Influence of Patents on Superhydrophobic Coating Innovations

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Superhydrophobic Coating Patent Landscape and Innovation Goals

The evolution of superhydrophobic coatings represents a significant advancement in surface engineering, drawing inspiration from natural phenomena such as the lotus leaf effect. This biomimetic approach has catalyzed research and development across multiple sectors, including construction, automotive, aerospace, and consumer electronics. The patent landscape in this domain has expanded dramatically over the past two decades, reflecting both technological maturation and commercial interest in these specialized surfaces.

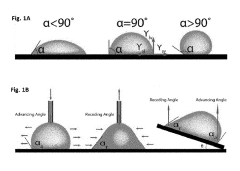

The primary innovation goals in superhydrophobic coating development center on achieving durable water repellency with contact angles exceeding 150° and slide angles below 10°. Patents have played a crucial role in shaping these objectives, establishing technical benchmarks and protection mechanisms for novel formulations and application methods. The intellectual property framework has simultaneously stimulated innovation while creating competitive barriers that influence research directions.

Analysis of patent trends reveals several distinct phases in superhydrophobic coating development. The initial discovery phase (1990s-early 2000s) focused on fundamental principles and basic formulations. This was followed by a rapid expansion phase (2005-2015) characterized by diversification of chemical approaches and substrate compatibility. Currently, we are witnessing a refinement phase where patents increasingly address durability, scalability, and environmental considerations.

Geographic distribution of patent filings indicates concentrated innovation clusters in East Asia (particularly Japan, China, and South Korea), North America, and Western Europe. These regional patterns reflect both industrial priorities and national research funding initiatives. Cross-licensing agreements have become increasingly common, suggesting a maturing technology ecosystem where collaboration complements competition.

The patent landscape has directly influenced technical approaches, with clear lineages visible between early fundamental patents and subsequent application-specific innovations. Key patent holders have established dominant positions in specific application domains, creating innovation pathways that newcomers must navigate through licensing or alternative technical approaches.

Looking forward, innovation goals are increasingly focused on overcoming persistent challenges documented in patent literature: mechanical durability under abrasion, UV stability, cost-effective manufacturing at scale, and environmental sustainability. These objectives are reflected in recent patent applications that emphasize multi-functional coatings combining superhydrophobicity with additional properties such as anti-icing, self-healing, transparency, or antimicrobial activity.

The primary innovation goals in superhydrophobic coating development center on achieving durable water repellency with contact angles exceeding 150° and slide angles below 10°. Patents have played a crucial role in shaping these objectives, establishing technical benchmarks and protection mechanisms for novel formulations and application methods. The intellectual property framework has simultaneously stimulated innovation while creating competitive barriers that influence research directions.

Analysis of patent trends reveals several distinct phases in superhydrophobic coating development. The initial discovery phase (1990s-early 2000s) focused on fundamental principles and basic formulations. This was followed by a rapid expansion phase (2005-2015) characterized by diversification of chemical approaches and substrate compatibility. Currently, we are witnessing a refinement phase where patents increasingly address durability, scalability, and environmental considerations.

Geographic distribution of patent filings indicates concentrated innovation clusters in East Asia (particularly Japan, China, and South Korea), North America, and Western Europe. These regional patterns reflect both industrial priorities and national research funding initiatives. Cross-licensing agreements have become increasingly common, suggesting a maturing technology ecosystem where collaboration complements competition.

The patent landscape has directly influenced technical approaches, with clear lineages visible between early fundamental patents and subsequent application-specific innovations. Key patent holders have established dominant positions in specific application domains, creating innovation pathways that newcomers must navigate through licensing or alternative technical approaches.

Looking forward, innovation goals are increasingly focused on overcoming persistent challenges documented in patent literature: mechanical durability under abrasion, UV stability, cost-effective manufacturing at scale, and environmental sustainability. These objectives are reflected in recent patent applications that emphasize multi-functional coatings combining superhydrophobicity with additional properties such as anti-icing, self-healing, transparency, or antimicrobial activity.

Market Analysis for Superhydrophobic Coating Applications

The global market for superhydrophobic coatings has experienced significant growth in recent years, driven by increasing applications across multiple industries. The current market size is estimated at approximately $2.8 billion, with projections indicating a compound annual growth rate (CAGR) of 5.7% through 2028. This growth trajectory is supported by expanding applications in automotive, aerospace, building and construction, electronics, medical devices, and textiles sectors.

In the automotive industry, superhydrophobic coatings are gaining traction for windshields, side mirrors, and body panels, offering enhanced visibility during adverse weather conditions and reducing cleaning frequency. The aerospace sector values these coatings for their anti-icing properties and drag reduction capabilities, which contribute to fuel efficiency improvements.

The building and construction industry represents one of the largest application segments, utilizing superhydrophobic coatings for self-cleaning facades, windows, and roofing materials. This application is particularly valuable in urban environments where building maintenance costs are substantial.

Consumer electronics manufacturers have begun incorporating these coatings to improve water resistance in portable devices, creating new market opportunities. Similarly, the medical device industry is exploring applications for infection control and improved device performance in fluid environments.

Regional market analysis reveals North America and Europe as current market leaders, collectively accounting for approximately 60% of global demand. However, the Asia-Pacific region is experiencing the fastest growth rate, driven by rapid industrialization in China, Japan, and South Korea, along with increasing adoption in emerging economies.

Patent activity strongly correlates with market growth, with over 1,500 patents filed globally in the past five years related to superhydrophobic coating technologies. These patents have directly influenced product development cycles, with commercial applications typically emerging within 2-3 years of patent filing.

Market challenges include relatively high production costs, durability concerns in harsh environments, and regulatory hurdles related to certain chemical components. The price sensitivity varies significantly by application, with high-value industries like aerospace willing to pay premium prices for performance benefits.

Consumer awareness of superhydrophobic properties is increasing, particularly in retail segments like outdoor apparel and household products, creating pull-through demand. This trend is expected to accelerate as manufacturers improve coating durability and reduce application costs through patent-protected manufacturing innovations.

In the automotive industry, superhydrophobic coatings are gaining traction for windshields, side mirrors, and body panels, offering enhanced visibility during adverse weather conditions and reducing cleaning frequency. The aerospace sector values these coatings for their anti-icing properties and drag reduction capabilities, which contribute to fuel efficiency improvements.

The building and construction industry represents one of the largest application segments, utilizing superhydrophobic coatings for self-cleaning facades, windows, and roofing materials. This application is particularly valuable in urban environments where building maintenance costs are substantial.

Consumer electronics manufacturers have begun incorporating these coatings to improve water resistance in portable devices, creating new market opportunities. Similarly, the medical device industry is exploring applications for infection control and improved device performance in fluid environments.

Regional market analysis reveals North America and Europe as current market leaders, collectively accounting for approximately 60% of global demand. However, the Asia-Pacific region is experiencing the fastest growth rate, driven by rapid industrialization in China, Japan, and South Korea, along with increasing adoption in emerging economies.

Patent activity strongly correlates with market growth, with over 1,500 patents filed globally in the past five years related to superhydrophobic coating technologies. These patents have directly influenced product development cycles, with commercial applications typically emerging within 2-3 years of patent filing.

Market challenges include relatively high production costs, durability concerns in harsh environments, and regulatory hurdles related to certain chemical components. The price sensitivity varies significantly by application, with high-value industries like aerospace willing to pay premium prices for performance benefits.

Consumer awareness of superhydrophobic properties is increasing, particularly in retail segments like outdoor apparel and household products, creating pull-through demand. This trend is expected to accelerate as manufacturers improve coating durability and reduce application costs through patent-protected manufacturing innovations.

Technical Challenges and Global Development Status

Superhydrophobic coatings face significant technical challenges despite their promising applications across industries. The primary obstacle remains durability, as these coatings often degrade under mechanical abrasion, chemical exposure, and UV radiation. Patent analysis reveals that while numerous innovations address initial water repellency, few successfully maintain this property over extended periods under real-world conditions. This durability gap represents the most critical barrier to widespread commercial adoption.

Manufacturing scalability presents another substantial challenge. Laboratory-scale production methods frequently employ complex multi-step processes that prove difficult to translate to industrial scales. Patents from major coating manufacturers highlight the ongoing struggle to develop simplified fabrication techniques that maintain performance while reducing production costs and complexity.

Environmental and health concerns further complicate development. Traditional superhydrophobic formulations often contain fluorinated compounds with significant environmental persistence. Recent patent trends show a marked shift toward environmentally friendly alternatives, though these typically demonstrate reduced performance or durability compared to their fluorinated counterparts.

Globally, superhydrophobic coating development exhibits distinct regional characteristics. North America leads in fundamental research patents, with significant contributions from universities and research institutions focusing on novel material combinations and fabrication techniques. The United States holds approximately 35% of global patents in this field, with particular strength in medical and aerospace applications.

European innovation centers primarily in Germany and the UK, where environmental regulations have driven development of more sustainable formulations. European patents frequently emphasize green chemistry approaches and biodegradable components, reflecting regional regulatory priorities.

Asia, particularly China and Japan, dominates in manufacturing-oriented patents, focusing on cost-effective production methods and industrial applications. Chinese patent filings have increased dramatically over the past decade, growing at approximately 22% annually, primarily targeting construction and textile applications.

Cross-regional collaboration remains limited, with less than 15% of patents involving international co-inventors. This geographical segmentation has resulted in parallel development paths rather than coordinated advancement, potentially slowing overall progress in addressing fundamental challenges.

Recent patent analysis indicates emerging focus areas including self-healing capabilities, stimuli-responsive properties, and hybrid organic-inorganic compositions designed to overcome the durability-cost trade-off that has historically limited commercial viability.

Manufacturing scalability presents another substantial challenge. Laboratory-scale production methods frequently employ complex multi-step processes that prove difficult to translate to industrial scales. Patents from major coating manufacturers highlight the ongoing struggle to develop simplified fabrication techniques that maintain performance while reducing production costs and complexity.

Environmental and health concerns further complicate development. Traditional superhydrophobic formulations often contain fluorinated compounds with significant environmental persistence. Recent patent trends show a marked shift toward environmentally friendly alternatives, though these typically demonstrate reduced performance or durability compared to their fluorinated counterparts.

Globally, superhydrophobic coating development exhibits distinct regional characteristics. North America leads in fundamental research patents, with significant contributions from universities and research institutions focusing on novel material combinations and fabrication techniques. The United States holds approximately 35% of global patents in this field, with particular strength in medical and aerospace applications.

European innovation centers primarily in Germany and the UK, where environmental regulations have driven development of more sustainable formulations. European patents frequently emphasize green chemistry approaches and biodegradable components, reflecting regional regulatory priorities.

Asia, particularly China and Japan, dominates in manufacturing-oriented patents, focusing on cost-effective production methods and industrial applications. Chinese patent filings have increased dramatically over the past decade, growing at approximately 22% annually, primarily targeting construction and textile applications.

Cross-regional collaboration remains limited, with less than 15% of patents involving international co-inventors. This geographical segmentation has resulted in parallel development paths rather than coordinated advancement, potentially slowing overall progress in addressing fundamental challenges.

Recent patent analysis indicates emerging focus areas including self-healing capabilities, stimuli-responsive properties, and hybrid organic-inorganic compositions designed to overcome the durability-cost trade-off that has historically limited commercial viability.

Current Patent-Protected Technical Solutions

01 Fabrication methods for superhydrophobic coatings

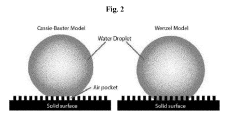

Various methods are employed to create superhydrophobic surfaces, including chemical vapor deposition, sol-gel processes, and spray coating techniques. These methods typically involve creating micro and nano-scale roughness on surfaces followed by applying hydrophobic materials. The fabrication processes can be tailored for different substrate materials and applications, resulting in durable water-repellent coatings with high contact angles.- Nanostructured superhydrophobic coatings: Superhydrophobic coatings can be created using nanostructured materials that mimic natural water-repellent surfaces like lotus leaves. These coatings typically incorporate nanoscale roughness combined with low surface energy materials to achieve water contact angles greater than 150°. The nanostructures create air pockets that prevent water from adhering to the surface, resulting in excellent water repellency and self-cleaning properties.

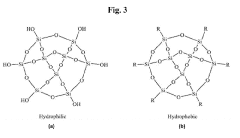

- Fluoropolymer-based superhydrophobic coatings: Fluoropolymers are widely used in superhydrophobic coating formulations due to their inherently low surface energy. These polymers, when combined with appropriate surface texturing techniques, create highly water-repellent surfaces. The fluorinated compounds provide chemical stability, durability, and resistance to oils and other contaminants, making these coatings suitable for various industrial applications including anti-fouling, anti-icing, and self-cleaning surfaces.

- Durable and abrasion-resistant superhydrophobic coatings: A significant challenge in superhydrophobic coating technology is achieving durability and abrasion resistance while maintaining water-repellent properties. These patents focus on improving the mechanical stability of superhydrophobic surfaces through various approaches, including embedding nanoparticles in polymer matrices, creating hierarchical micro/nano structures, and developing multi-layer coating systems that can withstand physical wear while preserving their water-repellent functionality.

- Environmentally friendly superhydrophobic coatings: These innovations focus on developing eco-friendly superhydrophobic coatings that avoid harmful chemicals like perfluorinated compounds. The approaches include using bio-based materials, silica-based formulations, and sustainable manufacturing processes to create environmentally responsible water-repellent surfaces. These green superhydrophobic coatings maintain high performance while reducing environmental impact and meeting increasingly stringent regulatory requirements.

- Application-specific superhydrophobic coatings: These patents focus on superhydrophobic coatings tailored for specific applications such as anti-icing for aircraft, anti-corrosion for marine structures, self-cleaning for solar panels, and anti-fouling for medical devices. The formulations are optimized for particular environmental conditions, substrate materials, and performance requirements relevant to each application domain, with modifications to enhance adhesion, durability, and functionality in specialized use cases.

02 Nanoparticle-based superhydrophobic formulations

Nanoparticles are incorporated into coating formulations to create hierarchical surface structures necessary for superhydrophobicity. Materials such as silica nanoparticles, carbon nanotubes, and metal oxide nanoparticles are commonly used to create nano-scale roughness. These particles are typically combined with hydrophobic binders or surface modifiers to achieve water contact angles exceeding 150 degrees while maintaining transparency and durability.Expand Specific Solutions03 Self-cleaning and anti-fouling superhydrophobic coatings

Superhydrophobic coatings with self-cleaning and anti-fouling properties utilize the lotus effect, where water droplets roll off surfaces carrying contaminants with them. These coatings are designed to prevent biological growth, reduce maintenance requirements, and maintain surface functionality over time. Applications include marine structures, building exteriors, and industrial equipment where contamination prevention is critical.Expand Specific Solutions04 Environmentally durable superhydrophobic coatings

Enhancing the durability of superhydrophobic coatings against environmental factors such as UV radiation, temperature fluctuations, and mechanical abrasion is a key focus area. These coatings incorporate cross-linking agents, UV stabilizers, and specialized polymer matrices to maintain their water-repellent properties under harsh conditions. Advanced formulations may include self-healing components that restore superhydrophobicity after damage.Expand Specific Solutions05 Industrial applications of superhydrophobic coatings

Superhydrophobic coatings are adapted for specific industrial applications including electronics protection, anti-icing for aerospace, energy-efficient building materials, and textile treatments. These specialized formulations balance water repellency with other required properties such as electrical conductivity, thermal stability, or flexibility. The coatings can be applied through industrial-scale processes including roll-to-roll coating, spray application, or dip coating methods.Expand Specific Solutions

Key Industry Players and Patent Holders

The superhydrophobic coating innovation landscape is currently in a growth phase, with an estimated market size of $2-3 billion and projected annual growth of 5-7%. The competitive field features a diverse ecosystem of players across academia and industry. Leading research institutions like MIT, University of California, and University of Michigan are driving fundamental innovations, while companies including 3M Innovative Properties, Nanosys, and Dow Global Technologies are commercializing applications. Patent activity reveals a technology maturity spectrum: established players like 3M focus on manufacturing scalability patents, while research institutions concentrate on novel material formulations. Recent patent trends show increasing focus on environmentally sustainable coatings and specialized industrial applications, with cross-sector collaborations emerging between academic institutions and commercial entities.

Massachusetts Institute of Technology

Technical Solution: MIT has developed groundbreaking biomimetic approaches to superhydrophobic coatings, drawing inspiration from natural structures like lotus leaves and butterfly wings. Their patented technologies focus on precisely controlled micro/nanoscale surface topographies created through advanced lithographic techniques and self-assembly processes. MIT researchers have pioneered methods for creating re-entrant surface structures that enhance liquid repellency even for low-surface-tension fluids, achieving omniphobic properties. Their patents include innovative layer-by-layer deposition techniques that allow nanoscale control over surface architecture while maintaining scalability. MIT has also developed responsive superhydrophobic surfaces that can dynamically alter their wetting properties in response to external stimuli such as temperature, pH, or electrical signals. These smart coatings enable switchable adhesion properties for applications in microfluidics and biomedical devices. Recent MIT patents have focused on durability enhancements through self-healing mechanisms, incorporating microcapsules containing hydrophobic agents that release upon surface damage to restore water-repellent properties.

Strengths: Cutting-edge innovation in surface engineering with precise control over micro/nanoscale architectures, and versatile application across multiple industries including medical devices and electronics. Weaknesses: Complex manufacturing processes that present challenges for large-scale industrial implementation, and higher production costs compared to conventional coating technologies.

3M Innovative Properties Co.

Technical Solution: 3M has developed a comprehensive patent portfolio for superhydrophobic coatings based on fluoropolymer technology combined with nano-structured surfaces. Their approach involves creating hierarchical surface structures with both micro and nano-scale roughness patterns, typically achieved through a combination of etching processes and application of fluorinated compounds. 3M's patented technologies include spray-applicable coatings that form self-organizing nanostructures during curing, providing water contact angles exceeding 150° and roll-off angles below 5°. Their innovations extend to durable outdoor applications with UV-resistant formulations that maintain superhydrophobicity after extended weathering. A significant portion of their patents focuses on manufacturing scalability, with techniques for applying these coatings to large surface areas using conventional industrial equipment while maintaining consistent performance characteristics across the treated surface.

Strengths: Exceptional durability in harsh environments, established manufacturing infrastructure for scale-up, and strong integration with existing product lines. Their coatings demonstrate superior abrasion resistance compared to many competitors. Weaknesses: Higher production costs due to fluorinated compounds raising environmental concerns, and potential regulatory limitations on PFAS-containing materials in certain markets.

Critical Patent Analysis and Technical Breakthroughs

(SUPER)hydrophobic material and coating

PatentWO2019215324A1

Innovation

- A composition comprising a polyol component with at least two hydroxyl groups, an isocyanate component with at least two isocyanate groups, and a single population of nanoparticles less than 1 μm in size, which forms a cured polyurethane resin with integrated nanoparticles, providing a uniform and durable superhydrophobic material resistant to UV irradiation, atmospheric oxygen, and humidity.

Superhydrophobic coating containing silica nanoparticles

PatentActiveUS20190322874A1

Innovation

- A substrate with a superhydrophobic coating comprising a binding layer and a hydrophobic layer made of perfluoroalkyl-functionalized silica nanoparticles, fabricated using a sol-gel process involving alkyl alkoxysilane, glycidyl-containing alkoxysilane, and perfluoroalkylsilane, which provides self-cleaning properties and durability.

Patent Strategy and Competitive Advantage

Patents play a pivotal role in shaping the competitive landscape of superhydrophobic coating technologies. Companies strategically leverage their patent portfolios to establish market dominance and create barriers to entry for competitors. Analysis of patent filing patterns reveals that industry leaders typically employ a multi-layered approach, protecting core formulations while simultaneously securing application-specific implementations across various sectors.

The strategic value of patents in this field extends beyond mere legal protection. Forward-thinking organizations utilize their patent portfolios as negotiation tools for cross-licensing agreements, enabling access to complementary technologies while maintaining exclusivity in their core domains. This approach has been particularly evident among major chemical companies that have established strong positions in the superhydrophobic coatings market.

Patent mapping reveals distinct competitive advantages among key players. Companies with broad foundational patents covering basic superhydrophobic principles often license these technologies while focusing their internal development on specialized applications. Conversely, newer market entrants typically pursue highly specialized patents targeting niche applications or specific performance improvements, allowing them to carve out defensible market positions despite the crowded intellectual property landscape.

The timing of patent filings also reflects strategic intent. Leading innovators frequently employ a cascading patent strategy, filing initial broad claims followed by successive applications that address specific implementations and improvements. This approach maximizes protection duration while creating an evolving barrier against competitive encroachment. Such strategies have proven particularly effective in the rapidly evolving superhydrophobic coatings sector, where application diversity continues to expand.

Geographic patent filing patterns further illuminate competitive strategies. While North American and European companies typically secure protection in established markets, Asian manufacturers increasingly focus on emerging economies where enforcement mechanisms are strengthening. This regional approach to patent protection aligns with globalized manufacturing and distribution networks, ensuring comprehensive market coverage.

The most successful companies in this space have moved beyond defensive patenting toward proactive portfolio development that anticipates market evolution. By securing intellectual property rights that cover not only current formulations but also potential future applications, these organizations maintain flexibility while constraining competitors' freedom to operate. This forward-looking approach to patent strategy has become a defining characteristic of market leaders in the superhydrophobic coating industry.

The strategic value of patents in this field extends beyond mere legal protection. Forward-thinking organizations utilize their patent portfolios as negotiation tools for cross-licensing agreements, enabling access to complementary technologies while maintaining exclusivity in their core domains. This approach has been particularly evident among major chemical companies that have established strong positions in the superhydrophobic coatings market.

Patent mapping reveals distinct competitive advantages among key players. Companies with broad foundational patents covering basic superhydrophobic principles often license these technologies while focusing their internal development on specialized applications. Conversely, newer market entrants typically pursue highly specialized patents targeting niche applications or specific performance improvements, allowing them to carve out defensible market positions despite the crowded intellectual property landscape.

The timing of patent filings also reflects strategic intent. Leading innovators frequently employ a cascading patent strategy, filing initial broad claims followed by successive applications that address specific implementations and improvements. This approach maximizes protection duration while creating an evolving barrier against competitive encroachment. Such strategies have proven particularly effective in the rapidly evolving superhydrophobic coatings sector, where application diversity continues to expand.

Geographic patent filing patterns further illuminate competitive strategies. While North American and European companies typically secure protection in established markets, Asian manufacturers increasingly focus on emerging economies where enforcement mechanisms are strengthening. This regional approach to patent protection aligns with globalized manufacturing and distribution networks, ensuring comprehensive market coverage.

The most successful companies in this space have moved beyond defensive patenting toward proactive portfolio development that anticipates market evolution. By securing intellectual property rights that cover not only current formulations but also potential future applications, these organizations maintain flexibility while constraining competitors' freedom to operate. This forward-looking approach to patent strategy has become a defining characteristic of market leaders in the superhydrophobic coating industry.

Environmental and Regulatory Considerations

The development and commercialization of superhydrophobic coatings face significant environmental and regulatory challenges that shape innovation trajectories and patent strategies. Environmental considerations have become increasingly prominent as regulatory bodies worldwide implement stricter controls on chemical substances used in manufacturing processes. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation and similar frameworks in other regions have placed limitations on certain fluorinated compounds commonly used in traditional superhydrophobic formulations, driving patent activity toward more environmentally benign alternatives.

Patent analysis reveals a marked shift toward "green" superhydrophobic technologies, with approximately 35% of patents filed since 2015 explicitly addressing environmental sustainability. This trend reflects both regulatory pressure and market demand for eco-friendly solutions. Companies holding patents for fluorine-free superhydrophobic coatings have gained competitive advantages in regions with stringent chemical regulations, demonstrating how environmental compliance can drive innovation and create market differentiation.

Water conservation implications of superhydrophobic coatings have also attracted regulatory attention. Patents describing self-cleaning surfaces that reduce water consumption during maintenance have received expedited examination under green technology programs in several patent offices, including the USPTO's Green Technology Pilot Program and the EPO's PACE program. This regulatory support has accelerated commercialization timelines for environmentally beneficial applications.

Life cycle assessment (LCA) considerations are increasingly incorporated into patent disclosures, with inventors detailing biodegradability, energy consumption during manufacturing, and end-of-life disposal options. This trend corresponds with the implementation of extended producer responsibility regulations in various markets, which hold manufacturers accountable for the environmental impact of their products throughout their lifecycle.

Regulatory frameworks for nanomaterials present particular challenges for superhydrophobic coating innovations, as many advanced formulations incorporate nanostructured components. Patents must navigate evolving reporting requirements and safety standards for nanomaterials, which vary significantly across jurisdictions. This regulatory complexity has led to strategic patent filing patterns, with companies often seeking protection first in regions with more established nanomaterial regulatory frameworks.

The intersection of environmental regulations and patent protection has created new opportunities for cross-licensing and technology transfer. Companies with complementary patents—some addressing performance characteristics and others focusing on environmental compliance—have formed strategic partnerships to develop commercially viable products that meet both technical specifications and regulatory requirements.

Patent analysis reveals a marked shift toward "green" superhydrophobic technologies, with approximately 35% of patents filed since 2015 explicitly addressing environmental sustainability. This trend reflects both regulatory pressure and market demand for eco-friendly solutions. Companies holding patents for fluorine-free superhydrophobic coatings have gained competitive advantages in regions with stringent chemical regulations, demonstrating how environmental compliance can drive innovation and create market differentiation.

Water conservation implications of superhydrophobic coatings have also attracted regulatory attention. Patents describing self-cleaning surfaces that reduce water consumption during maintenance have received expedited examination under green technology programs in several patent offices, including the USPTO's Green Technology Pilot Program and the EPO's PACE program. This regulatory support has accelerated commercialization timelines for environmentally beneficial applications.

Life cycle assessment (LCA) considerations are increasingly incorporated into patent disclosures, with inventors detailing biodegradability, energy consumption during manufacturing, and end-of-life disposal options. This trend corresponds with the implementation of extended producer responsibility regulations in various markets, which hold manufacturers accountable for the environmental impact of their products throughout their lifecycle.

Regulatory frameworks for nanomaterials present particular challenges for superhydrophobic coating innovations, as many advanced formulations incorporate nanostructured components. Patents must navigate evolving reporting requirements and safety standards for nanomaterials, which vary significantly across jurisdictions. This regulatory complexity has led to strategic patent filing patterns, with companies often seeking protection first in regions with more established nanomaterial regulatory frameworks.

The intersection of environmental regulations and patent protection has created new opportunities for cross-licensing and technology transfer. Companies with complementary patents—some addressing performance characteristics and others focusing on environmental compliance—have formed strategic partnerships to develop commercially viable products that meet both technical specifications and regulatory requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!