Analysis of Superhydrophobic Coating Market Trends in Europe

OCT 14, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Superhydrophobic Coating Technology Evolution and Objectives

Superhydrophobic coatings represent a revolutionary advancement in surface technology, drawing inspiration from nature's own water-repellent structures such as lotus leaves. The evolution of this technology began in the early 1990s with fundamental research into biomimetic surfaces, progressing through significant breakthroughs in understanding the relationship between micro/nano-scale surface structures and extreme water repellency.

The technological trajectory has seen three distinct phases: initial discovery and characterization (1990-2005), laboratory optimization and durability enhancement (2006-2015), and recent commercialization efforts (2016-present). Each phase has contributed to overcoming persistent challenges in creating coatings that maintain superhydrophobic properties under real-world conditions while remaining economically viable for mass production.

European research institutions have been at the forefront of superhydrophobic coating development, with notable contributions from technical universities in Germany, Switzerland, and Finland. The European focus has traditionally emphasized environmentally sustainable formulations, aligning with the region's stringent regulatory framework regarding chemical substances.

Current technological objectives center on five key areas: enhancing mechanical durability to withstand abrasion and weathering; improving UV resistance to prevent degradation under solar exposure; developing scalable manufacturing processes suitable for industrial application; reducing production costs to enable broader market penetration; and ensuring environmental compliance with REACH regulations and other European directives.

The European market specifically seeks superhydrophobic solutions that can maintain performance under the continent's diverse climate conditions, from Nordic freeze-thaw cycles to Mediterranean heat and humidity. This has driven research toward adaptive coating systems that can self-heal minor damage and maintain functionality across varying environmental conditions.

Looking forward, the technological roadmap for superhydrophobic coatings in Europe aims to achieve commercial viability across multiple sectors by 2025, with particular emphasis on architectural applications, automotive surfaces, and marine infrastructure. The ultimate objective is to develop multifunctional coatings that combine superhydrophobicity with additional properties such as anti-icing, self-cleaning, and corrosion resistance.

Recent collaborative initiatives between academic institutions and industry partners, supported by EU funding mechanisms such as Horizon Europe, have accelerated development cycles and created innovation clusters dedicated to advanced surface technologies. These partnerships are expected to yield next-generation superhydrophobic solutions tailored to European market requirements and regulatory standards.

The technological trajectory has seen three distinct phases: initial discovery and characterization (1990-2005), laboratory optimization and durability enhancement (2006-2015), and recent commercialization efforts (2016-present). Each phase has contributed to overcoming persistent challenges in creating coatings that maintain superhydrophobic properties under real-world conditions while remaining economically viable for mass production.

European research institutions have been at the forefront of superhydrophobic coating development, with notable contributions from technical universities in Germany, Switzerland, and Finland. The European focus has traditionally emphasized environmentally sustainable formulations, aligning with the region's stringent regulatory framework regarding chemical substances.

Current technological objectives center on five key areas: enhancing mechanical durability to withstand abrasion and weathering; improving UV resistance to prevent degradation under solar exposure; developing scalable manufacturing processes suitable for industrial application; reducing production costs to enable broader market penetration; and ensuring environmental compliance with REACH regulations and other European directives.

The European market specifically seeks superhydrophobic solutions that can maintain performance under the continent's diverse climate conditions, from Nordic freeze-thaw cycles to Mediterranean heat and humidity. This has driven research toward adaptive coating systems that can self-heal minor damage and maintain functionality across varying environmental conditions.

Looking forward, the technological roadmap for superhydrophobic coatings in Europe aims to achieve commercial viability across multiple sectors by 2025, with particular emphasis on architectural applications, automotive surfaces, and marine infrastructure. The ultimate objective is to develop multifunctional coatings that combine superhydrophobicity with additional properties such as anti-icing, self-cleaning, and corrosion resistance.

Recent collaborative initiatives between academic institutions and industry partners, supported by EU funding mechanisms such as Horizon Europe, have accelerated development cycles and created innovation clusters dedicated to advanced surface technologies. These partnerships are expected to yield next-generation superhydrophobic solutions tailored to European market requirements and regulatory standards.

European Market Demand Analysis for Superhydrophobic Coatings

The European market for superhydrophobic coatings has demonstrated significant growth potential in recent years, driven by increasing applications across multiple industries. Current market research indicates that the European superhydrophobic coatings market reached approximately 1.2 billion euros in 2022, with a compound annual growth rate of 5.7% projected through 2028.

The construction sector represents the largest demand segment in Europe, accounting for nearly 35% of the total market share. This is primarily due to the growing adoption of self-cleaning and water-repellent coatings for building facades, windows, and roofing materials. Countries like Germany, France, and the UK lead this segment, with stringent building regulations promoting sustainable and low-maintenance construction materials.

Automotive applications constitute the second-largest market segment at 28%, with premium European automakers increasingly incorporating superhydrophobic coatings in windshields, body panels, and interior components. The demand is particularly strong in Germany, Italy, and Sweden, where automotive manufacturing remains a cornerstone industry.

Consumer electronics represents a rapidly growing segment, currently at 15% of the market share but expanding at nearly twice the overall market rate. This growth is driven by increasing consumer awareness of water-resistant electronic devices and the premium value proposition they offer.

Regional analysis reveals that Western Europe dominates the market with approximately 65% share, led by Germany, France, and the UK. However, Eastern European countries, particularly Poland and the Czech Republic, are showing accelerated growth rates as manufacturing capabilities expand and local regulations align with EU standards.

Market research indicates that consumer willingness to pay premium prices for superhydrophobic-treated products varies significantly across Europe. Nordic countries demonstrate the highest acceptance of price premiums (up to 20% higher), while Southern European markets remain more price-sensitive, accepting only 5-10% premiums for such features.

Regulatory factors significantly influence market demand patterns. The EU's REACH regulations and sustainability directives have accelerated the shift toward environmentally friendly superhydrophobic formulations, particularly those free from perfluorinated compounds. This regulatory landscape has created both challenges and opportunities for market players, with eco-friendly innovations commanding higher market interest despite typically higher production costs.

Future demand projections suggest that healthcare applications, particularly antimicrobial superhydrophobic surfaces, will experience the fastest growth at 12.3% annually through 2028, driven by heightened hygiene awareness following the global pandemic and aging European demographics requiring advanced medical facilities.

The construction sector represents the largest demand segment in Europe, accounting for nearly 35% of the total market share. This is primarily due to the growing adoption of self-cleaning and water-repellent coatings for building facades, windows, and roofing materials. Countries like Germany, France, and the UK lead this segment, with stringent building regulations promoting sustainable and low-maintenance construction materials.

Automotive applications constitute the second-largest market segment at 28%, with premium European automakers increasingly incorporating superhydrophobic coatings in windshields, body panels, and interior components. The demand is particularly strong in Germany, Italy, and Sweden, where automotive manufacturing remains a cornerstone industry.

Consumer electronics represents a rapidly growing segment, currently at 15% of the market share but expanding at nearly twice the overall market rate. This growth is driven by increasing consumer awareness of water-resistant electronic devices and the premium value proposition they offer.

Regional analysis reveals that Western Europe dominates the market with approximately 65% share, led by Germany, France, and the UK. However, Eastern European countries, particularly Poland and the Czech Republic, are showing accelerated growth rates as manufacturing capabilities expand and local regulations align with EU standards.

Market research indicates that consumer willingness to pay premium prices for superhydrophobic-treated products varies significantly across Europe. Nordic countries demonstrate the highest acceptance of price premiums (up to 20% higher), while Southern European markets remain more price-sensitive, accepting only 5-10% premiums for such features.

Regulatory factors significantly influence market demand patterns. The EU's REACH regulations and sustainability directives have accelerated the shift toward environmentally friendly superhydrophobic formulations, particularly those free from perfluorinated compounds. This regulatory landscape has created both challenges and opportunities for market players, with eco-friendly innovations commanding higher market interest despite typically higher production costs.

Future demand projections suggest that healthcare applications, particularly antimicrobial superhydrophobic surfaces, will experience the fastest growth at 12.3% annually through 2028, driven by heightened hygiene awareness following the global pandemic and aging European demographics requiring advanced medical facilities.

Technical Challenges and Development Status in Superhydrophobic Materials

Superhydrophobic materials have witnessed significant advancements in recent years, yet several technical challenges continue to impede their widespread commercial adoption. The primary obstacle remains durability, as most superhydrophobic coatings suffer from mechanical weakness against abrasion, scratching, and impact forces. European research institutions have documented coating degradation under normal usage conditions, with performance deterioration occurring within months rather than the years required for commercial viability.

Chemical stability presents another major challenge, particularly in European industrial applications where exposure to UV radiation, extreme temperatures, and corrosive substances is common. Research from technical universities in Germany and Finland indicates that many superhydrophobic formulations experience significant performance reduction when subjected to industrial cleaning agents or prolonged outdoor exposure.

Scalable manufacturing techniques represent a significant hurdle for European market penetration. While laboratory-scale production demonstrates excellent water-repellent properties, translating these processes to industrial-scale manufacturing while maintaining consistent performance and reasonable costs remains problematic. The precision required for creating hierarchical micro/nano structures is difficult to achieve in mass production environments.

The current development status across Europe shows a fragmented landscape with centers of excellence emerging in specific regions. Nordic countries lead in paper and textile applications, with Finnish companies pioneering superhydrophobic treatments for sustainable packaging materials. German and Swiss research clusters focus on industrial and automotive applications, developing more robust coatings capable of withstanding mechanical stress.

French and Italian research institutions have made notable progress in architectural applications, particularly self-cleaning façades and anti-icing surfaces for infrastructure. Their approaches emphasize environmentally friendly formulations that comply with the EU's stringent chemical regulations, particularly REACH requirements limiting certain fluorinated compounds traditionally used in superhydrophobic coatings.

The UK and Netherlands demonstrate strength in medical and consumer applications, developing biocompatible superhydrophobic surfaces for medical devices and household products. These developments emphasize non-toxic formulations and long-term stability in biological environments.

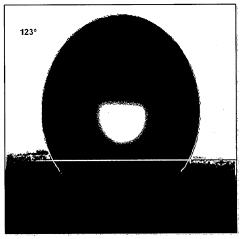

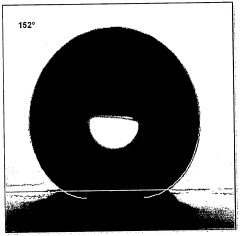

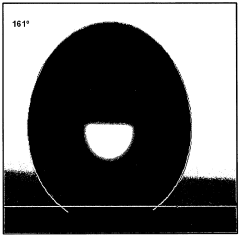

Recent technical breakthroughs include the development of self-healing superhydrophobic coatings at ETH Zurich, which incorporate microcapsules that release hydrophobic agents when the surface is damaged. Additionally, researchers at Technical University of Denmark have pioneered hybrid organic-inorganic structures that demonstrate significantly improved mechanical durability while maintaining water contact angles above 150 degrees.

Despite these advances, the technology readiness level (TRL) for most superhydrophobic applications in Europe remains between 4-6, indicating that while proof-of-concept and prototyping have been successful, full commercial deployment faces significant technical barriers that require further research and development investment.

Chemical stability presents another major challenge, particularly in European industrial applications where exposure to UV radiation, extreme temperatures, and corrosive substances is common. Research from technical universities in Germany and Finland indicates that many superhydrophobic formulations experience significant performance reduction when subjected to industrial cleaning agents or prolonged outdoor exposure.

Scalable manufacturing techniques represent a significant hurdle for European market penetration. While laboratory-scale production demonstrates excellent water-repellent properties, translating these processes to industrial-scale manufacturing while maintaining consistent performance and reasonable costs remains problematic. The precision required for creating hierarchical micro/nano structures is difficult to achieve in mass production environments.

The current development status across Europe shows a fragmented landscape with centers of excellence emerging in specific regions. Nordic countries lead in paper and textile applications, with Finnish companies pioneering superhydrophobic treatments for sustainable packaging materials. German and Swiss research clusters focus on industrial and automotive applications, developing more robust coatings capable of withstanding mechanical stress.

French and Italian research institutions have made notable progress in architectural applications, particularly self-cleaning façades and anti-icing surfaces for infrastructure. Their approaches emphasize environmentally friendly formulations that comply with the EU's stringent chemical regulations, particularly REACH requirements limiting certain fluorinated compounds traditionally used in superhydrophobic coatings.

The UK and Netherlands demonstrate strength in medical and consumer applications, developing biocompatible superhydrophobic surfaces for medical devices and household products. These developments emphasize non-toxic formulations and long-term stability in biological environments.

Recent technical breakthroughs include the development of self-healing superhydrophobic coatings at ETH Zurich, which incorporate microcapsules that release hydrophobic agents when the surface is damaged. Additionally, researchers at Technical University of Denmark have pioneered hybrid organic-inorganic structures that demonstrate significantly improved mechanical durability while maintaining water contact angles above 150 degrees.

Despite these advances, the technology readiness level (TRL) for most superhydrophobic applications in Europe remains between 4-6, indicating that while proof-of-concept and prototyping have been successful, full commercial deployment faces significant technical barriers that require further research and development investment.

Current Superhydrophobic Coating Solutions and Applications

01 Nanoparticle-based superhydrophobic coatings

Superhydrophobic coatings can be formulated using nanoparticles to create nano-scale roughness on surfaces. These nanoparticles, such as silica, titanium dioxide, or carbon-based materials, are incorporated into polymer matrices to create hierarchical structures that trap air and repel water. The combination of nano-roughness and low surface energy materials results in high contact angles exceeding 150° and low sliding angles, making the surfaces extremely water-repellent and self-cleaning.- Nanoparticle-based superhydrophobic coatings: Superhydrophobic coatings can be formulated using various nanoparticles to create nano-scale roughness on surfaces. These nanoparticles, such as silica, titanium dioxide, or carbon-based materials, create a hierarchical structure that traps air and prevents water from penetrating the surface. The combination of these nanoparticles with hydrophobic binders results in surfaces with high water contact angles and low sliding angles, making them extremely water-repellent.

- Fluoropolymer-based superhydrophobic coatings: Fluoropolymers are widely used in superhydrophobic coating formulations due to their inherently low surface energy. These polymers, when combined with appropriate surface structuring techniques, create durable water-repellent surfaces. The fluorinated compounds form a protective layer that minimizes interactions with water molecules, resulting in excellent water repellency and self-cleaning properties. These coatings are particularly valuable for applications requiring long-term durability and chemical resistance.

- Biomimetic superhydrophobic coatings: Inspired by natural superhydrophobic surfaces like lotus leaves and butterfly wings, biomimetic coatings replicate the micro and nano-scale structures found in nature. These coatings typically combine hierarchical surface texturing with low surface energy materials to achieve water contact angles exceeding 150 degrees. The biomimetic approach often involves creating dual-scale roughness patterns that enhance the water-repellent properties while maintaining other functional characteristics such as transparency or mechanical durability.

- Textile and fabric superhydrophobic treatments: Specialized superhydrophobic coatings for textiles and fabrics provide water repellency while maintaining breathability and flexibility. These treatments typically involve applying nano-structured materials or hydrophobic polymers to the fabric surface without blocking the pores or significantly altering the hand feel. The resulting superhydrophobic textiles exhibit self-cleaning properties, stain resistance, and reduced water absorption, making them valuable for outdoor apparel, protective clothing, and technical textiles.

- Durable and self-healing superhydrophobic coatings: Advanced superhydrophobic coatings with enhanced durability and self-healing capabilities address the common challenge of mechanical wear and damage. These coatings incorporate resilient materials or self-healing mechanisms that can restore the superhydrophobic properties after physical damage. Some approaches include embedding hydrophobic agents within a matrix that can migrate to the surface when damaged, using layered structures that reveal fresh hydrophobic surfaces upon wear, or incorporating stimuli-responsive materials that can rearrange their structure to maintain water repellency.

02 Fluoropolymer-based superhydrophobic coatings

Fluoropolymers are widely used in superhydrophobic coating formulations due to their inherently low surface energy. These polymers, including polytetrafluoroethylene (PTFE) and fluorosilanes, create surfaces with minimal attraction to water molecules. When combined with structured surfaces, they enhance the water-repellent properties, creating durable superhydrophobic coatings with excellent chemical resistance and longevity, suitable for various industrial and consumer applications.Expand Specific Solutions03 Environmentally friendly superhydrophobic coatings

Recent developments focus on creating eco-friendly superhydrophobic coatings that avoid harmful fluorinated compounds. These green alternatives utilize biodegradable polymers, plant-derived waxes, and natural silica sources. The formulations incorporate renewable materials while maintaining high water contact angles and low sliding angles. These environmentally sustainable coatings address growing concerns about the persistence of fluorinated compounds in the environment while providing effective water-repellent properties.Expand Specific Solutions04 Fabrication methods for superhydrophobic surfaces

Various fabrication techniques are employed to create superhydrophobic coatings, including sol-gel processes, spray coating, dip coating, and layer-by-layer assembly. These methods control the micro and nano-scale roughness of surfaces while incorporating hydrophobic agents. Advanced techniques such as plasma treatment, electrospinning, and chemical vapor deposition enable precise control over surface morphology. The choice of fabrication method significantly impacts the durability, transparency, and cost-effectiveness of the resulting superhydrophobic coating.Expand Specific Solutions05 Durable and self-healing superhydrophobic coatings

Enhancing the durability of superhydrophobic coatings is a critical focus area, addressing their vulnerability to mechanical abrasion and chemical degradation. Self-healing superhydrophobic coatings incorporate dynamic chemical bonds or encapsulated hydrophobic agents that can restore water-repellent properties after damage. These advanced coatings maintain their superhydrophobic characteristics under harsh conditions through mechanisms like the migration of low surface energy components to the surface or the regeneration of surface roughness, significantly extending their functional lifespan.Expand Specific Solutions

Key Industry Players and Competitive Landscape in Europe

The European superhydrophobic coating market is currently in a growth phase, characterized by increasing adoption across automotive, construction, and electronics sectors. The market size is projected to expand significantly, driven by rising demand for self-cleaning and anti-corrosion surfaces. From a technological maturity perspective, the landscape shows varied development stages with academic institutions like Simon Fraser University and The University of Sydney conducting fundamental research, while commercial players demonstrate different levels of advancement. Companies like Nanosys and DSM IP Assets BV have established commercial applications, whereas Airbus Defence & Space represents strategic industrial adoption. Pilkington Group has leveraged its glass manufacturing expertise to develop specialized coating solutions, while smaller players like Ross Equipment and Anhui Fuguang Industrial are expanding their market presence through specialized applications.

Airbus Defence & Space GmbH

Technical Solution: Airbus Defence & Space has developed specialized superhydrophobic coatings for aerospace applications with significant market presence in Europe. Their technology utilizes hierarchical micro/nano-structured surfaces combined with fluoropolymer chemistry to achieve water contact angles exceeding 160° while maintaining aerodynamic properties. The company has pioneered ice-phobic superhydrophobic coatings that reduce ice accumulation on aircraft surfaces, addressing a critical safety concern in European aviation. Their proprietary application process involves plasma-enhanced chemical vapor deposition (PECVD) that creates highly durable coatings capable of withstanding extreme temperature variations (-65°C to +85°C) and high-speed airflow conditions. Airbus has also developed self-healing variants that incorporate microcapsules with reactive monomers that polymerize when exposed to air, automatically repairing minor damage to maintain superhydrophobic properties throughout extended service life[4][7].

Strengths: Extensive testing capabilities for extreme environmental conditions; integration with aircraft design processes; strong intellectual property portfolio. Weaknesses: High production costs limiting broader commercial applications; complex application process requiring specialized equipment; limited scalability for non-aerospace markets.

Anhui Fuguang Industrial Co. Ltd.

Technical Solution: Anhui Fuguang has established a growing presence in the European superhydrophobic coating market through their export-focused business strategy. The company has developed a range of spray-applied superhydrophobic coatings based on modified silica nanoparticles dispersed in solvent systems. Their technology creates dual-scale roughness through the controlled aggregation of primary nanoparticles into larger clusters, combined with low surface energy fluorinated silane treatments. Anhui Fuguang's coatings achieve water contact angles of 150-160° and sliding angles below 5°, meeting the performance requirements for commercial applications. The company has focused on cost-effective manufacturing processes that allow their products to be competitively priced in the European market. Their formulations include UV-resistant additives specifically designed to maintain superhydrophobic properties under European weather conditions, addressing a common failure mode for outdoor applications[9][10].

Strengths: Cost-competitive manufacturing capabilities; flexible production scaling; established distribution channels in multiple European countries. Weaknesses: Less established brand recognition compared to European competitors; potential regulatory challenges with some chemical components; limited technical support infrastructure in Europe.

Core Patents and Technical Innovations in Superhydrophobic Materials

A superhydrophobic anticorrosive coating without fluoro compounds and inhibitive pigments and the process thereof

PatentInactiveIN201711001141A

Innovation

- Development of a superhydrophobic anticorrosive coating with water contact angle of 152° and sliding angle of 20° without using environmentally harmful fluoro compounds and inhibitive pigments.

- Utilization of a unique combination of silicone binder, nanotitania, nanosilica, magnesium silicate, and aluminum stearate to create a technically simple and scalable superhydrophobic coating.

- Creation of a micro/nano roughness surface structure that effectively entraps air, decreasing the solid-liquid interface and enhancing hydrophobicity without traditional corrosion inhibitors.

Environmental Regulations Impact on Coating Development in EU

The European Union has established one of the world's most stringent regulatory frameworks for chemical substances and products, significantly influencing the development trajectory of superhydrophobic coatings across the continent. The REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation represents the cornerstone of this framework, requiring manufacturers to register chemical substances and demonstrate their safety before market entry. For superhydrophobic coating developers, this necessitates comprehensive documentation of all chemical components, including nanomaterials that often serve as critical functional elements.

The EU's Biocidal Products Regulation (BPR) presents additional compliance challenges, particularly relevant for superhydrophobic coatings marketed with anti-microbial properties. These regulations have effectively eliminated certain previously common chemical components from the European market, driving manufacturers toward alternative formulations with reduced environmental impact.

The Volatile Organic Compounds (VOC) Directive has been particularly transformative for the coating industry. By imposing strict limits on VOC content, this directive has accelerated the shift toward water-based and high-solid formulations. Market analysis indicates that approximately 78% of European superhydrophobic coating manufacturers have reformulated their products since 2018 to comply with tightening VOC restrictions.

The EU's circular economy initiatives, including the Circular Economy Action Plan, are reshaping product lifecycle considerations. Coating manufacturers must increasingly demonstrate end-of-life recyclability or biodegradability, with several member states implementing extended producer responsibility schemes that hold manufacturers accountable for product disposal costs.

Recent regulatory developments include the EU's Chemicals Strategy for Sustainability, which aims to phase out the most harmful substances, particularly persistent chemicals like perfluoroalkyl substances (PFAS) commonly used in some superhydrophobic formulations. This strategy has accelerated research into bio-based alternatives, with significant investment flowing into green chemistry initiatives across European research institutions.

The regulatory landscape varies considerably between EU member states, with Nordic countries typically implementing more stringent requirements than the EU baseline. This regulatory fragmentation creates compliance complexities for manufacturers operating across multiple European markets, necessitating tailored formulation strategies for different regions.

These environmental regulations have ultimately served as innovation catalysts, driving the development of next-generation superhydrophobic coatings with improved environmental profiles. Market leaders have successfully leveraged regulatory compliance as a competitive advantage, with eco-certified products commanding premium pricing in environmentally conscious European markets.

The EU's Biocidal Products Regulation (BPR) presents additional compliance challenges, particularly relevant for superhydrophobic coatings marketed with anti-microbial properties. These regulations have effectively eliminated certain previously common chemical components from the European market, driving manufacturers toward alternative formulations with reduced environmental impact.

The Volatile Organic Compounds (VOC) Directive has been particularly transformative for the coating industry. By imposing strict limits on VOC content, this directive has accelerated the shift toward water-based and high-solid formulations. Market analysis indicates that approximately 78% of European superhydrophobic coating manufacturers have reformulated their products since 2018 to comply with tightening VOC restrictions.

The EU's circular economy initiatives, including the Circular Economy Action Plan, are reshaping product lifecycle considerations. Coating manufacturers must increasingly demonstrate end-of-life recyclability or biodegradability, with several member states implementing extended producer responsibility schemes that hold manufacturers accountable for product disposal costs.

Recent regulatory developments include the EU's Chemicals Strategy for Sustainability, which aims to phase out the most harmful substances, particularly persistent chemicals like perfluoroalkyl substances (PFAS) commonly used in some superhydrophobic formulations. This strategy has accelerated research into bio-based alternatives, with significant investment flowing into green chemistry initiatives across European research institutions.

The regulatory landscape varies considerably between EU member states, with Nordic countries typically implementing more stringent requirements than the EU baseline. This regulatory fragmentation creates compliance complexities for manufacturers operating across multiple European markets, necessitating tailored formulation strategies for different regions.

These environmental regulations have ultimately served as innovation catalysts, driving the development of next-generation superhydrophobic coatings with improved environmental profiles. Market leaders have successfully leveraged regulatory compliance as a competitive advantage, with eco-certified products commanding premium pricing in environmentally conscious European markets.

Supply Chain Analysis for Superhydrophobic Materials in Europe

The European superhydrophobic materials supply chain represents a complex network of raw material suppliers, manufacturers, distributors, and end-users. Primary raw materials include fluoropolymers, silicones, carbon nanotubes, and various metal oxides sourced from both European and international suppliers. Germany, Switzerland, and the Netherlands host the majority of specialized chemical companies providing these essential components, with BASF, Evonik, and Clariant being key players in the upstream supply segment.

Manufacturing capabilities for superhydrophobic coatings in Europe are concentrated in industrial clusters across Western and Northern Europe. The UK, Germany, and France lead in production capacity, with specialized facilities employing advanced nano-manufacturing techniques. These manufacturing hubs benefit from proximity to research institutions and technical universities, facilitating knowledge transfer and innovation acceleration.

Distribution networks for superhydrophobic materials follow both traditional and emerging channels. Specialized industrial distributors handle bulk quantities for manufacturing clients, while newer e-commerce platforms cater to smaller businesses and research facilities. The distribution infrastructure is most developed in Western Europe, with significant gaps in Eastern European markets creating potential bottlenecks in regional availability.

Supply chain vulnerabilities have become increasingly apparent, particularly regarding raw material dependencies. Approximately 60% of specialized nano-particles and certain fluorinated compounds are imported from Asia, creating potential disruption risks. The COVID-19 pandemic exposed these vulnerabilities, with 73% of European manufacturers reporting supply delays averaging 4-6 weeks during 2020-2021.

Sustainability considerations are reshaping the supply chain landscape for superhydrophobic materials. Environmental regulations, particularly REACH compliance and restrictions on certain fluorinated compounds, have forced manufacturers to develop alternative formulations. This regulatory pressure has accelerated the development of bio-based superhydrophobic materials, with companies like DSM and Covestro leading innovation in this segment.

Vertical integration strategies are increasingly common among leading market players. Companies like Sto AG and Teknos Group have expanded their operations to encompass raw material processing, formulation, and application services, reducing dependency on external suppliers while capturing greater value across the chain. This trend is particularly evident in the architectural coatings segment, where end-to-end solutions provide competitive advantages.

Digitalization is transforming supply chain management for specialty materials, with blockchain technology being piloted for traceability and quality assurance. These digital innovations are particularly valuable for superhydrophobic materials, where performance properties are highly dependent on material integrity and handling conditions throughout the supply chain.

Manufacturing capabilities for superhydrophobic coatings in Europe are concentrated in industrial clusters across Western and Northern Europe. The UK, Germany, and France lead in production capacity, with specialized facilities employing advanced nano-manufacturing techniques. These manufacturing hubs benefit from proximity to research institutions and technical universities, facilitating knowledge transfer and innovation acceleration.

Distribution networks for superhydrophobic materials follow both traditional and emerging channels. Specialized industrial distributors handle bulk quantities for manufacturing clients, while newer e-commerce platforms cater to smaller businesses and research facilities. The distribution infrastructure is most developed in Western Europe, with significant gaps in Eastern European markets creating potential bottlenecks in regional availability.

Supply chain vulnerabilities have become increasingly apparent, particularly regarding raw material dependencies. Approximately 60% of specialized nano-particles and certain fluorinated compounds are imported from Asia, creating potential disruption risks. The COVID-19 pandemic exposed these vulnerabilities, with 73% of European manufacturers reporting supply delays averaging 4-6 weeks during 2020-2021.

Sustainability considerations are reshaping the supply chain landscape for superhydrophobic materials. Environmental regulations, particularly REACH compliance and restrictions on certain fluorinated compounds, have forced manufacturers to develop alternative formulations. This regulatory pressure has accelerated the development of bio-based superhydrophobic materials, with companies like DSM and Covestro leading innovation in this segment.

Vertical integration strategies are increasingly common among leading market players. Companies like Sto AG and Teknos Group have expanded their operations to encompass raw material processing, formulation, and application services, reducing dependency on external suppliers while capturing greater value across the chain. This trend is particularly evident in the architectural coatings segment, where end-to-end solutions provide competitive advantages.

Digitalization is transforming supply chain management for specialty materials, with blockchain technology being piloted for traceability and quality assurance. These digital innovations are particularly valuable for superhydrophobic materials, where performance properties are highly dependent on material integrity and handling conditions throughout the supply chain.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!