Advanced Coatings for Corrosion Prevention in Turbine Engines

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Turbine Engine Corrosion Protection Background and Objectives

Turbine engines represent a critical component in various industries, including aviation, power generation, and marine propulsion. Since their inception in the early 20th century, these engines have undergone significant technological advancements, yet corrosion remains one of the most persistent challenges affecting their performance, reliability, and service life. The evolution of turbine engine technology has been marked by continuous improvements in materials, design, and operational parameters to enhance efficiency and power output.

Corrosion in turbine engines occurs through various mechanisms, including hot corrosion, oxidation, and galvanic corrosion, which are exacerbated by the extreme operating conditions these engines endure. Historically, the approach to corrosion prevention has evolved from simple metallic coatings to sophisticated multi-layered systems incorporating advanced materials and application techniques.

The development trajectory of protective coatings has seen several significant milestones, from early aluminide coatings in the 1950s to the introduction of MCrAlY overlay coatings in the 1970s, and more recently, the implementation of thermal barrier coatings (TBCs) and nanostructured coatings. Each advancement has addressed specific corrosion challenges while contributing to the overall improvement of engine performance and durability.

Current research trends indicate a growing focus on environmentally friendly coating solutions, as traditional methods often involve hazardous materials and processes. Additionally, there is increasing interest in smart coatings capable of self-diagnosis and self-healing, representing the next frontier in corrosion protection technology.

The primary objective of advanced coating development is to create protective systems that can withstand increasingly demanding operating conditions while extending component life and reducing maintenance requirements. This includes developing coatings that can perform reliably at higher temperatures, resist multiple forms of corrosion simultaneously, and maintain structural integrity over extended service periods.

Secondary objectives include reducing the environmental impact of coating processes, decreasing application costs, and improving compatibility with emerging turbine engine materials, particularly advanced composites and ceramic matrix components. The ultimate goal is to develop coating systems that contribute to overall engine efficiency improvements by allowing higher operating temperatures and reduced cooling requirements.

As turbine engines continue to evolve toward higher performance and efficiency standards, the development of advanced corrosion-resistant coatings becomes increasingly critical to meeting industry demands for reliability, sustainability, and cost-effectiveness. The technological trajectory suggests a future where integrated, multifunctional coating systems will play a pivotal role in enabling next-generation turbine engine capabilities.

Corrosion in turbine engines occurs through various mechanisms, including hot corrosion, oxidation, and galvanic corrosion, which are exacerbated by the extreme operating conditions these engines endure. Historically, the approach to corrosion prevention has evolved from simple metallic coatings to sophisticated multi-layered systems incorporating advanced materials and application techniques.

The development trajectory of protective coatings has seen several significant milestones, from early aluminide coatings in the 1950s to the introduction of MCrAlY overlay coatings in the 1970s, and more recently, the implementation of thermal barrier coatings (TBCs) and nanostructured coatings. Each advancement has addressed specific corrosion challenges while contributing to the overall improvement of engine performance and durability.

Current research trends indicate a growing focus on environmentally friendly coating solutions, as traditional methods often involve hazardous materials and processes. Additionally, there is increasing interest in smart coatings capable of self-diagnosis and self-healing, representing the next frontier in corrosion protection technology.

The primary objective of advanced coating development is to create protective systems that can withstand increasingly demanding operating conditions while extending component life and reducing maintenance requirements. This includes developing coatings that can perform reliably at higher temperatures, resist multiple forms of corrosion simultaneously, and maintain structural integrity over extended service periods.

Secondary objectives include reducing the environmental impact of coating processes, decreasing application costs, and improving compatibility with emerging turbine engine materials, particularly advanced composites and ceramic matrix components. The ultimate goal is to develop coating systems that contribute to overall engine efficiency improvements by allowing higher operating temperatures and reduced cooling requirements.

As turbine engines continue to evolve toward higher performance and efficiency standards, the development of advanced corrosion-resistant coatings becomes increasingly critical to meeting industry demands for reliability, sustainability, and cost-effectiveness. The technological trajectory suggests a future where integrated, multifunctional coating systems will play a pivotal role in enabling next-generation turbine engine capabilities.

Market Analysis for Advanced Anti-Corrosion Coatings

The global market for advanced anti-corrosion coatings in turbine engines has experienced significant growth over the past decade, driven primarily by increasing demand in aerospace, power generation, and marine industries. Current market valuation stands at approximately $3.2 billion, with projections indicating a compound annual growth rate of 6.8% through 2028, potentially reaching $4.7 billion by that time.

The aerospace sector represents the largest market segment, accounting for roughly 42% of total demand. This dominance stems from stringent safety requirements and the critical need to extend maintenance intervals for commercial aircraft engines. The power generation sector follows at 31%, with particular growth in gas turbine applications where high-temperature corrosion resistance is paramount.

Regional analysis reveals North America as the leading market with 38% share, followed by Europe (27%) and Asia-Pacific (24%). However, the Asia-Pacific region demonstrates the fastest growth trajectory at 8.3% annually, driven by rapid industrialization in China and India, alongside expanding aerospace manufacturing capabilities.

Customer demand patterns show increasing preference for multi-functional coatings that address not only corrosion but also provide thermal barrier properties and erosion resistance. This trend reflects the industry's move toward integrated solutions that reduce overall maintenance costs while extending component lifespans.

Price sensitivity varies significantly by application segment. While aerospace customers prioritize performance and reliability over cost, power generation and marine sectors demonstrate greater price sensitivity, creating distinct market approaches for coating manufacturers.

Regulatory factors substantially influence market dynamics, with environmental regulations increasingly restricting the use of hexavalent chromium and other hazardous substances traditionally used in corrosion-resistant coatings. This regulatory pressure has accelerated innovation in environmentally compliant alternatives, creating both challenges and opportunities for market participants.

Supply chain analysis indicates moderate concentration among raw material suppliers, with specialty chemical companies holding significant influence over pricing and availability. Recent global supply chain disruptions have highlighted vulnerabilities in this area, prompting coating manufacturers to pursue supplier diversification strategies.

Market forecasts suggest particular growth potential in ceramic-based nanocomposite coatings, which are projected to capture increasing market share due to superior performance characteristics. Additionally, the aftermarket segment for coating replacement and maintenance represents a stable revenue stream, estimated at 35% of the total market value with consistent growth patterns.

The aerospace sector represents the largest market segment, accounting for roughly 42% of total demand. This dominance stems from stringent safety requirements and the critical need to extend maintenance intervals for commercial aircraft engines. The power generation sector follows at 31%, with particular growth in gas turbine applications where high-temperature corrosion resistance is paramount.

Regional analysis reveals North America as the leading market with 38% share, followed by Europe (27%) and Asia-Pacific (24%). However, the Asia-Pacific region demonstrates the fastest growth trajectory at 8.3% annually, driven by rapid industrialization in China and India, alongside expanding aerospace manufacturing capabilities.

Customer demand patterns show increasing preference for multi-functional coatings that address not only corrosion but also provide thermal barrier properties and erosion resistance. This trend reflects the industry's move toward integrated solutions that reduce overall maintenance costs while extending component lifespans.

Price sensitivity varies significantly by application segment. While aerospace customers prioritize performance and reliability over cost, power generation and marine sectors demonstrate greater price sensitivity, creating distinct market approaches for coating manufacturers.

Regulatory factors substantially influence market dynamics, with environmental regulations increasingly restricting the use of hexavalent chromium and other hazardous substances traditionally used in corrosion-resistant coatings. This regulatory pressure has accelerated innovation in environmentally compliant alternatives, creating both challenges and opportunities for market participants.

Supply chain analysis indicates moderate concentration among raw material suppliers, with specialty chemical companies holding significant influence over pricing and availability. Recent global supply chain disruptions have highlighted vulnerabilities in this area, prompting coating manufacturers to pursue supplier diversification strategies.

Market forecasts suggest particular growth potential in ceramic-based nanocomposite coatings, which are projected to capture increasing market share due to superior performance characteristics. Additionally, the aftermarket segment for coating replacement and maintenance represents a stable revenue stream, estimated at 35% of the total market value with consistent growth patterns.

Current Challenges in Turbine Engine Corrosion Prevention

Turbine engines in aerospace and power generation sectors face severe corrosion challenges due to their extreme operating environments. These engines routinely operate at temperatures exceeding 1000°C while being exposed to combustion gases, particulates, and various contaminants that accelerate degradation processes. Hot corrosion, particularly Type I (800-950°C) and Type II (650-800°C), represents a significant threat to turbine components, causing accelerated oxidation through molten salt deposits that destroy protective oxide layers.

The industry currently struggles with coating durability limitations in these harsh environments. Traditional thermal barrier coatings (TBCs) and environmental barrier coatings (EBCs) often fail prematurely due to thermal cycling, which creates mismatches in thermal expansion coefficients between the coating and substrate materials. This leads to cracking, spallation, and eventual exposure of the base metal to corrosive elements.

Another persistent challenge is the trade-off between corrosion resistance and mechanical properties. Coatings that excel at preventing corrosion often compromise other critical performance parameters such as erosion resistance, thermal conductivity, or mechanical strength. This creates a complex optimization problem for engineers designing protective systems for turbine components.

The increasing demand for higher operating temperatures to improve engine efficiency further exacerbates these challenges. As turbines push toward higher temperature thresholds for better thermodynamic efficiency, conventional coating materials approach their functional limits. Materials that maintain structural integrity and corrosion resistance above 1200°C remain elusive despite significant research efforts.

Environmental compliance presents additional complications, as traditional corrosion-resistant coatings often contain environmentally problematic elements like chromium and cadmium. Regulatory pressures to eliminate these materials have accelerated the search for environmentally benign alternatives that can match or exceed the performance of conventional systems.

Application methods also present significant technical hurdles. Current deposition techniques like plasma spraying and physical vapor deposition struggle to provide uniform coverage on complex geometries, particularly in internal cooling passages and other hard-to-reach areas of turbine components. This results in inconsistent protection and potential failure points in critical engine components.

Cost considerations further constrain innovation, as advanced coating solutions must balance performance improvements against economic viability. Many promising laboratory-developed coatings remain commercially impractical due to expensive raw materials, complex application processes, or limited scalability for mass production.

The industry currently struggles with coating durability limitations in these harsh environments. Traditional thermal barrier coatings (TBCs) and environmental barrier coatings (EBCs) often fail prematurely due to thermal cycling, which creates mismatches in thermal expansion coefficients between the coating and substrate materials. This leads to cracking, spallation, and eventual exposure of the base metal to corrosive elements.

Another persistent challenge is the trade-off between corrosion resistance and mechanical properties. Coatings that excel at preventing corrosion often compromise other critical performance parameters such as erosion resistance, thermal conductivity, or mechanical strength. This creates a complex optimization problem for engineers designing protective systems for turbine components.

The increasing demand for higher operating temperatures to improve engine efficiency further exacerbates these challenges. As turbines push toward higher temperature thresholds for better thermodynamic efficiency, conventional coating materials approach their functional limits. Materials that maintain structural integrity and corrosion resistance above 1200°C remain elusive despite significant research efforts.

Environmental compliance presents additional complications, as traditional corrosion-resistant coatings often contain environmentally problematic elements like chromium and cadmium. Regulatory pressures to eliminate these materials have accelerated the search for environmentally benign alternatives that can match or exceed the performance of conventional systems.

Application methods also present significant technical hurdles. Current deposition techniques like plasma spraying and physical vapor deposition struggle to provide uniform coverage on complex geometries, particularly in internal cooling passages and other hard-to-reach areas of turbine components. This results in inconsistent protection and potential failure points in critical engine components.

Cost considerations further constrain innovation, as advanced coating solutions must balance performance improvements against economic viability. Many promising laboratory-developed coatings remain commercially impractical due to expensive raw materials, complex application processes, or limited scalability for mass production.

State-of-the-Art Corrosion Prevention Solutions

01 Nano-enhanced protective coatings

Advanced coatings incorporating nanomaterials offer superior corrosion protection by creating more effective barriers against corrosive elements. These nano-enhanced formulations typically include nanoparticles that fill microscopic gaps in the coating structure, preventing moisture and corrosive agents from reaching the substrate. The nanomaterials also contribute to improved adhesion, mechanical strength, and self-healing properties, extending the service life of protected surfaces in harsh environments.- Nano-enhanced protective coatings: Advanced coatings incorporating nanomaterials offer superior corrosion protection by creating dense barrier layers that prevent moisture and corrosive agents from reaching the substrate. These nano-enhanced coatings typically feature improved adhesion, mechanical strength, and self-healing properties. The nanomaterials can include metal oxides, carbon nanotubes, or graphene, which fill microscopic gaps and provide multiple protection mechanisms against corrosion initiation and propagation.

- Smart corrosion detection systems: Intelligent coating systems that incorporate corrosion detection capabilities allow for early identification of corrosion before visible damage occurs. These systems often use embedded sensors, color-changing indicators, or electrochemical monitoring components that respond to changes in pH, ion concentration, or electrical properties when corrosion begins. This technology enables preventive maintenance and timely intervention, significantly extending the service life of coated structures and components.

- Environmentally friendly anti-corrosion formulations: Modern eco-friendly corrosion prevention coatings replace traditional toxic compounds like chromates and heavy metals with sustainable alternatives. These formulations utilize plant extracts, bio-based polymers, and non-toxic inhibitors that provide effective corrosion protection while minimizing environmental impact. The coatings often feature controlled-release mechanisms that dispense inhibitors only when corrosion conditions are detected, optimizing protection while reducing the overall chemical load.

- Multi-layer protective coating systems: Advanced multi-layer coating systems provide comprehensive corrosion protection through specialized layers with distinct functions. These systems typically include a primer with active corrosion inhibitors, intermediate layers for barrier protection, and topcoats for UV and environmental resistance. The synergistic interaction between layers creates redundant protection mechanisms, ensuring that if one layer is compromised, the underlying layers continue to protect the substrate. This approach is particularly effective for harsh environments and critical infrastructure applications.

- Self-healing coating technologies: Self-healing coatings represent a breakthrough in corrosion prevention by automatically repairing damage without external intervention. These coatings incorporate microcapsules, vascular networks, or intrinsically self-healing polymers that release healing agents when the coating is scratched or damaged. The healing agents flow to the damaged area, polymerize or react to form a protective barrier, effectively sealing the breach before corrosion can initiate. This technology significantly extends coating lifespans and reduces maintenance requirements for protected structures.

02 Smart self-healing coating systems

Self-healing coating technologies represent a significant advancement in corrosion prevention, featuring encapsulated healing agents that are released when the coating is damaged. These systems can autonomously repair microcracks and scratches before corrosion begins, significantly extending protection duration. The healing mechanism typically involves either microencapsulated healing agents that rupture upon damage or reversible chemical bonds that reform after being broken, providing continuous protection even after mechanical damage occurs.Expand Specific Solutions03 Environmentally friendly corrosion inhibitors

Modern eco-friendly corrosion inhibitors are being developed to replace traditional toxic compounds while maintaining or improving protective performance. These green alternatives include plant extracts, biodegradable polymers, and non-toxic metal complexes that form protective films on metal surfaces. The inhibitors work by adsorbing onto metal surfaces, forming a protective barrier that prevents corrosive species from reaching the substrate, while meeting increasingly stringent environmental regulations.Expand Specific Solutions04 Advanced polymer-based protective coatings

Polymer-based protective coatings utilize specialized synthetic polymers engineered for superior corrosion resistance in extreme environments. These formulations often incorporate cross-linking technologies that create dense, impermeable barriers against moisture, oxygen, and corrosive chemicals. The polymer matrices can be modified with functional groups that enhance adhesion to metal substrates and improve resistance to UV degradation, temperature fluctuations, and chemical exposure, providing long-term protection for infrastructure and industrial equipment.Expand Specific Solutions05 Electrochemical corrosion protection systems

Electrochemical protection systems combine advanced coatings with cathodic or anodic protection mechanisms to provide comprehensive corrosion prevention. These systems may incorporate sacrificial metal particles within the coating that preferentially corrode to protect the underlying substrate, or they may feature conductive elements that enable the application of protective electrical currents. The integration of electrochemical principles with physical barrier properties creates multi-layered protection strategies particularly effective for critical infrastructure in marine environments and underground applications.Expand Specific Solutions

Leading Manufacturers and Research Institutions Analysis

The advanced coatings for corrosion prevention in turbine engines market is in a growth phase, with an expanding global footprint driven by increasing demand for efficient power generation and aviation solutions. Major players include established aerospace and industrial giants like RTX Corp., General Electric, Safran SA, and Siemens Energy, alongside specialized coating technology providers such as Praxair S.T. Technology and Oerlikon Surface Solutions. The market demonstrates varying levels of technical maturity, with companies like United Technologies and Honeywell International leading innovation through significant R&D investments. Research institutions like Southwest Research Institute and Centre National de la Recherche Scientifique contribute to advancing coating technologies, while regional players from China (AVIC Shenyang Liming, Weichai Power) are increasingly entering this high-value segment, indicating the market's global strategic importance.

General Electric Company

Technical Solution: GE has developed advanced thermal barrier coating (TBC) systems utilizing yttria-stabilized zirconia (YSZ) with enhanced strain tolerance through engineered microstructures. Their proprietary electron beam physical vapor deposition (EB-PVD) process creates columnar structures that provide superior thermal insulation while accommodating thermal expansion. GE's multi-layer approach incorporates a MCrAlY bond coat (where M represents nickel, cobalt, or both) that forms a thermally grown oxide layer of alumina, providing excellent adhesion and oxidation resistance[1]. Recent innovations include the incorporation of rare earth elements like hafnium and yttrium into the bond coat to improve oxide scale adhesion, and development of low thermal conductivity ceramic top coats with gadolinium zirconate and other complex oxides that offer improved phase stability at extreme temperatures[3]. GE has also pioneered smart coating systems with embedded sensors for real-time monitoring of coating degradation.

Strengths: Industry-leading EB-PVD technology creates superior strain-tolerant microstructures; extensive field validation data across diverse operating conditions; integrated coating-component design approach. Weaknesses: Higher manufacturing costs compared to conventional plasma spray methods; complex multi-layer systems require precise process control; some advanced formulations have limited field service history.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed a comprehensive corrosion prevention system for turbine engines centered around their HVOF (High Velocity Oxygen Fuel) thermal spray technology. This process applies MCrAlY coatings (where M is nickel, cobalt or a combination) at supersonic velocities, creating exceptionally dense, well-bonded protective layers with minimal oxidation during application[2]. Their proprietary coating architecture incorporates aluminum-rich diffusion layers beneath the thermal spray coating, forming a composite system that provides both high-temperature oxidation resistance and hot corrosion protection. Honeywell's innovation extends to nano-structured ceramic thermal barrier coatings (TBCs) with engineered porosity that enhances strain tolerance while maintaining thermal insulation properties[4]. For rotating components, they've developed specialized platinum-modified aluminide diffusion coatings with improved resistance to Type I hot corrosion (800-950°C) and Type II hot corrosion (650-800°C), particularly valuable for engines operating in marine or industrial environments[5].

Strengths: Superior coating density and adhesion through HVOF technology; excellent performance in sulfidation environments; integrated approach addressing both oxidation and corrosion mechanisms. Weaknesses: Higher initial implementation costs compared to conventional coating methods; some specialized coatings require complex multi-step application processes; optimization required for each specific engine component and operating environment.

Key Patents and Technical Innovations in Protective Coatings

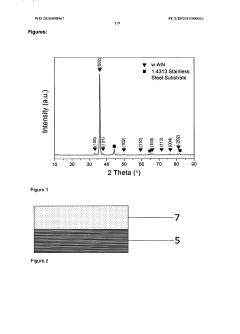

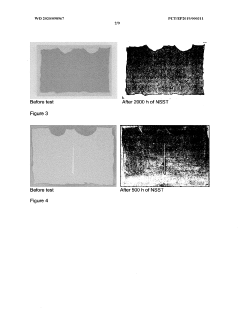

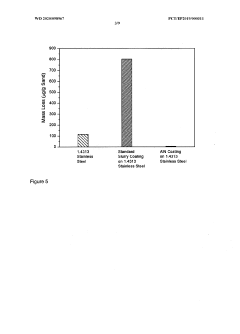

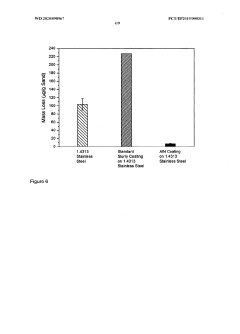

Coated article exhibiting high corrosion and erosion resistance including ain-layer

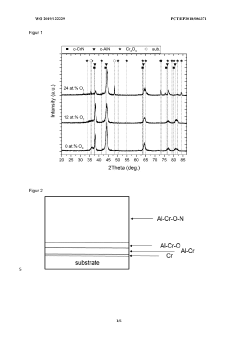

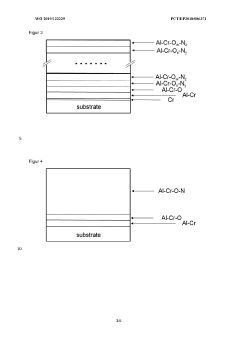

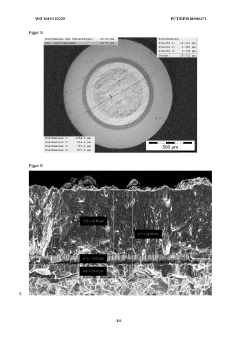

PatentWO2020098967A1

Innovation

- A coating system comprising an optional metallic interlayer and an aluminum nitride (AlN) intermediate layer, with an optional top layer of oxides or nitrides, deposited using cathodic arc physical vapor deposition (PVD) to enhance corrosion and erosion resistance, specifically designed for stainless steel and superalloy components.

Corrosion- and erosion-resistant coating for turbine blades of gas turbines

PatentWO2019122229A1

Innovation

- A coating system comprising a functional layer of Al, Cr, O, and N with a face-centered cubic structure, and an intermediate layer adapted to the substrate and environment, applied using PVD, enhances both erosion and corrosion resistance by increasing the hardness and modulus of elasticity of the functional layer, and includes an intermediate layer system of Cr and/or AlCr to improve adhesion and corrosion protection.

Environmental Impact and Sustainability Considerations

The environmental impact of advanced coatings for turbine engines represents a critical consideration in their development and implementation. Traditional coating processes often involve hazardous materials such as hexavalent chromium and cadmium, which pose significant risks to both human health and the environment. These substances have been linked to various health issues and environmental contamination, prompting regulatory bodies worldwide to impose increasingly stringent restrictions on their use.

Modern advanced coating technologies are evolving toward more environmentally friendly alternatives. Thermal spray coatings utilizing water-based suspensions rather than solvent-based systems significantly reduce volatile organic compound (VOC) emissions. Similarly, physical vapor deposition (PVD) and chemical vapor deposition (CVD) processes are being optimized to minimize waste generation and energy consumption, representing substantial improvements over conventional electroplating methods.

Life cycle assessment (LCA) studies indicate that despite the energy-intensive nature of some advanced coating application processes, the net environmental impact remains positive when considering the extended service life of coated components. By preventing corrosion and extending maintenance intervals, these coatings reduce the frequency of part replacement and associated resource consumption. Research suggests that high-performance ceramic coatings can extend turbine component life by 30-40%, translating to significant reductions in material usage and waste generation over the operational lifetime of an engine.

The recyclability of coated components presents both challenges and opportunities. While some coating materials complicate the recycling process by requiring specialized separation techniques, innovations in coating design are addressing this issue. Developments in easily removable sacrificial layers and thermally degradable bond coats facilitate more efficient end-of-life processing and material recovery.

Energy efficiency gains from advanced coatings contribute substantially to sustainability goals in aviation and power generation. Thermal barrier coatings enable higher operating temperatures, improving combustion efficiency and reducing fuel consumption. Studies demonstrate that modern coating systems can improve turbine efficiency by 1-2%, which translates to substantial reductions in greenhouse gas emissions when implemented across global fleets.

Regulatory compliance is driving innovation in this field, with international frameworks like REACH in Europe and similar regulations in North America and Asia pushing manufacturers toward greener alternatives. Industry leaders are increasingly adopting proactive approaches, developing coating technologies that not only meet current standards but anticipate future regulatory requirements, positioning environmental sustainability as a competitive advantage rather than merely a compliance obligation.

Modern advanced coating technologies are evolving toward more environmentally friendly alternatives. Thermal spray coatings utilizing water-based suspensions rather than solvent-based systems significantly reduce volatile organic compound (VOC) emissions. Similarly, physical vapor deposition (PVD) and chemical vapor deposition (CVD) processes are being optimized to minimize waste generation and energy consumption, representing substantial improvements over conventional electroplating methods.

Life cycle assessment (LCA) studies indicate that despite the energy-intensive nature of some advanced coating application processes, the net environmental impact remains positive when considering the extended service life of coated components. By preventing corrosion and extending maintenance intervals, these coatings reduce the frequency of part replacement and associated resource consumption. Research suggests that high-performance ceramic coatings can extend turbine component life by 30-40%, translating to significant reductions in material usage and waste generation over the operational lifetime of an engine.

The recyclability of coated components presents both challenges and opportunities. While some coating materials complicate the recycling process by requiring specialized separation techniques, innovations in coating design are addressing this issue. Developments in easily removable sacrificial layers and thermally degradable bond coats facilitate more efficient end-of-life processing and material recovery.

Energy efficiency gains from advanced coatings contribute substantially to sustainability goals in aviation and power generation. Thermal barrier coatings enable higher operating temperatures, improving combustion efficiency and reducing fuel consumption. Studies demonstrate that modern coating systems can improve turbine efficiency by 1-2%, which translates to substantial reductions in greenhouse gas emissions when implemented across global fleets.

Regulatory compliance is driving innovation in this field, with international frameworks like REACH in Europe and similar regulations in North America and Asia pushing manufacturers toward greener alternatives. Industry leaders are increasingly adopting proactive approaches, developing coating technologies that not only meet current standards but anticipate future regulatory requirements, positioning environmental sustainability as a competitive advantage rather than merely a compliance obligation.

High-Temperature Performance and Durability Assessment

The performance of advanced coatings for turbine engines under high-temperature conditions represents a critical factor in their overall effectiveness for corrosion prevention. Current generation thermal barrier coatings (TBCs) and environmental barrier coatings (EBCs) demonstrate remarkable stability at temperatures ranging from 1000°C to 1400°C, with some specialized formulations maintaining structural integrity up to 1600°C during short-duration exposure.

Durability testing protocols typically involve cyclic thermal exposure, where coated components undergo rapid heating and cooling cycles to simulate operational conditions. Industry standard tests include the Furnace Cycle Test (FCT) and Jet Engine Thermal Shock (JETS) test, with leading coatings demonstrating lifespans of 1000+ cycles before significant degradation occurs. This represents approximately 25,000-30,000 hours of operational service in modern turbine engines.

Microstructural stability remains a significant challenge, with phase transformations and interdiffusion between coating layers potentially compromising protective properties over time. Advanced yttria-stabilized zirconia (YSZ) coatings with carefully controlled dopant concentrations have shown superior resistance to sintering and phase destabilization, maintaining porosity levels necessary for thermal insulation even after extended high-temperature exposure.

Bond coat oxidation represents another critical performance parameter, with the formation of thermally grown oxide (TGO) layers at the interface between bond coat and ceramic top coat. Modern MCrAlY and platinum aluminide bond coats demonstrate controlled TGO growth rates of approximately 0.1-0.3 μm per 100 hours at operating temperatures, significantly extending coating system longevity.

Erosion resistance at elevated temperatures presents unique challenges, as material properties change dramatically under thermal loading. Recent advancements in nanostructured ceramic coatings have demonstrated up to 40% improvement in erosion resistance compared to conventional counterparts when tested at temperatures above 1000°C. These improvements stem from optimized grain boundary structures and enhanced fracture toughness.

Long-term performance assessment methodologies have evolved significantly, with accelerated testing protocols now incorporating multiple degradation mechanisms simultaneously. These include hot corrosion exposure combined with thermal cycling and mechanical loading, providing more realistic predictions of in-service behavior. Computational models utilizing finite element analysis and machine learning algorithms now enable more accurate lifetime predictions based on laboratory test data, reducing the need for extensive field testing.

Durability testing protocols typically involve cyclic thermal exposure, where coated components undergo rapid heating and cooling cycles to simulate operational conditions. Industry standard tests include the Furnace Cycle Test (FCT) and Jet Engine Thermal Shock (JETS) test, with leading coatings demonstrating lifespans of 1000+ cycles before significant degradation occurs. This represents approximately 25,000-30,000 hours of operational service in modern turbine engines.

Microstructural stability remains a significant challenge, with phase transformations and interdiffusion between coating layers potentially compromising protective properties over time. Advanced yttria-stabilized zirconia (YSZ) coatings with carefully controlled dopant concentrations have shown superior resistance to sintering and phase destabilization, maintaining porosity levels necessary for thermal insulation even after extended high-temperature exposure.

Bond coat oxidation represents another critical performance parameter, with the formation of thermally grown oxide (TGO) layers at the interface between bond coat and ceramic top coat. Modern MCrAlY and platinum aluminide bond coats demonstrate controlled TGO growth rates of approximately 0.1-0.3 μm per 100 hours at operating temperatures, significantly extending coating system longevity.

Erosion resistance at elevated temperatures presents unique challenges, as material properties change dramatically under thermal loading. Recent advancements in nanostructured ceramic coatings have demonstrated up to 40% improvement in erosion resistance compared to conventional counterparts when tested at temperatures above 1000°C. These improvements stem from optimized grain boundary structures and enhanced fracture toughness.

Long-term performance assessment methodologies have evolved significantly, with accelerated testing protocols now incorporating multiple degradation mechanisms simultaneously. These include hot corrosion exposure combined with thermal cycling and mechanical loading, providing more realistic predictions of in-service behavior. Computational models utilizing finite element analysis and machine learning algorithms now enable more accurate lifetime predictions based on laboratory test data, reducing the need for extensive field testing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!