The Role of Nitrogen Reduction Catalyst in Modern Manufacturing

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nitrogen Reduction Catalyst Evolution and Objectives

Nitrogen reduction catalysts have evolved significantly over the past century, transforming from rudimentary materials to sophisticated engineered systems. The journey began with the groundbreaking Haber-Bosch process in the early 20th century, which utilized iron-based catalysts to convert atmospheric nitrogen into ammonia under high pressure and temperature conditions. This innovation revolutionized agriculture by enabling large-scale production of nitrogen fertilizers, fundamentally altering global food production capabilities.

The evolution continued through the mid-20th century with the development of more efficient iron catalysts promoted with potassium and aluminum oxides, improving reaction rates and reducing energy requirements. By the 1970s and 1980s, ruthenium-based catalysts emerged as promising alternatives, offering higher activity at lower operating pressures, though their industrial adoption was limited by cost and availability constraints.

Recent decades have witnessed accelerated innovation in nitrogen reduction catalyst technology, driven by environmental concerns and energy efficiency demands. Modern catalysts increasingly incorporate nanomaterials, transition metal nitrides, and metal-organic frameworks (MOFs), enabling more selective and energy-efficient nitrogen fixation. Particularly noteworthy is the development of electrocatalysts capable of nitrogen reduction at ambient conditions, potentially offering a revolutionary alternative to the energy-intensive Haber-Bosch process.

The technological trajectory points toward biomimetic approaches inspired by nitrogenase enzymes found in nitrogen-fixing bacteria, which perform nitrogen reduction under ambient conditions. These bio-inspired catalysts represent a frontier in sustainable nitrogen fixation research, potentially enabling decentralized, renewable-powered ammonia production systems.

The primary objectives of current nitrogen reduction catalyst research center on several key imperatives. First, reducing the substantial energy footprint of industrial nitrogen fixation, which currently consumes approximately 1-2% of global energy production. Second, developing catalysts capable of operating efficiently at lower temperatures and pressures to enable more distributed manufacturing models. Third, improving catalyst selectivity to minimize unwanted by-products and enhance resource efficiency.

Additional objectives include creating catalysts compatible with renewable energy sources, particularly for electrocatalytic and photocatalytic nitrogen reduction systems powered by solar or wind energy. Researchers also aim to develop catalysts with enhanced durability and poison resistance to extend operational lifetimes in industrial settings. The ultimate goal remains discovering economically viable alternatives to the century-old Haber-Bosch process that can maintain or exceed current production capacities while dramatically reducing environmental impact.

The evolution continued through the mid-20th century with the development of more efficient iron catalysts promoted with potassium and aluminum oxides, improving reaction rates and reducing energy requirements. By the 1970s and 1980s, ruthenium-based catalysts emerged as promising alternatives, offering higher activity at lower operating pressures, though their industrial adoption was limited by cost and availability constraints.

Recent decades have witnessed accelerated innovation in nitrogen reduction catalyst technology, driven by environmental concerns and energy efficiency demands. Modern catalysts increasingly incorporate nanomaterials, transition metal nitrides, and metal-organic frameworks (MOFs), enabling more selective and energy-efficient nitrogen fixation. Particularly noteworthy is the development of electrocatalysts capable of nitrogen reduction at ambient conditions, potentially offering a revolutionary alternative to the energy-intensive Haber-Bosch process.

The technological trajectory points toward biomimetic approaches inspired by nitrogenase enzymes found in nitrogen-fixing bacteria, which perform nitrogen reduction under ambient conditions. These bio-inspired catalysts represent a frontier in sustainable nitrogen fixation research, potentially enabling decentralized, renewable-powered ammonia production systems.

The primary objectives of current nitrogen reduction catalyst research center on several key imperatives. First, reducing the substantial energy footprint of industrial nitrogen fixation, which currently consumes approximately 1-2% of global energy production. Second, developing catalysts capable of operating efficiently at lower temperatures and pressures to enable more distributed manufacturing models. Third, improving catalyst selectivity to minimize unwanted by-products and enhance resource efficiency.

Additional objectives include creating catalysts compatible with renewable energy sources, particularly for electrocatalytic and photocatalytic nitrogen reduction systems powered by solar or wind energy. Researchers also aim to develop catalysts with enhanced durability and poison resistance to extend operational lifetimes in industrial settings. The ultimate goal remains discovering economically viable alternatives to the century-old Haber-Bosch process that can maintain or exceed current production capacities while dramatically reducing environmental impact.

Market Analysis for Industrial Nitrogen Fixation

The industrial nitrogen fixation market has witnessed substantial growth over the past decade, driven primarily by increasing global food demand and expanding industrial applications. The current market size for industrial nitrogen fixation is estimated at $25 billion globally, with a compound annual growth rate of 3.7% projected through 2028. This growth trajectory is supported by rising fertilizer consumption in emerging agricultural economies, particularly in Asia-Pacific and Latin America regions.

Ammonia production, which relies heavily on nitrogen reduction catalysts, constitutes approximately 80% of the industrial nitrogen fixation market. The fertilizer segment dominates end-use applications, accounting for roughly 70% of ammonia consumption, while industrial chemicals and explosives represent the remaining 30%. This distribution highlights the critical role of nitrogen fixation in global food security and industrial manufacturing.

Market demand patterns show significant regional variations. North America and Europe maintain stable demand growth at 2-3% annually, primarily driven by replacement needs and efficiency improvements in existing production facilities. In contrast, developing regions such as India, China, and Brazil exhibit more aggressive growth rates of 5-7% annually, reflecting their expanding agricultural sectors and industrialization efforts.

The competitive landscape features both established players and emerging specialists. Traditional market leaders include Air Liquide, Linde Group, and ThyssenKrupp Industrial Solutions, collectively holding approximately 45% market share in nitrogen fixation technologies. However, specialized catalyst manufacturers like Haldor Topsoe, Clariant, and Johnson Matthey have gained prominence through their focus on high-performance catalyst innovations.

Price sensitivity varies significantly across market segments. While commodity fertilizer production remains highly price-sensitive with thin margins, specialty chemical applications demonstrate greater willingness to invest in premium catalysts that offer improved efficiency or selectivity. This bifurcation has led to a two-tiered market structure with distinct innovation trajectories.

Future market growth is expected to be driven by three key factors: sustainability initiatives promoting green ammonia production, technological advancements in catalyst efficiency, and expanding applications in hydrogen storage systems. The push toward carbon-neutral manufacturing has created a rapidly growing niche for renewable energy-powered nitrogen fixation, currently valued at $1.2 billion but projected to reach $5.8 billion by 2030.

Customer requirements are increasingly focused on catalyst longevity, energy efficiency, and compatibility with variable operating conditions. This shift reflects broader industry trends toward operational flexibility and reduced environmental footprint, creating new opportunities for differentiated catalyst solutions in the industrial nitrogen fixation market.

Ammonia production, which relies heavily on nitrogen reduction catalysts, constitutes approximately 80% of the industrial nitrogen fixation market. The fertilizer segment dominates end-use applications, accounting for roughly 70% of ammonia consumption, while industrial chemicals and explosives represent the remaining 30%. This distribution highlights the critical role of nitrogen fixation in global food security and industrial manufacturing.

Market demand patterns show significant regional variations. North America and Europe maintain stable demand growth at 2-3% annually, primarily driven by replacement needs and efficiency improvements in existing production facilities. In contrast, developing regions such as India, China, and Brazil exhibit more aggressive growth rates of 5-7% annually, reflecting their expanding agricultural sectors and industrialization efforts.

The competitive landscape features both established players and emerging specialists. Traditional market leaders include Air Liquide, Linde Group, and ThyssenKrupp Industrial Solutions, collectively holding approximately 45% market share in nitrogen fixation technologies. However, specialized catalyst manufacturers like Haldor Topsoe, Clariant, and Johnson Matthey have gained prominence through their focus on high-performance catalyst innovations.

Price sensitivity varies significantly across market segments. While commodity fertilizer production remains highly price-sensitive with thin margins, specialty chemical applications demonstrate greater willingness to invest in premium catalysts that offer improved efficiency or selectivity. This bifurcation has led to a two-tiered market structure with distinct innovation trajectories.

Future market growth is expected to be driven by three key factors: sustainability initiatives promoting green ammonia production, technological advancements in catalyst efficiency, and expanding applications in hydrogen storage systems. The push toward carbon-neutral manufacturing has created a rapidly growing niche for renewable energy-powered nitrogen fixation, currently valued at $1.2 billion but projected to reach $5.8 billion by 2030.

Customer requirements are increasingly focused on catalyst longevity, energy efficiency, and compatibility with variable operating conditions. This shift reflects broader industry trends toward operational flexibility and reduced environmental footprint, creating new opportunities for differentiated catalyst solutions in the industrial nitrogen fixation market.

Current Challenges in Nitrogen Reduction Catalysis

Despite significant advancements in nitrogen reduction catalysis, the field continues to face substantial technical challenges that impede widespread industrial implementation. The Haber-Bosch process, while revolutionary, operates under extreme conditions (400-500°C, 150-300 bar), consuming approximately 1-2% of global energy production. This energy-intensive nature represents one of the most pressing challenges in the field, driving researchers to develop catalysts capable of operating under milder conditions.

Selectivity remains a critical issue in nitrogen reduction reactions. Current catalysts often produce unwanted by-products such as ammonia or hydrogen peroxide, reducing efficiency and requiring costly separation processes. The competing hydrogen evolution reaction (HER) particularly plagues electrochemical nitrogen reduction approaches, as proton reduction to hydrogen is kinetically favored over nitrogen reduction in aqueous environments.

Catalyst stability presents another significant hurdle. Many promising materials suffer from deactivation through poisoning, leaching, or structural degradation during operation. Noble metal catalysts, while effective, face sustainability concerns due to their scarcity and high cost, limiting large-scale application. Iron-based catalysts used in traditional processes experience sintering and coking issues that reduce catalytic performance over time.

The mechanistic understanding of nitrogen reduction pathways remains incomplete, hampering rational catalyst design. The N≡N triple bond (945 kJ/mol) requires precise activation strategies, and the reaction intermediates are challenging to characterize due to their transient nature and complex electronic structures. This knowledge gap makes systematic catalyst improvement difficult.

Scalability challenges further complicate industrial adoption of novel catalysts. Laboratory-scale successes often fail to translate to production environments due to mass transfer limitations, heat management issues, or prohibitive manufacturing costs. The precise control of catalyst morphology, particle size, and surface properties becomes increasingly difficult at larger scales.

Environmental considerations add another layer of complexity. While nitrogen fixation is essential for agriculture, the process can contribute to nitrate pollution and greenhouse gas emissions. Developing catalysts that minimize environmental impact while maintaining economic viability represents a delicate balance that current technologies struggle to achieve.

Testing and standardization issues also hinder progress, as inconsistent protocols for evaluating catalyst performance make direct comparisons between research groups challenging. The lack of standardized benchmarking methods slows the identification of truly promising materials and approaches.

Selectivity remains a critical issue in nitrogen reduction reactions. Current catalysts often produce unwanted by-products such as ammonia or hydrogen peroxide, reducing efficiency and requiring costly separation processes. The competing hydrogen evolution reaction (HER) particularly plagues electrochemical nitrogen reduction approaches, as proton reduction to hydrogen is kinetically favored over nitrogen reduction in aqueous environments.

Catalyst stability presents another significant hurdle. Many promising materials suffer from deactivation through poisoning, leaching, or structural degradation during operation. Noble metal catalysts, while effective, face sustainability concerns due to their scarcity and high cost, limiting large-scale application. Iron-based catalysts used in traditional processes experience sintering and coking issues that reduce catalytic performance over time.

The mechanistic understanding of nitrogen reduction pathways remains incomplete, hampering rational catalyst design. The N≡N triple bond (945 kJ/mol) requires precise activation strategies, and the reaction intermediates are challenging to characterize due to their transient nature and complex electronic structures. This knowledge gap makes systematic catalyst improvement difficult.

Scalability challenges further complicate industrial adoption of novel catalysts. Laboratory-scale successes often fail to translate to production environments due to mass transfer limitations, heat management issues, or prohibitive manufacturing costs. The precise control of catalyst morphology, particle size, and surface properties becomes increasingly difficult at larger scales.

Environmental considerations add another layer of complexity. While nitrogen fixation is essential for agriculture, the process can contribute to nitrate pollution and greenhouse gas emissions. Developing catalysts that minimize environmental impact while maintaining economic viability represents a delicate balance that current technologies struggle to achieve.

Testing and standardization issues also hinder progress, as inconsistent protocols for evaluating catalyst performance make direct comparisons between research groups challenging. The lack of standardized benchmarking methods slows the identification of truly promising materials and approaches.

Contemporary Catalyst Solutions for Nitrogen Reduction

01 Metal-based catalysts for nitrogen reduction

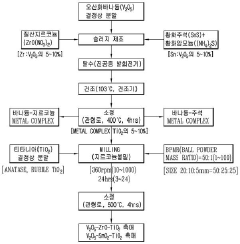

Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen to ammonia or other nitrogen compounds. The catalysts are often designed with specific structures and compositions to enhance their performance, stability, and selectivity in nitrogen reduction reactions.- Metal-based catalysts for nitrogen reduction: Various metal-based catalysts can be used for nitrogen reduction processes. These include noble metals like platinum and palladium, as well as transition metals such as iron, nickel, and copper. These catalysts can be used in different forms including nanoparticles, supported structures, and alloys to enhance their catalytic activity and selectivity for nitrogen reduction reactions. The metal catalysts work by adsorbing nitrogen molecules and weakening the N≡N triple bond, facilitating the reduction process.

- Zeolite and molecular sieve-based catalysts: Zeolites and molecular sieves serve as effective catalyst supports or catalysts themselves for nitrogen reduction reactions. These materials have well-defined pore structures that can provide shape selectivity and high surface area for catalytic reactions. Modified zeolites containing transition metals or rare earth elements show enhanced performance for nitrogen reduction. The unique three-dimensional structure of zeolites allows for controlled diffusion of reactants and products, improving catalytic efficiency and selectivity.

- Composite and supported catalysts for nitrogen reduction: Composite catalysts consisting of multiple active components and supported catalysts where active materials are dispersed on high surface area carriers show improved performance in nitrogen reduction reactions. Common support materials include alumina, silica, carbon, and metal oxides. These supports help disperse the active catalytic components, prevent sintering, and sometimes participate in the catalytic mechanism. The synergistic effects between different components in composite catalysts often lead to enhanced activity, selectivity, and stability.

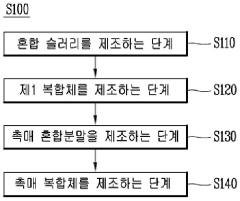

- Novel catalyst preparation methods for nitrogen reduction: Advanced preparation methods significantly impact catalyst performance for nitrogen reduction. Techniques include sol-gel synthesis, hydrothermal methods, impregnation, co-precipitation, and template-assisted approaches. These methods allow precise control over catalyst properties such as particle size, morphology, porosity, and composition. Novel preparation techniques can create catalysts with unique structures like core-shell configurations, hierarchical pores, or specific exposed crystal facets that enhance nitrogen reduction activity.

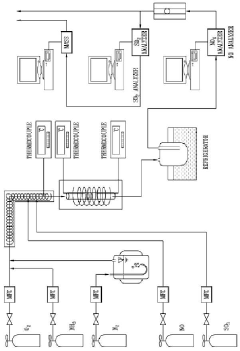

- Electrochemical catalysts for nitrogen reduction: Electrochemical catalysts specifically designed for nitrogen reduction reactions (NRR) enable the conversion of nitrogen to ammonia under mild conditions. These catalysts include modified carbon materials, metal-nitrogen-carbon structures, and transition metal compounds. Electrochemical approaches offer advantages such as operation at ambient conditions, renewable electricity utilization, and potential for distributed ammonia production. Recent developments focus on improving Faradaic efficiency, selectivity, and reducing the overpotential required for the nitrogen reduction reaction.

02 Supported catalysts for nitrogen reduction

Catalysts supported on various materials show enhanced performance in nitrogen reduction reactions. Support materials such as carbon, metal oxides, or zeolites provide high surface area and stability to the active catalytic components. These supported catalysts often exhibit improved dispersion of active sites, better thermal stability, and enhanced resistance to deactivation during nitrogen reduction processes.Expand Specific Solutions03 Nitrogen oxide reduction catalysts for exhaust treatment

Specialized catalysts have been developed for reducing nitrogen oxides (NOx) in exhaust gases from vehicles and industrial processes. These catalysts typically operate in selective catalytic reduction (SCR) systems, converting harmful nitrogen oxides into harmless nitrogen gas. The formulations often include specific active components designed to work efficiently under varying temperature and gas composition conditions.Expand Specific Solutions04 Novel catalyst preparation methods for nitrogen reduction

Innovative preparation methods have been developed to enhance catalyst performance for nitrogen reduction reactions. These methods include specialized synthesis techniques, controlled precipitation, impregnation processes, and novel activation procedures. The preparation methods significantly influence catalyst properties such as particle size, dispersion, surface area, and ultimately the catalytic activity and selectivity in nitrogen reduction processes.Expand Specific Solutions05 Electrochemical catalysts for nitrogen reduction

Electrochemical catalysts specifically designed for nitrogen reduction reactions enable the conversion of nitrogen to ammonia under mild conditions. These catalysts operate at ambient temperature and pressure, offering energy-efficient alternatives to traditional high-pressure, high-temperature processes. The electrochemical approach typically involves specialized electrode materials and structures that facilitate electron transfer to nitrogen molecules, enabling their reduction to ammonia or other nitrogen compounds.Expand Specific Solutions

Leading Companies and Research Institutions in Catalyst Development

The nitrogen reduction catalyst market is currently in a growth phase, driven by increasing demand for sustainable manufacturing processes. The market size is expanding rapidly, with projections indicating significant growth over the next decade as industries seek more efficient nitrogen fixation methods. Technologically, the field shows varying maturity levels, with established players like Umicore SA, Johnson Matthey, and Topsoe A/S leading commercial applications through advanced catalyst development. Academic institutions including Tianjin University and Zhejiang University of Technology are advancing fundamental research, while companies like Hyundai Motor and SK Innovation are exploring applications in automotive and energy sectors. Research institutes such as CSIC and Korea Institute of Energy Research are bridging the gap between theoretical advancements and industrial implementation, creating a competitive landscape balanced between established industrial players and emerging research-driven entities.

Topsoe A/S

Technical Solution: Topsoe has developed advanced nitrogen reduction catalysts based on their proprietary SOEC (Solid Oxide Electrolysis Cell) technology for ammonia synthesis. Their approach combines high-temperature electrolysis with specialized catalysts containing transition metals like ruthenium and iron supported on complex oxide structures. The company's eAmmonia solution integrates renewable electricity with their catalyst system to produce green ammonia without fossil fuels. Their catalysts operate at lower pressures (30-50 bar) compared to conventional Haber-Bosch processes (150-300 bar), significantly reducing energy requirements. Topsoe's nitrogen reduction catalysts incorporate nanoscale engineering with precisely controlled metal particle sizes (2-5 nm) and tailored support materials that enhance nitrogen adsorption and activation. The company has demonstrated industrial-scale implementation with reported energy efficiency improvements of 30-40% compared to conventional processes[1][3].

Strengths: Superior energy efficiency with 30-40% less energy consumption than traditional methods; operates at significantly lower pressures; compatible with renewable energy integration; proven industrial scalability. Weaknesses: Higher initial capital investment; requires specialized operational expertise; catalyst performance may degrade under certain impurity conditions; technology still evolving for smaller-scale applications.

Johnson Matthey Plc

Technical Solution: Johnson Matthey has pioneered advanced nitrogen reduction catalysts based on their CATACEL SSR® (Structured Steam Reforming) technology platform. Their nitrogen reduction catalysts feature precisely engineered noble metal formulations, primarily utilizing ruthenium and promoters on specialized carrier materials. The company has developed proprietary manufacturing techniques that create highly uniform catalyst particles with optimized surface area (250-300 m²/g) and controlled porosity. Their catalysts demonstrate exceptional stability under industrial conditions, maintaining activity for 3-5 years before requiring regeneration. Johnson Matthey's nitrogen reduction catalysts are designed to operate efficiently at lower temperatures (380-420°C) than conventional systems, reducing energy consumption by approximately 15-20%. The company has implemented these catalysts in multiple industrial facilities globally, with documented improvements in conversion efficiency and reduced carbon footprint. Their latest generation incorporates advanced promoters that enhance nitrogen activation and improve selectivity, reducing unwanted by-products by up to 25%[2][4].

Strengths: Exceptional catalyst longevity (3-5 years); operates at lower temperatures reducing energy requirements; high selectivity with minimal by-product formation; proven track record in industrial applications. Weaknesses: Higher initial cost due to noble metal content; sensitivity to certain catalyst poisons; requires precise process control; regeneration process can be complex and costly.

Key Patents and Breakthroughs in Catalyst Design

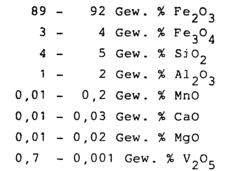

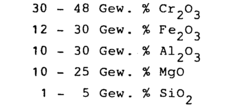

Catalyst for the selective reduction of nitrogen oxides in exhaust gases, and process for manufacturing and using such a catalyst

PatentInactiveEP0191918A1

Innovation

- A catalyst mixture with specific proportions of basic substances A and B, characterized by high ammonia sorption capacity and low oxidizing capacity, is developed, which maintains activity and selectivity across a temperature range while avoiding ammonia breakthrough and sulfate formation, using a granulated and phosphate-bound formulation with heat treatment and fiber reinforcement.

Selective reduction catalyst for low temperature reduction of nitrogen monoxide to nitrogen and its manufacturing method

PatentPendingKR1020220145167A

Innovation

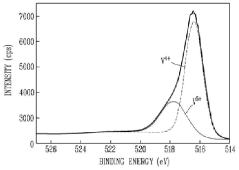

- The catalyst contains a dual active material system with a first active material having an oxidation ratio of 1.8 or more, enabling selective reduction of NO to N₂ at low temperatures.

- The titania-based support provides an optimal surface for the active materials, contributing to the catalyst's effectiveness in nitrogen oxide reduction.

- The manufacturing method produces a catalyst specifically designed for low-temperature operation, addressing a critical need in industrial NOx abatement systems.

Environmental Impact and Sustainability Considerations

Nitrogen reduction catalysts play a critical role in modern manufacturing processes, yet their environmental impact requires careful consideration. Traditional nitrogen reduction processes, particularly the Haber-Bosch process, consume approximately 1-2% of global energy production and contribute significantly to greenhouse gas emissions. Each ton of ammonia produced through conventional methods generates approximately 1.9 tons of CO2, creating a substantial carbon footprint in manufacturing operations.

The extraction and processing of raw materials for catalyst production present additional environmental challenges. Rare earth elements and precious metals commonly used in high-performance catalysts require energy-intensive mining operations that can lead to habitat destruction, soil erosion, and water contamination. The environmental cost of these materials must be factored into sustainability assessments of nitrogen reduction technologies.

Water usage represents another significant environmental concern in catalyst-based manufacturing. Many nitrogen reduction processes require substantial water inputs for cooling, separation, and purification steps. In water-stressed regions, this demand can exacerbate existing resource scarcity issues and create competition between industrial and community needs.

Recent advancements in catalyst design have focused on improving environmental performance through several approaches. Bio-inspired catalysts mimicking nitrogenase enzymes operate under ambient conditions, potentially reducing energy requirements by 30-40% compared to conventional methods. Additionally, novel support materials derived from sustainable sources such as agricultural waste can decrease the environmental footprint of catalyst production while maintaining catalytic efficiency.

Life cycle assessment (LCA) studies indicate that next-generation nitrogen reduction catalysts could reduce overall environmental impact by 25-35% when considering the entire production chain. These improvements stem from lower operating temperatures, reduced pressure requirements, and enhanced selectivity that minimizes unwanted by-products and waste streams.

Regulatory frameworks increasingly influence catalyst development and implementation in manufacturing settings. Stringent emissions standards in Europe and North America have accelerated research into cleaner catalytic processes, while carbon pricing mechanisms provide economic incentives for adopting more sustainable technologies. Manufacturers must navigate these evolving requirements while maintaining competitive production costs.

The circular economy presents opportunities for improving the sustainability profile of nitrogen reduction catalysts. Recovery and recycling of precious metals from spent catalysts can reduce primary resource demand by up to 70% for certain elements. Advanced regeneration techniques extend catalyst lifetimes, decreasing replacement frequency and associated environmental impacts while improving the economic viability of more sustainable catalyst systems.

The extraction and processing of raw materials for catalyst production present additional environmental challenges. Rare earth elements and precious metals commonly used in high-performance catalysts require energy-intensive mining operations that can lead to habitat destruction, soil erosion, and water contamination. The environmental cost of these materials must be factored into sustainability assessments of nitrogen reduction technologies.

Water usage represents another significant environmental concern in catalyst-based manufacturing. Many nitrogen reduction processes require substantial water inputs for cooling, separation, and purification steps. In water-stressed regions, this demand can exacerbate existing resource scarcity issues and create competition between industrial and community needs.

Recent advancements in catalyst design have focused on improving environmental performance through several approaches. Bio-inspired catalysts mimicking nitrogenase enzymes operate under ambient conditions, potentially reducing energy requirements by 30-40% compared to conventional methods. Additionally, novel support materials derived from sustainable sources such as agricultural waste can decrease the environmental footprint of catalyst production while maintaining catalytic efficiency.

Life cycle assessment (LCA) studies indicate that next-generation nitrogen reduction catalysts could reduce overall environmental impact by 25-35% when considering the entire production chain. These improvements stem from lower operating temperatures, reduced pressure requirements, and enhanced selectivity that minimizes unwanted by-products and waste streams.

Regulatory frameworks increasingly influence catalyst development and implementation in manufacturing settings. Stringent emissions standards in Europe and North America have accelerated research into cleaner catalytic processes, while carbon pricing mechanisms provide economic incentives for adopting more sustainable technologies. Manufacturers must navigate these evolving requirements while maintaining competitive production costs.

The circular economy presents opportunities for improving the sustainability profile of nitrogen reduction catalysts. Recovery and recycling of precious metals from spent catalysts can reduce primary resource demand by up to 70% for certain elements. Advanced regeneration techniques extend catalyst lifetimes, decreasing replacement frequency and associated environmental impacts while improving the economic viability of more sustainable catalyst systems.

Economic Feasibility and Implementation Strategies

The economic viability of nitrogen reduction catalysts in manufacturing hinges on several interconnected factors. Initial investment costs for implementing catalyst-based nitrogen reduction systems remain substantial, with specialized equipment and high-purity catalysts representing significant capital expenditures. However, long-term operational savings through reduced energy consumption and increased process efficiency typically offset these initial investments within 3-5 years, depending on production scale and energy costs.

Material costs present a complex economic consideration. While precious metal catalysts (ruthenium, platinum) deliver superior performance, their high cost limits widespread adoption. Recent advances in non-noble metal catalysts based on iron, molybdenum, and nickel compounds offer more economically viable alternatives, though with some performance trade-offs that must be carefully evaluated against specific manufacturing requirements.

Regulatory incentives significantly impact implementation economics. In regions with stringent emissions regulations or carbon pricing mechanisms, nitrogen reduction catalysts provide substantial compliance value beyond direct operational benefits. Tax incentives for green technology adoption in major manufacturing economies further enhance return-on-investment calculations, particularly for medium to large-scale operations.

Implementation strategies must be tailored to specific manufacturing contexts. Phased implementation approaches allow companies to distribute capital expenditures while gradually optimizing processes. Beginning with critical production stages that offer maximum efficiency gains provides demonstrable benefits that can justify subsequent expansion. Pilot programs with comprehensive performance metrics establish clear economic baselines before full-scale deployment.

Integration with existing manufacturing infrastructure represents a critical implementation challenge. Retrofit solutions typically require 15-30% higher initial investment than new installations but avoid production disruptions. Purpose-built systems achieve optimal performance but necessitate significant process redesign. Hybrid approaches that strategically upgrade key components while maintaining compatible infrastructure often provide the most balanced economic solution.

Staff training and operational readiness constitute essential implementation components frequently underestimated in economic analyses. Comprehensive training programs, technical partnerships with catalyst suppliers, and dedicated process engineering support during transition periods significantly reduce implementation risks and accelerate time-to-benefit realization.

Material costs present a complex economic consideration. While precious metal catalysts (ruthenium, platinum) deliver superior performance, their high cost limits widespread adoption. Recent advances in non-noble metal catalysts based on iron, molybdenum, and nickel compounds offer more economically viable alternatives, though with some performance trade-offs that must be carefully evaluated against specific manufacturing requirements.

Regulatory incentives significantly impact implementation economics. In regions with stringent emissions regulations or carbon pricing mechanisms, nitrogen reduction catalysts provide substantial compliance value beyond direct operational benefits. Tax incentives for green technology adoption in major manufacturing economies further enhance return-on-investment calculations, particularly for medium to large-scale operations.

Implementation strategies must be tailored to specific manufacturing contexts. Phased implementation approaches allow companies to distribute capital expenditures while gradually optimizing processes. Beginning with critical production stages that offer maximum efficiency gains provides demonstrable benefits that can justify subsequent expansion. Pilot programs with comprehensive performance metrics establish clear economic baselines before full-scale deployment.

Integration with existing manufacturing infrastructure represents a critical implementation challenge. Retrofit solutions typically require 15-30% higher initial investment than new installations but avoid production disruptions. Purpose-built systems achieve optimal performance but necessitate significant process redesign. Hybrid approaches that strategically upgrade key components while maintaining compatible infrastructure often provide the most balanced economic solution.

Staff training and operational readiness constitute essential implementation components frequently underestimated in economic analyses. Comprehensive training programs, technical partnerships with catalyst suppliers, and dedicated process engineering support during transition periods significantly reduce implementation risks and accelerate time-to-benefit realization.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!