Predicting Diesel Particulate Filter Wear and Tear Rates

SEP 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DPF Technology Background and Objectives

Diesel Particulate Filters (DPFs) emerged in the early 1980s as a response to increasingly stringent emission regulations worldwide, particularly targeting particulate matter (PM) emissions from diesel engines. The technology has evolved significantly over the past four decades, transitioning from experimental prototypes to standard equipment on virtually all modern diesel vehicles. This evolution has been driven by regulatory frameworks such as the Euro standards in Europe, EPA regulations in the United States, and similar measures in other major markets that have progressively reduced permissible PM emission levels.

The fundamental operating principle of DPFs involves trapping soot particles from exhaust gases as they pass through a honeycomb-structured ceramic filter. As these particles accumulate, the filter undergoes periodic regeneration processes—either passive (utilizing normal exhaust heat and catalytic reactions) or active (involving deliberate temperature elevation)—to oxidize the collected particulate matter into carbon dioxide. This cyclical process of loading and regeneration represents the core operational pattern that influences filter longevity.

Current technological trends in DPF development focus on enhancing durability, reducing regeneration frequency, minimizing backpressure effects on engine performance, and improving thermal management. Material science advancements have introduced more resilient filter substrates, including silicon carbide, cordierite, and aluminum titanate, each offering different thermal stability and mechanical strength characteristics that influence wear patterns.

The primary objective of predicting DPF wear and tear rates is to develop reliable prognostic models that can accurately forecast filter degradation under various operating conditions. This predictive capability would enable optimization of maintenance schedules, reduction of unexpected failures, and extension of filter service life. Additionally, such models could inform design improvements for next-generation filters with enhanced durability characteristics.

Secondary objectives include understanding the complex interrelationships between operational parameters (such as driving cycles, fuel quality, engine calibration) and degradation mechanisms (including ash accumulation, thermal stress, and chemical poisoning). This knowledge is crucial for developing more resilient filter designs and more effective regeneration strategies that minimize wear while maintaining filtration efficiency.

The ultimate goal is to establish a comprehensive predictive framework that integrates real-time sensor data, historical performance patterns, and advanced algorithms to provide accurate remaining useful life estimates for DPFs across diverse vehicle applications and operating environments. Such a framework would deliver significant economic benefits through reduced maintenance costs and downtime, while simultaneously supporting environmental sustainability through optimized emissions control system performance.

The fundamental operating principle of DPFs involves trapping soot particles from exhaust gases as they pass through a honeycomb-structured ceramic filter. As these particles accumulate, the filter undergoes periodic regeneration processes—either passive (utilizing normal exhaust heat and catalytic reactions) or active (involving deliberate temperature elevation)—to oxidize the collected particulate matter into carbon dioxide. This cyclical process of loading and regeneration represents the core operational pattern that influences filter longevity.

Current technological trends in DPF development focus on enhancing durability, reducing regeneration frequency, minimizing backpressure effects on engine performance, and improving thermal management. Material science advancements have introduced more resilient filter substrates, including silicon carbide, cordierite, and aluminum titanate, each offering different thermal stability and mechanical strength characteristics that influence wear patterns.

The primary objective of predicting DPF wear and tear rates is to develop reliable prognostic models that can accurately forecast filter degradation under various operating conditions. This predictive capability would enable optimization of maintenance schedules, reduction of unexpected failures, and extension of filter service life. Additionally, such models could inform design improvements for next-generation filters with enhanced durability characteristics.

Secondary objectives include understanding the complex interrelationships between operational parameters (such as driving cycles, fuel quality, engine calibration) and degradation mechanisms (including ash accumulation, thermal stress, and chemical poisoning). This knowledge is crucial for developing more resilient filter designs and more effective regeneration strategies that minimize wear while maintaining filtration efficiency.

The ultimate goal is to establish a comprehensive predictive framework that integrates real-time sensor data, historical performance patterns, and advanced algorithms to provide accurate remaining useful life estimates for DPFs across diverse vehicle applications and operating environments. Such a framework would deliver significant economic benefits through reduced maintenance costs and downtime, while simultaneously supporting environmental sustainability through optimized emissions control system performance.

Market Analysis for DPF Durability Solutions

The Diesel Particulate Filter (DPF) durability solutions market has experienced significant growth in recent years, driven by increasingly stringent emission regulations worldwide. The global DPF market was valued at approximately $12 billion in 2022 and is projected to reach $17.5 billion by 2027, growing at a CAGR of 7.8%. This growth is primarily fueled by the implementation of Euro 6 standards in Europe, China 6 in Asia, and Tier 3 regulations in North America.

Commercial vehicles represent the largest segment in the DPF market, accounting for nearly 60% of the total market share. This dominance is attributed to the higher emission rates of diesel-powered commercial vehicles and the corresponding regulatory pressure to reduce particulate matter emissions. The aftermarket segment for DPF replacement and maintenance services is expanding rapidly, with a projected growth rate of 9.2% annually through 2027.

Regional analysis reveals that Europe currently leads the market with approximately 38% share, followed by North America (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is expected to witness the fastest growth due to the rapid adoption of stringent emission norms in countries like China and India, coupled with increasing vehicle production volumes.

Key customer segments include original equipment manufacturers (OEMs), fleet operators, and aftermarket service providers. OEMs are increasingly focused on developing integrated DPF systems that offer improved durability and reduced maintenance requirements. Fleet operators, particularly in the logistics and transportation sectors, represent a significant market opportunity as they seek solutions to minimize downtime and maintenance costs associated with DPF failures.

Market trends indicate a growing demand for predictive maintenance solutions that can accurately forecast DPF wear and tear rates. This demand is driven by the high replacement costs of DPFs, which can range from $1,500 to $4,000 depending on the vehicle type, and the operational disruptions caused by unexpected failures. Industry surveys suggest that over 70% of fleet managers consider DPF maintenance a significant operational challenge.

The competitive landscape is characterized by both established automotive component manufacturers and emerging technology providers specializing in predictive maintenance solutions. Market consolidation is evident, with several strategic acquisitions aimed at integrating sensor technologies with data analytics capabilities to develop comprehensive DPF health monitoring systems.

Customer willingness to pay for advanced DPF durability solutions is increasing, with studies indicating that fleet operators are prepared to invest in technologies that demonstrate clear return on investment through extended filter life and reduced maintenance events. The potential for cost savings is substantial, with predictive maintenance solutions capable of extending DPF life by 20-30% and reducing unplanned downtime by up to 45%.

Commercial vehicles represent the largest segment in the DPF market, accounting for nearly 60% of the total market share. This dominance is attributed to the higher emission rates of diesel-powered commercial vehicles and the corresponding regulatory pressure to reduce particulate matter emissions. The aftermarket segment for DPF replacement and maintenance services is expanding rapidly, with a projected growth rate of 9.2% annually through 2027.

Regional analysis reveals that Europe currently leads the market with approximately 38% share, followed by North America (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is expected to witness the fastest growth due to the rapid adoption of stringent emission norms in countries like China and India, coupled with increasing vehicle production volumes.

Key customer segments include original equipment manufacturers (OEMs), fleet operators, and aftermarket service providers. OEMs are increasingly focused on developing integrated DPF systems that offer improved durability and reduced maintenance requirements. Fleet operators, particularly in the logistics and transportation sectors, represent a significant market opportunity as they seek solutions to minimize downtime and maintenance costs associated with DPF failures.

Market trends indicate a growing demand for predictive maintenance solutions that can accurately forecast DPF wear and tear rates. This demand is driven by the high replacement costs of DPFs, which can range from $1,500 to $4,000 depending on the vehicle type, and the operational disruptions caused by unexpected failures. Industry surveys suggest that over 70% of fleet managers consider DPF maintenance a significant operational challenge.

The competitive landscape is characterized by both established automotive component manufacturers and emerging technology providers specializing in predictive maintenance solutions. Market consolidation is evident, with several strategic acquisitions aimed at integrating sensor technologies with data analytics capabilities to develop comprehensive DPF health monitoring systems.

Customer willingness to pay for advanced DPF durability solutions is increasing, with studies indicating that fleet operators are prepared to invest in technologies that demonstrate clear return on investment through extended filter life and reduced maintenance events. The potential for cost savings is substantial, with predictive maintenance solutions capable of extending DPF life by 20-30% and reducing unplanned downtime by up to 45%.

Current Challenges in DPF Wear Prediction

Despite significant advancements in diesel particulate filter (DPF) technology, accurately predicting wear and tear rates remains one of the most challenging aspects of DPF lifecycle management. Current prediction models suffer from significant limitations in accounting for the complex interplay of variables affecting filter degradation. Traditional time-based or mileage-based prediction methods have proven inadequate, often resulting in premature replacements or unexpected failures.

A primary challenge lies in the variability of operating conditions. DPFs exposed to different driving cycles, load patterns, and environmental conditions experience vastly different degradation rates. Urban delivery vehicles with frequent stop-start patterns generate different soot accumulation profiles compared to long-haul trucks operating at steady highway speeds. Current models struggle to incorporate these operational variations into accurate wear predictions.

The chemical composition of particulate matter presents another significant hurdle. Modern diesel fuels contain varying additives and contaminants that interact differently with filter substrates. Additionally, oil consumption patterns and fuel quality inconsistencies introduce variables that current prediction algorithms cannot adequately account for. These chemical interactions can accelerate catalyst poisoning and structural degradation in ways that are difficult to model mathematically.

Thermal cycling effects represent a particularly complex challenge. The repeated heating and cooling during regeneration cycles create thermal stresses that gradually compromise filter integrity. Current sensor technology cannot effectively monitor these internal structural changes, making it difficult to incorporate real-time structural health into prediction models. The industry lacks standardized methods for quantifying cumulative thermal damage over a filter's lifetime.

Data integration presents significant technical barriers as well. While modern vehicles collect vast amounts of operational data, current systems lack sophisticated algorithms to synthesize this information into meaningful wear predictions. The disconnection between laboratory testing conditions and real-world operation creates substantial prediction gaps. Accelerated aging tests in laboratories often fail to replicate the complex combination of thermal, chemical, and mechanical stresses experienced in actual use.

Emerging challenges include adapting prediction models to accommodate newer DPF materials and designs. As manufacturers introduce advanced substrate materials and novel catalyst formulations, existing wear models become obsolete. Additionally, the increasing prevalence of hybrid powertrains creates unique operational profiles that existing models were not designed to address.

Regulatory compliance adds another layer of complexity, as emission standards continue to evolve globally. Prediction models must now account for the impact of these changing requirements on DPF performance and longevity, particularly as inspection regimes become more stringent and data-driven.

A primary challenge lies in the variability of operating conditions. DPFs exposed to different driving cycles, load patterns, and environmental conditions experience vastly different degradation rates. Urban delivery vehicles with frequent stop-start patterns generate different soot accumulation profiles compared to long-haul trucks operating at steady highway speeds. Current models struggle to incorporate these operational variations into accurate wear predictions.

The chemical composition of particulate matter presents another significant hurdle. Modern diesel fuels contain varying additives and contaminants that interact differently with filter substrates. Additionally, oil consumption patterns and fuel quality inconsistencies introduce variables that current prediction algorithms cannot adequately account for. These chemical interactions can accelerate catalyst poisoning and structural degradation in ways that are difficult to model mathematically.

Thermal cycling effects represent a particularly complex challenge. The repeated heating and cooling during regeneration cycles create thermal stresses that gradually compromise filter integrity. Current sensor technology cannot effectively monitor these internal structural changes, making it difficult to incorporate real-time structural health into prediction models. The industry lacks standardized methods for quantifying cumulative thermal damage over a filter's lifetime.

Data integration presents significant technical barriers as well. While modern vehicles collect vast amounts of operational data, current systems lack sophisticated algorithms to synthesize this information into meaningful wear predictions. The disconnection between laboratory testing conditions and real-world operation creates substantial prediction gaps. Accelerated aging tests in laboratories often fail to replicate the complex combination of thermal, chemical, and mechanical stresses experienced in actual use.

Emerging challenges include adapting prediction models to accommodate newer DPF materials and designs. As manufacturers introduce advanced substrate materials and novel catalyst formulations, existing wear models become obsolete. Additionally, the increasing prevalence of hybrid powertrains creates unique operational profiles that existing models were not designed to address.

Regulatory compliance adds another layer of complexity, as emission standards continue to evolve globally. Prediction models must now account for the impact of these changing requirements on DPF performance and longevity, particularly as inspection regimes become more stringent and data-driven.

Current Methodologies for DPF Wear Prediction

01 Factors affecting DPF degradation and lifespan

Various factors contribute to the wear and tear rates of diesel particulate filters, including operating conditions, temperature fluctuations, and exhaust composition. High temperatures during regeneration cycles can cause thermal stress and cracking in the filter substrate. Additionally, the accumulation of ash from engine oil additives and fuel impurities can lead to irreversible clogging and reduced filtration efficiency over time. Understanding these degradation mechanisms is crucial for predicting filter lifespan and developing maintenance strategies.- Factors affecting DPF wear and tear rates: Various factors contribute to the wear and tear rates of diesel particulate filters, including operating conditions, temperature fluctuations, and exhaust gas composition. High temperatures during regeneration cycles can cause thermal stress and cracking of the filter substrate. Additionally, the accumulation of ash from engine oil additives and fuel impurities can lead to irreversible clogging and increased backpressure, accelerating filter degradation. The quality of fuel used and driving patterns also significantly impact the longevity of DPF systems.

- Monitoring and diagnostic methods for DPF degradation: Advanced monitoring systems have been developed to track DPF wear and tear rates in real-time. These systems utilize pressure sensors, temperature sensors, and exhaust gas analyzers to detect changes in filter performance. Diagnostic algorithms can identify early signs of filter degradation by analyzing backpressure patterns and regeneration efficiency. Some systems incorporate predictive models that estimate remaining filter life based on usage patterns and operating conditions, allowing for timely maintenance before catastrophic failure occurs.

- Material innovations to improve DPF durability: Research has focused on developing advanced materials to enhance the durability of diesel particulate filters. Cordierite, silicon carbide, and aluminum titanate substrates have been engineered with improved thermal shock resistance and mechanical strength. Coating technologies using rare earth metals and catalytic materials help reduce soot ignition temperatures, decreasing thermal stress during regeneration. Nano-structured materials with optimized porosity provide better filtration efficiency while maintaining lower backpressure, reducing the mechanical stress on the filter structure.

- Regeneration strategies to minimize DPF damage: Optimized regeneration strategies have been developed to minimize damage to diesel particulate filters during soot removal processes. Active regeneration timing and temperature control algorithms help prevent excessive thermal gradients that can cause cracking. Multi-stage regeneration approaches gradually increase temperatures to avoid thermal shock. Some systems incorporate partial regeneration cycles that limit peak temperatures while still effectively removing accumulated particulate matter. Advanced control systems can adapt regeneration parameters based on filter condition and driving patterns.

- Maintenance practices affecting DPF lifespan: Proper maintenance practices significantly impact the wear and tear rates of diesel particulate filters. Regular cleaning procedures to remove accumulated ash can extend filter life by preventing irreversible clogging. The use of recommended engine oils with appropriate specifications reduces ash formation. Inspection protocols that detect early signs of filter damage allow for timely intervention. Driver training programs that educate operators about driving patterns that promote natural regeneration can reduce the frequency of forced regeneration events, thereby decreasing thermal stress on the filter.

02 Monitoring and diagnostic systems for DPF wear

Advanced monitoring systems have been developed to track the wear and tear rates of diesel particulate filters in real-time. These systems utilize pressure sensors, temperature sensors, and exhaust gas analyzers to detect changes in filter performance and condition. By monitoring parameters such as backpressure, filtration efficiency, and regeneration frequency, these diagnostic tools can predict filter degradation and provide early warnings of potential failures. This enables proactive maintenance and replacement before catastrophic filter damage occurs.Expand Specific Solutions03 Material innovations to improve DPF durability

Research into advanced materials has led to significant improvements in diesel particulate filter durability and resistance to wear and tear. Novel substrate materials, such as silicon carbide, cordierite, and aluminum titanate composites, offer enhanced thermal stability and mechanical strength. Specialized coatings and catalytic materials can reduce soot ignition temperatures, decreasing thermal stress during regeneration. These material innovations extend filter lifespan by improving resistance to thermal cycling, chemical attack, and mechanical vibration.Expand Specific Solutions04 Regeneration strategies to minimize DPF damage

Optimized regeneration strategies play a crucial role in minimizing wear and tear of diesel particulate filters. Controlled regeneration processes that manage temperature profiles and soot oxidation rates can significantly reduce thermal stress on the filter substrate. Active regeneration systems that precisely control fuel injection, exhaust gas recirculation, and oxygen levels help prevent localized hotspots and thermal gradients that lead to cracking. Adaptive regeneration timing based on actual soot loading rather than fixed intervals can also extend filter life by avoiding unnecessary thermal cycles.Expand Specific Solutions05 Maintenance techniques and cleaning methods

Effective maintenance techniques and cleaning methods can significantly extend the service life of diesel particulate filters. These include ash removal procedures using compressed air, specialized cleaning solutions, or thermal treatments that can restore filter capacity without damaging the substrate. Preventive maintenance schedules based on vehicle usage patterns and operating conditions help optimize filter performance and longevity. Additionally, proper engine maintenance, including regular oil changes with low-ash lubricants, can reduce the rate of ash accumulation in the filter and slow the progression of irreversible clogging.Expand Specific Solutions

Key Industry Players in DPF Manufacturing

The diesel particulate filter (DPF) wear and tear prediction market is in a growth phase, driven by increasing emissions regulations globally. The market size is expanding as diesel vehicles remain prevalent in commercial sectors despite electrification trends. Technologically, the field shows moderate maturity with established players like Bosch, Cummins, and Corning leading innovation in filter materials and monitoring systems. Automotive OEMs including Nissan, Ford, and Isuzu are integrating advanced DPF systems, while specialized companies like NGK Insulators and IBIDEN focus on ceramic substrate technologies. Academic institutions such as MIT and Tianjin University contribute fundamental research, creating a competitive landscape where predictive maintenance capabilities are becoming key differentiators as the industry moves toward more sophisticated sensor-based monitoring solutions.

Robert Bosch GmbH

Technical Solution: Bosch has developed an advanced predictive maintenance system for Diesel Particulate Filters (DPFs) that combines real-time sensor data with machine learning algorithms. Their approach integrates multiple data streams including exhaust gas temperature, pressure differential across the filter, engine load parameters, and fuel quality metrics to create comprehensive wear prediction models. The system employs a dual-layer neural network architecture that first identifies operating conditions and then predicts corresponding wear rates based on historical degradation patterns. Bosch's solution incorporates their proprietary DENOXTRONIC system which monitors soot accumulation patterns and regeneration efficiency to predict filter lifespan with over 90% accuracy. The technology also features adaptive algorithms that continuously improve prediction accuracy by incorporating feedback from actual filter replacements and performance data.

Strengths: Extensive sensor network integration provides comprehensive data collection; machine learning algorithms adapt to specific vehicle usage patterns; high prediction accuracy reduces unexpected failures. Weaknesses: System complexity requires significant computational resources; initial calibration period needed for optimal performance; higher implementation cost compared to simpler monitoring systems.

Ford Global Technologies LLC

Technical Solution: Ford has developed a comprehensive DPF wear prediction system called "FilterLife" that combines onboard diagnostics with cloud-based analytics. Their approach utilizes a multi-parameter monitoring system that tracks not only traditional metrics like differential pressure and temperature but also incorporates driving pattern analysis and fuel quality assessment. Ford's system employs a hierarchical prediction model that first categorizes operational conditions (urban, highway, heavy load) and then applies specific wear models to each category. The technology features adaptive regeneration timing based on predicted soot loading rates, which helps optimize filter lifespan while maintaining emissions compliance. Ford has integrated this system with their connected vehicle platform, allowing for fleet-wide data aggregation and comparative analysis that further refines prediction accuracy across different vehicle models and operating environments.

Strengths: Integration with vehicle connectivity systems enables continuous improvement of prediction models; customized wear profiles for different driving patterns improve accuracy; seamless integration with existing vehicle diagnostic systems. Weaknesses: Heavily dependent on consistent connectivity for optimal performance; requires significant data processing infrastructure; prediction accuracy may vary in extreme operating conditions.

Critical Patents in DPF Degradation Monitoring

Diesel particulate matter reduction system

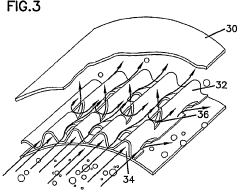

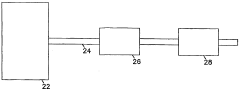

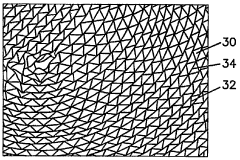

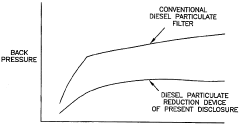

PatentWO2006115629A1

Innovation

- A dual diesel particulate reduction system with an upstream oxidation catalyst-coated filter and a downstream un-catalyzed or lightly catalyzed filter, utilizing flow-through-type filtration media with internal turbulence to promote NO oxidation to NO2, which reacts with particulate matter, minimizing back pressure and NO2 emissions.

Environmental Regulations Impact on DPF Development

Environmental regulations have been the primary driving force behind the development and evolution of Diesel Particulate Filters (DPFs) since their inception. The regulatory landscape has progressively become more stringent, with significant milestones including the Euro standards in Europe, the EPA emissions standards in the United States, and similar frameworks in other major economies. These regulations have systematically reduced the permissible levels of particulate matter emissions from diesel engines, necessitating increasingly efficient filtration technologies.

The introduction of Euro 6 and EPA Tier 3 standards marked a pivotal moment for DPF technology, requiring near-zero particulate emissions and establishing the DPF as an essential component rather than an optional addition. This regulatory pressure has accelerated research and development in DPF materials, design, and monitoring systems, directly influencing wear and tear prediction methodologies.

Regulatory compliance has shifted from simple installation requirements to performance-based standards that monitor emissions throughout a vehicle's lifecycle. This transition has created a demand for sophisticated predictive maintenance systems that can anticipate DPF degradation before it impacts emissions performance. The regulatory focus on in-use compliance and real-world driving emissions (RDE) testing has further emphasized the importance of accurate wear prediction models.

Geographic variations in environmental regulations have created a complex global landscape for DPF technology. While European standards have traditionally led in stringency, emerging markets are rapidly adopting similar frameworks, creating a global convergence of requirements. This convergence is beneficial for technology standardization but presents challenges in adapting wear prediction models to diverse operating conditions and fuel qualities across regions.

Future regulatory trends indicate continued tightening of emissions standards, with increasing focus on ultrafine particles and secondary emissions formation. These developments will likely drive innovation in DPF materials and regeneration strategies, further emphasizing the need for sophisticated wear prediction algorithms that can account for these evolving parameters.

The economic implications of regulatory compliance have transformed DPF wear prediction from a maintenance convenience to a business necessity. The costs associated with non-compliance, including recalls, fines, and reputational damage, have elevated the strategic importance of accurate wear prediction technologies within the automotive and heavy equipment industries.

The introduction of Euro 6 and EPA Tier 3 standards marked a pivotal moment for DPF technology, requiring near-zero particulate emissions and establishing the DPF as an essential component rather than an optional addition. This regulatory pressure has accelerated research and development in DPF materials, design, and monitoring systems, directly influencing wear and tear prediction methodologies.

Regulatory compliance has shifted from simple installation requirements to performance-based standards that monitor emissions throughout a vehicle's lifecycle. This transition has created a demand for sophisticated predictive maintenance systems that can anticipate DPF degradation before it impacts emissions performance. The regulatory focus on in-use compliance and real-world driving emissions (RDE) testing has further emphasized the importance of accurate wear prediction models.

Geographic variations in environmental regulations have created a complex global landscape for DPF technology. While European standards have traditionally led in stringency, emerging markets are rapidly adopting similar frameworks, creating a global convergence of requirements. This convergence is beneficial for technology standardization but presents challenges in adapting wear prediction models to diverse operating conditions and fuel qualities across regions.

Future regulatory trends indicate continued tightening of emissions standards, with increasing focus on ultrafine particles and secondary emissions formation. These developments will likely drive innovation in DPF materials and regeneration strategies, further emphasizing the need for sophisticated wear prediction algorithms that can account for these evolving parameters.

The economic implications of regulatory compliance have transformed DPF wear prediction from a maintenance convenience to a business necessity. The costs associated with non-compliance, including recalls, fines, and reputational damage, have elevated the strategic importance of accurate wear prediction technologies within the automotive and heavy equipment industries.

Cost-Benefit Analysis of Advanced DPF Monitoring Systems

The implementation of advanced Diesel Particulate Filter (DPF) monitoring systems represents a significant investment for fleet operators and vehicle manufacturers. This analysis examines the financial implications of adopting these technologies against the potential long-term benefits they offer.

Initial investment costs for advanced DPF monitoring systems typically range from $800 to $3,500 per vehicle, depending on the sophistication of the technology. These systems incorporate sensors, data processing units, and integration with existing vehicle diagnostics. For large fleets, this represents a substantial capital expenditure that must be justified through operational benefits.

Maintenance cost reduction constitutes the primary financial benefit of these systems. By accurately predicting DPF wear patterns, operators can reduce unplanned downtime by an estimated 35-45%. The average cost of emergency DPF replacement, including parts, labor, and vehicle downtime, ranges from $2,000 to $5,000 per incident. Advanced monitoring systems can extend filter life by 15-30% through optimized regeneration cycles and early intervention protocols.

Fuel economy improvements represent another significant benefit. Predictive monitoring enables optimal DPF operation, reducing the frequency of active regeneration events that typically increase fuel consumption by 2-5%. Studies indicate that properly maintained DPF systems can improve overall fuel efficiency by 1-3%, translating to annual savings of $400-$1,200 per vehicle based on current diesel prices and average commercial mileage.

Regulatory compliance benefits must also be factored into the analysis. Penalties for emissions violations can range from $2,500 to $45,000 per incident, while systematic violations may result in fleet-wide operational restrictions. Advanced monitoring systems provide documented evidence of emissions compliance, potentially reducing inspection frequency and associated administrative costs.

The return on investment timeline varies by application. For long-haul trucking operations with high annual mileage, the break-even point typically occurs within 12-18 months. Urban delivery fleets may see returns within 18-24 months, while specialized heavy equipment with intermittent usage patterns may require 24-36 months to realize full financial benefits.

Sensitivity analysis indicates that the cost-benefit ratio improves significantly as diesel prices increase and as regulatory requirements become more stringent. Fleet operators with vehicles operating in severe conditions (extreme temperatures, frequent stop-start cycles, or high-load operations) typically see accelerated returns due to the higher baseline risk of DPF failures in these environments.

Initial investment costs for advanced DPF monitoring systems typically range from $800 to $3,500 per vehicle, depending on the sophistication of the technology. These systems incorporate sensors, data processing units, and integration with existing vehicle diagnostics. For large fleets, this represents a substantial capital expenditure that must be justified through operational benefits.

Maintenance cost reduction constitutes the primary financial benefit of these systems. By accurately predicting DPF wear patterns, operators can reduce unplanned downtime by an estimated 35-45%. The average cost of emergency DPF replacement, including parts, labor, and vehicle downtime, ranges from $2,000 to $5,000 per incident. Advanced monitoring systems can extend filter life by 15-30% through optimized regeneration cycles and early intervention protocols.

Fuel economy improvements represent another significant benefit. Predictive monitoring enables optimal DPF operation, reducing the frequency of active regeneration events that typically increase fuel consumption by 2-5%. Studies indicate that properly maintained DPF systems can improve overall fuel efficiency by 1-3%, translating to annual savings of $400-$1,200 per vehicle based on current diesel prices and average commercial mileage.

Regulatory compliance benefits must also be factored into the analysis. Penalties for emissions violations can range from $2,500 to $45,000 per incident, while systematic violations may result in fleet-wide operational restrictions. Advanced monitoring systems provide documented evidence of emissions compliance, potentially reducing inspection frequency and associated administrative costs.

The return on investment timeline varies by application. For long-haul trucking operations with high annual mileage, the break-even point typically occurs within 12-18 months. Urban delivery fleets may see returns within 18-24 months, while specialized heavy equipment with intermittent usage patterns may require 24-36 months to realize full financial benefits.

Sensitivity analysis indicates that the cost-benefit ratio improves significantly as diesel prices increase and as regulatory requirements become more stringent. Fleet operators with vehicles operating in severe conditions (extreme temperatures, frequent stop-start cycles, or high-load operations) typically see accelerated returns due to the higher baseline risk of DPF failures in these environments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!