Solid Electrolyte Choices Benchmark For Anode-Free Solid-State

SEP 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid Electrolyte Evolution and Research Objectives

Solid electrolytes have undergone significant evolution since their initial discovery in the 1830s with the observation of silver sulfide's ionic conductivity. The field remained largely academic until the 1970s when the potential of solid-state batteries began to attract serious research attention. Early solid electrolytes suffered from extremely low ionic conductivities at room temperature, limiting their practical applications to specialized high-temperature environments.

The 1990s marked a turning point with the discovery of NASICON-type materials and the development of polymer-based electrolytes, which offered improved conductivity and processing capabilities. However, the real breakthrough came in the early 2000s with the identification of superionic conductors like Li10GeP2S12 (LGPS), which demonstrated ionic conductivities comparable to liquid electrolytes.

Recent years have witnessed an acceleration in solid electrolyte development, driven by the growing demand for safer, higher-energy-density batteries. Three main categories have emerged as frontrunners: oxide-based ceramics (such as LLZO and LATP), sulfide-based materials (including LGPS and Li3PS4), and polymer-based systems (PEO complexes and composite formulations). Each category presents distinct advantages and challenges regarding ionic conductivity, mechanical properties, and chemical stability.

The current research landscape is focused on addressing critical limitations that prevent widespread commercialization. These include interfacial resistance between electrolytes and electrodes, mechanical stability during cycling, and manufacturing scalability. Computational modeling and high-throughput screening have become essential tools in accelerating the discovery and optimization of new solid electrolyte compositions.

For anode-free solid-state batteries specifically, the technical objectives center on developing solid electrolytes that can effectively suppress lithium dendrite growth while maintaining high ionic conductivity. This requires electrolytes with sufficient mechanical strength (shear modulus >10 GPa) and electrochemical stability against lithium metal. Additionally, these electrolytes must facilitate uniform lithium plating during charging to prevent capacity fade and potential safety hazards.

The research objectives for next-generation solid electrolytes include achieving room-temperature ionic conductivities exceeding 10 mS/cm, extending electrochemical stability windows beyond 5V, enhancing mechanical flexibility to accommodate volume changes during cycling, and developing cost-effective, environmentally friendly synthesis methods suitable for large-scale production. These objectives align with the broader goal of enabling solid-state batteries with energy densities exceeding 500 Wh/kg while maintaining excellent safety characteristics and long cycle life.

The 1990s marked a turning point with the discovery of NASICON-type materials and the development of polymer-based electrolytes, which offered improved conductivity and processing capabilities. However, the real breakthrough came in the early 2000s with the identification of superionic conductors like Li10GeP2S12 (LGPS), which demonstrated ionic conductivities comparable to liquid electrolytes.

Recent years have witnessed an acceleration in solid electrolyte development, driven by the growing demand for safer, higher-energy-density batteries. Three main categories have emerged as frontrunners: oxide-based ceramics (such as LLZO and LATP), sulfide-based materials (including LGPS and Li3PS4), and polymer-based systems (PEO complexes and composite formulations). Each category presents distinct advantages and challenges regarding ionic conductivity, mechanical properties, and chemical stability.

The current research landscape is focused on addressing critical limitations that prevent widespread commercialization. These include interfacial resistance between electrolytes and electrodes, mechanical stability during cycling, and manufacturing scalability. Computational modeling and high-throughput screening have become essential tools in accelerating the discovery and optimization of new solid electrolyte compositions.

For anode-free solid-state batteries specifically, the technical objectives center on developing solid electrolytes that can effectively suppress lithium dendrite growth while maintaining high ionic conductivity. This requires electrolytes with sufficient mechanical strength (shear modulus >10 GPa) and electrochemical stability against lithium metal. Additionally, these electrolytes must facilitate uniform lithium plating during charging to prevent capacity fade and potential safety hazards.

The research objectives for next-generation solid electrolytes include achieving room-temperature ionic conductivities exceeding 10 mS/cm, extending electrochemical stability windows beyond 5V, enhancing mechanical flexibility to accommodate volume changes during cycling, and developing cost-effective, environmentally friendly synthesis methods suitable for large-scale production. These objectives align with the broader goal of enabling solid-state batteries with energy densities exceeding 500 Wh/kg while maintaining excellent safety characteristics and long cycle life.

Market Analysis for Anode-Free SSB Technologies

The anode-free solid-state battery (SSB) market is experiencing significant growth potential, driven by the increasing demand for high-energy-density energy storage solutions across multiple sectors. Current market projections indicate that the global solid-state battery market could reach $8 billion by 2026, with anode-free technologies potentially capturing 15-20% of this emerging segment due to their superior energy density advantages.

The automotive industry represents the primary market driver for anode-free SSB technologies, with major manufacturers actively seeking battery solutions that can enable electric vehicles with ranges exceeding 500 miles on a single charge. The elimination of the anode material can potentially increase energy density by 30-40% compared to conventional lithium-ion batteries, making this technology particularly attractive for premium electric vehicle segments.

Consumer electronics constitutes the second largest potential market, where device manufacturers are pursuing thinner, lighter, and longer-lasting power solutions. Market research indicates that smartphones and wearable devices manufacturers are willing to adopt premium battery technologies that offer 50% or greater improvements in energy density, creating a significant opportunity for anode-free SSB technologies.

The stationary energy storage sector presents a growing market opportunity, particularly for grid-scale applications where energy density, safety, and longevity are critical factors. Though currently dominated by conventional lithium-ion technologies, this sector is expected to gradually shift toward advanced solid-state solutions as manufacturing costs decrease and performance advantages become more economically viable.

Market adoption barriers remain significant, with cost being the primary obstacle. Current manufacturing processes for solid electrolytes suitable for anode-free configurations are estimated to be 5-8 times more expensive than conventional battery production. This cost differential is expected to narrow to 2-3 times by 2025 as production scales and manufacturing processes mature.

Regional market analysis reveals that Asia-Pacific, particularly Japan and South Korea, leads in commercial development of solid electrolytes suitable for anode-free configurations, while North American companies focus more on system integration and vehicle applications. European market participants are increasingly investing in sulfide-based solid electrolyte technologies that show promise for anode-free configurations.

Market timing suggests that initial commercial applications of anode-free SSB technologies will likely emerge in premium consumer electronics by 2023-2024, followed by limited automotive applications in 2025-2026, with broader market penetration expected after 2028 when manufacturing processes mature and costs decrease to competitive levels.

The automotive industry represents the primary market driver for anode-free SSB technologies, with major manufacturers actively seeking battery solutions that can enable electric vehicles with ranges exceeding 500 miles on a single charge. The elimination of the anode material can potentially increase energy density by 30-40% compared to conventional lithium-ion batteries, making this technology particularly attractive for premium electric vehicle segments.

Consumer electronics constitutes the second largest potential market, where device manufacturers are pursuing thinner, lighter, and longer-lasting power solutions. Market research indicates that smartphones and wearable devices manufacturers are willing to adopt premium battery technologies that offer 50% or greater improvements in energy density, creating a significant opportunity for anode-free SSB technologies.

The stationary energy storage sector presents a growing market opportunity, particularly for grid-scale applications where energy density, safety, and longevity are critical factors. Though currently dominated by conventional lithium-ion technologies, this sector is expected to gradually shift toward advanced solid-state solutions as manufacturing costs decrease and performance advantages become more economically viable.

Market adoption barriers remain significant, with cost being the primary obstacle. Current manufacturing processes for solid electrolytes suitable for anode-free configurations are estimated to be 5-8 times more expensive than conventional battery production. This cost differential is expected to narrow to 2-3 times by 2025 as production scales and manufacturing processes mature.

Regional market analysis reveals that Asia-Pacific, particularly Japan and South Korea, leads in commercial development of solid electrolytes suitable for anode-free configurations, while North American companies focus more on system integration and vehicle applications. European market participants are increasingly investing in sulfide-based solid electrolyte technologies that show promise for anode-free configurations.

Market timing suggests that initial commercial applications of anode-free SSB technologies will likely emerge in premium consumer electronics by 2023-2024, followed by limited automotive applications in 2025-2026, with broader market penetration expected after 2028 when manufacturing processes mature and costs decrease to competitive levels.

Current Solid Electrolyte Landscape and Barriers

The solid electrolyte landscape for anode-free solid-state batteries is currently dominated by three major categories: oxide-based, sulfide-based, and polymer-based electrolytes. Each category presents distinct advantages and limitations that significantly impact their commercial viability and technological implementation.

Oxide-based solid electrolytes, particularly LLZO (Li7La3Zr2O12) and LATP (Li1.3Al0.3Ti1.7(PO4)3), offer excellent thermal and chemical stability with high oxidation resistance. Their robust mechanical properties provide effective suppression of lithium dendrite growth. However, these materials suffer from relatively low ionic conductivity at room temperature (typically 10^-4 S/cm), high grain boundary resistance, and challenging processing requirements due to their brittle nature.

Sulfide-based electrolytes, including Li2S-P2S5 glass ceramics and argyrodite-type Li6PS5X, demonstrate superior ionic conductivity (10^-3 to 10^-2 S/cm at room temperature), comparable to liquid electrolytes. Their relatively soft mechanical properties facilitate better interfacial contact with electrodes. Nevertheless, these materials are highly sensitive to moisture and air, necessitating stringent manufacturing environments. They also exhibit limited electrochemical stability against lithium metal and high-voltage cathodes.

Polymer-based electrolytes, primarily PEO (polyethylene oxide) complexes, offer excellent flexibility and processability, enabling simpler battery manufacturing processes. Their compatibility with lithium metal is generally favorable. The major drawback is their significantly lower ionic conductivity at room temperature, often requiring operation at elevated temperatures (>60°C) to achieve practical performance levels.

A critical barrier across all solid electrolyte types is the solid-solid interface challenge. Unlike liquid electrolytes that naturally conform to electrode surfaces, solid electrolytes struggle to maintain intimate contact with electrodes during cycling, leading to increased interfacial resistance and capacity fade. This issue is particularly pronounced in anode-free configurations where significant volume changes occur during lithium plating and stripping.

The stability against lithium metal presents another universal challenge, especially relevant for anode-free designs. Many solid electrolytes undergo continuous reduction at the lithium interface, forming interphases that may be either beneficial or detrimental to long-term cycling performance.

Manufacturing scalability remains a significant hurdle, with most advanced solid electrolytes currently produced only at laboratory scales. The transition to industrial-scale production while maintaining consistent quality, especially for moisture-sensitive materials like sulfides, represents a substantial technical and economic challenge that must be overcome for commercial viability.

Oxide-based solid electrolytes, particularly LLZO (Li7La3Zr2O12) and LATP (Li1.3Al0.3Ti1.7(PO4)3), offer excellent thermal and chemical stability with high oxidation resistance. Their robust mechanical properties provide effective suppression of lithium dendrite growth. However, these materials suffer from relatively low ionic conductivity at room temperature (typically 10^-4 S/cm), high grain boundary resistance, and challenging processing requirements due to their brittle nature.

Sulfide-based electrolytes, including Li2S-P2S5 glass ceramics and argyrodite-type Li6PS5X, demonstrate superior ionic conductivity (10^-3 to 10^-2 S/cm at room temperature), comparable to liquid electrolytes. Their relatively soft mechanical properties facilitate better interfacial contact with electrodes. Nevertheless, these materials are highly sensitive to moisture and air, necessitating stringent manufacturing environments. They also exhibit limited electrochemical stability against lithium metal and high-voltage cathodes.

Polymer-based electrolytes, primarily PEO (polyethylene oxide) complexes, offer excellent flexibility and processability, enabling simpler battery manufacturing processes. Their compatibility with lithium metal is generally favorable. The major drawback is their significantly lower ionic conductivity at room temperature, often requiring operation at elevated temperatures (>60°C) to achieve practical performance levels.

A critical barrier across all solid electrolyte types is the solid-solid interface challenge. Unlike liquid electrolytes that naturally conform to electrode surfaces, solid electrolytes struggle to maintain intimate contact with electrodes during cycling, leading to increased interfacial resistance and capacity fade. This issue is particularly pronounced in anode-free configurations where significant volume changes occur during lithium plating and stripping.

The stability against lithium metal presents another universal challenge, especially relevant for anode-free designs. Many solid electrolytes undergo continuous reduction at the lithium interface, forming interphases that may be either beneficial or detrimental to long-term cycling performance.

Manufacturing scalability remains a significant hurdle, with most advanced solid electrolytes currently produced only at laboratory scales. The transition to industrial-scale production while maintaining consistent quality, especially for moisture-sensitive materials like sulfides, represents a substantial technical and economic challenge that must be overcome for commercial viability.

Benchmark Methodology for Solid Electrolytes

01 Polymer-based solid electrolytes for anode-free batteries

Polymer-based solid electrolytes offer advantages for anode-free solid-state batteries including flexibility, processability, and compatibility with lithium metal. These electrolytes typically incorporate polymers like polyethylene oxide (PEO) or polyvinylidene fluoride (PVDF) with lithium salts to achieve ionic conductivity. The addition of ceramic fillers can enhance mechanical properties and ionic conductivity. These electrolytes enable stable cycling in anode-free configurations by effectively suppressing lithium dendrite growth and providing a stable interface with the cathode material.- Polymer-based solid electrolytes for anode-free batteries: Polymer-based solid electrolytes offer advantages for anode-free solid-state batteries including flexibility, processability, and compatibility with lithium metal. These electrolytes typically incorporate polymers like PEO (polyethylene oxide) with lithium salts to achieve ionic conductivity. Performance benchmarks include ionic conductivity above 10^-4 S/cm at room temperature, high electrochemical stability windows (>4.5V), and mechanical properties that suppress lithium dendrite growth while maintaining good interfacial contact with electrodes.

- Ceramic and glass-ceramic solid electrolytes: Ceramic and glass-ceramic solid electrolytes demonstrate superior ionic conductivity and thermal stability for anode-free solid-state batteries. These materials, including NASICON-type, garnet-type (like LLZO), and sulfide-based ceramics, can achieve room temperature conductivities exceeding 10^-3 S/cm. Performance benchmarks include high mechanical strength to prevent lithium dendrite penetration, chemical stability against lithium metal, and minimal interfacial resistance. However, challenges include brittleness and manufacturing complexity that must be addressed for commercial viability.

- Composite and hybrid solid electrolytes: Composite and hybrid solid electrolytes combine polymers with ceramic fillers or create multi-layer structures to leverage the advantages of different electrolyte types. These systems aim to achieve high ionic conductivity from ceramic components while maintaining the flexibility and processability of polymers. Performance benchmarks include enhanced mechanical properties to suppress dendrite growth, reduced interfacial resistance, and improved electrochemical stability. The synergistic effects between components can lead to superior overall performance compared to single-component electrolytes.

- Interface engineering for solid electrolytes: Interface engineering is critical for optimizing solid electrolyte performance in anode-free batteries. This involves modifying the electrolyte-electrode interfaces to reduce resistance and improve stability. Techniques include surface coatings, buffer layers, and chemical modifications that enhance wetting and adhesion. Performance benchmarks include minimal interfacial impedance growth during cycling, stable cycling at practical current densities, and prevention of side reactions. Effective interface engineering can significantly improve cycle life and rate capability of anode-free solid-state batteries.

- Novel materials and additives for enhanced performance: Research on novel materials and additives focuses on improving the performance metrics of solid electrolytes for anode-free batteries. This includes developing new lithium-conducting materials with higher ionic conductivity, incorporating flame-retardant additives for safety, and using nanomaterials to enhance mechanical and electrochemical properties. Performance benchmarks include achieving conductivities above 10^-3 S/cm at room temperature, extended cycle life (>1000 cycles), high coulombic efficiency (>99.9%), and improved rate capability. These innovations aim to address the key challenges of solid-state battery commercialization.

02 Ceramic and glass-ceramic solid electrolytes

Ceramic and glass-ceramic solid electrolytes demonstrate superior ionic conductivity and mechanical strength for anode-free solid-state batteries. Materials such as NASICON-type, garnet-type (LLZO), and LAGP electrolytes provide high lithium-ion conductivity at room temperature while maintaining excellent thermal stability. These rigid electrolytes effectively prevent lithium dendrite penetration and enable high voltage operation. Performance benchmarks include ionic conductivities exceeding 10^-4 S/cm at room temperature, wide electrochemical stability windows, and negligible electronic conductivity to prevent self-discharge.Expand Specific Solutions03 Composite and hybrid solid electrolytes

Composite and hybrid solid electrolytes combine the advantages of different electrolyte types to achieve optimal performance in anode-free solid-state batteries. These typically integrate ceramic fillers within polymer matrices or create layered structures of different electrolyte materials. The composite approach addresses the limitations of single-component electrolytes by improving mechanical properties, enhancing ionic conductivity, and creating more stable interfaces. Performance benchmarks include reduced interfacial resistance, improved cycling stability, and enhanced rate capability compared to single-component systems.Expand Specific Solutions04 Interface engineering for solid electrolytes

Interface engineering is critical for optimizing solid electrolyte performance in anode-free batteries. Techniques include surface coatings, buffer layers, and chemical modifications to reduce interfacial resistance and improve compatibility between electrolytes and electrodes. Effective interface engineering prevents side reactions, stabilizes the solid electrolyte interphase (SEI), and facilitates uniform lithium deposition during cycling. Performance benchmarks include minimal interfacial impedance growth during cycling, uniform lithium plating/stripping, and long-term cycling stability with high Coulombic efficiency.Expand Specific Solutions05 Performance metrics and testing protocols

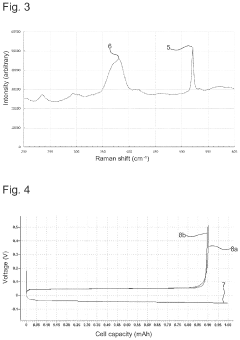

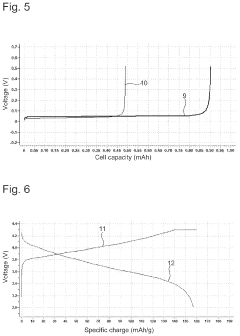

Standardized performance metrics and testing protocols are essential for evaluating solid electrolytes in anode-free solid-state batteries. Key performance indicators include ionic conductivity, electrochemical stability window, mechanical properties, and long-term cycling stability. Advanced characterization techniques such as impedance spectroscopy, in-situ XRD, and neutron diffraction provide insights into electrolyte behavior during operation. Accelerated testing methods help predict long-term performance and identify failure mechanisms. These benchmarks enable meaningful comparisons between different electrolyte systems and guide the development of improved materials.Expand Specific Solutions

Leading Companies in Solid Electrolyte Research

The solid-state battery market is currently in an early growth phase, characterized by significant R&D investment but limited commercial deployment. Market size is projected to expand rapidly as automotive manufacturers like Toyota, GM, Hyundai, and Nissan intensify their electrification strategies. Technical maturity varies across electrolyte types, with companies demonstrating different approaches: QuantumScape focuses on ceramic electrolytes, Samsung and LG Energy Solution are advancing sulfide-based systems, while Toyota and NGK Insulators develop oxide-based solutions. Academic institutions including University of California and Chinese Academy of Sciences are contributing fundamental research, while established battery manufacturers like Panasonic and emerging players such as Energy Exploration Technologies are working to overcome key challenges in ionic conductivity, interfacial stability, and manufacturing scalability for anode-free designs.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a composite solid electrolyte system specifically designed for anode-free solid-state batteries. Their approach combines a sulfide-based inorganic electrolyte (Li6PS5Cl) with a polymer matrix to create a hybrid electrolyte that addresses the mechanical and electrochemical challenges of pure solid systems. The technology achieves ionic conductivity of approximately 5×10^-4 S/cm at room temperature while maintaining flexibility to accommodate volume changes during cycling. LG's solid electrolyte incorporates nano-sized ceramic fillers (including LLZO and LATP) dispersed within the polymer matrix to enhance mechanical properties and lithium-ion transport pathways. Their benchmark testing shows the electrolyte maintains stability against lithium metal with an electrochemical stability window exceeding 4.5V vs. Li/Li+. The company has also developed specialized coating technologies for the electrolyte-cathode interface to minimize interfacial resistance, a common challenge in solid-state systems.

Strengths: Balanced approach combining mechanical flexibility of polymers with high conductivity of sulfides; established manufacturing infrastructure that can be adapted to solid electrolyte production; demonstrated compatibility with high-voltage cathode materials. Weaknesses: Lower ionic conductivity compared to pure sulfide systems; potential long-term stability issues at the polymer-ceramic interfaces; temperature sensitivity affecting performance in extreme conditions.

The Board of Regents of The University of Texas System

Technical Solution: The University of Texas System has developed a glass-ceramic solid electrolyte based on lithium phosphorous oxynitride (LiPON) derivatives with enhanced ionic conductivity for anode-free solid-state batteries. Their approach incorporates nitrogen doping into the glassy matrix to increase lithium-ion mobility while maintaining excellent electrochemical stability against lithium metal. The technology achieves moderate ionic conductivity (approximately 10^-5 to 10^-6 S/cm at room temperature) but compensates with exceptional stability and the ability to be deposited as ultra-thin films (< 1 μm), minimizing overall resistance. UT's solid electrolyte features a unique structural design that creates preferential lithium-ion transport pathways while blocking electron transport, enabling stable operation at high voltages (up to 5V vs. Li/Li+). Their research has demonstrated that this electrolyte can be integrated with various cathode chemistries including high-voltage options like LNMO and NMC811, showing minimal interfacial degradation during extended cycling.

Strengths: Exceptional electrochemical stability window allowing use with high-voltage cathodes; excellent compatibility with lithium metal without dendrite formation; ability to be processed as ultra-thin films reducing overall resistance. Weaknesses: Lower bulk ionic conductivity compared to sulfide and garnet systems; challenges in scaling thin-film deposition techniques for large-format cells; potential brittleness limiting application in flexible battery designs.

Critical Patents in Anode-Free SSB Electrolytes

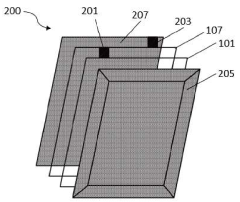

Solid state electrolyte for anode-free metal battery cell

PatentPendingUS20240213528A1

Innovation

- A solid state electrolyte comprising a non-aqueous solvent, metal salts, and an aluminium-based halogenated compound, along with a bis(fluorosulfonyl)imide anion, which reduces interaction between the solvent and metal ions, enhancing the stability and performance of the battery cell.

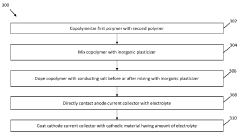

An anode-free solid-state battery and a method of making the same

PatentPendingIN202141047217A

Innovation

- An anode-free solid-state battery design utilizing a solid polymer electrolyte composed of a copolymer of polyvinylidene fluoride-co-hexafluoropropylene and methoxy poly(ethylene glycol) acrylate, doped with a conducting salt and an inorganic plasticizer, which is coated on both the anode and cathode current collectors to enhance ionic conductivity and stability.

Safety and Stability Considerations

Safety and stability considerations are paramount in the development of anode-free solid-state batteries (ASSBs) with solid electrolytes. The absence of a pre-deposited anode in these systems creates unique challenges that must be addressed to ensure reliable operation and commercial viability.

The primary safety concern in ASSBs relates to dendrite formation during lithium plating. Unlike conventional liquid electrolytes, solid electrolytes were initially thought to mechanically suppress dendrite growth. However, recent studies have demonstrated that lithium dendrites can still propagate through solid electrolytes, particularly along grain boundaries and defect sites. This penetration can lead to internal short circuits and catastrophic battery failure, posing significant safety risks.

Mechanical stability at the electrolyte-electrode interface presents another critical challenge. During cycling, the volume changes associated with lithium plating and stripping create mechanical stresses that can compromise the integrity of the solid electrolyte. Polymer-based electrolytes offer better accommodation of these volume changes but typically exhibit lower ionic conductivity compared to ceramic alternatives. Composite electrolytes combining ceramic fillers within polymer matrices represent a promising approach to balance mechanical compliance with ionic transport properties.

Chemical stability between the solid electrolyte and lithium metal is essential for long-term battery performance. Many solid electrolytes undergo undesirable reactions with lithium, forming interphases that increase interfacial resistance over time. Sulfide-based electrolytes, while offering high ionic conductivity, often demonstrate poor chemical stability against lithium metal. Oxide-based systems generally provide better chemical stability but face challenges related to high grain boundary resistance and processing difficulties.

Environmental stability must also be considered when benchmarking solid electrolytes. Sulfide-based electrolytes are notoriously sensitive to moisture and air, releasing toxic H2S gas upon exposure. This necessitates stringent manufacturing controls and specialized packaging, increasing production costs. In contrast, oxide and polymer electrolytes typically demonstrate superior environmental stability, simplifying handling requirements and potentially reducing manufacturing complexity.

Thermal stability across a wide operating temperature range represents another crucial benchmark parameter. The solid electrolyte must maintain structural integrity and adequate ionic conductivity under various thermal conditions. NASICON-type and garnet-type oxide electrolytes generally exhibit excellent thermal stability, while polymer electrolytes may face limitations at elevated temperatures due to softening or melting of the polymer matrix.

The primary safety concern in ASSBs relates to dendrite formation during lithium plating. Unlike conventional liquid electrolytes, solid electrolytes were initially thought to mechanically suppress dendrite growth. However, recent studies have demonstrated that lithium dendrites can still propagate through solid electrolytes, particularly along grain boundaries and defect sites. This penetration can lead to internal short circuits and catastrophic battery failure, posing significant safety risks.

Mechanical stability at the electrolyte-electrode interface presents another critical challenge. During cycling, the volume changes associated with lithium plating and stripping create mechanical stresses that can compromise the integrity of the solid electrolyte. Polymer-based electrolytes offer better accommodation of these volume changes but typically exhibit lower ionic conductivity compared to ceramic alternatives. Composite electrolytes combining ceramic fillers within polymer matrices represent a promising approach to balance mechanical compliance with ionic transport properties.

Chemical stability between the solid electrolyte and lithium metal is essential for long-term battery performance. Many solid electrolytes undergo undesirable reactions with lithium, forming interphases that increase interfacial resistance over time. Sulfide-based electrolytes, while offering high ionic conductivity, often demonstrate poor chemical stability against lithium metal. Oxide-based systems generally provide better chemical stability but face challenges related to high grain boundary resistance and processing difficulties.

Environmental stability must also be considered when benchmarking solid electrolytes. Sulfide-based electrolytes are notoriously sensitive to moisture and air, releasing toxic H2S gas upon exposure. This necessitates stringent manufacturing controls and specialized packaging, increasing production costs. In contrast, oxide and polymer electrolytes typically demonstrate superior environmental stability, simplifying handling requirements and potentially reducing manufacturing complexity.

Thermal stability across a wide operating temperature range represents another crucial benchmark parameter. The solid electrolyte must maintain structural integrity and adequate ionic conductivity under various thermal conditions. NASICON-type and garnet-type oxide electrolytes generally exhibit excellent thermal stability, while polymer electrolytes may face limitations at elevated temperatures due to softening or melting of the polymer matrix.

Manufacturing Scalability Assessment

The manufacturing scalability of solid electrolytes represents a critical factor in the commercial viability of anode-free solid-state batteries. Current production methods for oxide-based solid electrolytes typically involve energy-intensive high-temperature sintering processes, which present significant challenges for large-scale manufacturing. These processes often require temperatures exceeding 1000°C, resulting in substantial energy consumption and specialized equipment requirements that increase production costs.

Sulfide-based electrolytes offer more favorable manufacturing prospects, as they can be processed at lower temperatures and exhibit better mechanical properties for cold pressing techniques. However, their extreme sensitivity to moisture necessitates stringent environmental controls during production, adding complexity to manufacturing infrastructure. Companies like Solid Power and QuantumScape have made notable progress in scaling sulfide electrolyte production, though complete manufacturing solutions remain proprietary.

Polymer-based solid electrolytes present perhaps the most scalable option, leveraging existing lithium-ion battery manufacturing infrastructure with minimal modifications. Their flexibility and compatibility with roll-to-roll processing techniques represent significant advantages for mass production. However, their lower ionic conductivity at room temperature remains a limitation that impacts overall battery performance.

Composite electrolytes combining ceramic fillers with polymer matrices attempt to balance manufacturing feasibility with performance requirements. While these hybrid approaches show promise, optimizing the interface between components and ensuring homogeneous distribution of ceramic particles throughout the polymer matrix remain technical challenges for consistent large-scale production.

The capital expenditure (CAPEX) requirements vary significantly across electrolyte types. Oxide-based systems demand substantial investment in high-temperature processing equipment, while sulfide systems require sophisticated dry room facilities with advanced environmental controls. Polymer systems generally require lower initial investment but may incur higher material costs for performance-enhancing additives.

Material supply chain considerations also impact scalability. While lithium carbonate and lithium hydroxide are relatively abundant, specialized precursors for certain solid electrolytes may face supply constraints as production scales. Additionally, the geographical concentration of critical materials presents potential supply chain vulnerabilities that must be addressed through diversification strategies or material substitution approaches.

Ultimately, manufacturing yield and consistency will determine commercial viability. Current laboratory-scale production methods often achieve less than 80% yield for high-performance solid electrolytes, whereas commercial viability typically requires yields exceeding 95%. Bridging this gap represents a significant engineering challenge that will require process optimization and quality control innovations specific to each electrolyte chemistry.

Sulfide-based electrolytes offer more favorable manufacturing prospects, as they can be processed at lower temperatures and exhibit better mechanical properties for cold pressing techniques. However, their extreme sensitivity to moisture necessitates stringent environmental controls during production, adding complexity to manufacturing infrastructure. Companies like Solid Power and QuantumScape have made notable progress in scaling sulfide electrolyte production, though complete manufacturing solutions remain proprietary.

Polymer-based solid electrolytes present perhaps the most scalable option, leveraging existing lithium-ion battery manufacturing infrastructure with minimal modifications. Their flexibility and compatibility with roll-to-roll processing techniques represent significant advantages for mass production. However, their lower ionic conductivity at room temperature remains a limitation that impacts overall battery performance.

Composite electrolytes combining ceramic fillers with polymer matrices attempt to balance manufacturing feasibility with performance requirements. While these hybrid approaches show promise, optimizing the interface between components and ensuring homogeneous distribution of ceramic particles throughout the polymer matrix remain technical challenges for consistent large-scale production.

The capital expenditure (CAPEX) requirements vary significantly across electrolyte types. Oxide-based systems demand substantial investment in high-temperature processing equipment, while sulfide systems require sophisticated dry room facilities with advanced environmental controls. Polymer systems generally require lower initial investment but may incur higher material costs for performance-enhancing additives.

Material supply chain considerations also impact scalability. While lithium carbonate and lithium hydroxide are relatively abundant, specialized precursors for certain solid electrolytes may face supply constraints as production scales. Additionally, the geographical concentration of critical materials presents potential supply chain vulnerabilities that must be addressed through diversification strategies or material substitution approaches.

Ultimately, manufacturing yield and consistency will determine commercial viability. Current laboratory-scale production methods often achieve less than 80% yield for high-performance solid electrolytes, whereas commercial viability typically requires yields exceeding 95%. Bridging this gap represents a significant engineering challenge that will require process optimization and quality control innovations specific to each electrolyte chemistry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!