Standards and Regulations in Plasma Surface Treatment Processes

OCT 14, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma Treatment Technology Evolution and Objectives

Plasma surface treatment technology has evolved significantly since its inception in the early 20th century. Initially developed as a scientific curiosity in the 1920s, plasma treatment began gaining industrial relevance in the 1960s with the advent of vacuum plasma systems. These early applications were primarily focused on semiconductor manufacturing and specialized materials processing, with limited commercial adoption due to high costs and technical complexity.

The 1980s marked a pivotal shift with the development of atmospheric pressure plasma technologies, which eliminated the need for vacuum chambers and significantly reduced operational costs. This innovation expanded plasma treatment applications into new industries including automotive, medical device manufacturing, and consumer electronics. The technology's ability to modify surface properties without altering bulk material characteristics became increasingly valuable as manufacturers sought more sustainable and efficient production methods.

By the early 2000s, plasma treatment had become an established industrial process, with specialized equipment manufacturers emerging to serve diverse market segments. The technology's evolution has been characterized by increasing precision, reliability, and energy efficiency, alongside a steady reduction in equipment size and cost. Recent advancements have focused on developing selective treatment capabilities, real-time process monitoring, and integration with automated manufacturing systems.

The primary objective of modern plasma surface treatment technology is to achieve precise surface modification while maintaining compliance with increasingly stringent regulatory frameworks. This includes enhancing material properties such as adhesion, wettability, printability, and biocompatibility through controlled surface activation processes. Secondary objectives include reducing environmental impact by minimizing chemical waste, lowering energy consumption, and eliminating hazardous substances from manufacturing processes.

Current technological goals focus on standardizing plasma treatment protocols across industries to ensure consistent results and regulatory compliance. This includes developing universally accepted testing methodologies, performance metrics, and safety standards. Additionally, there is growing emphasis on creating plasma systems capable of treating complex three-dimensional geometries, temperature-sensitive substrates, and novel composite materials.

Looking forward, the technology aims to achieve greater process control through advanced diagnostics and feedback systems, enabling real-time adjustment of treatment parameters. Integration with Industry 4.0 principles represents another key objective, with efforts to incorporate data analytics, machine learning, and predictive maintenance capabilities into plasma treatment systems to optimize performance and ensure consistent regulatory compliance across global manufacturing operations.

The 1980s marked a pivotal shift with the development of atmospheric pressure plasma technologies, which eliminated the need for vacuum chambers and significantly reduced operational costs. This innovation expanded plasma treatment applications into new industries including automotive, medical device manufacturing, and consumer electronics. The technology's ability to modify surface properties without altering bulk material characteristics became increasingly valuable as manufacturers sought more sustainable and efficient production methods.

By the early 2000s, plasma treatment had become an established industrial process, with specialized equipment manufacturers emerging to serve diverse market segments. The technology's evolution has been characterized by increasing precision, reliability, and energy efficiency, alongside a steady reduction in equipment size and cost. Recent advancements have focused on developing selective treatment capabilities, real-time process monitoring, and integration with automated manufacturing systems.

The primary objective of modern plasma surface treatment technology is to achieve precise surface modification while maintaining compliance with increasingly stringent regulatory frameworks. This includes enhancing material properties such as adhesion, wettability, printability, and biocompatibility through controlled surface activation processes. Secondary objectives include reducing environmental impact by minimizing chemical waste, lowering energy consumption, and eliminating hazardous substances from manufacturing processes.

Current technological goals focus on standardizing plasma treatment protocols across industries to ensure consistent results and regulatory compliance. This includes developing universally accepted testing methodologies, performance metrics, and safety standards. Additionally, there is growing emphasis on creating plasma systems capable of treating complex three-dimensional geometries, temperature-sensitive substrates, and novel composite materials.

Looking forward, the technology aims to achieve greater process control through advanced diagnostics and feedback systems, enabling real-time adjustment of treatment parameters. Integration with Industry 4.0 principles represents another key objective, with efforts to incorporate data analytics, machine learning, and predictive maintenance capabilities into plasma treatment systems to optimize performance and ensure consistent regulatory compliance across global manufacturing operations.

Market Demand Analysis for Plasma Surface Treatment

The global market for plasma surface treatment technologies has experienced significant growth in recent years, driven by increasing demand across multiple industries for enhanced material properties and performance. The market size was valued at approximately 2.1 billion USD in 2022 and is projected to reach 3.4 billion USD by 2028, representing a compound annual growth rate (CAGR) of 8.3% during the forecast period.

Manufacturing sectors, particularly automotive and aerospace industries, constitute the largest market segment for plasma surface treatment technologies. These industries require high-performance materials with specific surface properties to meet stringent quality and safety standards. The automotive sector alone accounts for roughly 27% of the total market share, with applications ranging from improving adhesion properties for painting and coating to enhancing wear resistance of engine components.

Electronics and semiconductor industries represent the fastest-growing segment, with a CAGR of 10.5%. The miniaturization trend in electronic devices demands precise surface modification techniques that plasma treatment can provide. Additionally, the medical device industry has shown increasing adoption rates, particularly for applications requiring biocompatible surfaces and sterilization processes.

Geographically, Asia-Pacific dominates the market with approximately 38% share, followed by North America (29%) and Europe (24%). China and South Korea have emerged as manufacturing powerhouses with substantial investments in plasma treatment technologies, while Japan leads in technological innovations for specialized applications.

Consumer demand for environmentally friendly manufacturing processes has significantly influenced market dynamics. Plasma treatment offers a more sustainable alternative to traditional chemical treatments, aligning with increasingly stringent environmental regulations worldwide. This shift has created a premium segment for eco-friendly plasma technologies, which is growing at 12% annually.

The market is also witnessing increased demand for standardized plasma treatment solutions that comply with international regulations. Companies are actively seeking technologies that meet ISO standards and industry-specific certifications, particularly in highly regulated sectors such as medical devices and aerospace. This trend has created a competitive advantage for manufacturers who can demonstrate compliance with multiple regulatory frameworks.

Small and medium enterprises (SMEs) represent an emerging market segment, driven by the development of more affordable and compact plasma treatment systems. This democratization of technology has expanded the potential application base beyond traditional large-scale manufacturing operations to include specialized production facilities and research institutions.

Manufacturing sectors, particularly automotive and aerospace industries, constitute the largest market segment for plasma surface treatment technologies. These industries require high-performance materials with specific surface properties to meet stringent quality and safety standards. The automotive sector alone accounts for roughly 27% of the total market share, with applications ranging from improving adhesion properties for painting and coating to enhancing wear resistance of engine components.

Electronics and semiconductor industries represent the fastest-growing segment, with a CAGR of 10.5%. The miniaturization trend in electronic devices demands precise surface modification techniques that plasma treatment can provide. Additionally, the medical device industry has shown increasing adoption rates, particularly for applications requiring biocompatible surfaces and sterilization processes.

Geographically, Asia-Pacific dominates the market with approximately 38% share, followed by North America (29%) and Europe (24%). China and South Korea have emerged as manufacturing powerhouses with substantial investments in plasma treatment technologies, while Japan leads in technological innovations for specialized applications.

Consumer demand for environmentally friendly manufacturing processes has significantly influenced market dynamics. Plasma treatment offers a more sustainable alternative to traditional chemical treatments, aligning with increasingly stringent environmental regulations worldwide. This shift has created a premium segment for eco-friendly plasma technologies, which is growing at 12% annually.

The market is also witnessing increased demand for standardized plasma treatment solutions that comply with international regulations. Companies are actively seeking technologies that meet ISO standards and industry-specific certifications, particularly in highly regulated sectors such as medical devices and aerospace. This trend has created a competitive advantage for manufacturers who can demonstrate compliance with multiple regulatory frameworks.

Small and medium enterprises (SMEs) represent an emerging market segment, driven by the development of more affordable and compact plasma treatment systems. This democratization of technology has expanded the potential application base beyond traditional large-scale manufacturing operations to include specialized production facilities and research institutions.

Current Technological Status and Challenges in Plasma Processing

Plasma surface treatment technology has evolved significantly over the past decades, with major advancements in both equipment capabilities and process control. Currently, the global plasma processing market is dominated by established players in North America, Europe, and East Asia, particularly Japan and South Korea. The technology has reached a mature stage in many industrial applications, including semiconductor manufacturing, automotive components, medical devices, and packaging materials.

Despite its widespread adoption, plasma surface treatment faces several critical challenges. One major obstacle is the standardization of processes across different industries and applications. The lack of universally accepted standards creates inconsistencies in treatment quality and makes it difficult for manufacturers to ensure compliance across global operations. This is particularly problematic in highly regulated industries such as medical devices and aerospace, where material performance is critical.

Another significant challenge is the complexity of plasma physics and chemistry, which makes precise control and reproducibility difficult to achieve. The interaction between plasma and substrate surfaces involves numerous parameters including gas composition, pressure, power input, treatment time, and substrate characteristics. This complexity often results in process variability that can affect product quality and performance.

Environmental and safety regulations present additional challenges for plasma processing technologies. Many traditional plasma processes utilize gases with high global warming potential or other environmental concerns. Regulatory frameworks such as the EU's REACH regulation, RoHS directive, and various national environmental protection laws are increasingly restricting the use of certain process gases and chemicals, forcing the industry to develop alternative approaches.

Energy efficiency remains a persistent challenge, as plasma generation typically requires significant power input. With growing emphasis on sustainable manufacturing practices and rising energy costs, there is increasing pressure to develop more energy-efficient plasma systems without compromising treatment effectiveness.

The geographical distribution of plasma technology expertise shows concentration in industrialized regions, with emerging economies rapidly developing capabilities. China has made substantial investments in plasma technology research and manufacturing infrastructure, while countries like India, Brazil, and parts of Southeast Asia are expanding their technological capabilities in this field.

Accessibility of plasma technology for small and medium enterprises (SMEs) represents another challenge, as high-end equipment often requires significant capital investment and specialized knowledge for operation and maintenance. This creates a technological divide that limits broader adoption across diverse manufacturing sectors.

Despite its widespread adoption, plasma surface treatment faces several critical challenges. One major obstacle is the standardization of processes across different industries and applications. The lack of universally accepted standards creates inconsistencies in treatment quality and makes it difficult for manufacturers to ensure compliance across global operations. This is particularly problematic in highly regulated industries such as medical devices and aerospace, where material performance is critical.

Another significant challenge is the complexity of plasma physics and chemistry, which makes precise control and reproducibility difficult to achieve. The interaction between plasma and substrate surfaces involves numerous parameters including gas composition, pressure, power input, treatment time, and substrate characteristics. This complexity often results in process variability that can affect product quality and performance.

Environmental and safety regulations present additional challenges for plasma processing technologies. Many traditional plasma processes utilize gases with high global warming potential or other environmental concerns. Regulatory frameworks such as the EU's REACH regulation, RoHS directive, and various national environmental protection laws are increasingly restricting the use of certain process gases and chemicals, forcing the industry to develop alternative approaches.

Energy efficiency remains a persistent challenge, as plasma generation typically requires significant power input. With growing emphasis on sustainable manufacturing practices and rising energy costs, there is increasing pressure to develop more energy-efficient plasma systems without compromising treatment effectiveness.

The geographical distribution of plasma technology expertise shows concentration in industrialized regions, with emerging economies rapidly developing capabilities. China has made substantial investments in plasma technology research and manufacturing infrastructure, while countries like India, Brazil, and parts of Southeast Asia are expanding their technological capabilities in this field.

Accessibility of plasma technology for small and medium enterprises (SMEs) represents another challenge, as high-end equipment often requires significant capital investment and specialized knowledge for operation and maintenance. This creates a technological divide that limits broader adoption across diverse manufacturing sectors.

Current Regulatory Frameworks and Compliance Solutions

01 International standards for plasma surface treatment processes

Various international standards govern plasma surface treatment processes to ensure consistency and quality across different industries. These standards specify parameters such as plasma power, treatment time, gas composition, and pressure requirements. They also outline testing methods to verify the effectiveness of plasma treatments and establish benchmarks for surface energy, adhesion properties, and contamination levels. Compliance with these standards is essential for manufacturers operating in global markets.- International standards for plasma surface treatment: Various international standards govern plasma surface treatment processes, ensuring consistency and quality across different applications. These standards define parameters for plasma treatment equipment, process validation, and quality control measures. They also establish guidelines for safety protocols and environmental considerations in plasma treatment facilities. Compliance with these standards is essential for manufacturers using plasma treatment in industries such as electronics, automotive, and medical devices.

- Regulatory compliance for plasma-treated medical devices: Medical devices that undergo plasma surface treatment are subject to specific regulatory requirements to ensure patient safety. These regulations cover aspects such as biocompatibility testing, sterilization validation, and surface characterization of plasma-treated materials. Manufacturers must demonstrate that plasma treatment processes do not introduce harmful residues or alter the safety profile of medical devices. Documentation of plasma treatment parameters and their effects on device performance is required for regulatory submissions.

- Environmental regulations for plasma processing: Plasma surface treatment processes must comply with environmental regulations regarding emissions, waste management, and resource consumption. These regulations limit the release of potentially harmful gases and byproducts from plasma systems into the atmosphere. Energy efficiency standards for plasma equipment are also increasingly important as part of sustainability initiatives. Manufacturers must implement monitoring systems to track emissions and demonstrate compliance with local and international environmental protection requirements.

- Quality control standards for plasma-treated surfaces: Quality control standards for plasma-treated surfaces establish testing methodologies and acceptance criteria for treated materials. These standards define procedures for measuring surface energy, adhesion properties, and chemical composition after plasma treatment. They also specify requirements for process repeatability and uniformity across treated surfaces. Regular calibration of plasma equipment and validation of treatment parameters are essential components of quality control programs to ensure consistent surface modification results.

- Industry-specific plasma treatment protocols: Different industries have developed specialized protocols for plasma surface treatment that address their unique requirements. The semiconductor industry has strict standards for plasma cleaning and activation processes to ensure proper adhesion and electrical performance. Automotive manufacturers have established protocols for plasma treatment of polymers before painting or bonding. The textile industry has specific guidelines for plasma modification of fabrics to enhance properties such as water repellency or dye uptake. These industry-specific protocols often become de facto standards for suppliers and manufacturers.

02 Safety regulations for plasma treatment equipment

Safety regulations for plasma treatment equipment address potential hazards associated with high voltage, radiation, and reactive gases. These regulations mandate safety features such as interlocks, emergency shut-offs, proper ventilation systems, and radiation shielding. They also specify operator training requirements, maintenance protocols, and documentation procedures. Regular inspection and certification of plasma treatment equipment are required to ensure ongoing compliance with safety standards and to protect workers from potential workplace hazards.Expand Specific Solutions03 Environmental compliance for plasma processing

Environmental regulations for plasma surface treatment focus on controlling emissions, managing waste, and reducing the environmental impact of processing chemicals. These regulations limit the release of volatile organic compounds, ozone-depleting substances, and greenhouse gases from plasma systems. They also establish protocols for the disposal of spent materials and byproducts. Manufacturers must implement monitoring systems, maintain detailed records of environmental parameters, and regularly report compliance data to regulatory authorities.Expand Specific Solutions04 Quality control standards for plasma-treated surfaces

Quality control standards for plasma-treated surfaces establish testing methodologies and acceptance criteria to ensure consistent treatment results. These standards define procedures for measuring surface energy, contact angle, adhesion strength, and coating durability. They also specify sampling frequencies, statistical process control methods, and documentation requirements. Manufacturers must implement these standards to verify that plasma-treated products meet specified performance characteristics and to maintain traceability throughout the production process.Expand Specific Solutions05 Industry-specific plasma treatment regulations

Different industries have specialized regulations for plasma surface treatment processes based on their unique requirements. In medical device manufacturing, regulations focus on biocompatibility, sterility, and material compatibility. For electronics, standards address electrostatic discharge prevention and precise cleaning parameters. Aerospace applications have stringent requirements for surface preparation before bonding or coating. Automotive industry regulations emphasize durability and corrosion resistance. These industry-specific standards often incorporate additional testing protocols and validation requirements beyond general plasma treatment standards.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The plasma surface treatment industry is currently in a growth phase, with increasing market adoption across semiconductor, medical, and industrial sectors. The global market size is estimated to exceed $2 billion, driven by demand for advanced manufacturing processes requiring precise surface modifications. Regulatory frameworks are evolving, with leading companies like Nordson Corp., Tokyo Electron Ltd., and Applied Materials establishing industry standards through technological innovation and compliance protocols. Research institutions including Swiss Federal Institute of Technology and Fraunhofer-Gesellschaft collaborate with commercial entities to develop standardized testing methodologies. The technology has reached moderate maturity in established applications, while emerging areas like medical device treatment (supported by DePuy Synthes) and advanced electronics (developed by Alps Alpine and Semtech) are driving new regulatory considerations for safety, environmental impact, and process validation.

Nordson Corp.

Technical Solution: Nordson has developed the MARCH MediVac™ plasma treatment system specifically designed to meet medical device manufacturing standards, including ISO 13485 and FDA 21 CFR Part 820 requirements. Their plasma systems incorporate process validation protocols that align with GAMP 5 (Good Automated Manufacturing Practice) guidelines, ensuring consistent quality in regulated industries. Nordson's plasma treatment equipment features closed-loop control systems that maintain process parameters within validated ranges, supporting compliance with various product-specific standards such as ASTM F1147 for medical device surface treatments. Their documentation and traceability systems enable manufacturers to demonstrate compliance with EU Medical Device Regulation (MDR) and similar regulatory frameworks. Nordson has implemented a comprehensive Environmental Management System certified to ISO 14001 standards across their plasma treatment equipment manufacturing facilities, ensuring that both production processes and the equipment itself meet environmental regulations.

Strengths: Exceptional focus on medical and pharmaceutical regulatory compliance, strong documentation systems for validation, and specialized expertise in regulated industries. Weakness: More limited applications in semiconductor manufacturing compared to competitors, and higher costs associated with medical-grade compliance features that may not be necessary for all industrial applications.

Tokyo Electron Ltd.

Technical Solution: Tokyo Electron (TEL) has pioneered regulatory-compliant plasma surface treatment technologies through their Tactras™ platform, which adheres to both Japanese Industrial Standards (JIS) and international regulations. Their systems implement plasma process control that meets SEMI F47 standards while incorporating safety features compliant with IEC 60204-1. TEL's plasma treatment equipment features advanced emissions control systems that comply with the strictest environmental regulations, including the EU's Restriction of Hazardous Substances (RoHS) directive and various regional air quality standards. Their plasma chambers are designed with materials that meet FDA biocompatibility requirements (21 CFR Part 820) for medical device manufacturing applications. TEL has developed a proprietary "Green Plasma" technology that reduces perfluorocompound (PFC) emissions by over 95%, exceeding the requirements of the World Semiconductor Council's PFC reduction goals and the Kyoto Protocol targets for semiconductor manufacturing.

Strengths: Industry-leading emissions control technology, strong compliance with Asian regulatory frameworks (particularly Japanese standards), and excellent documentation systems for regulatory audits. Weakness: More limited presence in European regulatory environments compared to North American standards, and higher operational costs for maintaining compliance across multiple regulatory jurisdictions.

Critical Patents and Technical Literature in Plasma Treatment

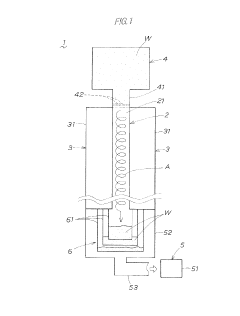

Plasma surface treatment method and plasma surface treatment apparatus

PatentActiveJPWO2018179344A1

Innovation

- A plasma surface treatment method using a tubular passage with a plasmatized processing gas flow intersecting the object's direction, ensuring thorough contact and treatment within a tubular passage.

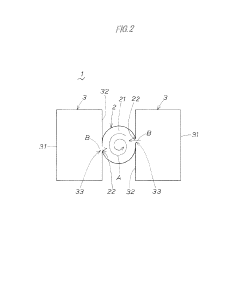

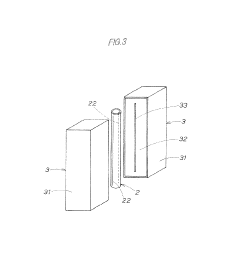

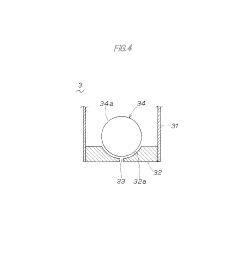

An apparatus for plasma treatment

PatentInactiveEP1716727A1

Innovation

- An apparatus comprising a plasma source, a plasma-control electrode, and a drive mechanism for relative movement between the plasma source and the substrate, allowing for controlled plasma treatment. The plasma-control electrode facilitates uniform or non-uniform surface treatment by controlling plasma energy distribution, and a guard wall confines the plasma to improve treatment quality.

Environmental Impact and Sustainability Considerations

Plasma surface treatment processes, while offering significant technological advantages, present notable environmental challenges that must be addressed through comprehensive sustainability frameworks. The energy consumption of plasma systems represents a primary environmental concern, with high-voltage equipment and vacuum systems requiring substantial electrical input. Recent industry benchmarks indicate that modern plasma treatment facilities consume between 50-200 kWh per production cycle, highlighting the need for energy efficiency improvements to reduce carbon footprints.

Process emissions constitute another critical environmental factor, as plasma treatments can generate volatile organic compounds (VOCs), ozone, and nitrogen oxides depending on the specific process parameters and working gases. Regulatory frameworks in the EU, particularly the Industrial Emissions Directive (2010/75/EU), have established increasingly stringent emission thresholds for these substances, necessitating advanced abatement technologies such as catalytic converters and thermal oxidizers to ensure compliance.

Water usage and contamination risks also merit careful consideration, especially in wet chemical post-treatment processes that often follow plasma modification. Closed-loop water recycling systems have demonstrated reduction potential of up to 80% in water consumption when properly implemented, representing a significant sustainability advancement in the industry. Additionally, the chemical precursors used in plasma-enhanced chemical vapor deposition (PECVD) and similar processes may present toxicity concerns requiring proper handling and disposal protocols.

Life cycle assessment (LCA) studies comparing plasma treatments to conventional surface modification techniques have revealed promising sustainability advantages. Research published in the Journal of Cleaner Production (2019) demonstrated that plasma treatments can reduce overall environmental impact by 30-45% compared to traditional wet chemical processes when considering the complete product lifecycle, primarily due to reduced chemical consumption and waste generation.

The transition toward more sustainable plasma technologies is evidenced by recent innovations in atmospheric pressure plasma systems that eliminate the need for energy-intensive vacuum equipment. These systems have shown energy efficiency improvements of up to 60% compared to traditional vacuum-based approaches while maintaining comparable surface treatment quality. Furthermore, the development of pulsed plasma technologies has demonstrated potential for reducing power consumption by 25-40% through optimized duty cycles that minimize continuous energy input requirements.

Industry leaders are increasingly adopting circular economy principles in plasma equipment design, with modular construction approaches that facilitate component replacement and recycling at end-of-life. This design philosophy, combined with extended equipment lifespans through predictive maintenance protocols, represents a holistic approach to sustainability that addresses both operational and embodied environmental impacts in plasma surface treatment technologies.

Process emissions constitute another critical environmental factor, as plasma treatments can generate volatile organic compounds (VOCs), ozone, and nitrogen oxides depending on the specific process parameters and working gases. Regulatory frameworks in the EU, particularly the Industrial Emissions Directive (2010/75/EU), have established increasingly stringent emission thresholds for these substances, necessitating advanced abatement technologies such as catalytic converters and thermal oxidizers to ensure compliance.

Water usage and contamination risks also merit careful consideration, especially in wet chemical post-treatment processes that often follow plasma modification. Closed-loop water recycling systems have demonstrated reduction potential of up to 80% in water consumption when properly implemented, representing a significant sustainability advancement in the industry. Additionally, the chemical precursors used in plasma-enhanced chemical vapor deposition (PECVD) and similar processes may present toxicity concerns requiring proper handling and disposal protocols.

Life cycle assessment (LCA) studies comparing plasma treatments to conventional surface modification techniques have revealed promising sustainability advantages. Research published in the Journal of Cleaner Production (2019) demonstrated that plasma treatments can reduce overall environmental impact by 30-45% compared to traditional wet chemical processes when considering the complete product lifecycle, primarily due to reduced chemical consumption and waste generation.

The transition toward more sustainable plasma technologies is evidenced by recent innovations in atmospheric pressure plasma systems that eliminate the need for energy-intensive vacuum equipment. These systems have shown energy efficiency improvements of up to 60% compared to traditional vacuum-based approaches while maintaining comparable surface treatment quality. Furthermore, the development of pulsed plasma technologies has demonstrated potential for reducing power consumption by 25-40% through optimized duty cycles that minimize continuous energy input requirements.

Industry leaders are increasingly adopting circular economy principles in plasma equipment design, with modular construction approaches that facilitate component replacement and recycling at end-of-life. This design philosophy, combined with extended equipment lifespans through predictive maintenance protocols, represents a holistic approach to sustainability that addresses both operational and embodied environmental impacts in plasma surface treatment technologies.

International Standards Harmonization and Certification Processes

The harmonization of international standards for plasma surface treatment processes represents a complex yet essential endeavor in today's globalized manufacturing landscape. Currently, several key standardization bodies govern this domain, including the International Organization for Standardization (ISO), ASTM International, and the International Electrotechnical Commission (IEC). These organizations have developed frameworks such as ISO 10993 for biomedical applications and ISO 4287 for surface roughness parameters, which are particularly relevant to plasma-treated surfaces.

The certification process for plasma treatment technologies typically follows a multi-stage approach. Initially, manufacturers must identify applicable standards based on their specific application domain and target markets. This is followed by rigorous testing procedures to verify compliance with these standards, often requiring specialized equipment and methodologies to measure surface energy, chemical composition, and durability of treated surfaces.

Regional variations in standards present significant challenges for global manufacturers. The European Union enforces the CE marking system, which includes specific requirements for plasma-treated medical devices under the Medical Device Regulation (MDR). Meanwhile, the United States FDA has its own regulatory framework, particularly stringent for plasma-treated surfaces in medical and food contact applications. Asian markets, especially Japan and China, maintain distinct certification requirements that often necessitate additional testing and documentation.

Mutual Recognition Agreements (MRAs) have emerged as valuable tools for reducing redundant testing requirements across different jurisdictions. These agreements allow conformity assessments performed in one region to be accepted in another, significantly streamlining the certification process. Notable examples include the EU-US MRA for medical devices and the Pacific Accreditation Cooperation (PAC) arrangements.

Recent trends indicate movement toward greater harmonization of plasma treatment standards globally. The ISO/TC 201 technical committee on surface chemical analysis has been instrumental in developing unified testing methodologies specifically applicable to plasma-treated surfaces. Additionally, industry consortia like the Plasma Surface Engineering Alliance have been working to establish common terminology and testing protocols across different application sectors.

For manufacturers, navigating this complex landscape requires a strategic approach to standards compliance. Developing a comprehensive regulatory roadmap early in product development can prevent costly redesigns and market access delays. Engagement with standards development organizations through technical committees offers opportunities to influence emerging standards and gain early insight into regulatory trends affecting plasma surface treatment technologies.

The certification process for plasma treatment technologies typically follows a multi-stage approach. Initially, manufacturers must identify applicable standards based on their specific application domain and target markets. This is followed by rigorous testing procedures to verify compliance with these standards, often requiring specialized equipment and methodologies to measure surface energy, chemical composition, and durability of treated surfaces.

Regional variations in standards present significant challenges for global manufacturers. The European Union enforces the CE marking system, which includes specific requirements for plasma-treated medical devices under the Medical Device Regulation (MDR). Meanwhile, the United States FDA has its own regulatory framework, particularly stringent for plasma-treated surfaces in medical and food contact applications. Asian markets, especially Japan and China, maintain distinct certification requirements that often necessitate additional testing and documentation.

Mutual Recognition Agreements (MRAs) have emerged as valuable tools for reducing redundant testing requirements across different jurisdictions. These agreements allow conformity assessments performed in one region to be accepted in another, significantly streamlining the certification process. Notable examples include the EU-US MRA for medical devices and the Pacific Accreditation Cooperation (PAC) arrangements.

Recent trends indicate movement toward greater harmonization of plasma treatment standards globally. The ISO/TC 201 technical committee on surface chemical analysis has been instrumental in developing unified testing methodologies specifically applicable to plasma-treated surfaces. Additionally, industry consortia like the Plasma Surface Engineering Alliance have been working to establish common terminology and testing protocols across different application sectors.

For manufacturers, navigating this complex landscape requires a strategic approach to standards compliance. Developing a comprehensive regulatory roadmap early in product development can prevent costly redesigns and market access delays. Engagement with standards development organizations through technical committees offers opportunities to influence emerging standards and gain early insight into regulatory trends affecting plasma surface treatment technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!