Cost Benefits of Ceramic Coatings in Turbine Engines

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ceramic Coating Technology Evolution and Objectives

Ceramic coatings for turbine engines have evolved significantly over the past seven decades, transforming from experimental materials to critical components in modern aerospace and power generation systems. The development journey began in the 1950s with simple aluminide coatings designed primarily for oxidation resistance. By the 1970s, the introduction of MCrAlY overlay coatings (where M represents nickel, cobalt, or a combination) marked a significant advancement, offering improved high-temperature capabilities and corrosion resistance.

The 1980s witnessed a revolutionary breakthrough with the development of thermal barrier coatings (TBCs), typically composed of yttria-stabilized zirconia (YSZ). These coatings provided exceptional thermal insulation properties, allowing turbine engines to operate at higher temperatures without compromising structural integrity. This advancement directly translated to improved engine efficiency and performance.

Recent decades have seen the refinement of ceramic coating technologies through the incorporation of nanostructured materials, advanced deposition techniques, and multi-layered coating systems. Modern ceramic coatings now commonly feature complex architectures with distinct functional layers, each engineered to address specific operational challenges such as oxidation, corrosion, erosion, and thermal management.

The primary technical objectives driving ceramic coating development center on enhancing engine efficiency, extending component lifespan, and reducing operational costs. By creating effective thermal barriers, these coatings enable higher combustion temperatures, which directly improves thermodynamic efficiency according to Carnot cycle principles. Each 50°C increase in operating temperature typically yields a 1-2% improvement in overall engine efficiency.

Component durability represents another critical objective, with ceramic coatings demonstrating the ability to extend part life by 2-3 times under optimal conditions. This translates to significant maintenance cost reductions and improved reliability metrics across the engine system. The protective properties of these coatings against various degradation mechanisms have become increasingly sophisticated, with modern formulations offering resistance to multiple damage modes simultaneously.

Looking forward, the technical trajectory for ceramic coatings aims toward self-healing capabilities, adaptive thermal properties, and improved manufacturing consistency. Emerging research focuses on ceramic matrix composites (CMCs) and environmental barrier coatings (EBCs) that can withstand temperatures exceeding 1400°C while maintaining structural integrity. These advancements align with industry goals to further increase fuel efficiency, reduce emissions, and extend maintenance intervals in next-generation turbine engines.

The 1980s witnessed a revolutionary breakthrough with the development of thermal barrier coatings (TBCs), typically composed of yttria-stabilized zirconia (YSZ). These coatings provided exceptional thermal insulation properties, allowing turbine engines to operate at higher temperatures without compromising structural integrity. This advancement directly translated to improved engine efficiency and performance.

Recent decades have seen the refinement of ceramic coating technologies through the incorporation of nanostructured materials, advanced deposition techniques, and multi-layered coating systems. Modern ceramic coatings now commonly feature complex architectures with distinct functional layers, each engineered to address specific operational challenges such as oxidation, corrosion, erosion, and thermal management.

The primary technical objectives driving ceramic coating development center on enhancing engine efficiency, extending component lifespan, and reducing operational costs. By creating effective thermal barriers, these coatings enable higher combustion temperatures, which directly improves thermodynamic efficiency according to Carnot cycle principles. Each 50°C increase in operating temperature typically yields a 1-2% improvement in overall engine efficiency.

Component durability represents another critical objective, with ceramic coatings demonstrating the ability to extend part life by 2-3 times under optimal conditions. This translates to significant maintenance cost reductions and improved reliability metrics across the engine system. The protective properties of these coatings against various degradation mechanisms have become increasingly sophisticated, with modern formulations offering resistance to multiple damage modes simultaneously.

Looking forward, the technical trajectory for ceramic coatings aims toward self-healing capabilities, adaptive thermal properties, and improved manufacturing consistency. Emerging research focuses on ceramic matrix composites (CMCs) and environmental barrier coatings (EBCs) that can withstand temperatures exceeding 1400°C while maintaining structural integrity. These advancements align with industry goals to further increase fuel efficiency, reduce emissions, and extend maintenance intervals in next-generation turbine engines.

Market Demand Analysis for High-Performance Turbine Engines

The global market for high-performance turbine engines continues to expand significantly, driven by increasing demand across multiple sectors including aerospace, power generation, and marine applications. Current market valuations indicate the high-performance turbine engine sector exceeds $50 billion annually, with projected growth rates of 4-6% through 2030, outpacing many other industrial segments.

Aerospace remains the dominant application sector, accounting for approximately 60% of market demand. Commercial aviation's recovery post-pandemic has accelerated replacement cycles, with airlines prioritizing fuel-efficient engines that offer reduced operational costs. Military aerospace applications represent a stable secondary market, with defense budgets in North America, Europe, and Asia allocating substantial funding for next-generation propulsion systems.

The power generation sector constitutes roughly 25% of market demand, with particular growth in distributed energy systems and peak-load management applications. As grid stability concerns increase globally, rapid-response turbine systems have seen demand increase by nearly 18% in the past three years.

Customer requirements have evolved significantly, with efficiency improvements now considered the primary purchase driver. End-users increasingly evaluate engines based on total lifecycle costs rather than initial acquisition expenses. This shift has created substantial market pull for advanced materials like ceramic coatings that extend service intervals and improve thermal efficiency.

Regional analysis reveals Asia-Pacific as the fastest-growing market, with China and India leading investment in both aerospace and power generation applications. North America maintains the largest market share at 38%, though this represents a gradual decline from historical dominance.

Market research indicates willingness-to-pay premiums of 15-22% for turbine engines demonstrating verifiable efficiency improvements of 5% or greater. This price elasticity directly benefits ceramic coating technologies that can deliver such performance enhancements while extending component lifespans.

Supply chain considerations have become increasingly important following recent global disruptions. Manufacturers capable of demonstrating resilient material sourcing and production capabilities for specialized components like ceramic-coated turbine blades command market premiums and preferred supplier status.

The competitive landscape shows increasing consolidation among tier-one suppliers, with vertical integration strategies becoming prevalent as companies seek to control critical technology elements. Market entry barriers remain substantial, with intellectual property portfolios and certification requirements creating significant moats around established players.

Aerospace remains the dominant application sector, accounting for approximately 60% of market demand. Commercial aviation's recovery post-pandemic has accelerated replacement cycles, with airlines prioritizing fuel-efficient engines that offer reduced operational costs. Military aerospace applications represent a stable secondary market, with defense budgets in North America, Europe, and Asia allocating substantial funding for next-generation propulsion systems.

The power generation sector constitutes roughly 25% of market demand, with particular growth in distributed energy systems and peak-load management applications. As grid stability concerns increase globally, rapid-response turbine systems have seen demand increase by nearly 18% in the past three years.

Customer requirements have evolved significantly, with efficiency improvements now considered the primary purchase driver. End-users increasingly evaluate engines based on total lifecycle costs rather than initial acquisition expenses. This shift has created substantial market pull for advanced materials like ceramic coatings that extend service intervals and improve thermal efficiency.

Regional analysis reveals Asia-Pacific as the fastest-growing market, with China and India leading investment in both aerospace and power generation applications. North America maintains the largest market share at 38%, though this represents a gradual decline from historical dominance.

Market research indicates willingness-to-pay premiums of 15-22% for turbine engines demonstrating verifiable efficiency improvements of 5% or greater. This price elasticity directly benefits ceramic coating technologies that can deliver such performance enhancements while extending component lifespans.

Supply chain considerations have become increasingly important following recent global disruptions. Manufacturers capable of demonstrating resilient material sourcing and production capabilities for specialized components like ceramic-coated turbine blades command market premiums and preferred supplier status.

The competitive landscape shows increasing consolidation among tier-one suppliers, with vertical integration strategies becoming prevalent as companies seek to control critical technology elements. Market entry barriers remain substantial, with intellectual property portfolios and certification requirements creating significant moats around established players.

Current State and Challenges of Ceramic Coating Implementation

Ceramic coatings in turbine engines have reached a significant level of technological maturity, with widespread implementation across aerospace, power generation, and industrial applications. Current state-of-the-art thermal barrier coatings (TBCs) primarily utilize yttria-stabilized zirconia (YSZ) as the standard material, offering thermal conductivity reduction of 30-50% compared to uncoated components. These coatings are typically applied through either air plasma spraying (APS) or electron beam physical vapor deposition (EB-PVD), with coating thicknesses ranging from 100 to 500 micrometers depending on application requirements.

Global implementation of ceramic coatings has seen uneven distribution, with North America, Europe, and East Asia dominating both research and industrial application. Recent market analysis indicates the global thermal barrier coatings market reached approximately $16.6 billion in 2022, with a projected CAGR of 4.7% through 2030, demonstrating sustained industry investment despite implementation challenges.

Despite widespread adoption, several significant technical challenges persist in ceramic coating implementation. Durability remains a primary concern, with coating spallation occurring due to thermal cycling fatigue and thermomechanical stress. Current YSZ coatings typically achieve 1000-3000 cycles before failure, falling short of ideal engine lifespans. This limitation necessitates more frequent maintenance intervals, offsetting some cost benefits.

Manufacturing consistency presents another substantial challenge. Variations in coating thickness, porosity, and microstructure can significantly impact performance and durability. Current production methods struggle to maintain tight tolerances across complex geometries, resulting in performance variability between components and even across different areas of the same component.

Environmental degradation mechanisms, particularly CMAS (calcium-magnesium-alumino-silicate) attack, continue to limit coating lifespans in certain operating environments. These contaminants infiltrate coating pores at high temperatures, causing progressive deterioration of the ceramic structure and premature failure. Current mitigation strategies provide only partial protection.

Cost remains a significant barrier to wider implementation, particularly in cost-sensitive sectors. The application process requires specialized equipment and expertise, with initial implementation costs ranging from $80-200 per square foot depending on complexity and specifications. This high initial investment often delays adoption despite long-term economic benefits.

Emerging challenges include developing coatings compatible with next-generation turbine materials and designs, which operate at increasingly extreme temperatures. Current ceramic formulations approach their functional limits around 1200-1300°C, while future engine designs target operating temperatures exceeding 1500°C, creating a technological gap that requires novel material solutions.

Global implementation of ceramic coatings has seen uneven distribution, with North America, Europe, and East Asia dominating both research and industrial application. Recent market analysis indicates the global thermal barrier coatings market reached approximately $16.6 billion in 2022, with a projected CAGR of 4.7% through 2030, demonstrating sustained industry investment despite implementation challenges.

Despite widespread adoption, several significant technical challenges persist in ceramic coating implementation. Durability remains a primary concern, with coating spallation occurring due to thermal cycling fatigue and thermomechanical stress. Current YSZ coatings typically achieve 1000-3000 cycles before failure, falling short of ideal engine lifespans. This limitation necessitates more frequent maintenance intervals, offsetting some cost benefits.

Manufacturing consistency presents another substantial challenge. Variations in coating thickness, porosity, and microstructure can significantly impact performance and durability. Current production methods struggle to maintain tight tolerances across complex geometries, resulting in performance variability between components and even across different areas of the same component.

Environmental degradation mechanisms, particularly CMAS (calcium-magnesium-alumino-silicate) attack, continue to limit coating lifespans in certain operating environments. These contaminants infiltrate coating pores at high temperatures, causing progressive deterioration of the ceramic structure and premature failure. Current mitigation strategies provide only partial protection.

Cost remains a significant barrier to wider implementation, particularly in cost-sensitive sectors. The application process requires specialized equipment and expertise, with initial implementation costs ranging from $80-200 per square foot depending on complexity and specifications. This high initial investment often delays adoption despite long-term economic benefits.

Emerging challenges include developing coatings compatible with next-generation turbine materials and designs, which operate at increasingly extreme temperatures. Current ceramic formulations approach their functional limits around 1200-1300°C, while future engine designs target operating temperatures exceeding 1500°C, creating a technological gap that requires novel material solutions.

Existing Ceramic Coating Solutions for Turbine Applications

01 Cost-effectiveness of ceramic coatings in industrial applications

Ceramic coatings provide significant cost benefits in industrial settings through reduced maintenance expenses and extended equipment lifespan. These coatings offer superior protection against corrosion, wear, and high temperatures, which decreases the frequency of repairs and replacements. The initial investment in ceramic coating technology is offset by long-term operational savings, improved energy efficiency, and reduced downtime, making them economically advantageous for manufacturing and processing industries.- Cost reduction in manufacturing processes: Ceramic coatings can significantly reduce manufacturing costs by improving process efficiency and reducing material waste. These coatings extend the lifespan of manufacturing equipment and tools, decreasing the frequency of replacements and maintenance. Additionally, ceramic coatings can optimize energy consumption during production processes, leading to lower operational costs and improved productivity in industrial applications.

- Enhanced durability and longevity of coated surfaces: Ceramic coatings provide superior protection against wear, corrosion, and environmental damage, significantly extending the service life of coated components. The enhanced durability translates to reduced replacement frequency and maintenance costs over time. These coatings create a hard, protective barrier that resists scratches, chemical damage, and thermal stress, making them particularly valuable for high-wear applications in automotive, aerospace, and industrial sectors.

- Thermal efficiency and energy savings: Ceramic coatings offer excellent thermal barrier properties that can significantly improve energy efficiency in various applications. By providing thermal insulation, these coatings reduce heat transfer and energy loss, leading to lower heating and cooling costs in buildings and industrial processes. The thermal resistance properties also enable equipment to operate at higher temperatures with improved efficiency, resulting in substantial energy savings and reduced operational costs over time.

- Maintenance cost reduction and extended service intervals: The application of ceramic coatings significantly reduces maintenance requirements and extends service intervals for coated components. The protective properties of these coatings minimize degradation from environmental factors, reducing the need for frequent cleaning, repair, or replacement. In automotive applications, ceramic coatings protect paint and exterior surfaces, eliminating the need for waxing and reducing cleaning frequency. Industrial equipment with ceramic coatings experiences less downtime for maintenance, contributing to overall operational cost savings.

- Performance enhancement and value addition: Ceramic coatings provide performance benefits that add significant value to products across various industries. These coatings improve surface properties such as hydrophobicity, chemical resistance, and aesthetic appeal, enhancing product functionality and customer satisfaction. In consumer products, ceramic-coated items command premium pricing due to their superior performance and longevity. For industrial applications, the performance improvements translate to increased productivity, reduced defects, and enhanced product quality, creating substantial value that justifies the initial investment in coating technology.

02 Thermal efficiency benefits and energy cost reduction

Ceramic coatings deliver substantial thermal efficiency benefits that translate to energy cost savings. By providing excellent thermal insulation properties, these coatings reduce heat transfer and energy loss in various applications. When applied to engine components, industrial equipment, or building materials, ceramic coatings help maintain optimal operating temperatures, reduce fuel consumption, and lower cooling requirements. The resulting energy efficiency improvements lead to significant cost savings over the operational lifetime of coated products.Expand Specific Solutions03 Lifecycle cost analysis of ceramic coating implementations

Lifecycle cost analysis demonstrates the economic advantages of ceramic coatings when evaluated over the complete service life of components. While initial application costs may be higher than conventional coatings, ceramic coatings offer superior durability and performance longevity. This extended service life reduces replacement frequency, maintenance requirements, and associated labor costs. Comprehensive lifecycle assessments show that ceramic coatings provide favorable return on investment through reduced total ownership costs, particularly in harsh operating environments where material degradation is accelerated.Expand Specific Solutions04 Environmental and regulatory compliance cost benefits

Ceramic coatings help organizations achieve environmental and regulatory compliance while reducing associated costs. These coatings often eliminate the need for environmentally harmful substances found in traditional coating systems, reducing disposal costs and environmental liabilities. By providing superior protection against environmental degradation, ceramic coatings minimize the risk of containment failures and subsequent remediation expenses. Additionally, their low-emission characteristics during application and service life help companies meet increasingly stringent environmental regulations without costly process modifications.Expand Specific Solutions05 Performance enhancement and value-added benefits

Ceramic coatings deliver performance enhancements that provide significant value-added benefits beyond direct cost savings. These include improved surface hardness, reduced friction, enhanced chemical resistance, and superior aesthetics. In automotive and consumer applications, ceramic coatings increase product value through improved appearance, easier cleaning, and enhanced durability. In precision manufacturing, the dimensional stability and wear resistance of ceramic-coated components improve product quality and reduce rejection rates. These performance advantages translate to competitive differentiation and premium pricing opportunities for manufacturers utilizing ceramic coating technologies.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Ceramic Coatings

The ceramic coatings market in turbine engines is currently in a growth phase, with increasing adoption driven by significant cost benefits including extended component life, improved fuel efficiency, and reduced maintenance expenses. The global market is expanding rapidly, estimated at several billion dollars with projected annual growth of 6-8%. Technologically, major players like United Technologies, General Electric, Rolls-Royce, and Siemens Energy are leading innovation with advanced thermal barrier coatings, while specialized firms such as nGimat and Oerlikon Metco focus on next-generation nanomaterial solutions. Research institutions including NASA and Central South University collaborate with industry to develop more durable and efficient ceramic composites. Chinese companies like XiAn Xinyao and AECC are emerging as significant competitors, particularly in aerospace applications.

General Electric Company

Technical Solution: GE's ceramic coating technology for turbine engines centers on their proprietary Environmental Barrier Coatings (EBCs) and Thermal Barrier Coatings (TBCs). Their advanced solution incorporates yttria-stabilized zirconia (YSZ) TBCs with sophisticated bond coats that enhance adhesion and oxidation resistance. GE has pioneered multi-layer coating systems that combine dense vertically-cracked outer layers with nanostructured inner layers, achieving thermal conductivity reductions of up to 40% compared to conventional coatings. Their electron beam physical vapor deposition (EB-PVD) technique creates columnar microstructures that provide superior strain tolerance during thermal cycling. Cost-benefit analyses demonstrate that despite the higher initial application costs (approximately 15-20% more than conventional coatings), GE's ceramic coatings extend turbine part life by 2-3x and enable operating temperature increases of 100-150°C, resulting in efficiency gains of 1-2% and fuel savings that typically recover the additional coating costs within 12-18 months of operation.

Strengths: Superior durability with 2-3x longer component life; enables higher operating temperatures for improved efficiency; established manufacturing infrastructure for consistent quality. Weaknesses: Higher initial application costs; requires specialized equipment and expertise; more complex repair procedures compared to conventional coatings.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed a comprehensive ceramic coating technology for turbine engines that focuses on both performance enhancement and cost optimization. Their solution employs advanced thermal barrier coatings (TBCs) based on yttria-stabilized zirconia with proprietary dopants that reduce thermal conductivity by up to 30% compared to conventional coatings. Honeywell utilizes a hybrid application approach combining plasma spraying for internal components and electron beam physical vapor deposition (EB-PVD) for highly stressed airfoils. Their multi-layer architecture incorporates nanostructured bond coats with improved oxidation resistance and self-healing properties. Cost-benefit analyses demonstrate that Honeywell's ceramic coatings extend component life by 1.5-2x in commercial applications and enable operating temperature increases of 50-100°C, resulting in specific fuel consumption improvements of approximately 1%. For smaller turbine applications like APUs and helicopter engines, where weight and size constraints are critical, their specialized thin ceramic coatings provide thermal protection with minimal thickness penalties. The technology delivers a return on investment typically within 2-3 years through reduced maintenance costs and fuel savings of 1-2% depending on the application profile.

Strengths: Optimized solutions for different engine sizes and applications; good balance between performance and cost; established repair procedures. Weaknesses: Less temperature capability than some competitors' solutions; requires careful application control to ensure consistency; higher initial investment for smaller engine manufacturers.

Key Technical Innovations in Thermal Barrier Coating Systems

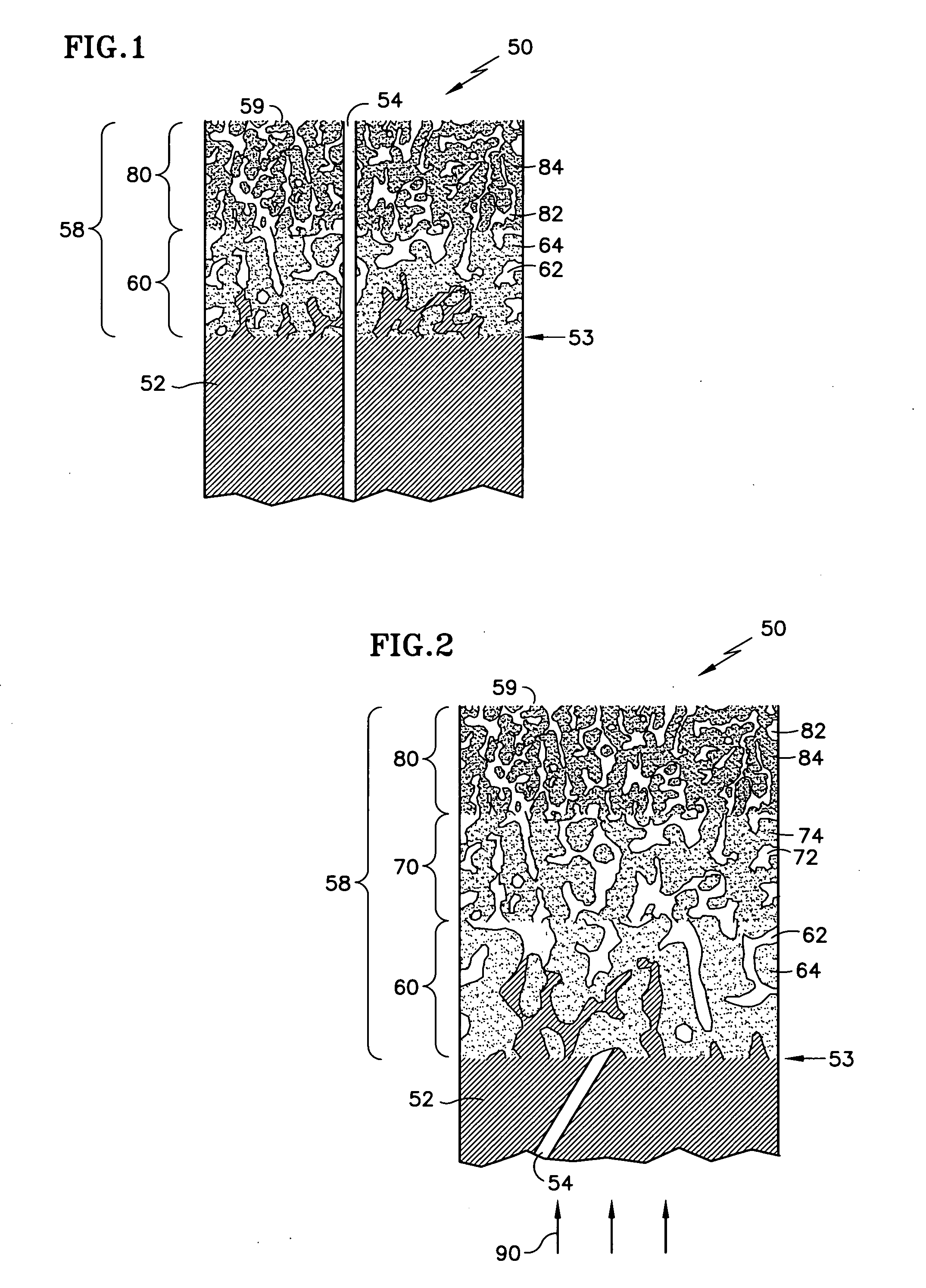

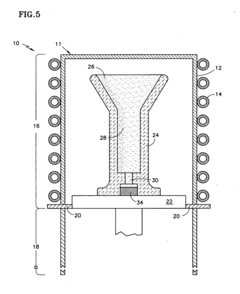

Thermal barrier coating and power generation system

PatentWO2017046942A1

Innovation

- A thermal barrier coating composed of ceramics with a higher melting point than metal, featuring a bonding layer and two ceramic layers with specific surface roughness and porosity, applied to turbine components to enhance durability and sealing performance.

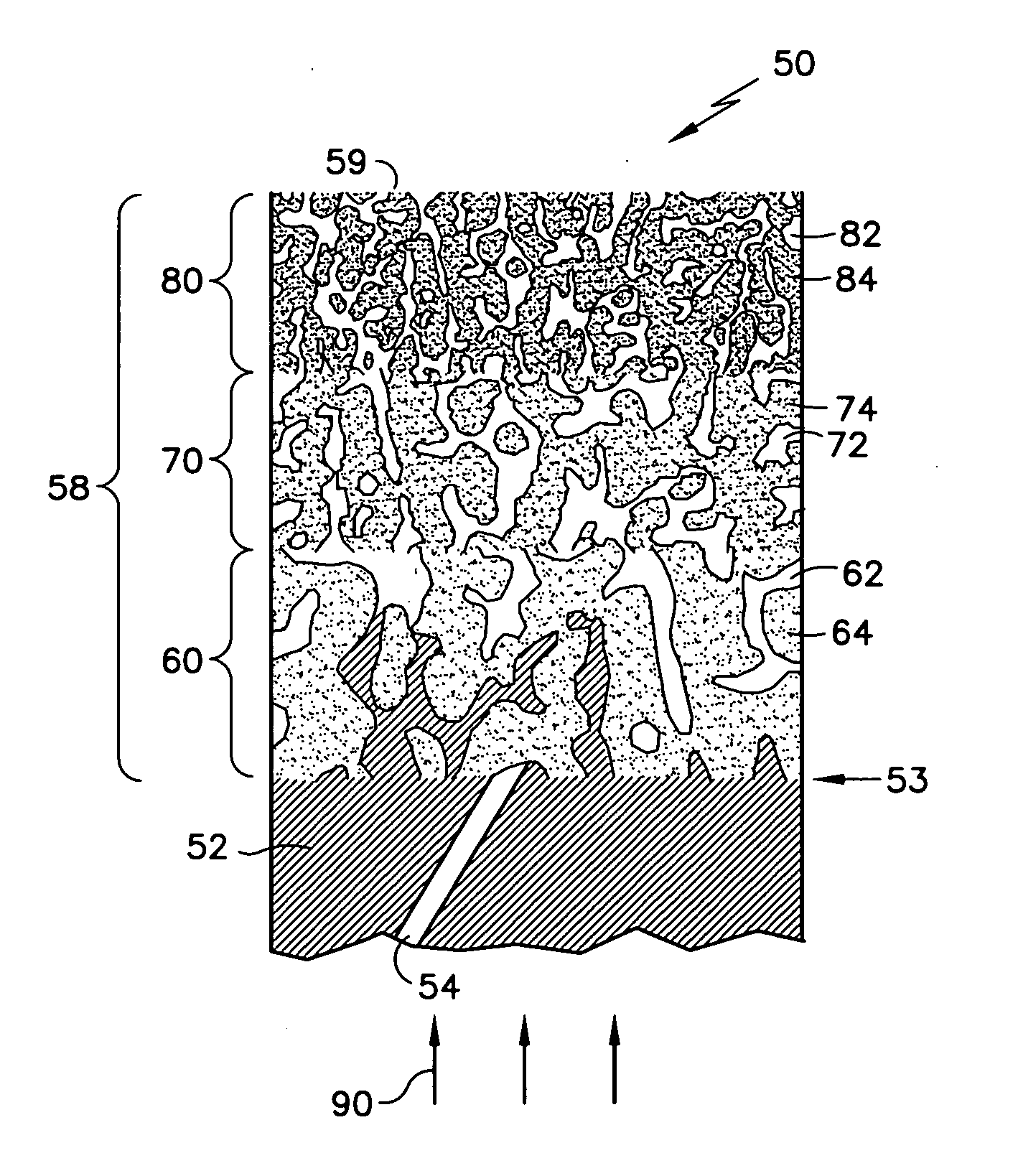

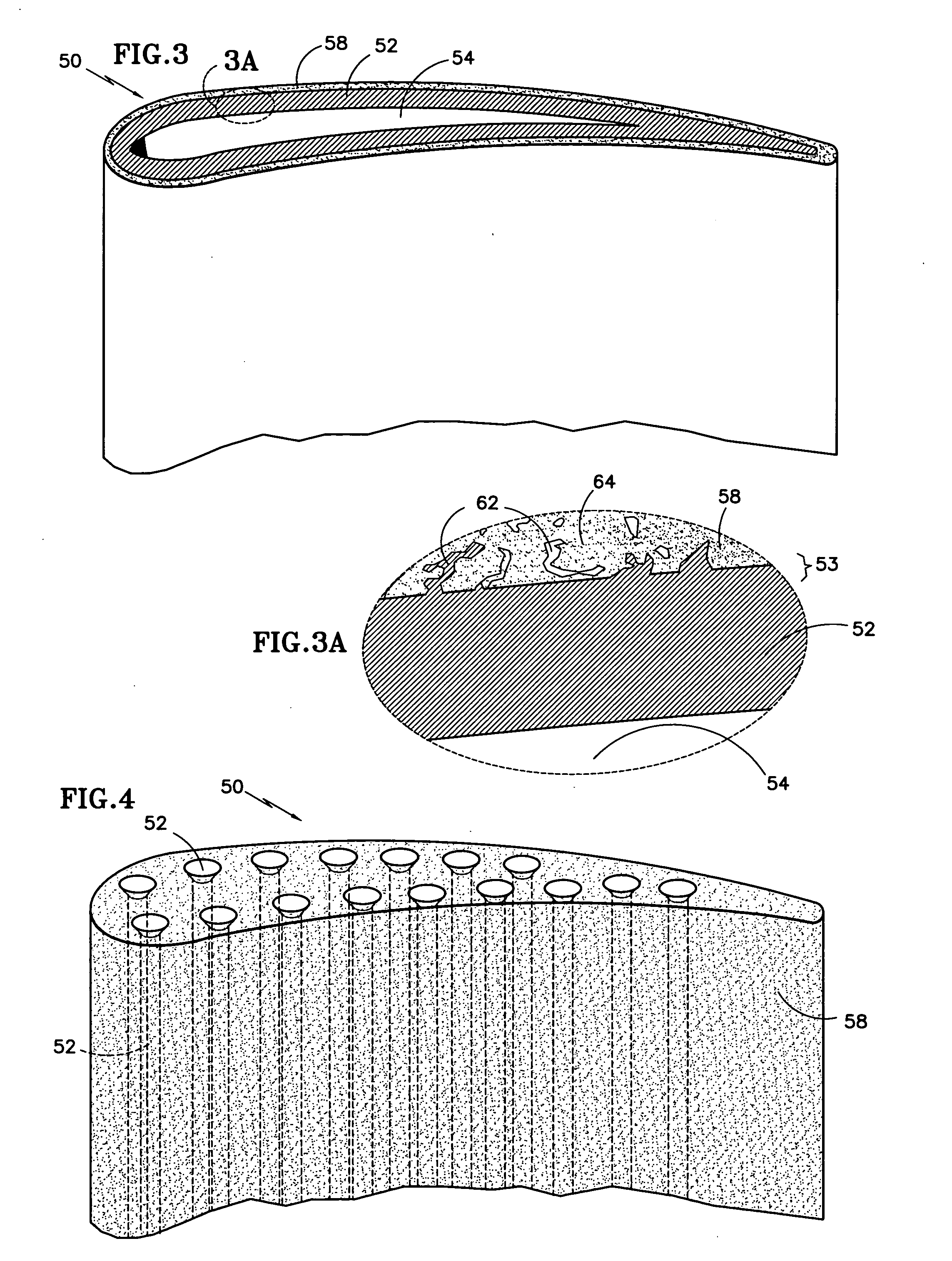

Integrated ceramic/metallic components and methods of making same

PatentInactiveUS20050249602A1

Innovation

- Integrated ceramic/metallic components are created by prefabricating single piece ceramic foam constructions with varying porosity regions and integrally casting them with metallic components, eliminating the need for separate bond coats and utilizing ceramic foam regions as coatings or structural parts, providing enhanced thermal protection and weight reduction.

Economic ROI Analysis of Ceramic Coating Implementation

The implementation of ceramic coatings in turbine engines represents a significant investment decision for aerospace and power generation companies. A comprehensive economic return on investment (ROI) analysis reveals that despite high initial costs, ceramic coatings deliver substantial long-term financial benefits through multiple value streams.

Initial implementation costs typically range from $50,000 to $200,000 per engine, depending on engine size, coating type, and application method. This includes material costs ($15,000-$60,000), specialized equipment ($20,000-$80,000), and skilled labor ($15,000-$60,000). While these figures represent a considerable upfront investment, they must be evaluated against the lifecycle economic benefits.

Fuel efficiency improvements of 1-3% translate to significant operational cost savings. For a commercial aircraft engine consuming $10 million in fuel annually, even a 1% efficiency gain yields $100,000 in annual savings per engine. Power generation turbines experience similar proportional benefits, with larger industrial gas turbines potentially saving $150,000-$300,000 annually in fuel costs.

Maintenance cost reduction provides another substantial economic benefit. Ceramic coatings extend component life by 20-40%, reducing replacement frequency and associated labor costs. A typical overhaul interval extension from 25,000 to 35,000 hours can save $300,000-$500,000 per maintenance cycle. Additionally, the reduction in emergency repairs and unplanned downtime prevents revenue losses estimated at $50,000-$100,000 per day for commercial aircraft and power generation facilities.

Performance retention economics further enhance the ROI profile. Conventional engines experience 0.5-1% efficiency degradation annually, while ceramic-coated engines maintain performance longer, preserving revenue and reducing operational costs. This performance retention value typically amounts to $75,000-$150,000 annually per engine.

Comprehensive ROI calculations indicate that ceramic coating investments typically achieve breakeven within 12-24 months of implementation. The five-year ROI ranges from 300-500%, with net present value (NPV) calculations showing returns of $1-3 million per engine over a ten-year operational period, assuming standard industry discount rates of 8-10%.

Environmental compliance benefits add further economic value through reduced emissions penalties and carbon tax savings, estimated at $50,000-$100,000 annually in regions with strict environmental regulations.

Initial implementation costs typically range from $50,000 to $200,000 per engine, depending on engine size, coating type, and application method. This includes material costs ($15,000-$60,000), specialized equipment ($20,000-$80,000), and skilled labor ($15,000-$60,000). While these figures represent a considerable upfront investment, they must be evaluated against the lifecycle economic benefits.

Fuel efficiency improvements of 1-3% translate to significant operational cost savings. For a commercial aircraft engine consuming $10 million in fuel annually, even a 1% efficiency gain yields $100,000 in annual savings per engine. Power generation turbines experience similar proportional benefits, with larger industrial gas turbines potentially saving $150,000-$300,000 annually in fuel costs.

Maintenance cost reduction provides another substantial economic benefit. Ceramic coatings extend component life by 20-40%, reducing replacement frequency and associated labor costs. A typical overhaul interval extension from 25,000 to 35,000 hours can save $300,000-$500,000 per maintenance cycle. Additionally, the reduction in emergency repairs and unplanned downtime prevents revenue losses estimated at $50,000-$100,000 per day for commercial aircraft and power generation facilities.

Performance retention economics further enhance the ROI profile. Conventional engines experience 0.5-1% efficiency degradation annually, while ceramic-coated engines maintain performance longer, preserving revenue and reducing operational costs. This performance retention value typically amounts to $75,000-$150,000 annually per engine.

Comprehensive ROI calculations indicate that ceramic coating investments typically achieve breakeven within 12-24 months of implementation. The five-year ROI ranges from 300-500%, with net present value (NPV) calculations showing returns of $1-3 million per engine over a ten-year operational period, assuming standard industry discount rates of 8-10%.

Environmental compliance benefits add further economic value through reduced emissions penalties and carbon tax savings, estimated at $50,000-$100,000 annually in regions with strict environmental regulations.

Environmental Impact and Sustainability Considerations

Ceramic coatings in turbine engines offer significant environmental benefits that extend beyond their direct cost advantages. These coatings substantially reduce fuel consumption by improving thermal efficiency and reducing operating temperatures, which directly translates to lower greenhouse gas emissions. Studies indicate that advanced ceramic thermal barrier coatings can reduce CO2 emissions by 5-8% compared to uncoated engine components, representing a substantial environmental impact when scaled across global aviation and power generation fleets.

The extended service life of ceramic-coated components also contributes to sustainability through reduced resource consumption. By protecting underlying metal components from oxidation and corrosion, these coatings minimize the frequency of part replacement, thereby decreasing the demand for raw materials extraction, processing, and manufacturing. This reduction in material throughput significantly lowers the embodied carbon footprint associated with turbine engine maintenance and overhaul cycles.

Ceramic coatings also enable turbine engines to operate with cleaner-burning fuels and at higher temperatures, which can reduce the formation of nitrogen oxides (NOx) and other harmful emissions. The improved combustion efficiency facilitated by these coatings can decrease particulate matter emissions by up to 15%, contributing to better air quality around airports and power plants. This aspect is increasingly important as environmental regulations become more stringent worldwide.

From a life cycle assessment perspective, the environmental benefits of ceramic coatings extend throughout the entire operational lifespan of turbine engines. While the coating application process itself requires energy input, the cumulative environmental savings over thousands of operational hours create a strongly positive environmental balance. The energy payback period for ceramic coating implementation is typically achieved within the first 1,000-2,000 hours of engine operation.

The recyclability of ceramic-coated components presents both challenges and opportunities. Current recycling technologies often struggle with separating ceramic coatings from base metals, potentially complicating end-of-life processing. However, research into advanced recycling methods specifically designed for coated components shows promise for improving material recovery rates and further enhancing the sustainability profile of these technologies.

As environmental regulations continue to tighten globally, the sustainability advantages of ceramic coatings may translate into regulatory compliance benefits and potential carbon credit opportunities for operators. Airlines and power generation companies implementing these technologies could gain competitive advantages in markets where environmental performance metrics influence customer decisions and regulatory treatment.

The extended service life of ceramic-coated components also contributes to sustainability through reduced resource consumption. By protecting underlying metal components from oxidation and corrosion, these coatings minimize the frequency of part replacement, thereby decreasing the demand for raw materials extraction, processing, and manufacturing. This reduction in material throughput significantly lowers the embodied carbon footprint associated with turbine engine maintenance and overhaul cycles.

Ceramic coatings also enable turbine engines to operate with cleaner-burning fuels and at higher temperatures, which can reduce the formation of nitrogen oxides (NOx) and other harmful emissions. The improved combustion efficiency facilitated by these coatings can decrease particulate matter emissions by up to 15%, contributing to better air quality around airports and power plants. This aspect is increasingly important as environmental regulations become more stringent worldwide.

From a life cycle assessment perspective, the environmental benefits of ceramic coatings extend throughout the entire operational lifespan of turbine engines. While the coating application process itself requires energy input, the cumulative environmental savings over thousands of operational hours create a strongly positive environmental balance. The energy payback period for ceramic coating implementation is typically achieved within the first 1,000-2,000 hours of engine operation.

The recyclability of ceramic-coated components presents both challenges and opportunities. Current recycling technologies often struggle with separating ceramic coatings from base metals, potentially complicating end-of-life processing. However, research into advanced recycling methods specifically designed for coated components shows promise for improving material recovery rates and further enhancing the sustainability profile of these technologies.

As environmental regulations continue to tighten globally, the sustainability advantages of ceramic coatings may translate into regulatory compliance benefits and potential carbon credit opportunities for operators. Airlines and power generation companies implementing these technologies could gain competitive advantages in markets where environmental performance metrics influence customer decisions and regulatory treatment.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!