Regulatory Impact on Superhydrophobic Coating Manufacturing Practices

OCT 14, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Superhydrophobic Coating Technology Background and Objectives

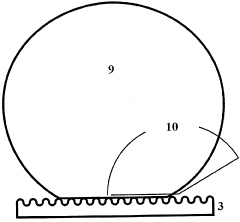

Superhydrophobic coatings represent a revolutionary advancement in surface technology, drawing inspiration from nature's own water-repellent structures such as lotus leaves and butterfly wings. Since their initial development in the early 1990s, these coatings have evolved from laboratory curiosities to commercially viable solutions with applications spanning multiple industries. The fundamental principle behind superhydrophobic surfaces involves creating a combination of micro and nano-scale roughness coupled with low surface energy materials, resulting in contact angles exceeding 150° and slide angles below 10°.

The evolution of superhydrophobic coating technology has followed a trajectory from basic research to increasingly sophisticated formulations. Early developments focused primarily on understanding the theoretical principles, while recent advancements have emphasized durability, transparency, and scalable manufacturing processes. Current research trends indicate a growing interest in environmentally sustainable formulations that maintain exceptional performance while reducing reliance on fluorinated compounds and volatile organic solvents.

Regulatory frameworks worldwide are increasingly scrutinizing chemical manufacturing practices, particularly those involving fluorinated compounds often used in superhydrophobic coatings. The European Union's REACH regulations, the United States EPA's PFAS Action Plan, and similar initiatives in Asia-Pacific markets are reshaping manufacturing requirements and driving innovation toward greener alternatives. These regulatory pressures represent both challenges and opportunities for technological advancement in this field.

The primary technical objectives for superhydrophobic coating development in the current regulatory landscape include: developing non-fluorinated alternatives with comparable performance characteristics; enhancing durability under mechanical abrasion and chemical exposure; improving adhesion to diverse substrate materials; and establishing scalable, environmentally responsible manufacturing processes that comply with evolving global regulations.

Market-driven objectives include reducing production costs to enable broader commercial adoption, developing specialized formulations for sector-specific applications such as medical devices and consumer electronics, and creating standardized testing protocols that accurately predict real-world performance and regulatory compliance. The intersection of these technical and market objectives defines the innovation landscape for superhydrophobic coatings.

The long-term technological vision encompasses self-healing superhydrophobic surfaces, bio-inspired adaptive coatings that respond to environmental stimuli, and integration with other functional properties such as antimicrobial activity and thermal management. Achieving these ambitious goals requires interdisciplinary collaboration between materials scientists, chemical engineers, regulatory experts, and manufacturing specialists to navigate the complex interplay between technical innovation and regulatory compliance.

The evolution of superhydrophobic coating technology has followed a trajectory from basic research to increasingly sophisticated formulations. Early developments focused primarily on understanding the theoretical principles, while recent advancements have emphasized durability, transparency, and scalable manufacturing processes. Current research trends indicate a growing interest in environmentally sustainable formulations that maintain exceptional performance while reducing reliance on fluorinated compounds and volatile organic solvents.

Regulatory frameworks worldwide are increasingly scrutinizing chemical manufacturing practices, particularly those involving fluorinated compounds often used in superhydrophobic coatings. The European Union's REACH regulations, the United States EPA's PFAS Action Plan, and similar initiatives in Asia-Pacific markets are reshaping manufacturing requirements and driving innovation toward greener alternatives. These regulatory pressures represent both challenges and opportunities for technological advancement in this field.

The primary technical objectives for superhydrophobic coating development in the current regulatory landscape include: developing non-fluorinated alternatives with comparable performance characteristics; enhancing durability under mechanical abrasion and chemical exposure; improving adhesion to diverse substrate materials; and establishing scalable, environmentally responsible manufacturing processes that comply with evolving global regulations.

Market-driven objectives include reducing production costs to enable broader commercial adoption, developing specialized formulations for sector-specific applications such as medical devices and consumer electronics, and creating standardized testing protocols that accurately predict real-world performance and regulatory compliance. The intersection of these technical and market objectives defines the innovation landscape for superhydrophobic coatings.

The long-term technological vision encompasses self-healing superhydrophobic surfaces, bio-inspired adaptive coatings that respond to environmental stimuli, and integration with other functional properties such as antimicrobial activity and thermal management. Achieving these ambitious goals requires interdisciplinary collaboration between materials scientists, chemical engineers, regulatory experts, and manufacturing specialists to navigate the complex interplay between technical innovation and regulatory compliance.

Market Analysis for Superhydrophobic Coating Applications

The global market for superhydrophobic coatings has experienced significant growth in recent years, driven by increasing applications across diverse industries. The market size was valued at approximately $2.8 billion in 2022 and is projected to reach $5.6 billion by 2028, representing a compound annual growth rate (CAGR) of 12.3%. This growth trajectory is supported by expanding applications in automotive, aerospace, construction, electronics, and medical sectors.

In the automotive industry, superhydrophobic coatings are gaining traction for windshields, body panels, and interior components, offering enhanced visibility during adverse weather conditions and reducing cleaning requirements. The aerospace sector values these coatings for their anti-icing properties and drag reduction capabilities, which contribute to fuel efficiency improvements of up to 8% in certain applications.

The construction industry represents the largest market segment, accounting for 34% of the total market share. Applications include self-cleaning building facades, solar panels, and infrastructure components exposed to harsh environmental conditions. The electronics sector is rapidly adopting superhydrophobic technologies for waterproofing consumer devices, with market penetration increasing by 18% annually since 2020.

Regional analysis reveals North America and Europe as mature markets with established regulatory frameworks, collectively holding 58% of the global market share. However, the Asia-Pacific region is emerging as the fastest-growing market with a 15.7% CAGR, driven by rapid industrialization in China, India, and South Korea, alongside increasing environmental awareness and regulatory developments.

Consumer demand patterns indicate a growing preference for environmentally friendly formulations, with 76% of end-users expressing willingness to pay premium prices for coatings that comply with stringent environmental regulations. This trend is particularly pronounced in developed economies where regulatory frameworks are more established.

Market challenges include price sensitivity in emerging economies, technical limitations in coating durability under extreme conditions, and evolving regulatory landscapes that impact manufacturing processes. The average lifespan of current superhydrophobic coatings ranges from 1-5 years depending on application conditions, presenting opportunities for innovations in durability enhancement.

Future market growth is expected to be driven by technological advancements in nano-engineered surfaces, bio-inspired coating designs, and environmentally compliant formulations that address regulatory concerns while maintaining performance characteristics. The medical and healthcare sectors represent emerging high-value niches, with applications in antimicrobial surfaces and biocompatible implants showing promise for premium market positioning.

In the automotive industry, superhydrophobic coatings are gaining traction for windshields, body panels, and interior components, offering enhanced visibility during adverse weather conditions and reducing cleaning requirements. The aerospace sector values these coatings for their anti-icing properties and drag reduction capabilities, which contribute to fuel efficiency improvements of up to 8% in certain applications.

The construction industry represents the largest market segment, accounting for 34% of the total market share. Applications include self-cleaning building facades, solar panels, and infrastructure components exposed to harsh environmental conditions. The electronics sector is rapidly adopting superhydrophobic technologies for waterproofing consumer devices, with market penetration increasing by 18% annually since 2020.

Regional analysis reveals North America and Europe as mature markets with established regulatory frameworks, collectively holding 58% of the global market share. However, the Asia-Pacific region is emerging as the fastest-growing market with a 15.7% CAGR, driven by rapid industrialization in China, India, and South Korea, alongside increasing environmental awareness and regulatory developments.

Consumer demand patterns indicate a growing preference for environmentally friendly formulations, with 76% of end-users expressing willingness to pay premium prices for coatings that comply with stringent environmental regulations. This trend is particularly pronounced in developed economies where regulatory frameworks are more established.

Market challenges include price sensitivity in emerging economies, technical limitations in coating durability under extreme conditions, and evolving regulatory landscapes that impact manufacturing processes. The average lifespan of current superhydrophobic coatings ranges from 1-5 years depending on application conditions, presenting opportunities for innovations in durability enhancement.

Future market growth is expected to be driven by technological advancements in nano-engineered surfaces, bio-inspired coating designs, and environmentally compliant formulations that address regulatory concerns while maintaining performance characteristics. The medical and healthcare sectors represent emerging high-value niches, with applications in antimicrobial surfaces and biocompatible implants showing promise for premium market positioning.

Technical Challenges and Regulatory Constraints

The manufacturing of superhydrophobic coatings faces significant technical challenges compounded by increasingly stringent regulatory frameworks worldwide. Current production methods often rely on fluorinated compounds that provide excellent water repellency but pose serious environmental concerns. These compounds, particularly long-chain perfluoroalkyl substances (PFAS), demonstrate remarkable persistence in the environment, bioaccumulation potential, and toxicity profiles that have triggered regulatory scrutiny across major markets.

In the European Union, the REACH regulation has placed several fluorinated compounds on the Substances of Very High Concern (SVHC) list, with phase-out timelines already established. Similarly, the U.S. Environmental Protection Agency has implemented the PFAS Action Plan, progressively restricting the use of these chemicals in industrial applications, including specialty coatings. These regulatory constraints create immediate technical challenges for manufacturers who must reformulate products while maintaining performance characteristics.

The technical difficulty lies in achieving comparable hydrophobicity (contact angles >150°) and low sliding angles (<10°) without fluorinated compounds. Alternative approaches using silicone-based chemistries or hydrocarbon materials typically achieve only 110-130° contact angles, falling short of superhydrophobic performance thresholds. Additionally, these alternatives often lack the durability and chemical resistance that fluorinated compounds provide, particularly in harsh environmental conditions or high-touch applications.

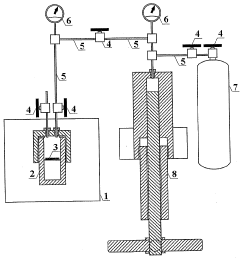

Manufacturing processes themselves face technical constraints related to emission controls and worker safety. Traditional spray application methods generate volatile organic compounds (VOCs) and potentially hazardous particulates that are increasingly regulated under clean air legislation. Manufacturers must implement costly extraction systems and personal protective equipment protocols to comply with occupational exposure limits, which vary significantly across jurisdictions.

Water usage and wastewater management present another regulatory challenge. The production of superhydrophobic coatings often involves water-intensive cleaning and rinsing steps, with effluent containing trace amounts of nanomaterials or chemical precursors. Regulatory frameworks for nanomaterial discharge remain inconsistent globally but are trending toward greater restriction, requiring manufacturers to implement advanced filtration and treatment systems.

Quality control processes are further complicated by regulatory requirements for product testing and certification. Different markets maintain distinct protocols for leaching tests, durability assessments, and environmental impact studies. This regulatory fragmentation necessitates multiple testing regimes, increasing development costs and time-to-market for new formulations, while creating technical barriers to global product harmonization.

In the European Union, the REACH regulation has placed several fluorinated compounds on the Substances of Very High Concern (SVHC) list, with phase-out timelines already established. Similarly, the U.S. Environmental Protection Agency has implemented the PFAS Action Plan, progressively restricting the use of these chemicals in industrial applications, including specialty coatings. These regulatory constraints create immediate technical challenges for manufacturers who must reformulate products while maintaining performance characteristics.

The technical difficulty lies in achieving comparable hydrophobicity (contact angles >150°) and low sliding angles (<10°) without fluorinated compounds. Alternative approaches using silicone-based chemistries or hydrocarbon materials typically achieve only 110-130° contact angles, falling short of superhydrophobic performance thresholds. Additionally, these alternatives often lack the durability and chemical resistance that fluorinated compounds provide, particularly in harsh environmental conditions or high-touch applications.

Manufacturing processes themselves face technical constraints related to emission controls and worker safety. Traditional spray application methods generate volatile organic compounds (VOCs) and potentially hazardous particulates that are increasingly regulated under clean air legislation. Manufacturers must implement costly extraction systems and personal protective equipment protocols to comply with occupational exposure limits, which vary significantly across jurisdictions.

Water usage and wastewater management present another regulatory challenge. The production of superhydrophobic coatings often involves water-intensive cleaning and rinsing steps, with effluent containing trace amounts of nanomaterials or chemical precursors. Regulatory frameworks for nanomaterial discharge remain inconsistent globally but are trending toward greater restriction, requiring manufacturers to implement advanced filtration and treatment systems.

Quality control processes are further complicated by regulatory requirements for product testing and certification. Different markets maintain distinct protocols for leaching tests, durability assessments, and environmental impact studies. This regulatory fragmentation necessitates multiple testing regimes, increasing development costs and time-to-market for new formulations, while creating technical barriers to global product harmonization.

Current Manufacturing Compliance Solutions

01 Nanoparticle-based superhydrophobic coatings

Superhydrophobic coatings can be formulated using nanoparticles to create nano-scale roughness on surfaces. These nanoparticles, such as silica, titanium dioxide, or carbon-based materials, create a hierarchical structure that traps air pockets, enhancing the water-repellent properties. The combination of these nanoparticles with hydrophobic binders results in surfaces with high contact angles exceeding 150° and low sliding angles, making them extremely water-repellent and self-cleaning.- Nanoparticle-based superhydrophobic coatings: Superhydrophobic coatings can be formulated using various nanoparticles to create nano-scale roughness on surfaces. These nanoparticles, such as silica, titanium dioxide, or carbon-based materials, create a hierarchical surface structure that traps air and prevents water from penetrating. The combination of these nanoparticles with hydrophobic binders results in surfaces with water contact angles greater than 150° and low sliding angles, making them highly water-repellent and self-cleaning.

- Fluoropolymer-based superhydrophobic coatings: Fluoropolymers are widely used in superhydrophobic coating formulations due to their inherently low surface energy. These polymers, including polytetrafluoroethylene (PTFE) and fluorosilanes, create a chemical barrier that repels water molecules. When combined with surface roughening techniques, fluoropolymer coatings can achieve extreme water repellency. These coatings are particularly valuable for applications requiring long-term durability and chemical resistance.

- Environmentally-friendly superhydrophobic coatings: Recent developments focus on creating superhydrophobic coatings using environmentally friendly materials and processes. These green approaches utilize bio-based materials, such as plant waxes, cellulose derivatives, and chitosan, combined with non-toxic nanoparticles to achieve superhydrophobicity. These coatings avoid harmful fluorinated compounds while maintaining excellent water-repellent properties, making them suitable for applications where environmental impact is a concern.

- Durable and abrasion-resistant superhydrophobic coatings: Enhancing the mechanical durability of superhydrophobic coatings is crucial for practical applications. These coatings incorporate reinforcing elements such as polymer networks, ceramic particles, or cross-linking agents to improve abrasion resistance while maintaining superhydrophobicity. Multi-layer approaches and self-healing mechanisms are also employed to extend coating lifespan under harsh conditions. These durable coatings can withstand physical contact, weathering, and repeated wetting cycles without losing their water-repellent properties.

- Application-specific superhydrophobic coating technologies: Specialized superhydrophobic coating technologies are developed for specific applications such as textiles, building materials, electronics, and medical devices. These coatings are tailored to meet the unique requirements of each application, including flexibility for textiles, transparency for optical surfaces, conductivity for electronics, or biocompatibility for medical uses. The formulations may incorporate additional functionalities such as antimicrobial properties, UV resistance, or thermal stability depending on the intended use case.

02 Fluoropolymer-based superhydrophobic coatings

Fluoropolymers are widely used in superhydrophobic coating formulations due to their inherently low surface energy. These polymers, including polytetrafluoroethylene (PTFE) and fluorosilanes, provide strong water repellency when combined with surface roughening techniques. The fluorine-containing compounds create a chemical barrier that prevents water adhesion, while the engineered surface topography enhances the hydrophobic effect, resulting in durable water-repellent coatings for various applications.Expand Specific Solutions03 Environmentally friendly superhydrophobic coatings

Recent innovations focus on developing eco-friendly superhydrophobic coatings that avoid harmful fluorinated compounds. These green alternatives utilize bio-based materials such as plant waxes, cellulose derivatives, and silica extracted from natural sources. The formulations incorporate biodegradable polymers and non-toxic solvents while maintaining excellent water-repellent properties. These environmentally sustainable coatings address concerns about persistence and bioaccumulation associated with traditional fluorinated superhydrophobic materials.Expand Specific Solutions04 Durable and self-healing superhydrophobic coatings

Enhancing the durability of superhydrophobic coatings is achieved through self-healing mechanisms and improved mechanical properties. These advanced formulations incorporate elastomeric components, cross-linking agents, and regenerative additives that restore the surface structure after damage. Some designs feature multi-layer architectures with sacrificial top layers and more durable base layers. The self-healing properties are activated by environmental triggers such as temperature, humidity, or UV light, extending the functional lifetime of the coating.Expand Specific Solutions05 Application-specific superhydrophobic coating technologies

Specialized superhydrophobic coatings are developed for specific applications such as anti-icing, anti-corrosion, and textile treatments. These formulations are tailored to the substrate material and environmental conditions of the intended use. For example, anti-icing coatings combine superhydrophobicity with low ice adhesion additives, while anti-corrosion variants incorporate passivating agents. Textile treatments maintain breathability while providing water repellency. The application methods are also customized, including spray coating, dip coating, and vapor deposition techniques to ensure optimal performance.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The regulatory landscape for superhydrophobic coating manufacturing is evolving within a growing market projected to expand significantly due to increasing industrial applications. Currently, the industry is in its growth phase, with academic institutions like Indian Institute of Technology Kanpur, Xi'an Jiaotong University, and University of Florida leading fundamental research, while companies such as Luna Innovations, Detrapel, and Xerox are commercializing applications. Regulatory frameworks are tightening around chemical components, manufacturing emissions, and disposal methods, particularly affecting commercial players like Illinois Tool Works and Sun Chemical. Research organizations including the Agency for Science, Technology & Research and Council of Scientific & Industrial Research are developing environmentally compliant formulations to address these challenges, indicating a shift toward sustainable manufacturing practices that balance performance with regulatory compliance.

Luna Innovations, Inc.

Technical Solution: Luna Innovations has developed a sophisticated regulatory compliance framework for their advanced superhydrophobic coating manufacturing operations. Their technical solution incorporates a modular manufacturing platform that can rapidly adapt to changing regulatory requirements across different markets. Luna's approach features automated process controls that precisely monitor and adjust chemical usage to maintain compliance with strict emission standards while ensuring product consistency. Their manufacturing facilities utilize advanced filtration and scrubbing technologies that reduce hazardous air pollutants by over 95% compared to conventional processes. Luna has also implemented a comprehensive chemical substitution program that systematically evaluates and replaces restricted substances with regulatory-compliant alternatives while maintaining coating performance. Their regulatory information management system integrates with manufacturing controls to ensure real-time compliance with jurisdictional requirements, including EPA, REACH, RoHS, and emerging regulations targeting nanomaterials.

Strengths: Advanced emissions control technology; adaptable manufacturing platform; sophisticated regulatory tracking capabilities. Weaknesses: High capital investment requirements; complex implementation process; potential challenges with global supply chain compliance.

Detrapel, Inc.

Technical Solution: Detrapel has developed an innovative regulatory-compliant superhydrophobic coating technology focused on consumer safety and environmental sustainability. Their technical approach centers on fluorine-free formulations that eliminate PFAS (per- and polyfluoroalkyl substances) chemicals, which face increasing regulatory scrutiny worldwide. Detrapel's manufacturing process employs a proprietary silica-based nanoparticle technology that achieves superhydrophobic properties without traditional fluorinated compounds. Their production methodology incorporates real-time emissions monitoring systems that ensure compliance with Clean Air Act standards while maintaining production efficiency. Detrapel has also implemented a comprehensive chemical inventory management system that tracks regulatory status of all input materials across global markets, enabling rapid reformulation when regulatory changes occur. Their technical documentation system provides detailed safety data sheets and environmental impact assessments that meet or exceed GHS (Globally Harmonized System) requirements.

Strengths: PFAS-free formulations position them favorably amid tightening regulations; adaptable manufacturing processes; strong regulatory documentation systems. Weaknesses: Potentially higher production costs; newer technology with less long-term performance data; challenges in achieving equivalent durability to traditional formulations.

Key Patents and Innovations in Regulatory-Compliant Coatings

Water repellent element and a method for producing a hydrophobic coating

PatentWO2007126327A1

Innovation

- A hydrophobic coating is applied from a solution of a hydrophobic polymer or copolymer using supercritical CO2 on substrates with complex geometries, such as rough, porous, or highly developed surfaces, within a sealed reactor at controlled pressure and temperature, allowing deep and uniform penetration without distorting the substrate morphology.

Water repellent coating composition, and coated films and coated articles using the same

PatentInactiveUS6117555A

Innovation

- A water repellent coating composition using fluororesin powder with a specific surface area of 8 to 50 m²/g and molecular weight of 10,000 to 100,000, combined with a binder resin and solvent, providing improved water repellency and heat resistance without the need for fluorinated PTFE powders.

Environmental Impact Assessment and Sustainability Metrics

The manufacturing of superhydrophobic coatings presents significant environmental considerations that must be systematically evaluated through comprehensive impact assessments. Current manufacturing processes often involve fluorinated compounds and volatile organic compounds (VOCs), which pose substantial environmental risks including ozone depletion, greenhouse gas emissions, and water contamination. Regulatory bodies worldwide have established increasingly stringent standards for these substances, necessitating the development of quantifiable sustainability metrics for the industry.

Environmental impact assessments for superhydrophobic coating production typically evaluate several key parameters: energy consumption during manufacturing, water usage, waste generation, emissions profiles, and end-of-life disposal considerations. Recent studies indicate that traditional manufacturing methods can consume between 15-30 kWh of energy per square meter of coating produced, with corresponding carbon emissions of 5-12 kg CO2 equivalent. Water usage varies significantly based on production technology, ranging from 5-20 liters per square meter.

Sustainability metrics have evolved to provide standardized measurement frameworks for the industry. The Environmental Performance Index (EPI) specifically adapted for coating technologies incorporates lifecycle assessment methodologies to quantify environmental impacts across the entire value chain. Leading manufacturers have begun implementing the Coating Sustainability Assessment Tool (CSAT), which evaluates products on a 100-point scale across multiple environmental dimensions including resource efficiency, toxicity, and biodegradability.

Regulatory pressures have catalyzed innovation in greener manufacturing practices. Bio-based alternatives utilizing plant-derived silica nanoparticles have demonstrated promising environmental profiles, reducing manufacturing carbon footprints by up to 40% compared to conventional methods. Water-based formulations have achieved VOC reductions exceeding 80%, though challenges remain in matching performance characteristics of traditional solvent-based systems.

The industry is witnessing a transition toward closed-loop manufacturing systems that recover and reuse solvents and raw materials. These systems have demonstrated waste reduction rates of 50-70% in pilot implementations. Additionally, energy-efficient curing technologies utilizing UV and infrared radiation have reduced energy consumption by 30-45% compared to conventional thermal curing processes.

Future sustainability advancements will likely focus on developing standardized environmental product declarations (EPDs) specific to superhydrophobic coatings, enabling transparent comparison across products and manufacturers. The integration of real-time monitoring systems for environmental parameters during manufacturing represents another promising frontier, potentially enabling dynamic optimization of production processes to minimize environmental impacts while maintaining product quality.

Environmental impact assessments for superhydrophobic coating production typically evaluate several key parameters: energy consumption during manufacturing, water usage, waste generation, emissions profiles, and end-of-life disposal considerations. Recent studies indicate that traditional manufacturing methods can consume between 15-30 kWh of energy per square meter of coating produced, with corresponding carbon emissions of 5-12 kg CO2 equivalent. Water usage varies significantly based on production technology, ranging from 5-20 liters per square meter.

Sustainability metrics have evolved to provide standardized measurement frameworks for the industry. The Environmental Performance Index (EPI) specifically adapted for coating technologies incorporates lifecycle assessment methodologies to quantify environmental impacts across the entire value chain. Leading manufacturers have begun implementing the Coating Sustainability Assessment Tool (CSAT), which evaluates products on a 100-point scale across multiple environmental dimensions including resource efficiency, toxicity, and biodegradability.

Regulatory pressures have catalyzed innovation in greener manufacturing practices. Bio-based alternatives utilizing plant-derived silica nanoparticles have demonstrated promising environmental profiles, reducing manufacturing carbon footprints by up to 40% compared to conventional methods. Water-based formulations have achieved VOC reductions exceeding 80%, though challenges remain in matching performance characteristics of traditional solvent-based systems.

The industry is witnessing a transition toward closed-loop manufacturing systems that recover and reuse solvents and raw materials. These systems have demonstrated waste reduction rates of 50-70% in pilot implementations. Additionally, energy-efficient curing technologies utilizing UV and infrared radiation have reduced energy consumption by 30-45% compared to conventional thermal curing processes.

Future sustainability advancements will likely focus on developing standardized environmental product declarations (EPDs) specific to superhydrophobic coatings, enabling transparent comparison across products and manufacturers. The integration of real-time monitoring systems for environmental parameters during manufacturing represents another promising frontier, potentially enabling dynamic optimization of production processes to minimize environmental impacts while maintaining product quality.

Global Regulatory Framework Comparison and Harmonization

The global regulatory landscape for superhydrophobic coating manufacturing exhibits significant variation across regions, creating compliance challenges for manufacturers operating internationally. In North America, the EPA's Toxic Substances Control Act (TSCA) and Canada's Chemical Management Plan impose stringent requirements on fluorinated compounds commonly used in superhydrophobic formulations. These regulations mandate extensive testing and reporting protocols, particularly for novel nanomaterials that may present unknown environmental risks.

European regulations present a more comprehensive framework through REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), which employs the precautionary principle and places the burden of proof on manufacturers to demonstrate safety. The EU has progressively restricted certain perfluorinated compounds (PFCs) used in superhydrophobic applications, requiring manufacturers to develop alternative formulations specifically for the European market.

Asia-Pacific regulatory frameworks show considerable diversity, with Japan's Chemical Substances Control Law implementing rigorous evaluation systems, while China's newer environmental regulations under the Ministry of Ecology and Environment are rapidly evolving but still lack consistent enforcement mechanisms. This regional variation creates significant compliance costs for global manufacturers who must reformulate products to meet different standards.

Emerging harmonization efforts are visible through international initiatives like the Strategic Approach to International Chemicals Management (SAICM) and the Globally Harmonized System of Classification and Labelling of Chemicals (GHS). These frameworks aim to standardize hazard communication and establish consistent risk assessment methodologies across borders, though implementation remains inconsistent.

Industry-specific standards further complicate the regulatory landscape. Medical device coatings face additional scrutiny under FDA and EMA guidelines, while architectural applications must comply with volatile organic compound (VOC) limitations that vary significantly between California's SCAQMD rules and European Decopaint Directive requirements.

The fragmentation of global regulations creates market access barriers and increases compliance costs, with an estimated 15-20% of R&D budgets now allocated to regulatory adaptation. Companies pursuing global distribution must navigate this complex landscape through sophisticated regulatory intelligence systems and modular formulation approaches that can be rapidly adapted to regional requirements.

Harmonization trends suggest movement toward stricter controls on persistent chemicals and increased emphasis on sustainable alternatives, with regulatory convergence likely to accelerate around nanomaterial safety standards and environmental persistence criteria. Forward-looking manufacturers are proactively developing compliant formulations that anticipate these regulatory trends rather than reacting to individual regional changes.

European regulations present a more comprehensive framework through REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), which employs the precautionary principle and places the burden of proof on manufacturers to demonstrate safety. The EU has progressively restricted certain perfluorinated compounds (PFCs) used in superhydrophobic applications, requiring manufacturers to develop alternative formulations specifically for the European market.

Asia-Pacific regulatory frameworks show considerable diversity, with Japan's Chemical Substances Control Law implementing rigorous evaluation systems, while China's newer environmental regulations under the Ministry of Ecology and Environment are rapidly evolving but still lack consistent enforcement mechanisms. This regional variation creates significant compliance costs for global manufacturers who must reformulate products to meet different standards.

Emerging harmonization efforts are visible through international initiatives like the Strategic Approach to International Chemicals Management (SAICM) and the Globally Harmonized System of Classification and Labelling of Chemicals (GHS). These frameworks aim to standardize hazard communication and establish consistent risk assessment methodologies across borders, though implementation remains inconsistent.

Industry-specific standards further complicate the regulatory landscape. Medical device coatings face additional scrutiny under FDA and EMA guidelines, while architectural applications must comply with volatile organic compound (VOC) limitations that vary significantly between California's SCAQMD rules and European Decopaint Directive requirements.

The fragmentation of global regulations creates market access barriers and increases compliance costs, with an estimated 15-20% of R&D budgets now allocated to regulatory adaptation. Companies pursuing global distribution must navigate this complex landscape through sophisticated regulatory intelligence systems and modular formulation approaches that can be rapidly adapted to regional requirements.

Harmonization trends suggest movement toward stricter controls on persistent chemicals and increased emphasis on sustainable alternatives, with regulatory convergence likely to accelerate around nanomaterial safety standards and environmental persistence criteria. Forward-looking manufacturers are proactively developing compliant formulations that anticipate these regulatory trends rather than reacting to individual regional changes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!