How to Prototype Diesel Particulate Filter Substrates

SEP 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DPF Substrate Development Background and Objectives

Diesel Particulate Filter (DPF) technology emerged in the late 1970s as a response to increasingly stringent emission regulations worldwide. The primary function of DPFs is to capture and remove particulate matter (PM) from diesel engine exhaust, significantly reducing harmful emissions that contribute to air pollution and associated health risks. Over the past four decades, DPF technology has evolved from simple mechanical filtration systems to sophisticated components integrated with advanced engine management systems.

The evolution of DPF substrates has been marked by significant material innovations. Early DPFs utilized cordierite ceramic materials, while later developments introduced silicon carbide, aluminum titanate, and various metal-based substrates. Each material iteration has aimed to improve filtration efficiency, thermal durability, and pressure drop characteristics - the three critical performance parameters for effective DPF operation.

Current market trends indicate a growing demand for more efficient and durable DPF substrates that can withstand higher temperatures and provide enhanced filtration performance while minimizing backpressure on the engine. This demand is driven by both regulatory pressures and the automotive industry's push toward more efficient diesel engines with lower environmental impact.

The technical objectives for DPF substrate prototyping encompass several key areas. First, developing substrates with optimized porosity structures that balance filtration efficiency and pressure drop characteristics. Second, enhancing thermal durability to withstand the extreme temperature conditions during regeneration cycles, which can exceed 600°C. Third, improving ash storage capacity to extend service intervals and overall filter lifetime.

Additionally, there is a growing focus on reducing the cost and complexity of manufacturing processes for DPF substrates. Current production methods often involve energy-intensive sintering processes and complex extrusion techniques, which contribute significantly to the overall cost of emission control systems.

Looking forward, the trajectory of DPF substrate development is increasingly influenced by the broader transition toward electrification in the transportation sector. However, diesel engines are expected to remain prevalent in heavy-duty applications, marine transport, and certain industrial sectors for decades to come, ensuring continued relevance for DPF technology advancement.

The ultimate goal of DPF substrate prototyping is to develop next-generation filters that can achieve near-zero particulate emissions while maintaining optimal engine performance and fuel efficiency. This requires a multidisciplinary approach combining materials science, fluid dynamics, thermodynamics, and manufacturing technology to create innovative substrate designs that meet increasingly demanding performance requirements.

The evolution of DPF substrates has been marked by significant material innovations. Early DPFs utilized cordierite ceramic materials, while later developments introduced silicon carbide, aluminum titanate, and various metal-based substrates. Each material iteration has aimed to improve filtration efficiency, thermal durability, and pressure drop characteristics - the three critical performance parameters for effective DPF operation.

Current market trends indicate a growing demand for more efficient and durable DPF substrates that can withstand higher temperatures and provide enhanced filtration performance while minimizing backpressure on the engine. This demand is driven by both regulatory pressures and the automotive industry's push toward more efficient diesel engines with lower environmental impact.

The technical objectives for DPF substrate prototyping encompass several key areas. First, developing substrates with optimized porosity structures that balance filtration efficiency and pressure drop characteristics. Second, enhancing thermal durability to withstand the extreme temperature conditions during regeneration cycles, which can exceed 600°C. Third, improving ash storage capacity to extend service intervals and overall filter lifetime.

Additionally, there is a growing focus on reducing the cost and complexity of manufacturing processes for DPF substrates. Current production methods often involve energy-intensive sintering processes and complex extrusion techniques, which contribute significantly to the overall cost of emission control systems.

Looking forward, the trajectory of DPF substrate development is increasingly influenced by the broader transition toward electrification in the transportation sector. However, diesel engines are expected to remain prevalent in heavy-duty applications, marine transport, and certain industrial sectors for decades to come, ensuring continued relevance for DPF technology advancement.

The ultimate goal of DPF substrate prototyping is to develop next-generation filters that can achieve near-zero particulate emissions while maintaining optimal engine performance and fuel efficiency. This requires a multidisciplinary approach combining materials science, fluid dynamics, thermodynamics, and manufacturing technology to create innovative substrate designs that meet increasingly demanding performance requirements.

Market Analysis for Advanced DPF Technologies

The global market for Diesel Particulate Filter (DPF) technologies continues to expand significantly, driven primarily by increasingly stringent emission regulations across major automotive markets. The current market valuation stands at approximately 12 billion USD with projections indicating growth to reach 18 billion USD by 2028, representing a compound annual growth rate of 7.2%. This growth trajectory is particularly pronounced in regions implementing Euro 6/VI, China 6, and US EPA Tier 3 emission standards.

Market segmentation reveals distinct patterns based on vehicle categories. Heavy-duty commercial vehicles constitute the largest market segment, accounting for 45% of total DPF demand, followed by light-duty vehicles at 35% and off-road applications at 20%. This distribution reflects the regulatory focus on reducing particulate emissions from diesel-powered commercial transportation.

Regional analysis indicates Europe maintains market leadership with 38% market share, attributed to early adoption of stringent emission standards. North America follows at 28%, while Asia-Pacific represents the fastest-growing region with a 10.5% annual growth rate, primarily driven by regulatory developments in China and India.

Customer demand patterns show increasing preference for advanced DPF technologies offering improved regeneration efficiency, reduced backpressure, and extended service intervals. Fleet operators specifically prioritize solutions that minimize operational downtime and maintenance costs, with total cost of ownership becoming a critical decision factor rather than initial acquisition cost.

Emerging market trends include integration of DPF systems with other emission control technologies, particularly selective catalytic reduction (SCR) systems, creating comprehensive emission management solutions. Additionally, there is growing interest in electrically heated DPFs for cold-start emission control and low-temperature applications, especially relevant for urban delivery vehicles operating in stop-start conditions.

The aftermarket segment presents substantial growth opportunities, currently valued at 3.5 billion USD annually, with replacement cycles typically occurring every 120,000-150,000 miles depending on operating conditions. This segment is characterized by price sensitivity and increasing competition from third-party manufacturers.

Future market dynamics will likely be shaped by the transition toward alternative powertrains, particularly in light-duty applications. However, medium and heavy-duty diesel applications are expected to maintain significant market presence through 2035, ensuring continued demand for advanced DPF technologies in these sectors.

Market segmentation reveals distinct patterns based on vehicle categories. Heavy-duty commercial vehicles constitute the largest market segment, accounting for 45% of total DPF demand, followed by light-duty vehicles at 35% and off-road applications at 20%. This distribution reflects the regulatory focus on reducing particulate emissions from diesel-powered commercial transportation.

Regional analysis indicates Europe maintains market leadership with 38% market share, attributed to early adoption of stringent emission standards. North America follows at 28%, while Asia-Pacific represents the fastest-growing region with a 10.5% annual growth rate, primarily driven by regulatory developments in China and India.

Customer demand patterns show increasing preference for advanced DPF technologies offering improved regeneration efficiency, reduced backpressure, and extended service intervals. Fleet operators specifically prioritize solutions that minimize operational downtime and maintenance costs, with total cost of ownership becoming a critical decision factor rather than initial acquisition cost.

Emerging market trends include integration of DPF systems with other emission control technologies, particularly selective catalytic reduction (SCR) systems, creating comprehensive emission management solutions. Additionally, there is growing interest in electrically heated DPFs for cold-start emission control and low-temperature applications, especially relevant for urban delivery vehicles operating in stop-start conditions.

The aftermarket segment presents substantial growth opportunities, currently valued at 3.5 billion USD annually, with replacement cycles typically occurring every 120,000-150,000 miles depending on operating conditions. This segment is characterized by price sensitivity and increasing competition from third-party manufacturers.

Future market dynamics will likely be shaped by the transition toward alternative powertrains, particularly in light-duty applications. However, medium and heavy-duty diesel applications are expected to maintain significant market presence through 2035, ensuring continued demand for advanced DPF technologies in these sectors.

Current Challenges in DPF Substrate Prototyping

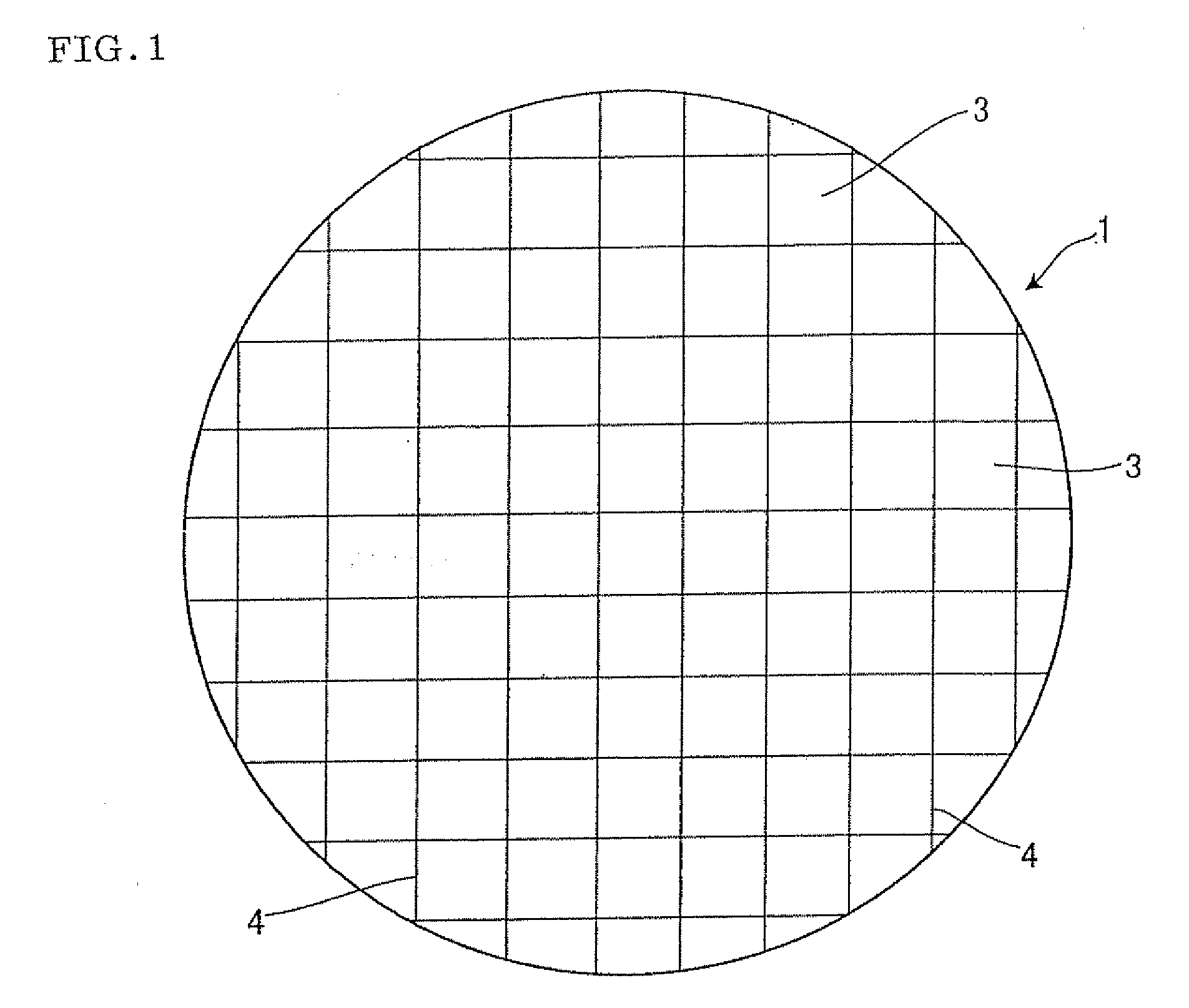

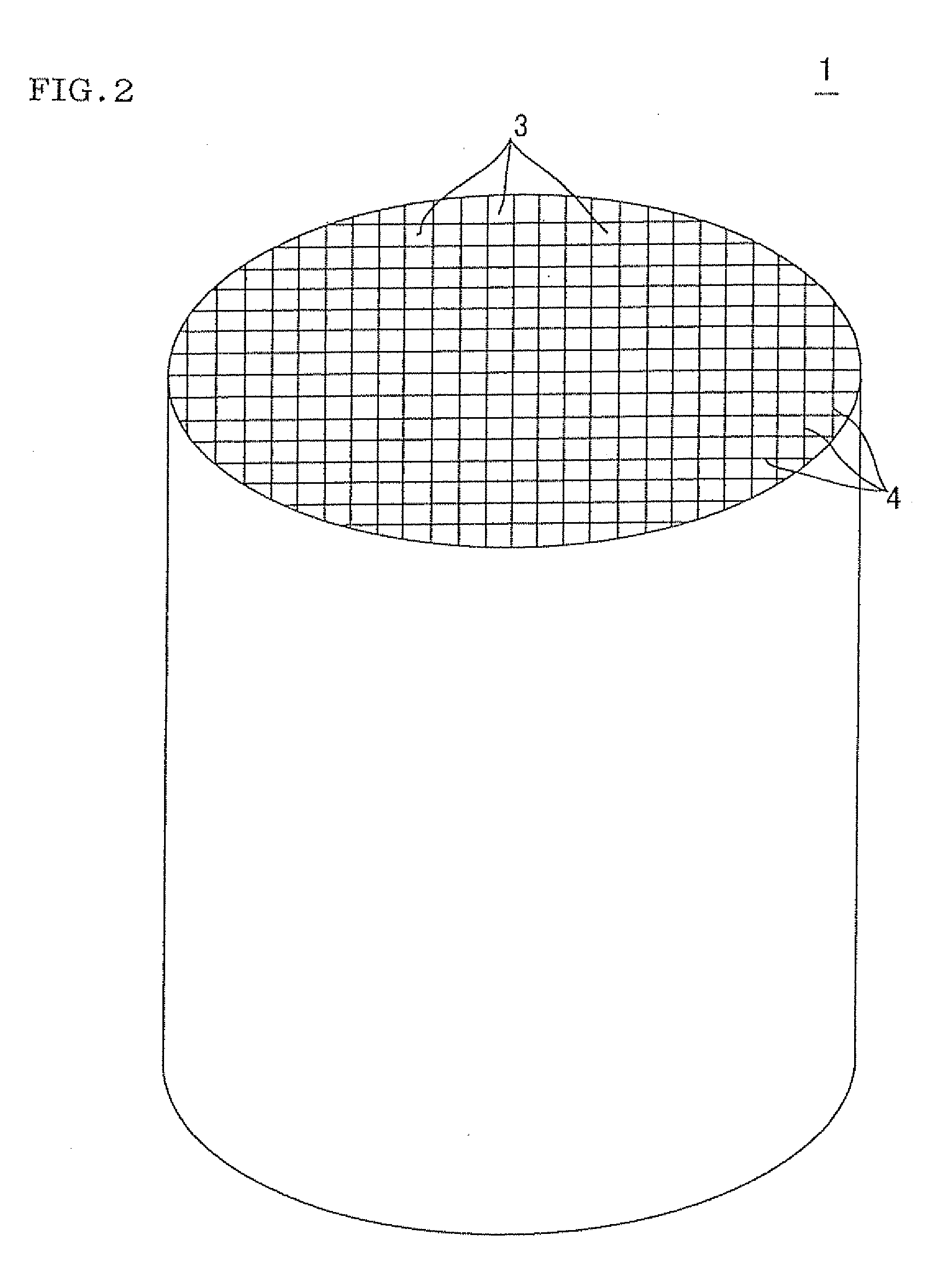

Despite significant advancements in diesel particulate filter (DPF) technology, the prototyping of DPF substrates continues to face numerous technical challenges that impede rapid innovation and cost-effective development. The complex microstructure of DPF substrates, typically characterized by honeycomb channels with porous walls, presents substantial manufacturing difficulties during the prototyping phase.

Material selection remains a primary challenge, as prototype substrates must accurately represent the thermal, mechanical, and chemical properties of production materials. Traditional cordierite and silicon carbide materials require high-temperature sintering processes that are difficult to replicate in small-batch prototyping environments. Alternative materials often fail to provide comparable porosity, permeability, and thermal shock resistance characteristics essential for accurate performance testing.

Geometry control presents another significant obstacle. The intricate honeycomb structure with cell densities ranging from 100 to 300 cells per square inch and wall thicknesses between 0.2-0.4mm demands exceptional precision. Conventional prototyping methods struggle to maintain consistent wall thickness and channel uniformity, leading to performance variations that compromise test validity.

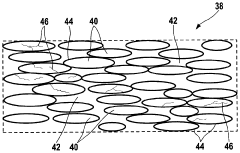

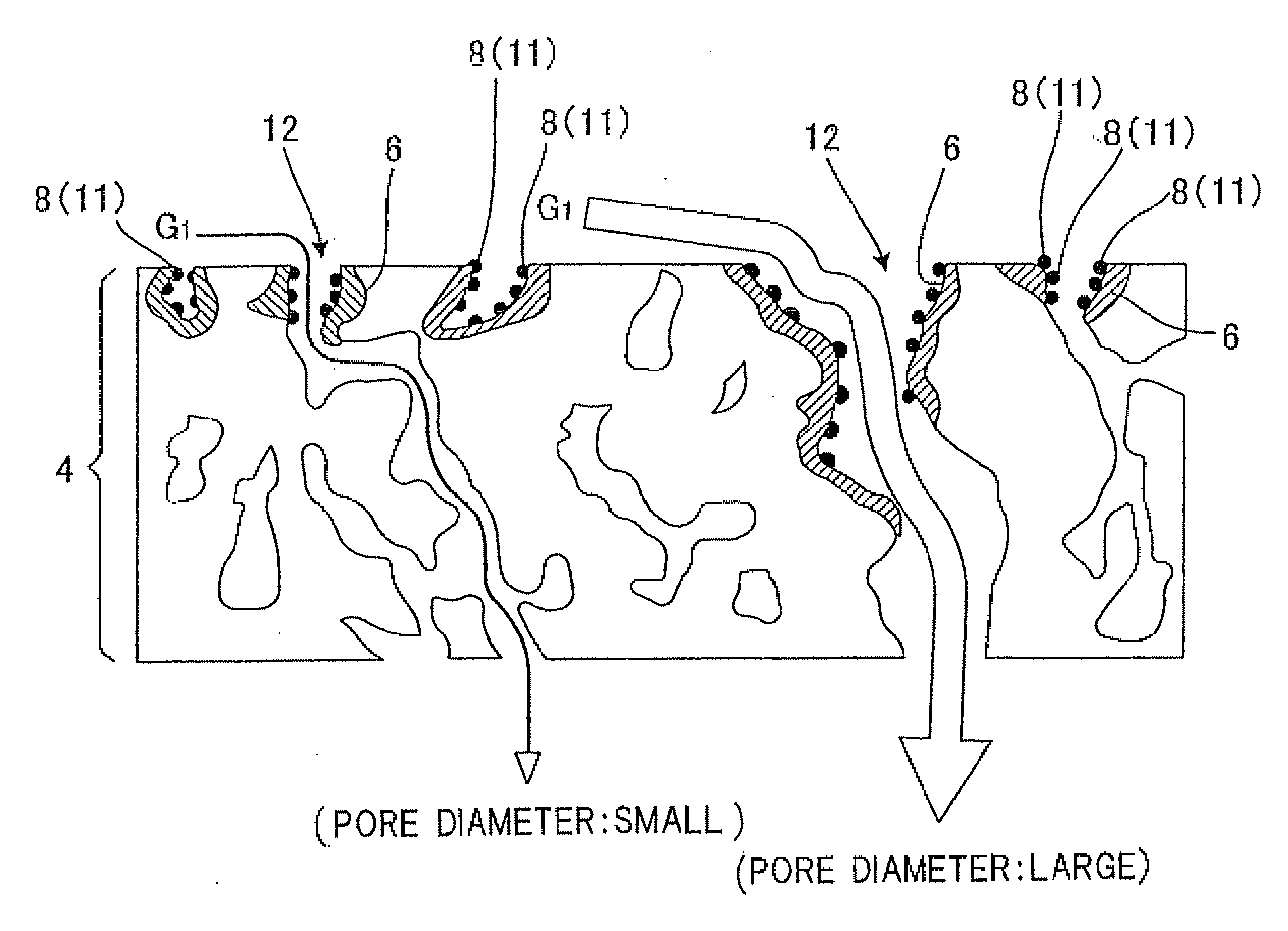

Porosity management constitutes perhaps the most technically challenging aspect of DPF substrate prototyping. The controlled development of interconnected pores with specific size distributions (typically 10-30 μm) is critical for filtration efficiency and pressure drop characteristics. Current prototyping techniques often fail to replicate the bimodal pore structure found in commercial DPFs, resulting in prototypes with non-representative filtration behavior.

Scale-up considerations further complicate the prototyping process. Laboratory-scale prototypes frequently exhibit different performance characteristics compared to full-sized components due to thermal gradient variations and flow distribution differences. This scale discrepancy creates significant uncertainty when extrapolating prototype performance to production-scale filters.

Advanced manufacturing techniques like additive manufacturing offer potential solutions but face limitations in material compatibility and resolution capabilities. While 3D printing enables complex geometries, current technologies struggle to achieve the necessary microstructural features and material properties required for functional DPF substrates.

Testing and validation of prototypes present additional challenges. Accelerated aging protocols often fail to accurately simulate real-world degradation mechanisms, while laboratory testing equipment may not fully replicate engine operating conditions. This creates a disconnect between prototype performance metrics and actual field performance.

Cost and time constraints further exacerbate these technical challenges. The iterative nature of prototyping requires multiple design revisions, each incurring significant material and processing costs. Traditional ceramic processing routes typically require weeks to months per iteration, substantially extending development timelines and increasing project expenses.

Material selection remains a primary challenge, as prototype substrates must accurately represent the thermal, mechanical, and chemical properties of production materials. Traditional cordierite and silicon carbide materials require high-temperature sintering processes that are difficult to replicate in small-batch prototyping environments. Alternative materials often fail to provide comparable porosity, permeability, and thermal shock resistance characteristics essential for accurate performance testing.

Geometry control presents another significant obstacle. The intricate honeycomb structure with cell densities ranging from 100 to 300 cells per square inch and wall thicknesses between 0.2-0.4mm demands exceptional precision. Conventional prototyping methods struggle to maintain consistent wall thickness and channel uniformity, leading to performance variations that compromise test validity.

Porosity management constitutes perhaps the most technically challenging aspect of DPF substrate prototyping. The controlled development of interconnected pores with specific size distributions (typically 10-30 μm) is critical for filtration efficiency and pressure drop characteristics. Current prototyping techniques often fail to replicate the bimodal pore structure found in commercial DPFs, resulting in prototypes with non-representative filtration behavior.

Scale-up considerations further complicate the prototyping process. Laboratory-scale prototypes frequently exhibit different performance characteristics compared to full-sized components due to thermal gradient variations and flow distribution differences. This scale discrepancy creates significant uncertainty when extrapolating prototype performance to production-scale filters.

Advanced manufacturing techniques like additive manufacturing offer potential solutions but face limitations in material compatibility and resolution capabilities. While 3D printing enables complex geometries, current technologies struggle to achieve the necessary microstructural features and material properties required for functional DPF substrates.

Testing and validation of prototypes present additional challenges. Accelerated aging protocols often fail to accurately simulate real-world degradation mechanisms, while laboratory testing equipment may not fully replicate engine operating conditions. This creates a disconnect between prototype performance metrics and actual field performance.

Cost and time constraints further exacerbate these technical challenges. The iterative nature of prototyping requires multiple design revisions, each incurring significant material and processing costs. Traditional ceramic processing routes typically require weeks to months per iteration, substantially extending development timelines and increasing project expenses.

Contemporary Prototyping Methods for DPF Substrates

01 Ceramic materials for DPF substrates

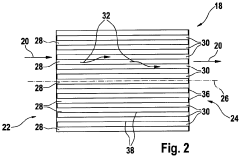

Ceramic materials, particularly cordierite and silicon carbide, are widely used as substrates for diesel particulate filters due to their high thermal stability and durability. These materials can withstand the high temperatures generated during filter regeneration processes while maintaining structural integrity. The ceramic substrates are typically designed with a honeycomb structure featuring alternately plugged channels to force exhaust gases through porous walls, trapping particulate matter effectively.- Ceramic materials for DPF substrates: Ceramic materials, particularly cordierite and silicon carbide, are commonly used as substrates for diesel particulate filters due to their high thermal stability and durability. These materials can withstand the high temperatures generated during filter regeneration processes while maintaining structural integrity. The porous structure of ceramic substrates allows for efficient particulate matter capture while maintaining acceptable backpressure levels in the exhaust system.

- Filter wall structure and porosity optimization: The wall structure and porosity of diesel particulate filter substrates significantly impact filtration efficiency and pressure drop characteristics. Optimizing pore size distribution, wall thickness, and channel density can enhance particulate matter capture while minimizing backpressure. Advanced manufacturing techniques allow for controlled porosity gradients within the filter walls to balance filtration efficiency and flow resistance, extending filter life and improving engine performance.

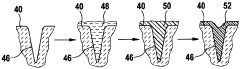

- Catalyst coatings for DPF substrates: Applying catalyst coatings to diesel particulate filter substrates enhances passive regeneration capabilities by lowering the temperature required for soot oxidation. These catalytic coatings typically contain precious metals like platinum, palladium, or base metals that promote oxidation reactions. The catalyst formulation and loading must be optimized to ensure effective soot combustion without compromising filter performance or durability, while maintaining compliance with increasingly stringent emissions regulations.

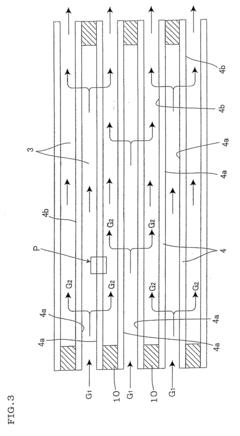

- Advanced filter geometries and designs: Innovative filter geometries and designs are being developed to improve the performance of diesel particulate filters. These include asymmetric channel designs, variable cell density structures, and segmented filter arrangements. Such advanced designs aim to increase filtration surface area, optimize flow distribution, and enhance ash storage capacity. These improvements lead to extended service intervals, reduced maintenance costs, and better overall system efficiency throughout the filter's operational life.

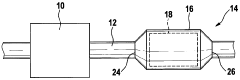

- Filter monitoring and regeneration systems: Sophisticated monitoring and regeneration systems are essential for effective diesel particulate filter operation. These systems employ pressure sensors, temperature sensors, and advanced algorithms to determine filter loading status and trigger appropriate regeneration events. Active regeneration strategies may include fuel injection modifications, exhaust gas temperature control, or dedicated heating elements. Proper monitoring and control systems help prevent filter damage from excessive soot accumulation while optimizing fuel economy and emissions performance.

02 Filter structure and channel configurations

The structural design of diesel particulate filter substrates significantly impacts filtration efficiency and pressure drop characteristics. Various channel configurations, including square, hexagonal, and asymmetric cell structures, are employed to optimize the balance between filtration surface area and backpressure. Wall thickness, porosity, and pore size distribution are carefully controlled to enhance particulate capture while minimizing restriction to exhaust flow. Advanced designs incorporate variable cell density and wall thickness throughout the filter to improve performance.Expand Specific Solutions03 Catalyst coatings for passive regeneration

Catalyst coatings applied to filter substrates enable passive regeneration by lowering the oxidation temperature of trapped soot particles. These catalytic materials, including precious metals like platinum and palladium or metal oxides, are deposited on the substrate walls to promote continuous oxidation of particulate matter during normal vehicle operation. The catalyst formulations are designed to maintain activity over extended periods while resisting poisoning from exhaust contaminants. This approach reduces the need for active regeneration events, improving fuel economy and filter durability.Expand Specific Solutions04 Advanced manufacturing techniques

Innovative manufacturing processes are employed to produce diesel particulate filter substrates with precise structural characteristics. Extrusion techniques combined with controlled sintering processes allow for the creation of complex honeycomb structures with uniform wall thickness and porosity. Additive manufacturing methods enable the production of filter substrates with novel geometries that would be difficult to achieve using conventional techniques. These advanced manufacturing approaches help optimize filter performance while improving production efficiency and reducing costs.Expand Specific Solutions05 Monitoring and diagnostic systems

Sophisticated monitoring and diagnostic systems are integrated with diesel particulate filters to assess filter condition and performance in real-time. These systems utilize pressure sensors, temperature sensors, and advanced algorithms to determine soot loading levels and detect potential filter failures. On-board diagnostic capabilities enable precise control of regeneration timing and duration, optimizing filter cleaning while preventing thermal damage. The monitoring systems also provide feedback to engine control units for adjusting operating parameters to extend filter life and maintain emissions compliance.Expand Specific Solutions

Leading Manufacturers and Research Institutions in DPF Technology

The diesel particulate filter (DPF) substrate prototyping market is currently in a growth phase, driven by increasingly stringent emissions regulations worldwide. The global market size for DPF technologies is expanding steadily, estimated at approximately $12-15 billion annually with projected CAGR of 8-10%. Leading players include established materials specialists like Corning, NGK Insulators, and Johnson Matthey who possess advanced ceramic substrate technologies, alongside automotive OEMs such as Ford, Mercedes-Benz, and Renault who integrate these systems. The technology landscape shows varying maturity levels, with companies like MANN+HUMMEL and Donaldson focusing on filtration efficiency improvements, while Umicore and Johnson Matthey lead in catalyst coating technologies. Research institutions like China Petroleum University Beijing collaborate with manufacturers to develop next-generation substrate materials with enhanced thermal durability and reduced backpressure characteristics.

Corning, Inc.

Technical Solution: Corning has developed advanced cellular ceramic substrates for diesel particulate filters (DPFs) using their proprietary extrusion technology. Their DuraTrap® filter technology features a honeycomb structure with alternately plugged channels that force exhaust gases through porous ceramic walls. The company employs cordierite and silicon carbide materials, with their latest innovations focusing on thin-wall designs (as thin as 2-5 mils) that optimize filtration efficiency while minimizing backpressure. Corning's prototyping process involves computer modeling for flow dynamics, followed by small-scale extrusion trials using specialized dies that create the precise cell geometry and wall porosity required. They've developed rapid thermal cycling techniques to evaluate material durability and have implemented advanced coating methods for catalytic functionality integration directly into the substrate material[1][3]. Their manufacturing process allows for customization of cell density (typically 100-300 cells per square inch) and porosity levels (45-65%) to meet specific engine requirements.

Strengths: Industry-leading expertise in ceramic extrusion technology; proprietary materials with superior thermal shock resistance; integrated manufacturing capabilities from raw materials to finished products. Weaknesses: Higher production costs compared to some competitors; cordierite materials may have limitations in extremely high-temperature applications requiring specialized silicon carbide alternatives.

MANN+HUMMEL GmbH

Technical Solution: MANN+HUMMEL has developed innovative approaches to DPF substrate prototyping with a focus on metal fiber technologies alongside traditional ceramic options. Their metal fiber substrates utilize sintered metal fibers (typically stainless steel alloys) with controlled porosity (40-60%) and fiber diameter (8-20 microns) to create flexible filter structures. The company's prototyping process begins with computational modeling to optimize fiber orientation and packing density for specific filtration requirements. MANN+HUMMEL employs specialized sintering techniques that create strong inter-fiber bonds while maintaining high porosity and permeability. Their hybrid substrate designs combine different materials in layered structures to optimize filtration efficiency across varying particle size ranges. The company has developed proprietary coating methods for applying catalytic materials to metal fiber substrates, overcoming traditional adhesion challenges[6]. Their prototyping facilities include specialized flow benches that can measure pressure drop characteristics under pulsating flow conditions that simulate real engine operation. MANN+HUMMEL's latest innovations include 3D-printed substrate prototypes with complex internal geometries that would be impossible to create using traditional manufacturing methods, enabling rapid iteration of novel filter designs before scaling to production.

Strengths: Expertise in both ceramic and metal fiber substrate technologies; metal fiber substrates offer excellent mechanical durability and thermal conductivity; flexible manufacturing capabilities for customized solutions. Weaknesses: Metal fiber substrates typically have higher cost than ceramic alternatives; potential for oxidation at extremely high temperatures; more complex manufacturing process for consistent quality control.

Key Patents and Technical Innovations in DPF Substrate Design

Method for producing a porous substrate for a catalyst or a filter to remove soot particle from an exhaust gas flow of an internal combustion engine, comprises wetting a filter substrate made of a ceramic material with monomers

PatentInactiveDE102007028495A1

Innovation

- Wetting the filter substrate with monomers followed by an initiator to form polymers that fill and seal the microcracks, which burn off during high temperatures, maintaining thermal stability and preventing particle ingress.

Catalytic diesel particulate filter and manufacturing method thereof

PatentInactiveUS20090247399A1

Innovation

- A catalytic diesel particulate filter design featuring separate ceria-based and noble metal-based catalyst coat layers on a honeycomb structure substrate, with the ceria layer containing no noble metal and the noble metal layer supported by a metal oxide, allowing oxygen to be supplied to low-concentration areas and enhancing low-temperature activity.

Environmental Regulations Driving DPF Development

The evolution of environmental regulations has been the primary catalyst for diesel particulate filter (DPF) development over the past three decades. Since the 1990s, increasingly stringent emissions standards have been implemented across major markets, with the European Union, United States, and Japan leading the regulatory framework. The Euro standards in Europe, EPA regulations in the US, and corresponding Japanese emissions limits have progressively reduced allowable particulate matter (PM) emissions by over 95% from their initial levels.

The California Air Resources Board (CARB) has been particularly influential, often establishing standards that eventually become nationwide requirements in the US. Their Truck and Bus Regulation mandated DPF retrofits for older diesel vehicles, creating significant market demand for cost-effective filter solutions. Similarly, the European Commission's implementation of Euro 6/VI standards has necessitated advanced DPF technologies capable of capturing ultrafine particles below 100 nanometers.

Regulatory focus has expanded beyond just mass-based PM measurements to include particle number (PN) limits, recognizing the health impacts of smaller particles that contribute minimally to overall mass. This shift has driven the development of more efficient filtration substrates with optimized pore structures and enhanced surface treatments to capture nanoparticles while maintaining acceptable backpressure levels.

Real Driving Emissions (RDE) testing requirements have further complicated DPF substrate development, as filters must now perform effectively across diverse operating conditions rather than just standardized laboratory cycles. This has led to innovations in thermal management and regeneration strategies integrated into substrate designs to ensure consistent performance in variable real-world scenarios.

Future regulatory trends indicate continued tightening of emissions standards globally, with emerging economies like China and India accelerating their adoption of Euro-equivalent standards. The regulatory timeline for implementation creates distinct market windows for new DPF technologies, with typically 3-5 years between announcement and enforcement of new standards.

Non-road mobile machinery (NRMM) and marine applications represent expanding regulatory frontiers, with recent legislation extending DPF requirements to these sectors. This diversification of application environments demands specialized substrate solutions capable of withstanding unique operational stresses while maintaining filtration efficiency.

The regulatory landscape has also begun addressing the entire lifecycle of DPF systems, with requirements emerging for durability verification, in-use compliance monitoring, and end-of-life recycling considerations. These evolving requirements significantly influence prototype development priorities, particularly regarding material selection and structural design parameters.

The California Air Resources Board (CARB) has been particularly influential, often establishing standards that eventually become nationwide requirements in the US. Their Truck and Bus Regulation mandated DPF retrofits for older diesel vehicles, creating significant market demand for cost-effective filter solutions. Similarly, the European Commission's implementation of Euro 6/VI standards has necessitated advanced DPF technologies capable of capturing ultrafine particles below 100 nanometers.

Regulatory focus has expanded beyond just mass-based PM measurements to include particle number (PN) limits, recognizing the health impacts of smaller particles that contribute minimally to overall mass. This shift has driven the development of more efficient filtration substrates with optimized pore structures and enhanced surface treatments to capture nanoparticles while maintaining acceptable backpressure levels.

Real Driving Emissions (RDE) testing requirements have further complicated DPF substrate development, as filters must now perform effectively across diverse operating conditions rather than just standardized laboratory cycles. This has led to innovations in thermal management and regeneration strategies integrated into substrate designs to ensure consistent performance in variable real-world scenarios.

Future regulatory trends indicate continued tightening of emissions standards globally, with emerging economies like China and India accelerating their adoption of Euro-equivalent standards. The regulatory timeline for implementation creates distinct market windows for new DPF technologies, with typically 3-5 years between announcement and enforcement of new standards.

Non-road mobile machinery (NRMM) and marine applications represent expanding regulatory frontiers, with recent legislation extending DPF requirements to these sectors. This diversification of application environments demands specialized substrate solutions capable of withstanding unique operational stresses while maintaining filtration efficiency.

The regulatory landscape has also begun addressing the entire lifecycle of DPF systems, with requirements emerging for durability verification, in-use compliance monitoring, and end-of-life recycling considerations. These evolving requirements significantly influence prototype development priorities, particularly regarding material selection and structural design parameters.

Cost-Benefit Analysis of Prototype Manufacturing Approaches

When evaluating different approaches to prototyping Diesel Particulate Filter (DPF) substrates, a comprehensive cost-benefit analysis reveals significant variations across manufacturing methods. Traditional manufacturing techniques such as extrusion molding require substantial initial investment in tooling and equipment, ranging from $50,000 to $200,000, but offer economies of scale for larger production runs. The per-unit cost decreases significantly when producing more than 500 units, making this approach cost-effective for later-stage development.

In contrast, additive manufacturing technologies present lower initial investment requirements ($15,000-$75,000) but higher per-unit costs. 3D printing of ceramic substrates costs approximately $200-600 per unit compared to $50-150 for traditional methods at scale. However, the rapid iteration capability of additive manufacturing can reduce development cycles by 40-60%, potentially saving months of development time and associated labor costs.

Laboratory-scale coating methods represent the most accessible entry point, with initial investments as low as $5,000-20,000. While these methods produce substrates with less consistent properties than industrial approaches, they enable rapid proof-of-concept testing at approximately $100-300 per prototype. This approach is particularly valuable for early-stage research when multiple formulations need evaluation.

Time-to-market considerations significantly impact the overall economic equation. Traditional manufacturing methods typically require 2-4 months for tooling development before production can begin, while additive manufacturing can deliver initial prototypes within 1-2 weeks. This acceleration can provide substantial competitive advantages, particularly in fast-evolving regulatory environments.

Quality and performance metrics must also factor into the cost-benefit calculation. Traditionally manufactured substrates typically demonstrate 10-15% better filtration efficiency and 5-10% lower pressure drop than additively manufactured alternatives. These performance differences can significantly impact downstream development costs and ultimate product viability.

Hybrid approaches combining multiple manufacturing methods often yield the optimal cost-benefit ratio across the development lifecycle. Early conceptual work benefits from low-cost laboratory methods, while mid-stage development leverages the speed of additive manufacturing. Final validation and pre-production can then transition to traditional manufacturing methods that better represent production-intent components.

In contrast, additive manufacturing technologies present lower initial investment requirements ($15,000-$75,000) but higher per-unit costs. 3D printing of ceramic substrates costs approximately $200-600 per unit compared to $50-150 for traditional methods at scale. However, the rapid iteration capability of additive manufacturing can reduce development cycles by 40-60%, potentially saving months of development time and associated labor costs.

Laboratory-scale coating methods represent the most accessible entry point, with initial investments as low as $5,000-20,000. While these methods produce substrates with less consistent properties than industrial approaches, they enable rapid proof-of-concept testing at approximately $100-300 per prototype. This approach is particularly valuable for early-stage research when multiple formulations need evaluation.

Time-to-market considerations significantly impact the overall economic equation. Traditional manufacturing methods typically require 2-4 months for tooling development before production can begin, while additive manufacturing can deliver initial prototypes within 1-2 weeks. This acceleration can provide substantial competitive advantages, particularly in fast-evolving regulatory environments.

Quality and performance metrics must also factor into the cost-benefit calculation. Traditionally manufactured substrates typically demonstrate 10-15% better filtration efficiency and 5-10% lower pressure drop than additively manufactured alternatives. These performance differences can significantly impact downstream development costs and ultimate product viability.

Hybrid approaches combining multiple manufacturing methods often yield the optimal cost-benefit ratio across the development lifecycle. Early conceptual work benefits from low-cost laboratory methods, while mid-stage development leverages the speed of additive manufacturing. Final validation and pre-production can then transition to traditional manufacturing methods that better represent production-intent components.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!