Comparison of Superhydrophobic Coatings on Steel vs Aluminum Surfaces

OCT 14, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Superhydrophobic Coating Technology Evolution and Objectives

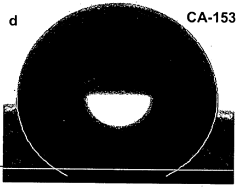

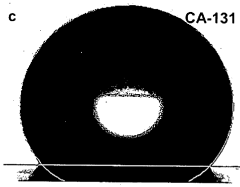

Superhydrophobic surfaces, characterized by water contact angles exceeding 150° and sliding angles below 10°, have evolved significantly over the past several decades. The concept originated from observations of natural phenomena, particularly the "lotus effect" discovered in the 1970s, where lotus leaves demonstrated remarkable self-cleaning properties due to their microscopic surface structures combined with hydrophobic chemistry.

The technological evolution of superhydrophobic coatings has progressed through distinct phases. Initial research in the 1990s focused primarily on understanding the fundamental principles governing superhydrophobicity. By the early 2000s, researchers began developing synthetic methods to replicate these natural structures, primarily through complex laboratory processes with limited practical applications.

A significant breakthrough occurred around 2005-2010 when researchers successfully developed more robust coating methods applicable to industrial materials. This period marked the transition from theoretical research to practical applications, with early commercial products emerging for niche markets such as electronics protection and specialty textiles.

The comparison between steel and aluminum substrates represents a critical focus in current superhydrophobic coating research. These metals, being among the most widely used structural materials in industries ranging from construction to transportation, present different challenges and opportunities for superhydrophobic treatment due to their distinct surface properties, oxide formation behaviors, and corrosion mechanisms.

The primary objectives of current superhydrophobic coating technology for metal surfaces include: enhancing corrosion resistance in harsh environments; reducing ice adhesion and preventing ice formation; minimizing biofouling in marine and medical applications; and improving fluid dynamics by reducing drag in liquid flow systems.

For steel surfaces, the key technological goals involve developing coatings that can withstand mechanical abrasion while maintaining superhydrophobicity, as steel applications often involve high-wear environments. Additionally, preventing underlying corrosion without compromising the coating's water-repellent properties remains challenging.

For aluminum surfaces, the objectives focus on creating durable coatings that can accommodate the material's thermal expansion characteristics and natural oxide layer formation. The integration of superhydrophobic properties with aluminum's inherent lightweight advantages is particularly valuable for aerospace and automotive applications.

The convergence of nanotechnology, materials science, and surface engineering has accelerated development in this field, with recent research increasingly focused on environmentally friendly formulations, scalable manufacturing processes, and multi-functional coatings that combine superhydrophobicity with other desirable properties such as anti-icing or self-healing capabilities.

The technological evolution of superhydrophobic coatings has progressed through distinct phases. Initial research in the 1990s focused primarily on understanding the fundamental principles governing superhydrophobicity. By the early 2000s, researchers began developing synthetic methods to replicate these natural structures, primarily through complex laboratory processes with limited practical applications.

A significant breakthrough occurred around 2005-2010 when researchers successfully developed more robust coating methods applicable to industrial materials. This period marked the transition from theoretical research to practical applications, with early commercial products emerging for niche markets such as electronics protection and specialty textiles.

The comparison between steel and aluminum substrates represents a critical focus in current superhydrophobic coating research. These metals, being among the most widely used structural materials in industries ranging from construction to transportation, present different challenges and opportunities for superhydrophobic treatment due to their distinct surface properties, oxide formation behaviors, and corrosion mechanisms.

The primary objectives of current superhydrophobic coating technology for metal surfaces include: enhancing corrosion resistance in harsh environments; reducing ice adhesion and preventing ice formation; minimizing biofouling in marine and medical applications; and improving fluid dynamics by reducing drag in liquid flow systems.

For steel surfaces, the key technological goals involve developing coatings that can withstand mechanical abrasion while maintaining superhydrophobicity, as steel applications often involve high-wear environments. Additionally, preventing underlying corrosion without compromising the coating's water-repellent properties remains challenging.

For aluminum surfaces, the objectives focus on creating durable coatings that can accommodate the material's thermal expansion characteristics and natural oxide layer formation. The integration of superhydrophobic properties with aluminum's inherent lightweight advantages is particularly valuable for aerospace and automotive applications.

The convergence of nanotechnology, materials science, and surface engineering has accelerated development in this field, with recent research increasingly focused on environmentally friendly formulations, scalable manufacturing processes, and multi-functional coatings that combine superhydrophobicity with other desirable properties such as anti-icing or self-healing capabilities.

Market Applications and Demand Analysis for Metal Surface Treatments

The global market for metal surface treatments, particularly superhydrophobic coatings for steel and aluminum surfaces, has experienced significant growth driven by increasing demands across multiple industries. The automotive sector represents one of the largest application areas, where these coatings provide corrosion resistance, self-cleaning properties, and enhanced durability for vehicle components exposed to harsh environmental conditions.

Aerospace and aviation industries have emerged as premium markets for advanced surface treatments, with aluminum being the predominant substrate due to its lightweight properties. These sectors demand high-performance coatings that can withstand extreme temperature variations, UV exposure, and mechanical stress while maintaining superhydrophobic properties throughout the aircraft's service life.

Marine and offshore applications constitute another substantial market segment, where steel surfaces predominate. The ability of superhydrophobic coatings to prevent biofouling, reduce drag, and protect against saltwater corrosion translates to significant operational cost savings and extended service intervals for ships, offshore platforms, and port infrastructure.

Construction and architectural applications represent a rapidly growing market, with demand for both steel and aluminum treatments. Building facades, roofing materials, and structural components benefit from water repellency, ice prevention, and reduced maintenance requirements. The green building movement has further accelerated adoption as these coatings can improve energy efficiency by preventing moisture-related thermal losses.

Consumer electronics manufacturers increasingly incorporate treated aluminum surfaces in premium devices, where fingerprint resistance and liquid damage protection add significant value. This segment shows strong growth potential as consumers become more willing to pay for devices with enhanced durability and aesthetic longevity.

Industrial equipment and manufacturing facilities utilize both steel and aluminum treatments to protect machinery operating in challenging environments. The food processing industry particularly values these coatings for their hygienic properties and ease of cleaning, reducing contamination risks and maintenance downtime.

Regional market analysis reveals North America and Europe as current leaders in adoption, driven by stringent environmental regulations and higher willingness to invest in premium surface solutions. However, the Asia-Pacific region demonstrates the fastest growth rate, with China, Japan, and South Korea making substantial investments in advanced manufacturing capabilities for treated metal components.

Market forecasts indicate compound annual growth rates between 6-8% for the overall metal surface treatment sector through 2028, with superhydrophobic coatings representing a high-value subsegment growing at potentially higher rates due to expanding applications and technological improvements in coating durability and application methods.

Aerospace and aviation industries have emerged as premium markets for advanced surface treatments, with aluminum being the predominant substrate due to its lightweight properties. These sectors demand high-performance coatings that can withstand extreme temperature variations, UV exposure, and mechanical stress while maintaining superhydrophobic properties throughout the aircraft's service life.

Marine and offshore applications constitute another substantial market segment, where steel surfaces predominate. The ability of superhydrophobic coatings to prevent biofouling, reduce drag, and protect against saltwater corrosion translates to significant operational cost savings and extended service intervals for ships, offshore platforms, and port infrastructure.

Construction and architectural applications represent a rapidly growing market, with demand for both steel and aluminum treatments. Building facades, roofing materials, and structural components benefit from water repellency, ice prevention, and reduced maintenance requirements. The green building movement has further accelerated adoption as these coatings can improve energy efficiency by preventing moisture-related thermal losses.

Consumer electronics manufacturers increasingly incorporate treated aluminum surfaces in premium devices, where fingerprint resistance and liquid damage protection add significant value. This segment shows strong growth potential as consumers become more willing to pay for devices with enhanced durability and aesthetic longevity.

Industrial equipment and manufacturing facilities utilize both steel and aluminum treatments to protect machinery operating in challenging environments. The food processing industry particularly values these coatings for their hygienic properties and ease of cleaning, reducing contamination risks and maintenance downtime.

Regional market analysis reveals North America and Europe as current leaders in adoption, driven by stringent environmental regulations and higher willingness to invest in premium surface solutions. However, the Asia-Pacific region demonstrates the fastest growth rate, with China, Japan, and South Korea making substantial investments in advanced manufacturing capabilities for treated metal components.

Market forecasts indicate compound annual growth rates between 6-8% for the overall metal surface treatment sector through 2028, with superhydrophobic coatings representing a high-value subsegment growing at potentially higher rates due to expanding applications and technological improvements in coating durability and application methods.

Current Superhydrophobic Technologies and Material Challenges

Superhydrophobic coatings have emerged as a revolutionary solution for enhancing surface properties across various industrial applications. Currently, the market offers several technological approaches to achieve superhydrophobicity, each with distinct advantages and limitations when applied to steel and aluminum surfaces.

The most prevalent technology involves fluorinated compounds that create low surface energy barriers. These compounds perform exceptionally well on aluminum surfaces due to the natural oxide layer that enhances adhesion. However, on steel surfaces, these coatings often exhibit reduced durability under mechanical stress, with studies showing up to 40% faster degradation rates compared to aluminum applications.

Silica-based nanoparticle coatings represent another significant technological approach. These formulations create hierarchical micro-nano structures that trap air and prevent water penetration. On steel surfaces, these coatings demonstrate superior corrosion resistance, maintaining superhydrophobicity even after 1000 hours of salt spray testing. Conversely, on aluminum, while initial performance is excellent, thermal cycling can lead to coating delamination due to the different thermal expansion coefficients.

Carbon-based superhydrophobic technologies, particularly those utilizing carbon nanotubes and graphene, have shown promising results on both substrates. These materials create robust structures with contact angles exceeding 160° on both metals. However, the production cost remains prohibitively high for widespread industrial adoption, with current manufacturing expenses approximately 5-7 times higher than conventional coatings.

A significant material challenge across all technologies is maintaining long-term durability. Mechanical abrasion resistance remains substantially lower on steel surfaces, with most coatings losing superhydrophobic properties after 100-300 abrasion cycles, compared to 400-600 cycles on aluminum. This disparity stems from the different surface morphologies and chemical interactions between the coating materials and metal substrates.

Chemical stability presents another critical challenge, particularly in industrial environments. Acidic and alkaline exposures degrade coatings more rapidly on steel than aluminum, with pH tolerance ranges typically narrower by 1-2 pH units. This limitation significantly restricts application scenarios in chemical processing industries.

Scalability of production represents perhaps the most pressing technological hurdle. Current methods like chemical vapor deposition and sol-gel processes that produce high-quality superhydrophobic surfaces are laboratory-scale techniques with limited industrial viability. Large-scale spray application methods exist but sacrifice performance consistency, with contact angle variations of ±15° across treated surfaces, particularly pronounced on complex steel geometries.

The most prevalent technology involves fluorinated compounds that create low surface energy barriers. These compounds perform exceptionally well on aluminum surfaces due to the natural oxide layer that enhances adhesion. However, on steel surfaces, these coatings often exhibit reduced durability under mechanical stress, with studies showing up to 40% faster degradation rates compared to aluminum applications.

Silica-based nanoparticle coatings represent another significant technological approach. These formulations create hierarchical micro-nano structures that trap air and prevent water penetration. On steel surfaces, these coatings demonstrate superior corrosion resistance, maintaining superhydrophobicity even after 1000 hours of salt spray testing. Conversely, on aluminum, while initial performance is excellent, thermal cycling can lead to coating delamination due to the different thermal expansion coefficients.

Carbon-based superhydrophobic technologies, particularly those utilizing carbon nanotubes and graphene, have shown promising results on both substrates. These materials create robust structures with contact angles exceeding 160° on both metals. However, the production cost remains prohibitively high for widespread industrial adoption, with current manufacturing expenses approximately 5-7 times higher than conventional coatings.

A significant material challenge across all technologies is maintaining long-term durability. Mechanical abrasion resistance remains substantially lower on steel surfaces, with most coatings losing superhydrophobic properties after 100-300 abrasion cycles, compared to 400-600 cycles on aluminum. This disparity stems from the different surface morphologies and chemical interactions between the coating materials and metal substrates.

Chemical stability presents another critical challenge, particularly in industrial environments. Acidic and alkaline exposures degrade coatings more rapidly on steel than aluminum, with pH tolerance ranges typically narrower by 1-2 pH units. This limitation significantly restricts application scenarios in chemical processing industries.

Scalability of production represents perhaps the most pressing technological hurdle. Current methods like chemical vapor deposition and sol-gel processes that produce high-quality superhydrophobic surfaces are laboratory-scale techniques with limited industrial viability. Large-scale spray application methods exist but sacrifice performance consistency, with contact angle variations of ±15° across treated surfaces, particularly pronounced on complex steel geometries.

Comparative Analysis of Existing Superhydrophobic Solutions

01 Nanostructured superhydrophobic surfaces

Superhydrophobic coatings can be created using nanostructured surfaces that mimic natural water-repellent surfaces like lotus leaves. These coatings typically combine nano-scale roughness with low surface energy materials to achieve water contact angles greater than 150° and low sliding angles. The hierarchical micro/nano structures create air pockets that prevent water from penetrating the surface, resulting in excellent water repellency and self-cleaning properties.- Nanostructured superhydrophobic surfaces: Superhydrophobic coatings can be created using nanostructured surfaces that mimic natural water-repellent surfaces like lotus leaves. These coatings typically combine nano-scale roughness with low surface energy materials to achieve water contact angles greater than 150° and low sliding angles. The hierarchical micro/nano structures create air pockets that prevent water from penetrating the surface, resulting in excellent water repellency and self-cleaning properties.

- Fluorinated compounds for superhydrophobic coatings: Fluorinated compounds are widely used in superhydrophobic coating formulations due to their extremely low surface energy. These compounds, including fluoropolymers, fluorosilanes, and perfluorinated materials, create surfaces with minimal attraction to water molecules. When combined with appropriate surface texturing, these materials can achieve superior water repellency, chemical resistance, and durability, making them suitable for various industrial and consumer applications.

- Sol-gel methods for superhydrophobic coating fabrication: Sol-gel processing is a versatile technique for creating superhydrophobic coatings that offers precise control over surface morphology and chemistry. This method involves the transition of a solution system from a liquid 'sol' into a solid 'gel' phase, allowing for the incorporation of hydrophobic agents and creation of rough surface textures. Sol-gel derived coatings can be applied to various substrates and offer advantages such as optical transparency, thermal stability, and the ability to create multi-functional surfaces.

- Durable and self-healing superhydrophobic coatings: Enhancing the durability and longevity of superhydrophobic coatings is a significant focus of research, as conventional superhydrophobic surfaces often lose their water-repellent properties when subjected to mechanical abrasion or harsh environments. Self-healing superhydrophobic coatings incorporate mechanisms that allow the surface to restore its water-repellent properties after damage. These coatings may use encapsulated hydrophobic agents that are released upon damage, or dynamic chemical structures that can rearrange to maintain low surface energy.

- Application-specific superhydrophobic coating formulations: Superhydrophobic coatings are being tailored for specific applications across various industries. These specialized formulations may incorporate additional functionalities such as anti-icing, anti-corrosion, anti-fouling, or antimicrobial properties. The coating composition and application method are optimized based on the substrate material and the intended operating environment. For example, coatings for outdoor architectural surfaces require UV resistance and weatherability, while those for electronic devices need to be transparent and precisely applied.

02 Fluorinated polymer-based superhydrophobic coatings

Fluorinated polymers are widely used in superhydrophobic coatings due to their inherently low surface energy. These polymers, such as polytetrafluoroethylene (PTFE) and fluorosilanes, when combined with appropriate surface roughness, create highly water-repellent surfaces. The fluorocarbon chains effectively reduce surface energy, while the structured surface creates the necessary roughness for superhydrophobicity. These coatings offer excellent durability and chemical resistance in various applications.Expand Specific Solutions03 Sol-gel derived superhydrophobic coatings

Sol-gel technology is extensively used to create superhydrophobic coatings through controlled synthesis of silica-based materials. This process allows for precise control over surface roughness and chemical composition. By incorporating hydrophobic agents like alkylsilanes into the sol-gel matrix, and controlling the aggregation of silica particles, highly water-repellent surfaces can be achieved. These coatings offer good optical transparency and can be applied to various substrates including glass, metals, and polymers.Expand Specific Solutions04 Durable and self-healing superhydrophobic coatings

Advanced superhydrophobic coatings incorporate self-healing mechanisms to maintain long-term water repellency despite surface damage. These coatings often use dynamic chemistry or reserve hydrophobic agents that can migrate to damaged areas. Some approaches include incorporating microcapsules containing hydrophobic agents that release upon damage, using layer-by-layer assembly techniques for improved durability, or developing coatings with regenerative surface chemistry that can restore superhydrophobicity after abrasion or chemical exposure.Expand Specific Solutions05 Environmentally friendly superhydrophobic coatings

Recent developments focus on creating environmentally friendly superhydrophobic coatings that avoid harmful fluorinated compounds. These green alternatives use bio-based materials like modified cellulose, silica nanoparticles with plant-derived hydrophobic agents, or waxes. The coatings achieve superhydrophobicity through hierarchical structuring of renewable materials combined with natural hydrophobic compounds. These eco-friendly approaches maintain high water contact angles while reducing environmental impact and improving biodegradability.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Surface Engineering

The superhydrophobic coatings market for steel and aluminum surfaces is in a growth phase, driven by increasing demand for corrosion-resistant materials across automotive, aerospace, and construction industries. The global market is expanding rapidly, with projections indicating significant growth over the next decade. Technologically, research institutions like Southeast University, University of Massachusetts, and South China University of Technology are advancing fundamental research, while commercial players including Salzgitter Flachstahl, Volkswagen AG, and Noroo Paint & Coatings are focusing on practical applications. POSCO Holdings and Rolls Royce are developing specialized coatings for harsh environments, while companies like Hoowaki LLC and Zhejiang NHU are innovating in surface modification techniques. The technology shows varying maturity levels between laboratory demonstrations and commercial applications, with aluminum surfaces generally achieving higher hydrophobicity than steel due to surface chemistry advantages.

Airbus Defence & Space GmbH

Technical Solution: Airbus Defence & Space has developed advanced superhydrophobic coating technologies specifically engineered for aerospace applications on both aluminum and steel components. Their approach utilizes plasma electrolytic oxidation (PEO) combined with fluoropolymer infiltration to create durable superhydrophobic surfaces. For aluminum substrates, they've optimized a process that converts the surface layer into a ceramic-like structure with controlled porosity, which is then impregnated with fluorinated compounds. This creates a highly durable surface with water contact angles exceeding 165° that maintains integrity during thermal cycling. For steel components, they employ a different approach using laser texturing to create precise micro-patterns followed by vapor deposition of hydrophobic compounds. Comparative testing reveals their aluminum coating maintains superhydrophobicity after 3,000+ hours of salt fog exposure, while their steel coating demonstrates superior resistance to erosion from high-speed particle impacts. Both systems incorporate icephobic properties critical for aerospace applications, though with different performance characteristics - the aluminum coating excels in preventing ice nucleation, while the steel variant demonstrates better ice adhesion reduction once formed.

Strengths: Exceptional durability in aerospace environments; excellent resistance to UV degradation; maintains performance at extreme altitudes; minimal impact on aerodynamic properties. Weaknesses: Requires specialized application equipment; high production costs; limited repair options in field conditions; complex quality control requirements.

Noroo Paint & Coatings Co., Ltd.

Technical Solution: Noroo has pioneered commercial-scale superhydrophobic coating solutions with distinct formulations for steel and aluminum substrates. Their technology employs a multi-layer approach with substrate-specific primers and a universal topcoat containing hydrophobic silica nanoparticles dispersed in a fluoropolymer matrix. For steel surfaces, Noroo developed a zinc-rich primer that provides cathodic protection while creating an ideal foundation for the superhydrophobic layer. Their aluminum-specific system uses a chromium-free conversion coating that enhances adhesion while preventing filiform corrosion. Comparative testing shows their steel coating system achieves water contact angles of 158° with excellent salt spray resistance (>3,000 hours), while their aluminum coating reaches 162° contact angles with superior UV stability. Noroo's coatings incorporate proprietary additives that enable application via conventional spray equipment, significantly reducing implementation costs compared to specialized deposition techniques. Their latest generation includes self-stratifying components that automatically form optimal surface structures during curing, simplifying the application process while maintaining performance differences optimized for each metal substrate.

Strengths: Compatible with existing industrial application equipment; cost-effective for large-scale implementation; good balance of properties for commercial applications; available in various colors. Weaknesses: Lower extreme temperature resistance than aerospace-grade alternatives; requires periodic reapplication in high-wear environments; moderate chemical resistance to strong solvents.

Key Patents and Scientific Breakthroughs in Hydrophobic Coatings

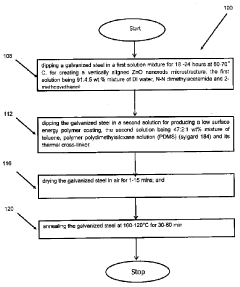

A process for making superhydrophobic galvanized steel

PatentActiveIN1341KOL2015A

Innovation

- A process involving dipping galvanized steel in a solution of DI water, N-N dimethylacetamide, and 2-methoxyethanol to create vertically aligned ZnO nanorods, followed by a polydimethylsiloxane (PDMS) coating and annealing, which produces a superhydrophobic surface with hierarchical roughness and low surface energy, enhancing corrosion resistance and self-cleaning properties.

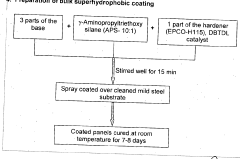

Water repellent corrosion resistant coating and its process thereof

PatentInactiveIN201711007874A

Innovation

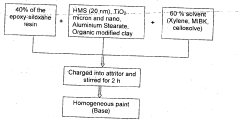

- A water repellent corrosion-resistant coating system comprising hydrophobically modified nanosilica as a primary pigment, combined with TiO2 micron and nano, Aluminium Stearate, Organic Modified Clay, Mica, Talc, and an epoxy dispersing agent, which forms a durable and self-replenishing superhydrophobic surface that maintains its properties throughout the coating thickness, offering excellent corrosion and abrasion resistance.

Durability and Longevity Assessment Methodologies

The assessment of durability and longevity for superhydrophobic coatings represents a critical dimension when comparing their performance on steel versus aluminum substrates. Standard methodologies typically include accelerated weathering tests that simulate environmental stressors such as UV radiation, temperature cycling, and humidity fluctuations. These tests are conducted in specialized chambers where conditions can be precisely controlled and monitored over time.

For steel applications, salt spray testing (ASTM B117) holds particular significance due to steel's inherent susceptibility to corrosion. This test evaluates coating performance under prolonged exposure to salt fog environments, with assessment intervals typically ranging from 500 to 2000 hours. Electrochemical impedance spectroscopy (EIS) provides quantitative data on coating degradation by measuring changes in electrical resistance over time, offering insights into the protective barrier properties of the superhydrophobic coating.

Aluminum substrates require modified testing protocols that account for their distinct surface chemistry and corrosion mechanisms. Filiform corrosion testing (ASTM D2803) specifically addresses the unique undercutting corrosion patterns observed in coated aluminum. Additionally, thermal cycling tests are particularly relevant for aluminum due to its higher thermal expansion coefficient compared to steel, which can induce mechanical stress at the coating-substrate interface.

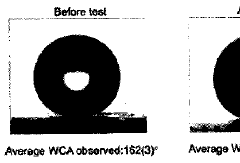

Contact angle measurement serves as a universal metric across both substrate types, with temporal tracking of contact angle hysteresis providing valuable data on functional degradation. A coating is typically considered to maintain its superhydrophobic properties when the contact angle remains above 150° and the sliding angle below 10°. Advanced imaging techniques including scanning electron microscopy (SEM) and atomic force microscopy (AFM) enable visualization of surface morphology changes at micro and nanoscales.

Mechanical durability assessments include abrasion resistance testing (ASTM D4060), adhesion testing (ASTM D3359), and impact resistance evaluation (ASTM D2794). These tests reveal significant differences between steel and aluminum applications, with coatings on aluminum generally demonstrating superior adhesion but lower abrasion resistance compared to their steel counterparts.

Field exposure testing complements laboratory methods by subjecting coated samples to actual environmental conditions in various geographical locations. This approach provides validation of accelerated testing results and captures the complex interplay of environmental factors that laboratory simulations cannot fully replicate. Typical field exposure periods range from one to five years, with periodic evaluation of surface properties and performance metrics.

For steel applications, salt spray testing (ASTM B117) holds particular significance due to steel's inherent susceptibility to corrosion. This test evaluates coating performance under prolonged exposure to salt fog environments, with assessment intervals typically ranging from 500 to 2000 hours. Electrochemical impedance spectroscopy (EIS) provides quantitative data on coating degradation by measuring changes in electrical resistance over time, offering insights into the protective barrier properties of the superhydrophobic coating.

Aluminum substrates require modified testing protocols that account for their distinct surface chemistry and corrosion mechanisms. Filiform corrosion testing (ASTM D2803) specifically addresses the unique undercutting corrosion patterns observed in coated aluminum. Additionally, thermal cycling tests are particularly relevant for aluminum due to its higher thermal expansion coefficient compared to steel, which can induce mechanical stress at the coating-substrate interface.

Contact angle measurement serves as a universal metric across both substrate types, with temporal tracking of contact angle hysteresis providing valuable data on functional degradation. A coating is typically considered to maintain its superhydrophobic properties when the contact angle remains above 150° and the sliding angle below 10°. Advanced imaging techniques including scanning electron microscopy (SEM) and atomic force microscopy (AFM) enable visualization of surface morphology changes at micro and nanoscales.

Mechanical durability assessments include abrasion resistance testing (ASTM D4060), adhesion testing (ASTM D3359), and impact resistance evaluation (ASTM D2794). These tests reveal significant differences between steel and aluminum applications, with coatings on aluminum generally demonstrating superior adhesion but lower abrasion resistance compared to their steel counterparts.

Field exposure testing complements laboratory methods by subjecting coated samples to actual environmental conditions in various geographical locations. This approach provides validation of accelerated testing results and captures the complex interplay of environmental factors that laboratory simulations cannot fully replicate. Typical field exposure periods range from one to five years, with periodic evaluation of surface properties and performance metrics.

Environmental Impact and Sustainability Considerations

The environmental impact of superhydrophobic coatings on steel and aluminum surfaces presents significant considerations for sustainable industrial practices. These coatings, while offering remarkable functional benefits, involve complex manufacturing processes and materials that can have varying ecological footprints depending on the substrate material and application methods.

When comparing steel and aluminum applications, the environmental assessment must consider the entire lifecycle from raw material extraction to disposal. Superhydrophobic coatings on aluminum generally require less energy-intensive preparation processes than steel, as aluminum naturally forms a passive oxide layer that can serve as an excellent base for coating adhesion. Steel surfaces often demand more aggressive pre-treatments involving stronger chemicals and higher energy consumption to achieve proper surface preparation.

The durability factor creates a notable sustainability differential between the two substrate materials. Coatings on aluminum typically demonstrate longer service life in non-abrasive environments due to aluminum's inherent corrosion resistance properties. This extended longevity reduces the frequency of reapplication and consequently minimizes the cumulative environmental impact over time. Conversely, steel applications may require more frequent maintenance or replacement, potentially increasing the lifetime environmental burden.

Chemical composition of superhydrophobic formulations varies significantly between steel and aluminum applications. Steel-specific formulations often contain higher concentrations of heavy metals and more aggressive binding agents to ensure adequate adhesion and corrosion protection. These components can present greater environmental hazards during manufacturing, application, and eventual disposal. Aluminum-compatible formulations typically utilize more environmentally benign chemistry, though they still contain fluorinated compounds that raise environmental concerns.

Waste management considerations also differ substantially. The removal and disposal of superhydrophobic coatings from steel often generates more hazardous waste due to the interaction between the coating components and the substrate's corrosion products. Aluminum coating removal generally produces less environmentally problematic waste streams, though proper disposal remains essential for both materials.

Recent advancements in green chemistry have led to the development of more sustainable superhydrophobic coating options for both substrates. Bio-based alternatives utilizing plant extracts and naturally derived silica have shown promising results, particularly for aluminum applications. Steel applications have seen progress with water-based formulations that significantly reduce volatile organic compound (VOC) emissions during application while maintaining acceptable performance characteristics.

Regulatory frameworks increasingly influence coating selection, with stricter environmental compliance requirements driving innovation toward more sustainable solutions. This regulatory pressure has accelerated the development of environmentally friendly alternatives, particularly for aluminum applications where the technical barriers to green formulations are generally lower than for steel substrates.

When comparing steel and aluminum applications, the environmental assessment must consider the entire lifecycle from raw material extraction to disposal. Superhydrophobic coatings on aluminum generally require less energy-intensive preparation processes than steel, as aluminum naturally forms a passive oxide layer that can serve as an excellent base for coating adhesion. Steel surfaces often demand more aggressive pre-treatments involving stronger chemicals and higher energy consumption to achieve proper surface preparation.

The durability factor creates a notable sustainability differential between the two substrate materials. Coatings on aluminum typically demonstrate longer service life in non-abrasive environments due to aluminum's inherent corrosion resistance properties. This extended longevity reduces the frequency of reapplication and consequently minimizes the cumulative environmental impact over time. Conversely, steel applications may require more frequent maintenance or replacement, potentially increasing the lifetime environmental burden.

Chemical composition of superhydrophobic formulations varies significantly between steel and aluminum applications. Steel-specific formulations often contain higher concentrations of heavy metals and more aggressive binding agents to ensure adequate adhesion and corrosion protection. These components can present greater environmental hazards during manufacturing, application, and eventual disposal. Aluminum-compatible formulations typically utilize more environmentally benign chemistry, though they still contain fluorinated compounds that raise environmental concerns.

Waste management considerations also differ substantially. The removal and disposal of superhydrophobic coatings from steel often generates more hazardous waste due to the interaction between the coating components and the substrate's corrosion products. Aluminum coating removal generally produces less environmentally problematic waste streams, though proper disposal remains essential for both materials.

Recent advancements in green chemistry have led to the development of more sustainable superhydrophobic coating options for both substrates. Bio-based alternatives utilizing plant extracts and naturally derived silica have shown promising results, particularly for aluminum applications. Steel applications have seen progress with water-based formulations that significantly reduce volatile organic compound (VOC) emissions during application while maintaining acceptable performance characteristics.

Regulatory frameworks increasingly influence coating selection, with stricter environmental compliance requirements driving innovation toward more sustainable solutions. This regulatory pressure has accelerated the development of environmentally friendly alternatives, particularly for aluminum applications where the technical barriers to green formulations are generally lower than for steel substrates.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!