What Are the Challenges in Scaling Superhydrophobic Coatings for Mass Production

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Superhydrophobic Coating Technology Evolution and Objectives

Superhydrophobic surfaces, characterized by water contact angles exceeding 150° and low sliding angles, have fascinated scientists since the discovery of the "lotus effect" in the 1970s. This natural phenomenon, where water droplets roll off lotus leaves carrying away contaminants, has inspired decades of research into artificial superhydrophobic coatings. The evolution of these coatings has progressed from simple observations of natural surfaces to sophisticated engineered materials with multifunctional properties.

The technological trajectory began with fundamental studies of wetting phenomena by researchers like Young, Wenzel, and Cassie-Baxter, who established the theoretical foundations for understanding superhydrophobicity. Early developments in the 1990s focused primarily on laboratory demonstrations with limited practical applications. By the early 2000s, researchers had begun developing more robust coatings using various fabrication techniques including sol-gel processes, layer-by-layer assembly, and lithographic methods.

A significant breakthrough occurred around 2010-2015 with the emergence of scalable fabrication methods such as spray coating, dip coating, and roll-to-roll processing, which opened possibilities for industrial applications. Recent advancements have focused on addressing durability issues through the development of self-healing coatings and mechanically robust hierarchical structures that maintain superhydrophobicity even after physical damage.

The current technological landscape is characterized by a shift from purely academic research to commercial development, with increasing emphasis on cost-effective production methods and environmental sustainability. Several startups and established companies have begun commercializing superhydrophobic products for specific applications, though widespread adoption remains limited by scalability challenges.

The primary objectives for advancing superhydrophobic coating technology include developing manufacturing processes capable of consistent, high-throughput production while maintaining nano/micro-scale precision. Researchers aim to enhance coating durability under harsh environmental conditions and mechanical abrasion, a critical barrier to widespread adoption. Cost reduction represents another key goal, as current production methods often involve expensive materials or complex processes that limit commercial viability.

Additionally, there is growing focus on environmentally friendly formulations that avoid harmful chemicals like perfluorinated compounds, responding to increasing regulatory pressure and market demand for sustainable solutions. The ultimate technological objective is to create multifunctional coatings that combine superhydrophobicity with other desirable properties such as transparency, conductivity, or antimicrobial activity, thereby expanding potential applications across industries including automotive, construction, textiles, and consumer electronics.

The technological trajectory began with fundamental studies of wetting phenomena by researchers like Young, Wenzel, and Cassie-Baxter, who established the theoretical foundations for understanding superhydrophobicity. Early developments in the 1990s focused primarily on laboratory demonstrations with limited practical applications. By the early 2000s, researchers had begun developing more robust coatings using various fabrication techniques including sol-gel processes, layer-by-layer assembly, and lithographic methods.

A significant breakthrough occurred around 2010-2015 with the emergence of scalable fabrication methods such as spray coating, dip coating, and roll-to-roll processing, which opened possibilities for industrial applications. Recent advancements have focused on addressing durability issues through the development of self-healing coatings and mechanically robust hierarchical structures that maintain superhydrophobicity even after physical damage.

The current technological landscape is characterized by a shift from purely academic research to commercial development, with increasing emphasis on cost-effective production methods and environmental sustainability. Several startups and established companies have begun commercializing superhydrophobic products for specific applications, though widespread adoption remains limited by scalability challenges.

The primary objectives for advancing superhydrophobic coating technology include developing manufacturing processes capable of consistent, high-throughput production while maintaining nano/micro-scale precision. Researchers aim to enhance coating durability under harsh environmental conditions and mechanical abrasion, a critical barrier to widespread adoption. Cost reduction represents another key goal, as current production methods often involve expensive materials or complex processes that limit commercial viability.

Additionally, there is growing focus on environmentally friendly formulations that avoid harmful chemicals like perfluorinated compounds, responding to increasing regulatory pressure and market demand for sustainable solutions. The ultimate technological objective is to create multifunctional coatings that combine superhydrophobicity with other desirable properties such as transparency, conductivity, or antimicrobial activity, thereby expanding potential applications across industries including automotive, construction, textiles, and consumer electronics.

Market Demand Analysis for Industrial-Scale Superhydrophobic Applications

The global market for superhydrophobic coatings is experiencing significant growth, driven by increasing demand across multiple industries seeking solutions for water repellency, self-cleaning, anti-icing, and corrosion resistance. Current market valuations estimate the superhydrophobic coatings sector at approximately 2.8 billion USD in 2023, with projections indicating a compound annual growth rate of 5-7% through 2030.

The automotive industry represents one of the largest potential markets, with applications ranging from windshields and exterior body panels to interior upholstery protection. Market research indicates that premium vehicle manufacturers are particularly interested in incorporating these coatings as value-added features, with consumer willingness-to-pay studies showing positive reception for such innovations.

Construction and building materials constitute another substantial market segment, where superhydrophobic coatings offer significant value through extended material lifespans, reduced maintenance costs, and improved energy efficiency. The growing focus on sustainable building practices has further accelerated interest in these coatings, as they can reduce cleaning chemical usage and extend renovation cycles.

Electronics manufacturers are increasingly exploring superhydrophobic solutions to enhance device water resistance without compromising functionality. This segment shows particularly strong growth potential as consumer expectations for device durability continue to rise, especially in wearable technology and outdoor-use electronics.

Maritime and aerospace industries represent high-value but specialized markets, where the performance benefits of superhydrophobic coatings translate directly to operational efficiencies through reduced drag, lower fuel consumption, and decreased maintenance requirements.

Market penetration analysis reveals significant regional variations, with North America and Europe currently leading adoption rates, while Asia-Pacific markets show the highest growth potential due to rapid industrialization and increasing environmental regulations. Consumer awareness of superhydrophobic technologies remains relatively low in many regions, suggesting untapped market potential through targeted education campaigns.

Price sensitivity studies indicate that while industrial applications prioritize performance and durability metrics, consumer markets remain highly cost-conscious. Current production costs create a significant barrier to mass-market adoption, with price points typically 3-5 times higher than conventional coatings. Market forecasts suggest that achieving price parity with premium conventional coatings would trigger widespread adoption across multiple sectors.

Supply chain analysis identifies raw material availability and specialized manufacturing requirements as potential constraints on market growth, highlighting the need for alternative formulations and streamlined production processes to meet projected demand increases.

The automotive industry represents one of the largest potential markets, with applications ranging from windshields and exterior body panels to interior upholstery protection. Market research indicates that premium vehicle manufacturers are particularly interested in incorporating these coatings as value-added features, with consumer willingness-to-pay studies showing positive reception for such innovations.

Construction and building materials constitute another substantial market segment, where superhydrophobic coatings offer significant value through extended material lifespans, reduced maintenance costs, and improved energy efficiency. The growing focus on sustainable building practices has further accelerated interest in these coatings, as they can reduce cleaning chemical usage and extend renovation cycles.

Electronics manufacturers are increasingly exploring superhydrophobic solutions to enhance device water resistance without compromising functionality. This segment shows particularly strong growth potential as consumer expectations for device durability continue to rise, especially in wearable technology and outdoor-use electronics.

Maritime and aerospace industries represent high-value but specialized markets, where the performance benefits of superhydrophobic coatings translate directly to operational efficiencies through reduced drag, lower fuel consumption, and decreased maintenance requirements.

Market penetration analysis reveals significant regional variations, with North America and Europe currently leading adoption rates, while Asia-Pacific markets show the highest growth potential due to rapid industrialization and increasing environmental regulations. Consumer awareness of superhydrophobic technologies remains relatively low in many regions, suggesting untapped market potential through targeted education campaigns.

Price sensitivity studies indicate that while industrial applications prioritize performance and durability metrics, consumer markets remain highly cost-conscious. Current production costs create a significant barrier to mass-market adoption, with price points typically 3-5 times higher than conventional coatings. Market forecasts suggest that achieving price parity with premium conventional coatings would trigger widespread adoption across multiple sectors.

Supply chain analysis identifies raw material availability and specialized manufacturing requirements as potential constraints on market growth, highlighting the need for alternative formulations and streamlined production processes to meet projected demand increases.

Technical Barriers and Global Development Status

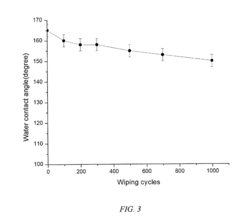

Despite significant advancements in superhydrophobic coating technologies, scaling these innovations from laboratory settings to mass production remains challenging. The primary technical barrier lies in maintaining consistent performance across large surface areas. Laboratory-scale production can achieve water contact angles exceeding 150° with minimal hysteresis, but these properties often deteriorate when scaled up due to processing inconsistencies and material limitations.

Material selection presents another significant obstacle. Many superhydrophobic coatings rely on fluorinated compounds that face increasing regulatory scrutiny worldwide due to environmental concerns. The European Union's REACH regulations and similar frameworks in North America have restricted several perfluorinated compounds, forcing manufacturers to develop alternative chemistries that often demonstrate inferior performance or durability.

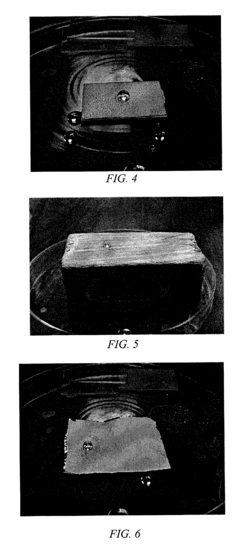

Durability remains perhaps the most critical challenge. Superhydrophobic surfaces typically rely on delicate micro and nanostructures that are susceptible to mechanical abrasion, chemical degradation, and UV exposure. Industrial applications demand coatings that can withstand harsh environments for extended periods, a requirement that current technologies struggle to meet consistently at scale.

The global development landscape shows regional specialization patterns. North American research institutions and companies focus predominantly on advanced materials science approaches, with significant patent activity from companies like 3M and PPG Industries. European efforts concentrate on environmentally sustainable alternatives to traditional fluorinated compounds, with notable contributions from research clusters in Germany and Switzerland.

In Asia, particularly China and Japan, development emphasizes cost-effective manufacturing processes and application-specific solutions. Chinese research output in this field has grown exponentially over the past decade, with institutions like the Chinese Academy of Sciences leading numerous breakthroughs in scalable fabrication techniques.

Cost factors further complicate mass production viability. Current manufacturing processes for high-performance superhydrophobic coatings often involve multiple steps, specialized equipment, and expensive raw materials. Production costs typically range from $50-200 per square meter, significantly higher than conventional protective coatings at $5-20 per square meter, limiting market penetration to high-value applications.

Quality control methodologies present additional challenges, as standardized testing protocols for superhydrophobicity at industrial scales remain underdeveloped. The lack of universally accepted performance metrics and accelerated aging tests makes it difficult to compare different technologies and predict long-term performance in real-world applications.

Material selection presents another significant obstacle. Many superhydrophobic coatings rely on fluorinated compounds that face increasing regulatory scrutiny worldwide due to environmental concerns. The European Union's REACH regulations and similar frameworks in North America have restricted several perfluorinated compounds, forcing manufacturers to develop alternative chemistries that often demonstrate inferior performance or durability.

Durability remains perhaps the most critical challenge. Superhydrophobic surfaces typically rely on delicate micro and nanostructures that are susceptible to mechanical abrasion, chemical degradation, and UV exposure. Industrial applications demand coatings that can withstand harsh environments for extended periods, a requirement that current technologies struggle to meet consistently at scale.

The global development landscape shows regional specialization patterns. North American research institutions and companies focus predominantly on advanced materials science approaches, with significant patent activity from companies like 3M and PPG Industries. European efforts concentrate on environmentally sustainable alternatives to traditional fluorinated compounds, with notable contributions from research clusters in Germany and Switzerland.

In Asia, particularly China and Japan, development emphasizes cost-effective manufacturing processes and application-specific solutions. Chinese research output in this field has grown exponentially over the past decade, with institutions like the Chinese Academy of Sciences leading numerous breakthroughs in scalable fabrication techniques.

Cost factors further complicate mass production viability. Current manufacturing processes for high-performance superhydrophobic coatings often involve multiple steps, specialized equipment, and expensive raw materials. Production costs typically range from $50-200 per square meter, significantly higher than conventional protective coatings at $5-20 per square meter, limiting market penetration to high-value applications.

Quality control methodologies present additional challenges, as standardized testing protocols for superhydrophobicity at industrial scales remain underdeveloped. The lack of universally accepted performance metrics and accelerated aging tests makes it difficult to compare different technologies and predict long-term performance in real-world applications.

Current Mass Production Approaches and Limitations

01 Fabrication methods for superhydrophobic coatings

Various fabrication methods can be employed to create superhydrophobic coatings with scaled production capabilities. These methods include sol-gel processes, spray coating, dip coating, and layer-by-layer deposition techniques. The fabrication process often involves creating micro and nano-scale roughness on surfaces followed by applying low surface energy materials to achieve superhydrophobicity. These methods can be optimized for industrial-scale production while maintaining the desired water-repellent properties.- Nanostructured superhydrophobic coatings for industrial scaling: Nanostructured materials are used to create superhydrophobic coatings suitable for industrial-scale applications. These coatings incorporate nanoscale roughness features that trap air and create a composite solid-air interface, significantly increasing water repellency. The manufacturing processes have been optimized for large-scale production while maintaining the coating's superhydrophobic properties. These scalable approaches enable application on various industrial substrates and surfaces.

- Environmentally durable superhydrophobic coating compositions: Formulations designed to withstand harsh environmental conditions while maintaining superhydrophobic properties. These coatings incorporate specialized binders, adhesion promoters, and protective additives that enhance durability against UV exposure, temperature fluctuations, mechanical abrasion, and chemical exposure. The compositions are engineered to maintain their water-repellent characteristics over extended periods in outdoor and industrial environments, making them suitable for large-scale commercial applications.

- Biomimetic approaches for scalable superhydrophobic surfaces: Inspired by natural superhydrophobic surfaces like lotus leaves and butterfly wings, these coatings mimic biological structures to achieve extreme water repellency. The biomimetic approach involves creating hierarchical micro and nano-scale surface patterns combined with low surface energy materials. These nature-inspired designs are adapted for industrial scaling through innovative manufacturing techniques that can reproduce complex biological surface structures efficiently and cost-effectively.

- Spray-based methods for large-scale superhydrophobic coating application: Spray application techniques developed specifically for depositing superhydrophobic coatings over large surface areas. These methods utilize specialized spray formulations containing hydrophobic nanoparticles, binders, and solvents optimized for uniform coverage and adhesion. The spray processes are designed for industrial implementation, allowing rapid coating of complex geometries and large structures while maintaining consistent superhydrophobic properties across the entire treated surface.

- Self-healing superhydrophobic coatings for extended service life: Advanced coating systems with self-healing capabilities to address the challenge of maintaining superhydrophobicity over time. These coatings incorporate responsive materials that can repair damage from abrasion or chemical exposure, restoring the surface structure necessary for superhydrophobicity. The self-healing mechanisms are designed to function autonomously, extending the functional lifespan of the coating in industrial applications and reducing maintenance requirements for large-scale implementations.

02 Nanoparticle-based superhydrophobic formulations

Nanoparticles are incorporated into coating formulations to create hierarchical surface structures necessary for superhydrophobicity. Materials such as silica nanoparticles, titanium dioxide, carbon nanotubes, and zinc oxide are commonly used. These nanoparticles create the required surface roughness while fluorinated or silane compounds provide the low surface energy. The challenge in scaling involves maintaining uniform nanoparticle dispersion and preventing agglomeration during large-scale production to ensure consistent superhydrophobic performance.Expand Specific Solutions03 Durability enhancement for industrial applications

Improving the mechanical durability and wear resistance of superhydrophobic coatings is crucial for industrial scaling. Approaches include incorporating polymer binders, creating covalent bonds between the coating and substrate, using cross-linking agents, and developing multi-layer systems. Enhanced durability allows superhydrophobic coatings to withstand real-world conditions such as abrasion, chemical exposure, and UV radiation, making them suitable for large-scale commercial applications in various industries.Expand Specific Solutions04 Environmental and cost considerations in scaling

Scaling superhydrophobic coating production requires addressing environmental and cost factors. This includes developing eco-friendly formulations that reduce or eliminate volatile organic compounds and hazardous materials, implementing cost-effective production methods, utilizing renewable resources, and optimizing material usage. These considerations are essential for commercial viability and regulatory compliance when transitioning from laboratory-scale to industrial-scale production of superhydrophobic coatings.Expand Specific Solutions05 Application-specific formulation adaptations

Superhydrophobic coating formulations must be adapted for specific applications when scaling to industrial production. Different substrates (metals, textiles, glass, polymers) require tailored approaches to ensure adhesion and performance. Additionally, specific industry requirements such as transparency for optical applications, flexibility for textiles, or corrosion resistance for metals necessitate customized formulations. These adaptations involve modifying the base chemistry, application methods, and curing conditions while maintaining the fundamental superhydrophobic properties.Expand Specific Solutions

Leading Companies and Research Institutions in Superhydrophobic Coatings

The superhydrophobic coatings market is currently in a growth phase, with increasing applications across industries despite technical challenges in mass production. The global market size is projected to reach $2-3 billion by 2025, growing at 5-7% CAGR. Technical maturity varies significantly among key players. Research institutions like University of Florida and Xi'an Jiaotong University are advancing fundamental science, while companies such as Luna Innovations and Detrapel have commercialized products but face scaling challenges. Major corporations including Saint-Gobain and Saudi Aramco are investing in industrial applications, though uniform quality, durability, and cost-effective manufacturing processes remain significant hurdles. Specialized firms like Surfactis Technologies and Silana GmbH are developing proprietary solutions to address these scaling limitations.

Detrapel, Inc.

Technical Solution: Detrapel has developed a scalable approach to superhydrophobic coatings using environmentally friendly fluorine-free chemistry. Their technology employs a proprietary blend of silica nanoparticles and hydrophobic polymers that can be applied through conventional spray methods. The company has engineered their formulations to achieve rapid curing at room temperature, eliminating the need for energy-intensive heat treatment processes that typically limit mass production. Their manufacturing process incorporates continuous mixing systems that ensure consistent particle dispersion and coating quality across large production volumes. Detrapel has also developed specialized application equipment that allows for uniform coating thickness on various substrate materials, addressing one of the key challenges in superhydrophobic coating scale-up.

Strengths: Environmentally friendly formulation reduces regulatory barriers to mass adoption; room-temperature curing significantly reduces energy costs and processing time. Weaknesses: May offer less durability compared to fluorinated alternatives; performance in extreme conditions or with certain substrates may be limited without specialized pre-treatments.

Saudi Arabian Oil Co.

Technical Solution: Saudi Arabian Oil Co. (Saudi Aramco) has developed an innovative approach to superhydrophobic coatings specifically designed for oil and gas infrastructure. Their technology utilizes a combination of functionalized nanoparticles and hydrophobic polymers that can be applied through conventional industrial coating equipment. To address scaling challenges, they've engineered a single-component system that eliminates the need for precise mixing ratios in field applications. Their formulation incorporates self-healing capabilities through the inclusion of mobile hydrophobic agents that can migrate to damaged areas, extending coating lifetime in harsh environments. Saudi Aramco has also developed specialized surface preparation protocols that enhance adhesion to metal substrates commonly used in industrial settings, solving one of the key durability challenges for mass-produced superhydrophobic coatings.

Strengths: Formulation specifically engineered for industrial durability in harsh environments; self-healing properties extend functional lifetime and reduce maintenance costs. Weaknesses: May be optimized primarily for oil and gas applications, potentially limiting versatility; likely higher cost than conventional industrial coatings.

Key Patents and Breakthroughs in Scalable Manufacturing

Durable and Scalable Superhydrophobic Paint

PatentActiveUS20170121530A1

Innovation

- A superhydrophobic paint is developed using hydrophobic metal oxide particles coated with fluorinated alkyl silane, combined with a polymer binder blend of PMMA and PVDF, and plasticizers like triethyl phosphate and perfluoro(butyltetrahydrofuran), which can be applied to various substrates to form a durable, water-repellent coating.

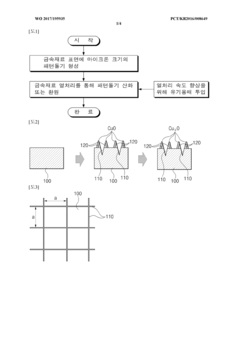

Method for manufacturing superhydrophobic metal material surface and superhydrophobic metal piping surface

PatentWO2017195935A1

Innovation

- Forming micron-sized pattern protrusions on metal surfaces, followed by heat treatment and oxidation or reduction to achieve superhydrophobicity, which simplifies the manufacturing process and reduces production time.

Cost-Benefit Analysis of Large-Scale Implementation

The economic viability of scaling superhydrophobic coatings for mass production requires thorough cost-benefit analysis. Initial implementation costs are substantial, encompassing specialized equipment acquisition, facility modifications, and workforce training. Manufacturing equipment for precise micro/nanoscale surface texturing can range from $500,000 to several million dollars, while clean room facilities may add $1,000-$3,000 per square foot to infrastructure costs.

Raw material expenses vary significantly based on coating formulation. Fluorinated compounds, essential for many superhydrophobic coatings, can cost 5-10 times more than conventional coating materials. However, economies of scale may reduce per-unit costs by 30-40% when production volumes exceed certain thresholds, typically in the millions of units annually.

Energy consumption presents another significant cost factor. Processes like plasma treatment and vacuum deposition require substantial power inputs, potentially adding $0.05-0.15 per unit in energy costs alone. Water and chemical waste management systems further increase operational expenses by 5-15% depending on regulatory requirements.

Against these costs, several benefits must be weighed. Product longevity improvements of 30-50% have been documented for items with superhydrophobic protection, translating to reduced replacement frequency and associated costs. Maintenance savings are equally significant, with studies showing 40-60% reductions in cleaning frequency and solution usage for treated surfaces.

Energy efficiency gains represent another substantial benefit, particularly in applications like heat exchangers and condensers, where performance improvements of 15-25% have been demonstrated. For transportation applications, drag reduction properties can yield fuel savings of 2-8% depending on the implementation scope.

Premium pricing opportunities also exist, with consumers demonstrating willingness to pay 20-30% more for products with superior water and stain resistance. This margin potential accelerates return on investment timelines significantly.

The break-even point for large-scale implementation varies by industry but typically ranges from 18-36 months for high-volume consumer products to 3-5 years for specialized industrial applications. Sensitivity analysis indicates that production volume is the most critical factor affecting ROI, with material costs and premium pricing potential following closely.

Raw material expenses vary significantly based on coating formulation. Fluorinated compounds, essential for many superhydrophobic coatings, can cost 5-10 times more than conventional coating materials. However, economies of scale may reduce per-unit costs by 30-40% when production volumes exceed certain thresholds, typically in the millions of units annually.

Energy consumption presents another significant cost factor. Processes like plasma treatment and vacuum deposition require substantial power inputs, potentially adding $0.05-0.15 per unit in energy costs alone. Water and chemical waste management systems further increase operational expenses by 5-15% depending on regulatory requirements.

Against these costs, several benefits must be weighed. Product longevity improvements of 30-50% have been documented for items with superhydrophobic protection, translating to reduced replacement frequency and associated costs. Maintenance savings are equally significant, with studies showing 40-60% reductions in cleaning frequency and solution usage for treated surfaces.

Energy efficiency gains represent another substantial benefit, particularly in applications like heat exchangers and condensers, where performance improvements of 15-25% have been demonstrated. For transportation applications, drag reduction properties can yield fuel savings of 2-8% depending on the implementation scope.

Premium pricing opportunities also exist, with consumers demonstrating willingness to pay 20-30% more for products with superior water and stain resistance. This margin potential accelerates return on investment timelines significantly.

The break-even point for large-scale implementation varies by industry but typically ranges from 18-36 months for high-volume consumer products to 3-5 years for specialized industrial applications. Sensitivity analysis indicates that production volume is the most critical factor affecting ROI, with material costs and premium pricing potential following closely.

Environmental Impact and Sustainability Considerations

The scaling of superhydrophobic coatings for mass production raises significant environmental and sustainability concerns that must be addressed for responsible industrial implementation. Traditional manufacturing processes for these specialized surfaces often involve fluorinated compounds, volatile organic compounds (VOCs), and other potentially harmful chemicals that pose environmental risks through air and water pollution. As production scales up, these impacts would be magnified, potentially leading to increased greenhouse gas emissions and chemical waste generation.

Manufacturing superhydrophobic coatings typically requires substantial energy inputs, particularly for processes involving high-temperature curing or plasma treatments. The carbon footprint associated with mass production could be considerable unless renewable energy sources are integrated into manufacturing facilities. Additionally, the durability challenges of current superhydrophobic coatings lead to frequent reapplication needs, creating a cycle of resource consumption that contradicts sustainability principles.

Water conservation presents a paradoxical challenge in this field. While superhydrophobic coatings can reduce water consumption in applications like self-cleaning surfaces, their production often requires significant water usage, particularly for cleaning and processing steps. Closed-loop water systems and water recycling technologies must be developed specifically for these manufacturing processes to mitigate this contradiction.

Raw material sourcing represents another critical sustainability consideration. Many advanced superhydrophobic formulations rely on nanomaterials or rare elements with complex supply chains and extraction processes that may involve significant environmental degradation. Developing alternative formulations using abundant, renewable, or recycled materials could substantially improve the sustainability profile of these coatings.

End-of-life considerations remain largely unaddressed in current superhydrophobic coating technologies. The persistence of nanoparticles and polymer components in the environment after disposal raises concerns about bioaccumulation and long-term ecological impacts. Designing coatings with biodegradability or recyclability in mind would align with circular economy principles and reduce waste management challenges.

Regulatory frameworks worldwide are increasingly focusing on chemical safety and environmental protection, with restrictions on certain compounds used in superhydrophobic formulations. Companies scaling up production must navigate this complex regulatory landscape while developing environmentally benign alternatives that maintain performance characteristics. This regulatory pressure, while challenging, may drive innovation toward greener chemistry approaches and more sustainable manufacturing methods.

Manufacturing superhydrophobic coatings typically requires substantial energy inputs, particularly for processes involving high-temperature curing or plasma treatments. The carbon footprint associated with mass production could be considerable unless renewable energy sources are integrated into manufacturing facilities. Additionally, the durability challenges of current superhydrophobic coatings lead to frequent reapplication needs, creating a cycle of resource consumption that contradicts sustainability principles.

Water conservation presents a paradoxical challenge in this field. While superhydrophobic coatings can reduce water consumption in applications like self-cleaning surfaces, their production often requires significant water usage, particularly for cleaning and processing steps. Closed-loop water systems and water recycling technologies must be developed specifically for these manufacturing processes to mitigate this contradiction.

Raw material sourcing represents another critical sustainability consideration. Many advanced superhydrophobic formulations rely on nanomaterials or rare elements with complex supply chains and extraction processes that may involve significant environmental degradation. Developing alternative formulations using abundant, renewable, or recycled materials could substantially improve the sustainability profile of these coatings.

End-of-life considerations remain largely unaddressed in current superhydrophobic coating technologies. The persistence of nanoparticles and polymer components in the environment after disposal raises concerns about bioaccumulation and long-term ecological impacts. Designing coatings with biodegradability or recyclability in mind would align with circular economy principles and reduce waste management challenges.

Regulatory frameworks worldwide are increasingly focusing on chemical safety and environmental protection, with restrictions on certain compounds used in superhydrophobic formulations. Companies scaling up production must navigate this complex regulatory landscape while developing environmentally benign alternatives that maintain performance characteristics. This regulatory pressure, while challenging, may drive innovation toward greener chemistry approaches and more sustainable manufacturing methods.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!