Enhance Diesel Particulate Filter Recycling Processes

SEP 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DPF Recycling Technology Background and Objectives

Diesel Particulate Filters (DPFs) emerged in the early 1980s as a response to increasingly stringent emissions regulations worldwide. These ceramic or metallic devices capture particulate matter (PM) from diesel exhaust, preventing harmful soot particles from entering the atmosphere. The evolution of DPF technology has been closely tied to environmental legislation, with major milestones including the Euro standards in Europe and Tier regulations in the United States, which have progressively reduced allowable particulate emissions.

As these filters have become standard equipment on diesel vehicles since the mid-2000s, a significant challenge has emerged: the accumulation of millions of spent DPFs requiring proper end-of-life management. Traditional disposal methods involve landfilling, which wastes valuable materials and creates environmental hazards due to trapped contaminants like heavy metals and ash.

The technical objective of enhanced DPF recycling processes is multifaceted. Primary goals include recovering valuable materials such as cordierite, silicon carbide, and precious metals (platinum, palladium, rhodium) used as catalysts, while minimizing environmental impact. Additionally, developing economically viable recycling methods that can be scaled industrially represents a critical technical challenge.

Current recycling rates remain low, with estimates suggesting less than 10% of DPFs are effectively recycled globally. This presents both an environmental concern and a missed economic opportunity, as each filter contains approximately 1-3 grams of precious metals worth hundreds of dollars at current market prices.

The technology trajectory shows a clear evolution from basic mechanical crushing and separation methods toward more sophisticated approaches involving thermal, chemical, and hybrid processes. Recent innovations focus on selective recovery techniques that can isolate specific valuable components while neutralizing hazardous materials.

Looking forward, the field aims to develop closed-loop recycling systems where materials recovered from spent DPFs can be directly reincorporated into new filter production. This circular economy approach would significantly reduce the environmental footprint of diesel emission control systems while creating economic incentives for comprehensive collection and processing infrastructure.

The technical challenges that must be overcome include developing energy-efficient separation methods, managing the heterogeneous composition of filter substrates and contaminants, and creating standardized processes that can accommodate the variety of DPF designs currently in use across different vehicle manufacturers and applications.

As these filters have become standard equipment on diesel vehicles since the mid-2000s, a significant challenge has emerged: the accumulation of millions of spent DPFs requiring proper end-of-life management. Traditional disposal methods involve landfilling, which wastes valuable materials and creates environmental hazards due to trapped contaminants like heavy metals and ash.

The technical objective of enhanced DPF recycling processes is multifaceted. Primary goals include recovering valuable materials such as cordierite, silicon carbide, and precious metals (platinum, palladium, rhodium) used as catalysts, while minimizing environmental impact. Additionally, developing economically viable recycling methods that can be scaled industrially represents a critical technical challenge.

Current recycling rates remain low, with estimates suggesting less than 10% of DPFs are effectively recycled globally. This presents both an environmental concern and a missed economic opportunity, as each filter contains approximately 1-3 grams of precious metals worth hundreds of dollars at current market prices.

The technology trajectory shows a clear evolution from basic mechanical crushing and separation methods toward more sophisticated approaches involving thermal, chemical, and hybrid processes. Recent innovations focus on selective recovery techniques that can isolate specific valuable components while neutralizing hazardous materials.

Looking forward, the field aims to develop closed-loop recycling systems where materials recovered from spent DPFs can be directly reincorporated into new filter production. This circular economy approach would significantly reduce the environmental footprint of diesel emission control systems while creating economic incentives for comprehensive collection and processing infrastructure.

The technical challenges that must be overcome include developing energy-efficient separation methods, managing the heterogeneous composition of filter substrates and contaminants, and creating standardized processes that can accommodate the variety of DPF designs currently in use across different vehicle manufacturers and applications.

Market Analysis for DPF Recycling Solutions

The global market for Diesel Particulate Filter (DPF) recycling solutions is experiencing significant growth driven by stringent emission regulations and increasing environmental consciousness. Currently valued at approximately $1.2 billion, the market is projected to expand at a compound annual growth rate of 5.8% through 2028, reflecting the rising demand for sustainable automotive waste management solutions.

Regional analysis reveals that Europe dominates the DPF recycling market, accounting for nearly 40% of global market share. This dominance stems from the region's early adoption of strict emission standards and well-established recycling infrastructure. North America follows with roughly 30% market share, while Asia-Pacific represents the fastest-growing region with annual growth rates exceeding 7%, primarily driven by China and India's rapidly expanding automotive sectors and tightening environmental regulations.

The demand landscape for DPF recycling is primarily shaped by three key factors. First, the increasing global vehicle fleet, particularly diesel-powered commercial vehicles, has expanded the potential recyclable DPF pool. Second, regulatory frameworks such as Euro 6 standards in Europe and equivalent regulations worldwide have mandated DPF installation in diesel vehicles, creating a substantial future recycling market. Third, the rising costs of precious metals used in DPFs, including platinum, palladium, and rhodium, have enhanced the economic viability of recycling operations.

Market segmentation reveals distinct customer groups with varying needs. Original Equipment Manufacturers (OEMs) seek recycling partnerships to fulfill extended producer responsibility obligations and enhance sustainability credentials. Fleet operators prioritize cost-effective solutions that minimize vehicle downtime. Meanwhile, independent recyclers focus on maximizing precious metal recovery rates while minimizing processing costs.

Pricing trends indicate that the value proposition of DPF recycling is strengthening. The average recycling service cost ranges from $50-200 per unit, while recovered materials can yield $100-400 in revenue depending on filter type, condition, and precious metal content. This favorable economics has attracted new market entrants, intensifying competition.

Distribution channels are evolving toward more integrated models. Traditional collection networks through automotive service centers are being supplemented by direct manufacturer take-back programs and specialized recycling service providers offering comprehensive solutions including logistics, processing, and certification of proper disposal.

Future market growth will likely be driven by technological innovations improving recovery rates, regulatory tightening around proper disposal, and increasing awareness of circular economy principles in the automotive sector. Emerging markets in Asia and Latin America present significant expansion opportunities as their vehicle fleets mature and environmental regulations strengthen.

Regional analysis reveals that Europe dominates the DPF recycling market, accounting for nearly 40% of global market share. This dominance stems from the region's early adoption of strict emission standards and well-established recycling infrastructure. North America follows with roughly 30% market share, while Asia-Pacific represents the fastest-growing region with annual growth rates exceeding 7%, primarily driven by China and India's rapidly expanding automotive sectors and tightening environmental regulations.

The demand landscape for DPF recycling is primarily shaped by three key factors. First, the increasing global vehicle fleet, particularly diesel-powered commercial vehicles, has expanded the potential recyclable DPF pool. Second, regulatory frameworks such as Euro 6 standards in Europe and equivalent regulations worldwide have mandated DPF installation in diesel vehicles, creating a substantial future recycling market. Third, the rising costs of precious metals used in DPFs, including platinum, palladium, and rhodium, have enhanced the economic viability of recycling operations.

Market segmentation reveals distinct customer groups with varying needs. Original Equipment Manufacturers (OEMs) seek recycling partnerships to fulfill extended producer responsibility obligations and enhance sustainability credentials. Fleet operators prioritize cost-effective solutions that minimize vehicle downtime. Meanwhile, independent recyclers focus on maximizing precious metal recovery rates while minimizing processing costs.

Pricing trends indicate that the value proposition of DPF recycling is strengthening. The average recycling service cost ranges from $50-200 per unit, while recovered materials can yield $100-400 in revenue depending on filter type, condition, and precious metal content. This favorable economics has attracted new market entrants, intensifying competition.

Distribution channels are evolving toward more integrated models. Traditional collection networks through automotive service centers are being supplemented by direct manufacturer take-back programs and specialized recycling service providers offering comprehensive solutions including logistics, processing, and certification of proper disposal.

Future market growth will likely be driven by technological innovations improving recovery rates, regulatory tightening around proper disposal, and increasing awareness of circular economy principles in the automotive sector. Emerging markets in Asia and Latin America present significant expansion opportunities as their vehicle fleets mature and environmental regulations strengthen.

Current Challenges in DPF Recycling Technologies

Despite significant advancements in diesel particulate filter (DPF) recycling technologies, the industry continues to face substantial challenges that impede widespread implementation and efficiency. The primary obstacle remains the complex composition of DPFs, which typically contain a ceramic substrate coated with precious metals such as platinum, palladium, and rhodium, encased in a stainless steel housing. This heterogeneous structure necessitates sophisticated separation techniques that are both technically demanding and energy-intensive.

Current recycling processes exhibit low recovery rates for precious metals, with industry averages hovering between 60-75%, representing significant economic losses considering the high market value of these materials. The thermal processes commonly employed for ash and soot removal operate at temperatures exceeding 600°C, resulting in substantial energy consumption and associated carbon emissions that contradict sustainability objectives.

Chemical leaching methods, while effective for metal recovery, generate hazardous waste streams containing acids and heavy metals that require additional treatment and disposal protocols. This creates a secondary environmental burden that diminishes the net ecological benefit of recycling efforts. Furthermore, the variability in DPF designs across manufacturers complicates the development of standardized recycling protocols, necessitating customized approaches that reduce operational efficiency.

The economic viability of recycling operations is further challenged by fluctuating precious metal prices and high operational costs. Current estimates indicate that processing costs can consume 40-60% of the recovered material value, creating marginal profitability that discourages investment in advanced recycling infrastructure. This economic constraint is particularly pronounced for smaller recycling facilities that lack economies of scale.

Regulatory frameworks governing DPF recycling remain inconsistent across regions, creating compliance challenges for operators with international operations. The classification of spent DPFs as hazardous waste in certain jurisdictions imposes additional handling, transportation, and documentation requirements that increase operational complexity and cost.

Technical limitations in contamination detection and sorting technologies result in processing inefficiencies, as filters with varying degrees of contamination and damage require different treatment approaches. Current automated systems struggle to accurately categorize incoming filters, often necessitating manual inspection that reduces throughput and increases labor costs.

The industry also faces significant knowledge gaps regarding the long-term environmental impacts of current recycling methods, particularly concerning airborne emissions from thermal processes and potential groundwater contamination from improper handling of chemical leachates. These uncertainties complicate risk assessment and regulatory compliance efforts.

Current recycling processes exhibit low recovery rates for precious metals, with industry averages hovering between 60-75%, representing significant economic losses considering the high market value of these materials. The thermal processes commonly employed for ash and soot removal operate at temperatures exceeding 600°C, resulting in substantial energy consumption and associated carbon emissions that contradict sustainability objectives.

Chemical leaching methods, while effective for metal recovery, generate hazardous waste streams containing acids and heavy metals that require additional treatment and disposal protocols. This creates a secondary environmental burden that diminishes the net ecological benefit of recycling efforts. Furthermore, the variability in DPF designs across manufacturers complicates the development of standardized recycling protocols, necessitating customized approaches that reduce operational efficiency.

The economic viability of recycling operations is further challenged by fluctuating precious metal prices and high operational costs. Current estimates indicate that processing costs can consume 40-60% of the recovered material value, creating marginal profitability that discourages investment in advanced recycling infrastructure. This economic constraint is particularly pronounced for smaller recycling facilities that lack economies of scale.

Regulatory frameworks governing DPF recycling remain inconsistent across regions, creating compliance challenges for operators with international operations. The classification of spent DPFs as hazardous waste in certain jurisdictions imposes additional handling, transportation, and documentation requirements that increase operational complexity and cost.

Technical limitations in contamination detection and sorting technologies result in processing inefficiencies, as filters with varying degrees of contamination and damage require different treatment approaches. Current automated systems struggle to accurately categorize incoming filters, often necessitating manual inspection that reduces throughput and increases labor costs.

The industry also faces significant knowledge gaps regarding the long-term environmental impacts of current recycling methods, particularly concerning airborne emissions from thermal processes and potential groundwater contamination from improper handling of chemical leachates. These uncertainties complicate risk assessment and regulatory compliance efforts.

Current DPF Recycling Technical Solutions

01 Thermal regeneration methods for DPF recycling

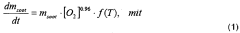

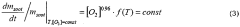

Thermal regeneration is a key method for recycling diesel particulate filters by burning off accumulated soot and particulate matter. This process involves heating the filter to high temperatures in controlled conditions to oxidize carbon deposits without damaging the filter structure. Advanced thermal regeneration techniques can include precise temperature control systems, staged heating processes, and the use of catalysts to lower the combustion temperature required for effective regeneration.- Thermal regeneration methods for DPF recycling: Thermal regeneration is a key method for recycling diesel particulate filters by burning off accumulated soot and particulate matter. This process involves heating the filter to high temperatures, which oxidizes the carbon deposits and restores filter functionality. Advanced thermal regeneration techniques include controlled temperature ramping, oxygen concentration management, and post-treatment cooling processes to prevent thermal damage to the filter substrate while maximizing cleaning efficiency.

- Chemical cleaning processes for DPF restoration: Chemical cleaning processes offer an alternative approach to DPF recycling by using specialized solutions to dissolve and remove accumulated particulate matter, ash, and other contaminants. These processes typically involve immersing the filter in chemical baths or circulating cleaning agents through the filter channels. Effective chemical formulations can break down carbon deposits, metallic ash, and oil residues without damaging the filter substrate or catalyst coatings, thereby extending filter life and improving performance.

- Ultrasonic and mechanical cleaning techniques: Ultrasonic and mechanical cleaning techniques enhance DPF recycling by using sound waves or physical agitation to dislodge trapped particulates. Ultrasonic cleaning employs high-frequency sound waves in a liquid medium to create cavitation bubbles that implode against filter surfaces, effectively removing contaminants from hard-to-reach areas. Mechanical methods include controlled air pulsation, vibration, and reverse flow techniques that physically dislodge accumulated particles without damaging the filter structure.

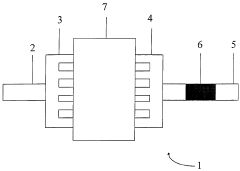

- Diagnostic systems for DPF recycling efficiency: Advanced diagnostic systems play a crucial role in optimizing DPF recycling by accurately assessing filter condition before and after treatment. These systems employ pressure differential measurements, flow testing, and imaging technologies to quantify soot loading, ash accumulation, and channel blockage. Real-time monitoring during the recycling process allows for adaptive control of cleaning parameters, ensuring thorough restoration while preventing damage to the filter substrate.

- Catalyst reactivation and performance enhancement: Catalyst reactivation techniques focus on restoring and enhancing the catalytic functionality of DPFs during recycling. These methods address catalyst poisoning, sintering, and deactivation that occur during normal operation. Specialized treatments can remove contaminants that block active catalyst sites, redistribute catalyst materials for optimal coverage, and in some cases, reapply catalyst coatings to restore or even improve the original catalytic performance, resulting in more efficient particulate oxidation and lower regeneration temperatures.

02 Chemical cleaning processes for DPF restoration

Chemical cleaning processes involve the use of specialized solutions and solvents to dissolve and remove accumulated ash, soot, and other contaminants from diesel particulate filters. These methods can include immersion in cleaning solutions, pressurized spray systems, or ultrasonic cleaning combined with chemical agents. The chemical processes are designed to remove contaminants that cannot be eliminated through thermal regeneration alone, particularly metal oxides and inorganic compounds that remain after combustion of carbonaceous materials.Expand Specific Solutions03 Monitoring and diagnostic systems for DPF recycling efficiency

Advanced monitoring and diagnostic systems are employed to assess the condition of diesel particulate filters before, during, and after the recycling process. These systems utilize pressure differential measurements, flow testing, and imaging technologies to evaluate filter efficiency and identify potential damage. Real-time monitoring during regeneration helps optimize the process parameters and prevent thermal damage to the filter substrate. Diagnostic tools can also determine when a filter has reached the end of its recyclable life and should be replaced.Expand Specific Solutions04 Catalyst recovery and reapplication techniques

Catalyst recovery and reapplication techniques focus on preserving or restoring the catalytic coating on diesel particulate filters during the recycling process. These methods include careful removal of contaminants without damaging the catalyst layer, assessment of catalyst activity, and reapplication of catalytic materials when necessary. Innovative approaches involve the use of specialized washing solutions that selectively remove contaminants while preserving precious metal catalysts, as well as techniques for reactivating partially deactivated catalytic surfaces.Expand Specific Solutions05 Automated and industrial-scale DPF recycling systems

Automated and industrial-scale systems for diesel particulate filter recycling incorporate multiple cleaning stages and high-throughput processing capabilities. These systems often combine thermal, mechanical, and chemical cleaning methods in a sequential process optimized for efficiency and effectiveness. Advanced features include robotic handling, programmable cleaning cycles based on filter type and condition, and environmental controls to manage emissions from the recycling process itself. These systems are designed to handle large volumes of filters while maintaining consistent quality and minimizing manual intervention.Expand Specific Solutions

Key Industry Players in DPF Recycling Sector

The diesel particulate filter (DPF) recycling market is currently in a growth phase, driven by increasing environmental regulations and sustainability initiatives. The global market size is expanding steadily, estimated to reach significant value as automotive manufacturers and environmental technology companies invest in advanced recycling solutions. Technologically, the field shows varying maturity levels, with established players like Bosch, Donaldson, and Toyota leading innovation through patented processes. Automotive giants including Nissan, Peugeot, GM, and Hyundai are integrating recycling considerations into filter design, while specialized environmental firms like Guangzhou Tuokai and Yashen Technology are developing novel extraction and purification methods. Academic-industry partnerships, exemplified by Beijing Jiaotong University's research collaborations, are accelerating technological advancement in this increasingly competitive landscape.

Donaldson Co., Inc.

Technical Solution: Donaldson has pioneered a comprehensive DPF recycling technology that focuses on material recovery and environmental sustainability. Their process begins with a proprietary non-destructive evaluation system that categorizes filters based on remaining useful life, directing some for reconditioning rather than full recycling. For end-of-life filters, Donaldson employs a patented thermal-mechanical separation process that efficiently removes accumulated ash and soot while preserving the ceramic substrate structure. The company's advanced hydrometallurgical technique uses environmentally friendly reagents to extract over 90% of precious metals from the filter material. Donaldson has also developed specialized logistics networks that optimize collection and transportation of used filters, reducing the carbon footprint of the entire recycling chain by approximately 30% compared to traditional methods. Their facilities incorporate energy recovery systems that capture and reuse heat generated during thermal processing stages.

Strengths: Comprehensive approach covering both reconditioning and recycling, environmentally friendly reagents, and optimized logistics network. Weaknesses: Process efficiency decreases with certain contaminants present in filters from specific engine types, and regional availability of their recycling infrastructure remains limited.

Corning, Inc.

Technical Solution: Corning has developed a sophisticated DPF recycling technology leveraging their expertise as a leading manufacturer of ceramic substrates. Their approach centers on a patented high-temperature ceramic recovery process that maintains the structural integrity of the cordierite or silicon carbide materials. The system employs precision ultrasonic cleaning combined with controlled thermal regeneration to remove carbon deposits without damaging the substrate microstructure. Corning's process achieves material recovery rates of up to 85% for ceramic components, significantly higher than industry averages. Their technology incorporates advanced material characterization techniques including X-ray diffraction and electron microscopy to optimize processing parameters for different filter types. The company has also developed a novel catalyst recovery method using supercritical CO2 extraction, which eliminates the need for harsh chemicals typically used in hydrometallurgical processes, reducing environmental impact while maintaining precious metal recovery rates above 92%. Corning's closed-loop manufacturing system reintegrates recovered materials directly into new filter production.

Strengths: Superior ceramic substrate recovery rates, environmentally friendly catalyst extraction, and direct integration with manufacturing. Weaknesses: Higher energy consumption during high-temperature processing stages, and technology primarily optimized for Corning's own filter designs rather than universal application.

Critical Patents and Innovations in DPF Recycling

Particulate filter regeneration method involving the input of a solution containing hydroxyl compounds

PatentWO2000050744A1

Innovation

- A process involving the upstream supply of a solution containing hydroxyl compounds, such as water or alcohols, to the engine's intake or exhaust gases to lower the regeneration temperature and reduce thermal stress on filter materials, potentially combined with catalytic phases or additives, allowing for more frequent and efficient filter regeneration.

Method for regenerating a diesel particulate filter

PatentWO2014079535A1

Innovation

- The method involves optimizing the throttle valve to increase exhaust gas temperature and reduce residual oxygen, using unburned post-injection to control engine operation, and adjusting injection parameters to maximize exhaust gas temperature, thereby enhancing soot oxidation in the diesel particulate filter.

Environmental Impact Assessment of DPF Recycling

The environmental impact assessment of Diesel Particulate Filter (DPF) recycling reveals significant ecological benefits compared to traditional disposal methods. Conventional approaches typically involve landfilling used DPFs, which not only wastes valuable materials but also poses environmental hazards due to potential leaching of heavy metals and other contaminants into soil and groundwater systems. Recycling processes, by contrast, demonstrate substantial reductions in environmental footprint across multiple ecological dimensions.

Life cycle assessment (LCA) studies indicate that DPF recycling can reduce carbon emissions by approximately 30-45% compared to manufacturing new filters from virgin materials. This reduction stems primarily from avoiding energy-intensive mining and processing of precious metals like platinum, palladium, and rhodium. The energy consumption differential is particularly notable, with recycling processes requiring only about 25-35% of the energy needed for new filter production.

Water conservation represents another critical environmental benefit of DPF recycling. Advanced recycling technologies have evolved to implement closed-loop water systems that minimize freshwater consumption by up to 80% compared to primary production methods. These systems also prevent the discharge of contaminated wastewater containing heavy metals and ceramic particles into natural water bodies.

Resource conservation metrics are equally compelling. Effective DPF recycling can recover up to 95% of precious metals contained within the filters, significantly reducing the demand for new mining activities. This translates to approximately 1-3 grams of platinum group metals (PGMs) recovered per filter, depending on the original specifications and vehicle type. The ceramic substrates, once properly processed, can be repurposed in construction materials or road base applications, further reducing waste volumes.

Air quality improvements associated with DPF recycling operations are notable when compared to primary metal production. Recycling facilities emit significantly lower levels of sulfur dioxide, nitrogen oxides, and particulate matter than mining and smelting operations. Modern recycling facilities equipped with advanced emission control systems can reduce airborne pollutants by up to 85% compared to primary production methods.

Land use impact assessments demonstrate that DPF recycling contributes to reduced mining activities, which typically disturb large land areas and can lead to habitat destruction and biodiversity loss. For every ton of recycled DPF material, approximately 3-4 tons of mining waste generation is avoided, significantly reducing the ecological footprint of filter material sourcing.

Life cycle assessment (LCA) studies indicate that DPF recycling can reduce carbon emissions by approximately 30-45% compared to manufacturing new filters from virgin materials. This reduction stems primarily from avoiding energy-intensive mining and processing of precious metals like platinum, palladium, and rhodium. The energy consumption differential is particularly notable, with recycling processes requiring only about 25-35% of the energy needed for new filter production.

Water conservation represents another critical environmental benefit of DPF recycling. Advanced recycling technologies have evolved to implement closed-loop water systems that minimize freshwater consumption by up to 80% compared to primary production methods. These systems also prevent the discharge of contaminated wastewater containing heavy metals and ceramic particles into natural water bodies.

Resource conservation metrics are equally compelling. Effective DPF recycling can recover up to 95% of precious metals contained within the filters, significantly reducing the demand for new mining activities. This translates to approximately 1-3 grams of platinum group metals (PGMs) recovered per filter, depending on the original specifications and vehicle type. The ceramic substrates, once properly processed, can be repurposed in construction materials or road base applications, further reducing waste volumes.

Air quality improvements associated with DPF recycling operations are notable when compared to primary metal production. Recycling facilities emit significantly lower levels of sulfur dioxide, nitrogen oxides, and particulate matter than mining and smelting operations. Modern recycling facilities equipped with advanced emission control systems can reduce airborne pollutants by up to 85% compared to primary production methods.

Land use impact assessments demonstrate that DPF recycling contributes to reduced mining activities, which typically disturb large land areas and can lead to habitat destruction and biodiversity loss. For every ton of recycled DPF material, approximately 3-4 tons of mining waste generation is avoided, significantly reducing the ecological footprint of filter material sourcing.

Regulatory Framework for Automotive Waste Management

The regulatory landscape governing diesel particulate filter (DPF) recycling is complex and continuously evolving, reflecting growing environmental concerns and sustainability imperatives. At the international level, the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and their Disposal provides the overarching framework for managing automotive waste, including spent catalytic components like DPFs. This convention establishes principles for environmentally sound management and restricts certain waste movements across borders.

In the European Union, the End-of-Life Vehicles (ELV) Directive 2000/53/EC mandates specific recovery and recycling targets for vehicles, requiring 95% recovery and 85% recycling by weight. The directive explicitly addresses components containing precious metals, including DPFs. Complementing this, the EU Waste Framework Directive 2008/98/EC establishes the waste hierarchy prioritizing prevention, reuse, recycling, and recovery over disposal, directly influencing DPF management strategies.

The United States approaches DPF regulation primarily through the Resource Conservation and Recovery Act (RCRA) and state-level programs. The EPA's National Vehicle and Fuel Emissions Laboratory oversees compliance with emissions standards that indirectly impact DPF lifecycle management. California's more stringent regulations through CARB (California Air Resources Board) often set precedents for other states, particularly regarding particulate matter emissions and aftertreatment systems.

Asian markets demonstrate varying regulatory maturity. Japan's Automobile Recycling Law mandates proper recycling of vehicle components, while China's rapidly developing regulatory framework includes the Measures for the Administration of Recycling of Scrapped Motor Vehicles, recently updated to address advanced emission control systems like DPFs.

Emerging regulations increasingly focus on circular economy principles, with the EU's Circular Economy Action Plan and similar initiatives worldwide promoting design for recyclability and resource efficiency. These frameworks are shifting from waste management to resource management paradigms, emphasizing material recovery from DPFs.

Industry-specific standards also shape DPF recycling practices. ISO 22628 for vehicle recyclability calculations and SAE standards for automotive recycling provide technical guidelines that complement regulatory requirements. These standards are increasingly incorporating sustainability metrics and lifecycle assessment methodologies specific to emission control systems.

Compliance challenges remain significant, with regulatory fragmentation across jurisdictions creating operational complexities for global recycling operations. Harmonization efforts through international bodies like the OECD and UNEP aim to standardize approaches to automotive waste management, potentially streamlining DPF recycling processes across markets.

In the European Union, the End-of-Life Vehicles (ELV) Directive 2000/53/EC mandates specific recovery and recycling targets for vehicles, requiring 95% recovery and 85% recycling by weight. The directive explicitly addresses components containing precious metals, including DPFs. Complementing this, the EU Waste Framework Directive 2008/98/EC establishes the waste hierarchy prioritizing prevention, reuse, recycling, and recovery over disposal, directly influencing DPF management strategies.

The United States approaches DPF regulation primarily through the Resource Conservation and Recovery Act (RCRA) and state-level programs. The EPA's National Vehicle and Fuel Emissions Laboratory oversees compliance with emissions standards that indirectly impact DPF lifecycle management. California's more stringent regulations through CARB (California Air Resources Board) often set precedents for other states, particularly regarding particulate matter emissions and aftertreatment systems.

Asian markets demonstrate varying regulatory maturity. Japan's Automobile Recycling Law mandates proper recycling of vehicle components, while China's rapidly developing regulatory framework includes the Measures for the Administration of Recycling of Scrapped Motor Vehicles, recently updated to address advanced emission control systems like DPFs.

Emerging regulations increasingly focus on circular economy principles, with the EU's Circular Economy Action Plan and similar initiatives worldwide promoting design for recyclability and resource efficiency. These frameworks are shifting from waste management to resource management paradigms, emphasizing material recovery from DPFs.

Industry-specific standards also shape DPF recycling practices. ISO 22628 for vehicle recyclability calculations and SAE standards for automotive recycling provide technical guidelines that complement regulatory requirements. These standards are increasingly incorporating sustainability metrics and lifecycle assessment methodologies specific to emission control systems.

Compliance challenges remain significant, with regulatory fragmentation across jurisdictions creating operational complexities for global recycling operations. Harmonization efforts through international bodies like the OECD and UNEP aim to standardize approaches to automotive waste management, potentially streamlining DPF recycling processes across markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!