The Influence of Industry Standards on Nitrogen Reduction Catalyst

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nitrogen Reduction Catalyst Standards Evolution

The evolution of industry standards for nitrogen reduction catalysts has followed a trajectory closely aligned with environmental regulations and technological advancements. In the 1970s, initial standards focused primarily on basic performance metrics such as conversion efficiency under standard conditions, with minimal consideration for durability or varied operating environments. These early standards, including the U.S. EPA's first emissions guidelines, established rudimentary benchmarks but lacked comprehensive testing protocols.

The 1990s marked a significant shift with the introduction of more sophisticated standards like ISO 14001 and the European Union's increasingly stringent emissions regulations. These frameworks began incorporating lifecycle performance requirements and expanded testing conditions, reflecting growing environmental concerns. Catalyst manufacturers were required to demonstrate consistent performance across wider temperature ranges and in the presence of various contaminants.

By the early 2000s, standards evolved to address the complex interplay between catalyst formulation, substrate materials, and coating technologies. The International Organization for Standardization (ISO) developed specialized testing methodologies specifically for nitrogen reduction catalysts, establishing standardized procedures for measuring conversion efficiency, selectivity, and durability. These standards facilitated meaningful comparisons between different catalyst technologies and accelerated innovation through benchmarking.

The period from 2010 to 2020 witnessed the integration of real-world performance metrics into standard requirements. Regulatory bodies worldwide began requiring testing under dynamic operating conditions rather than steady-state scenarios alone. This shift acknowledged the significant performance gap often observed between laboratory testing and actual field applications, particularly in automotive and industrial settings.

Most recently, standards have expanded to encompass sustainability criteria beyond mere performance metrics. Modern frameworks now evaluate catalysts based on critical raw material usage, manufacturing energy intensity, and end-of-life recyclability. The European Chemical Agency's REACH regulations and similar frameworks worldwide have imposed additional requirements regarding the toxicity and environmental impact of catalyst components.

The geographical distribution of standard development has also evolved significantly. While early standards originated primarily from North American and European regulatory bodies, recent decades have seen substantial contributions from Asian countries, particularly China and Japan. This globalization of standards development reflects both the worldwide nature of environmental challenges and the increasingly distributed nature of catalyst research and manufacturing capabilities.

The 1990s marked a significant shift with the introduction of more sophisticated standards like ISO 14001 and the European Union's increasingly stringent emissions regulations. These frameworks began incorporating lifecycle performance requirements and expanded testing conditions, reflecting growing environmental concerns. Catalyst manufacturers were required to demonstrate consistent performance across wider temperature ranges and in the presence of various contaminants.

By the early 2000s, standards evolved to address the complex interplay between catalyst formulation, substrate materials, and coating technologies. The International Organization for Standardization (ISO) developed specialized testing methodologies specifically for nitrogen reduction catalysts, establishing standardized procedures for measuring conversion efficiency, selectivity, and durability. These standards facilitated meaningful comparisons between different catalyst technologies and accelerated innovation through benchmarking.

The period from 2010 to 2020 witnessed the integration of real-world performance metrics into standard requirements. Regulatory bodies worldwide began requiring testing under dynamic operating conditions rather than steady-state scenarios alone. This shift acknowledged the significant performance gap often observed between laboratory testing and actual field applications, particularly in automotive and industrial settings.

Most recently, standards have expanded to encompass sustainability criteria beyond mere performance metrics. Modern frameworks now evaluate catalysts based on critical raw material usage, manufacturing energy intensity, and end-of-life recyclability. The European Chemical Agency's REACH regulations and similar frameworks worldwide have imposed additional requirements regarding the toxicity and environmental impact of catalyst components.

The geographical distribution of standard development has also evolved significantly. While early standards originated primarily from North American and European regulatory bodies, recent decades have seen substantial contributions from Asian countries, particularly China and Japan. This globalization of standards development reflects both the worldwide nature of environmental challenges and the increasingly distributed nature of catalyst research and manufacturing capabilities.

Market Demand for Emission Control Technologies

The global market for emission control technologies has experienced significant growth in recent years, driven primarily by increasingly stringent environmental regulations across major economies. The demand for nitrogen reduction catalysts specifically has surged as governments worldwide implement more rigorous standards to combat air pollution and mitigate climate change impacts. According to recent market analyses, the global catalytic converter market, a key application area for nitrogen reduction catalysts, was valued at approximately $42.4 billion in 2021 and is projected to reach $73.1 billion by 2030, growing at a CAGR of 7.3%.

The automotive sector remains the largest consumer of emission control technologies, particularly nitrogen reduction catalysts. With global vehicle production exceeding 80 million units annually and increasing electrification trends, there is a dual market dynamic emerging. While traditional internal combustion engine vehicles continue to require advanced catalytic systems to meet Euro 7, China 7, and US Tier 3 standards, the growing hybrid vehicle segment also presents substantial demand for specialized catalyst solutions optimized for intermittent engine operation.

Industrial applications represent another rapidly expanding market segment for nitrogen reduction catalysts. Power generation facilities, chemical manufacturing plants, and industrial boilers are facing mounting pressure to reduce NOx emissions, creating a robust demand for selective catalytic reduction (SCR) systems. The industrial SCR market is expected to grow at 8.2% annually through 2028, with particularly strong demand in developing economies where industrial expansion coincides with tightening environmental regulations.

Regional market analysis reveals varying demand patterns. Europe leads in adoption of advanced emission control technologies due to its pioneering role in environmental regulation, with the EU's Green Deal further accelerating implementation timelines. China has emerged as the fastest-growing market following the implementation of China 6 emission standards, with domestic catalyst production capacity expanding rapidly to meet local demand. North America maintains steady growth driven by EPA regulations, while emerging markets in India and Southeast Asia are showing accelerated adoption rates as they implement equivalent standards to Euro 5 and Euro 6.

Customer requirements are evolving beyond mere regulatory compliance. End-users increasingly demand catalysts with enhanced durability, reduced precious metal content, and improved performance under real-world driving conditions. This shift is creating market opportunities for innovative catalyst formulations that can maintain efficiency across broader temperature ranges and withstand more variable operating conditions, particularly as vehicle manufacturers optimize engines for fuel efficiency rather than consistent exhaust temperatures.

The automotive sector remains the largest consumer of emission control technologies, particularly nitrogen reduction catalysts. With global vehicle production exceeding 80 million units annually and increasing electrification trends, there is a dual market dynamic emerging. While traditional internal combustion engine vehicles continue to require advanced catalytic systems to meet Euro 7, China 7, and US Tier 3 standards, the growing hybrid vehicle segment also presents substantial demand for specialized catalyst solutions optimized for intermittent engine operation.

Industrial applications represent another rapidly expanding market segment for nitrogen reduction catalysts. Power generation facilities, chemical manufacturing plants, and industrial boilers are facing mounting pressure to reduce NOx emissions, creating a robust demand for selective catalytic reduction (SCR) systems. The industrial SCR market is expected to grow at 8.2% annually through 2028, with particularly strong demand in developing economies where industrial expansion coincides with tightening environmental regulations.

Regional market analysis reveals varying demand patterns. Europe leads in adoption of advanced emission control technologies due to its pioneering role in environmental regulation, with the EU's Green Deal further accelerating implementation timelines. China has emerged as the fastest-growing market following the implementation of China 6 emission standards, with domestic catalyst production capacity expanding rapidly to meet local demand. North America maintains steady growth driven by EPA regulations, while emerging markets in India and Southeast Asia are showing accelerated adoption rates as they implement equivalent standards to Euro 5 and Euro 6.

Customer requirements are evolving beyond mere regulatory compliance. End-users increasingly demand catalysts with enhanced durability, reduced precious metal content, and improved performance under real-world driving conditions. This shift is creating market opportunities for innovative catalyst formulations that can maintain efficiency across broader temperature ranges and withstand more variable operating conditions, particularly as vehicle manufacturers optimize engines for fuel efficiency rather than consistent exhaust temperatures.

Current Challenges in Catalyst Development

Despite significant advancements in nitrogen reduction catalyst technology, several critical challenges continue to impede progress in this field. The development of efficient, stable, and economically viable catalysts for nitrogen reduction remains hindered by fundamental scientific and engineering obstacles that require innovative solutions.

The primary challenge facing catalyst development is achieving sufficient activity under ambient conditions. While the Haber-Bosch process operates efficiently at high temperatures and pressures, developing catalysts that can reduce nitrogen at room temperature and atmospheric pressure has proven exceptionally difficult. Industry standards currently demand catalysts with high turnover frequencies, but most experimental catalysts fall short of these benchmarks by several orders of magnitude.

Selectivity presents another significant hurdle. Competing reactions, particularly hydrogen evolution in aqueous systems, often dominate over nitrogen reduction. Industry standards typically require nitrogen selectivity above 60%, yet most reported catalysts struggle to exceed 30%. This discrepancy between standard requirements and actual performance creates a substantial gap in practical applications.

Stability and durability of nitrogen reduction catalysts remain problematic under operating conditions. Industry standards generally require catalysts to maintain performance for thousands of hours, but many experimental catalysts degrade significantly after just tens of hours. The harsh electrochemical environments and reactive intermediates often lead to catalyst poisoning or structural degradation.

Reproducibility issues plague the field, with many reported catalysts showing inconsistent performance across different laboratories. This variability undermines confidence in emerging technologies and complicates standardization efforts. The lack of universally accepted testing protocols further exacerbates this problem, making direct comparisons between different catalysts challenging.

Cost considerations also present significant barriers. While industry standards increasingly emphasize sustainability and reduced reliance on precious metals, many high-performing catalysts still depend on platinum-group metals or complex synthesis procedures. The economic viability threshold for commercial adoption typically requires catalyst costs below $500 per kilogram, a target that many advanced materials exceed substantially.

Scalability remains a persistent challenge, with many promising laboratory-scale catalysts failing to maintain performance when scaled to industrial levels. The gap between academic research and industrial implementation is particularly pronounced in this field, with industry standards for manufacturing feasibility often overlooked in fundamental research.

Environmental and safety concerns add another layer of complexity, as industry standards increasingly incorporate lifecycle assessment metrics. Catalysts containing toxic elements or requiring hazardous synthesis procedures face significant regulatory hurdles, regardless of their performance characteristics.

The primary challenge facing catalyst development is achieving sufficient activity under ambient conditions. While the Haber-Bosch process operates efficiently at high temperatures and pressures, developing catalysts that can reduce nitrogen at room temperature and atmospheric pressure has proven exceptionally difficult. Industry standards currently demand catalysts with high turnover frequencies, but most experimental catalysts fall short of these benchmarks by several orders of magnitude.

Selectivity presents another significant hurdle. Competing reactions, particularly hydrogen evolution in aqueous systems, often dominate over nitrogen reduction. Industry standards typically require nitrogen selectivity above 60%, yet most reported catalysts struggle to exceed 30%. This discrepancy between standard requirements and actual performance creates a substantial gap in practical applications.

Stability and durability of nitrogen reduction catalysts remain problematic under operating conditions. Industry standards generally require catalysts to maintain performance for thousands of hours, but many experimental catalysts degrade significantly after just tens of hours. The harsh electrochemical environments and reactive intermediates often lead to catalyst poisoning or structural degradation.

Reproducibility issues plague the field, with many reported catalysts showing inconsistent performance across different laboratories. This variability undermines confidence in emerging technologies and complicates standardization efforts. The lack of universally accepted testing protocols further exacerbates this problem, making direct comparisons between different catalysts challenging.

Cost considerations also present significant barriers. While industry standards increasingly emphasize sustainability and reduced reliance on precious metals, many high-performing catalysts still depend on platinum-group metals or complex synthesis procedures. The economic viability threshold for commercial adoption typically requires catalyst costs below $500 per kilogram, a target that many advanced materials exceed substantially.

Scalability remains a persistent challenge, with many promising laboratory-scale catalysts failing to maintain performance when scaled to industrial levels. The gap between academic research and industrial implementation is particularly pronounced in this field, with industry standards for manufacturing feasibility often overlooked in fundamental research.

Environmental and safety concerns add another layer of complexity, as industry standards increasingly incorporate lifecycle assessment metrics. Catalysts containing toxic elements or requiring hazardous synthesis procedures face significant regulatory hurdles, regardless of their performance characteristics.

Standard-Compliant Catalyst Solutions

01 Metal-based catalysts for nitrogen reduction

Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen compounds. These catalysts often feature specific surface structures and compositions that enhance their selectivity and efficiency in nitrogen reduction reactions, particularly in environmental applications such as NOx reduction in exhaust gases.- Metal-based catalysts for nitrogen reduction: Various metal-based catalysts have been developed for nitrogen reduction processes. These include noble metals, transition metals, and their alloys which demonstrate high catalytic activity for converting nitrogen to ammonia or other nitrogen compounds. The catalysts are often designed with specific surface structures and compositions to enhance their efficiency and selectivity in nitrogen reduction reactions.

- Supported catalysts for nitrogen reduction: Nitrogen reduction catalysts supported on various materials show enhanced performance and stability. Support materials include carbon-based materials, metal oxides, and zeolites which provide high surface area and improved dispersion of active catalytic sites. These supported catalysts often exhibit better durability and can be tailored for specific reaction conditions in nitrogen reduction processes.

- Electrochemical nitrogen reduction catalysts: Electrochemical catalysts facilitate nitrogen reduction under ambient conditions using electrical energy. These catalysts are designed to operate at electrode surfaces where they can efficiently convert nitrogen to ammonia or other nitrogen compounds with applied voltage. Recent developments focus on improving the Faradaic efficiency and reducing the overpotential required for these electrochemical nitrogen reduction reactions.

- Nitrogen oxide reduction catalysts for emissions control: Specialized catalysts have been developed for reducing nitrogen oxides (NOx) in exhaust gases from combustion processes. These catalysts are crucial components in emissions control systems for vehicles and industrial facilities. They typically operate through selective catalytic reduction (SCR) mechanisms, converting harmful nitrogen oxides to harmless nitrogen gas using reducing agents such as ammonia or urea.

- Novel catalyst preparation methods for nitrogen reduction: Innovative preparation methods have been developed to create more efficient nitrogen reduction catalysts. These include advanced synthesis techniques such as controlled precipitation, sol-gel processes, and template-assisted growth. The preparation methods focus on controlling particle size, morphology, and composition to optimize catalytic performance in nitrogen reduction reactions while minimizing the use of precious metals.

02 Zeolite and molecular sieve catalysts

Zeolites and molecular sieves serve as effective catalysts for nitrogen reduction due to their unique porous structures and ion-exchange capabilities. These materials provide selective reaction sites and can be modified with various metals to enhance their catalytic performance. They are particularly useful in selective catalytic reduction (SCR) systems where their stability at high temperatures and resistance to poisoning make them valuable for industrial applications.Expand Specific Solutions03 Supported catalysts and composite materials

Supported catalysts consist of active catalytic components dispersed on high-surface-area carrier materials, enhancing the efficiency of nitrogen reduction reactions. These composite materials combine the advantages of different components to achieve improved performance. Common support materials include alumina, silica, and carbon-based materials, which help to increase the dispersion of active sites and improve the thermal stability of the catalyst system.Expand Specific Solutions04 Novel catalyst preparation methods

Innovative preparation techniques have been developed to enhance the performance of nitrogen reduction catalysts. These methods include sol-gel processes, hydrothermal synthesis, impregnation techniques, and advanced deposition methods. The preparation approach significantly influences catalyst properties such as particle size, dispersion, surface area, and ultimately the catalytic activity and selectivity in nitrogen reduction reactions.Expand Specific Solutions05 Electrochemical nitrogen reduction catalysts

Electrochemical catalysts facilitate nitrogen reduction reactions through electrical energy input, offering an environmentally friendly approach to nitrogen compound conversion. These catalysts are designed to operate at ambient conditions and can be used for applications such as ammonia synthesis from atmospheric nitrogen. Recent developments focus on improving the efficiency, selectivity, and stability of these catalysts while reducing energy consumption in electrochemical nitrogen reduction processes.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The nitrogen reduction catalyst industry is currently in a growth phase, with increasing market demand driven by stringent emission regulations worldwide. The market size is expanding rapidly, projected to reach significant value as automotive and industrial sectors seek compliance with environmental standards. Technology maturity varies across applications, with companies like Umicore SA, Topsoe A/S, and Caterpillar leading innovation in automotive catalysts, while academic institutions such as East China University of Science & Technology and Zhejiang University contribute fundamental research. Major automotive manufacturers including Hyundai, Kia, Mercedes-Benz, and Ford are actively integrating advanced catalyst technologies. Industry standards are significantly influencing development trajectories, pushing companies toward more efficient, durable, and environmentally compatible catalyst formulations while creating competitive differentiation opportunities.

Umicore SA

Technical Solution: Umicore has developed proprietary nitrogen reduction catalyst technology centered on copper-chabazite (Cu-CHA) zeolite structures for automotive and industrial applications. Their SCR catalysts incorporate precisely controlled copper ion exchange in small-pore zeolites, achieving over 90% NOx conversion efficiency while maintaining hydrothermal stability up to 850°C. Umicore's technology features advanced coating techniques that deposit uniform catalyst layers (50-150 μm thickness) on ceramic substrates, optimizing precious metal utilization and reducing material costs. Their catalysts employ a dual-layer architecture with distinct functional zones: a copper-zeolite layer for NOx reduction and a platinum-group metal layer for hydrocarbon/CO oxidation and ammonia slip control. Umicore has also pioneered vanadium-free formulations that address environmental concerns while maintaining performance comparable to traditional V2O5-WO3/TiO2 systems, particularly for applications requiring resistance to sulfur poisoning.

Strengths: Superior hydrothermal stability in high-temperature applications; advanced coating technology enabling material efficiency; comprehensive catalyst system integration capabilities. Weaknesses: Higher production costs for Cu-zeolite systems compared to conventional vanadium catalysts; performance degradation in presence of certain lubricant-derived poisons; requires precise manufacturing controls.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai has developed an integrated Lean NOx Trap (LNT) and Selective Catalytic Reduction (SCR) system for nitrogen oxide reduction in automotive applications. Their hybrid catalyst architecture combines platinum-group metals on alumina/ceria supports (for LNT functionality) with copper-exchanged zeolites (for SCR activity), achieving over 85% NOx conversion across diverse driving conditions. Hyundai's technology features a close-coupled catalyst configuration that accelerates light-off performance, reaching operational temperatures 30% faster than conventional systems. Their catalysts incorporate advanced washcoat formulations with optimized oxygen storage capacity and improved sulfur tolerance, extending catalyst lifetime by approximately 20%. Hyundai has also pioneered passive ammonia generation mechanisms within the LNT component, reducing the need for separate urea injection systems in certain vehicle applications while maintaining compliance with Euro 6d and SULEV30 emission standards.

Strengths: Effective NOx reduction across diverse driving cycles; reduced system complexity through passive ammonia generation; optimized catalyst positioning for rapid light-off performance. Weaknesses: Higher precious metal content increases production costs; performance degradation in extended low-temperature operation; requires sophisticated engine control strategies.

Key Patents in Nitrogen Reduction Technology

Nitrogen oxide-reducing catalyst and method for reducing nitrogen oxide

PatentActiveUS20090155152A1

Innovation

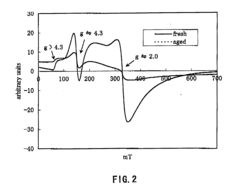

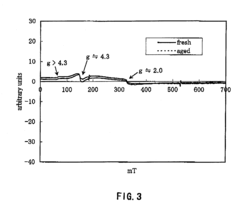

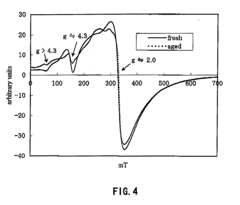

- Development of β-type ferrosilicate catalysts with specific iron-containing β-framework structures and SiO2/Fe2O3 ratios, ensuring at least 80% of iron is isolated Fe3+ for high catalytic activity and hydrothermal stability, using ammonia, urea, or organic amines as reducing agents.

Catalyst for reducing nitrogen oxides and method for producing the same

PatentInactiveUS20130005563A1

Innovation

- A zeolite-containing catalyst with specific physical and chemical properties, including a metal supported on zeolite particles of 0.5 nm to 20 nm diameter and a coefficient of variation in metal intensity of at least 20%, produced using a method that involves rapid removal of the dispersion medium and calcination under gas circulation, enhancing low-temperature NOx reduction capability and durability.

Environmental Policy Impact

Environmental policies across global jurisdictions have become increasingly influential in shaping the development and implementation of nitrogen reduction catalyst technologies. The regulatory landscape has evolved significantly over the past decade, with more stringent emission standards driving innovation in catalyst formulations and applications. The European Union's Industrial Emissions Directive (IED) and the Clean Air Act in the United States have established progressively lower NOx emission thresholds, compelling industries to adopt more efficient catalyst solutions.

These regulatory frameworks have created a dual effect on the nitrogen reduction catalyst market. On one hand, they have accelerated research and development investments, leading to breakthroughs in catalyst efficiency and durability. On the other hand, they have increased compliance costs for industries, particularly in sectors like power generation, transportation, and chemical manufacturing. The varying implementation timelines across different regions have also created market fragmentation, with catalyst manufacturers developing region-specific solutions.

Carbon pricing mechanisms and emissions trading schemes have further influenced the economic viability of nitrogen reduction catalysts. In regions with established carbon markets, the financial incentives for NOx reduction have strengthened the business case for advanced catalyst technologies. This has led to increased adoption rates in industries previously resistant to implementation due to cost concerns.

The policy focus on integrated pollution prevention and control has expanded the scope of nitrogen reduction catalyst applications. Regulators increasingly emphasize lifecycle environmental impacts, pushing for catalysts that not only reduce nitrogen emissions but also minimize secondary pollutants and resource consumption. This holistic approach has fostered innovation in multi-functional catalyst designs that address multiple environmental concerns simultaneously.

International environmental agreements, such as the Gothenburg Protocol and Paris Agreement, have established transboundary cooperation frameworks that influence national policies on nitrogen emissions. These agreements have facilitated knowledge sharing and technology transfer, accelerating the global diffusion of best practices in catalyst technology. They have also created more predictable regulatory environments, enabling longer-term investment planning in catalyst research and manufacturing capacity.

Emerging economies are increasingly adopting similar regulatory approaches, though often with extended compliance timelines. This gradual global convergence of environmental standards is expanding market opportunities for nitrogen reduction catalyst technologies while necessitating adaptations to diverse operating conditions and economic constraints. The policy trend toward technology-neutral performance standards, rather than prescriptive technical requirements, has created space for innovative catalyst solutions that might not fit traditional regulatory categories.

These regulatory frameworks have created a dual effect on the nitrogen reduction catalyst market. On one hand, they have accelerated research and development investments, leading to breakthroughs in catalyst efficiency and durability. On the other hand, they have increased compliance costs for industries, particularly in sectors like power generation, transportation, and chemical manufacturing. The varying implementation timelines across different regions have also created market fragmentation, with catalyst manufacturers developing region-specific solutions.

Carbon pricing mechanisms and emissions trading schemes have further influenced the economic viability of nitrogen reduction catalysts. In regions with established carbon markets, the financial incentives for NOx reduction have strengthened the business case for advanced catalyst technologies. This has led to increased adoption rates in industries previously resistant to implementation due to cost concerns.

The policy focus on integrated pollution prevention and control has expanded the scope of nitrogen reduction catalyst applications. Regulators increasingly emphasize lifecycle environmental impacts, pushing for catalysts that not only reduce nitrogen emissions but also minimize secondary pollutants and resource consumption. This holistic approach has fostered innovation in multi-functional catalyst designs that address multiple environmental concerns simultaneously.

International environmental agreements, such as the Gothenburg Protocol and Paris Agreement, have established transboundary cooperation frameworks that influence national policies on nitrogen emissions. These agreements have facilitated knowledge sharing and technology transfer, accelerating the global diffusion of best practices in catalyst technology. They have also created more predictable regulatory environments, enabling longer-term investment planning in catalyst research and manufacturing capacity.

Emerging economies are increasingly adopting similar regulatory approaches, though often with extended compliance timelines. This gradual global convergence of environmental standards is expanding market opportunities for nitrogen reduction catalyst technologies while necessitating adaptations to diverse operating conditions and economic constraints. The policy trend toward technology-neutral performance standards, rather than prescriptive technical requirements, has created space for innovative catalyst solutions that might not fit traditional regulatory categories.

Cost-Benefit Analysis

The implementation of nitrogen reduction catalysts in industrial processes involves significant financial considerations that must be carefully evaluated through comprehensive cost-benefit analysis. Initial capital expenditures for catalyst integration include procurement costs, installation expenses, and potential facility modifications to accommodate new catalytic systems. These upfront investments typically range from $500,000 to several million dollars depending on facility scale and existing infrastructure compatibility.

Operational expenditures present another critical dimension, encompassing catalyst replacement cycles, energy consumption differentials, and maintenance requirements. Industry standards significantly influence these costs by establishing minimum performance thresholds that manufacturers must meet. Facilities adhering to stricter standards may face 15-30% higher initial implementation costs but often realize superior long-term economic returns through extended catalyst lifespans and reduced replacement frequency.

Energy efficiency improvements represent a substantial benefit, with modern nitrogen reduction catalysts designed to industry standards typically reducing energy consumption by 8-12% compared to previous generation technologies. This translates to annual savings of $50,000-200,000 for medium-sized industrial operations, with payback periods averaging 2-4 years depending on energy prices and operational intensity.

Regulatory compliance benefits constitute another significant economic advantage. Facilities implementing standard-compliant catalysts avoid potential non-compliance penalties ranging from $10,000 to $1 million annually depending on jurisdiction and violation severity. Furthermore, many regions offer tax incentives and subsidies for early adoption of technologies meeting or exceeding emerging standards, potentially offsetting 15-25% of implementation costs.

Production efficiency improvements deliver additional economic benefits through increased throughput and reduced downtime. Standard-compliant catalysts demonstrate 5-8% higher nitrogen conversion efficiency and 10-15% longer operational lifespans before requiring regeneration or replacement, significantly enhancing overall process economics.

Environmental externalities, while challenging to quantify precisely, represent substantial economic value. Reduced nitrogen emissions translate to decreased environmental remediation costs, lower carbon taxation exposure, and enhanced corporate sustainability profiles that increasingly influence customer preferences and investor decisions. Conservative estimates suggest these benefits contribute an additional 10-20% return on investment beyond direct operational savings.

The comprehensive cost-benefit equation strongly favors implementation of industry standard-compliant nitrogen reduction catalysts, with most industrial applications achieving full return on investment within 3-5 years while positioning operations advantageously for increasingly stringent future regulatory requirements.

Operational expenditures present another critical dimension, encompassing catalyst replacement cycles, energy consumption differentials, and maintenance requirements. Industry standards significantly influence these costs by establishing minimum performance thresholds that manufacturers must meet. Facilities adhering to stricter standards may face 15-30% higher initial implementation costs but often realize superior long-term economic returns through extended catalyst lifespans and reduced replacement frequency.

Energy efficiency improvements represent a substantial benefit, with modern nitrogen reduction catalysts designed to industry standards typically reducing energy consumption by 8-12% compared to previous generation technologies. This translates to annual savings of $50,000-200,000 for medium-sized industrial operations, with payback periods averaging 2-4 years depending on energy prices and operational intensity.

Regulatory compliance benefits constitute another significant economic advantage. Facilities implementing standard-compliant catalysts avoid potential non-compliance penalties ranging from $10,000 to $1 million annually depending on jurisdiction and violation severity. Furthermore, many regions offer tax incentives and subsidies for early adoption of technologies meeting or exceeding emerging standards, potentially offsetting 15-25% of implementation costs.

Production efficiency improvements deliver additional economic benefits through increased throughput and reduced downtime. Standard-compliant catalysts demonstrate 5-8% higher nitrogen conversion efficiency and 10-15% longer operational lifespans before requiring regeneration or replacement, significantly enhancing overall process economics.

Environmental externalities, while challenging to quantify precisely, represent substantial economic value. Reduced nitrogen emissions translate to decreased environmental remediation costs, lower carbon taxation exposure, and enhanced corporate sustainability profiles that increasingly influence customer preferences and investor decisions. Conservative estimates suggest these benefits contribute an additional 10-20% return on investment beyond direct operational savings.

The comprehensive cost-benefit equation strongly favors implementation of industry standard-compliant nitrogen reduction catalysts, with most industrial applications achieving full return on investment within 3-5 years while positioning operations advantageously for increasingly stringent future regulatory requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!