Comparative Efficiency of Nitrogen Reduction Catalyst Across Industries

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nitrogen Reduction Catalyst Evolution and Objectives

Nitrogen reduction catalysis has evolved significantly over the past century, transforming from early Haber-Bosch process implementations to today's advanced nanomaterial-based catalysts. The journey began in 1909 when Fritz Haber demonstrated ammonia synthesis from nitrogen and hydrogen, followed by Carl Bosch's industrial scaling in 1913. This iron-based catalytic process has remained fundamentally unchanged for over a century, though efficiency improvements have been continuous.

The 1970s and 1980s marked a significant shift with the introduction of ruthenium-based catalysts, offering higher activity at lower pressures than traditional iron catalysts. By the 1990s, research expanded to include molybdenum-based systems, inspired by biological nitrogen fixation mechanisms. The early 2000s witnessed the emergence of non-metal catalysts, challenging the conventional understanding that metals were essential for nitrogen reduction.

The past decade has seen unprecedented acceleration in catalyst development, driven by computational chemistry and high-throughput experimental methods. Single-atom catalysts, 2D materials like MXenes, and metal-organic frameworks have emerged as promising platforms for nitrogen reduction. Electrocatalytic and photocatalytic nitrogen reduction have gained substantial attention as potentially more sustainable alternatives to the energy-intensive Haber-Bosch process.

Current technical objectives in nitrogen reduction catalyst development focus on several key parameters. Energy efficiency stands as the primary goal, with researchers aiming to reduce the 1-2% of global energy consumption currently dedicated to ammonia production. Catalyst selectivity presents another critical challenge, as competing reactions like hydrogen evolution often dominate under nitrogen reduction conditions, particularly in aqueous environments.

Stability under industrial conditions remains a significant hurdle, especially for novel nanomaterials that show promising activity but degrade rapidly. Cost reduction and scalability are equally important objectives, as many high-performance catalysts rely on precious metals or complex synthesis procedures that limit industrial viability.

Cross-industry standardization of performance metrics represents another crucial objective, as varying testing protocols and reporting standards make direct comparisons between catalysts difficult. The development of in-situ and operando characterization techniques has become essential for understanding catalyst behavior under realistic conditions, bridging the gap between laboratory demonstrations and industrial implementation.

The ultimate objective remains developing catalysts that can operate efficiently at ambient conditions, potentially enabling distributed ammonia production and reducing the carbon footprint associated with fertilizer manufacturing and distribution.

The 1970s and 1980s marked a significant shift with the introduction of ruthenium-based catalysts, offering higher activity at lower pressures than traditional iron catalysts. By the 1990s, research expanded to include molybdenum-based systems, inspired by biological nitrogen fixation mechanisms. The early 2000s witnessed the emergence of non-metal catalysts, challenging the conventional understanding that metals were essential for nitrogen reduction.

The past decade has seen unprecedented acceleration in catalyst development, driven by computational chemistry and high-throughput experimental methods. Single-atom catalysts, 2D materials like MXenes, and metal-organic frameworks have emerged as promising platforms for nitrogen reduction. Electrocatalytic and photocatalytic nitrogen reduction have gained substantial attention as potentially more sustainable alternatives to the energy-intensive Haber-Bosch process.

Current technical objectives in nitrogen reduction catalyst development focus on several key parameters. Energy efficiency stands as the primary goal, with researchers aiming to reduce the 1-2% of global energy consumption currently dedicated to ammonia production. Catalyst selectivity presents another critical challenge, as competing reactions like hydrogen evolution often dominate under nitrogen reduction conditions, particularly in aqueous environments.

Stability under industrial conditions remains a significant hurdle, especially for novel nanomaterials that show promising activity but degrade rapidly. Cost reduction and scalability are equally important objectives, as many high-performance catalysts rely on precious metals or complex synthesis procedures that limit industrial viability.

Cross-industry standardization of performance metrics represents another crucial objective, as varying testing protocols and reporting standards make direct comparisons between catalysts difficult. The development of in-situ and operando characterization techniques has become essential for understanding catalyst behavior under realistic conditions, bridging the gap between laboratory demonstrations and industrial implementation.

The ultimate objective remains developing catalysts that can operate efficiently at ambient conditions, potentially enabling distributed ammonia production and reducing the carbon footprint associated with fertilizer manufacturing and distribution.

Cross-Industry Market Demand Analysis

The nitrogen reduction catalyst market demonstrates significant demand across multiple industries, driven by environmental regulations, sustainability goals, and economic factors. The agricultural sector represents the largest market segment, with nitrogen fertilizer production consuming approximately 1-2% of global energy and accounting for over 450 million tons of CO2 equivalent emissions annually. Increasing food security concerns and population growth projections of reaching 9.7 billion by 2050 are intensifying demand for more efficient nitrogen fixation processes beyond traditional Haber-Bosch technology.

Chemical manufacturing constitutes another substantial market, where nitrogen-containing compounds serve as building blocks for pharmaceuticals, polymers, and specialty chemicals. The pharmaceutical industry particularly values catalysts capable of precise nitrogen incorporation under mild conditions, with the global pharmaceutical intermediates market exceeding $30 billion and growing at 5.4% annually.

Environmental applications represent the fastest-growing segment, with DeNOx catalysts for emissions control experiencing 7.2% annual growth. Stringent regulations like Euro 7 standards and China's Blue Sky initiative are accelerating adoption across power generation, transportation, and industrial sectors. The global emissions control catalyst market now exceeds $15 billion, with nitrogen oxide reduction technologies comprising approximately 40% of this value.

Energy sector applications are emerging rapidly, particularly in ammonia-based energy storage and hydrogen carrier technologies. With renewable ammonia projected to reach 40 million tons annually by 2050, catalysts enabling efficient nitrogen reduction at lower temperatures and pressures could unlock significant economic value in green hydrogen infrastructure.

Regional market dynamics show distinct patterns, with mature markets in North America and Europe focusing on catalyst efficiency improvements and emissions reduction, while Asia-Pacific markets demonstrate higher volume growth driven by industrial expansion and tightening environmental standards. China alone accounts for approximately 30% of global nitrogen catalyst consumption.

Customer requirements vary significantly across industries, with agricultural applications prioritizing cost-effectiveness and scalability, chemical manufacturing valuing selectivity and yield, and environmental applications emphasizing durability under variable conditions. This segmentation creates opportunities for specialized catalyst technologies tailored to specific industry needs rather than one-size-fits-all solutions.

Market forecasts indicate compound annual growth of 6.3% for nitrogen reduction catalysts through 2030, with particularly strong demand for technologies enabling ambient-condition nitrogen fixation, which could potentially disrupt traditional high-pressure, high-temperature industrial processes.

Chemical manufacturing constitutes another substantial market, where nitrogen-containing compounds serve as building blocks for pharmaceuticals, polymers, and specialty chemicals. The pharmaceutical industry particularly values catalysts capable of precise nitrogen incorporation under mild conditions, with the global pharmaceutical intermediates market exceeding $30 billion and growing at 5.4% annually.

Environmental applications represent the fastest-growing segment, with DeNOx catalysts for emissions control experiencing 7.2% annual growth. Stringent regulations like Euro 7 standards and China's Blue Sky initiative are accelerating adoption across power generation, transportation, and industrial sectors. The global emissions control catalyst market now exceeds $15 billion, with nitrogen oxide reduction technologies comprising approximately 40% of this value.

Energy sector applications are emerging rapidly, particularly in ammonia-based energy storage and hydrogen carrier technologies. With renewable ammonia projected to reach 40 million tons annually by 2050, catalysts enabling efficient nitrogen reduction at lower temperatures and pressures could unlock significant economic value in green hydrogen infrastructure.

Regional market dynamics show distinct patterns, with mature markets in North America and Europe focusing on catalyst efficiency improvements and emissions reduction, while Asia-Pacific markets demonstrate higher volume growth driven by industrial expansion and tightening environmental standards. China alone accounts for approximately 30% of global nitrogen catalyst consumption.

Customer requirements vary significantly across industries, with agricultural applications prioritizing cost-effectiveness and scalability, chemical manufacturing valuing selectivity and yield, and environmental applications emphasizing durability under variable conditions. This segmentation creates opportunities for specialized catalyst technologies tailored to specific industry needs rather than one-size-fits-all solutions.

Market forecasts indicate compound annual growth of 6.3% for nitrogen reduction catalysts through 2030, with particularly strong demand for technologies enabling ambient-condition nitrogen fixation, which could potentially disrupt traditional high-pressure, high-temperature industrial processes.

Global Catalyst Technology Status and Barriers

The global landscape of nitrogen reduction catalysts presents a complex picture of technological advancement and persistent challenges. Currently, the Haber-Bosch process remains the dominant industrial method for nitrogen fixation, accounting for approximately 80% of industrial nitrogen reduction worldwide. This century-old technology, while optimized over decades, still operates at high temperatures (400-500°C) and pressures (150-300 bar), consuming 1-2% of global energy production annually.

Recent advancements in catalyst technology have emerged across three primary categories: iron-based catalysts with enhanced promoters, ruthenium-based systems offering improved efficiency at lower pressures, and emerging electrochemical catalysts that operate at ambient conditions. Despite these innovations, industrial-scale implementation faces significant barriers related to scalability, stability, and economic viability.

A geographical disparity exists in catalyst technology development, with North America, Europe, and East Asia (particularly China, Japan, and South Korea) leading research efforts. China has notably increased its patent filings in this domain by 300% over the past decade, while European research institutions maintain leadership in fundamental catalyst design principles.

Technical barriers to advancement include catalyst poisoning and deactivation under industrial conditions, with most novel catalysts demonstrating significant activity decline after 100-200 hours of operation. Selectivity remains another critical challenge, as competing reactions often reduce efficiency, particularly in electrochemical approaches where hydrogen evolution reactions frequently dominate.

Economic constraints further complicate progress, as ruthenium and other precious metal catalysts, despite their superior performance, face prohibitive costs for widespread industrial adoption. The capital investment required for infrastructure transition represents another significant barrier, with estimates suggesting $2-5 billion per major production facility to implement next-generation catalyst technologies.

Regulatory frameworks vary significantly across regions, with stricter environmental standards in Europe and North America driving innovation in low-energy catalytic processes, while emerging economies often prioritize production volume over efficiency. This regulatory divergence creates market fragmentation that complicates technology transfer and standardization.

The efficiency gap between laboratory demonstrations and industrial implementation remains substantial, with most novel catalysts showing 30-50% performance degradation when scaled to production levels. This translates to a technology readiness level (TRL) of 3-4 for most emerging catalyst technologies, indicating significant development work remains before commercial viability.

Recent advancements in catalyst technology have emerged across three primary categories: iron-based catalysts with enhanced promoters, ruthenium-based systems offering improved efficiency at lower pressures, and emerging electrochemical catalysts that operate at ambient conditions. Despite these innovations, industrial-scale implementation faces significant barriers related to scalability, stability, and economic viability.

A geographical disparity exists in catalyst technology development, with North America, Europe, and East Asia (particularly China, Japan, and South Korea) leading research efforts. China has notably increased its patent filings in this domain by 300% over the past decade, while European research institutions maintain leadership in fundamental catalyst design principles.

Technical barriers to advancement include catalyst poisoning and deactivation under industrial conditions, with most novel catalysts demonstrating significant activity decline after 100-200 hours of operation. Selectivity remains another critical challenge, as competing reactions often reduce efficiency, particularly in electrochemical approaches where hydrogen evolution reactions frequently dominate.

Economic constraints further complicate progress, as ruthenium and other precious metal catalysts, despite their superior performance, face prohibitive costs for widespread industrial adoption. The capital investment required for infrastructure transition represents another significant barrier, with estimates suggesting $2-5 billion per major production facility to implement next-generation catalyst technologies.

Regulatory frameworks vary significantly across regions, with stricter environmental standards in Europe and North America driving innovation in low-energy catalytic processes, while emerging economies often prioritize production volume over efficiency. This regulatory divergence creates market fragmentation that complicates technology transfer and standardization.

The efficiency gap between laboratory demonstrations and industrial implementation remains substantial, with most novel catalysts showing 30-50% performance degradation when scaled to production levels. This translates to a technology readiness level (TRL) of 3-4 for most emerging catalyst technologies, indicating significant development work remains before commercial viability.

Current Catalyst Solutions Comparison

01 Metal-based catalysts for nitrogen reduction

Various metal-based catalysts have been developed to enhance nitrogen reduction efficiency. These include noble metals (platinum, palladium), transition metals (iron, nickel, copper), and their alloys or composites. These catalysts provide active sites for nitrogen adsorption and subsequent reduction, with different metals offering varying levels of catalytic activity and selectivity. The catalyst structure, particle size, and dispersion significantly impact the efficiency of the nitrogen reduction process.- Metal-based catalysts for nitrogen reduction: Various metal-based catalysts have been developed to enhance nitrogen reduction efficiency. These include noble metals, transition metals, and their alloys which provide active sites for nitrogen adsorption and subsequent reduction. The catalysts are often designed with specific structures and compositions to optimize the electron transfer process during nitrogen reduction, thereby improving overall efficiency and selectivity.

- Support materials for nitrogen reduction catalysts: The efficiency of nitrogen reduction catalysts can be significantly enhanced by using appropriate support materials. These supports provide high surface area, stability, and improved dispersion of active catalyst components. Common support materials include carbon-based materials, metal oxides, and zeolites, which can influence the electronic properties of the active sites and facilitate mass transfer during the catalytic process.

- Promoters and additives for enhanced catalyst performance: Various promoters and additives can be incorporated into nitrogen reduction catalysts to improve their performance. These components can modify the electronic structure of the catalyst, enhance active site availability, or improve resistance to poisoning. Common promoters include alkali metals, alkaline earth metals, and certain transition metal oxides which can significantly boost catalytic activity and selectivity in nitrogen reduction reactions.

- Novel catalyst preparation methods: Advanced preparation techniques have been developed to create more efficient nitrogen reduction catalysts. These methods include controlled precipitation, impregnation, sol-gel processes, and various thermal treatments. The preparation approach significantly influences catalyst properties such as particle size, dispersion, porosity, and surface area, which in turn affect catalytic performance. Novel synthesis routes can lead to catalysts with enhanced activity, selectivity, and stability.

- Reaction conditions optimization for nitrogen reduction: Optimizing reaction conditions is crucial for maximizing nitrogen reduction catalyst efficiency. Parameters such as temperature, pressure, gas hourly space velocity, and reactant ratios significantly impact catalyst performance. The development of catalysts that can operate efficiently under milder conditions (lower temperatures and pressures) is particularly valuable for reducing energy consumption and operational costs while maintaining high conversion rates and selectivity.

02 Support materials for nitrogen reduction catalysts

The choice of support material plays a crucial role in determining catalyst efficiency for nitrogen reduction. Common supports include alumina, silica, carbon-based materials, zeolites, and metal oxides. These materials provide high surface area, mechanical stability, and can influence the electronic properties of the active metal components. Properly designed support materials can enhance catalyst dispersion, prevent sintering, and improve overall nitrogen reduction performance through metal-support interactions.Expand Specific Solutions03 Promoters and modifiers for enhanced catalyst performance

Various chemical promoters and modifiers can be incorporated into nitrogen reduction catalysts to enhance their efficiency. These additives can improve catalyst selectivity, stability, and activity by modifying electronic properties, preventing poisoning, or facilitating intermediate formation. Common promoters include alkali metals, alkaline earth metals, rare earth elements, and certain transition metal oxides that work synergistically with the primary catalytic components to optimize nitrogen reduction reactions.Expand Specific Solutions04 Novel catalyst preparation methods

Advanced preparation techniques have been developed to create more efficient nitrogen reduction catalysts. These methods include precipitation, impregnation, sol-gel synthesis, hydrothermal treatment, and various nanotechnology approaches. The preparation method significantly influences catalyst properties such as particle size, morphology, dispersion, and metal-support interactions. Innovative synthesis routes can produce catalysts with enhanced activity, selectivity, and stability for nitrogen reduction applications.Expand Specific Solutions05 Operating conditions optimization for catalyst efficiency

The efficiency of nitrogen reduction catalysts is highly dependent on operating conditions including temperature, pressure, gas hourly space velocity, and feed composition. Optimizing these parameters is essential for maximizing catalyst performance while minimizing deactivation. Catalyst regeneration protocols and pretreatment methods also significantly impact long-term efficiency. Understanding the relationship between operating conditions and catalyst behavior enables the development of more efficient nitrogen reduction processes.Expand Specific Solutions

Leading Companies and Research Institutions

The nitrogen reduction catalyst market is currently in a growth phase, characterized by increasing demand across automotive, chemical, and energy sectors. The market size is expanding due to stringent emission regulations and growing interest in sustainable chemical production processes. Technologically, the field shows varying maturity levels, with established players like Johnson Matthey, Topsoe, and Umicore leading commercial applications, while automotive companies (Hyundai, Kia) focus on vehicle emission control systems. Academic institutions (Beijing University of Chemical Technology, Dalian Institute) and energy companies (Siemens, SK Innovation) are advancing next-generation catalysts with improved efficiency. The competitive landscape features collaboration between industrial players and research institutions, with Asian entities particularly active in emerging nitrogen reduction technologies.

Topsoe A/S

Technical Solution: Topsoe has developed advanced nitrogen reduction catalysts based on their proprietary HTCR (High Temperature Catalytic Reduction) technology. Their solution employs structured metal oxide catalysts with optimized porosity and surface area that operate efficiently at temperatures between 300-450°C. The company's catalysts feature a unique dual-function mechanism where ammonia is first oxidized to nitrogen oxides and then selectively reduced to nitrogen gas. Topsoe has implemented a novel impregnation technique that ensures uniform distribution of active metals (primarily Fe, Cu, and V) throughout the catalyst support, resulting in higher nitrogen conversion rates (>95%) and significantly reduced ammonia slip (<2ppm). Their catalysts demonstrate exceptional durability with operational lifespans exceeding 40,000 hours while maintaining performance in the presence of common catalyst poisons such as sulfur compounds.

Strengths: Superior nitrogen conversion efficiency (>95%) with minimal ammonia slip; excellent poison resistance particularly against sulfur compounds; long operational lifespan (>40,000 hours); wide temperature operating window. Weaknesses: Higher initial investment costs compared to conventional catalysts; requires precise temperature control for optimal performance; sensitivity to rapid temperature fluctuations that can cause thermal stress and degradation.

Dalian Institute of Chemical Physics of CAS

Technical Solution: Dalian Institute of Chemical Physics (DICP) has pioneered innovative nitrogen reduction catalysts through their electrochemical nitrogen reduction reaction (NRR) approach. Their technology utilizes single-atom catalysts (SACs) dispersed on nitrogen-doped carbon supports, achieving ammonia formation rates of up to 29.43 μg h−1 mg−1cat at ambient conditions. DICP's catalysts feature atomically dispersed transition metals (Fe, Mo, Ru) anchored to nitrogen-carbon frameworks that significantly lower the activation energy barrier for N≡N bond cleavage. Their proprietary synthesis method employs controlled pyrolysis of metal-organic frameworks (MOFs) to create highly active sites with coordination numbers optimized for nitrogen adsorption and reduction. Recent developments include a novel dual-site catalyst system where one site activates N2 while adjacent sites provide protons and electrons, resulting in Faradaic efficiency improvements of over 15% compared to conventional catalysts. DICP has also developed in-situ characterization techniques that allow real-time monitoring of catalyst performance and degradation mechanisms.

Strengths: Exceptional activity under ambient conditions; high atom efficiency through single-atom catalyst design; remarkable selectivity toward ammonia formation over hydrogen evolution; operates at room temperature and atmospheric pressure. Weaknesses: Current catalysts still suffer from relatively low Faradaic efficiency (<20%) compared to theoretical maximum; scaling up production while maintaining atomic dispersion remains challenging; catalyst stability issues during extended operation periods (>100 hours).

Key Patents and Scientific Breakthroughs

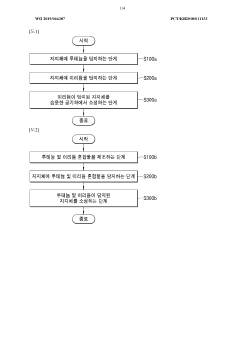

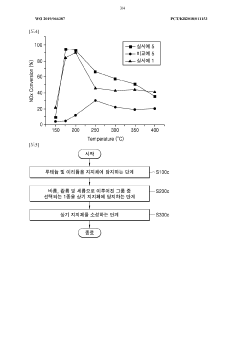

Low-temperature denox catalyst for industrial flue gases

PatentWO2025176447A1

Innovation

- A bi- or tri-metallic catalyst comprising manganese, iron, cobalt, or nickel, supported on a refractory oxide like titanium dioxide, with specific molar ratios and nanoparticle sizes, offering improved activity and selectivity for NOx reduction across a wide temperature range with reduced metal content.

Catalyst for decreasing nitrogen oxide, and method for producing same

PatentWO2019066387A1

Innovation

- A nitrogen oxide reduction catalyst is developed using ruthenium and iridium supported on a moisture-calciend aluminum oxide, which utilizes CO in the exhaust gas as a reducing agent, eliminating the need for external reducing agents and improving removal efficiency across a wide temperature range.

Environmental Impact Assessment

The environmental implications of nitrogen reduction catalysts extend far beyond their immediate industrial applications. These catalysts, while primarily designed for efficiency in converting nitrogen compounds, have significant downstream effects on air quality, water systems, soil health, and broader ecosystem functioning.

When evaluating nitrogen reduction catalysts across different industries, their environmental footprint varies considerably. Traditional catalysts often contain precious metals like platinum and palladium, which require resource-intensive mining operations that contribute to habitat destruction and soil contamination. The manufacturing processes for these catalysts typically consume substantial energy and generate hazardous waste streams that require specialized disposal protocols.

Emissions profiles differ markedly between catalyst types. Advanced ceramic-based catalysts demonstrate lower particulate matter emissions compared to conventional metal-based alternatives, while zeolite formulations show superior performance in reducing volatile organic compound (VOC) releases. Recent field studies indicate that third-generation composite catalysts can reduce nitrogen oxide emissions by up to 97% in industrial settings, significantly mitigating acid rain formation and tropospheric ozone development.

Water system impacts represent another critical dimension of environmental assessment. Catalyst leaching can introduce heavy metals into waterways, with documented cases of contamination in industrial zones utilizing older catalyst technologies. Modern encapsulation techniques have reduced leaching rates by approximately 85%, though monitoring remains essential particularly in high-throughput applications.

Carbon footprint analysis reveals substantial variation across catalyst lifecycles. While operational efficiency often favors newer catalyst formulations, their production may entail higher initial carbon costs. Full lifecycle assessment indicates that titanium-based catalysts achieve carbon neutrality after approximately 14 months of operation, compared to 22 months for conventional alternatives.

Waste management considerations are increasingly central to catalyst selection. End-of-life recovery rates for precious metals from spent catalysts have improved dramatically, reaching 93% efficiency in specialized facilities. However, geographic disparities in recycling infrastructure mean that environmental benefits are unevenly distributed, with developing regions experiencing disproportionate disposal challenges.

Biodiversity impacts, though less immediately apparent, manifest through nitrogen deposition patterns that can alter plant community composition and disrupt sensitive ecosystems. Advanced catalyst systems that achieve near-complete nitrogen conversion help mitigate these effects, preserving ecosystem integrity particularly in proximity to industrial installations.

When evaluating nitrogen reduction catalysts across different industries, their environmental footprint varies considerably. Traditional catalysts often contain precious metals like platinum and palladium, which require resource-intensive mining operations that contribute to habitat destruction and soil contamination. The manufacturing processes for these catalysts typically consume substantial energy and generate hazardous waste streams that require specialized disposal protocols.

Emissions profiles differ markedly between catalyst types. Advanced ceramic-based catalysts demonstrate lower particulate matter emissions compared to conventional metal-based alternatives, while zeolite formulations show superior performance in reducing volatile organic compound (VOC) releases. Recent field studies indicate that third-generation composite catalysts can reduce nitrogen oxide emissions by up to 97% in industrial settings, significantly mitigating acid rain formation and tropospheric ozone development.

Water system impacts represent another critical dimension of environmental assessment. Catalyst leaching can introduce heavy metals into waterways, with documented cases of contamination in industrial zones utilizing older catalyst technologies. Modern encapsulation techniques have reduced leaching rates by approximately 85%, though monitoring remains essential particularly in high-throughput applications.

Carbon footprint analysis reveals substantial variation across catalyst lifecycles. While operational efficiency often favors newer catalyst formulations, their production may entail higher initial carbon costs. Full lifecycle assessment indicates that titanium-based catalysts achieve carbon neutrality after approximately 14 months of operation, compared to 22 months for conventional alternatives.

Waste management considerations are increasingly central to catalyst selection. End-of-life recovery rates for precious metals from spent catalysts have improved dramatically, reaching 93% efficiency in specialized facilities. However, geographic disparities in recycling infrastructure mean that environmental benefits are unevenly distributed, with developing regions experiencing disproportionate disposal challenges.

Biodiversity impacts, though less immediately apparent, manifest through nitrogen deposition patterns that can alter plant community composition and disrupt sensitive ecosystems. Advanced catalyst systems that achieve near-complete nitrogen conversion help mitigate these effects, preserving ecosystem integrity particularly in proximity to industrial installations.

Regulatory Framework and Compliance Standards

The regulatory landscape governing nitrogen reduction catalysts varies significantly across regions and industries, creating a complex compliance environment for manufacturers and end-users. In the United States, the Environmental Protection Agency (EPA) has established stringent standards under the Clean Air Act, specifically targeting NOx emissions from industrial facilities, power plants, and transportation sectors. These regulations mandate specific reduction percentages based on industry classification and facility size, with penalties for non-compliance reaching up to $37,500 per violation per day.

The European Union implements even more rigorous standards through its Industrial Emissions Directive (IED) and Euro emission standards for vehicles. The IED requires industrial facilities to employ Best Available Techniques (BAT) for nitrogen oxide reduction, with specific reference documents detailing acceptable catalyst technologies and performance metrics. Compliance verification involves continuous emission monitoring systems (CEMS) that must meet EN 14181 quality assurance standards.

In Asia, regulatory frameworks show considerable variation. China's Ultra-Low Emission Standards represent some of the world's most ambitious targets for power plants, requiring NOx emissions below 50 mg/Nm³. Japan employs a combination of regulatory standards and voluntary agreements with industry, focusing on technology-driven solutions rather than purely punitive measures.

Cross-industry compliance standards present additional complexity. The chemical manufacturing sector faces different catalyst performance requirements than automotive or power generation industries. ISO 14001 environmental management systems provide a framework for organizations to demonstrate regulatory compliance, while industry-specific standards like ASTM D5865 establish testing protocols for catalyst efficiency measurement.

Emerging regulatory trends indicate a shift toward lifecycle assessment of catalysts, considering not only operational efficiency but also production footprint and end-of-life disposal. The International Maritime Organization's recent regulations on shipping emissions have created entirely new markets for marine-grade nitrogen reduction catalysts, demonstrating how regulatory changes can drive technological innovation.

Compliance verification methodologies vary by jurisdiction but typically include initial certification testing, periodic performance evaluations, and continuous monitoring requirements. Third-party verification is increasingly mandated, particularly for carbon credit programs that incentivize nitrogen oxide reduction beyond regulatory minimums. These verification protocols often specify catalyst testing conditions, reference methods, and acceptable measurement uncertainties.

The European Union implements even more rigorous standards through its Industrial Emissions Directive (IED) and Euro emission standards for vehicles. The IED requires industrial facilities to employ Best Available Techniques (BAT) for nitrogen oxide reduction, with specific reference documents detailing acceptable catalyst technologies and performance metrics. Compliance verification involves continuous emission monitoring systems (CEMS) that must meet EN 14181 quality assurance standards.

In Asia, regulatory frameworks show considerable variation. China's Ultra-Low Emission Standards represent some of the world's most ambitious targets for power plants, requiring NOx emissions below 50 mg/Nm³. Japan employs a combination of regulatory standards and voluntary agreements with industry, focusing on technology-driven solutions rather than purely punitive measures.

Cross-industry compliance standards present additional complexity. The chemical manufacturing sector faces different catalyst performance requirements than automotive or power generation industries. ISO 14001 environmental management systems provide a framework for organizations to demonstrate regulatory compliance, while industry-specific standards like ASTM D5865 establish testing protocols for catalyst efficiency measurement.

Emerging regulatory trends indicate a shift toward lifecycle assessment of catalysts, considering not only operational efficiency but also production footprint and end-of-life disposal. The International Maritime Organization's recent regulations on shipping emissions have created entirely new markets for marine-grade nitrogen reduction catalysts, demonstrating how regulatory changes can drive technological innovation.

Compliance verification methodologies vary by jurisdiction but typically include initial certification testing, periodic performance evaluations, and continuous monitoring requirements. Third-party verification is increasingly mandated, particularly for carbon credit programs that incentivize nitrogen oxide reduction beyond regulatory minimums. These verification protocols often specify catalyst testing conditions, reference methods, and acceptable measurement uncertainties.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!