Optimizing Diesel Particulate Filter Carbon Capture

SEP 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DPF Carbon Capture Technology Background and Objectives

Diesel Particulate Filter (DPF) technology has evolved significantly since its introduction in the 1980s as a response to increasingly stringent emissions regulations. Initially designed to capture particulate matter from diesel engine exhaust, DPFs have undergone substantial refinement in materials, design, and functionality. The evolution of this technology represents a critical advancement in reducing harmful emissions from diesel engines, which remain prevalent in transportation, construction, and power generation sectors globally.

Recent research has identified a promising new application for DPF technology: carbon capture. This innovative approach leverages the existing filtration infrastructure of DPFs to not only trap particulate matter but also capture carbon dioxide emissions. This dual functionality presents a potentially transformative opportunity to address two critical environmental challenges simultaneously: particulate pollution and greenhouse gas emissions.

The carbon capture capabilities of DPFs are particularly significant given the global imperative to reduce carbon emissions. With transportation accounting for approximately 24% of direct CO2 emissions from fuel combustion, enhancing the carbon capture efficiency of diesel engines could substantially contribute to climate change mitigation efforts. The technology shows particular promise for heavy-duty vehicles and industrial applications where electrification remains challenging.

Current DPF systems typically achieve particulate matter filtration efficiencies exceeding 95%, but their carbon capture capabilities are still in early development stages. The primary technical objective is to optimize DPF structures and materials to enhance CO2 adsorption while maintaining or improving particulate filtration performance. This requires a delicate balance, as modifications to improve carbon capture must not compromise the filter's primary function or durability.

The technological trajectory suggests several promising pathways for optimization, including novel catalyst formulations, advanced ceramic substrate designs, and innovative regeneration strategies. These developments aim to increase carbon capture efficiency while addressing challenges related to backpressure, thermal management, and system integration.

Looking forward, the ultimate goal is to develop a next-generation DPF system capable of capturing at least 40% of carbon emissions from diesel exhaust while maintaining optimal engine performance and meeting increasingly stringent particulate emissions standards. This technology could serve as a transitional solution in the broader movement toward zero-emission transportation, providing significant environmental benefits during the gradual phase-out of internal combustion engines.

Recent research has identified a promising new application for DPF technology: carbon capture. This innovative approach leverages the existing filtration infrastructure of DPFs to not only trap particulate matter but also capture carbon dioxide emissions. This dual functionality presents a potentially transformative opportunity to address two critical environmental challenges simultaneously: particulate pollution and greenhouse gas emissions.

The carbon capture capabilities of DPFs are particularly significant given the global imperative to reduce carbon emissions. With transportation accounting for approximately 24% of direct CO2 emissions from fuel combustion, enhancing the carbon capture efficiency of diesel engines could substantially contribute to climate change mitigation efforts. The technology shows particular promise for heavy-duty vehicles and industrial applications where electrification remains challenging.

Current DPF systems typically achieve particulate matter filtration efficiencies exceeding 95%, but their carbon capture capabilities are still in early development stages. The primary technical objective is to optimize DPF structures and materials to enhance CO2 adsorption while maintaining or improving particulate filtration performance. This requires a delicate balance, as modifications to improve carbon capture must not compromise the filter's primary function or durability.

The technological trajectory suggests several promising pathways for optimization, including novel catalyst formulations, advanced ceramic substrate designs, and innovative regeneration strategies. These developments aim to increase carbon capture efficiency while addressing challenges related to backpressure, thermal management, and system integration.

Looking forward, the ultimate goal is to develop a next-generation DPF system capable of capturing at least 40% of carbon emissions from diesel exhaust while maintaining optimal engine performance and meeting increasingly stringent particulate emissions standards. This technology could serve as a transitional solution in the broader movement toward zero-emission transportation, providing significant environmental benefits during the gradual phase-out of internal combustion engines.

Market Analysis for Enhanced DPF Carbon Capture Solutions

The global market for enhanced Diesel Particulate Filter (DPF) carbon capture solutions is experiencing significant growth, driven by increasingly stringent emissions regulations and a growing focus on environmental sustainability. The current market size for DPF technologies is estimated at $12.3 billion in 2023, with projections indicating growth to reach $18.7 billion by 2028, representing a compound annual growth rate of 8.7%. This growth trajectory is particularly pronounced in regions with advanced emissions standards such as Europe, North America, and increasingly in Asia-Pacific markets.

Customer demand for enhanced DPF carbon capture solutions is primarily segmented across commercial vehicles, passenger vehicles, and off-road equipment sectors. The commercial vehicle segment currently dominates the market share at approximately 45%, followed by passenger vehicles at 35%, and off-road equipment at 20%. This distribution reflects the higher regulatory pressure on commercial fleet operators and the greater carbon emission volumes associated with these vehicles.

Market research indicates that fleet operators are increasingly willing to invest in advanced DPF solutions that offer dual benefits: compliance with emissions regulations and improved fuel efficiency. A recent industry survey revealed that 78% of fleet managers consider enhanced carbon capture capabilities as "important" or "very important" in their purchasing decisions, representing a significant shift from just 52% five years ago.

Regional market analysis shows Europe leading in adoption rates for advanced DPF technologies, accounting for 38% of global market share, followed by North America at 29% and Asia-Pacific at 24%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate over the next five years at 12.3% annually, primarily driven by China and India implementing more stringent emissions standards.

The competitive landscape features both established automotive component manufacturers and specialized environmental technology companies. Tier-1 automotive suppliers control approximately 65% of the market, while specialized environmental technology firms have captured 25%, with the remaining 10% distributed among smaller innovative startups. This distribution highlights the importance of established manufacturing capabilities and distribution networks, while also indicating opportunities for disruptive technologies from specialized players.

Price sensitivity analysis reveals that commercial fleet operators demonstrate greater willingness to pay premium prices for enhanced DPF solutions that offer demonstrable reductions in maintenance costs and extended service intervals. The average price premium that fleet operators are willing to pay for advanced carbon capture capabilities stands at 15-20% above standard DPF solutions, provided that total cost of ownership benefits can be clearly demonstrated.

Customer demand for enhanced DPF carbon capture solutions is primarily segmented across commercial vehicles, passenger vehicles, and off-road equipment sectors. The commercial vehicle segment currently dominates the market share at approximately 45%, followed by passenger vehicles at 35%, and off-road equipment at 20%. This distribution reflects the higher regulatory pressure on commercial fleet operators and the greater carbon emission volumes associated with these vehicles.

Market research indicates that fleet operators are increasingly willing to invest in advanced DPF solutions that offer dual benefits: compliance with emissions regulations and improved fuel efficiency. A recent industry survey revealed that 78% of fleet managers consider enhanced carbon capture capabilities as "important" or "very important" in their purchasing decisions, representing a significant shift from just 52% five years ago.

Regional market analysis shows Europe leading in adoption rates for advanced DPF technologies, accounting for 38% of global market share, followed by North America at 29% and Asia-Pacific at 24%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate over the next five years at 12.3% annually, primarily driven by China and India implementing more stringent emissions standards.

The competitive landscape features both established automotive component manufacturers and specialized environmental technology companies. Tier-1 automotive suppliers control approximately 65% of the market, while specialized environmental technology firms have captured 25%, with the remaining 10% distributed among smaller innovative startups. This distribution highlights the importance of established manufacturing capabilities and distribution networks, while also indicating opportunities for disruptive technologies from specialized players.

Price sensitivity analysis reveals that commercial fleet operators demonstrate greater willingness to pay premium prices for enhanced DPF solutions that offer demonstrable reductions in maintenance costs and extended service intervals. The average price premium that fleet operators are willing to pay for advanced carbon capture capabilities stands at 15-20% above standard DPF solutions, provided that total cost of ownership benefits can be clearly demonstrated.

Current Challenges in Diesel Particulate Filtration Technology

Despite significant advancements in diesel particulate filter (DPF) technology over the past two decades, several critical challenges persist in optimizing these systems for effective carbon capture. The primary technical hurdle remains the inherent trade-off between filtration efficiency and backpressure. As filters become more efficient at capturing particulate matter, they inevitably create higher backpressure in the exhaust system, reducing engine performance and increasing fuel consumption.

Material limitations represent another significant challenge. Current ceramic substrates, typically made from cordierite or silicon carbide, face durability issues under extreme thermal conditions during regeneration cycles. These materials often experience thermal stress cracking after repeated heating and cooling cycles, compromising the structural integrity of the filter and reducing its operational lifespan.

The regeneration process itself presents complex challenges. Passive regeneration systems rely on exhaust temperature and NO2 concentration, which are highly variable depending on driving conditions. Active regeneration systems require precise control algorithms and additional fuel consumption, increasing the overall carbon footprint of the vehicle. Finding the optimal balance between regeneration frequency and efficiency remains problematic.

Soot loading measurement and prediction technologies lack sufficient accuracy for real-time optimization. Current sensor technologies cannot precisely determine the distribution of particulate matter within the filter, leading to suboptimal regeneration timing and potentially incomplete regeneration events. This results in uneven thermal profiles and accelerated filter degradation.

Emerging emission standards present additional challenges, as they increasingly focus on ultrafine particles (UFPs) below 100 nanometers in diameter. Conventional DPF designs struggle to efficiently capture these smaller particles without significantly increasing backpressure. The trade-off between capturing efficiency for different particle size distributions remains a technical barrier.

Cold-start emissions represent another significant challenge, as DPF systems operate with reduced efficiency until reaching optimal operating temperatures. During this warm-up period, particulate emissions can bypass effective filtration, contributing disproportionately to overall emissions profiles.

Integration challenges with other emission control systems, particularly selective catalytic reduction (SCR) systems for NOx control, create complex design constraints. The optimal placement and thermal management of these combined systems often involve competing requirements, complicating system architecture and control strategies.

Cost pressures remain substantial, as automotive manufacturers seek more efficient DPF solutions without increasing vehicle prices. This economic constraint limits the adoption of advanced materials and sensing technologies that could potentially address many of the technical challenges outlined above.

Material limitations represent another significant challenge. Current ceramic substrates, typically made from cordierite or silicon carbide, face durability issues under extreme thermal conditions during regeneration cycles. These materials often experience thermal stress cracking after repeated heating and cooling cycles, compromising the structural integrity of the filter and reducing its operational lifespan.

The regeneration process itself presents complex challenges. Passive regeneration systems rely on exhaust temperature and NO2 concentration, which are highly variable depending on driving conditions. Active regeneration systems require precise control algorithms and additional fuel consumption, increasing the overall carbon footprint of the vehicle. Finding the optimal balance between regeneration frequency and efficiency remains problematic.

Soot loading measurement and prediction technologies lack sufficient accuracy for real-time optimization. Current sensor technologies cannot precisely determine the distribution of particulate matter within the filter, leading to suboptimal regeneration timing and potentially incomplete regeneration events. This results in uneven thermal profiles and accelerated filter degradation.

Emerging emission standards present additional challenges, as they increasingly focus on ultrafine particles (UFPs) below 100 nanometers in diameter. Conventional DPF designs struggle to efficiently capture these smaller particles without significantly increasing backpressure. The trade-off between capturing efficiency for different particle size distributions remains a technical barrier.

Cold-start emissions represent another significant challenge, as DPF systems operate with reduced efficiency until reaching optimal operating temperatures. During this warm-up period, particulate emissions can bypass effective filtration, contributing disproportionately to overall emissions profiles.

Integration challenges with other emission control systems, particularly selective catalytic reduction (SCR) systems for NOx control, create complex design constraints. The optimal placement and thermal management of these combined systems often involve competing requirements, complicating system architecture and control strategies.

Cost pressures remain substantial, as automotive manufacturers seek more efficient DPF solutions without increasing vehicle prices. This economic constraint limits the adoption of advanced materials and sensing technologies that could potentially address many of the technical challenges outlined above.

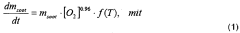

Current DPF Carbon Capture Optimization Approaches

01 DPF systems with carbon capture capabilities

Diesel Particulate Filter (DPF) systems can be designed to capture carbon dioxide emissions from diesel engines. These systems integrate carbon capture technology with traditional particulate filtration to reduce both particulate matter and greenhouse gas emissions. The captured carbon can be stored temporarily within the filter system before being transferred to a more permanent storage solution or utilized in other applications.- DPF systems with carbon capture capabilities: Diesel particulate filters can be designed to not only trap particulate matter but also capture carbon dioxide emissions. These systems integrate carbon capture technology with traditional DPF functionality, allowing for the reduction of both particulate matter and greenhouse gases from diesel exhaust. The captured carbon can then be stored or processed for further use or sequestration, contributing to overall emission reduction strategies.

- Advanced filter materials for enhanced carbon capture: Specialized materials can be incorporated into diesel particulate filters to improve carbon capture efficiency. These materials include activated carbon, zeolites, metal-organic frameworks, and other adsorbents with high surface area that can selectively bind carbon dioxide molecules. By optimizing the composition and structure of these filter materials, both particulate filtration and carbon capture performance can be significantly enhanced.

- Regeneration systems for carbon-capturing DPFs: Regeneration systems are essential for maintaining the efficiency of diesel particulate filters with carbon capture capabilities. These systems can use thermal, chemical, or electrical methods to periodically clean the filter of accumulated particulates while preserving the carbon capture functionality. Advanced regeneration techniques can also help in processing the captured carbon for storage or utilization, extending the operational life of the filter system.

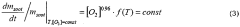

- Monitoring and control systems for DPF carbon capture: Sophisticated monitoring and control systems are developed to optimize the performance of diesel particulate filters with carbon capture functionality. These systems use sensors to track filter loading, carbon capture efficiency, and exhaust conditions in real-time. The collected data enables dynamic adjustment of operating parameters to maximize carbon capture while maintaining engine performance and ensuring timely regeneration of the filter system.

- Integration with exhaust aftertreatment systems: Carbon-capturing diesel particulate filters can be integrated with other exhaust aftertreatment components to create comprehensive emission control systems. These integrated systems may combine DPF technology with selective catalytic reduction (SCR), exhaust gas recirculation (EGR), or oxidation catalysts to simultaneously address multiple pollutants including particulates, NOx, and carbon dioxide. The strategic positioning and sequencing of these components optimize the overall emission reduction performance.

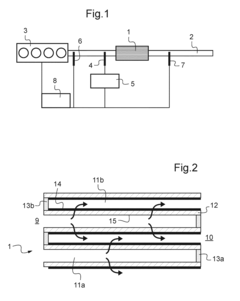

02 Filter materials and structures for enhanced carbon capture

Specialized filter materials and structures can significantly improve carbon capture efficiency in diesel exhaust systems. These materials may include advanced ceramics, metal-organic frameworks, or carbon-based adsorbents that have high affinity for carbon dioxide molecules. The filter structure can be designed with optimized porosity, surface area, and channel configurations to maximize contact between exhaust gases and capture surfaces while maintaining acceptable back pressure levels.Expand Specific Solutions03 Regeneration and carbon recovery methods

Various regeneration techniques can be employed to maintain filter efficiency while recovering captured carbon. These methods include thermal regeneration, pressure swing processes, and chemical treatments that release trapped carbon compounds for collection. The recovered carbon can then be compressed, stored, or converted into useful products. Effective regeneration systems are crucial for maintaining filter performance and ensuring continuous operation of the vehicle.Expand Specific Solutions04 Integration with engine management systems

Carbon capture DPF systems can be integrated with engine management systems to optimize performance based on operating conditions. Sensors monitor exhaust composition, temperature, and filter loading to adjust engine parameters and filter operation accordingly. Advanced control algorithms can balance emissions reduction, fuel efficiency, and filter regeneration needs. This integration ensures optimal carbon capture without compromising engine performance or reliability.Expand Specific Solutions05 Post-capture carbon utilization and storage

After carbon is captured in the DPF system, various methods can be employed for its utilization or storage. The captured carbon can be converted into valuable products such as synthetic fuels, building materials, or chemical feedstocks. Alternatively, it can be compressed and stored for later disposal or use. Mobile carbon capture systems present unique challenges for storage and transfer that require innovative solutions for practical implementation in vehicles.Expand Specific Solutions

Key Industry Players in DPF Technology Development

The diesel particulate filter (DPF) carbon capture technology market is currently in a growth phase, characterized by increasing regulatory pressures for emissions reduction in transportation and industrial sectors. The market size is expanding rapidly, projected to reach significant value as carbon capture becomes essential for meeting global climate goals. In terms of technical maturity, established automotive manufacturers like Toyota, Honda, and GM are leading development with advanced filter technologies, while specialized companies such as Corning, Sumitomo Electric, and IBIDEN focus on material innovations for enhanced carbon capture efficiency. Academic institutions including Tongji University and China Petroleum University Beijing are contributing fundamental research. The competitive landscape shows automotive OEMs collaborating with specialized filter manufacturers to optimize DPF carbon capture performance while meeting increasingly stringent emissions standards.

Toyota Motor Corp.

Technical Solution: Toyota has developed an advanced DPF system that integrates carbon capture functionality with their existing emission control technologies. Their approach utilizes a dual-layer filter structure with specialized catalytic coatings that enhance particulate matter filtration while simultaneously capturing carbon dioxide. The system incorporates real-time monitoring sensors that optimize regeneration cycles based on driving conditions and filter loading status. Toyota's technology employs a proprietary zeolite-based material that can adsorb carbon at lower temperatures (150-300°C) compared to conventional systems, improving cold-start emissions performance. Their system also features adaptive control algorithms that balance filtration efficiency with fuel economy by dynamically adjusting backpressure parameters based on engine load and exhaust temperature profiles.

Strengths: Superior integration with existing vehicle systems, excellent low-temperature carbon capture efficiency, and reduced regeneration frequency leading to better fuel economy. Weaknesses: Higher initial manufacturing costs and potential durability concerns with the advanced catalytic materials under extreme operating conditions.

Corning, Inc.

Technical Solution: Corning has pioneered ceramic substrate technology for DPF carbon capture optimization through their advanced cordierite and silicon carbide filter designs. Their latest innovation features a cellular honeycomb structure with asymmetric channel walls that increase filtration surface area by approximately 30% while maintaining manageable backpressure levels. The company has developed a proprietary manufacturing process that creates precisely controlled porosity gradients within filter walls, enhancing both particulate capture efficiency and carbon adsorption capabilities. Corning's DPF technology incorporates specialized catalyst washcoats that promote carbon capture through chemical adsorption mechanisms while facilitating more complete regeneration cycles. Their filters utilize a thermal management system that optimizes carbon capture efficiency across a wider temperature range (200-600°C) than conventional filters, making them suitable for various driving conditions and engine types.

Strengths: Industry-leading substrate durability, exceptional thermal stability during regeneration cycles, and consistent performance across diverse operating conditions. Weaknesses: Higher production costs compared to conventional filters and requires specialized coating processes for optimal performance.

Critical Patents and Innovations in DPF Technology

Method for regenerating a diesel particulate filter

PatentWO2014079535A1

Innovation

- The method involves optimizing the throttle valve to increase exhaust gas temperature and reduce residual oxygen, using unburned post-injection to control engine operation, and adjusting injection parameters to maximize exhaust gas temperature, thereby enhancing soot oxidation in the diesel particulate filter.

Particle filter

PatentActiveEP2474716A1

Innovation

- Incorporating adsorbent materials into the catalytic coatings that adsorb nitrogen oxides at low temperatures and desorb them at higher temperatures, allowing for subsequent reduction by surrounding catalysts when the desorption temperature is reached.

Environmental Regulations Impacting DPF Development

Environmental regulations have become increasingly stringent worldwide, significantly influencing the development trajectory of Diesel Particulate Filter (DPF) technologies. The European Union's Euro standards have been at the forefront, with Euro 6d imposing particulate matter (PM) limits of 0.0045 g/km for diesel vehicles. These regulations have catalyzed innovation in DPF design, pushing manufacturers to enhance filtration efficiency while maintaining acceptable back pressure levels.

In the United States, the Environmental Protection Agency (EPA) and California Air Resources Board (CARB) have implemented comparable stringent standards. The EPA's Tier 3 regulations require particulate emissions below 0.003 g/mile, while CARB has introduced even more demanding requirements for vehicles operating in California. These regulatory frameworks have accelerated the integration of advanced carbon capture capabilities into DPF systems.

China has rapidly evolved its regulatory landscape with the implementation of China VI standards, which closely align with Euro 6 requirements. This global regulatory convergence has created a unified market demand for high-performance DPF systems with enhanced carbon capture efficiency, driving standardization across international automotive platforms.

The regulatory focus has expanded beyond mere filtration efficiency to include durability requirements. Modern DPFs must maintain performance over extended periods, typically 150,000-240,000 kilometers depending on the jurisdiction. This longevity requirement has prompted research into advanced materials and regeneration strategies that preserve carbon capture effectiveness throughout the filter's operational life.

Greenhouse gas (GHG) emission regulations have added another dimension to DPF development. The integration of carbon capture functionality into DPFs represents a strategic approach to addressing both particulate matter and carbon dioxide emissions simultaneously. The European Commission's proposed Euro 7 standards and similar initiatives globally are expected to further emphasize this dual functionality.

Real Driving Emissions (RDE) testing protocols have transformed the regulatory landscape by requiring DPF systems to perform effectively across diverse operating conditions, not merely in laboratory settings. This has necessitated the development of adaptive regeneration strategies and robust filter designs capable of maintaining optimal carbon capture efficiency across varying temperature profiles and driving cycles.

Future regulatory trends indicate a continued tightening of emission standards with increasing focus on ultrafine particles and non-exhaust emissions. The potential inclusion of particle number (PN) limits for particles below 23 nanometers will likely drive further innovation in DPF filtration technology, potentially leveraging enhanced carbon capture mechanisms to address these challenging regulatory requirements.

In the United States, the Environmental Protection Agency (EPA) and California Air Resources Board (CARB) have implemented comparable stringent standards. The EPA's Tier 3 regulations require particulate emissions below 0.003 g/mile, while CARB has introduced even more demanding requirements for vehicles operating in California. These regulatory frameworks have accelerated the integration of advanced carbon capture capabilities into DPF systems.

China has rapidly evolved its regulatory landscape with the implementation of China VI standards, which closely align with Euro 6 requirements. This global regulatory convergence has created a unified market demand for high-performance DPF systems with enhanced carbon capture efficiency, driving standardization across international automotive platforms.

The regulatory focus has expanded beyond mere filtration efficiency to include durability requirements. Modern DPFs must maintain performance over extended periods, typically 150,000-240,000 kilometers depending on the jurisdiction. This longevity requirement has prompted research into advanced materials and regeneration strategies that preserve carbon capture effectiveness throughout the filter's operational life.

Greenhouse gas (GHG) emission regulations have added another dimension to DPF development. The integration of carbon capture functionality into DPFs represents a strategic approach to addressing both particulate matter and carbon dioxide emissions simultaneously. The European Commission's proposed Euro 7 standards and similar initiatives globally are expected to further emphasize this dual functionality.

Real Driving Emissions (RDE) testing protocols have transformed the regulatory landscape by requiring DPF systems to perform effectively across diverse operating conditions, not merely in laboratory settings. This has necessitated the development of adaptive regeneration strategies and robust filter designs capable of maintaining optimal carbon capture efficiency across varying temperature profiles and driving cycles.

Future regulatory trends indicate a continued tightening of emission standards with increasing focus on ultrafine particles and non-exhaust emissions. The potential inclusion of particle number (PN) limits for particles below 23 nanometers will likely drive further innovation in DPF filtration technology, potentially leveraging enhanced carbon capture mechanisms to address these challenging regulatory requirements.

Cost-Benefit Analysis of Advanced DPF Technologies

The economic viability of advanced Diesel Particulate Filter (DPF) technologies must be thoroughly evaluated through comprehensive cost-benefit analysis. Initial investment costs for implementing cutting-edge DPF systems with enhanced carbon capture capabilities range from $3,000 to $8,000 per unit, depending on vehicle class and application requirements. These costs encompass hardware components, integration engineering, and calibration expenses necessary for optimal performance.

Operational expenses represent another significant cost factor, with maintenance requirements for advanced DPF systems typically occurring at 100,000-150,000 mile intervals. Regeneration processes, essential for maintaining filter efficiency, consume additional fuel at rates of 1-3% above normal operation, translating to approximately $400-$1,200 in extra fuel costs annually for heavy-duty applications.

Against these expenditures, quantifiable benefits include extended filter lifespan, with next-generation DPFs demonstrating 20-30% longer service intervals compared to conventional models. This translates to maintenance cost reductions of approximately $800-$1,500 over the vehicle's operational life. Enhanced carbon capture efficiency, reaching up to 99% particulate matter removal in advanced systems, significantly reduces environmental compliance costs and potential regulatory penalties.

Fleet operators implementing advanced DPF technologies report fuel economy improvements of 1-2% due to optimized backpressure management and more efficient regeneration cycles. For commercial fleets, this represents potential savings of $600-$1,200 annually per vehicle. The reduced downtime associated with more reliable DPF systems further contributes to operational cost savings, estimated at $2,000-$4,000 annually for commercial vehicles.

Return on investment calculations indicate payback periods ranging from 18 to 36 months for most commercial applications, with variations based on duty cycles and operational environments. Public health benefits, though more difficult to quantify directly, include reduced healthcare costs associated with improved air quality, estimated at $5-$10 billion annually across major metropolitan areas when advanced emission control technologies achieve widespread adoption.

Carbon credit opportunities present an emerging financial incentive, with advanced DPF systems potentially generating $200-$500 in annual carbon offset value per vehicle. This market is expected to grow as carbon pricing mechanisms mature globally. Government incentive programs in various regions offer tax credits, grants, and subsidies ranging from $1,000 to $5,000 per vehicle for early adopters of superior emission control technologies, significantly improving the cost-benefit equation.

Operational expenses represent another significant cost factor, with maintenance requirements for advanced DPF systems typically occurring at 100,000-150,000 mile intervals. Regeneration processes, essential for maintaining filter efficiency, consume additional fuel at rates of 1-3% above normal operation, translating to approximately $400-$1,200 in extra fuel costs annually for heavy-duty applications.

Against these expenditures, quantifiable benefits include extended filter lifespan, with next-generation DPFs demonstrating 20-30% longer service intervals compared to conventional models. This translates to maintenance cost reductions of approximately $800-$1,500 over the vehicle's operational life. Enhanced carbon capture efficiency, reaching up to 99% particulate matter removal in advanced systems, significantly reduces environmental compliance costs and potential regulatory penalties.

Fleet operators implementing advanced DPF technologies report fuel economy improvements of 1-2% due to optimized backpressure management and more efficient regeneration cycles. For commercial fleets, this represents potential savings of $600-$1,200 annually per vehicle. The reduced downtime associated with more reliable DPF systems further contributes to operational cost savings, estimated at $2,000-$4,000 annually for commercial vehicles.

Return on investment calculations indicate payback periods ranging from 18 to 36 months for most commercial applications, with variations based on duty cycles and operational environments. Public health benefits, though more difficult to quantify directly, include reduced healthcare costs associated with improved air quality, estimated at $5-$10 billion annually across major metropolitan areas when advanced emission control technologies achieve widespread adoption.

Carbon credit opportunities present an emerging financial incentive, with advanced DPF systems potentially generating $200-$500 in annual carbon offset value per vehicle. This market is expected to grow as carbon pricing mechanisms mature globally. Government incentive programs in various regions offer tax credits, grants, and subsidies ranging from $1,000 to $5,000 per vehicle for early adopters of superior emission control technologies, significantly improving the cost-benefit equation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!