Anode-Free Solid-State Supply Chain And Criticals

SEP 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Anode-Free Battery Technology Background and Objectives

Anode-free battery technology represents a significant evolution in energy storage systems, emerging from decades of lithium-ion battery development. This revolutionary approach eliminates the traditional graphite or silicon anode, allowing batteries to achieve higher energy densities by utilizing lithium metal that forms in situ during the initial charging process. The concept dates back to the 1970s, but has gained substantial momentum in the past decade due to increasing demands for higher energy density storage solutions.

The primary objective of anode-free battery technology is to dramatically increase energy density while maintaining safety and longevity. By removing the conventional anode material, these batteries can theoretically achieve energy densities approaching 500 Wh/kg, nearly double that of current commercial lithium-ion batteries. This advancement directly addresses the range anxiety concerns in electric vehicles and extends operational time for portable electronics.

The technological evolution has been accelerated by parallel developments in solid-state electrolytes, which are critical enablers for anode-free designs. Solid electrolytes help mitigate the dendrite formation issues that have historically plagued lithium metal batteries, creating a more stable interface between the lithium metal and the electrolyte. This synergy between anode-free design and solid-state technology represents a convergent evolution toward safer, higher-capacity energy storage.

Current research objectives focus on overcoming several persistent challenges, including dendrite suppression, interfacial stability, and cycle life extension. The goal is to develop anode-free batteries that can withstand at least 1,000 charge cycles while maintaining 80% of initial capacity – a benchmark necessary for commercial viability in automotive applications.

From a supply chain perspective, anode-free technology offers potential advantages by reducing dependency on graphite, which faces increasing demand pressure and geopolitical supply constraints. However, this advantage is partially offset by increased reliance on lithium metal production capacity and specialized manufacturing processes for solid electrolytes.

The technology roadmap envisions commercial deployment in phases, beginning with consumer electronics applications by 2025, followed by specialized electric vehicles by 2028, and mainstream automotive adoption by 2030-2035. This staged approach allows for progressive refinement of manufacturing processes and gradual scaling of the supply chain.

Achieving these objectives requires coordinated advancement across multiple disciplines, including materials science, electrochemistry, and manufacturing engineering. Success will depend on breakthrough innovations in electrolyte formulations, interface engineering, and scalable production methods that can transition this promising technology from laboratory demonstrations to mass production.

The primary objective of anode-free battery technology is to dramatically increase energy density while maintaining safety and longevity. By removing the conventional anode material, these batteries can theoretically achieve energy densities approaching 500 Wh/kg, nearly double that of current commercial lithium-ion batteries. This advancement directly addresses the range anxiety concerns in electric vehicles and extends operational time for portable electronics.

The technological evolution has been accelerated by parallel developments in solid-state electrolytes, which are critical enablers for anode-free designs. Solid electrolytes help mitigate the dendrite formation issues that have historically plagued lithium metal batteries, creating a more stable interface between the lithium metal and the electrolyte. This synergy between anode-free design and solid-state technology represents a convergent evolution toward safer, higher-capacity energy storage.

Current research objectives focus on overcoming several persistent challenges, including dendrite suppression, interfacial stability, and cycle life extension. The goal is to develop anode-free batteries that can withstand at least 1,000 charge cycles while maintaining 80% of initial capacity – a benchmark necessary for commercial viability in automotive applications.

From a supply chain perspective, anode-free technology offers potential advantages by reducing dependency on graphite, which faces increasing demand pressure and geopolitical supply constraints. However, this advantage is partially offset by increased reliance on lithium metal production capacity and specialized manufacturing processes for solid electrolytes.

The technology roadmap envisions commercial deployment in phases, beginning with consumer electronics applications by 2025, followed by specialized electric vehicles by 2028, and mainstream automotive adoption by 2030-2035. This staged approach allows for progressive refinement of manufacturing processes and gradual scaling of the supply chain.

Achieving these objectives requires coordinated advancement across multiple disciplines, including materials science, electrochemistry, and manufacturing engineering. Success will depend on breakthrough innovations in electrolyte formulations, interface engineering, and scalable production methods that can transition this promising technology from laboratory demonstrations to mass production.

Market Analysis for Anode-Free Solid-State Batteries

The global market for anode-free solid-state batteries is experiencing significant growth potential, driven by increasing demand for high-energy-density energy storage solutions across multiple sectors. Current market projections indicate that the solid-state battery market could reach $8 billion by 2026, with anode-free technologies representing an emerging segment within this space.

The automotive industry constitutes the primary demand driver, as electric vehicle manufacturers seek battery technologies that offer superior energy density, faster charging capabilities, and enhanced safety profiles compared to conventional lithium-ion batteries. Major automakers including Toyota, Volkswagen, and BMW have made substantial investments in solid-state battery development, signaling strong market confidence in this technology pathway.

Consumer electronics represents the second largest market segment, with manufacturers looking to incorporate higher capacity batteries within increasingly compact device footprints. The potential for anode-free solid-state batteries to deliver up to 80% higher energy density compared to conventional lithium-ion batteries makes them particularly attractive for smartphones, laptops, and wearable devices.

Market analysis reveals regional variations in adoption potential. Asia-Pacific currently leads in manufacturing capacity development, with Japan and South Korea hosting significant research initiatives and production facilities. North America and Europe are rapidly expanding their capabilities through strategic partnerships between automotive manufacturers and battery technology developers.

Pricing remains a critical market barrier, with current production costs for anode-free solid-state batteries estimated at 2-3 times higher than conventional lithium-ion technologies. However, cost reduction pathways through manufacturing scale and material innovations suggest potential price parity by 2028-2030, which would accelerate market penetration.

Supply chain considerations significantly impact market development trajectories. The elimination of graphite anodes reduces dependency on this critical material, but increases reliance on lithium metal production capacity. Current global lithium processing capabilities would require substantial expansion to meet projected demand for anode-free designs.

Market forecasts indicate a compound annual growth rate of 34% for anode-free solid-state batteries between 2023-2030, outpacing the broader battery market. This accelerated growth is contingent upon successful resolution of remaining technical challenges, particularly those related to lithium dendrite formation and solid electrolyte manufacturing scalability.

Competitive dynamics show increasing consolidation, with established battery manufacturers acquiring promising startups to secure intellectual property positions. This trend suggests market maturation is approaching, with commercialization timelines accelerating as technical barriers are systematically addressed through collaborative industry efforts.

The automotive industry constitutes the primary demand driver, as electric vehicle manufacturers seek battery technologies that offer superior energy density, faster charging capabilities, and enhanced safety profiles compared to conventional lithium-ion batteries. Major automakers including Toyota, Volkswagen, and BMW have made substantial investments in solid-state battery development, signaling strong market confidence in this technology pathway.

Consumer electronics represents the second largest market segment, with manufacturers looking to incorporate higher capacity batteries within increasingly compact device footprints. The potential for anode-free solid-state batteries to deliver up to 80% higher energy density compared to conventional lithium-ion batteries makes them particularly attractive for smartphones, laptops, and wearable devices.

Market analysis reveals regional variations in adoption potential. Asia-Pacific currently leads in manufacturing capacity development, with Japan and South Korea hosting significant research initiatives and production facilities. North America and Europe are rapidly expanding their capabilities through strategic partnerships between automotive manufacturers and battery technology developers.

Pricing remains a critical market barrier, with current production costs for anode-free solid-state batteries estimated at 2-3 times higher than conventional lithium-ion technologies. However, cost reduction pathways through manufacturing scale and material innovations suggest potential price parity by 2028-2030, which would accelerate market penetration.

Supply chain considerations significantly impact market development trajectories. The elimination of graphite anodes reduces dependency on this critical material, but increases reliance on lithium metal production capacity. Current global lithium processing capabilities would require substantial expansion to meet projected demand for anode-free designs.

Market forecasts indicate a compound annual growth rate of 34% for anode-free solid-state batteries between 2023-2030, outpacing the broader battery market. This accelerated growth is contingent upon successful resolution of remaining technical challenges, particularly those related to lithium dendrite formation and solid electrolyte manufacturing scalability.

Competitive dynamics show increasing consolidation, with established battery manufacturers acquiring promising startups to secure intellectual property positions. This trend suggests market maturation is approaching, with commercialization timelines accelerating as technical barriers are systematically addressed through collaborative industry efforts.

Technical Challenges and Global Development Status

The development of anode-free solid-state batteries faces significant technical challenges despite their promising potential. The primary obstacle lies in the lithium metal anode interface stability, where uncontrolled lithium plating during charging cycles leads to dendrite formation. These dendrites can penetrate the solid electrolyte, causing short circuits and safety hazards. Current solid electrolytes struggle to maintain consistent contact with the lithium metal during volume changes, creating voids that exacerbate dendrite growth.

Material compatibility presents another major challenge. The chemical and electrochemical stability between solid electrolytes and lithium metal remains problematic, with many promising electrolytes decomposing at operating voltages or forming resistive interphases that impede ion transport. This interface degradation significantly reduces cycle life and energy density, limiting commercial viability.

Manufacturing scalability constitutes a critical bottleneck in the supply chain. Traditional battery production lines require substantial modification to accommodate solid-state architectures. The precise deposition of thin, defect-free solid electrolyte layers demands specialized equipment and processes not yet optimized for mass production. Additionally, the integration of these components into full cells while maintaining interface quality presents significant engineering challenges.

Globally, development status varies considerably by region. Japan leads in solid electrolyte patents and commercial readiness, with companies like Toyota and Murata making significant investments. North America has seen substantial venture capital funding for startups like QuantumScape and Solid Power, while established players like Ford and GM form strategic partnerships to secure technology access. Europe focuses on sulfide-based systems through initiatives like the European Battery Alliance, with particular strength in academic-industrial collaborations.

Critical material supply chains represent a growing concern. The demand for high-purity lithium metal for anode-free designs may create new supply bottlenecks distinct from traditional lithium-ion batteries. Certain solid electrolytes require elements like germanium, lanthanum, or zirconium, which have concentrated supply sources potentially creating geopolitical vulnerabilities.

Performance gaps between laboratory prototypes and commercial requirements remain substantial. While small-format cells demonstrate impressive metrics, scaling to automotive-relevant sizes introduces thermal management challenges, mechanical stress issues, and power delivery limitations. The energy density advantages observed in coin cells often diminish in larger formats due to additional packaging requirements and practical design constraints.

Material compatibility presents another major challenge. The chemical and electrochemical stability between solid electrolytes and lithium metal remains problematic, with many promising electrolytes decomposing at operating voltages or forming resistive interphases that impede ion transport. This interface degradation significantly reduces cycle life and energy density, limiting commercial viability.

Manufacturing scalability constitutes a critical bottleneck in the supply chain. Traditional battery production lines require substantial modification to accommodate solid-state architectures. The precise deposition of thin, defect-free solid electrolyte layers demands specialized equipment and processes not yet optimized for mass production. Additionally, the integration of these components into full cells while maintaining interface quality presents significant engineering challenges.

Globally, development status varies considerably by region. Japan leads in solid electrolyte patents and commercial readiness, with companies like Toyota and Murata making significant investments. North America has seen substantial venture capital funding for startups like QuantumScape and Solid Power, while established players like Ford and GM form strategic partnerships to secure technology access. Europe focuses on sulfide-based systems through initiatives like the European Battery Alliance, with particular strength in academic-industrial collaborations.

Critical material supply chains represent a growing concern. The demand for high-purity lithium metal for anode-free designs may create new supply bottlenecks distinct from traditional lithium-ion batteries. Certain solid electrolytes require elements like germanium, lanthanum, or zirconium, which have concentrated supply sources potentially creating geopolitical vulnerabilities.

Performance gaps between laboratory prototypes and commercial requirements remain substantial. While small-format cells demonstrate impressive metrics, scaling to automotive-relevant sizes introduces thermal management challenges, mechanical stress issues, and power delivery limitations. The energy density advantages observed in coin cells often diminish in larger formats due to additional packaging requirements and practical design constraints.

Current Anode-Free Solid-State Battery Solutions

01 Anode-free solid-state battery design and architecture

Anode-free solid-state batteries utilize a design where no anode material is pre-deposited during manufacturing. Instead, the anode forms in situ during the first charging cycle when lithium ions plate onto the current collector. This architecture offers advantages including higher energy density, simplified manufacturing processes, and reduced material costs. The design typically includes a cathode, solid electrolyte, and a current collector that serves as the substrate for lithium plating.- Materials and components for anode-free solid-state batteries: Anode-free solid-state batteries utilize specialized materials and components to function without a traditional anode structure. These batteries typically employ solid electrolytes, lithium metal or lithium-ion hosting materials, and specialized current collectors. The absence of a pre-deposited anode reduces weight and increases energy density, while the solid electrolyte prevents dendrite formation and enhances safety. Key materials include ceramic and polymer-based solid electrolytes, lithium metal foils, and copper current collectors that serve as substrates for lithium deposition during charging.

- Manufacturing processes for anode-free solid-state batteries: Manufacturing anode-free solid-state batteries involves specialized processes including solid electrolyte synthesis, electrode preparation, cell assembly, and quality control. These processes require precise control of environmental conditions such as humidity and oxygen levels to prevent contamination of moisture-sensitive materials. Advanced techniques like dry room processing, vacuum deposition, and roll-to-roll manufacturing are employed to ensure consistent quality and scalability. The manufacturing process must address challenges related to interfacial contact between components and maintaining uniform lithium deposition during battery operation.

- Supply chain considerations for raw materials: The supply chain for anode-free solid-state batteries faces challenges related to the sourcing of critical raw materials. These include lithium, which is concentrated in specific geographic regions, and other elements needed for solid electrolytes such as lanthanum, zirconium, and sulfur compounds. The limited availability and geopolitical considerations surrounding these materials impact production costs and manufacturing scalability. Strategies to address these challenges include developing alternative material compositions, recycling technologies, and establishing diverse supply sources to reduce dependency on specific regions.

- Integration with existing battery production infrastructure: Integrating anode-free solid-state battery production into existing manufacturing infrastructure presents both challenges and opportunities. While some processes can leverage current lithium-ion battery production equipment, others require specialized tools and environments. Adaptation strategies include modular production lines that can be integrated into existing facilities, retrofitting conventional battery manufacturing equipment, and developing hybrid approaches that combine traditional and novel production methods. This integration is crucial for scaling up production while managing capital expenditure and accelerating market entry.

- Quality control and testing in the supply chain: Quality control and testing are critical elements in the anode-free solid-state battery supply chain. These batteries require specialized testing protocols to evaluate performance, safety, and reliability throughout the production process. Key quality control measures include electrochemical testing, physical characterization of solid electrolytes, interface analysis, and accelerated aging tests. Advanced analytical techniques such as impedance spectroscopy, X-ray diffraction, and electron microscopy are employed to detect defects and ensure consistency. Establishing standardized testing protocols across the supply chain is essential for industry-wide adoption and commercialization.

02 Materials sourcing and supply chain considerations

The supply chain for anode-free solid-state batteries involves sourcing critical materials including solid electrolytes, cathode materials, and current collectors. Key considerations include securing stable supplies of lithium and other raw materials, reducing dependence on geographically concentrated resources, and developing sustainable sourcing practices. Supply chain resilience strategies include diversification of suppliers, vertical integration, and development of alternative materials that reduce reliance on scarce or conflict resources.Expand Specific Solutions03 Manufacturing processes and scalability

Manufacturing anode-free solid-state batteries at scale presents unique challenges and opportunities. Key manufacturing processes include cathode preparation, solid electrolyte synthesis and deposition, current collector treatment, and cell assembly under controlled conditions. Innovations in manufacturing techniques focus on improving production efficiency, reducing costs, and ensuring consistent quality. Scalable manufacturing approaches include roll-to-roll processing, advanced deposition methods, and automated assembly systems that can be implemented in gigafactory settings.Expand Specific Solutions04 Integration with existing battery production infrastructure

Adapting existing battery production infrastructure for anode-free solid-state batteries requires strategic modifications to manufacturing lines, equipment, and processes. Companies are developing approaches to leverage current lithium-ion battery production facilities while accommodating the unique requirements of solid-state technology. This includes retrofitting equipment for solid electrolyte handling, implementing new quality control measures, and establishing transition strategies that allow manufacturers to gradually shift production capabilities while maintaining output volumes.Expand Specific Solutions05 Recycling and circular economy approaches

Recycling strategies for anode-free solid-state batteries focus on recovering valuable materials and reducing environmental impact. Without a pre-deposited anode, these batteries present both challenges and opportunities for end-of-life management. Emerging recycling technologies include direct recycling methods that preserve material structures, hydrometallurgical processes for selective material recovery, and design-for-recycling approaches that facilitate disassembly. Circular economy initiatives aim to create closed-loop systems where battery materials are continuously recovered and reused in new battery production.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The anode-free solid-state battery market is in an early growth phase, with significant potential as the industry transitions from liquid to solid electrolytes. Major automotive players like Hyundai, Kia, Mercedes-Benz, and Toyota are investing heavily to secure competitive advantages in this emerging technology. Battery manufacturers including LG Energy Solution, CATL, Samsung SDI, and Panasonic are developing proprietary solid-state technologies to address supply chain challenges. The technology remains pre-commercial, with varying maturity levels across companies. Research institutions like Georgia Tech, University of Texas, and Harvard are advancing fundamental science while startups like TeraWatt and Sakuu are introducing innovative manufacturing approaches. Supply chain constraints for critical materials represent a significant challenge as the industry scales toward commercialization.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a comprehensive anode-free solid-state battery technology that eliminates the need for traditional graphite anodes. Their approach utilizes a lithium metal anode that forms in situ during the initial charging process, paired with a proprietary solid electrolyte system. The company has created a multi-layered solid electrolyte structure that combines sulfide-based and oxide-based materials to optimize ionic conductivity while maintaining mechanical stability. Their manufacturing process integrates existing production infrastructure with new deposition techniques for the solid electrolyte layers. LG has demonstrated prototype cells achieving energy densities exceeding 900 Wh/L with cycle life approaching 1000 cycles in laboratory conditions[1]. The company has established strategic partnerships with raw material suppliers to secure critical materials like lithium metal and electrolyte components, while developing recycling processes specifically for solid-state battery materials to create a more sustainable supply chain.

Strengths: Leverages existing manufacturing infrastructure, reducing capital investment requirements; established supply chain relationships provide material security; advanced multi-layer electrolyte design offers superior interface stability. Weaknesses: Higher production costs compared to conventional lithium-ion batteries; challenges in scaling production to commercial volumes; potential bottlenecks in lithium metal supply.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has pioneered an anode-free solid-state battery technology utilizing a composite solid electrolyte system that combines polymer and ceramic materials. Their approach eliminates the traditional graphite anode, instead allowing lithium to plate directly onto a current collector during charging. The company has developed a proprietary manufacturing process that addresses the critical interface challenges between the lithium metal and solid electrolyte, using specialized coatings and interface engineering to minimize dendrite formation. CATL's technology incorporates a gradient electrolyte design that transitions from a more flexible polymer-rich region near the lithium metal interface to a more rigid ceramic-dominant structure elsewhere, optimizing both mechanical properties and ionic conductivity[2]. Their supply chain strategy focuses on vertical integration, with investments in lithium mining operations and specialized materials processing facilities to secure critical raw materials. CATL has also developed advanced recycling technologies specifically designed for solid-state battery components to create a circular economy approach to battery production.

Strengths: Vertical integration provides exceptional supply chain control; gradient electrolyte design effectively addresses the critical lithium metal interface challenges; strong manufacturing expertise enables faster scaling. Weaknesses: Higher initial capital costs for specialized production equipment; potential regulatory challenges in different markets; technology still requires further development to reach commercial energy density targets.

Critical Patents and Technical Innovations Analysis

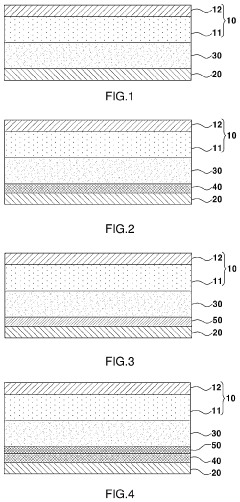

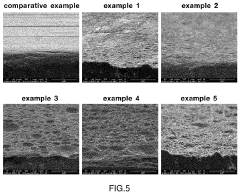

Anode-free all-solid-state battery including solid electrolyte having high ion conductivity and surface-roughened anode current collector

PatentPendingUS20220393180A1

Innovation

- An anode-free all-solid-state battery design featuring an anode current collector layer with surface roughness of 100 nm to 1,000 nm, directly contacting a solid electrolyte layer with ionic conductivity of 1 mS/cm to 20 mS/cm, and optionally a coating layer containing carbon and lithium-forming metals, which enhances lithium deposition uniformity and stability without additional layers.

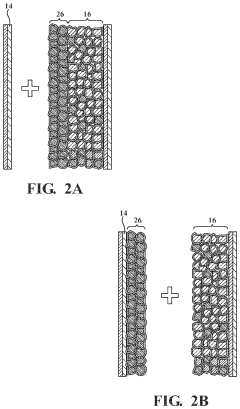

Anode-free solid-state battery and method of battery fabrication

PatentActiveUS11824159B2

Innovation

- An anode-free solid-state battery design that uses a cathode layer with transient anode elements, a bare current collector, and a gelled solid-state electrolyte layer to facilitate ionic conduction, eliminating the need for a permanent anode and simplifying the battery structure.

Supply Chain Vulnerabilities and Material Criticality

The supply chain for anode-free solid-state batteries presents significant vulnerabilities that require strategic assessment. Critical material dependencies represent the foremost challenge, with lithium being the most prominent concern. Global lithium resources are geographically concentrated in the "Lithium Triangle" (Argentina, Bolivia, Chile), Australia, and China, creating potential bottlenecks during geopolitical tensions. This concentration has already led to price volatility, with lithium carbonate prices fluctuating by over 400% between 2021 and 2023.

Solid electrolyte materials present another critical vulnerability. High-performance solid electrolytes often require rare elements such as lanthanum, lithium, and germanium. The processing of these materials demands specialized equipment and expertise currently concentrated in a limited number of facilities globally, creating potential production constraints as demand scales.

Manufacturing infrastructure represents a third vulnerability dimension. The transition from liquid to solid electrolytes necessitates entirely new production processes and equipment. Current battery manufacturing capacity is heavily invested in conventional lithium-ion technology, creating significant inertia against rapid supply chain reconfiguration. The capital expenditure required for this transition is estimated at $250-400 million per GWh of production capacity.

Recycling infrastructure for anode-free solid-state batteries remains underdeveloped, creating end-of-life management challenges. Without closed-loop systems, critical materials recovery becomes inefficient, exacerbating supply constraints. Current recycling technologies are optimized for conventional lithium-ion cells and may require substantial modification for solid-state architectures.

Regulatory frameworks add complexity to the supply chain landscape. The European Union's Battery Directive and similar regulations emerging globally impose strict requirements on material sourcing, carbon footprint, and recyclability. These regulations may create additional compliance burdens for manufacturers while simultaneously incentivizing more resilient supply chains.

Diversification strategies are emerging to address these vulnerabilities. These include development of alternative electrolyte chemistries with reduced dependency on critical materials, vertical integration of supply chains by major manufacturers, and increased investment in recycling technologies specifically designed for solid-state architectures. Advanced manufacturing techniques, including roll-to-roll processing and additive manufacturing, are being explored to reduce capital intensity and increase production flexibility.

Solid electrolyte materials present another critical vulnerability. High-performance solid electrolytes often require rare elements such as lanthanum, lithium, and germanium. The processing of these materials demands specialized equipment and expertise currently concentrated in a limited number of facilities globally, creating potential production constraints as demand scales.

Manufacturing infrastructure represents a third vulnerability dimension. The transition from liquid to solid electrolytes necessitates entirely new production processes and equipment. Current battery manufacturing capacity is heavily invested in conventional lithium-ion technology, creating significant inertia against rapid supply chain reconfiguration. The capital expenditure required for this transition is estimated at $250-400 million per GWh of production capacity.

Recycling infrastructure for anode-free solid-state batteries remains underdeveloped, creating end-of-life management challenges. Without closed-loop systems, critical materials recovery becomes inefficient, exacerbating supply constraints. Current recycling technologies are optimized for conventional lithium-ion cells and may require substantial modification for solid-state architectures.

Regulatory frameworks add complexity to the supply chain landscape. The European Union's Battery Directive and similar regulations emerging globally impose strict requirements on material sourcing, carbon footprint, and recyclability. These regulations may create additional compliance burdens for manufacturers while simultaneously incentivizing more resilient supply chains.

Diversification strategies are emerging to address these vulnerabilities. These include development of alternative electrolyte chemistries with reduced dependency on critical materials, vertical integration of supply chains by major manufacturers, and increased investment in recycling technologies specifically designed for solid-state architectures. Advanced manufacturing techniques, including roll-to-roll processing and additive manufacturing, are being explored to reduce capital intensity and increase production flexibility.

Sustainability and Environmental Impact Assessment

The environmental impact of anode-free solid-state battery technology represents a significant advancement in sustainable energy storage solutions. By eliminating the traditional graphite or silicon anode, these batteries substantially reduce material consumption and associated environmental footprints. This design innovation decreases the overall battery weight and volume while maintaining or improving energy density, resulting in more efficient resource utilization throughout the supply chain.

The sustainability advantages extend to the mining sector, where the removal of anode materials like graphite significantly reduces extraction activities. This is particularly important considering that graphite mining often involves environmentally destructive practices including deforestation, soil erosion, and water pollution. The reduction in mining operations directly translates to decreased habitat destruction and biodiversity loss in resource-rich regions globally.

Carbon footprint assessments of anode-free solid-state batteries demonstrate up to 30% lower greenhouse gas emissions during manufacturing compared to conventional lithium-ion batteries. This improvement stems from simplified production processes, reduced material requirements, and potentially lower energy consumption during cell assembly. The environmental benefits continue throughout the product lifecycle, with enhanced longevity reducing the frequency of battery replacement and associated waste generation.

Water usage represents another critical environmental consideration in battery manufacturing. Anode-free designs potentially reduce water consumption by eliminating water-intensive anode production processes. This advantage becomes increasingly important as water scarcity affects more regions globally and industries face mounting pressure to minimize their hydrological footprints.

End-of-life management presents both challenges and opportunities for anode-free solid-state technology. While the simplified chemistry facilitates more efficient recycling processes, the novel materials used in solid electrolytes may require specialized recycling infrastructure. Developing closed-loop systems for these batteries will be essential to maximize their sustainability benefits and prevent new waste streams from emerging.

Regulatory frameworks worldwide are evolving to address battery sustainability, with initiatives like the EU Battery Directive increasingly focusing on full lifecycle environmental impact. Anode-free solid-state technologies are well-positioned to meet these stricter environmental standards, potentially gaining market advantages as sustainability requirements intensify. However, comprehensive lifecycle assessments must continue to evaluate potential unintended consequences, such as shifts in resource dependencies or the introduction of new materials with unknown environmental impacts.

The sustainability advantages extend to the mining sector, where the removal of anode materials like graphite significantly reduces extraction activities. This is particularly important considering that graphite mining often involves environmentally destructive practices including deforestation, soil erosion, and water pollution. The reduction in mining operations directly translates to decreased habitat destruction and biodiversity loss in resource-rich regions globally.

Carbon footprint assessments of anode-free solid-state batteries demonstrate up to 30% lower greenhouse gas emissions during manufacturing compared to conventional lithium-ion batteries. This improvement stems from simplified production processes, reduced material requirements, and potentially lower energy consumption during cell assembly. The environmental benefits continue throughout the product lifecycle, with enhanced longevity reducing the frequency of battery replacement and associated waste generation.

Water usage represents another critical environmental consideration in battery manufacturing. Anode-free designs potentially reduce water consumption by eliminating water-intensive anode production processes. This advantage becomes increasingly important as water scarcity affects more regions globally and industries face mounting pressure to minimize their hydrological footprints.

End-of-life management presents both challenges and opportunities for anode-free solid-state technology. While the simplified chemistry facilitates more efficient recycling processes, the novel materials used in solid electrolytes may require specialized recycling infrastructure. Developing closed-loop systems for these batteries will be essential to maximize their sustainability benefits and prevent new waste streams from emerging.

Regulatory frameworks worldwide are evolving to address battery sustainability, with initiatives like the EU Battery Directive increasingly focusing on full lifecycle environmental impact. Anode-free solid-state technologies are well-positioned to meet these stricter environmental standards, potentially gaining market advantages as sustainability requirements intensify. However, comprehensive lifecycle assessments must continue to evaluate potential unintended consequences, such as shifts in resource dependencies or the introduction of new materials with unknown environmental impacts.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!