary V2O5-WO3/TiO2 formulation achieves over 90% NOx reduction while minimizing ammonia slip to below 5ppm. Sinopec has pioneered catalyst manufacturing techniques that enhance durability against sulfur poisoning and particulate fouling, extending catalyst lifespan by approximately 20% compared to industry standards. Their integrated approach combines catalyst technology with precise urea dosing systems and advanced control algorithms to meet China VI emission standards for both stationary sources and mobile applications. Sinopec has also developed low-temperature SCR catalysts that maintain over 80% NOx conversion efficiency at temperatures as low as 200°C, addressing cold-start emissions challenges.

Strengths: Extensive refinery integration expertise allowing for optimized system design; strong domestic supply chain control; advanced manufacturing capabilities for large-scale catalyst production. Weaknesses: International market penetration remains limited compared to European competitors; catalyst performance in extreme low-temperature conditions (<180°C) still requires improvement.

Umicore SA

Technical Solution: Umicore has developed proprietary nitrogen reduction catalyst technologies centered around their advanced Selective Catalytic Reduction (SCR) systems. Their flagship product line features copper-zeolite (Cu-CHA) catalysts that demonstrate exceptional NOx conversion efficiency (>95%) across a broad temperature window (200-500°C). Umicore's catalysts incorporate innovative coating technologies that maximize active surface area while minimizing precious metal content, achieving compliance with Euro VI and EPA Tier 4 Final regulations. Their dual-layer catalyst design combines SCR functionality with ammonia slip control, enabling precise dosing strategies that optimize both NOx reduction and ammonia utilization. Umicore has pioneered catalyst manufacturing processes that enhance hydrothermal stability, allowing their products to maintain performance even after exposure to temperatures exceeding 800°C during regeneration cycles. Their latest generation catalysts demonstrate remarkable resistance to sulfur poisoning and hydrocarbon inhibition, addressing key challenges in real-world operating conditions.

Strengths: Extensive materials science expertise; vertically integrated precious metals management; global manufacturing footprint enabling consistent quality and supply security. Weaknesses: Higher initial cost compared to vanadium-based alternatives; performance degradation in applications with very high particulate matter concentrations requires additional filtration systems.

Patent Analysis of Advanced Nitrogen Reduction Catalysts

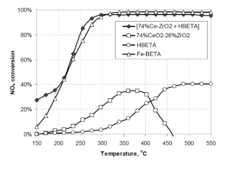

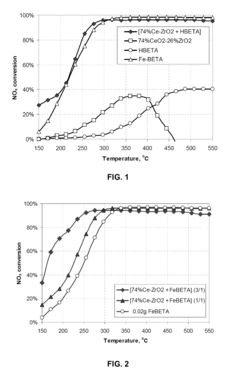

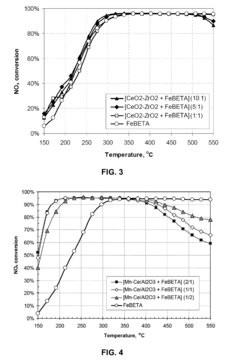

Catalyst composition and method for use in selective catalytic reduction of nitrogen oxides

PatentActiveUS9168517B2

Innovation

- A catalyst composition comprising acidic zeolite or zeotype components physically admixed with redox active metal compounds, such as CeO2-ZrO2, Cu/Al2O3, and Mn/Al2O3, which exhibit a synergistic effect in enhancing NOx reduction and soot oxidation activities, allowing for reduced zeolite content without sacrificing performance.

Process and catalyst system for selective reduction of nitrogen oxides

PatentWO2014169935A1

Innovation

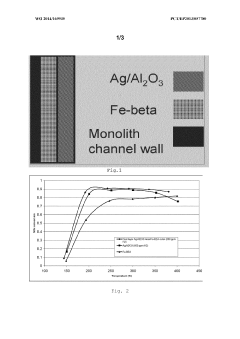

- A sandwiched catalyst system comprising alternately layered iron-beta-zeolite (Fe-beta-zeolite) and silver supported on alumina (Ag/Al203) catalysts, with the Ag/Al203 forming the outer layer and Fe-BEA the inner layer, enhances NOx reduction performance across a broad temperature range and improves sulphur tolerance by maintaining close contact between catalysts, allowing for efficient diffusion and reaction of NOx and reducing agents.

Environmental Impact Assessment

The implementation of nitrogen reduction catalysts in industrial processes has significant environmental implications that must be carefully assessed. Regulatory frameworks worldwide increasingly emphasize comprehensive environmental impact evaluations before approving catalyst technologies, particularly those aimed at reducing nitrogen oxide (NOx) emissions.

Nitrogen reduction catalysts, while designed to mitigate harmful emissions, can themselves create secondary environmental effects. The production, use, and disposal of these catalysts involve heavy metals such as vanadium, tungsten, and platinum that may contaminate soil and water systems if improperly managed. Regulatory bodies typically require detailed life cycle assessments that quantify these potential impacts across the catalyst's entire operational lifespan.

Air quality improvements represent the primary environmental benefit of nitrogen reduction technologies. Studies indicate that effective SCR (Selective Catalytic Reduction) systems can reduce NOx emissions by 80-95%, significantly decreasing ground-level ozone formation and acid rain precipitation. Regulations increasingly mandate these environmental benefits be quantified through standardized measurement protocols and continuous monitoring systems.

Water resource impacts constitute another critical assessment area. Certain catalyst systems, particularly those using ammonia or urea as reducing agents, can create ammonia slip that potentially contaminates waterways. Regulatory frameworks in Europe and North America specifically limit ammonia emissions and require sophisticated control technologies to prevent these secondary pollutants.

Climate change considerations have become increasingly prominent in environmental impact assessments. While nitrogen reduction catalysts primarily target NOx emissions, regulations now often require evaluation of their impact on greenhouse gas emissions. This includes both direct effects (such as N2O formation, a potent greenhouse gas) and indirect benefits (reduced ozone formation which has warming potential).

Ecosystem and biodiversity impacts must also be evaluated under most regulatory frameworks. Reduced nitrogen deposition in sensitive ecosystems can prevent eutrophication and protect biodiversity. Modern regulations increasingly require modeling of these ecosystem-level benefits when approving new catalyst technologies or installations.

Resource efficiency represents the final major component of environmental impact assessment. Regulations increasingly emphasize catalyst longevity, regeneration capabilities, and end-of-life recovery of precious metals. The European Union's circular economy initiatives specifically target improved resource efficiency in catalyst technologies, requiring manufacturers to demonstrate responsible material stewardship throughout the product lifecycle.

Nitrogen reduction catalysts, while designed to mitigate harmful emissions, can themselves create secondary environmental effects. The production, use, and disposal of these catalysts involve heavy metals such as vanadium, tungsten, and platinum that may contaminate soil and water systems if improperly managed. Regulatory bodies typically require detailed life cycle assessments that quantify these potential impacts across the catalyst's entire operational lifespan.

Air quality improvements represent the primary environmental benefit of nitrogen reduction technologies. Studies indicate that effective SCR (Selective Catalytic Reduction) systems can reduce NOx emissions by 80-95%, significantly decreasing ground-level ozone formation and acid rain precipitation. Regulations increasingly mandate these environmental benefits be quantified through standardized measurement protocols and continuous monitoring systems.

Water resource impacts constitute another critical assessment area. Certain catalyst systems, particularly those using ammonia or urea as reducing agents, can create ammonia slip that potentially contaminates waterways. Regulatory frameworks in Europe and North America specifically limit ammonia emissions and require sophisticated control technologies to prevent these secondary pollutants.

Climate change considerations have become increasingly prominent in environmental impact assessments. While nitrogen reduction catalysts primarily target NOx emissions, regulations now often require evaluation of their impact on greenhouse gas emissions. This includes both direct effects (such as N2O formation, a potent greenhouse gas) and indirect benefits (reduced ozone formation which has warming potential).

Ecosystem and biodiversity impacts must also be evaluated under most regulatory frameworks. Reduced nitrogen deposition in sensitive ecosystems can prevent eutrophication and protect biodiversity. Modern regulations increasingly require modeling of these ecosystem-level benefits when approving new catalyst technologies or installations.

Resource efficiency represents the final major component of environmental impact assessment. Regulations increasingly emphasize catalyst longevity, regeneration capabilities, and end-of-life recovery of precious metals. The European Union's circular economy initiatives specifically target improved resource efficiency in catalyst technologies, requiring manufacturers to demonstrate responsible material stewardship throughout the product lifecycle.

Cost-Benefit Analysis of Regulatory Compliance

Regulatory compliance in the nitrogen reduction catalyst sector presents a complex economic equation for industry stakeholders. The implementation of stringent emissions standards, particularly NOx regulations like Euro 6/7, US EPA Tier 3, and China 6, creates substantial upfront costs for manufacturers and end-users. These expenses include catalyst system redesign, certification testing, and production line modifications, often reaching millions of dollars per engine family or industrial installation.

Initial compliance investments typically range from $2-5 million for small-scale industrial applications to $50-100 million for large automotive manufacturers implementing fleet-wide solutions. Ongoing compliance costs include more frequent catalyst replacement cycles, increased precious metal loadings, and enhanced monitoring systems, adding 15-30% to operational expenses compared to less regulated environments.

However, these compliance costs must be weighed against significant economic benefits. Non-compliance penalties have increased dramatically, with regulatory fines potentially reaching $37,500 per violation per day in the US and similar punitive structures in the EU and Asia. The Volkswagen emissions scandal demonstrated the catastrophic financial impact of non-compliance, resulting in over $30 billion in penalties and settlements.

Proactive compliance also generates competitive advantages through improved corporate reputation, access to restricted markets, and reduced liability exposure. Companies with advanced nitrogen reduction technologies report 5-15% price premiums in environmentally conscious markets and improved stakeholder relations. Early adopters of stringent compliance measures frequently secure favorable positions as regulations tighten globally.

Long-term economic analysis reveals that regulatory compliance often yields positive returns over a 5-10 year horizon. While initial capital expenditures are substantial, operational efficiencies from newer catalyst technologies, reduced environmental remediation costs, and avoidance of non-compliance penalties typically offset these investments. Studies indicate that companies implementing comprehensive compliance strategies achieve 12-18% better financial performance compared to reactive competitors.

The regulatory landscape continues to evolve toward more stringent standards, suggesting that early investment in advanced nitrogen reduction technologies represents a prudent economic strategy. Forward-looking cost-benefit analyses increasingly incorporate carbon pricing mechanisms, ecosystem service valuations, and public health impact assessments, further strengthening the economic case for robust compliance programs beyond mere regulatory adherence.

Initial compliance investments typically range from $2-5 million for small-scale industrial applications to $50-100 million for large automotive manufacturers implementing fleet-wide solutions. Ongoing compliance costs include more frequent catalyst replacement cycles, increased precious metal loadings, and enhanced monitoring systems, adding 15-30% to operational expenses compared to less regulated environments.

However, these compliance costs must be weighed against significant economic benefits. Non-compliance penalties have increased dramatically, with regulatory fines potentially reaching $37,500 per violation per day in the US and similar punitive structures in the EU and Asia. The Volkswagen emissions scandal demonstrated the catastrophic financial impact of non-compliance, resulting in over $30 billion in penalties and settlements.

Proactive compliance also generates competitive advantages through improved corporate reputation, access to restricted markets, and reduced liability exposure. Companies with advanced nitrogen reduction technologies report 5-15% price premiums in environmentally conscious markets and improved stakeholder relations. Early adopters of stringent compliance measures frequently secure favorable positions as regulations tighten globally.

Long-term economic analysis reveals that regulatory compliance often yields positive returns over a 5-10 year horizon. While initial capital expenditures are substantial, operational efficiencies from newer catalyst technologies, reduced environmental remediation costs, and avoidance of non-compliance penalties typically offset these investments. Studies indicate that companies implementing comprehensive compliance strategies achieve 12-18% better financial performance compared to reactive competitors.

The regulatory landscape continues to evolve toward more stringent standards, suggesting that early investment in advanced nitrogen reduction technologies represents a prudent economic strategy. Forward-looking cost-benefit analyses increasingly incorporate carbon pricing mechanisms, ecosystem service valuations, and public health impact assessments, further strengthening the economic case for robust compliance programs beyond mere regulatory adherence.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!