Diesel Particulate Filter Regeneration vs Replacement

SEP 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DPF Technology Background and Objectives

Diesel Particulate Filters (DPFs) emerged in the early 1980s as a response to increasingly stringent emissions regulations targeting particulate matter (PM) from diesel engines. The technology evolved significantly in the late 1990s when it began to be commercially implemented in passenger vehicles, particularly in Europe where diesel engines were prevalent. By the early 2000s, DPF systems became mandatory equipment on diesel vehicles in most developed markets as emissions standards like Euro 5, US EPA Tier 2, and California's LEV II standards came into effect.

The fundamental purpose of DPF technology is to capture and remove soot particles from diesel exhaust gases, preventing their release into the atmosphere. These particulates are associated with numerous health concerns including respiratory diseases, cardiovascular issues, and are classified as carcinogenic by the World Health Organization. Modern DPFs can capture over 95% of diesel particulate matter, making them a critical component in meeting current emissions standards.

DPF systems face the inherent challenge of accumulating captured soot over time, which gradually restricts exhaust flow and increases backpressure on the engine. This necessitates either regeneration (burning off accumulated soot) or eventual replacement of the filter. The technical evolution of DPF systems has largely focused on optimizing this regeneration-replacement balance to maximize filter lifespan while maintaining engine performance and emissions compliance.

The technological trajectory has seen several key developments, including advanced substrate materials (transitioning from cordierite to silicon carbide), improved catalyst coatings for passive regeneration, and sophisticated engine management systems that can actively trigger regeneration cycles. Recent innovations have focused on reducing the temperature required for effective regeneration, extending filter durability, and integrating DPF monitoring into comprehensive emissions control systems.

Current technical objectives in the field center around several key areas: extending filter service life beyond current averages of 100,000-150,000 miles; reducing the frequency of active regeneration events to improve fuel economy; developing more efficient passive regeneration systems; creating more robust filters that can withstand thermal cycling; and integrating DPF systems with other emissions technologies like Selective Catalytic Reduction (SCR) for comprehensive emissions control.

The industry is also exploring next-generation solutions that may fundamentally alter the regeneration versus replacement paradigm, including self-cleaning filter technologies, advanced thermal management systems, and novel catalyst formulations that could enable continuous passive regeneration under normal operating conditions.

The fundamental purpose of DPF technology is to capture and remove soot particles from diesel exhaust gases, preventing their release into the atmosphere. These particulates are associated with numerous health concerns including respiratory diseases, cardiovascular issues, and are classified as carcinogenic by the World Health Organization. Modern DPFs can capture over 95% of diesel particulate matter, making them a critical component in meeting current emissions standards.

DPF systems face the inherent challenge of accumulating captured soot over time, which gradually restricts exhaust flow and increases backpressure on the engine. This necessitates either regeneration (burning off accumulated soot) or eventual replacement of the filter. The technical evolution of DPF systems has largely focused on optimizing this regeneration-replacement balance to maximize filter lifespan while maintaining engine performance and emissions compliance.

The technological trajectory has seen several key developments, including advanced substrate materials (transitioning from cordierite to silicon carbide), improved catalyst coatings for passive regeneration, and sophisticated engine management systems that can actively trigger regeneration cycles. Recent innovations have focused on reducing the temperature required for effective regeneration, extending filter durability, and integrating DPF monitoring into comprehensive emissions control systems.

Current technical objectives in the field center around several key areas: extending filter service life beyond current averages of 100,000-150,000 miles; reducing the frequency of active regeneration events to improve fuel economy; developing more efficient passive regeneration systems; creating more robust filters that can withstand thermal cycling; and integrating DPF systems with other emissions technologies like Selective Catalytic Reduction (SCR) for comprehensive emissions control.

The industry is also exploring next-generation solutions that may fundamentally alter the regeneration versus replacement paradigm, including self-cleaning filter technologies, advanced thermal management systems, and novel catalyst formulations that could enable continuous passive regeneration under normal operating conditions.

Market Demand Analysis for DPF Solutions

The global market for Diesel Particulate Filter (DPF) solutions has experienced significant growth in recent years, driven primarily by increasingly stringent emission regulations worldwide. The market value for DPF systems reached approximately $12 billion in 2022, with projections indicating a compound annual growth rate of 8.3% through 2028. This growth trajectory reflects the essential role DPFs play in reducing particulate matter emissions from diesel engines.

Consumer demand patterns reveal a distinct shift toward cost-effective maintenance solutions rather than complete replacements. Fleet operators and individual vehicle owners increasingly seek regeneration services that can extend filter lifespan, with market research indicating that regeneration services cost 30-40% less than complete replacement. This economic incentive has created a robust secondary market for DPF cleaning and regeneration services, currently valued at approximately $3.5 billion globally.

Regional analysis shows varying market dynamics. European markets demonstrate the highest adoption rates for advanced DPF technologies, accounting for 38% of global demand, driven by Euro 6 and upcoming Euro 7 emission standards. North America follows at 29% market share, with the Asia-Pacific region showing the fastest growth at 12.4% annually as countries like China and India implement stricter emission controls.

Commercial vehicle applications represent the largest segment (62%) of the DPF solutions market, with heavy-duty trucks and buses being primary contributors. The off-road equipment sector, including construction and agricultural machinery, constitutes a rapidly expanding segment growing at 9.7% annually as emission regulations extend to these previously less regulated categories.

Market research indicates evolving consumer preferences regarding regeneration versus replacement decisions. Approximately 65% of fleet operators prefer regeneration services when feasible, while 35% opt for replacement, typically when filters have undergone multiple regeneration cycles or sustained physical damage. This preference pattern has stimulated innovation in regeneration technologies, with thermal, chemical, and pneumatic methods competing for market share.

The aftermarket service sector has responded with specialized DPF cleaning facilities, with over 3,800 dedicated service centers established globally since 2018. This service infrastructure development indicates strong sustained demand for regeneration solutions as alternatives to complete replacement, particularly in markets with aging diesel vehicle fleets.

Future market growth is expected to be driven by technological advancements in regeneration efficiency, with predictive maintenance solutions and remote monitoring capabilities emerging as key differentiators for service providers. The integration of IoT and telematics with DPF management systems represents a high-growth segment, projected to expand at 14.2% annually through 2028.

Consumer demand patterns reveal a distinct shift toward cost-effective maintenance solutions rather than complete replacements. Fleet operators and individual vehicle owners increasingly seek regeneration services that can extend filter lifespan, with market research indicating that regeneration services cost 30-40% less than complete replacement. This economic incentive has created a robust secondary market for DPF cleaning and regeneration services, currently valued at approximately $3.5 billion globally.

Regional analysis shows varying market dynamics. European markets demonstrate the highest adoption rates for advanced DPF technologies, accounting for 38% of global demand, driven by Euro 6 and upcoming Euro 7 emission standards. North America follows at 29% market share, with the Asia-Pacific region showing the fastest growth at 12.4% annually as countries like China and India implement stricter emission controls.

Commercial vehicle applications represent the largest segment (62%) of the DPF solutions market, with heavy-duty trucks and buses being primary contributors. The off-road equipment sector, including construction and agricultural machinery, constitutes a rapidly expanding segment growing at 9.7% annually as emission regulations extend to these previously less regulated categories.

Market research indicates evolving consumer preferences regarding regeneration versus replacement decisions. Approximately 65% of fleet operators prefer regeneration services when feasible, while 35% opt for replacement, typically when filters have undergone multiple regeneration cycles or sustained physical damage. This preference pattern has stimulated innovation in regeneration technologies, with thermal, chemical, and pneumatic methods competing for market share.

The aftermarket service sector has responded with specialized DPF cleaning facilities, with over 3,800 dedicated service centers established globally since 2018. This service infrastructure development indicates strong sustained demand for regeneration solutions as alternatives to complete replacement, particularly in markets with aging diesel vehicle fleets.

Future market growth is expected to be driven by technological advancements in regeneration efficiency, with predictive maintenance solutions and remote monitoring capabilities emerging as key differentiators for service providers. The integration of IoT and telematics with DPF management systems represents a high-growth segment, projected to expand at 14.2% annually through 2028.

Current DPF Challenges and Technical Limitations

Despite significant advancements in Diesel Particulate Filter (DPF) technology, several critical challenges and technical limitations persist in both regeneration and replacement processes. Current DPF systems face efficiency degradation over time, with most filters experiencing a 15-20% reduction in filtration capacity after 100,000 miles of operation, even with regular regeneration cycles.

The regeneration process itself presents substantial technical hurdles. Passive regeneration requires sustained high exhaust temperatures (typically above 350°C) that many vehicles fail to achieve during normal operation, particularly in urban driving conditions or cold climates. This temperature threshold limitation results in incomplete combustion of accumulated particulate matter, leading to progressive ash buildup that cannot be removed through standard regeneration procedures.

Active regeneration systems, while more effective at lower temperatures, introduce their own set of challenges. The fuel injection required for active regeneration increases consumption by approximately 2-5%, negatively impacting overall vehicle efficiency. Furthermore, the thermal stress from repeated high-temperature regeneration cycles (often exceeding 600°C) accelerates structural degradation of the filter substrate, particularly at the inlet face where temperature gradients are most severe.

Material limitations represent another significant barrier. Current cordierite and silicon carbide substrates demonstrate vulnerability to thermal shock during rapid temperature fluctuations, with failure rates increasing dramatically after 4-5 years of operation in heavy-duty applications. The development of more thermally resilient materials has been constrained by cost considerations, as advanced ceramic composites can increase filter costs by 30-50%.

Sensor technology limitations further complicate DPF management. Current differential pressure sensors lack the precision to accurately detect partial blockages or uneven soot distribution, often triggering regeneration cycles either prematurely or too late. This imprecise monitoring contributes to unnecessary fuel consumption and accelerated filter degradation.

From a maintenance perspective, the industry faces challenges with diagnostic capabilities. Workshop-level diagnostic tools frequently misinterpret backpressure readings, leading to unnecessary replacements when regeneration might suffice. Conversely, repeated regeneration attempts on structurally compromised filters waste resources and potentially damage other exhaust components.

Oil ash contamination represents a growing concern as extended oil change intervals become more common. Unlike soot, oil ash cannot be removed through regeneration, creating a permanent restriction that eventually necessitates replacement regardless of regeneration frequency. Studies indicate that oil ash can account for up to 40% of total ash accumulation in long-service DPFs.

These technical limitations create a complex decision matrix for fleet operators and vehicle owners when evaluating regeneration versus replacement options, with significant implications for operational costs, environmental compliance, and vehicle performance.

The regeneration process itself presents substantial technical hurdles. Passive regeneration requires sustained high exhaust temperatures (typically above 350°C) that many vehicles fail to achieve during normal operation, particularly in urban driving conditions or cold climates. This temperature threshold limitation results in incomplete combustion of accumulated particulate matter, leading to progressive ash buildup that cannot be removed through standard regeneration procedures.

Active regeneration systems, while more effective at lower temperatures, introduce their own set of challenges. The fuel injection required for active regeneration increases consumption by approximately 2-5%, negatively impacting overall vehicle efficiency. Furthermore, the thermal stress from repeated high-temperature regeneration cycles (often exceeding 600°C) accelerates structural degradation of the filter substrate, particularly at the inlet face where temperature gradients are most severe.

Material limitations represent another significant barrier. Current cordierite and silicon carbide substrates demonstrate vulnerability to thermal shock during rapid temperature fluctuations, with failure rates increasing dramatically after 4-5 years of operation in heavy-duty applications. The development of more thermally resilient materials has been constrained by cost considerations, as advanced ceramic composites can increase filter costs by 30-50%.

Sensor technology limitations further complicate DPF management. Current differential pressure sensors lack the precision to accurately detect partial blockages or uneven soot distribution, often triggering regeneration cycles either prematurely or too late. This imprecise monitoring contributes to unnecessary fuel consumption and accelerated filter degradation.

From a maintenance perspective, the industry faces challenges with diagnostic capabilities. Workshop-level diagnostic tools frequently misinterpret backpressure readings, leading to unnecessary replacements when regeneration might suffice. Conversely, repeated regeneration attempts on structurally compromised filters waste resources and potentially damage other exhaust components.

Oil ash contamination represents a growing concern as extended oil change intervals become more common. Unlike soot, oil ash cannot be removed through regeneration, creating a permanent restriction that eventually necessitates replacement regardless of regeneration frequency. Studies indicate that oil ash can account for up to 40% of total ash accumulation in long-service DPFs.

These technical limitations create a complex decision matrix for fleet operators and vehicle owners when evaluating regeneration versus replacement options, with significant implications for operational costs, environmental compliance, and vehicle performance.

Current Regeneration and Replacement Solutions

01 DPF Regeneration Methods and Strategies

Various methods and strategies for regenerating diesel particulate filters (DPFs) to remove accumulated soot and restore filter functionality. These include active regeneration using fuel injection or heating elements, passive regeneration through catalytic oxidation, and combined approaches. Regeneration strategies may involve temperature control, pressure monitoring, and timing optimization to ensure efficient soot removal while preventing filter damage.- DPF Regeneration Methods and Strategies: Various methods and strategies for regenerating diesel particulate filters (DPFs) to remove accumulated soot and restore filter functionality. These include active regeneration using fuel injection or heating elements, passive regeneration through catalytic oxidation, and combined approaches. Regeneration strategies may involve temperature control, exhaust gas management, and timing optimization to effectively burn off particulate matter while maintaining engine performance and fuel efficiency.

- DPF Replacement Criteria and Procedures: Guidelines and procedures for determining when a DPF should be replaced rather than regenerated. This includes assessment of filter damage, ash accumulation beyond cleanable levels, pressure differential measurements, and performance degradation indicators. Replacement procedures involve proper removal of the old filter, installation techniques for new filters, and system recalibration to ensure optimal performance of the emission control system after replacement.

- DPF Monitoring and Diagnostic Systems: Systems and methods for monitoring DPF condition and diagnosing regeneration or replacement needs. These include sensors for measuring back pressure, temperature, and particulate matter accumulation, along with diagnostic algorithms to interpret sensor data. Advanced monitoring systems may incorporate predictive maintenance capabilities, real-time performance analysis, and driver notification systems to optimize filter management and prevent unexpected failures.

- DPF Design Innovations for Extended Lifespan: Innovations in DPF design that extend operational lifespan and reduce the frequency of regeneration or replacement. These include advanced filter materials, optimized cell structures, improved catalyst coatings, and enhanced ash storage capacity. Design innovations focus on increasing filtration efficiency while reducing back pressure, improving thermal durability, and enhancing regeneration effectiveness to maximize filter longevity.

- Cost-Benefit Analysis of Regeneration vs. Replacement: Methodologies and considerations for evaluating the economic and performance trade-offs between DPF regeneration and replacement. This includes analysis of operational costs, downtime implications, environmental impact, and long-term engine health. Decision frameworks help fleet managers and vehicle owners determine the most cost-effective approach based on filter condition, vehicle usage patterns, and regulatory compliance requirements.

02 DPF Replacement Criteria and Procedures

Guidelines and procedures for determining when a DPF requires replacement rather than regeneration. This includes assessment of filter damage, ash accumulation beyond cleanable levels, structural integrity issues, and performance degradation. Replacement procedures involve proper removal of the damaged filter, installation of new components, and system recalibration to ensure optimal exhaust aftertreatment performance.Expand Specific Solutions03 DPF Monitoring and Diagnostic Systems

Systems and methods for monitoring DPF condition and diagnosing issues to determine whether regeneration or replacement is needed. These include pressure differential sensors, temperature sensors, soot load estimation algorithms, and onboard diagnostic systems that can detect filter clogging, regeneration failures, or structural damage. Advanced diagnostic tools may use machine learning or predictive analytics to optimize filter maintenance decisions.Expand Specific Solutions04 DPF Design Improvements for Enhanced Regeneration

Innovations in DPF design that improve regeneration efficiency and reduce the need for replacement. These include advanced substrate materials, optimized cell structures, improved catalyst coatings, and thermal management features. Design improvements focus on increasing ash storage capacity, improving thermal durability, enhancing soot oxidation, and extending service intervals between regeneration events.Expand Specific Solutions05 Cost and Environmental Considerations

Economic and environmental factors influencing the decision between DPF regeneration and replacement. This includes comparative cost analysis of regeneration versus replacement, environmental impact of disposal and manufacturing, fuel economy implications, and emissions compliance requirements. Considerations also include downtime for maintenance, operational costs, and long-term sustainability of different maintenance approaches.Expand Specific Solutions

Key Industry Players in DPF Market

The diesel particulate filter (DPF) regeneration versus replacement market is currently in a growth phase, with increasing regulatory pressure on emissions driving adoption across commercial and passenger vehicle segments. The global market size is expanding steadily, projected to reach significant value as emission standards tighten worldwide. Technologically, the field shows moderate maturity with ongoing innovation from key players. Industry leaders like Bosch, Volkswagen, and Toyota have established robust regeneration technologies, while companies including Corning and IBIDEN lead in filter substrate development. Nissan, Ford, and Hyundai are advancing on-board diagnostic systems for DPF management, with Mercedes-Benz and Renault focusing on integration with broader emission control systems. Specialized players like Umicore contribute catalyst technologies essential for passive regeneration processes.

Robert Bosch GmbH

Technical Solution: Bosch has developed advanced Diesel Particulate Filter (DPF) regeneration systems that utilize precise fuel injection control and intelligent thermal management. Their technology employs post-injection strategies to increase exhaust gas temperatures when needed for regeneration, typically between 550-650°C. Bosch's system incorporates sophisticated sensors to monitor back pressure, temperature, and soot load, enabling dynamic regeneration timing based on actual conditions rather than fixed intervals. Their latest systems feature adaptive regeneration algorithms that learn from driving patterns to optimize the regeneration process, reducing fuel consumption penalties by up to 3% compared to conventional systems. Bosch also implements a multi-stage regeneration approach that combines passive regeneration (using normal exhaust temperatures with NO2 as catalyst) and active regeneration (with temperature increase) to extend filter life and improve efficiency.

Strengths: Superior sensor integration and control algorithms provide more precise regeneration timing, reducing unnecessary cycles. Advanced thermal management reduces fuel consumption penalty during regeneration. Weaknesses: Higher system complexity increases initial cost and potential diagnostic challenges. Requires sophisticated electronic control units that may be difficult to retrofit to older vehicles.

Umicore SA

Technical Solution: Umicore has developed catalytic coating technologies that significantly impact the DPF regeneration process. Their catalyst formulations lower the soot combustion temperature by approximately 100-150°C compared to uncoated filters, enabling more frequent passive regeneration during normal vehicle operation. Umicore's latest generation catalysts incorporate platinum group metals (PGMs) in optimized ratios and dispersion patterns that maximize catalytic efficiency while minimizing precious metal content, reducing overall system cost. Their technology includes specialized washcoat formulations that improve catalyst adhesion to filter substrates, maintaining performance even after hundreds of regeneration cycles. Umicore has also pioneered dual-layer coating technologies that combine soot oxidation catalysts with NOx reduction capabilities, creating multifunctional filter systems. These advanced coatings can reduce active regeneration frequency by up to 40% in typical driving cycles, significantly extending filter life and reducing fuel consumption associated with active regeneration. Additionally, Umicore's catalysts demonstrate improved resistance to sulfur and ash poisoning, maintaining performance even as the filter accumulates contaminants over its lifetime.

Strengths: Advanced catalyst formulations significantly reduce regeneration temperature requirements, enabling more passive regeneration and less fuel penalty. Improved poison resistance extends effective catalyst life even as filters age. Weaknesses: Premium catalyst formulations add cost to initial filter production. Performance benefits may diminish over time as ash accumulates and physically blocks catalyst sites.

Critical Patents and Innovations in DPF Technology

Method and system for regenerating diesel particle filters

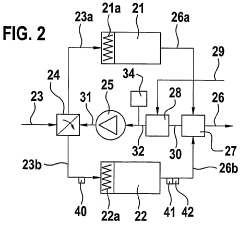

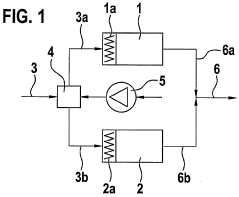

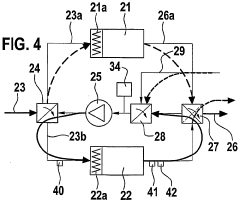

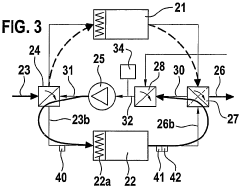

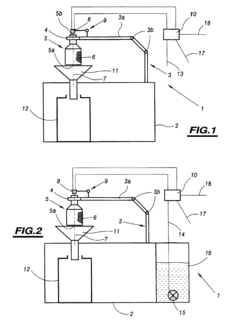

PatentWO2003048535A1

Innovation

- Regenerating diesel particle filters in a partially closed circulating air circuit, allowing for controlled heating independent of exhaust gas flow, oxygen content, and pressure, using a combination of electric heating and controlled fresh air addition to achieve quick temperature increases without additives.

Process and apparatus for cleaning a particle filter and process for treating the effluent produced from cleaning

PatentInactiveEP1060780A1

Innovation

- A method involving the disassembly of the exhaust line, reversal of the particulate filter for controlled passage of cleaning fluids, including water and compressed air, to dissociate and remove residues, followed by reassembly and regeneration, allowing for effective cleaning without replacement.

Environmental Regulations Impact on DPF Technology

Environmental regulations have become a driving force in the evolution of Diesel Particulate Filter (DPF) technology, creating a complex landscape that significantly impacts both regeneration and replacement strategies. Since the early 2000s, increasingly stringent emission standards worldwide have accelerated the development and adoption of DPF systems, with landmark regulations such as Euro 6 in Europe, Tier 4 Final in the US, and China VI fundamentally reshaping diesel engine technology.

These regulations have progressively lowered the permissible levels of particulate matter (PM) emissions, effectively making DPF systems mandatory for diesel vehicles. The regulatory timeline has created distinct technology adoption waves, with each new standard pushing manufacturers to enhance filter efficiency, durability, and regeneration capabilities.

The geographical variations in regulatory frameworks have led to regional differences in DPF technology implementation. European regulations have traditionally focused on CO2 reduction alongside particulate emissions, while US standards have emphasized NOx control. These nuanced approaches have resulted in market-specific DPF solutions, complicating global vehicle platforms and aftermarket support systems.

Compliance requirements have directly influenced the regeneration vs. replacement decision matrix. As emission limits tightened, manufacturers have invested heavily in advanced regeneration technologies to extend filter life and reduce replacement frequency. Active regeneration systems have become more sophisticated, incorporating multiple sensors, precise thermal management, and intelligent control algorithms to optimize the combustion of trapped particulates.

The regulatory focus has shifted beyond tailpipe emissions to include real-world driving emissions (RDE) and in-use compliance monitoring. This evolution has prompted the development of more robust DPF systems with enhanced monitoring capabilities and predictive maintenance features, fundamentally changing how fleet operators approach filter management.

Looking forward, upcoming regulations are poised to further impact DPF technology trajectories. The proposed Euro 7 standards and similar initiatives globally will likely accelerate the development of hybrid regeneration approaches and potentially revolutionary filter materials. These regulations may also expand the scope to include particle number limits and non-exhaust emissions, potentially transforming the fundamental design parameters for DPF systems.

The regulatory landscape has also created significant market opportunities for aftermarket solutions that can cost-effectively extend DPF life through enhanced regeneration processes, potentially delaying replacement while maintaining compliance with increasingly strict emission standards.

These regulations have progressively lowered the permissible levels of particulate matter (PM) emissions, effectively making DPF systems mandatory for diesel vehicles. The regulatory timeline has created distinct technology adoption waves, with each new standard pushing manufacturers to enhance filter efficiency, durability, and regeneration capabilities.

The geographical variations in regulatory frameworks have led to regional differences in DPF technology implementation. European regulations have traditionally focused on CO2 reduction alongside particulate emissions, while US standards have emphasized NOx control. These nuanced approaches have resulted in market-specific DPF solutions, complicating global vehicle platforms and aftermarket support systems.

Compliance requirements have directly influenced the regeneration vs. replacement decision matrix. As emission limits tightened, manufacturers have invested heavily in advanced regeneration technologies to extend filter life and reduce replacement frequency. Active regeneration systems have become more sophisticated, incorporating multiple sensors, precise thermal management, and intelligent control algorithms to optimize the combustion of trapped particulates.

The regulatory focus has shifted beyond tailpipe emissions to include real-world driving emissions (RDE) and in-use compliance monitoring. This evolution has prompted the development of more robust DPF systems with enhanced monitoring capabilities and predictive maintenance features, fundamentally changing how fleet operators approach filter management.

Looking forward, upcoming regulations are poised to further impact DPF technology trajectories. The proposed Euro 7 standards and similar initiatives globally will likely accelerate the development of hybrid regeneration approaches and potentially revolutionary filter materials. These regulations may also expand the scope to include particle number limits and non-exhaust emissions, potentially transforming the fundamental design parameters for DPF systems.

The regulatory landscape has also created significant market opportunities for aftermarket solutions that can cost-effectively extend DPF life through enhanced regeneration processes, potentially delaying replacement while maintaining compliance with increasingly strict emission standards.

Cost-Benefit Analysis of Regeneration vs Replacement

The economic implications of DPF management strategies represent a critical decision point for fleet operators and individual vehicle owners. When comparing regeneration versus replacement options, initial cost considerations heavily favor regeneration, which typically ranges from $300-800 per service compared to $1,000-3,000 for complete filter replacement, depending on vehicle make and model.

Operational downtime presents another significant cost factor. Regeneration services generally require 2-4 hours of vehicle downtime, while replacement procedures may necessitate 4-8 hours or longer if parts availability is limited. For commercial operations, this translates to substantial opportunity costs beyond the direct service expenses.

Long-term financial analysis reveals more nuanced considerations. Regeneration frequency increases as filters age, with diminishing effectiveness after multiple cleaning cycles. Data indicates that after 3-4 regeneration procedures, efficiency drops by approximately 15-20%, potentially leading to increased fuel consumption and reduced engine performance.

Replacement provides definitive resolution with predictable performance restoration, while regeneration offers diminishing returns over time. The crossover point where replacement becomes more economical than continued regeneration typically occurs after 3-5 regeneration cycles, depending on operating conditions and filter degradation rate.

Environmental compliance costs must also factor into the equation. Inadequately regenerated filters may lead to vehicles failing emissions testing, resulting in regulatory penalties and additional remediation expenses. These compliance failures represent both direct costs and reputational damage for commercial operators.

Preventive maintenance strategies significantly impact the cost-benefit equation. Proactive regeneration at recommended intervals (typically every 100,000-150,000 miles under normal conditions) extends filter lifespan by 30-40% compared to reactive approaches triggered by performance issues or warning lights.

Advanced diagnostic technologies now enable condition-based maintenance decisions rather than time or mileage-based protocols. Differential pressure monitoring systems can identify optimal regeneration timing, maximizing effectiveness while minimizing unnecessary procedures, potentially reducing lifetime DPF management costs by 15-25% compared to traditional maintenance schedules.

The comprehensive cost-benefit analysis must therefore consider not just immediate service expenses, but the complete lifecycle implications including performance degradation, fuel economy impacts, compliance risks, and operational reliability across the vehicle's service life.

Operational downtime presents another significant cost factor. Regeneration services generally require 2-4 hours of vehicle downtime, while replacement procedures may necessitate 4-8 hours or longer if parts availability is limited. For commercial operations, this translates to substantial opportunity costs beyond the direct service expenses.

Long-term financial analysis reveals more nuanced considerations. Regeneration frequency increases as filters age, with diminishing effectiveness after multiple cleaning cycles. Data indicates that after 3-4 regeneration procedures, efficiency drops by approximately 15-20%, potentially leading to increased fuel consumption and reduced engine performance.

Replacement provides definitive resolution with predictable performance restoration, while regeneration offers diminishing returns over time. The crossover point where replacement becomes more economical than continued regeneration typically occurs after 3-5 regeneration cycles, depending on operating conditions and filter degradation rate.

Environmental compliance costs must also factor into the equation. Inadequately regenerated filters may lead to vehicles failing emissions testing, resulting in regulatory penalties and additional remediation expenses. These compliance failures represent both direct costs and reputational damage for commercial operators.

Preventive maintenance strategies significantly impact the cost-benefit equation. Proactive regeneration at recommended intervals (typically every 100,000-150,000 miles under normal conditions) extends filter lifespan by 30-40% compared to reactive approaches triggered by performance issues or warning lights.

Advanced diagnostic technologies now enable condition-based maintenance decisions rather than time or mileage-based protocols. Differential pressure monitoring systems can identify optimal regeneration timing, maximizing effectiveness while minimizing unnecessary procedures, potentially reducing lifetime DPF management costs by 15-25% compared to traditional maintenance schedules.

The comprehensive cost-benefit analysis must therefore consider not just immediate service expenses, but the complete lifecycle implications including performance degradation, fuel economy impacts, compliance risks, and operational reliability across the vehicle's service life.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!