Analysis of Nitrogen Reduction Catalyst's Market Position

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nitrogen Reduction Catalyst Evolution and Objectives

Nitrogen reduction catalysts have evolved significantly over the past century, with major breakthroughs occurring in the early 1900s through the Haber-Bosch process. This industrial-scale ammonia synthesis method revolutionized agriculture and chemical manufacturing by enabling atmospheric nitrogen fixation under high pressure and temperature conditions. The iron-based catalysts initially developed by Fritz Haber and Carl Bosch have undergone continuous refinement, with ruthenium-based alternatives emerging in the 1970s offering improved efficiency.

The technological trajectory has been driven by increasing demands for more energy-efficient and environmentally sustainable nitrogen fixation processes. Traditional catalysts require extreme operating conditions (400-500°C, 150-300 bar), consuming approximately 1-2% of global energy production. This significant energy footprint has accelerated research into ambient-condition alternatives that could dramatically reduce the carbon footprint of nitrogen reduction reactions.

Recent advances in nanotechnology have enabled the development of novel catalyst architectures with enhanced surface area and active site distribution. Single-atom catalysts, particularly those utilizing transition metals on various supports, have demonstrated promising nitrogen reduction reaction (NRR) performance under milder conditions. Concurrently, biomimetic approaches inspired by nitrogenase enzymes have opened new avenues for catalyst design, attempting to replicate nature's ability to fix nitrogen at ambient temperatures and pressures.

Electrocatalytic nitrogen reduction has emerged as a particularly promising direction, with significant research focusing on developing catalysts capable of efficiently converting nitrogen to ammonia using renewable electricity. This approach aligns with global decarbonization efforts and could enable distributed, small-scale ammonia production systems powered by intermittent renewable energy sources.

The primary technological objectives in this field include developing catalysts with substantially improved Faradaic efficiency, selectivity for nitrogen reduction over competing hydrogen evolution reactions, and stability under operating conditions. Researchers aim to achieve ammonia production rates exceeding 10^-9 mol cm^-2 s^-1 with Faradaic efficiencies above 50% at ambient or near-ambient conditions—metrics that would enable commercial viability for electrocatalytic systems.

Additional objectives include understanding fundamental reaction mechanisms at the molecular level, which remains challenging due to the triple bond strength of nitrogen molecules and the complex multi-electron transfer processes involved. Computational modeling and advanced in-situ characterization techniques are increasingly employed to elucidate these mechanisms and guide rational catalyst design.

The field is now moving toward integrated systems that combine catalyst development with optimized reactor designs and process engineering to overcome mass transport limitations and improve overall system efficiency. The ultimate goal remains developing economically viable alternatives to the century-old Haber-Bosch process that can operate using renewable energy inputs while maintaining or exceeding current production capabilities.

The technological trajectory has been driven by increasing demands for more energy-efficient and environmentally sustainable nitrogen fixation processes. Traditional catalysts require extreme operating conditions (400-500°C, 150-300 bar), consuming approximately 1-2% of global energy production. This significant energy footprint has accelerated research into ambient-condition alternatives that could dramatically reduce the carbon footprint of nitrogen reduction reactions.

Recent advances in nanotechnology have enabled the development of novel catalyst architectures with enhanced surface area and active site distribution. Single-atom catalysts, particularly those utilizing transition metals on various supports, have demonstrated promising nitrogen reduction reaction (NRR) performance under milder conditions. Concurrently, biomimetic approaches inspired by nitrogenase enzymes have opened new avenues for catalyst design, attempting to replicate nature's ability to fix nitrogen at ambient temperatures and pressures.

Electrocatalytic nitrogen reduction has emerged as a particularly promising direction, with significant research focusing on developing catalysts capable of efficiently converting nitrogen to ammonia using renewable electricity. This approach aligns with global decarbonization efforts and could enable distributed, small-scale ammonia production systems powered by intermittent renewable energy sources.

The primary technological objectives in this field include developing catalysts with substantially improved Faradaic efficiency, selectivity for nitrogen reduction over competing hydrogen evolution reactions, and stability under operating conditions. Researchers aim to achieve ammonia production rates exceeding 10^-9 mol cm^-2 s^-1 with Faradaic efficiencies above 50% at ambient or near-ambient conditions—metrics that would enable commercial viability for electrocatalytic systems.

Additional objectives include understanding fundamental reaction mechanisms at the molecular level, which remains challenging due to the triple bond strength of nitrogen molecules and the complex multi-electron transfer processes involved. Computational modeling and advanced in-situ characterization techniques are increasingly employed to elucidate these mechanisms and guide rational catalyst design.

The field is now moving toward integrated systems that combine catalyst development with optimized reactor designs and process engineering to overcome mass transport limitations and improve overall system efficiency. The ultimate goal remains developing economically viable alternatives to the century-old Haber-Bosch process that can operate using renewable energy inputs while maintaining or exceeding current production capabilities.

Market Demand Analysis for Nitrogen Reduction Technologies

The global market for nitrogen reduction technologies has witnessed significant growth in recent years, driven primarily by increasing environmental concerns and stringent regulations on nitrogen oxide emissions. The demand for efficient nitrogen reduction catalysts spans across multiple industries, with the automotive sector representing the largest market segment due to tightening emission standards worldwide. According to recent market analyses, the global catalytic converter market, a significant application area for nitrogen reduction catalysts, was valued at approximately $42.4 billion in 2020 and is projected to reach $73.1 billion by 2025, growing at a CAGR of 11.5%.

The agricultural sector presents another substantial market for nitrogen reduction technologies, particularly in fertilizer production and management. With growing concerns about nitrate pollution in groundwater and surface water bodies, there is increasing demand for catalysts that can efficiently convert nitrogen compounds into less harmful substances. The market for environmental catalysts used in water treatment applications alone is expected to grow at a rate of 5.7% annually through 2026.

Industrial applications, including power plants, chemical manufacturing, and waste management facilities, constitute the third major market segment. These industries face mounting pressure to reduce nitrogen oxide emissions, creating a steady demand for advanced catalytic solutions. The industrial DeNOx systems market, which heavily relies on nitrogen reduction catalysts, is projected to expand at a CAGR of 6.8% over the next five years.

Regionally, Asia-Pacific dominates the market for nitrogen reduction technologies, accounting for over 40% of global demand. This is primarily attributed to rapid industrialization, expanding automotive production, and increasingly stringent emission regulations in countries like China, Japan, and South Korea. North America and Europe follow closely, driven by mature regulatory frameworks and growing investment in green technologies.

Consumer awareness and preference for environmentally friendly products are also influencing market dynamics. The willingness to pay premium prices for products with lower environmental footprints has encouraged manufacturers to invest in advanced nitrogen reduction technologies. This trend is particularly evident in the automotive sector, where low-emission vehicles command higher market prices and consumer loyalty.

Looking at future market trajectories, the demand for nitrogen reduction catalysts is expected to be further bolstered by emerging applications in renewable energy systems, particularly in ammonia-based energy storage solutions and hydrogen production pathways. The growing interest in green ammonia as a carbon-free fuel and energy carrier could potentially create a new multi-billion dollar market segment for specialized nitrogen reduction catalysts within the next decade.

The agricultural sector presents another substantial market for nitrogen reduction technologies, particularly in fertilizer production and management. With growing concerns about nitrate pollution in groundwater and surface water bodies, there is increasing demand for catalysts that can efficiently convert nitrogen compounds into less harmful substances. The market for environmental catalysts used in water treatment applications alone is expected to grow at a rate of 5.7% annually through 2026.

Industrial applications, including power plants, chemical manufacturing, and waste management facilities, constitute the third major market segment. These industries face mounting pressure to reduce nitrogen oxide emissions, creating a steady demand for advanced catalytic solutions. The industrial DeNOx systems market, which heavily relies on nitrogen reduction catalysts, is projected to expand at a CAGR of 6.8% over the next five years.

Regionally, Asia-Pacific dominates the market for nitrogen reduction technologies, accounting for over 40% of global demand. This is primarily attributed to rapid industrialization, expanding automotive production, and increasingly stringent emission regulations in countries like China, Japan, and South Korea. North America and Europe follow closely, driven by mature regulatory frameworks and growing investment in green technologies.

Consumer awareness and preference for environmentally friendly products are also influencing market dynamics. The willingness to pay premium prices for products with lower environmental footprints has encouraged manufacturers to invest in advanced nitrogen reduction technologies. This trend is particularly evident in the automotive sector, where low-emission vehicles command higher market prices and consumer loyalty.

Looking at future market trajectories, the demand for nitrogen reduction catalysts is expected to be further bolstered by emerging applications in renewable energy systems, particularly in ammonia-based energy storage solutions and hydrogen production pathways. The growing interest in green ammonia as a carbon-free fuel and energy carrier could potentially create a new multi-billion dollar market segment for specialized nitrogen reduction catalysts within the next decade.

Global Catalyst Development Status and Challenges

The global nitrogen reduction catalyst market is currently experiencing significant technological evolution, with research centers across North America, Europe, and Asia leading development efforts. Traditional catalysts based on iron and ruthenium have dominated industrial applications for decades, particularly in ammonia synthesis via the Haber-Bosch process, which consumes approximately 1-2% of global energy production and remains the backbone of fertilizer manufacturing worldwide.

Recent advancements in catalyst technology have focused on addressing the high energy requirements and harsh operating conditions of conventional nitrogen fixation processes. Research institutions in Germany, China, and the United States have made notable progress in developing catalysts that can operate at lower temperatures and pressures, potentially reducing energy consumption by 20-30% compared to traditional methods.

A major challenge facing the industry is the development of economically viable electrocatalysts for ambient-condition nitrogen reduction. Despite promising laboratory results, particularly with transition metal nitrides and single-atom catalysts, scaling these technologies to industrial levels remains problematic. Current electrochemical nitrogen reduction reaction (NRR) catalysts struggle with low Faradaic efficiency (typically below 15%) and insufficient production rates for commercial viability.

Environmental regulations are increasingly influencing catalyst development trajectories. Stringent emissions standards in Europe and North America have accelerated research into catalysts that minimize byproduct formation and reduce carbon footprints. This regulatory pressure has created regional variations in catalyst adoption patterns, with Asian markets generally prioritizing cost-effectiveness while Western markets emphasize sustainability metrics.

The geographical distribution of catalyst innovation shows interesting patterns, with fundamental research concentrated in academic institutions across Germany, Japan, and the United States, while application-focused development is increasingly shifting to China and India. This distribution reflects both historical expertise and emerging industrial priorities in nitrogen-based chemical production.

Material scarcity presents another significant challenge, particularly for catalysts incorporating platinum group metals or rare earth elements. Research into earth-abundant alternatives has intensified, with promising results from iron-based catalysts modified with nitrogen-doped carbon structures showing comparable activity to more expensive materials in certain applications.

Computational catalyst design has emerged as a transformative approach, with machine learning algorithms now capable of predicting catalyst performance and guiding experimental work. This computational revolution has accelerated development cycles by approximately 40% compared to traditional trial-and-error approaches, though the integration of these computational insights into industrial catalyst manufacturing remains incomplete.

Recent advancements in catalyst technology have focused on addressing the high energy requirements and harsh operating conditions of conventional nitrogen fixation processes. Research institutions in Germany, China, and the United States have made notable progress in developing catalysts that can operate at lower temperatures and pressures, potentially reducing energy consumption by 20-30% compared to traditional methods.

A major challenge facing the industry is the development of economically viable electrocatalysts for ambient-condition nitrogen reduction. Despite promising laboratory results, particularly with transition metal nitrides and single-atom catalysts, scaling these technologies to industrial levels remains problematic. Current electrochemical nitrogen reduction reaction (NRR) catalysts struggle with low Faradaic efficiency (typically below 15%) and insufficient production rates for commercial viability.

Environmental regulations are increasingly influencing catalyst development trajectories. Stringent emissions standards in Europe and North America have accelerated research into catalysts that minimize byproduct formation and reduce carbon footprints. This regulatory pressure has created regional variations in catalyst adoption patterns, with Asian markets generally prioritizing cost-effectiveness while Western markets emphasize sustainability metrics.

The geographical distribution of catalyst innovation shows interesting patterns, with fundamental research concentrated in academic institutions across Germany, Japan, and the United States, while application-focused development is increasingly shifting to China and India. This distribution reflects both historical expertise and emerging industrial priorities in nitrogen-based chemical production.

Material scarcity presents another significant challenge, particularly for catalysts incorporating platinum group metals or rare earth elements. Research into earth-abundant alternatives has intensified, with promising results from iron-based catalysts modified with nitrogen-doped carbon structures showing comparable activity to more expensive materials in certain applications.

Computational catalyst design has emerged as a transformative approach, with machine learning algorithms now capable of predicting catalyst performance and guiding experimental work. This computational revolution has accelerated development cycles by approximately 40% compared to traditional trial-and-error approaches, though the integration of these computational insights into industrial catalyst manufacturing remains incomplete.

Current Catalyst Solutions and Implementation Strategies

01 Transition metal-based catalysts for nitrogen reduction

Transition metals such as iron, nickel, and cobalt are widely used as catalysts for nitrogen reduction reactions. These metals, often in combination with support materials, demonstrate high catalytic activity for converting nitrogen to ammonia under various conditions. The catalysts can be optimized through different preparation methods to enhance their performance, stability, and selectivity in nitrogen reduction applications.- Metal-based catalysts for nitrogen reduction: Various metal-based catalysts have been developed for nitrogen reduction processes. These catalysts typically include noble metals, transition metals, or their combinations that facilitate the conversion of nitrogen compounds. The catalysts are designed with specific structures and compositions to enhance their activity, selectivity, and stability in nitrogen reduction reactions, particularly in applications such as NOx reduction in exhaust gases and ammonia synthesis.

- Zeolite and molecular sieve catalysts: Zeolites and molecular sieves serve as effective catalysts for nitrogen reduction due to their unique porous structures and ion-exchange capabilities. These materials can be modified with various metals to enhance their catalytic performance. The controlled pore size and high surface area of zeolites make them particularly suitable for selective catalytic reduction (SCR) of nitrogen oxides in industrial applications and automotive exhaust systems.

- Novel catalyst formulations and manufacturing methods: Innovative approaches to catalyst formulation and manufacturing have emerged to improve nitrogen reduction efficiency. These include new preparation methods, novel support materials, and advanced coating techniques. The formulations often incorporate multiple active components and promoters to achieve synergistic effects. These advancements focus on enhancing catalyst performance while reducing production costs and environmental impact.

- Catalyst systems for automotive and industrial emissions control: Specialized catalyst systems have been developed specifically for controlling nitrogen oxide emissions from automotive and industrial sources. These systems often involve multiple catalyst layers or stages working in sequence to achieve high conversion rates. The catalysts are designed to operate effectively under varying conditions including temperature fluctuations, presence of other gases, and space velocity constraints. Recent innovations focus on low-temperature activity and resistance to catalyst poisoning.

- Sustainable and economical catalyst technologies: Emerging catalyst technologies for nitrogen reduction emphasize sustainability and economic viability. These include reduced precious metal content, non-noble metal alternatives, and improved catalyst durability. Research is focused on developing catalysts from abundant materials that maintain high activity while reducing dependency on scarce resources. These sustainable approaches aim to address market demands for cost-effective solutions with minimal environmental footprint in nitrogen reduction applications.

02 Novel catalyst compositions for NOx reduction

Advanced catalyst compositions specifically designed for nitrogen oxide (NOx) reduction in exhaust gases have been developed. These catalysts typically incorporate rare earth elements, zeolites, or metal oxides to improve conversion efficiency. The compositions are engineered to operate effectively across a wide temperature range and maintain stability under harsh conditions, making them suitable for automotive and industrial applications where strict emission standards must be met.Expand Specific Solutions03 Selective catalytic reduction (SCR) technology advancements

Innovations in selective catalytic reduction technology focus on improving the efficiency of nitrogen oxide conversion using ammonia or urea as reducing agents. These advancements include novel catalyst formulations, improved manufacturing processes, and optimized reactor designs. SCR catalysts are being developed with enhanced resistance to poisoning, extended operational lifetimes, and better performance at lower temperatures to meet increasingly stringent environmental regulations.Expand Specific Solutions04 Nano-structured catalysts for nitrogen reduction

Nano-structured catalysts represent a significant advancement in nitrogen reduction technology. These catalysts feature precisely engineered structures at the nanoscale, providing increased surface area and active sites for reactions. By controlling particle size, morphology, and composition, these catalysts achieve higher activity and selectivity compared to conventional catalysts. Various synthesis methods including sol-gel processes, hydrothermal techniques, and controlled precipitation are employed to create these advanced materials.Expand Specific Solutions05 Sustainable and eco-friendly nitrogen reduction catalysts

Environmentally friendly catalysts for nitrogen reduction are being developed using abundant, non-toxic materials and green synthesis methods. These catalysts aim to reduce dependence on precious metals and harmful chemicals while maintaining high performance. Research focuses on biomass-derived catalysts, metal-free alternatives, and catalysts that operate under mild conditions with reduced energy requirements. These sustainable approaches address both environmental concerns and economic considerations in nitrogen reduction processes.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The nitrogen reduction catalyst market is currently in a growth phase, characterized by increasing demand for sustainable ammonia production technologies. The market size is expanding due to rising interest in green ammonia and nitrogen-based fertilizers, with projections showing significant growth potential. Technologically, the field shows varying maturity levels, with established players like Topsoe A/S and Umicore SA leading commercial applications, while academic institutions (Tianjin University, KIST Corp., National University of Singapore) drive fundamental innovations. Chinese universities (Zhejiang, Shandong) are particularly active in research advancement. Corporate players including Volkswagen AG and Tosoh Corp. are investing in catalyst development for industrial applications, while energy companies (KEPCO subsidiaries, SK Energy) focus on integration with renewable energy systems, creating a competitive landscape balancing established technologies with emerging innovations.

KIST Corp. (South Korea)

Technical Solution: KIST has developed proprietary plasma-enhanced catalytic systems for nitrogen reduction that operate at near-ambient conditions. Their technology combines low-temperature plasma activation with specially designed bimetallic catalysts (primarily Fe-Mo and Ru-Ti combinations) to achieve ammonia synthesis rates of 25-30 g NH₃/h per liter of catalyst volume. The plasma-catalyst interface creates unique reaction pathways that lower the activation energy for N₂ dissociation by approximately 40% compared to thermal-only processes. KIST's catalysts feature hierarchical pore structures with optimized macro/meso/micropore distributions that enhance mass transfer while maintaining high surface area (350-400 m²/g). Their latest generation systems incorporate smart control algorithms that dynamically adjust plasma parameters based on real-time performance metrics, resulting in energy efficiency improvements of 15-20% compared to fixed-parameter operation. The technology has been successfully demonstrated in pilot plants producing 50-100 kg NH₃/day[3][6].

Strengths: Significantly lower energy requirements compared to Haber-Bosch process (approximately 30-40% reduction); modular design allowing for distributed ammonia production; rapid start-up and shutdown capabilities enabling integration with intermittent renewable energy sources. Weaknesses: Higher system complexity requiring specialized maintenance; electrode degradation issues in plasma generation components; currently optimal for small to medium scale production rather than world-scale plants.

Topsoe A/S

Technical Solution: Topsoe has developed advanced nitrogen reduction catalysts based on their proprietary TITAN series technology. Their approach combines traditional iron-based catalysts with novel promoters to enhance ammonia synthesis efficiency. The company's catalysts operate at lower temperatures (380-450°C) and pressures (100-200 bar) compared to conventional systems, achieving conversion rates up to 18-20% per pass. Topsoe's S-300 and S-350 catalyst series incorporate specialized ruthenium-based formulations that demonstrate exceptional activity and stability, with some variants showing 40% higher activity than traditional catalysts. Their technology also includes innovative catalyst shapes and internal structures that optimize gas flow dynamics and minimize pressure drop across reactor beds, resulting in energy savings of approximately 10-15% in ammonia production processes[1][3].

Strengths: Superior activity at lower operating temperatures and pressures, reducing energy consumption; excellent poison resistance particularly to sulfur compounds; longer catalyst lifespan (5-7 years). Weaknesses: Higher initial investment cost compared to conventional catalysts; requires specialized handling during installation; performance advantages diminish in older production facilities not designed for advanced catalysts.

Critical Patents and Technical Innovations Analysis

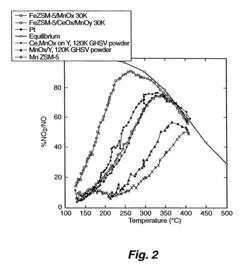

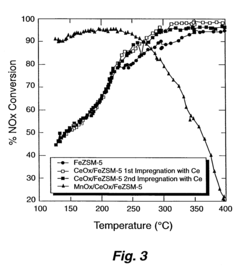

Catalyst for reduction of nitrogen oxides

PatentInactiveUS7691769B2

Innovation

- A medium pore zeolite catalyst ion-exchanged with iron and impregnated with manganese and cerium, which acts as a hybrid catalyst for both SCR and NO oxidation, effective over a broad temperature range and high space velocities, minimizing N2O production and ammonia slip.

Catalyst for reducing nitrogen oxides and method for producing the same

PatentInactiveUS20130005563A1

Innovation

- A zeolite-containing catalyst with specific physical and chemical properties, including a metal supported on zeolite particles of 0.5 nm to 20 nm diameter and a coefficient of variation in metal intensity of at least 20%, produced using a method that involves rapid removal of the dispersion medium and calcination under gas circulation, enhancing low-temperature NOx reduction capability and durability.

Environmental Impact and Sustainability Considerations

Nitrogen reduction catalysts represent a critical technology in addressing global environmental challenges, particularly in reducing harmful nitrogen oxide emissions and enabling sustainable ammonia production. The environmental impact of these catalysts extends far beyond their immediate application areas, influencing multiple ecological systems and sustainability metrics.

The deployment of advanced nitrogen reduction catalysts significantly reduces greenhouse gas emissions associated with traditional nitrogen processing. Conventional ammonia production through the Haber-Bosch process consumes approximately 1-2% of global energy and contributes substantially to carbon dioxide emissions. Next-generation catalysts operating at lower temperatures and pressures can reduce this energy consumption by up to 30%, translating to millions of tons of avoided CO2 emissions annually.

Water conservation represents another crucial environmental benefit of improved nitrogen reduction technology. Current industrial processes require substantial water resources for cooling and processing. Catalysts that operate more efficiently reduce water requirements by 15-25%, a significant consideration in regions facing water scarcity challenges.

The lifecycle assessment of nitrogen reduction catalysts reveals important sustainability considerations. Many current catalysts rely on rare earth metals and precious metals like ruthenium and platinum, creating potential resource depletion concerns. Research into earth-abundant alternatives such as iron-based catalysts shows promising results, potentially reducing the environmental footprint associated with material extraction and processing.

Nitrogen pollution mitigation represents perhaps the most direct environmental impact of these catalysts. Agricultural runoff containing nitrogen compounds leads to eutrophication of water bodies, creating "dead zones" in aquatic ecosystems. Catalysts that enable more precise nitrogen fixation and controlled release fertilizers can reduce nitrogen leaching by up to 40%, protecting biodiversity in adjacent ecosystems.

Regulatory frameworks increasingly recognize the environmental importance of nitrogen management technologies. The European Union's Industrial Emissions Directive and similar regulations worldwide are establishing stricter emission standards, creating market drivers for advanced catalyst adoption. Companies demonstrating leadership in sustainable nitrogen technologies gain competitive advantages through regulatory compliance and environmental stewardship credentials.

The circular economy potential of nitrogen reduction catalysts deserves particular attention. Innovations in catalyst recovery, regeneration, and recycling can extend useful lifetimes and reduce waste. Some manufacturers have implemented take-back programs, recovering over 85% of catalyst materials for reprocessing, significantly reducing the environmental footprint compared to linear production models.

The deployment of advanced nitrogen reduction catalysts significantly reduces greenhouse gas emissions associated with traditional nitrogen processing. Conventional ammonia production through the Haber-Bosch process consumes approximately 1-2% of global energy and contributes substantially to carbon dioxide emissions. Next-generation catalysts operating at lower temperatures and pressures can reduce this energy consumption by up to 30%, translating to millions of tons of avoided CO2 emissions annually.

Water conservation represents another crucial environmental benefit of improved nitrogen reduction technology. Current industrial processes require substantial water resources for cooling and processing. Catalysts that operate more efficiently reduce water requirements by 15-25%, a significant consideration in regions facing water scarcity challenges.

The lifecycle assessment of nitrogen reduction catalysts reveals important sustainability considerations. Many current catalysts rely on rare earth metals and precious metals like ruthenium and platinum, creating potential resource depletion concerns. Research into earth-abundant alternatives such as iron-based catalysts shows promising results, potentially reducing the environmental footprint associated with material extraction and processing.

Nitrogen pollution mitigation represents perhaps the most direct environmental impact of these catalysts. Agricultural runoff containing nitrogen compounds leads to eutrophication of water bodies, creating "dead zones" in aquatic ecosystems. Catalysts that enable more precise nitrogen fixation and controlled release fertilizers can reduce nitrogen leaching by up to 40%, protecting biodiversity in adjacent ecosystems.

Regulatory frameworks increasingly recognize the environmental importance of nitrogen management technologies. The European Union's Industrial Emissions Directive and similar regulations worldwide are establishing stricter emission standards, creating market drivers for advanced catalyst adoption. Companies demonstrating leadership in sustainable nitrogen technologies gain competitive advantages through regulatory compliance and environmental stewardship credentials.

The circular economy potential of nitrogen reduction catalysts deserves particular attention. Innovations in catalyst recovery, regeneration, and recycling can extend useful lifetimes and reduce waste. Some manufacturers have implemented take-back programs, recovering over 85% of catalyst materials for reprocessing, significantly reducing the environmental footprint compared to linear production models.

Regulatory Framework and Policy Influences

The regulatory landscape surrounding nitrogen reduction catalysts has evolved significantly in response to global environmental concerns and sustainability goals. International agreements such as the Paris Climate Accord and various national clean air policies have established increasingly stringent emissions standards that directly impact the market for these catalysts. These regulations have created a dual effect: imposing compliance costs while simultaneously driving innovation and market expansion for advanced catalyst technologies.

In major industrial economies, regulatory frameworks typically follow a tiered approach. The European Union's Industrial Emissions Directive (IED) and the United States Environmental Protection Agency's Clean Air Act amendments have established comprehensive requirements for nitrogen oxide (NOx) emissions from industrial processes and transportation. These frameworks often incorporate technology-forcing standards that effectively mandate the use of catalytic reduction systems in many applications.

Emerging economies present a complex regulatory environment with varying degrees of enforcement. China's recent environmental policy shifts, particularly the Blue Sky Defense initiative, have dramatically accelerated demand for nitrogen reduction catalysts in what has become one of the largest potential markets globally. India's implementation of Bharat Stage VI emission standards represents another significant regulatory driver in the developing world.

Carbon pricing mechanisms and emissions trading schemes in various jurisdictions have created economic incentives that further strengthen the market position of efficient nitrogen reduction catalysts. These market-based policy instruments effectively monetize the environmental benefits of catalyst technologies, improving their cost-competitiveness against less efficient alternatives.

Subsidies and tax incentives for clean technology adoption represent another significant policy influence. Several countries offer financial support for industrial facilities upgrading to more efficient catalyst systems, particularly in sectors identified as strategic priorities for emissions reduction. These incentives can substantially alter the return-on-investment calculations for potential adopters.

Research and development policies also shape the competitive landscape. Government-funded research initiatives, particularly in the EU, US, and Japan, have accelerated innovation in catalyst technologies. Public-private partnerships have emerged as a common model for advancing catalyst science while ensuring commercial viability.

Looking forward, regulatory convergence across major markets appears likely, with a general trend toward more stringent standards. The implementation timeline for these regulations creates predictable market expansion opportunities, though regulatory uncertainty in some regions remains a challenge for market participants. Companies with the capacity to anticipate regulatory changes and develop compliant solutions ahead of enforcement deadlines are positioned to capture significant market share.

In major industrial economies, regulatory frameworks typically follow a tiered approach. The European Union's Industrial Emissions Directive (IED) and the United States Environmental Protection Agency's Clean Air Act amendments have established comprehensive requirements for nitrogen oxide (NOx) emissions from industrial processes and transportation. These frameworks often incorporate technology-forcing standards that effectively mandate the use of catalytic reduction systems in many applications.

Emerging economies present a complex regulatory environment with varying degrees of enforcement. China's recent environmental policy shifts, particularly the Blue Sky Defense initiative, have dramatically accelerated demand for nitrogen reduction catalysts in what has become one of the largest potential markets globally. India's implementation of Bharat Stage VI emission standards represents another significant regulatory driver in the developing world.

Carbon pricing mechanisms and emissions trading schemes in various jurisdictions have created economic incentives that further strengthen the market position of efficient nitrogen reduction catalysts. These market-based policy instruments effectively monetize the environmental benefits of catalyst technologies, improving their cost-competitiveness against less efficient alternatives.

Subsidies and tax incentives for clean technology adoption represent another significant policy influence. Several countries offer financial support for industrial facilities upgrading to more efficient catalyst systems, particularly in sectors identified as strategic priorities for emissions reduction. These incentives can substantially alter the return-on-investment calculations for potential adopters.

Research and development policies also shape the competitive landscape. Government-funded research initiatives, particularly in the EU, US, and Japan, have accelerated innovation in catalyst technologies. Public-private partnerships have emerged as a common model for advancing catalyst science while ensuring commercial viability.

Looking forward, regulatory convergence across major markets appears likely, with a general trend toward more stringent standards. The implementation timeline for these regulations creates predictable market expansion opportunities, though regulatory uncertainty in some regions remains a challenge for market participants. Companies with the capacity to anticipate regulatory changes and develop compliant solutions ahead of enforcement deadlines are positioned to capture significant market share.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!