Assessing Plasma Treatment for Advanced Material Solutions

OCT 14, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma Treatment Technology Evolution and Objectives

Plasma treatment technology has evolved significantly over the past several decades, transforming from a niche scientific process to a versatile industrial application. Initially developed in the mid-20th century for semiconductor manufacturing, plasma treatment has expanded into numerous industries including medical devices, automotive, aerospace, and consumer electronics. This evolution has been driven by the increasing demand for advanced surface modification techniques that can enhance material properties without altering bulk characteristics.

The fundamental principle of plasma treatment involves creating an ionized gas environment that interacts with material surfaces to modify their physical and chemical properties. Early applications primarily focused on cleaning and etching processes, but technological advancements have enabled more sophisticated applications such as surface activation, coating adhesion improvement, and biocompatibility enhancement.

The 1980s marked a significant turning point with the development of atmospheric pressure plasma systems, which eliminated the need for vacuum chambers and substantially reduced operational costs. This innovation democratized plasma technology, making it accessible to a broader range of industries and applications. The 1990s and early 2000s saw further refinements in control systems, allowing for more precise manipulation of plasma parameters and treatment outcomes.

Recent technological trends include the development of cold plasma technologies that can treat heat-sensitive materials, miniaturized plasma systems for targeted applications, and environmentally friendly plasma processes that reduce chemical waste. The integration of plasma treatment with other manufacturing processes has also emerged as a key trend, enabling inline processing and improving production efficiency.

The primary objective of current plasma treatment research is to develop more energy-efficient, environmentally sustainable, and precisely controllable plasma systems. This includes optimizing plasma chemistry for specific material interactions, reducing energy consumption, and minimizing process variability. Another critical goal is to expand the range of treatable materials, particularly challenging substrates like high-performance polymers and composite materials.

Looking forward, the field aims to achieve greater understanding of plasma-surface interactions at the molecular level, which would enable more predictable and tailored treatment outcomes. The development of real-time monitoring and feedback systems represents another important objective, potentially allowing for adaptive plasma treatment processes that can respond to variations in material properties or environmental conditions.

The convergence of plasma technology with nanotechnology and advanced manufacturing presents exciting opportunities for creating novel material solutions with unprecedented properties and functionalities. As industries continue to demand materials with increasingly specialized characteristics, plasma treatment is positioned to play a crucial role in meeting these evolving needs.

The fundamental principle of plasma treatment involves creating an ionized gas environment that interacts with material surfaces to modify their physical and chemical properties. Early applications primarily focused on cleaning and etching processes, but technological advancements have enabled more sophisticated applications such as surface activation, coating adhesion improvement, and biocompatibility enhancement.

The 1980s marked a significant turning point with the development of atmospheric pressure plasma systems, which eliminated the need for vacuum chambers and substantially reduced operational costs. This innovation democratized plasma technology, making it accessible to a broader range of industries and applications. The 1990s and early 2000s saw further refinements in control systems, allowing for more precise manipulation of plasma parameters and treatment outcomes.

Recent technological trends include the development of cold plasma technologies that can treat heat-sensitive materials, miniaturized plasma systems for targeted applications, and environmentally friendly plasma processes that reduce chemical waste. The integration of plasma treatment with other manufacturing processes has also emerged as a key trend, enabling inline processing and improving production efficiency.

The primary objective of current plasma treatment research is to develop more energy-efficient, environmentally sustainable, and precisely controllable plasma systems. This includes optimizing plasma chemistry for specific material interactions, reducing energy consumption, and minimizing process variability. Another critical goal is to expand the range of treatable materials, particularly challenging substrates like high-performance polymers and composite materials.

Looking forward, the field aims to achieve greater understanding of plasma-surface interactions at the molecular level, which would enable more predictable and tailored treatment outcomes. The development of real-time monitoring and feedback systems represents another important objective, potentially allowing for adaptive plasma treatment processes that can respond to variations in material properties or environmental conditions.

The convergence of plasma technology with nanotechnology and advanced manufacturing presents exciting opportunities for creating novel material solutions with unprecedented properties and functionalities. As industries continue to demand materials with increasingly specialized characteristics, plasma treatment is positioned to play a crucial role in meeting these evolving needs.

Market Applications and Demand Analysis for Plasma-Treated Materials

The global market for plasma-treated materials has experienced significant growth in recent years, driven by increasing demand across multiple industries seeking enhanced material properties. The current market size is estimated at $8.2 billion with a compound annual growth rate of 6.7% projected through 2028, indicating robust expansion potential for plasma treatment technologies.

The electronics and semiconductor industry represents the largest application segment, accounting for approximately 32% of the total market share. This dominance stems from the critical need for surface modification in microelectronics manufacturing, where plasma treatments enable precise etching, cleaning, and deposition processes essential for miniaturization and performance enhancement of electronic components. The increasing complexity of semiconductor devices and the growth of IoT applications continue to fuel demand in this sector.

Medical and healthcare applications constitute the fastest-growing segment with a projected growth rate of 9.3% annually. Plasma treatment provides antimicrobial properties and improves biocompatibility for medical devices, surgical instruments, and implants. The rising prevalence of hospital-acquired infections and the growing emphasis on infection control measures have significantly boosted demand for plasma-treated medical products.

Automotive and aerospace industries collectively represent approximately 18% of the market. These sectors utilize plasma-treated materials for improved adhesion properties, enhanced corrosion resistance, and weight reduction in composite materials. The push toward electric vehicles and fuel-efficient aircraft has accelerated the adoption of advanced materials requiring plasma treatment to achieve desired performance characteristics.

Packaging applications, particularly in food and pharmaceutical industries, have shown substantial growth potential. Plasma treatment improves barrier properties, printability, and adhesion characteristics of packaging materials while maintaining food safety standards. The shift toward sustainable packaging solutions has further stimulated interest in plasma technologies as environmentally friendly alternatives to chemical treatments.

Textile and consumer goods sectors have also embraced plasma treatment technologies for creating water-repellent, stain-resistant, and antimicrobial fabrics. The premium apparel market segment has particularly benefited from these advancements, with consumers willing to pay higher prices for enhanced functionality in everyday products.

Regional analysis reveals that Asia-Pacific dominates the market with a 41% share, driven by the strong presence of electronics manufacturing and rapid industrialization in countries like China, South Korea, and Taiwan. North America and Europe follow with 28% and 24% market shares respectively, with particular strength in medical and aerospace applications requiring high-precision plasma treatments.

The electronics and semiconductor industry represents the largest application segment, accounting for approximately 32% of the total market share. This dominance stems from the critical need for surface modification in microelectronics manufacturing, where plasma treatments enable precise etching, cleaning, and deposition processes essential for miniaturization and performance enhancement of electronic components. The increasing complexity of semiconductor devices and the growth of IoT applications continue to fuel demand in this sector.

Medical and healthcare applications constitute the fastest-growing segment with a projected growth rate of 9.3% annually. Plasma treatment provides antimicrobial properties and improves biocompatibility for medical devices, surgical instruments, and implants. The rising prevalence of hospital-acquired infections and the growing emphasis on infection control measures have significantly boosted demand for plasma-treated medical products.

Automotive and aerospace industries collectively represent approximately 18% of the market. These sectors utilize plasma-treated materials for improved adhesion properties, enhanced corrosion resistance, and weight reduction in composite materials. The push toward electric vehicles and fuel-efficient aircraft has accelerated the adoption of advanced materials requiring plasma treatment to achieve desired performance characteristics.

Packaging applications, particularly in food and pharmaceutical industries, have shown substantial growth potential. Plasma treatment improves barrier properties, printability, and adhesion characteristics of packaging materials while maintaining food safety standards. The shift toward sustainable packaging solutions has further stimulated interest in plasma technologies as environmentally friendly alternatives to chemical treatments.

Textile and consumer goods sectors have also embraced plasma treatment technologies for creating water-repellent, stain-resistant, and antimicrobial fabrics. The premium apparel market segment has particularly benefited from these advancements, with consumers willing to pay higher prices for enhanced functionality in everyday products.

Regional analysis reveals that Asia-Pacific dominates the market with a 41% share, driven by the strong presence of electronics manufacturing and rapid industrialization in countries like China, South Korea, and Taiwan. North America and Europe follow with 28% and 24% market shares respectively, with particular strength in medical and aerospace applications requiring high-precision plasma treatments.

Current Plasma Treatment Technologies and Challenges

Plasma treatment technologies have evolved significantly over the past decades, establishing themselves as versatile tools for material surface modification across numerous industries. Currently, several mainstream plasma treatment technologies dominate the market, each with specific applications and limitations. Low-pressure plasma systems operate in vacuum environments and offer excellent uniformity and control but require complex equipment and batch processing. Atmospheric pressure plasma systems, including dielectric barrier discharge (DBD) and plasma jets, provide more accessible implementation without vacuum requirements, enabling continuous processing capabilities for industrial applications.

Corona discharge systems represent another widely adopted technology, particularly in the packaging and printing industries, offering cost-effective surface activation but with limited treatment depth and uniformity. For more precise applications, radio frequency (RF) plasma and microwave plasma systems deliver higher energy densities and enhanced control over plasma parameters, though at increased operational complexity and cost.

Despite these advancements, significant challenges persist in plasma treatment technology. Process scalability remains problematic, with laboratory-scale successes often failing to translate effectively to industrial production environments. The uniformity of treatment across complex geometries and three-dimensional objects continues to challenge engineers, particularly when dealing with intricate components or materials with varying surface properties.

Energy efficiency represents another critical concern, as conventional plasma systems typically convert only a small percentage of input energy into useful plasma effects, with the remainder dissipated as heat. This inefficiency increases operational costs and can damage temperature-sensitive materials, limiting application scope.

The transient nature of plasma treatment effects poses additional challenges, as many treated surfaces experience hydrophobic recovery over time, reducing the longevity of beneficial surface modifications. This necessitates either repeated treatments or additional processing steps to stabilize surface properties, complicating manufacturing workflows.

From a technical perspective, precise control of plasma parameters remains difficult, with slight variations in gas composition, pressure, power input, or treatment duration potentially leading to significant differences in treatment outcomes. This sensitivity makes process standardization and quality control particularly challenging across different production batches or equipment.

Environmental and safety considerations also present obstacles, as certain plasma processes generate ozone, NOx compounds, or other potentially harmful byproducts. Regulatory compliance and worker safety protocols add complexity to implementation, particularly in sensitive industries such as medical device manufacturing or food packaging.

Corona discharge systems represent another widely adopted technology, particularly in the packaging and printing industries, offering cost-effective surface activation but with limited treatment depth and uniformity. For more precise applications, radio frequency (RF) plasma and microwave plasma systems deliver higher energy densities and enhanced control over plasma parameters, though at increased operational complexity and cost.

Despite these advancements, significant challenges persist in plasma treatment technology. Process scalability remains problematic, with laboratory-scale successes often failing to translate effectively to industrial production environments. The uniformity of treatment across complex geometries and three-dimensional objects continues to challenge engineers, particularly when dealing with intricate components or materials with varying surface properties.

Energy efficiency represents another critical concern, as conventional plasma systems typically convert only a small percentage of input energy into useful plasma effects, with the remainder dissipated as heat. This inefficiency increases operational costs and can damage temperature-sensitive materials, limiting application scope.

The transient nature of plasma treatment effects poses additional challenges, as many treated surfaces experience hydrophobic recovery over time, reducing the longevity of beneficial surface modifications. This necessitates either repeated treatments or additional processing steps to stabilize surface properties, complicating manufacturing workflows.

From a technical perspective, precise control of plasma parameters remains difficult, with slight variations in gas composition, pressure, power input, or treatment duration potentially leading to significant differences in treatment outcomes. This sensitivity makes process standardization and quality control particularly challenging across different production batches or equipment.

Environmental and safety considerations also present obstacles, as certain plasma processes generate ozone, NOx compounds, or other potentially harmful byproducts. Regulatory compliance and worker safety protocols add complexity to implementation, particularly in sensitive industries such as medical device manufacturing or food packaging.

Current Plasma Treatment Methods and Implementation

01 Plasma chamber design and configuration

Various designs and configurations of plasma chambers are used to optimize plasma treatment processes. These include specialized electrode arrangements, chamber geometries, and gas flow systems that enhance plasma uniformity and treatment efficiency. Advanced chamber designs can incorporate features for controlling plasma density, temperature, and other parameters critical for specific applications.- Plasma treatment systems for semiconductor processing: Plasma treatment systems are widely used in semiconductor manufacturing for etching, deposition, and surface modification. These systems typically include plasma chambers with specialized electrodes, RF power sources, and gas delivery systems that enable precise control of plasma parameters. Advanced plasma treatment technologies allow for nanoscale processing of semiconductor materials, improving device performance and manufacturing efficiency.

- Plasma chamber design and components: Specialized plasma chamber designs incorporate various components to optimize plasma generation and control. These chambers feature electrode configurations, gas distribution systems, and temperature control mechanisms that enhance treatment uniformity and efficiency. Innovations in chamber design include improved substrate holders, plasma confinement structures, and materials that resist plasma-induced degradation, resulting in more reliable and consistent treatment processes.

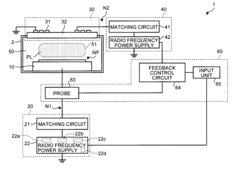

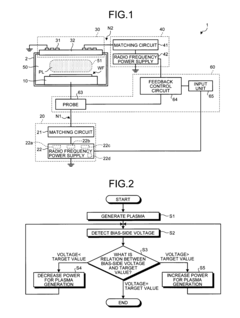

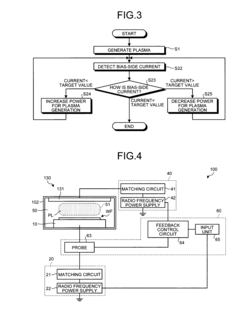

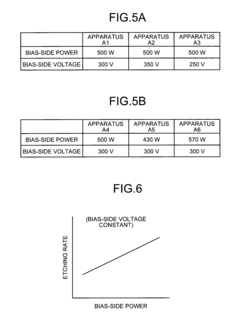

- Plasma power supply and control systems: Advanced power supply and control systems are essential for precise plasma generation and manipulation. These systems include RF generators, impedance matching networks, and sophisticated control algorithms that maintain stable plasma conditions. Modern plasma treatment equipment incorporates real-time monitoring and feedback mechanisms to adjust power delivery based on process requirements, ensuring consistent treatment results across various applications.

- Surface modification using plasma treatment: Plasma treatment is effective for modifying surface properties of various materials including polymers, metals, and ceramics. The process can alter surface energy, wettability, adhesion characteristics, and chemical functionality without affecting bulk material properties. Applications include improving adhesion for coatings, enhancing biocompatibility of medical devices, and creating functional surfaces with specific chemical or physical properties tailored for particular industrial needs.

- Atmospheric pressure plasma treatment technologies: Atmospheric pressure plasma systems enable treatment without vacuum requirements, offering advantages in processing speed and integration with continuous manufacturing lines. These technologies include dielectric barrier discharge, plasma jets, and corona discharge systems that operate at ambient pressure conditions. Recent innovations focus on improving uniformity, reducing energy consumption, and expanding the range of treatable materials, making plasma treatment more accessible for various industrial applications.

02 Plasma generation and control mechanisms

Technologies for generating and precisely controlling plasma conditions are essential for effective treatment processes. These include power supply systems, frequency modulators, and feedback control mechanisms that regulate plasma parameters such as density, temperature, and ion energy. Advanced control systems enable real-time adjustments to maintain optimal plasma conditions throughout the treatment process.Expand Specific Solutions03 Semiconductor processing applications

Plasma treatment plays a crucial role in semiconductor manufacturing processes, including etching, deposition, and surface modification. Specialized plasma techniques are used to create precise microstructures, remove contaminants, and modify material properties at the nanoscale. These processes enable the fabrication of advanced semiconductor devices with increasingly smaller feature sizes and complex architectures.Expand Specific Solutions04 Surface modification and functionalization

Plasma treatment is widely used for modifying surface properties of various materials. The process can alter surface energy, wettability, adhesion characteristics, and chemical functionality without affecting bulk material properties. Applications include improving adhesion for coatings, enhancing biocompatibility of medical devices, and creating specialized surface properties for technical textiles and polymers.Expand Specific Solutions05 Advanced plasma technologies for emerging applications

Novel plasma treatment technologies are being developed for emerging applications across various industries. These include atmospheric pressure plasma systems, plasma-assisted chemical processes, and hybrid plasma technologies that combine multiple treatment mechanisms. Such advanced approaches enable new capabilities in fields like nanomaterials processing, biomedical applications, and environmental remediation.Expand Specific Solutions

Leading Companies and Research Institutions in Plasma Treatment

Plasma treatment technology for advanced materials is currently in a growth phase, with the market expected to expand significantly due to increasing applications in semiconductor manufacturing, medical devices, and surface modification. The global market size is projected to reach several billion dollars by 2025, driven by demand for high-performance materials across industries. Leading players include Tokyo Electron, Applied Materials, and Lam Research, who dominate the semiconductor plasma equipment sector with mature technology offerings. Emerging competitors like NAURA Microelectronics and US Patent Innovations are developing specialized applications, while research institutions such as IMEC and University of Washington are advancing fundamental plasma science. The technology shows varying maturity levels, with semiconductor applications being highly developed while medical and advanced material applications remain in earlier development stages.

Tokyo Electron Ltd.

Technical Solution: Tokyo Electron (TEL) has developed sophisticated plasma treatment solutions for advanced materials processing, with particular strength in plasma-enhanced atomic layer deposition (PEALD) and plasma etching technologies. Their TACTRAS™ platform utilizes inductively coupled plasma (ICP) sources to achieve high-density, low-damage plasma treatment for sensitive materials[1]. TEL's Trias™ system employs a unique three-dimensional plasma generation approach that enables uniform treatment of complex 3D structures and high-aspect-ratio features. The company has also pioneered plasma-assisted molecular layer etching (MLE) technology that provides atomic-level precision for removing material layers while preserving underlying structures[2]. Their systems incorporate advanced plasma diagnostics that monitor electron temperature, ion energy distribution, and radical species concentration in real-time, allowing precise optimization of plasma parameters for specific material treatment requirements.

Strengths: Exceptional plasma uniformity control; specialized solutions for high-aspect-ratio structures; advanced plasma diagnostics for process optimization. Weaknesses: Higher system complexity requiring specialized maintenance; some solutions have limited throughput compared to competitors.

Applied Materials, Inc.

Technical Solution: Applied Materials has developed comprehensive plasma treatment solutions for advanced materials processing, particularly in semiconductor manufacturing. Their flagship Endura® platform incorporates plasma-enhanced physical vapor deposition (PVD) technology that enables precise material modification at the atomic level. The company's Producer® plasma-enhanced chemical vapor deposition (PECVD) systems utilize high-density plasma sources to create uniform thin films with excellent step coverage and gap-fill capabilities[1]. Applied Materials has also pioneered remote plasma source (RPS) technology that generates high-density plasma away from the substrate, reducing potential damage while maintaining effective surface modification. Their plasma treatment solutions incorporate advanced process control systems that enable real-time adjustments based on in-situ measurements, ensuring consistent results across large substrate areas[2].

Strengths: Industry-leading plasma process control with nanometer-scale precision; extensive IP portfolio in plasma technology; integrated solutions that combine multiple plasma treatment steps. Weaknesses: Higher capital investment requirements compared to some competitors; complex systems may require specialized technical expertise for operation and maintenance.

Key Patents and Innovations in Plasma Surface Modification

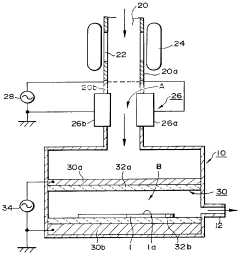

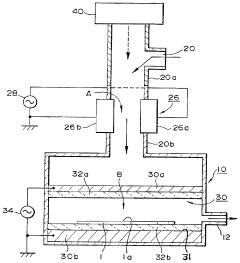

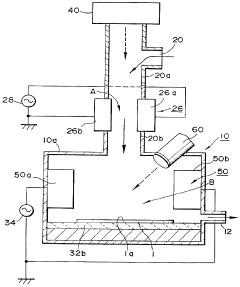

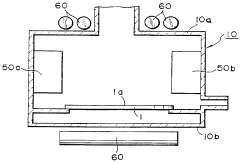

Plasma treatment apparatus and plasma treatment method

PatentInactiveUS20120000887A1

Innovation

- A plasma treatment apparatus with a control unit that includes a sensing unit and feedback control circuit to regulate power supply, ensuring that the sensed parameters, such as power and voltage, match predetermined target values, thereby maintaining consistent ion current and plasma density across different apparatuses.

Plasma treatment apparatus and method

PatentInactiveUS5753886A

Innovation

- A plasma treatment apparatus with multiple plasma generation units along the gas flow path, where the upstream unit preactivates the gas and the downstream unit maintains the activated state, increasing plasma density and excitation levels, and using different frequency and power settings to minimize plasma damage to the object.

Environmental Impact and Sustainability of Plasma Processes

Plasma treatment technologies, while offering significant advantages in material processing, present important environmental considerations that must be addressed for sustainable implementation. The environmental footprint of plasma processes is considerably lower than many conventional chemical treatments, primarily due to reduced chemical waste generation and lower energy consumption. Atmospheric plasma systems, in particular, operate without vacuum requirements, further decreasing energy demands compared to low-pressure alternatives.

Water consumption represents another significant advantage of plasma technologies. Traditional wet chemical processes often require substantial volumes of water for cleaning, treatment, and waste dilution. In contrast, plasma treatments operate in dry conditions, eliminating process water requirements and associated wastewater treatment challenges. This aspect becomes increasingly valuable as water scarcity concerns intensify globally.

Regarding emissions, modern plasma systems produce minimal air pollutants when properly designed and operated. The primary byproducts typically include ozone and nitrogen oxides, which can be effectively managed through appropriate ventilation and filtration systems. Advanced plasma equipment incorporates closed-loop designs that capture and neutralize these byproducts before release, ensuring compliance with stringent environmental regulations.

Life cycle assessment (LCA) studies comparing plasma treatments to conventional processes demonstrate significant sustainability advantages. Research indicates that plasma surface modification can reduce the overall environmental impact by 30-60% compared to chemical treatments for similar applications. These benefits stem from reduced resource consumption, decreased waste generation, and lower energy requirements across the technology lifecycle.

The recyclability of plasma-treated materials presents another environmental benefit. Unlike some chemical treatments that may compromise material recyclability, plasma modifications typically affect only the surface properties without altering the bulk material composition. This characteristic preserves end-of-life recycling options, supporting circular economy principles and reducing landfill waste.

Industry adoption of plasma technologies aligns with broader sustainability initiatives and regulatory compliance requirements. Companies implementing plasma treatments report improvements in environmental performance metrics, including reduced hazardous waste generation, lower carbon footprints, and decreased water usage. These environmental benefits translate to cost savings through reduced waste management expenses and improved regulatory compliance.

Future developments in plasma technology continue to emphasize environmental performance. Research focuses on further reducing energy consumption through more efficient power supplies, optimizing process parameters, and developing hybrid systems that combine plasma with other green technologies. These innovations promise to further enhance the sustainability profile of plasma treatments in advanced material applications.

Water consumption represents another significant advantage of plasma technologies. Traditional wet chemical processes often require substantial volumes of water for cleaning, treatment, and waste dilution. In contrast, plasma treatments operate in dry conditions, eliminating process water requirements and associated wastewater treatment challenges. This aspect becomes increasingly valuable as water scarcity concerns intensify globally.

Regarding emissions, modern plasma systems produce minimal air pollutants when properly designed and operated. The primary byproducts typically include ozone and nitrogen oxides, which can be effectively managed through appropriate ventilation and filtration systems. Advanced plasma equipment incorporates closed-loop designs that capture and neutralize these byproducts before release, ensuring compliance with stringent environmental regulations.

Life cycle assessment (LCA) studies comparing plasma treatments to conventional processes demonstrate significant sustainability advantages. Research indicates that plasma surface modification can reduce the overall environmental impact by 30-60% compared to chemical treatments for similar applications. These benefits stem from reduced resource consumption, decreased waste generation, and lower energy requirements across the technology lifecycle.

The recyclability of plasma-treated materials presents another environmental benefit. Unlike some chemical treatments that may compromise material recyclability, plasma modifications typically affect only the surface properties without altering the bulk material composition. This characteristic preserves end-of-life recycling options, supporting circular economy principles and reducing landfill waste.

Industry adoption of plasma technologies aligns with broader sustainability initiatives and regulatory compliance requirements. Companies implementing plasma treatments report improvements in environmental performance metrics, including reduced hazardous waste generation, lower carbon footprints, and decreased water usage. These environmental benefits translate to cost savings through reduced waste management expenses and improved regulatory compliance.

Future developments in plasma technology continue to emphasize environmental performance. Research focuses on further reducing energy consumption through more efficient power supplies, optimizing process parameters, and developing hybrid systems that combine plasma with other green technologies. These innovations promise to further enhance the sustainability profile of plasma treatments in advanced material applications.

Cost-Benefit Analysis of Industrial Plasma Applications

The economic viability of plasma treatment technologies in industrial applications requires thorough cost-benefit analysis to justify implementation. Initial capital expenditure for plasma systems varies significantly based on scale and complexity, ranging from $50,000 for basic atmospheric pressure systems to several million dollars for advanced vacuum plasma installations. These substantial upfront investments necessitate careful financial planning and often represent a significant barrier to adoption for small and medium enterprises.

Operational costs present another critical consideration, encompassing energy consumption, process gases, maintenance, and specialized personnel. Energy efficiency has improved substantially in modern plasma systems, with newer models demonstrating 30-40% reduction in power consumption compared to systems from a decade ago. However, certain high-energy plasma processes still incur significant electricity costs that must be factored into production economics.

The financial benefits of plasma treatment manifest across multiple dimensions. Production efficiency gains of 15-25% are commonly reported when replacing conventional chemical processes with plasma alternatives. Material waste reduction represents another significant advantage, with plasma-treated products showing defect rate decreases of up to 40% in industries such as electronics and medical device manufacturing.

Environmental compliance cost avoidance constitutes an increasingly important economic benefit. As regulatory frameworks worldwide impose stricter controls on chemical waste disposal and emissions, plasma technologies offer substantial savings by eliminating or reducing hazardous chemical usage. Companies implementing plasma surface modification have reported regulatory compliance cost reductions of 30-60% compared to traditional chemical treatment methods.

Return on investment timelines vary by application but typically range from 18-36 months for standard industrial implementations. High-value applications in aerospace, medical, and semiconductor industries often demonstrate faster ROI periods of 12-18 months due to the premium value of enhanced material performance and reduced rejection rates.

Total cost of ownership analyses reveal that while plasma systems require higher initial investment, their lower operational costs, reduced material waste, and enhanced product performance typically result in favorable long-term economics. Case studies across various industries demonstrate that plasma treatment technologies can reduce overall production costs by 10-30% when evaluated over a five-year operational period, with particularly strong economic performance in applications requiring high precision and reliability.

Operational costs present another critical consideration, encompassing energy consumption, process gases, maintenance, and specialized personnel. Energy efficiency has improved substantially in modern plasma systems, with newer models demonstrating 30-40% reduction in power consumption compared to systems from a decade ago. However, certain high-energy plasma processes still incur significant electricity costs that must be factored into production economics.

The financial benefits of plasma treatment manifest across multiple dimensions. Production efficiency gains of 15-25% are commonly reported when replacing conventional chemical processes with plasma alternatives. Material waste reduction represents another significant advantage, with plasma-treated products showing defect rate decreases of up to 40% in industries such as electronics and medical device manufacturing.

Environmental compliance cost avoidance constitutes an increasingly important economic benefit. As regulatory frameworks worldwide impose stricter controls on chemical waste disposal and emissions, plasma technologies offer substantial savings by eliminating or reducing hazardous chemical usage. Companies implementing plasma surface modification have reported regulatory compliance cost reductions of 30-60% compared to traditional chemical treatment methods.

Return on investment timelines vary by application but typically range from 18-36 months for standard industrial implementations. High-value applications in aerospace, medical, and semiconductor industries often demonstrate faster ROI periods of 12-18 months due to the premium value of enhanced material performance and reduced rejection rates.

Total cost of ownership analyses reveal that while plasma systems require higher initial investment, their lower operational costs, reduced material waste, and enhanced product performance typically result in favorable long-term economics. Case studies across various industries demonstrate that plasma treatment technologies can reduce overall production costs by 10-30% when evaluated over a five-year operational period, with particularly strong economic performance in applications requiring high precision and reliability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!