Compliance and Standards for Nitrogen Reduction Catalysts in Europe

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nitrogen Reduction Catalysts Background and Objectives

Nitrogen reduction catalysts have emerged as critical components in addressing environmental challenges related to nitrogen oxide (NOx) emissions across Europe. The evolution of these catalysts traces back to the 1970s when initial concerns about air pollution prompted research into emission control technologies. Over subsequent decades, technological advancements have transformed these catalysts from rudimentary systems to sophisticated materials capable of achieving significant NOx reduction rates under various operating conditions.

The European regulatory landscape has been a primary driver in catalyst development, with increasingly stringent emission standards established through Euro 1 (1992) to Euro 6 (2014) for vehicles, and the Industrial Emissions Directive (2010/75/EU) for industrial applications. These regulations have continuously pushed the technological boundaries, necessitating innovation in catalyst design, composition, and performance characteristics.

Current nitrogen reduction catalyst technologies predominantly include Selective Catalytic Reduction (SCR), Lean NOx Traps (LNT), and Three-Way Catalytic Converters (TWC), each with specific applications across automotive, industrial, and power generation sectors. The market has witnessed a significant shift toward SCR systems due to their superior NOx conversion efficiency and adaptability to various operational parameters.

The primary technical objective in this field is to develop catalysts that maintain high conversion efficiency (>95%) across broader temperature windows (150-550°C) while demonstrating enhanced durability against thermal aging and chemical poisoning. Additionally, reducing the dependency on precious metals and rare earth elements represents a critical sustainability goal, driving research into alternative materials and novel catalyst architectures.

European research institutions and industrial entities are increasingly focusing on next-generation catalysts that can address the challenges posed by real-world driving conditions, which often deviate significantly from laboratory testing environments. This includes developing systems that maintain performance during cold starts, variable loads, and in the presence of contaminants.

The integration of digital technologies for real-time monitoring and adaptive control of catalyst systems represents an emerging trend, enabling optimized performance across diverse operational scenarios. This convergence of materials science with digital innovation is expected to define the next phase of catalyst evolution, particularly as Europe transitions toward more stringent Euro 7 standards and enhanced industrial emission controls.

Looking forward, the technical trajectory is oriented toward developing catalysts that not only meet compliance requirements but also contribute to broader sustainability objectives, including reduced resource consumption, lower carbon footprints in manufacturing, and end-of-life recyclability considerations.

The European regulatory landscape has been a primary driver in catalyst development, with increasingly stringent emission standards established through Euro 1 (1992) to Euro 6 (2014) for vehicles, and the Industrial Emissions Directive (2010/75/EU) for industrial applications. These regulations have continuously pushed the technological boundaries, necessitating innovation in catalyst design, composition, and performance characteristics.

Current nitrogen reduction catalyst technologies predominantly include Selective Catalytic Reduction (SCR), Lean NOx Traps (LNT), and Three-Way Catalytic Converters (TWC), each with specific applications across automotive, industrial, and power generation sectors. The market has witnessed a significant shift toward SCR systems due to their superior NOx conversion efficiency and adaptability to various operational parameters.

The primary technical objective in this field is to develop catalysts that maintain high conversion efficiency (>95%) across broader temperature windows (150-550°C) while demonstrating enhanced durability against thermal aging and chemical poisoning. Additionally, reducing the dependency on precious metals and rare earth elements represents a critical sustainability goal, driving research into alternative materials and novel catalyst architectures.

European research institutions and industrial entities are increasingly focusing on next-generation catalysts that can address the challenges posed by real-world driving conditions, which often deviate significantly from laboratory testing environments. This includes developing systems that maintain performance during cold starts, variable loads, and in the presence of contaminants.

The integration of digital technologies for real-time monitoring and adaptive control of catalyst systems represents an emerging trend, enabling optimized performance across diverse operational scenarios. This convergence of materials science with digital innovation is expected to define the next phase of catalyst evolution, particularly as Europe transitions toward more stringent Euro 7 standards and enhanced industrial emission controls.

Looking forward, the technical trajectory is oriented toward developing catalysts that not only meet compliance requirements but also contribute to broader sustainability objectives, including reduced resource consumption, lower carbon footprints in manufacturing, and end-of-life recyclability considerations.

European Market Analysis for DeNOx Technologies

The European DeNOx technologies market has experienced significant growth over the past decade, driven primarily by stringent environmental regulations and increasing awareness of air pollution impacts. Currently valued at approximately 2.1 billion euros, this market is projected to grow at a compound annual growth rate of 5.7% through 2028, according to recent industry analyses.

Germany, France, and Italy represent the largest markets for DeNOx technologies in Europe, collectively accounting for over 60% of regional demand. Germany, with its robust industrial base and strict environmental standards, leads with approximately 28% market share. The Nordic countries, despite their smaller economies, demonstrate high adoption rates due to progressive environmental policies and public pressure for cleaner industrial operations.

Power generation remains the dominant application sector, representing approximately 42% of the total DeNOx market in Europe. However, the transportation sector is showing the fastest growth rate at 7.3% annually, driven by Euro 7 emission standards implementation and increasing electrification of vehicle fleets requiring specialized nitrogen oxide treatment solutions during manufacturing processes.

Selective Catalytic Reduction (SCR) technology dominates the European market with approximately 65% share, followed by Selective Non-Catalytic Reduction (SNCR) at 20%. Advanced hybrid systems combining multiple NOx reduction approaches are gaining traction, particularly in countries with the most stringent emission requirements like Germany and Switzerland.

Market penetration varies significantly across European regions, with Western Europe showing near-saturation levels in power generation applications while Eastern European markets present substantial growth opportunities due to ongoing industrial modernization efforts and alignment with EU environmental directives. The implementation timeline for various EU directives has created a predictable demand curve that is expected to sustain market growth through 2030.

Customer segments show distinct preferences, with large utilities and power generators favoring comprehensive turnkey solutions, while industrial manufacturers increasingly seek modular, scalable systems that can be integrated into existing infrastructure with minimal disruption. This trend has prompted leading suppliers to diversify their product portfolios to address varying customer requirements across different market segments.

Price sensitivity varies by region and application, with Eastern European markets demonstrating higher price elasticity compared to Western European counterparts. However, total cost of ownership calculations increasingly favor advanced DeNOx solutions as regulatory penalties for non-compliance continue to increase across the continent.

Germany, France, and Italy represent the largest markets for DeNOx technologies in Europe, collectively accounting for over 60% of regional demand. Germany, with its robust industrial base and strict environmental standards, leads with approximately 28% market share. The Nordic countries, despite their smaller economies, demonstrate high adoption rates due to progressive environmental policies and public pressure for cleaner industrial operations.

Power generation remains the dominant application sector, representing approximately 42% of the total DeNOx market in Europe. However, the transportation sector is showing the fastest growth rate at 7.3% annually, driven by Euro 7 emission standards implementation and increasing electrification of vehicle fleets requiring specialized nitrogen oxide treatment solutions during manufacturing processes.

Selective Catalytic Reduction (SCR) technology dominates the European market with approximately 65% share, followed by Selective Non-Catalytic Reduction (SNCR) at 20%. Advanced hybrid systems combining multiple NOx reduction approaches are gaining traction, particularly in countries with the most stringent emission requirements like Germany and Switzerland.

Market penetration varies significantly across European regions, with Western Europe showing near-saturation levels in power generation applications while Eastern European markets present substantial growth opportunities due to ongoing industrial modernization efforts and alignment with EU environmental directives. The implementation timeline for various EU directives has created a predictable demand curve that is expected to sustain market growth through 2030.

Customer segments show distinct preferences, with large utilities and power generators favoring comprehensive turnkey solutions, while industrial manufacturers increasingly seek modular, scalable systems that can be integrated into existing infrastructure with minimal disruption. This trend has prompted leading suppliers to diversify their product portfolios to address varying customer requirements across different market segments.

Price sensitivity varies by region and application, with Eastern European markets demonstrating higher price elasticity compared to Western European counterparts. However, total cost of ownership calculations increasingly favor advanced DeNOx solutions as regulatory penalties for non-compliance continue to increase across the continent.

Technical Challenges in Catalyst Development

The development of nitrogen reduction catalysts faces significant technical hurdles that must be overcome to meet European compliance standards. Current catalysts often struggle with low conversion efficiency, particularly at the lower temperature ranges required by EU emissions regulations. Most commercial catalysts achieve optimal performance between 350-450°C, while newer Euro 7 standards demand effective operation at temperatures as low as 150°C during cold starts and urban driving cycles.

Catalyst poisoning presents another major challenge, as sulfur compounds in fuel can irreversibly deactivate catalyst active sites. European fuel quality directives have progressively reduced sulfur content, but even trace amounts can accumulate over time, reducing catalyst longevity and performance. This necessitates the development of sulfur-resistant materials that maintain nitrogen reduction efficiency throughout the catalyst's operational lifetime.

Thermal stability remains problematic, particularly for vehicles operating under variable load conditions. Catalysts must withstand thermal cycling between ambient temperatures and over 800°C without structural degradation. Current platinum group metal (PGM) catalysts face sintering issues at high temperatures, leading to reduced active surface area and diminished catalytic performance over time. This challenge is particularly acute for meeting the 160,000 km durability requirements specified in European regulations.

Material scarcity and cost considerations significantly constrain catalyst development. Traditional catalysts rely heavily on platinum, palladium, and rhodium—all classified as critical raw materials by the EU. Price volatility and supply chain vulnerabilities for these metals have intensified research into alternative formulations using more abundant elements, though these alternatives typically demonstrate lower activity and selectivity.

Manufacturing scalability presents additional complications, as laboratory-developed catalysts often face challenges in industrial-scale production. Maintaining uniform dispersion of active components, consistent pore structure, and washcoat adhesion during mass production requires sophisticated process control that can significantly impact production costs and catalyst performance consistency.

Emerging regulatory requirements for real-world driving emissions (RDE) testing have exposed performance gaps in catalysts optimized for standardized test cycles. Catalysts must now function effectively across a broader range of operating conditions, including low-load urban driving and high-speed highway operation, while maintaining compliance with increasingly stringent NOx limits throughout the vehicle's operational lifetime.

Catalyst poisoning presents another major challenge, as sulfur compounds in fuel can irreversibly deactivate catalyst active sites. European fuel quality directives have progressively reduced sulfur content, but even trace amounts can accumulate over time, reducing catalyst longevity and performance. This necessitates the development of sulfur-resistant materials that maintain nitrogen reduction efficiency throughout the catalyst's operational lifetime.

Thermal stability remains problematic, particularly for vehicles operating under variable load conditions. Catalysts must withstand thermal cycling between ambient temperatures and over 800°C without structural degradation. Current platinum group metal (PGM) catalysts face sintering issues at high temperatures, leading to reduced active surface area and diminished catalytic performance over time. This challenge is particularly acute for meeting the 160,000 km durability requirements specified in European regulations.

Material scarcity and cost considerations significantly constrain catalyst development. Traditional catalysts rely heavily on platinum, palladium, and rhodium—all classified as critical raw materials by the EU. Price volatility and supply chain vulnerabilities for these metals have intensified research into alternative formulations using more abundant elements, though these alternatives typically demonstrate lower activity and selectivity.

Manufacturing scalability presents additional complications, as laboratory-developed catalysts often face challenges in industrial-scale production. Maintaining uniform dispersion of active components, consistent pore structure, and washcoat adhesion during mass production requires sophisticated process control that can significantly impact production costs and catalyst performance consistency.

Emerging regulatory requirements for real-world driving emissions (RDE) testing have exposed performance gaps in catalysts optimized for standardized test cycles. Catalysts must now function effectively across a broader range of operating conditions, including low-load urban driving and high-speed highway operation, while maintaining compliance with increasingly stringent NOx limits throughout the vehicle's operational lifetime.

Current Catalyst Solutions and Implementation Strategies

01 Metal-based catalysts for nitrogen reduction

Various metal-based catalysts have been developed for nitrogen reduction processes. These catalysts typically include transition metals such as iron, nickel, cobalt, and ruthenium, which can effectively break the strong triple bond in nitrogen molecules. The catalysts are often supported on materials like alumina or carbon to increase their surface area and stability. Metal-based catalysts are widely used in industrial nitrogen reduction processes due to their high activity and selectivity.- Metal-based catalysts for nitrogen reduction: Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen into ammonia or other nitrogen compounds. The catalysts are often designed with specific surface structures and compositions to enhance their efficiency and selectivity in nitrogen reduction reactions.

- Supported catalysts for nitrogen reduction: Catalysts supported on various materials show enhanced performance in nitrogen reduction reactions. Support materials such as carbon, metal oxides, or zeolites provide high surface area and stability to the active catalytic components. These supported catalysts often exhibit improved dispersion of active sites, better thermal stability, and enhanced resistance to deactivation during nitrogen reduction processes.

- Electrochemical catalysts for nitrogen reduction: Electrochemical catalysts facilitate nitrogen reduction through electrochemical processes, enabling the conversion of nitrogen to ammonia under ambient conditions. These catalysts operate at the electrode-electrolyte interface and can work at room temperature and atmospheric pressure, offering energy-efficient alternatives to traditional high-pressure, high-temperature processes. Various materials including metals, metal oxides, and carbon-based materials have been developed as effective electrocatalysts for nitrogen reduction.

- Bimetallic and composite catalysts: Bimetallic and composite catalysts combine two or more active components to achieve synergistic effects in nitrogen reduction reactions. These catalysts often exhibit enhanced activity, selectivity, and stability compared to their single-component counterparts. The combination of different metals or metal compounds creates unique electronic structures and active sites that facilitate more efficient nitrogen activation and conversion.

- Novel catalyst preparation methods: Advanced preparation methods for nitrogen reduction catalysts focus on controlling the size, shape, composition, and structure of catalytic materials. Techniques such as sol-gel synthesis, hydrothermal methods, impregnation, and precipitation are employed to create catalysts with optimized properties. These methods enable the development of catalysts with high surface area, controlled porosity, and specific active sites that enhance nitrogen reduction efficiency.

02 Nitrogen oxide reduction catalysts for exhaust systems

Specialized catalysts designed for reducing nitrogen oxides (NOx) in exhaust gases from vehicles and industrial processes. These catalysts typically operate in oxygen-rich environments and can convert harmful nitrogen oxides into harmless nitrogen gas. Common formulations include selective catalytic reduction (SCR) systems using ammonia or urea as reducing agents, and lean NOx trap (LNT) technologies. These catalysts are crucial for meeting stringent emission standards in automotive and industrial applications.Expand Specific Solutions03 Nanocatalysts for nitrogen reduction reactions

Nanotechnology-based catalysts that offer enhanced performance for nitrogen reduction reactions due to their high surface area and unique electronic properties. These include nanoparticles, nanowires, and nanostructured materials that can efficiently catalyze the conversion of nitrogen to ammonia or other nitrogen compounds. Nanocatalysts often demonstrate improved activity at milder conditions compared to conventional catalysts, potentially enabling more energy-efficient nitrogen reduction processes.Expand Specific Solutions04 Electrochemical catalysts for nitrogen reduction

Catalysts specifically designed for electrochemical nitrogen reduction reactions, which use electricity to convert nitrogen into ammonia or other nitrogen compounds. These catalysts are typically applied to electrode surfaces and facilitate electron transfer to nitrogen molecules. Electrochemical nitrogen reduction is considered a promising alternative to the traditional Haber-Bosch process as it can potentially operate under ambient conditions using renewable electricity, making the process more sustainable.Expand Specific Solutions05 Photocatalysts for nitrogen reduction

Light-activated catalysts that can harness solar energy to drive nitrogen reduction reactions. These photocatalysts typically consist of semiconductor materials that generate electron-hole pairs upon light absorption, which can then participate in nitrogen reduction. Some photocatalysts incorporate co-catalysts or sensitizers to enhance their performance. Photocatalytic nitrogen reduction represents a sustainable approach that can potentially operate at ambient temperature and pressure using only sunlight as the energy input.Expand Specific Solutions

Leading Companies and Research Institutions in Catalyst Industry

The nitrogen reduction catalyst market in Europe is currently in a growth phase, characterized by increasing regulatory pressures and sustainability demands. The market size is expanding steadily as emission standards become more stringent across industrial and automotive sectors. Leading companies like Umicore SA, Johnson Matthey, BASF SE, and Topsoe A/S dominate the competitive landscape with advanced catalyst technologies. These firms are investing heavily in R&D to develop more efficient and durable catalysts that meet Euro 7 standards. Automotive manufacturers including Hyundai, Kia, and Ford are collaborating with catalyst producers to ensure compliance. Research institutions such as CNRS, IFP Energies Nouvelles, and various universities are contributing significantly to technological advancements, focusing on improved NOx conversion efficiency and reduced precious metal content.

Umicore SA

Technical Solution: Umicore has developed cutting-edge nitrogen reduction catalyst technologies specifically engineered to meet stringent European emissions standards. Their flagship SCR catalyst system utilizes a proprietary copper-chabazite (Cu-CHA) zeolite formulation with optimized copper loading and distribution to achieve superior NOx conversion efficiency across a wide temperature range (180-550°C). Umicore's catalysts feature enhanced hydrothermal stability through proprietary stabilization techniques that maintain catalyst performance even after exposure to temperatures exceeding 800°C during diesel particulate filter regeneration events. The company has pioneered advanced manufacturing methods including precision washcoating technology that ensures uniform catalyst distribution while minimizing precious metal usage. Their catalysts achieve NOx conversion rates exceeding 95% under real driving conditions while maintaining ammonia slip below 10 ppm to comply with European regulatory requirements. Umicore has also developed integrated SCR on Filter (SCRoF) technology that combines particulate filtration and NOx reduction in a single substrate, addressing space constraints in modern vehicle designs while meeting Euro 6d and upcoming Euro 7 emissions standards. The company's catalyst formulations are fully compliant with European REACH regulations and feature reduced dependency on critical raw materials.

Strengths: Exceptional hydrothermal stability ensuring long-term performance under severe operating conditions; advanced manufacturing techniques providing consistent quality and reduced precious metal usage; integrated solutions addressing multiple emissions challenges simultaneously. Weaknesses: Higher initial cost compared to conventional technologies; complex system integration requirements; sensitivity to certain catalyst poisons requiring careful fuel quality management.

IFP Energies Nouvelles

Technical Solution: IFP Energies Nouvelles has developed advanced nitrogen reduction catalyst technologies tailored to European regulatory frameworks. Their proprietary NOxCAT™ system employs a multi-component catalyst architecture featuring copper-exchanged small-pore zeolites (Cu-SSZ-13) combined with iron-exchanged beta zeolites to provide exceptional NOx conversion across a broad temperature window (175-550°C). The catalyst formulation incorporates stability enhancers that prevent deactivation under hydrothermal aging conditions, maintaining over 90% of initial activity after 160,000 km equivalent aging. IFP's technology utilizes advanced coating techniques that optimize precious metal distribution and minimize washcoat thickness, reducing pressure drop while maximizing contact efficiency. Their catalysts are designed with European sustainability principles in mind, featuring reduced rare earth content and compliance with REACH regulations. The company has pioneered passive NOx adsorber components that trap NOx during cold starts and release it when temperatures reach the SCR activation window, addressing one of the most challenging aspects of emissions compliance under real driving conditions. IFP's catalyst systems are validated using European driving cycles including WLTC and RDE protocols to ensure real-world compliance.

Strengths: Exceptional cold-start performance through innovative adsorber technology; broad temperature window operation enabling compliance across diverse driving conditions; advanced aging resistance exceeding Euro 6d durability requirements. Weaknesses: More complex system architecture increasing integration challenges; higher manufacturing complexity requiring specialized production facilities; potential ammonia breakthrough under certain operating conditions requiring careful control strategy implementation.

Key Patents and Technical Innovations in DeNOx Catalysis

Nitrogen oxide reduction catalyst and method of preparing the same

PatentInactiveUS20160256853A1

Innovation

- A nitrogen oxide reduction catalyst utilizing a titanium oxide nanostructure with a polycrystalline structure formed through hydrothermal synthesis, allowing for high vanadium loading and enhanced catalytic activity without the need for a co-catalyst, achieved by mixing titanium oxide with an alkaline solution like lithium hydroxide to create a high specific surface area support.

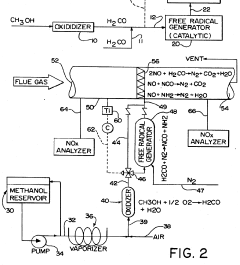

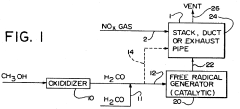

Reduction of nitrogen oxide in effluent gases using formaldehyde and/or formaldehyde-derived free radicals

PatentInactiveUS5234671A

Innovation

- The method involves alternately using formaldehyde or formaldehyde-derived free radicals to reduce nitrogen oxide content in combustion gases, with formaldehyde reacting at elevated temperatures and free radicals generated by reacting formaldehyde with nitrogen or nitrogen oxide in the presence of catalysts like zirconium, cerium, or vanadium, effectively reducing NOx levels at lower temperatures.

European Regulatory Framework and Emission Standards

The European Union has established one of the world's most comprehensive regulatory frameworks for controlling nitrogen oxide (NOx) emissions, primarily through the Euro emission standards. These standards have progressively tightened since their introduction in 1992, with the current Euro 6 standards for passenger vehicles limiting NOx emissions to 80 mg/km for diesel engines and 60 mg/km for gasoline engines. The upcoming Euro 7 standards, expected to be implemented by 2025, aim to further reduce these limits and harmonize requirements across different vehicle types.

Beyond vehicle emissions, the Industrial Emissions Directive (IED) regulates NOx emissions from industrial processes, requiring the implementation of Best Available Techniques (BAT) for pollution control. The National Emission Ceilings Directive (NECD) complements these regulations by setting country-specific limits on total annual emissions of various pollutants, including NOx.

Compliance verification in Europe follows a multi-tiered approach. The Type Approval process ensures that new vehicle models meet all applicable standards before market entry. This includes laboratory testing under the Worldwide Harmonized Light Vehicles Test Procedure (WLTP) and Real Driving Emissions (RDE) tests that measure emissions during actual road use. For industrial applications, continuous emission monitoring systems (CEMS) are often required to demonstrate ongoing compliance.

The regulatory landscape varies somewhat across European countries, with certain nations implementing more stringent requirements than the EU baseline. For example, several major European cities have established Low Emission Zones (LEZs) that restrict entry of higher-polluting vehicles. Germany's TA Luft regulations provide detailed technical instructions on air quality control that often exceed EU minimums for industrial emissions.

Non-compliance carries significant penalties, including substantial fines, mandatory recalls, and potential market exclusion. The "Dieselgate" scandal of 2015 demonstrated the serious consequences of circumventing these regulations, resulting in billions of euros in fines and compensation payments for affected manufacturers.

The European regulatory framework has driven significant technological innovation in nitrogen reduction catalysts. Three-way catalytic converters, Selective Catalytic Reduction (SCR) systems, and Lean NOx Traps (LNT) have all evolved substantially to meet increasingly stringent standards. The upcoming Euro 7 standards are expected to further accelerate development of advanced catalyst technologies and system integration approaches.

Beyond vehicle emissions, the Industrial Emissions Directive (IED) regulates NOx emissions from industrial processes, requiring the implementation of Best Available Techniques (BAT) for pollution control. The National Emission Ceilings Directive (NECD) complements these regulations by setting country-specific limits on total annual emissions of various pollutants, including NOx.

Compliance verification in Europe follows a multi-tiered approach. The Type Approval process ensures that new vehicle models meet all applicable standards before market entry. This includes laboratory testing under the Worldwide Harmonized Light Vehicles Test Procedure (WLTP) and Real Driving Emissions (RDE) tests that measure emissions during actual road use. For industrial applications, continuous emission monitoring systems (CEMS) are often required to demonstrate ongoing compliance.

The regulatory landscape varies somewhat across European countries, with certain nations implementing more stringent requirements than the EU baseline. For example, several major European cities have established Low Emission Zones (LEZs) that restrict entry of higher-polluting vehicles. Germany's TA Luft regulations provide detailed technical instructions on air quality control that often exceed EU minimums for industrial emissions.

Non-compliance carries significant penalties, including substantial fines, mandatory recalls, and potential market exclusion. The "Dieselgate" scandal of 2015 demonstrated the serious consequences of circumventing these regulations, resulting in billions of euros in fines and compensation payments for affected manufacturers.

The European regulatory framework has driven significant technological innovation in nitrogen reduction catalysts. Three-way catalytic converters, Selective Catalytic Reduction (SCR) systems, and Lean NOx Traps (LNT) have all evolved substantially to meet increasingly stringent standards. The upcoming Euro 7 standards are expected to further accelerate development of advanced catalyst technologies and system integration approaches.

Environmental Impact Assessment of Catalyst Technologies

The environmental impact assessment of nitrogen reduction catalyst technologies reveals significant ecological implications across their lifecycle. These catalysts, primarily used in industrial processes and automotive applications, demonstrate both positive and negative environmental effects that must be carefully evaluated.

Nitrogen reduction catalysts substantially contribute to air quality improvement by converting harmful nitrogen oxides (NOx) into harmless nitrogen and oxygen. In automotive applications, selective catalytic reduction (SCR) systems can reduce NOx emissions by up to 95%, directly improving urban air quality and reducing acid rain formation. Industrial applications show similar benefits, with catalytic technologies enabling compliance with the EU Industrial Emissions Directive's stringent limits.

However, the production phase presents notable environmental concerns. Mining of platinum group metals and rare earth elements for catalyst manufacturing causes habitat destruction, soil erosion, and water contamination. Life cycle assessments indicate that catalyst production generates significant carbon emissions - approximately 5-7 tonnes of CO2 equivalent per tonne of catalyst produced, primarily from energy-intensive refining processes.

Water resource impacts also warrant attention. Catalyst manufacturing consumes substantial water volumes, with estimates suggesting 50-70 cubic meters per tonne of finished catalyst. Additionally, wastewater from production facilities often contains heavy metals and chemical residues requiring specialized treatment systems to prevent watershed contamination.

End-of-life management presents both challenges and opportunities. While spent catalysts contain valuable recoverable materials, improper disposal can lead to soil and groundwater contamination. Advanced recycling technologies now achieve recovery rates of 95% for platinum group metals, significantly reducing the need for virgin material extraction.

Recent comparative studies demonstrate that despite production-phase impacts, the net environmental benefit of nitrogen reduction catalysts remains strongly positive. Over a typical five-year operational lifespan, modern catalysts prevent approximately 50-100 times more pollution than their production generates, representing a favorable environmental return on investment.

The European Environmental Agency's latest assessment framework now requires comprehensive impact evaluation across all lifecycle stages, with particular emphasis on circular economy principles and resource efficiency metrics. This holistic approach ensures that catalyst technologies deliver genuine environmental benefits while minimizing ecological disruption.

Nitrogen reduction catalysts substantially contribute to air quality improvement by converting harmful nitrogen oxides (NOx) into harmless nitrogen and oxygen. In automotive applications, selective catalytic reduction (SCR) systems can reduce NOx emissions by up to 95%, directly improving urban air quality and reducing acid rain formation. Industrial applications show similar benefits, with catalytic technologies enabling compliance with the EU Industrial Emissions Directive's stringent limits.

However, the production phase presents notable environmental concerns. Mining of platinum group metals and rare earth elements for catalyst manufacturing causes habitat destruction, soil erosion, and water contamination. Life cycle assessments indicate that catalyst production generates significant carbon emissions - approximately 5-7 tonnes of CO2 equivalent per tonne of catalyst produced, primarily from energy-intensive refining processes.

Water resource impacts also warrant attention. Catalyst manufacturing consumes substantial water volumes, with estimates suggesting 50-70 cubic meters per tonne of finished catalyst. Additionally, wastewater from production facilities often contains heavy metals and chemical residues requiring specialized treatment systems to prevent watershed contamination.

End-of-life management presents both challenges and opportunities. While spent catalysts contain valuable recoverable materials, improper disposal can lead to soil and groundwater contamination. Advanced recycling technologies now achieve recovery rates of 95% for platinum group metals, significantly reducing the need for virgin material extraction.

Recent comparative studies demonstrate that despite production-phase impacts, the net environmental benefit of nitrogen reduction catalysts remains strongly positive. Over a typical five-year operational lifespan, modern catalysts prevent approximately 50-100 times more pollution than their production generates, representing a favorable environmental return on investment.

The European Environmental Agency's latest assessment framework now requires comprehensive impact evaluation across all lifecycle stages, with particular emphasis on circular economy principles and resource efficiency metrics. This holistic approach ensures that catalyst technologies deliver genuine environmental benefits while minimizing ecological disruption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!