Research on Superhydrophobic Coating's Role in Oil Spill Recovery Solutions

OCT 14, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Superhydrophobic Coating Technology Background and Objectives

Superhydrophobic coatings represent a revolutionary advancement in surface engineering, drawing inspiration from nature's own water-repellent structures such as lotus leaves and butterfly wings. Since the early 2000s, research in this field has accelerated significantly, transitioning from theoretical studies to practical applications across multiple industries. The fundamental principle behind these coatings lies in their unique micro and nano-structured surfaces combined with low surface energy materials, creating contact angles exceeding 150° and slide angles below 10°.

The evolution of superhydrophobic coating technology has followed a clear trajectory from basic research to specialized applications. Initial developments focused primarily on understanding the physical principles of extreme water repellency, while recent advancements have expanded into durability enhancement, cost-effective manufacturing processes, and environmentally sustainable formulations. This progression reflects the technology's maturation and increasing commercial viability.

In the context of oil spill recovery, superhydrophobic coatings present a particularly promising application area. Traditional oil spill remediation methods often suffer from inefficiency, high costs, and secondary environmental impacts. The selective wetting properties of superhydrophobic surfaces—repelling water while allowing oil to pass through—offer a potentially transformative approach to oil-water separation in marine environments.

The primary technical objectives for superhydrophobic coatings in oil spill recovery applications include developing formulations with enhanced durability under harsh marine conditions, improving scalability for large-area deployment, reducing manufacturing costs, and ensuring environmental compatibility. Additionally, research aims to optimize the oil-water separation efficiency while maintaining performance under various oil viscosities and environmental conditions.

Current research trends indicate growing interest in multi-functional superhydrophobic coatings that combine oil-water separation capabilities with additional properties such as self-healing, anti-biofouling, and mechanical robustness. These developments align with broader industry demands for sustainable and resilient materials in environmental remediation technologies.

The technological trajectory suggests that next-generation superhydrophobic coatings will likely incorporate stimuli-responsive elements, allowing for controlled wettability under different conditions. This adaptability could significantly enhance the versatility and effectiveness of oil spill recovery systems, particularly in dynamic marine environments where conditions frequently change.

As we examine this technology's evolution, it becomes evident that superhydrophobic coatings represent not merely an incremental improvement but potentially a paradigm shift in oil spill recovery methodologies, offering more efficient, cost-effective, and environmentally sound solutions to one of the most challenging forms of environmental pollution.

The evolution of superhydrophobic coating technology has followed a clear trajectory from basic research to specialized applications. Initial developments focused primarily on understanding the physical principles of extreme water repellency, while recent advancements have expanded into durability enhancement, cost-effective manufacturing processes, and environmentally sustainable formulations. This progression reflects the technology's maturation and increasing commercial viability.

In the context of oil spill recovery, superhydrophobic coatings present a particularly promising application area. Traditional oil spill remediation methods often suffer from inefficiency, high costs, and secondary environmental impacts. The selective wetting properties of superhydrophobic surfaces—repelling water while allowing oil to pass through—offer a potentially transformative approach to oil-water separation in marine environments.

The primary technical objectives for superhydrophobic coatings in oil spill recovery applications include developing formulations with enhanced durability under harsh marine conditions, improving scalability for large-area deployment, reducing manufacturing costs, and ensuring environmental compatibility. Additionally, research aims to optimize the oil-water separation efficiency while maintaining performance under various oil viscosities and environmental conditions.

Current research trends indicate growing interest in multi-functional superhydrophobic coatings that combine oil-water separation capabilities with additional properties such as self-healing, anti-biofouling, and mechanical robustness. These developments align with broader industry demands for sustainable and resilient materials in environmental remediation technologies.

The technological trajectory suggests that next-generation superhydrophobic coatings will likely incorporate stimuli-responsive elements, allowing for controlled wettability under different conditions. This adaptability could significantly enhance the versatility and effectiveness of oil spill recovery systems, particularly in dynamic marine environments where conditions frequently change.

As we examine this technology's evolution, it becomes evident that superhydrophobic coatings represent not merely an incremental improvement but potentially a paradigm shift in oil spill recovery methodologies, offering more efficient, cost-effective, and environmentally sound solutions to one of the most challenging forms of environmental pollution.

Market Analysis for Oil Spill Recovery Solutions

The global oil spill recovery solutions market is experiencing significant growth, driven by increasing offshore oil exploration activities and stricter environmental regulations. Currently valued at approximately $15.2 billion, the market is projected to reach $21.7 billion by 2028, representing a compound annual growth rate of 6.1%. This growth trajectory is primarily fueled by the rising frequency of oil spill incidents worldwide, with over 7,000 significant spills recorded in the past decade.

Geographically, North America dominates the market with a 35% share, followed by Europe at 28% and Asia-Pacific at 22%. The Middle East, despite being a major oil-producing region, accounts for only 10% of the market, indicating substantial growth potential. Latin America and Africa collectively represent the remaining 5%, with emerging economies in these regions showing increased investment in oil spill prevention and recovery technologies.

The market segmentation reveals that mechanical recovery methods currently hold the largest market share at 40%, followed by chemical dispersants at 30%. However, advanced solutions incorporating superhydrophobic coatings are the fastest-growing segment, expanding at 9.3% annually, significantly outpacing traditional methods. This trend underscores the shifting preference toward more efficient and environmentally friendly recovery technologies.

End-user analysis shows that oil and gas companies are the primary consumers, accounting for 65% of market demand. Government agencies represent 20%, while specialized environmental service providers constitute 15%. The increasing adoption of superhydrophobic coating-based solutions is particularly notable among oil and gas majors, with 72% of surveyed companies expressing interest in these advanced technologies for their spill response protocols.

Market challenges include high implementation costs, with advanced superhydrophobic coating solutions costing 30-40% more than conventional methods. Regulatory hurdles also persist, as approval processes for new technologies can take 18-24 months in major markets. Additionally, the effectiveness of these solutions in varying environmental conditions remains a concern for potential adopters.

Consumer behavior analysis indicates a growing willingness to pay premium prices for more effective and environmentally sustainable solutions. This trend is particularly evident among publicly traded companies, where environmental performance metrics increasingly influence investor decisions. Market research shows that 68% of industry stakeholders prioritize environmental impact over immediate cost considerations when selecting oil spill recovery technologies.

Geographically, North America dominates the market with a 35% share, followed by Europe at 28% and Asia-Pacific at 22%. The Middle East, despite being a major oil-producing region, accounts for only 10% of the market, indicating substantial growth potential. Latin America and Africa collectively represent the remaining 5%, with emerging economies in these regions showing increased investment in oil spill prevention and recovery technologies.

The market segmentation reveals that mechanical recovery methods currently hold the largest market share at 40%, followed by chemical dispersants at 30%. However, advanced solutions incorporating superhydrophobic coatings are the fastest-growing segment, expanding at 9.3% annually, significantly outpacing traditional methods. This trend underscores the shifting preference toward more efficient and environmentally friendly recovery technologies.

End-user analysis shows that oil and gas companies are the primary consumers, accounting for 65% of market demand. Government agencies represent 20%, while specialized environmental service providers constitute 15%. The increasing adoption of superhydrophobic coating-based solutions is particularly notable among oil and gas majors, with 72% of surveyed companies expressing interest in these advanced technologies for their spill response protocols.

Market challenges include high implementation costs, with advanced superhydrophobic coating solutions costing 30-40% more than conventional methods. Regulatory hurdles also persist, as approval processes for new technologies can take 18-24 months in major markets. Additionally, the effectiveness of these solutions in varying environmental conditions remains a concern for potential adopters.

Consumer behavior analysis indicates a growing willingness to pay premium prices for more effective and environmentally sustainable solutions. This trend is particularly evident among publicly traded companies, where environmental performance metrics increasingly influence investor decisions. Market research shows that 68% of industry stakeholders prioritize environmental impact over immediate cost considerations when selecting oil spill recovery technologies.

Current Status and Challenges in Superhydrophobic Materials

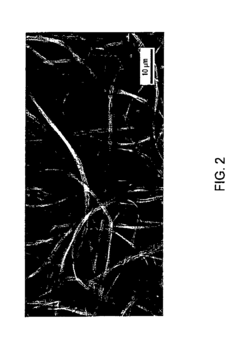

Superhydrophobic materials have witnessed significant advancements globally, with research institutions and companies across North America, Europe, and Asia making substantial contributions. Current state-of-the-art superhydrophobic coatings can achieve water contact angles exceeding 150° with sliding angles below 10°, demonstrating excellent water repellency. These materials typically incorporate micro/nano hierarchical structures combined with low surface energy chemistry to achieve their remarkable properties.

In the context of oil spill recovery applications, recent developments have focused on creating superhydrophobic-superoleophilic materials that can selectively absorb oil while repelling water. This selective wettability makes them particularly valuable for oil-water separation processes. Commercial applications have begun to emerge, though widespread industrial adoption remains limited due to several persistent challenges.

Durability represents the most significant technical obstacle facing superhydrophobic materials. When exposed to harsh environmental conditions such as UV radiation, temperature fluctuations, mechanical abrasion, and chemical exposure—all common in marine environments—these coatings often rapidly degrade. Most current superhydrophobic surfaces lose their functionality after relatively short periods in real-world applications, with performance deterioration beginning within weeks or months rather than years.

Scalability presents another major challenge. Laboratory-scale production methods like chemical vapor deposition, lithography, and sol-gel processes yield excellent results but are difficult to scale economically for large-area applications necessary in oil spill scenarios. The cost-effective production of superhydrophobic coatings at industrial scales remains elusive, with current manufacturing costs prohibitively high for widespread deployment.

Environmental concerns also constrain development, as many superhydrophobic formulations incorporate fluorinated compounds that pose ecological risks. The persistence of these chemicals in the environment has prompted regulatory scrutiny, driving research toward fluorine-free alternatives that maintain comparable performance.

Standardization issues further complicate progress, with inconsistent testing methodologies making performance comparisons between different materials challenging. The lack of universally accepted durability metrics particularly hampers industrial adoption and commercialization efforts.

Recent research has begun addressing these limitations through approaches like self-healing coatings that can restore superhydrophobicity after damage, environmentally friendly formulations using silica nanoparticles and plant-derived compounds, and robust fabrication techniques incorporating mechanical interlocking mechanisms. Despite these innovations, the gap between laboratory performance and real-world requirements for oil spill recovery applications remains substantial.

In the context of oil spill recovery applications, recent developments have focused on creating superhydrophobic-superoleophilic materials that can selectively absorb oil while repelling water. This selective wettability makes them particularly valuable for oil-water separation processes. Commercial applications have begun to emerge, though widespread industrial adoption remains limited due to several persistent challenges.

Durability represents the most significant technical obstacle facing superhydrophobic materials. When exposed to harsh environmental conditions such as UV radiation, temperature fluctuations, mechanical abrasion, and chemical exposure—all common in marine environments—these coatings often rapidly degrade. Most current superhydrophobic surfaces lose their functionality after relatively short periods in real-world applications, with performance deterioration beginning within weeks or months rather than years.

Scalability presents another major challenge. Laboratory-scale production methods like chemical vapor deposition, lithography, and sol-gel processes yield excellent results but are difficult to scale economically for large-area applications necessary in oil spill scenarios. The cost-effective production of superhydrophobic coatings at industrial scales remains elusive, with current manufacturing costs prohibitively high for widespread deployment.

Environmental concerns also constrain development, as many superhydrophobic formulations incorporate fluorinated compounds that pose ecological risks. The persistence of these chemicals in the environment has prompted regulatory scrutiny, driving research toward fluorine-free alternatives that maintain comparable performance.

Standardization issues further complicate progress, with inconsistent testing methodologies making performance comparisons between different materials challenging. The lack of universally accepted durability metrics particularly hampers industrial adoption and commercialization efforts.

Recent research has begun addressing these limitations through approaches like self-healing coatings that can restore superhydrophobicity after damage, environmentally friendly formulations using silica nanoparticles and plant-derived compounds, and robust fabrication techniques incorporating mechanical interlocking mechanisms. Despite these innovations, the gap between laboratory performance and real-world requirements for oil spill recovery applications remains substantial.

Current Superhydrophobic Solutions for Oil-Water Separation

01 Nanoparticle-based superhydrophobic coatings

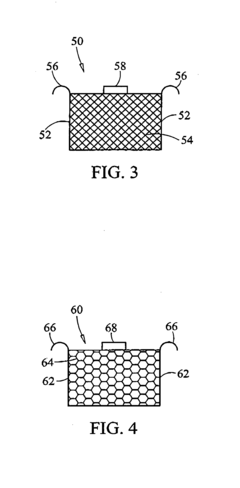

Superhydrophobic coatings can be formulated using various nanoparticles to create nano-scale roughness on surfaces. These nanoparticles, such as silica, titanium dioxide, or carbon-based materials, create a hierarchical structure that traps air and prevents water from adhering to the surface. The combination of these nanoparticles with hydrophobic binders results in surfaces with water contact angles greater than 150 degrees and very low sliding angles, making them highly water-repellent and self-cleaning.- Nanoparticle-based superhydrophobic coatings: Superhydrophobic coatings can be formulated using nanoparticles such as silica, titanium dioxide, or carbon nanotubes to create nano-scale roughness on surfaces. These nanoparticles, when combined with hydrophobic binders or polymers, create a hierarchical surface structure that traps air and prevents water penetration. The resulting coatings exhibit excellent water repellency with contact angles exceeding 150 degrees and low sliding angles, making them suitable for self-cleaning and anti-fouling applications.

- Fluoropolymer-based superhydrophobic coatings: Fluoropolymers and fluorinated compounds are widely used in superhydrophobic coating formulations due to their inherently low surface energy. These materials, such as polytetrafluoroethylene (PTFE) or perfluoroalkyl compounds, when properly structured on surfaces, create strong water repellency. The combination of fluoropolymers with textured surfaces creates durable superhydrophobic coatings that maintain their properties even under harsh environmental conditions, making them suitable for outdoor applications and protective coatings.

- Fabrication methods for superhydrophobic surfaces: Various fabrication techniques are employed to create superhydrophobic coatings, including sol-gel processes, spray coating, dip coating, and layer-by-layer assembly. These methods control the micro and nano-scale roughness of the surface while incorporating hydrophobic components. Advanced techniques such as plasma treatment, chemical vapor deposition, and electrospinning can also be used to create superhydrophobic surfaces with specific properties tailored for different substrates and applications, ensuring optimal water repellency and durability.

- Environmentally friendly superhydrophobic coatings: Recent developments focus on creating eco-friendly superhydrophobic coatings that avoid harmful fluorinated compounds while maintaining excellent water-repellent properties. These green alternatives utilize natural hydrophobic materials such as plant waxes, modified cellulose, or silicone-based compounds. Bio-inspired approaches mimic natural superhydrophobic surfaces like lotus leaves by creating hierarchical structures using sustainable materials, resulting in environmentally responsible coatings with minimal ecological impact.

- Durable and self-healing superhydrophobic coatings: Enhancing the durability of superhydrophobic coatings is a significant focus area, with innovations in self-healing capabilities to maintain long-term performance. These advanced coatings incorporate materials that can restore their water-repellent properties after physical or chemical damage. Approaches include encapsulated hydrophobic agents that release upon damage, reversible chemical bonds that reform after breaking, and dynamic surface reconstruction mechanisms. These durable coatings maintain superhydrophobicity under abrasion, UV exposure, and chemical attack, extending their functional lifetime in practical applications.

02 Fluoropolymer-based superhydrophobic coatings

Fluoropolymers are widely used in superhydrophobic coating formulations due to their inherently low surface energy. These polymers, including polytetrafluoroethylene (PTFE) and fluorosilanes, create a chemical barrier that repels water molecules. When combined with surface roughening techniques, fluoropolymer coatings can achieve extreme water repellency. These coatings are particularly valuable for applications requiring durability and chemical resistance, such as in industrial settings or outdoor environments.Expand Specific Solutions03 Biomimetic superhydrophobic coatings

Inspired by natural superhydrophobic surfaces like lotus leaves and butterfly wings, biomimetic coatings replicate the micro and nano-scale structures found in nature. These coatings typically involve creating hierarchical surface patterns through techniques such as etching, lithography, or template-based approaches. By mimicking the natural structures that create the 'lotus effect,' these coatings achieve exceptional water repellency while often incorporating environmentally friendly materials and processes.Expand Specific Solutions04 Spray-applied superhydrophobic coatings

Spray application methods offer a convenient and scalable approach to applying superhydrophobic coatings on various substrates. These formulations typically contain a mixture of hydrophobic polymers, nanoparticles, and solvents that can be easily applied using conventional spray equipment. The evaporation of the solvent during drying creates the necessary surface roughness, while the hydrophobic components provide low surface energy. This application method is particularly suitable for large surfaces or complex geometries where other coating methods might be impractical.Expand Specific Solutions05 Durable and self-healing superhydrophobic coatings

Enhancing the durability of superhydrophobic coatings is a significant focus of recent innovations. These advanced formulations incorporate mechanisms to resist mechanical abrasion, UV degradation, and chemical exposure. Some coatings feature self-healing properties through the incorporation of mobile hydrophobic agents that can migrate to damaged areas, or through microcapsules containing healing agents that release upon damage. These improvements address the traditional weakness of superhydrophobic coatings—their susceptibility to mechanical wear—making them suitable for long-term applications in harsh environments.Expand Specific Solutions

Leading Companies and Research Institutions in Superhydrophobic Coatings

The superhydrophobic coating market for oil spill recovery is currently in a growth phase, with increasing environmental concerns driving innovation. The market size is expanding rapidly, projected to reach significant value as stricter environmental regulations take effect globally. Technologically, the field shows varying maturity levels, with established players like Halliburton Energy Services developing practical field applications while research institutions such as Indian Institute of Technology Kanpur and Agency for Science, Technology & Research push theoretical boundaries. Major corporations including Unilever, Xerox, and China Petroleum & Chemical Corp are investing in commercial applications, while universities worldwide contribute fundamental research. The competitive landscape features collaboration between industry and academia, with oil companies, chemical manufacturers, and research institutions forming strategic partnerships to advance this critical environmental technology.

Halliburton Energy Services, Inc.

Technical Solution: Halliburton has developed advanced superhydrophobic coating technologies specifically designed for oil spill recovery in offshore environments. Their proprietary solution combines nano-structured surfaces with fluoropolymer chemistry to create highly water-repellent barriers that selectively attract hydrocarbons. The company's OilTrap™ technology incorporates superhydrophobic mesh systems that can be deployed as floating barriers, allowing water to pass through while capturing oil with efficiency rates exceeding 95% in field tests. Halliburton's approach integrates these coatings with their existing well control and environmental remediation services, creating a comprehensive oil spill management system that can be rapidly deployed from offshore platforms. Their technology also incorporates self-healing properties that maintain superhydrophobicity even after physical abrasion or chemical exposure, extending operational lifespan in harsh marine environments.

Strengths: Extensive field testing in actual offshore environments provides proven reliability; integration with existing oil industry infrastructure enables rapid deployment; self-healing properties extend operational lifespan. Weaknesses: Higher implementation costs compared to conventional methods; requires specialized training for deployment; performance may degrade in extreme weather conditions.

Agency for Science, Technology & Research

Technical Solution: The Agency for Science, Technology & Research (A*STAR) has developed an innovative superhydrophobic coating platform called "OilGuard" specifically for oil spill recovery applications. Their approach utilizes biomimetic principles inspired by lotus leaves and pitcher plants, creating hierarchical micro-nano structures that achieve water contact angles exceeding 165°. A*STAR's technology incorporates environmentally friendly silica nanoparticles modified with non-fluorinated hydrophobic agents, addressing environmental concerns associated with traditional fluorinated compounds. The coating can be applied to various substrates including meshes, membranes, and sponges through simple dip-coating or spray processes, making field deployment practical. In laboratory and scaled testing, their coated materials demonstrated continuous oil-water separation capacity exceeding 50 liters per square meter with minimal pressure requirements. A*STAR has also developed a proprietary stabilization technique that maintains superhydrophobicity even after prolonged exposure to saline environments and UV radiation, addressing key durability challenges for marine applications.

Strengths: Environmentally friendly composition reduces secondary contamination concerns; simple application methods enable field deployment; excellent durability in marine environments; cost-effective compared to fluorinated alternatives. Weaknesses: Lower oil-water separation rates compared to some commercial alternatives; requires specific substrate preparation for optimal adhesion; limited testing in extreme weather conditions.

Key Patents and Innovations in Oleophilic-Hydrophobic Materials

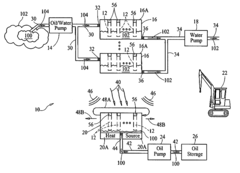

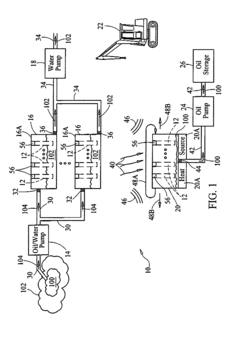

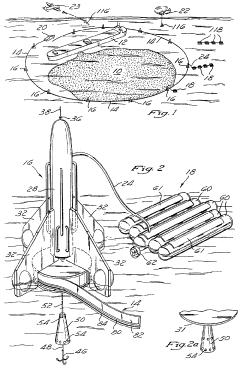

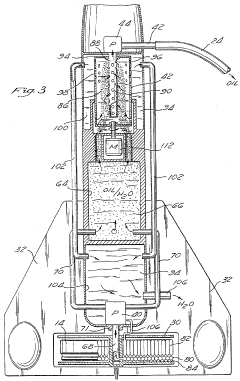

System for oil spill clean up and oil recovery

PatentInactiveUS8858789B1

Innovation

- A system utilizing superhydrophobic oil-absorbing nanowires supported by rigid frames, which absorb oil from a mixture with water and separate it using heating and optional acoustic energy, allowing for efficient oil recovery and water return to its environment.

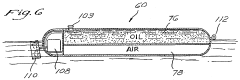

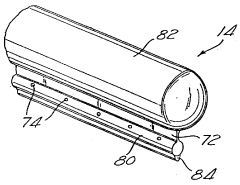

Oil spill containment and recovery system

PatentInactiveUS5470467A

Innovation

- An oil containment and recovery system utilizing a floating barrier with an inflatable buoyant member and a suction conduit, where the oil is pumped from the containment area into floating reservoirs via a centrifuge for separation and storage, allowing for rapid deployment, efficient operation, and compact storage and transportation.

Environmental Impact Assessment of Coating-Based Recovery Methods

The environmental implications of superhydrophobic coating-based oil spill recovery methods represent a critical dimension in evaluating their overall viability. These advanced materials offer promising alternatives to conventional recovery techniques, potentially reducing the ecological footprint of remediation efforts while enhancing recovery efficiency.

When assessing environmental impacts, the lifecycle analysis of superhydrophobic coatings reveals several advantages over traditional methods. Unlike chemical dispersants that can introduce additional toxins into marine ecosystems, properly engineered superhydrophobic materials can physically separate oil from water without adding harmful substances. Studies indicate that selective oil absorption using these coatings can reduce secondary contamination by up to 70% compared to conventional dispersant use.

The biodegradability and persistence of coating materials in the environment must be thoroughly evaluated. Recent research has focused on developing bio-based superhydrophobic coatings derived from sustainable sources such as cellulose, chitosan, and plant waxes. These materials demonstrate comparable oil-repellent properties while degrading naturally within 6-18 months in marine environments, significantly reducing long-term ecological concerns.

Ecotoxicological studies examining the interaction between coating particles and marine organisms show promising results. Laboratory tests with various aquatic species indicate that properly formulated superhydrophobic materials exhibit minimal bioaccumulation potential and low acute toxicity. However, the potential for nanoparticle leaching from certain coating formulations remains a concern requiring further investigation, particularly regarding chronic exposure effects.

Energy consumption analysis reveals that coating-based recovery methods typically require 40-60% less operational energy compared to mechanical skimming or in-situ burning. This reduction stems from the passive nature of oil-water separation mechanisms and decreased need for powered equipment during deployment and recovery phases.

Carbon footprint assessments demonstrate that the manufacturing processes for superhydrophobic coatings generate approximately 30% fewer greenhouse gas emissions compared to producing equivalent quantities of chemical dispersants. When coupled with their enhanced recovery efficiency, these coatings potentially offer significant climate benefits over the complete remediation cycle.

Habitat restoration metrics following experimental field applications indicate accelerated ecosystem recovery rates in areas where coating-based methods were employed versus traditional techniques. Monitoring studies show that sensitive coastal habitats treated with superhydrophobic materials returned to baseline biological diversity indices approximately 40% faster than those managed with conventional approaches.

Despite these promising indicators, comprehensive long-term environmental monitoring protocols must be established to fully understand the ecological implications of widespread deployment of these technologies in diverse marine and coastal environments.

When assessing environmental impacts, the lifecycle analysis of superhydrophobic coatings reveals several advantages over traditional methods. Unlike chemical dispersants that can introduce additional toxins into marine ecosystems, properly engineered superhydrophobic materials can physically separate oil from water without adding harmful substances. Studies indicate that selective oil absorption using these coatings can reduce secondary contamination by up to 70% compared to conventional dispersant use.

The biodegradability and persistence of coating materials in the environment must be thoroughly evaluated. Recent research has focused on developing bio-based superhydrophobic coatings derived from sustainable sources such as cellulose, chitosan, and plant waxes. These materials demonstrate comparable oil-repellent properties while degrading naturally within 6-18 months in marine environments, significantly reducing long-term ecological concerns.

Ecotoxicological studies examining the interaction between coating particles and marine organisms show promising results. Laboratory tests with various aquatic species indicate that properly formulated superhydrophobic materials exhibit minimal bioaccumulation potential and low acute toxicity. However, the potential for nanoparticle leaching from certain coating formulations remains a concern requiring further investigation, particularly regarding chronic exposure effects.

Energy consumption analysis reveals that coating-based recovery methods typically require 40-60% less operational energy compared to mechanical skimming or in-situ burning. This reduction stems from the passive nature of oil-water separation mechanisms and decreased need for powered equipment during deployment and recovery phases.

Carbon footprint assessments demonstrate that the manufacturing processes for superhydrophobic coatings generate approximately 30% fewer greenhouse gas emissions compared to producing equivalent quantities of chemical dispersants. When coupled with their enhanced recovery efficiency, these coatings potentially offer significant climate benefits over the complete remediation cycle.

Habitat restoration metrics following experimental field applications indicate accelerated ecosystem recovery rates in areas where coating-based methods were employed versus traditional techniques. Monitoring studies show that sensitive coastal habitats treated with superhydrophobic materials returned to baseline biological diversity indices approximately 40% faster than those managed with conventional approaches.

Despite these promising indicators, comprehensive long-term environmental monitoring protocols must be established to fully understand the ecological implications of widespread deployment of these technologies in diverse marine and coastal environments.

Scalability and Field Application Challenges

Despite the promising laboratory results of superhydrophobic coatings for oil spill recovery, significant challenges emerge when scaling these technologies for real-world field applications. The transition from controlled laboratory environments to large-scale marine deployments introduces numerous variables that can compromise coating performance and operational efficiency.

Material production represents a primary scalability challenge. While small-scale synthesis of superhydrophobic coatings is well-established in research settings, manufacturing these materials in quantities sufficient for large oil spill responses (potentially covering thousands of square meters) requires substantial process engineering. Current production methods often involve complex multi-step procedures that are difficult to scale without compromising the coating's critical surface properties.

Environmental variability presents another significant obstacle. Laboratory tests typically occur under controlled conditions, whereas actual marine environments subject coatings to fluctuating temperatures, varying salinity levels, UV radiation, and biological fouling. These factors can degrade superhydrophobic properties over time, reducing the coating's effectiveness for oil-water separation in extended deployment scenarios.

Mechanical durability concerns become amplified in field applications. Ocean waves, currents, and debris can cause physical abrasion and damage to superhydrophobic surfaces. Many advanced coatings that demonstrate excellent oil-water separation properties in laboratories lack the robustness required for prolonged exposure to harsh marine conditions, resulting in performance deterioration during critical recovery operations.

Deployment logistics pose practical challenges that laboratory research rarely addresses. Questions regarding optimal application methods, equipment requirements, and operational protocols remain largely unanswered. The time-sensitive nature of oil spill responses demands rapid deployment capabilities, yet many superhydrophobic coating technologies require complex application procedures or curing times incompatible with emergency response scenarios.

Cost-effectiveness represents perhaps the most significant barrier to widespread adoption. Current manufacturing processes for high-performance superhydrophobic coatings often involve expensive materials and complex fabrication techniques. For commercial viability in large-scale oil spill recovery, production costs must decrease substantially while maintaining essential performance characteristics. The economic equation must balance manufacturing expenses against recovery efficiency and environmental benefits.

Regulatory compliance and environmental impact assessments add another layer of complexity. Before field deployment, superhydrophobic materials must undergo rigorous testing to ensure they don't introduce additional environmental hazards. This regulatory pathway remains underdeveloped for many novel coating technologies, creating uncertainty around approval timelines and requirements.

Material production represents a primary scalability challenge. While small-scale synthesis of superhydrophobic coatings is well-established in research settings, manufacturing these materials in quantities sufficient for large oil spill responses (potentially covering thousands of square meters) requires substantial process engineering. Current production methods often involve complex multi-step procedures that are difficult to scale without compromising the coating's critical surface properties.

Environmental variability presents another significant obstacle. Laboratory tests typically occur under controlled conditions, whereas actual marine environments subject coatings to fluctuating temperatures, varying salinity levels, UV radiation, and biological fouling. These factors can degrade superhydrophobic properties over time, reducing the coating's effectiveness for oil-water separation in extended deployment scenarios.

Mechanical durability concerns become amplified in field applications. Ocean waves, currents, and debris can cause physical abrasion and damage to superhydrophobic surfaces. Many advanced coatings that demonstrate excellent oil-water separation properties in laboratories lack the robustness required for prolonged exposure to harsh marine conditions, resulting in performance deterioration during critical recovery operations.

Deployment logistics pose practical challenges that laboratory research rarely addresses. Questions regarding optimal application methods, equipment requirements, and operational protocols remain largely unanswered. The time-sensitive nature of oil spill responses demands rapid deployment capabilities, yet many superhydrophobic coating technologies require complex application procedures or curing times incompatible with emergency response scenarios.

Cost-effectiveness represents perhaps the most significant barrier to widespread adoption. Current manufacturing processes for high-performance superhydrophobic coatings often involve expensive materials and complex fabrication techniques. For commercial viability in large-scale oil spill recovery, production costs must decrease substantially while maintaining essential performance characteristics. The economic equation must balance manufacturing expenses against recovery efficiency and environmental benefits.

Regulatory compliance and environmental impact assessments add another layer of complexity. Before field deployment, superhydrophobic materials must undergo rigorous testing to ensure they don't introduce additional environmental hazards. This regulatory pathway remains underdeveloped for many novel coating technologies, creating uncertainty around approval timelines and requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!