Advanced Diesel Particulate Filter Clogging Mitigation

SEP 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DPF Technology Evolution and Objectives

Diesel Particulate Filters (DPFs) have evolved significantly since their introduction in the early 1980s as a response to increasingly stringent emission regulations worldwide. Initially developed as simple ceramic wall-flow filters, DPFs were designed to capture particulate matter (PM) from diesel exhaust gases. These early systems faced considerable challenges related to filter durability, regeneration efficiency, and pressure drop management.

The evolution of DPF technology can be traced through several distinct generations. First-generation DPFs (1980s-1990s) were primarily passive systems with limited regeneration capabilities, often requiring manual intervention for cleaning. Second-generation systems (2000s) introduced active regeneration strategies using fuel injection or electrical heating elements to periodically burn accumulated soot. Current third-generation DPFs incorporate sophisticated sensors, predictive algorithms, and advanced substrate materials to optimize filtration efficiency while minimizing backpressure effects.

A critical milestone in DPF development was the introduction of catalyzed filters in the mid-2000s, which significantly lowered the temperature required for soot oxidation. This innovation, combined with improved thermal management systems, addressed many early reliability concerns while enhancing regeneration efficiency.

The primary objective of modern DPF technology is to achieve a delicate balance between contradictory requirements: maximizing particulate matter capture efficiency while minimizing impact on engine performance and fuel economy. Current research aims to develop systems capable of maintaining filtration efficiency above 95% throughout the vehicle's operational lifetime while preventing excessive backpressure that could compromise engine performance.

Another key objective is extending filter service life by mitigating clogging mechanisms. This includes developing advanced ash management strategies, as incombustible ash from lubricant additives and engine wear represents a growing concern for long-term DPF functionality. Research indicates that ash accumulation can reduce filter capacity by up to 30% over 150,000 miles of operation.

Looking forward, DPF technology development is increasingly focused on addressing cold-start emissions, improving regeneration strategies for low-temperature urban driving cycles, and developing more robust solutions for heavy-duty applications where filter clogging presents significant operational challenges. Additionally, there is growing interest in developing filter substrates with enhanced thermal durability and reduced manufacturing costs to support broader market adoption.

The trajectory of DPF technology continues to be shaped by regulatory pressures, with upcoming Euro 7 and EPA standards driving innovation toward more efficient, durable, and intelligent filtration systems capable of addressing both regulated particulate emissions and emerging concerns regarding ultrafine particles.

The evolution of DPF technology can be traced through several distinct generations. First-generation DPFs (1980s-1990s) were primarily passive systems with limited regeneration capabilities, often requiring manual intervention for cleaning. Second-generation systems (2000s) introduced active regeneration strategies using fuel injection or electrical heating elements to periodically burn accumulated soot. Current third-generation DPFs incorporate sophisticated sensors, predictive algorithms, and advanced substrate materials to optimize filtration efficiency while minimizing backpressure effects.

A critical milestone in DPF development was the introduction of catalyzed filters in the mid-2000s, which significantly lowered the temperature required for soot oxidation. This innovation, combined with improved thermal management systems, addressed many early reliability concerns while enhancing regeneration efficiency.

The primary objective of modern DPF technology is to achieve a delicate balance between contradictory requirements: maximizing particulate matter capture efficiency while minimizing impact on engine performance and fuel economy. Current research aims to develop systems capable of maintaining filtration efficiency above 95% throughout the vehicle's operational lifetime while preventing excessive backpressure that could compromise engine performance.

Another key objective is extending filter service life by mitigating clogging mechanisms. This includes developing advanced ash management strategies, as incombustible ash from lubricant additives and engine wear represents a growing concern for long-term DPF functionality. Research indicates that ash accumulation can reduce filter capacity by up to 30% over 150,000 miles of operation.

Looking forward, DPF technology development is increasingly focused on addressing cold-start emissions, improving regeneration strategies for low-temperature urban driving cycles, and developing more robust solutions for heavy-duty applications where filter clogging presents significant operational challenges. Additionally, there is growing interest in developing filter substrates with enhanced thermal durability and reduced manufacturing costs to support broader market adoption.

The trajectory of DPF technology continues to be shaped by regulatory pressures, with upcoming Euro 7 and EPA standards driving innovation toward more efficient, durable, and intelligent filtration systems capable of addressing both regulated particulate emissions and emerging concerns regarding ultrafine particles.

Market Demand Analysis for Advanced DPF Solutions

The global market for Advanced Diesel Particulate Filter (DPF) solutions is experiencing significant growth, driven primarily by increasingly stringent emission regulations across major automotive markets. The European Union's Euro 7 standards, the United States EPA's Tier 3 regulations, and China's National 6 standards have collectively created substantial demand for more efficient and durable DPF technologies. Current market valuations place the global DPF market at approximately 12 billion USD in 2023, with projections indicating growth to reach 18 billion USD by 2028, representing a compound annual growth rate of 8.4%.

Commercial vehicle fleets represent the largest market segment, accounting for nearly 60% of total DPF demand. Fleet operators face significant operational challenges related to DPF clogging, including increased downtime, higher maintenance costs, and reduced fuel efficiency. A recent industry survey revealed that 78% of fleet managers consider DPF-related issues among their top three maintenance concerns, highlighting the critical need for advanced clogging mitigation solutions.

The aftermarket segment for DPF maintenance and replacement has shown particularly robust growth, expanding at 10.2% annually as aging vehicle fleets require more frequent filter servicing. This trend is especially pronounced in developing markets where diesel vehicles often operate in challenging conditions with variable fuel quality, accelerating filter clogging rates.

Regional analysis indicates that Europe currently leads the market with 38% share, followed by North America (29%) and Asia-Pacific (24%). However, the fastest growth is occurring in emerging markets, particularly India and Southeast Asia, where diesel vehicle populations are expanding rapidly alongside tightening emission standards.

Customer demand patterns reveal a clear shift toward preventative solutions rather than reactive maintenance. End-users increasingly seek integrated systems that combine advanced filter materials with predictive diagnostics and automated regeneration capabilities. Market research indicates willingness-to-pay premiums of 15-20% for solutions that can demonstrably extend filter life and reduce maintenance frequency.

Industry forecasts suggest that the market for advanced DPF clogging mitigation specifically will grow at 12.3% annually through 2030, outpacing the broader DPF market. This accelerated growth reflects the increasing recognition of clogging as the primary failure mode and operational constraint in DPF systems.

Key customer requirements driving innovation include: reduced backpressure impact on engine performance, extended service intervals between forced regenerations, compatibility with varying fuel qualities, and integration with vehicle telematics for predictive maintenance. Additionally, there is growing demand for retrofit solutions applicable to existing vehicle fleets, representing a significant market opportunity estimated at 3.5 billion USD globally.

Commercial vehicle fleets represent the largest market segment, accounting for nearly 60% of total DPF demand. Fleet operators face significant operational challenges related to DPF clogging, including increased downtime, higher maintenance costs, and reduced fuel efficiency. A recent industry survey revealed that 78% of fleet managers consider DPF-related issues among their top three maintenance concerns, highlighting the critical need for advanced clogging mitigation solutions.

The aftermarket segment for DPF maintenance and replacement has shown particularly robust growth, expanding at 10.2% annually as aging vehicle fleets require more frequent filter servicing. This trend is especially pronounced in developing markets where diesel vehicles often operate in challenging conditions with variable fuel quality, accelerating filter clogging rates.

Regional analysis indicates that Europe currently leads the market with 38% share, followed by North America (29%) and Asia-Pacific (24%). However, the fastest growth is occurring in emerging markets, particularly India and Southeast Asia, where diesel vehicle populations are expanding rapidly alongside tightening emission standards.

Customer demand patterns reveal a clear shift toward preventative solutions rather than reactive maintenance. End-users increasingly seek integrated systems that combine advanced filter materials with predictive diagnostics and automated regeneration capabilities. Market research indicates willingness-to-pay premiums of 15-20% for solutions that can demonstrably extend filter life and reduce maintenance frequency.

Industry forecasts suggest that the market for advanced DPF clogging mitigation specifically will grow at 12.3% annually through 2030, outpacing the broader DPF market. This accelerated growth reflects the increasing recognition of clogging as the primary failure mode and operational constraint in DPF systems.

Key customer requirements driving innovation include: reduced backpressure impact on engine performance, extended service intervals between forced regenerations, compatibility with varying fuel qualities, and integration with vehicle telematics for predictive maintenance. Additionally, there is growing demand for retrofit solutions applicable to existing vehicle fleets, representing a significant market opportunity estimated at 3.5 billion USD globally.

Global DPF Technology Status and Challenges

Diesel Particulate Filters (DPFs) have become a critical component in modern diesel emission control systems worldwide. Currently, the global DPF technology landscape exhibits significant regional variations in adoption rates and technological sophistication. In Europe, stringent Euro 6/VI emissions standards have driven widespread implementation of advanced DPF systems with integrated sensing and regeneration capabilities. North American markets follow similar patterns under EPA regulations, while emerging economies in Asia are experiencing rapid adoption as they implement equivalent emissions standards.

The current technological state of DPFs centers around ceramic wall-flow filters, predominantly utilizing cordierite or silicon carbide substrates. These materials offer excellent filtration efficiency (typically >95% for particulate matter) while maintaining acceptable backpressure characteristics. Recent advancements include the development of asymmetric cell structures and variable porosity substrates that optimize the balance between filtration efficiency and flow resistance.

Despite significant progress, several critical challenges persist in DPF technology. Filter clogging remains the foremost issue, particularly in vehicles operating under unfavorable conditions such as frequent short trips or extended idle periods that prevent proper regeneration cycles. This leads to accelerated ash accumulation and incomplete soot oxidation, ultimately reducing filter lifespan and engine performance.

Thermal management represents another significant challenge, as DPF regeneration requires precise temperature control to effectively oxidize accumulated particulate matter without damaging the filter substrate. Current systems struggle to maintain optimal regeneration temperatures across diverse operating conditions, particularly in cold climates or during low-load operation.

Oil-derived ash accumulation presents a long-term irreversible clogging mechanism that cannot be addressed through standard regeneration processes. As this ash gradually accumulates over the filter lifetime, it permanently reduces effective filtration area and increases backpressure, eventually necessitating costly filter replacement or cleaning procedures.

Sensor technology limitations further complicate DPF management, as current pressure differential and temperature sensors provide only indirect measurements of filter loading status. This often results in suboptimal regeneration timing and incomplete soot removal. The industry lacks cost-effective direct measurement technologies for real-time soot load monitoring.

Geographically, DPF technology development remains concentrated in regions with established automotive manufacturing bases and stringent emissions regulations. Japan, Germany, and the United States lead in patent filings and research publications, with emerging contributions from China as its domestic emissions standards tighten. This concentration creates challenges for technology transfer to developing markets where different operating conditions and maintenance infrastructures may require adapted solutions.

The current technological state of DPFs centers around ceramic wall-flow filters, predominantly utilizing cordierite or silicon carbide substrates. These materials offer excellent filtration efficiency (typically >95% for particulate matter) while maintaining acceptable backpressure characteristics. Recent advancements include the development of asymmetric cell structures and variable porosity substrates that optimize the balance between filtration efficiency and flow resistance.

Despite significant progress, several critical challenges persist in DPF technology. Filter clogging remains the foremost issue, particularly in vehicles operating under unfavorable conditions such as frequent short trips or extended idle periods that prevent proper regeneration cycles. This leads to accelerated ash accumulation and incomplete soot oxidation, ultimately reducing filter lifespan and engine performance.

Thermal management represents another significant challenge, as DPF regeneration requires precise temperature control to effectively oxidize accumulated particulate matter without damaging the filter substrate. Current systems struggle to maintain optimal regeneration temperatures across diverse operating conditions, particularly in cold climates or during low-load operation.

Oil-derived ash accumulation presents a long-term irreversible clogging mechanism that cannot be addressed through standard regeneration processes. As this ash gradually accumulates over the filter lifetime, it permanently reduces effective filtration area and increases backpressure, eventually necessitating costly filter replacement or cleaning procedures.

Sensor technology limitations further complicate DPF management, as current pressure differential and temperature sensors provide only indirect measurements of filter loading status. This often results in suboptimal regeneration timing and incomplete soot removal. The industry lacks cost-effective direct measurement technologies for real-time soot load monitoring.

Geographically, DPF technology development remains concentrated in regions with established automotive manufacturing bases and stringent emissions regulations. Japan, Germany, and the United States lead in patent filings and research publications, with emerging contributions from China as its domestic emissions standards tighten. This concentration creates challenges for technology transfer to developing markets where different operating conditions and maintenance infrastructures may require adapted solutions.

Current DPF Clogging Mitigation Approaches

01 Regeneration strategies for DPF cleaning

Various regeneration strategies can be employed to clean diesel particulate filters (DPFs) and prevent clogging. These include active regeneration through temperature increase, passive regeneration using catalysts, and combined approaches. The regeneration process burns off accumulated soot and particulate matter, restoring filter efficiency and reducing back pressure in the exhaust system.- Regeneration strategies for DPF cleaning: Various regeneration strategies can be employed to clean diesel particulate filters by burning off accumulated soot. These include active regeneration through temperature increase, passive regeneration using catalysts, and forced regeneration during specific operating conditions. Effective regeneration timing and control systems help prevent filter clogging while maintaining optimal engine performance and fuel efficiency.

- Fuel additives and catalytic coatings: Specialized fuel additives and catalytic coatings can be incorporated to lower the combustion temperature of particulate matter trapped in the filter. These materials promote continuous passive regeneration during normal vehicle operation, reducing the frequency of active regeneration cycles and preventing excessive soot accumulation. The catalysts can be applied directly to the filter substrate or introduced through the fuel system.

- Advanced monitoring and diagnostic systems: Sophisticated monitoring systems can detect filter loading levels and predict potential clogging issues before they become severe. These systems utilize pressure differential sensors, temperature sensors, and predictive algorithms to determine the optimal timing for regeneration events. Real-time diagnostics allow for adaptive control strategies that respond to varying driving conditions and soot accumulation rates.

- Filter design and material innovations: Innovations in filter design and materials can significantly reduce clogging tendencies. These include optimized cell structures, asymmetric channel designs, and advanced ceramic materials with enhanced porosity characteristics. Some designs incorporate multiple filtration zones with varying pore sizes or special flow distribution patterns to maximize soot loading capacity while minimizing backpressure.

- Exhaust system configuration and thermal management: Strategic placement of components within the exhaust system and effective thermal management can prevent filter clogging. This includes positioning the DPF for optimal temperature maintenance, incorporating insulation to retain heat, and implementing pre-filter devices to capture larger particulates. Some systems use exhaust gas recirculation control or supplementary heating elements to maintain favorable conditions for continuous regeneration.

02 Additives and fuel modifications to reduce DPF clogging

Specialized fuel additives and modifications can significantly reduce particulate matter formation and improve DPF performance. These include catalytic additives that lower soot ignition temperatures, detergents that prevent deposit formation, and fuel formulations that produce cleaner combustion. Such approaches help extend the intervals between regeneration cycles and prolong filter life.Expand Specific Solutions03 Advanced monitoring and diagnostic systems

Sophisticated monitoring and diagnostic systems can detect early signs of DPF clogging and optimize maintenance timing. These systems utilize pressure sensors, temperature sensors, and advanced algorithms to assess filter loading conditions. Real-time monitoring enables predictive maintenance strategies and can trigger automatic regeneration when needed, preventing severe clogging situations.Expand Specific Solutions04 Filter design and material innovations

Innovations in filter design and materials can significantly improve DPF performance and reduce clogging tendencies. These include advanced substrate materials, optimized cell structures, improved porosity distributions, and novel coating technologies. Such design improvements enhance filtration efficiency while maintaining lower back pressure and improving ash handling capacity.Expand Specific Solutions05 Exhaust system configuration and thermal management

Optimized exhaust system configurations and thermal management strategies can prevent DPF clogging. These approaches include strategic placement of components, improved insulation, exhaust gas recirculation control, and intelligent heat management systems. Proper thermal management ensures that the DPF operates within ideal temperature ranges, facilitating more efficient particulate matter oxidation and preventing excessive accumulation.Expand Specific Solutions

Key Industry Players in DPF Technology

The diesel particulate filter (DPF) clogging mitigation technology market is in a growth phase, with increasing regulatory pressure driving innovation. The global market size is expanding as emission standards tighten worldwide, particularly in automotive and industrial sectors. Technologically, solutions are advancing from basic mechanical approaches to sophisticated electronic and chemical systems. Leading players include automotive OEMs like Toyota, Hyundai, and Subaru, who are integrating advanced DPF systems into their vehicles. Component specialists such as Bosch, DENSO, and Umicore are developing catalyst technologies and electronic control systems, while filter manufacturers like Corning and UFI Filters focus on material innovations. Research institutions like IFP Energies Nouvelles and Chang'an University are contributing fundamental research to address this critical environmental challenge.

Toyota Motor Corp.

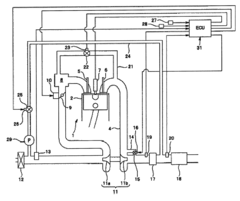

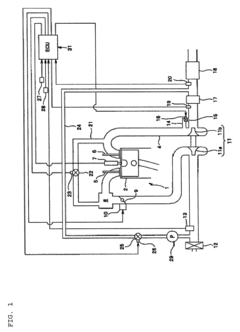

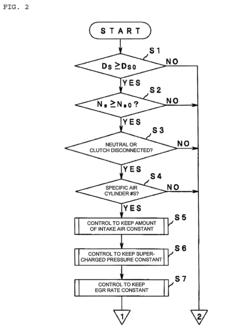

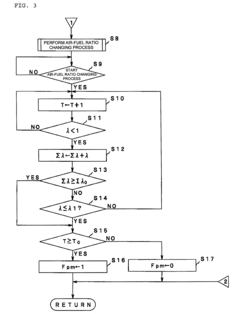

Technical Solution: Toyota has pioneered a multi-layered approach to DPF clogging mitigation through their D-CAT (Diesel Clean Advanced Technology) system. Their solution combines hardware innovations with sophisticated software control strategies. The system features a dual-layer DPF structure with different pore sizes that distribute particulate matter more evenly throughout the filter, preventing localized clogging. Toyota's approach includes an advanced thermal management system that precisely controls exhaust temperatures through a combination of intake throttling, EGR cooling modulation, and post-injection strategies. Their latest generation incorporates predictive analytics that anticipates regeneration needs based on driving patterns and environmental conditions. Toyota has also developed a proprietary catalyst formulation that promotes continuous passive regeneration at lower temperatures (approximately 250-300°C), significantly reducing the need for active regeneration events. The system is fully integrated with Toyota's hybrid technology in applicable models, utilizing electric power to maintain optimal catalyst temperatures during low-load operation.

Strengths: Excellent integration with overall powertrain management; reduced regeneration frequency due to enhanced passive regeneration capabilities; proven reliability in diverse operating conditions. Weaknesses: System complexity may lead to higher manufacturing costs; proprietary technology may limit aftermarket service options; optimization primarily for Toyota's specific engine families.

DENSO Corp.

Technical Solution: DENSO has developed an innovative DPF system called "i-ART" (Intelligent Accuracy Refinement Technology) specifically targeting clogging mitigation. Their approach combines hardware optimization with advanced control strategies. The system features a ceramic filter substrate with optimized channel geometry and wall porosity that balances filtration efficiency with pressure drop characteristics. DENSO's technology incorporates individual cylinder pressure sensors and precise injection control to manage combustion quality, significantly reducing the production of difficult-to-regenerate soot structures. Their solution includes a multi-stage regeneration strategy with variable temperature profiles based on soot loading conditions, utilizing both in-cylinder post-injection and dedicated hydrocarbon dosing systems. DENSO has also implemented predictive diagnostics that can detect early signs of abnormal clogging patterns and adjust regeneration parameters accordingly. The system features adaptive learning algorithms that continuously optimize regeneration timing and duration based on historical data and current operating conditions, minimizing fuel consumption penalties while maintaining filter cleanliness.

Strengths: Exceptional precision in injection control leading to cleaner combustion; comprehensive diagnostic capabilities to prevent severe clogging events; highly efficient regeneration strategies with minimal fuel economy impact. Weaknesses: Requires sophisticated sensors and actuators increasing system cost; higher complexity may impact long-term reliability; requires significant computational resources for real-time control.

Critical Patents in DPF Regeneration Technology

Diesel particulate filter unit and regeneration control method of the same

PatentInactiveEP1460245B1

Innovation

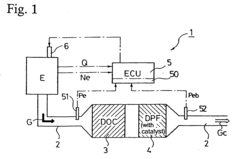

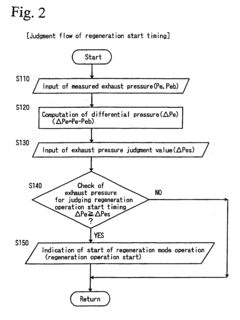

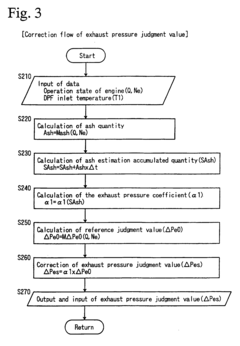

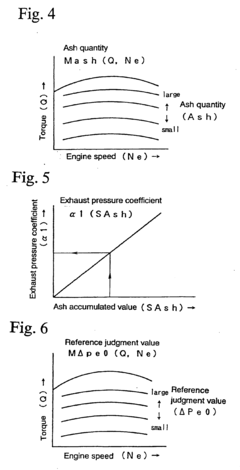

- A DPF unit with exhaust pressure sensors and a regeneration control system that estimates ash accumulation based on engine torque and speed, adjusting the exhaust pressure judgment value to correctly determine regeneration timing, thereby compensating for ash accumulation and preventing filter clogging.

Filter clogging determination apparatus for diesel engine

PatentInactiveUS7980060B2

Innovation

- A filter clogging determination apparatus that uses an exhaust sensor to detect air-fuel ratio or oxygen concentration, calculating response time to determine clogging, thereby estimating exhaust pressure without additional sensors or extensive data storage, reducing component count and costs.

Emissions Regulations Impact on DPF Development

The evolution of emissions regulations has been a primary driver for Diesel Particulate Filter (DPF) development over the past two decades. Since the introduction of Euro 4 standards in Europe and Tier 2 Bin 5 in the United States in the early 2000s, regulatory frameworks have progressively tightened particulate matter (PM) emission limits, necessitating increasingly sophisticated DPF technologies.

The implementation of Euro 6 standards in Europe and Tier 3 regulations in the US marked a significant turning point, reducing allowable PM emissions by over 80% compared to previous standards. These stringent requirements have directly influenced DPF design parameters, including filtration efficiency, backpressure characteristics, and regeneration strategies to prevent clogging.

Regulatory bodies have also expanded their focus beyond simply measuring tailpipe emissions to include real-world driving emissions (RDE) testing protocols. This shift has compelled manufacturers to develop DPF systems that maintain effectiveness across diverse operating conditions, not merely optimized for laboratory test cycles. The introduction of portable emissions measurement systems (PEMS) testing has further emphasized the need for robust clogging mitigation strategies in varied driving scenarios.

Regional variations in emissions standards have created a complex global landscape for DPF development. While European regulations have traditionally emphasized NOx reduction alongside PM control, US standards have maintained stricter PM limits. Meanwhile, emerging markets like China and India have accelerated their regulatory timelines, rapidly adopting standards equivalent to Euro 5 or Euro 6, creating new market dynamics for advanced DPF technologies.

Future regulatory trends indicate continued tightening of emissions standards, with particular attention to ultrafine particles and particle number (PN) limits. The Euro 7 proposal and equivalent standards in other regions are expected to further reduce allowable emission thresholds and expand the conditions under which vehicles must comply, potentially including cold starts and extended durability requirements.

These evolving regulatory frameworks have catalyzed significant investment in advanced DPF technologies that can maintain performance while minimizing regeneration frequency and fuel economy penalties. Manufacturers are increasingly focused on developing systems that can demonstrate compliance with emissions standards throughout the vehicle's useful life, even as ash accumulation occurs, driving innovation in filter substrate materials, catalyst formulations, and regeneration management strategies.

The implementation of Euro 6 standards in Europe and Tier 3 regulations in the US marked a significant turning point, reducing allowable PM emissions by over 80% compared to previous standards. These stringent requirements have directly influenced DPF design parameters, including filtration efficiency, backpressure characteristics, and regeneration strategies to prevent clogging.

Regulatory bodies have also expanded their focus beyond simply measuring tailpipe emissions to include real-world driving emissions (RDE) testing protocols. This shift has compelled manufacturers to develop DPF systems that maintain effectiveness across diverse operating conditions, not merely optimized for laboratory test cycles. The introduction of portable emissions measurement systems (PEMS) testing has further emphasized the need for robust clogging mitigation strategies in varied driving scenarios.

Regional variations in emissions standards have created a complex global landscape for DPF development. While European regulations have traditionally emphasized NOx reduction alongside PM control, US standards have maintained stricter PM limits. Meanwhile, emerging markets like China and India have accelerated their regulatory timelines, rapidly adopting standards equivalent to Euro 5 or Euro 6, creating new market dynamics for advanced DPF technologies.

Future regulatory trends indicate continued tightening of emissions standards, with particular attention to ultrafine particles and particle number (PN) limits. The Euro 7 proposal and equivalent standards in other regions are expected to further reduce allowable emission thresholds and expand the conditions under which vehicles must comply, potentially including cold starts and extended durability requirements.

These evolving regulatory frameworks have catalyzed significant investment in advanced DPF technologies that can maintain performance while minimizing regeneration frequency and fuel economy penalties. Manufacturers are increasingly focused on developing systems that can demonstrate compliance with emissions standards throughout the vehicle's useful life, even as ash accumulation occurs, driving innovation in filter substrate materials, catalyst formulations, and regeneration management strategies.

Material Science Advancements for DPF Durability

Recent advancements in material science have significantly contributed to enhancing the durability and performance of Diesel Particulate Filters (DPFs). Traditional DPF materials like cordierite and silicon carbide, while effective, have shown limitations in terms of thermal stability and resistance to ash accumulation. The evolution of these materials has been driven by increasingly stringent emission regulations and the need for longer service intervals.

Advanced ceramic composites represent a breakthrough in DPF material technology. These composites incorporate nano-structured elements that provide superior thermal shock resistance while maintaining high filtration efficiency. Research indicates that these materials can withstand temperatures exceeding 1000°C without significant degradation, compared to conventional materials that begin to deteriorate at around 800°C.

Surface modification techniques have emerged as another promising approach to enhance DPF durability. Catalytic coatings with improved adherence properties and resistance to thermal cycling have been developed. These coatings not only facilitate passive regeneration at lower temperatures but also create surfaces that resist ash adhesion, thereby extending the operational life of filters between cleaning intervals.

Porous membrane technology represents another frontier in DPF material science. Ultra-thin membranes with precisely controlled pore size distribution offer reduced backpressure while maintaining high particulate capture efficiency. These membranes, often made from advanced polymers or ceramic-polymer hybrids, demonstrate remarkable resistance to clogging and can be engineered to facilitate more uniform soot distribution.

Self-healing materials are perhaps the most innovative development in this field. These materials contain microencapsulated healing agents that are released when cracks form due to thermal stress. Initial laboratory tests show that such materials can restore up to 80% of original structural integrity after damage events, potentially extending DPF service life by 30-40% compared to conventional materials.

Computational material science has accelerated these advancements through predictive modeling of material behavior under various operating conditions. This approach has enabled researchers to optimize material compositions and structures before physical prototyping, significantly reducing development time and costs while improving performance outcomes.

The integration of these material science innovations into commercial DPF products is gradually occurring, with premium heavy-duty applications leading adoption. Cost remains a significant barrier to widespread implementation, though economies of scale and manufacturing process improvements are steadily reducing this gap.

Advanced ceramic composites represent a breakthrough in DPF material technology. These composites incorporate nano-structured elements that provide superior thermal shock resistance while maintaining high filtration efficiency. Research indicates that these materials can withstand temperatures exceeding 1000°C without significant degradation, compared to conventional materials that begin to deteriorate at around 800°C.

Surface modification techniques have emerged as another promising approach to enhance DPF durability. Catalytic coatings with improved adherence properties and resistance to thermal cycling have been developed. These coatings not only facilitate passive regeneration at lower temperatures but also create surfaces that resist ash adhesion, thereby extending the operational life of filters between cleaning intervals.

Porous membrane technology represents another frontier in DPF material science. Ultra-thin membranes with precisely controlled pore size distribution offer reduced backpressure while maintaining high particulate capture efficiency. These membranes, often made from advanced polymers or ceramic-polymer hybrids, demonstrate remarkable resistance to clogging and can be engineered to facilitate more uniform soot distribution.

Self-healing materials are perhaps the most innovative development in this field. These materials contain microencapsulated healing agents that are released when cracks form due to thermal stress. Initial laboratory tests show that such materials can restore up to 80% of original structural integrity after damage events, potentially extending DPF service life by 30-40% compared to conventional materials.

Computational material science has accelerated these advancements through predictive modeling of material behavior under various operating conditions. This approach has enabled researchers to optimize material compositions and structures before physical prototyping, significantly reducing development time and costs while improving performance outcomes.

The integration of these material science innovations into commercial DPF products is gradually occurring, with premium heavy-duty applications leading adoption. Cost remains a significant barrier to widespread implementation, though economies of scale and manufacturing process improvements are steadily reducing this gap.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!