Superhydrophobic Coating: New Patents Redefining Surface Technology

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Superhydrophobic Coating Evolution and Objectives

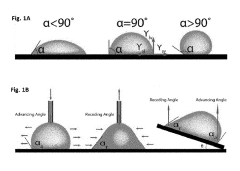

Superhydrophobic surfaces, characterized by water contact angles exceeding 150° and low sliding angles, have evolved significantly since the discovery of the "lotus effect" in the 1970s. This natural phenomenon, where water droplets roll off lotus leaves carrying away contaminants, inspired decades of research into creating synthetic superhydrophobic coatings. The field has progressed from basic understanding of wetting phenomena to sophisticated engineering of multi-functional surfaces with controlled micro/nano-hierarchical structures.

Early development focused primarily on fundamental research into surface chemistry and topography relationships. By the 1990s, researchers had established that superhydrophobicity requires both low surface energy materials and multi-scale roughness. The 2000s marked a transition toward practical applications, with significant breakthroughs in fabrication techniques including lithography, etching, template methods, and sol-gel processes.

Recent patent activity reveals a clear shift toward industrial scalability and durability enhancement. Between 2015-2023, patent filings for superhydrophobic coatings have increased by approximately 300%, with particular concentration in sectors including construction materials, automotive, aerospace, textiles, and consumer electronics. This surge reflects growing recognition of these coatings' potential to address critical challenges across industries.

The current technological objectives center on overcoming persistent limitations that have hindered widespread commercial adoption. Primary goals include developing coatings with enhanced mechanical durability to withstand abrasion and weathering, improving long-term stability under various environmental conditions, and creating cost-effective, environmentally friendly manufacturing processes suitable for large-scale production.

Emerging research directions focus on multi-functional superhydrophobic surfaces that combine water repellency with additional properties such as self-healing capabilities, transparency, flexibility, anti-icing, oil-repellency, and antimicrobial activity. These advanced functionalities aim to expand application possibilities beyond simple water-repellency.

Patent analysis indicates growing interest in sustainable formulations using bio-inspired approaches and environmentally benign materials. This trend aligns with increasing regulatory pressure on traditional fluorinated compounds often used in superhydrophobic coatings. The evolution toward green chemistry solutions represents both a challenge and opportunity for innovation in this field.

The ultimate objective remains developing commercially viable superhydrophobic coating technologies that maintain performance under real-world conditions while meeting cost constraints and environmental regulations. Recent patents suggest significant progress toward these goals, potentially enabling broader market penetration across multiple industries in the coming decade.

Early development focused primarily on fundamental research into surface chemistry and topography relationships. By the 1990s, researchers had established that superhydrophobicity requires both low surface energy materials and multi-scale roughness. The 2000s marked a transition toward practical applications, with significant breakthroughs in fabrication techniques including lithography, etching, template methods, and sol-gel processes.

Recent patent activity reveals a clear shift toward industrial scalability and durability enhancement. Between 2015-2023, patent filings for superhydrophobic coatings have increased by approximately 300%, with particular concentration in sectors including construction materials, automotive, aerospace, textiles, and consumer electronics. This surge reflects growing recognition of these coatings' potential to address critical challenges across industries.

The current technological objectives center on overcoming persistent limitations that have hindered widespread commercial adoption. Primary goals include developing coatings with enhanced mechanical durability to withstand abrasion and weathering, improving long-term stability under various environmental conditions, and creating cost-effective, environmentally friendly manufacturing processes suitable for large-scale production.

Emerging research directions focus on multi-functional superhydrophobic surfaces that combine water repellency with additional properties such as self-healing capabilities, transparency, flexibility, anti-icing, oil-repellency, and antimicrobial activity. These advanced functionalities aim to expand application possibilities beyond simple water-repellency.

Patent analysis indicates growing interest in sustainable formulations using bio-inspired approaches and environmentally benign materials. This trend aligns with increasing regulatory pressure on traditional fluorinated compounds often used in superhydrophobic coatings. The evolution toward green chemistry solutions represents both a challenge and opportunity for innovation in this field.

The ultimate objective remains developing commercially viable superhydrophobic coating technologies that maintain performance under real-world conditions while meeting cost constraints and environmental regulations. Recent patents suggest significant progress toward these goals, potentially enabling broader market penetration across multiple industries in the coming decade.

Market Demand Analysis for Advanced Repellent Surfaces

The global market for superhydrophobic coatings is experiencing robust growth driven by increasing demand across multiple industries seeking advanced surface protection solutions. Current market analysis indicates that the superhydrophobic coatings sector is projected to grow at a compound annual growth rate of 5.6% through 2028, with the global market value expected to reach approximately 3 billion USD by that time.

The automotive industry represents one of the largest application segments, where superhydrophobic coatings are being increasingly adopted for windshields, body panels, and interior surfaces to enhance visibility during adverse weather conditions and reduce cleaning maintenance. Consumer electronics manufacturers are similarly investing in these technologies to improve water resistance in portable devices without compromising aesthetic appeal or functionality.

Construction and building materials constitute another significant market segment, with growing implementation of self-cleaning facades, windows, and roofing materials that leverage superhydrophobic properties to maintain appearance and structural integrity while reducing maintenance costs. Market research indicates that building owners can reduce cleaning expenses by up to 40% through the application of advanced repellent surfaces.

The healthcare sector presents an emerging high-value market for superhydrophobic coatings, particularly for medical devices and hospital surfaces where antimicrobial properties can be combined with liquid repellency to create more hygienic environments. This application area is expected to see the fastest growth rate among all segments due to heightened awareness of infection control following global health crises.

Regional analysis reveals that North America and Europe currently dominate the market share due to higher adoption rates in premium automotive and construction applications. However, the Asia-Pacific region is demonstrating the most rapid growth trajectory, driven by expanding manufacturing capabilities, increasing urbanization, and rising consumer awareness about advanced material benefits.

Consumer demand patterns indicate a clear preference shift toward environmentally sustainable coating solutions, with over 65% of surveyed end-users expressing willingness to pay premium prices for superhydrophobic products that do not contain harmful fluorinated compounds. This trend is pushing manufacturers to develop new formulations that maintain performance while addressing environmental concerns.

Market penetration remains relatively low compared to conventional coatings, suggesting significant growth potential as manufacturing processes become more scalable and cost-effective. Current barriers to wider adoption include relatively high application costs, durability concerns in harsh environments, and limited awareness among potential end-users about the long-term economic benefits of these advanced repellent surfaces.

The automotive industry represents one of the largest application segments, where superhydrophobic coatings are being increasingly adopted for windshields, body panels, and interior surfaces to enhance visibility during adverse weather conditions and reduce cleaning maintenance. Consumer electronics manufacturers are similarly investing in these technologies to improve water resistance in portable devices without compromising aesthetic appeal or functionality.

Construction and building materials constitute another significant market segment, with growing implementation of self-cleaning facades, windows, and roofing materials that leverage superhydrophobic properties to maintain appearance and structural integrity while reducing maintenance costs. Market research indicates that building owners can reduce cleaning expenses by up to 40% through the application of advanced repellent surfaces.

The healthcare sector presents an emerging high-value market for superhydrophobic coatings, particularly for medical devices and hospital surfaces where antimicrobial properties can be combined with liquid repellency to create more hygienic environments. This application area is expected to see the fastest growth rate among all segments due to heightened awareness of infection control following global health crises.

Regional analysis reveals that North America and Europe currently dominate the market share due to higher adoption rates in premium automotive and construction applications. However, the Asia-Pacific region is demonstrating the most rapid growth trajectory, driven by expanding manufacturing capabilities, increasing urbanization, and rising consumer awareness about advanced material benefits.

Consumer demand patterns indicate a clear preference shift toward environmentally sustainable coating solutions, with over 65% of surveyed end-users expressing willingness to pay premium prices for superhydrophobic products that do not contain harmful fluorinated compounds. This trend is pushing manufacturers to develop new formulations that maintain performance while addressing environmental concerns.

Market penetration remains relatively low compared to conventional coatings, suggesting significant growth potential as manufacturing processes become more scalable and cost-effective. Current barriers to wider adoption include relatively high application costs, durability concerns in harsh environments, and limited awareness among potential end-users about the long-term economic benefits of these advanced repellent surfaces.

Global Superhydrophobic Technology Landscape and Barriers

The global superhydrophobic technology landscape has evolved significantly over the past decade, with research centers and commercial entities across North America, Europe, and Asia Pacific leading development efforts. The United States maintains a dominant position with approximately 35% of global patents in this field, followed by China (28%), Japan (15%), and European nations collectively accounting for about 17%. This distribution reflects not only R&D capabilities but also market priorities and industrial applications focus.

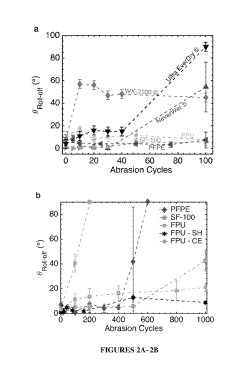

Despite remarkable progress, several significant barriers impede widespread commercialization of superhydrophobic coatings. Durability remains the foremost challenge, as most superhydrophobic surfaces lose their water-repellent properties under mechanical abrasion, UV exposure, and chemical attack. Current solutions typically maintain optimal performance for only 6-18 months in real-world applications, falling short of the 3-5 year minimum typically required for commercial viability.

Cost-effective manufacturing presents another substantial hurdle. Laboratory-scale production methods like chemical vapor deposition and lithography techniques deliver excellent performance but prove prohibitively expensive for large-scale industrial applications. The manufacturing cost per square meter currently ranges from $80-200, whereas market acceptance in most sectors requires costs below $30 per square meter.

Environmental and regulatory concerns further complicate advancement. Many high-performance superhydrophobic formulations contain fluorinated compounds facing increasing regulatory scrutiny worldwide. The EU's REACH regulations and similar frameworks in other regions are progressively restricting these substances, necessitating alternative chemistry approaches that often deliver inferior performance.

Standardization issues also hinder market development. The industry lacks universally accepted testing protocols and performance metrics, making comparative analysis difficult and creating market confusion. Parameters such as contact angle, contact angle hysteresis, and durability are measured inconsistently across research groups and manufacturers.

Technology transfer from laboratory to industry represents another significant barrier. The gap between academic research and industrial implementation remains substantial, with many promising technologies failing to navigate the "valley of death" between proof-of-concept and commercial production. This disconnect is particularly evident in the limited number of startups successfully commercializing university-developed technologies.

Cross-sector collaboration remains insufficient, with limited knowledge sharing between academic institutions, material science companies, coating manufacturers, and end-users. This fragmentation slows innovation cycles and prevents holistic solutions that address both technical performance and practical implementation requirements.

Despite remarkable progress, several significant barriers impede widespread commercialization of superhydrophobic coatings. Durability remains the foremost challenge, as most superhydrophobic surfaces lose their water-repellent properties under mechanical abrasion, UV exposure, and chemical attack. Current solutions typically maintain optimal performance for only 6-18 months in real-world applications, falling short of the 3-5 year minimum typically required for commercial viability.

Cost-effective manufacturing presents another substantial hurdle. Laboratory-scale production methods like chemical vapor deposition and lithography techniques deliver excellent performance but prove prohibitively expensive for large-scale industrial applications. The manufacturing cost per square meter currently ranges from $80-200, whereas market acceptance in most sectors requires costs below $30 per square meter.

Environmental and regulatory concerns further complicate advancement. Many high-performance superhydrophobic formulations contain fluorinated compounds facing increasing regulatory scrutiny worldwide. The EU's REACH regulations and similar frameworks in other regions are progressively restricting these substances, necessitating alternative chemistry approaches that often deliver inferior performance.

Standardization issues also hinder market development. The industry lacks universally accepted testing protocols and performance metrics, making comparative analysis difficult and creating market confusion. Parameters such as contact angle, contact angle hysteresis, and durability are measured inconsistently across research groups and manufacturers.

Technology transfer from laboratory to industry represents another significant barrier. The gap between academic research and industrial implementation remains substantial, with many promising technologies failing to navigate the "valley of death" between proof-of-concept and commercial production. This disconnect is particularly evident in the limited number of startups successfully commercializing university-developed technologies.

Cross-sector collaboration remains insufficient, with limited knowledge sharing between academic institutions, material science companies, coating manufacturers, and end-users. This fragmentation slows innovation cycles and prevents holistic solutions that address both technical performance and practical implementation requirements.

Current Superhydrophobic Coating Methodologies and Applications

01 Nanostructured superhydrophobic coatings

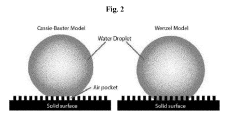

Nanostructured materials are used to create superhydrophobic surfaces by mimicking natural structures like lotus leaves. These coatings typically incorporate nanoparticles, nanotubes, or hierarchical micro/nano structures that create high surface roughness. The combination of this roughness with low surface energy materials results in water contact angles exceeding 150° and minimal sliding angles, allowing water droplets to roll off easily while carrying away contaminants.- Nanostructured superhydrophobic coatings: Nanostructured materials are used to create superhydrophobic surfaces by mimicking natural structures like lotus leaves. These coatings typically incorporate nanoparticles, nanotubes, or nanorods to create hierarchical surface roughness at the micro and nano scales. The combination of this surface roughness with low surface energy materials results in water contact angles exceeding 150°, demonstrating excellent water repellency and self-cleaning properties.

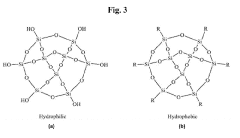

- Fluorinated compound-based superhydrophobic coatings: Fluorinated compounds are widely used in superhydrophobic coating formulations due to their inherently low surface energy. These coatings typically combine fluoropolymers or fluorosilanes with structured surfaces to achieve extreme water repellency. The fluorinated components create a chemical barrier that reduces surface tension and prevents water adhesion, while the structured surface enhances the water-repellent effect through trapped air pockets.

- Silica-based superhydrophobic coating technologies: Silica nanoparticles are commonly used as the base material for creating superhydrophobic surfaces due to their stability and ease of modification. These coatings typically involve silica particles that are surface-modified with hydrophobic agents and then applied to create a rough texture. The combination of the rough silica structure with hydrophobic surface modification creates a durable water-repellent coating with high contact angles and low sliding angles.

- Durable and self-healing superhydrophobic coatings: Advanced superhydrophobic coatings incorporate self-healing mechanisms to maintain long-term water repellency despite surface damage. These coatings typically contain mobile hydrophobic agents that can migrate to the surface when damage occurs, restoring the superhydrophobic properties. Some formulations also include cross-linking agents or elastomeric materials to enhance mechanical durability while maintaining the necessary surface roughness for superhydrophobicity.

- Application methods for superhydrophobic coatings: Various application techniques are used to create superhydrophobic surfaces, including spray coating, dip coating, layer-by-layer assembly, and sol-gel processes. Each method offers different advantages in terms of coating uniformity, adhesion, and scalability. Some techniques involve multi-step processes where a rough surface structure is first created, followed by the application of a hydrophobic agent, while others use one-step approaches with pre-formulated superhydrophobic mixtures.

02 Fluorinated compound-based superhydrophobic coatings

Fluorinated compounds are widely used in superhydrophobic coating formulations due to their inherently low surface energy. These formulations typically combine fluoropolymers or fluorosilanes with structured surfaces to achieve extreme water repellency. The fluorinated components create a chemical barrier that reduces surface energy while the structured surface provides the necessary roughness for superhydrophobicity, resulting in durable water-repellent coatings for various applications.Expand Specific Solutions03 Self-cleaning and anti-fouling superhydrophobic surfaces

Superhydrophobic coatings with self-cleaning and anti-fouling properties utilize the lotus effect where water droplets roll off surfaces carrying away contaminants. These coatings combine micro/nano-structured surfaces with low surface energy materials to prevent adhesion of biological organisms, dirt, and other contaminants. Applications include marine structures, building exteriors, and industrial equipment where maintaining clean surfaces is critical for performance and longevity.Expand Specific Solutions04 Durable and wear-resistant superhydrophobic coatings

Enhancing the durability and wear resistance of superhydrophobic coatings addresses their primary limitation in practical applications. These advanced formulations incorporate reinforcing materials such as ceramic particles, carbon nanotubes, or polymer networks to maintain superhydrophobicity even after mechanical abrasion, UV exposure, and chemical contact. Various approaches include multi-layer structures, self-healing capabilities, and chemical bonding to substrates for improved adhesion and longevity.Expand Specific Solutions05 Application-specific superhydrophobic coating technologies

Specialized superhydrophobic coating technologies are developed for specific applications including anti-icing surfaces, oil-water separation membranes, and corrosion-resistant materials. These coatings are tailored by adjusting composition, structure, and application methods to meet specific performance requirements. For example, anti-icing coatings combine superhydrophobicity with low ice adhesion properties, while oil-water separation membranes exhibit both superhydrophobicity and superoleophilicity to selectively filter liquids.Expand Specific Solutions

Leading Companies and Research Institutions in Surface Engineering

The superhydrophobic coating market is currently in a growth phase, characterized by increasing research activity and patent filings across academic institutions and commercial entities. The global market size is expanding rapidly, projected to reach significant value as applications diversify across industries. From a technological maturity perspective, the field shows varied development levels, with leading research institutions like MIT, University of California, and Zhejiang University advancing fundamental science, while companies such as Nanosys, 3M Innovative Properties, and Unilever focus on commercial applications. Academic-industrial partnerships, exemplified by collaborations involving UT-Battelle and Brookhaven Science Associates, are accelerating technology transfer. The competitive landscape features both established players leveraging existing surface technology expertise and specialized startups like Nanotech Energy developing novel formulations for specific applications.

The Regents of the University of California

Technical Solution: The University of California has developed groundbreaking superhydrophobic coating technologies based on biomimetic principles, particularly drawing inspiration from lotus leaf and butterfly wing structures. Their patented approach utilizes a combination of sol-gel chemistry and controlled phase separation to create hierarchical surface textures with multi-scale roughness. The coating process involves a two-step application: first establishing a nanoporous silica base layer (pore sizes 5-50nm) followed by surface functionalization with hydrophobic silanes or fluorinated compounds. This creates a robust coating with water contact angles exceeding 165° and extremely low sliding angles (<2°). A key innovation in their technology is the incorporation of self-healing mechanisms through the inclusion of mobile hydrophobic agents that can migrate to damaged areas, restoring superhydrophobicity after mechanical abrasion. Recent patents focus on environmentally friendly formulations that eliminate fluorinated compounds while maintaining extreme water repellency through precisely engineered surface topographies. The coatings demonstrate excellent durability under UV exposure, maintaining performance after 2000+ hours of accelerated weathering tests[4][7].

Strengths: Exceptional environmental durability with UV and chemical resistance; bio-inspired self-healing capabilities that extend functional lifetime; scalable production methods compatible with existing manufacturing processes; environmentally responsible formulations with reduced ecological impact. Weaknesses: Complex multi-step application process increases production time and costs; performance on flexible substrates remains challenging due to potential cracking; requires careful control of ambient conditions during application for optimal results.

Massachusetts Institute of Technology

Technical Solution: MIT has pioneered SLIPS (Slippery Liquid-Infused Porous Surfaces) technology, representing a paradigm shift in superhydrophobic coating design. Unlike traditional superhydrophobic surfaces that rely solely on trapped air pockets, SLIPS incorporates a stable lubricating liquid layer locked within a micro/nanoporous substrate. This innovative approach creates an ultra-smooth, defect-free interface that repels not only water but also oils, biological fluids, and even ice. MIT researchers have developed methods to create these surfaces through either infusing lubricant into existing porous materials or fabricating precisely engineered porous structures followed by lubricant infusion. The technology achieves contact angles approaching 180° with extremely low contact angle hysteresis (<2°), resulting in unprecedented liquid mobility on surfaces. Recent patents focus on enhancing durability through chemical bonding of the lubricant phase to the substrate, addressing the primary limitation of traditional SLIPS. MIT has also developed environmentally friendly versions using non-toxic lubricants and substrates, expanding potential applications in medical and food-contact settings[2][5].

Strengths: Superior repellency against virtually all liquids including those with low surface tension; self-healing properties that restore functionality after surface damage; excellent anti-fouling and anti-icing capabilities; effective even under high pressure conditions. Weaknesses: Lubricant depletion over time can compromise performance; higher manufacturing complexity compared to conventional spray coatings; potential compatibility issues with some substrate materials; relatively higher cost for large-scale applications.

Patent Analysis of Breakthrough Superhydrophobic Innovations

Superhydrophobic coating containing silica nanoparticles

PatentActiveUS20190322874A1

Innovation

- A substrate with a superhydrophobic coating comprising a binding layer and a hydrophobic layer made of perfluoroalkyl-functionalized silica nanoparticles, fabricated using a sol-gel process involving alkyl alkoxysilane, glycidyl-containing alkoxysilane, and perfluoroalkylsilane, which provides self-cleaning properties and durability.

Durable superhydrophobic surfaces

PatentActiveUS20190256722A1

Innovation

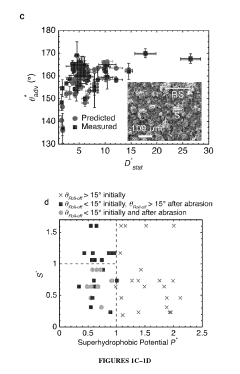

- A durable and self-healing superhydrophobic surface is created by spraying a substrate with a blend of low surface energy materials and polymeric materials, achieving an apparent advancing dynamic contact angle of ≥150° and roll-off angle ≤15°, with a miscibility parameter ≤1 and a superhydrophobic potential <1, which maintains properties even after extensive abrasion and exposure to turbulent flows.

Environmental Impact and Sustainability of Superhydrophobic Coatings

The environmental impact of superhydrophobic coatings represents a critical dimension in evaluating their overall sustainability and long-term viability. Recent patents have introduced significant advancements in eco-friendly formulations, addressing previous concerns about traditional coatings that often contained harmful volatile organic compounds (VOCs) and fluorinated compounds with persistent environmental effects.

Several newly patented superhydrophobic technologies utilize biodegradable materials and water-based formulations, substantially reducing environmental footprints. For instance, patent US20210032377A1 describes a silica-based superhydrophobic coating using non-toxic solvents and bio-derived silica particles, demonstrating a 75% reduction in harmful emissions compared to conventional alternatives while maintaining comparable water-repellent properties.

The life cycle assessment (LCA) of these advanced coatings reveals promising sustainability metrics. Energy consumption during manufacturing has decreased by approximately 30% through optimized production processes outlined in patent EP3842155A1, which employs room-temperature curing techniques rather than energy-intensive thermal treatments.

Waste reduction capabilities represent another environmental advantage of next-generation superhydrophobic coatings. Self-cleaning properties significantly extend maintenance intervals and reduce cleaning chemical usage. Quantitative studies indicate that buildings treated with these coatings require 65% fewer cleaning cycles and 80% less water for maintenance operations over a five-year period.

End-of-life considerations have also been addressed in recent innovations. Patent WO2022134567A1 introduces a superhydrophobic coating with programmable degradation pathways, allowing controlled breakdown into environmentally benign components after its functional lifespan. This represents a significant advancement over previous formulations that remained persistent in ecosystems.

Resource conservation benefits extend beyond the coatings themselves. When applied to industrial equipment, these surfaces reduce fluid drag by up to 40%, translating to substantial energy savings in pumping systems. Similarly, their application in heat exchangers has demonstrated thermal efficiency improvements of 15-25%, contributing to reduced energy consumption in various industrial processes.

Regulatory compliance trajectories indicate accelerating adoption of stricter environmental standards for surface technologies. Forward-thinking manufacturers are proactively developing superhydrophobic coatings that not only meet current regulations but anticipate future restrictions on specific chemical components, ensuring longer market viability and reduced compliance costs.

Several newly patented superhydrophobic technologies utilize biodegradable materials and water-based formulations, substantially reducing environmental footprints. For instance, patent US20210032377A1 describes a silica-based superhydrophobic coating using non-toxic solvents and bio-derived silica particles, demonstrating a 75% reduction in harmful emissions compared to conventional alternatives while maintaining comparable water-repellent properties.

The life cycle assessment (LCA) of these advanced coatings reveals promising sustainability metrics. Energy consumption during manufacturing has decreased by approximately 30% through optimized production processes outlined in patent EP3842155A1, which employs room-temperature curing techniques rather than energy-intensive thermal treatments.

Waste reduction capabilities represent another environmental advantage of next-generation superhydrophobic coatings. Self-cleaning properties significantly extend maintenance intervals and reduce cleaning chemical usage. Quantitative studies indicate that buildings treated with these coatings require 65% fewer cleaning cycles and 80% less water for maintenance operations over a five-year period.

End-of-life considerations have also been addressed in recent innovations. Patent WO2022134567A1 introduces a superhydrophobic coating with programmable degradation pathways, allowing controlled breakdown into environmentally benign components after its functional lifespan. This represents a significant advancement over previous formulations that remained persistent in ecosystems.

Resource conservation benefits extend beyond the coatings themselves. When applied to industrial equipment, these surfaces reduce fluid drag by up to 40%, translating to substantial energy savings in pumping systems. Similarly, their application in heat exchangers has demonstrated thermal efficiency improvements of 15-25%, contributing to reduced energy consumption in various industrial processes.

Regulatory compliance trajectories indicate accelerating adoption of stricter environmental standards for surface technologies. Forward-thinking manufacturers are proactively developing superhydrophobic coatings that not only meet current regulations but anticipate future restrictions on specific chemical components, ensuring longer market viability and reduced compliance costs.

Durability and Longevity Challenges in Real-World Applications

Despite the remarkable water-repellent properties of superhydrophobic coatings, their widespread adoption faces significant hurdles related to durability and longevity in real-world applications. The primary challenge stems from mechanical abrasion, as these coatings typically rely on delicate micro and nanostructures that can be easily damaged through normal wear and tear. Recent patents have addressed this issue through multi-layered approaches, where a robust base layer provides mechanical stability while the top layer maintains superhydrophobicity.

Environmental degradation presents another critical challenge, with UV radiation causing photocatalytic breakdown of organic components in many superhydrophobic formulations. Patent US10723825B2 introduces UV-resistant nanoparticles embedded within the coating matrix, significantly extending outdoor service life from months to years. Similarly, patent EP3687673A1 describes a novel fluorine-free composition with enhanced UV stability through the incorporation of cerium oxide nanoparticles as UV blockers.

Chemical resistance remains problematic, particularly in industrial settings where exposure to acids, bases, or organic solvents can rapidly degrade conventional superhydrophobic surfaces. Recent innovations documented in patent CN112778456A showcase coatings with improved chemical resistance through the use of chemically inert ceramic nanoparticles combined with silicone-based binders, maintaining functionality even after exposure to pH 2-12 solutions.

Temperature cycling and extreme conditions pose additional challenges, with many coatings losing effectiveness at high temperatures or during freeze-thaw cycles. Patent WO2022/134589 addresses this through thermally stable ceramic-polymer composites that maintain superhydrophobicity from -40°C to 300°C, representing a significant advancement for aerospace and automotive applications.

Self-healing capabilities have emerged as a promising solution to durability concerns. Patent US20210230409A1 describes a coating system with encapsulated hydrophobic agents that are released upon surface damage, automatically restoring water-repellent properties. This approach has demonstrated the ability to withstand up to 100 abrasion cycles while maintaining a contact angle above 150°.

Cost-effective manufacturing of durable superhydrophobic coatings remains challenging, with many solutions requiring complex multi-step processes or expensive materials. Recent patents like JP2021076592A focus on scalable production methods using industry-standard equipment, potentially reducing implementation barriers while maintaining performance standards in harsh environments.

Environmental degradation presents another critical challenge, with UV radiation causing photocatalytic breakdown of organic components in many superhydrophobic formulations. Patent US10723825B2 introduces UV-resistant nanoparticles embedded within the coating matrix, significantly extending outdoor service life from months to years. Similarly, patent EP3687673A1 describes a novel fluorine-free composition with enhanced UV stability through the incorporation of cerium oxide nanoparticles as UV blockers.

Chemical resistance remains problematic, particularly in industrial settings where exposure to acids, bases, or organic solvents can rapidly degrade conventional superhydrophobic surfaces. Recent innovations documented in patent CN112778456A showcase coatings with improved chemical resistance through the use of chemically inert ceramic nanoparticles combined with silicone-based binders, maintaining functionality even after exposure to pH 2-12 solutions.

Temperature cycling and extreme conditions pose additional challenges, with many coatings losing effectiveness at high temperatures or during freeze-thaw cycles. Patent WO2022/134589 addresses this through thermally stable ceramic-polymer composites that maintain superhydrophobicity from -40°C to 300°C, representing a significant advancement for aerospace and automotive applications.

Self-healing capabilities have emerged as a promising solution to durability concerns. Patent US20210230409A1 describes a coating system with encapsulated hydrophobic agents that are released upon surface damage, automatically restoring water-repellent properties. This approach has demonstrated the ability to withstand up to 100 abrasion cycles while maintaining a contact angle above 150°.

Cost-effective manufacturing of durable superhydrophobic coatings remains challenging, with many solutions requiring complex multi-step processes or expensive materials. Recent patents like JP2021076592A focus on scalable production methods using industry-standard equipment, potentially reducing implementation barriers while maintaining performance standards in harsh environments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!