Investigating Plasma Technology Patents and Their Applications

OCT 14, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma Technology Evolution and Research Objectives

Plasma technology has evolved significantly since its initial discovery in the late 19th century. Sir William Crookes first identified plasma as the "fourth state of matter" in 1879, but practical applications remained limited until the mid-20th century. The development trajectory accelerated dramatically after World War II, with significant breakthroughs in plasma physics leading to applications in various industries including semiconductor manufacturing, materials processing, and energy generation.

The 1970s marked a pivotal era with the emergence of plasma etching techniques that revolutionized microelectronics fabrication. This period established plasma as a cornerstone technology in the semiconductor industry, enabling the miniaturization trend that continues to drive computing advances today. The 1990s witnessed further diversification with plasma applications expanding into environmental remediation, medical treatments, and advanced materials synthesis.

Recent technological evolution has focused on precision control of plasma parameters, enabling highly selective surface modifications at the nanoscale. Low-temperature atmospheric pressure plasma technologies have emerged as particularly promising, offering energy-efficient processing without vacuum requirements. These developments have opened new application domains in biomedicine, agriculture, and food safety that were previously inaccessible due to thermal constraints.

Patent activity in plasma technology demonstrates a consistent upward trajectory, with notable acceleration in the past decade. Analysis reveals geographic concentration in innovation hubs across North America, East Asia, and Europe, with emerging contributions from research institutions in developing economies. The patent landscape indicates a shift from fundamental plasma generation patents toward application-specific innovations targeting niche industrial problems.

The primary research objectives in this field now center on addressing several key challenges: enhancing energy efficiency of plasma systems, developing precise control mechanisms for plasma-surface interactions, extending operational lifetimes of plasma-facing components, and establishing standardized characterization methodologies for plasma processes. These objectives align with broader industrial demands for sustainable manufacturing technologies and advanced material functionalization.

This technical investigation aims to comprehensively map the plasma technology patent landscape, identify emerging application trends, assess technological readiness levels across different sectors, and forecast potential breakthrough areas. The analysis will prioritize patents with cross-industry applicability and those addressing critical manufacturing bottlenecks. Special attention will be given to innovations that demonstrate potential for significant cost reduction or performance enhancement in established plasma applications.

The 1970s marked a pivotal era with the emergence of plasma etching techniques that revolutionized microelectronics fabrication. This period established plasma as a cornerstone technology in the semiconductor industry, enabling the miniaturization trend that continues to drive computing advances today. The 1990s witnessed further diversification with plasma applications expanding into environmental remediation, medical treatments, and advanced materials synthesis.

Recent technological evolution has focused on precision control of plasma parameters, enabling highly selective surface modifications at the nanoscale. Low-temperature atmospheric pressure plasma technologies have emerged as particularly promising, offering energy-efficient processing without vacuum requirements. These developments have opened new application domains in biomedicine, agriculture, and food safety that were previously inaccessible due to thermal constraints.

Patent activity in plasma technology demonstrates a consistent upward trajectory, with notable acceleration in the past decade. Analysis reveals geographic concentration in innovation hubs across North America, East Asia, and Europe, with emerging contributions from research institutions in developing economies. The patent landscape indicates a shift from fundamental plasma generation patents toward application-specific innovations targeting niche industrial problems.

The primary research objectives in this field now center on addressing several key challenges: enhancing energy efficiency of plasma systems, developing precise control mechanisms for plasma-surface interactions, extending operational lifetimes of plasma-facing components, and establishing standardized characterization methodologies for plasma processes. These objectives align with broader industrial demands for sustainable manufacturing technologies and advanced material functionalization.

This technical investigation aims to comprehensively map the plasma technology patent landscape, identify emerging application trends, assess technological readiness levels across different sectors, and forecast potential breakthrough areas. The analysis will prioritize patents with cross-industry applicability and those addressing critical manufacturing bottlenecks. Special attention will be given to innovations that demonstrate potential for significant cost reduction or performance enhancement in established plasma applications.

Market Applications and Demand Analysis for Plasma Technologies

The global plasma technology market has witnessed substantial growth in recent years, driven by increasing applications across diverse industries. Current market valuations place the plasma technology sector at approximately $22 billion, with projections indicating a compound annual growth rate of 5.8% through 2028. This growth trajectory is supported by expanding applications in semiconductor manufacturing, medical devices, surface modification, and environmental remediation.

In the semiconductor industry, plasma technologies have become indispensable for etching and deposition processes. The continuous miniaturization of electronic components, following Moore's Law, has intensified demand for precise plasma-based manufacturing techniques. Market analysis reveals that approximately 70% of critical steps in advanced semiconductor fabrication now rely on plasma processes, creating a sustained demand for innovation in this sector.

The healthcare sector represents another significant market for plasma technologies. Plasma sterilization systems for medical equipment have gained prominence due to their effectiveness against resistant pathogens and reduced environmental impact compared to chemical alternatives. Additionally, plasma medicine applications, including wound healing and cancer treatment, are emerging as promising growth segments with increasing clinical validation supporting their efficacy.

Environmental applications constitute a rapidly expanding market for plasma technologies. Plasma-based water treatment systems address growing concerns about pharmaceutical residues and persistent organic pollutants that conventional treatment methods struggle to remove. Similarly, plasma systems for air purification and industrial emission control are experiencing increased adoption due to stricter environmental regulations worldwide and growing public awareness about air quality.

Material processing represents another substantial market segment. Plasma surface modification technologies enable manufacturers to enhance material properties without altering bulk characteristics, creating value across industries from automotive to packaging. The textile industry has also embraced plasma treatments for developing functional fabrics with water-repellent, antimicrobial, or flame-retardant properties.

Regional analysis indicates that Asia-Pacific currently dominates the plasma technology market, accounting for approximately 45% of global demand, primarily driven by the region's robust semiconductor and electronics manufacturing sectors. North America and Europe follow with significant market shares, with Europe showing particular strength in plasma-based environmental technologies and medical applications.

Consumer demand trends suggest growing interest in sustainable manufacturing processes, creating opportunities for plasma technologies that reduce chemical usage and waste generation. This alignment with broader sustainability goals positions plasma technologies favorably in the evolving regulatory landscape focused on reducing environmental impacts across industrial processes.

In the semiconductor industry, plasma technologies have become indispensable for etching and deposition processes. The continuous miniaturization of electronic components, following Moore's Law, has intensified demand for precise plasma-based manufacturing techniques. Market analysis reveals that approximately 70% of critical steps in advanced semiconductor fabrication now rely on plasma processes, creating a sustained demand for innovation in this sector.

The healthcare sector represents another significant market for plasma technologies. Plasma sterilization systems for medical equipment have gained prominence due to their effectiveness against resistant pathogens and reduced environmental impact compared to chemical alternatives. Additionally, plasma medicine applications, including wound healing and cancer treatment, are emerging as promising growth segments with increasing clinical validation supporting their efficacy.

Environmental applications constitute a rapidly expanding market for plasma technologies. Plasma-based water treatment systems address growing concerns about pharmaceutical residues and persistent organic pollutants that conventional treatment methods struggle to remove. Similarly, plasma systems for air purification and industrial emission control are experiencing increased adoption due to stricter environmental regulations worldwide and growing public awareness about air quality.

Material processing represents another substantial market segment. Plasma surface modification technologies enable manufacturers to enhance material properties without altering bulk characteristics, creating value across industries from automotive to packaging. The textile industry has also embraced plasma treatments for developing functional fabrics with water-repellent, antimicrobial, or flame-retardant properties.

Regional analysis indicates that Asia-Pacific currently dominates the plasma technology market, accounting for approximately 45% of global demand, primarily driven by the region's robust semiconductor and electronics manufacturing sectors. North America and Europe follow with significant market shares, with Europe showing particular strength in plasma-based environmental technologies and medical applications.

Consumer demand trends suggest growing interest in sustainable manufacturing processes, creating opportunities for plasma technologies that reduce chemical usage and waste generation. This alignment with broader sustainability goals positions plasma technologies favorably in the evolving regulatory landscape focused on reducing environmental impacts across industrial processes.

Global Plasma Technology Landscape and Technical Barriers

Plasma technology has experienced significant global development over the past decades, with varying levels of advancement across different regions. North America, particularly the United States, maintains leadership in plasma-based semiconductor manufacturing and fusion energy research, hosting major facilities like the Princeton Plasma Physics Laboratory. The European Union demonstrates strength in industrial plasma applications and medical plasma technologies, with Germany, France, and the UK serving as innovation hubs.

Asia has emerged as a formidable competitor, with Japan excelling in plasma display technology and semiconductor processing, while South Korea focuses on consumer electronics applications. China has rapidly expanded its plasma technology capabilities, particularly in materials processing and environmental applications, investing heavily in research infrastructure and talent development.

Despite these advancements, the plasma technology field faces several critical technical barriers. Plasma stability and control remain fundamental challenges, especially in fusion energy applications where maintaining stable plasma confinement at extreme temperatures presents significant engineering difficulties. The development of suitable materials capable of withstanding plasma's harsh conditions constitutes another major obstacle, as existing materials often degrade rapidly under plasma exposure.

Energy efficiency represents a persistent challenge, with many plasma processes requiring substantial power inputs that limit commercial viability. The scaling of laboratory plasma technologies to industrial applications frequently encounters difficulties in maintaining consistent plasma properties across larger volumes or higher throughputs. Additionally, precise plasma diagnostics and monitoring systems need improvement to enable real-time control and optimization.

Regulatory frameworks and safety standards vary significantly across regions, creating compliance challenges for global technology deployment. The interdisciplinary nature of plasma technology necessitates collaboration between physics, materials science, electrical engineering, and other fields, which can impede rapid innovation due to communication barriers.

Cost factors remain a significant impediment to widespread adoption, particularly for emerging applications like plasma medicine and environmental remediation. High initial equipment investments and operational expenses often delay market penetration despite promising technical results. The specialized knowledge required for plasma system operation and maintenance further restricts adoption in many potential application areas.

Addressing these technical barriers requires coordinated international research efforts, increased public-private partnerships, and targeted funding initiatives to overcome the fundamental challenges limiting plasma technology's full potential across various industries.

Asia has emerged as a formidable competitor, with Japan excelling in plasma display technology and semiconductor processing, while South Korea focuses on consumer electronics applications. China has rapidly expanded its plasma technology capabilities, particularly in materials processing and environmental applications, investing heavily in research infrastructure and talent development.

Despite these advancements, the plasma technology field faces several critical technical barriers. Plasma stability and control remain fundamental challenges, especially in fusion energy applications where maintaining stable plasma confinement at extreme temperatures presents significant engineering difficulties. The development of suitable materials capable of withstanding plasma's harsh conditions constitutes another major obstacle, as existing materials often degrade rapidly under plasma exposure.

Energy efficiency represents a persistent challenge, with many plasma processes requiring substantial power inputs that limit commercial viability. The scaling of laboratory plasma technologies to industrial applications frequently encounters difficulties in maintaining consistent plasma properties across larger volumes or higher throughputs. Additionally, precise plasma diagnostics and monitoring systems need improvement to enable real-time control and optimization.

Regulatory frameworks and safety standards vary significantly across regions, creating compliance challenges for global technology deployment. The interdisciplinary nature of plasma technology necessitates collaboration between physics, materials science, electrical engineering, and other fields, which can impede rapid innovation due to communication barriers.

Cost factors remain a significant impediment to widespread adoption, particularly for emerging applications like plasma medicine and environmental remediation. High initial equipment investments and operational expenses often delay market penetration despite promising technical results. The specialized knowledge required for plasma system operation and maintenance further restricts adoption in many potential application areas.

Addressing these technical barriers requires coordinated international research efforts, increased public-private partnerships, and targeted funding initiatives to overcome the fundamental challenges limiting plasma technology's full potential across various industries.

Current Plasma Technology Solutions and Implementation Methods

01 Plasma technology in semiconductor manufacturing

Plasma technology is widely used in semiconductor manufacturing processes, including etching, deposition, and surface modification. These processes utilize plasma to create precise patterns on semiconductor wafers, deposit thin films, and modify surface properties. The controlled plasma environment allows for nanoscale precision in fabrication, which is essential for modern electronic devices.- Plasma technology in semiconductor manufacturing: Plasma technology is widely used in semiconductor manufacturing processes, including etching, deposition, and surface modification. These processes utilize plasma to create precise patterns on semiconductor wafers, deposit thin films, and modify surface properties. The technology enables the production of smaller, more efficient electronic components and devices with improved performance characteristics.

- Plasma-based waste treatment and environmental applications: Plasma technology is employed for waste treatment and environmental applications, including the decomposition of hazardous substances, air purification, and water treatment. The high-energy plasma can break down complex organic compounds, destroy pathogens, and neutralize pollutants. These applications leverage the reactive species generated in plasma to provide efficient and environmentally friendly solutions for waste management and pollution control.

- Plasma technology in medical and biological applications: Plasma technology has significant applications in medical and biological fields, including sterilization, wound healing, cancer treatment, and tissue engineering. Cold atmospheric plasma can be used to kill bacteria without damaging surrounding tissues, promote wound healing through stimulation of cell proliferation, and selectively target cancer cells. These medical applications utilize the unique properties of plasma to provide novel therapeutic approaches.

- Plasma-based surface modification and coating technologies: Plasma technology is utilized for surface modification and coating applications across various industries. Plasma treatments can alter surface properties such as wettability, adhesion, and hardness without affecting bulk material properties. Plasma-enhanced chemical vapor deposition (PECVD) enables the creation of thin films with specific properties at lower temperatures than conventional methods. These technologies improve product performance and durability in industries ranging from automotive to textiles.

- Plasma technology in financial and business systems: Plasma technology concepts are being applied to financial and business systems, particularly in data processing, transaction management, and security applications. These systems utilize distributed processing architectures inspired by plasma physics principles to handle large volumes of transactions efficiently. The technology enables secure, scalable, and high-performance financial platforms that can process complex transactions while maintaining data integrity and security.

02 Plasma-based surface treatment systems

Plasma technology is employed for surface treatment of various materials, enhancing properties such as adhesion, wettability, and biocompatibility. These systems use low-temperature plasma to modify surface characteristics without affecting the bulk properties of the material. Applications include medical device manufacturing, textile processing, and automotive components where surface properties are critical for performance.Expand Specific Solutions03 Plasma technology in waste treatment and environmental applications

Plasma systems are utilized for waste treatment, air purification, and water treatment applications. These technologies leverage the high-energy plasma state to break down pollutants, hazardous compounds, and biological contaminants. The process can convert waste materials into syngas or other valuable byproducts while reducing environmental impact compared to conventional treatment methods.Expand Specific Solutions04 Plasma technology in financial and transaction systems

Innovative applications of plasma technology principles have been adapted for financial technology systems, including transaction processing, security protocols, and data management. These systems utilize concepts from plasma physics for developing secure, efficient financial platforms that can handle high-volume transactions while maintaining data integrity and security.Expand Specific Solutions05 Plasma-based medical and therapeutic devices

Plasma technology is applied in medical devices for sterilization, wound healing, and therapeutic treatments. These devices generate controlled plasma that can inactivate pathogens, stimulate tissue regeneration, and provide targeted therapy. Cold atmospheric plasma specifically allows for treatment of heat-sensitive tissues and has shown promise in dermatology, dentistry, and cancer treatment applications.Expand Specific Solutions

Leading Companies and Research Institutions in Plasma Technology

The plasma technology market is currently in a growth phase, characterized by increasing applications across semiconductor manufacturing, medical devices, and environmental sectors. The global market size is expanding rapidly, driven by demand for advanced semiconductor processing equipment and innovative medical treatments. In terms of technical maturity, established players like Tokyo Electron, Applied Materials, and Lam Research dominate the semiconductor plasma equipment segment with mature technologies, while companies such as CAPS Medical and AcouSort represent emerging applications in healthcare. The competitive landscape shows a geographic concentration in Japan and the United States, with increasing participation from Chinese entities like Jiangsu Leuven Instrument. Research institutions including Technion, University of Technology Sydney, and Nagoya University are advancing fundamental plasma science, indicating continued innovation potential in this field.

Tokyo Electron Ltd.

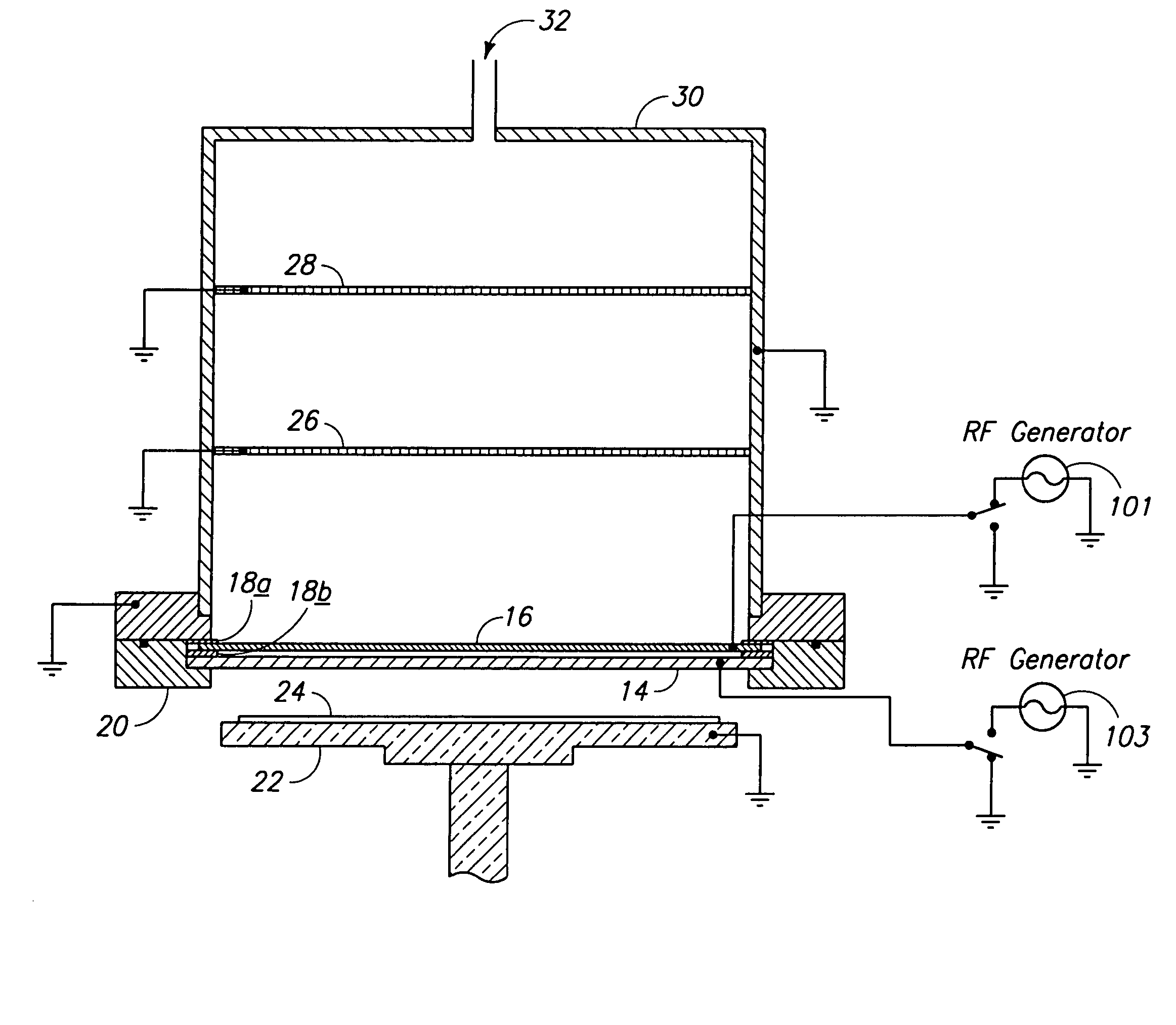

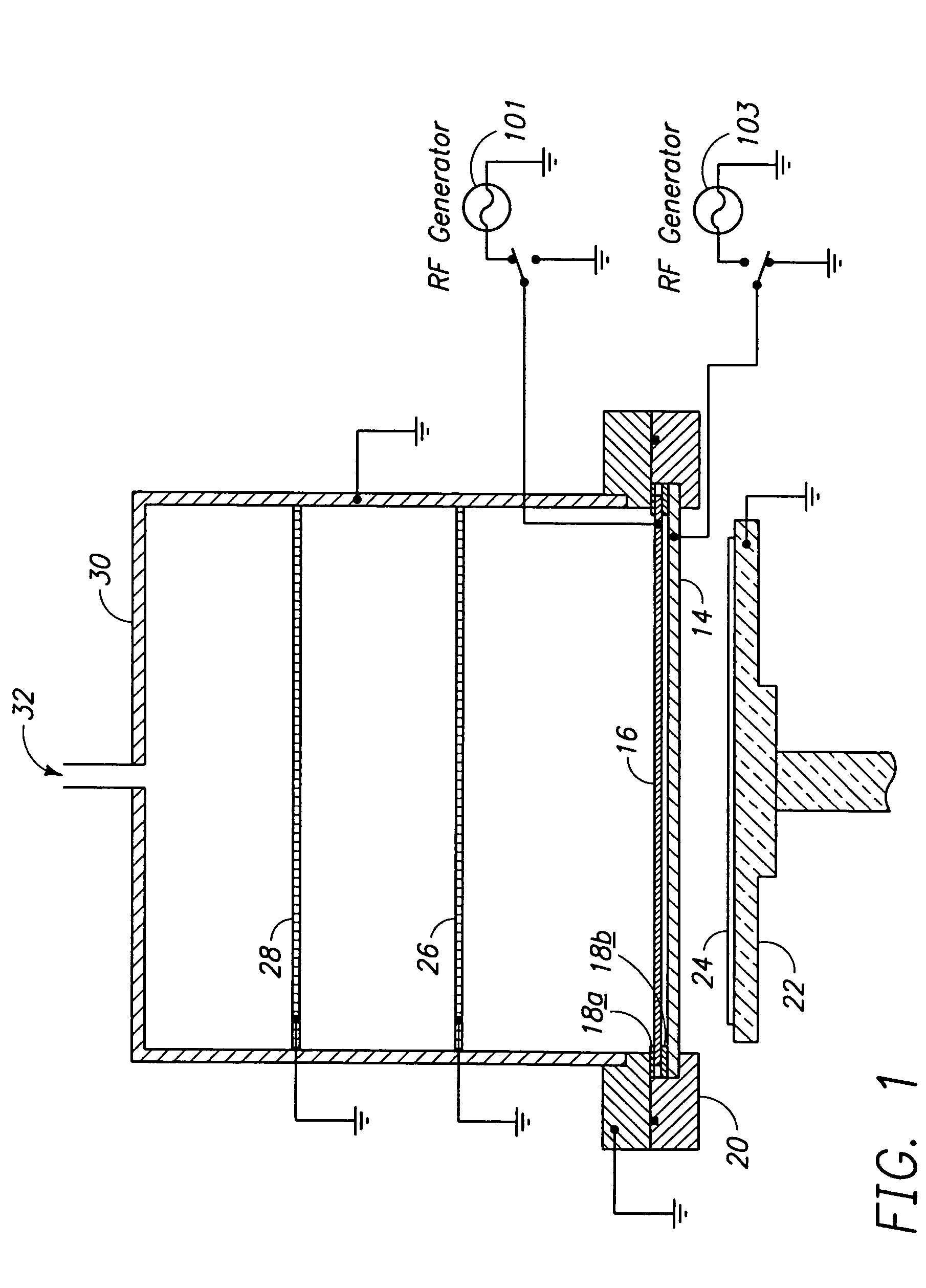

Technical Solution: Tokyo Electron (TEL) has developed advanced plasma etching and deposition technologies for semiconductor manufacturing. Their TACTRAS™ platform utilizes high-density plasma sources with precise radio frequency (RF) power control to achieve nanometer-scale etching precision. TEL's plasma technology incorporates multi-frequency capacitively coupled plasma (CCP) systems that enable independent control of ion energy and plasma density, critical for advanced node processing. Their Tactras™ Flex system specifically employs a unique dual-frequency RF matching network that optimizes plasma stability while processing 300mm wafers[1]. TEL has also pioneered plasma-enhanced atomic layer deposition (PE-ALD) techniques that combine plasma activation with traditional ALD to enable lower temperature processing and improved film quality for high-aspect-ratio structures in advanced logic and memory devices[3].

Strengths: Superior process control with multi-frequency capabilities allowing independent optimization of plasma characteristics; excellent uniformity across large wafers; high throughput for production environments. Weaknesses: Higher system complexity requiring sophisticated control systems; potentially higher cost of ownership compared to simpler plasma systems; requires specialized expertise for operation and maintenance.

Lam Research Corp.

Technical Solution: Lam Research has developed the Sense.i™ plasma etch platform that incorporates advanced RF power delivery systems with real-time feedback control. Their technology utilizes a proprietary Transformer Coupled Plasma (TCP) source that generates high-density, low-pressure plasma with exceptional uniformity across the wafer surface. Lam's plasma systems feature multi-zone gas distribution technology that enables precise control of plasma chemistry across different regions of the wafer[2]. Their patented RF pulsing techniques allow for enhanced etch selectivity and reduced damage to sensitive device structures. Lam has also pioneered atomic layer etching (ALE) processes using plasma technology that enables atomic-scale precision in material removal, critical for fabricating devices at sub-5nm nodes[4]. Their systems incorporate advanced endpoint detection using optical emission spectroscopy and RF impedance monitoring to precisely control process termination[5].

Strengths: Industry-leading plasma uniformity control; advanced pulsed plasma capabilities for enhanced selectivity; sophisticated real-time monitoring and control systems; excellent process repeatability. Weaknesses: Complex system architecture requiring specialized maintenance; higher initial capital investment; potentially longer process development cycles for new applications.

Key Patent Analysis and Technical Innovations in Plasma Field

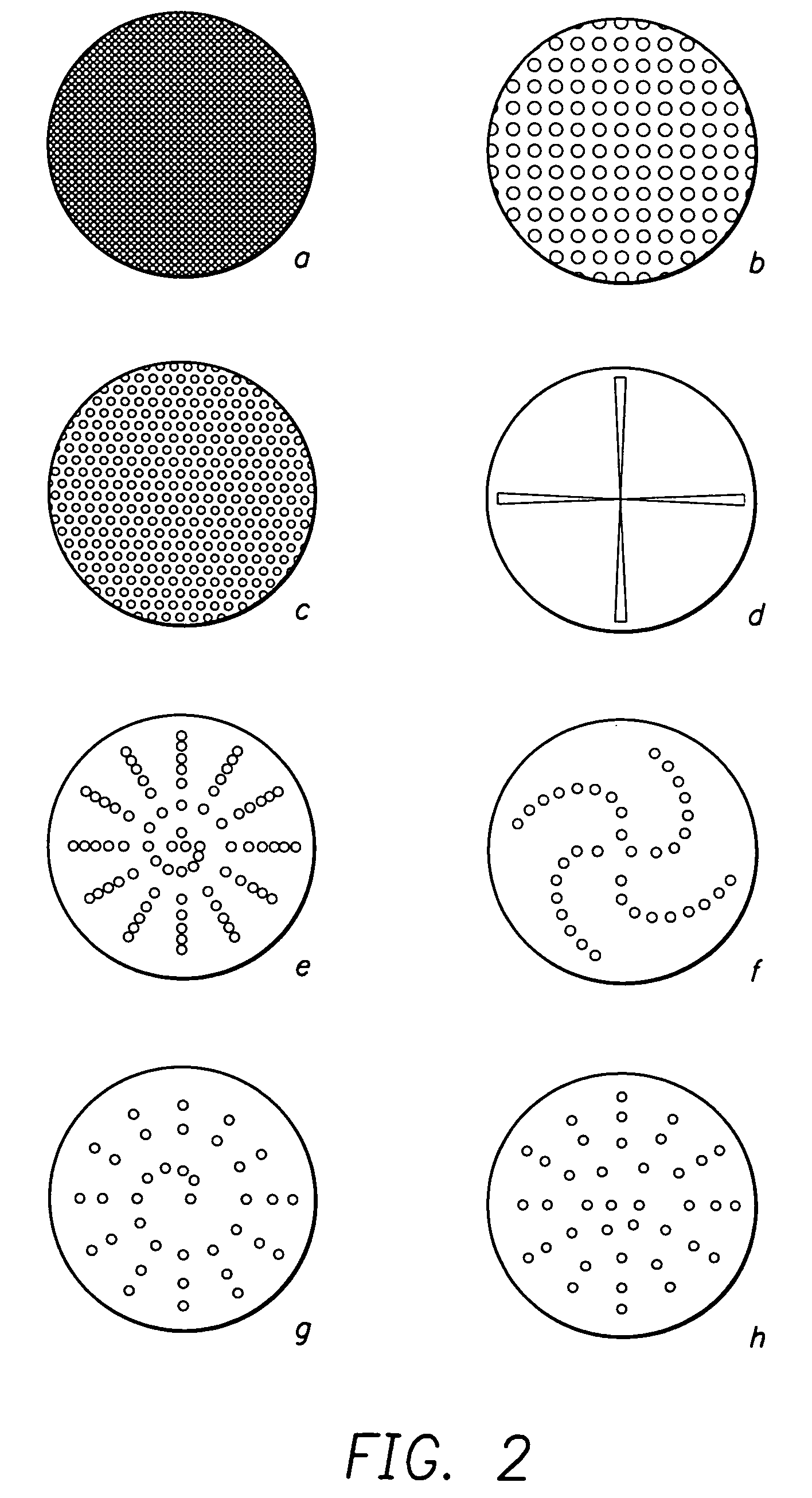

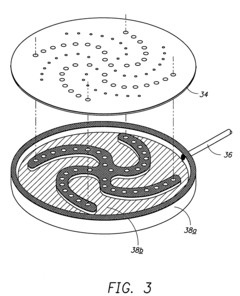

Image-based digital control of plasma processing

PatentWO2022164661A1

Innovation

- Implementing a digital process control system that uses a processing device to receive and adjust plasma exposure values for individual plasma elements, allowing for independent activation and deactivation of plasma cells to expose substrates to plasma fluxes with precise duration control, enabling local and time-dependent exposure of plasma related fluxes.

Method of processing a substrate

PatentInactiveUS20050093458A1

Innovation

- A plasma flow device design that generates a uniform plasma flux over a large area by using a housing with insulated electrodes and a signal generator to excite ions in a gas flow, allowing for operation at pressures ranging from 10 to 1000 Torr, confining reactive species to the treatment area and minimizing ion impact.

Intellectual Property Strategy and Patent Portfolio Management

Effective intellectual property management is crucial for companies investing in plasma technology research and development. A comprehensive IP strategy should begin with a thorough patent landscape analysis to identify existing patents, their owners, and potential white spaces for innovation. This analysis reveals that plasma technology patents are concentrated in several key jurisdictions including the United States, Japan, Germany, and increasingly China, with specialized applications across medical devices, semiconductor manufacturing, and environmental remediation sectors.

Organizations should adopt a strategic approach to patent portfolio development by focusing on both defensive and offensive patent strategies. Defensively, companies need to secure core technology patents that protect fundamental plasma generation methods, control systems, and application-specific implementations. Offensively, strategic patenting around competitors' technologies can create freedom to operate and potential licensing opportunities.

Patent quality should be prioritized over quantity, with emphasis on claims that cover commercially viable applications and future technology directions. For plasma technology specifically, patents that address energy efficiency improvements, novel electrode designs, and specialized plasma chemistry formulations tend to provide stronger competitive advantages and licensing potential.

Cross-licensing agreements have become increasingly important in the plasma technology sector, particularly at the intersection with semiconductor manufacturing and medical applications. Companies should identify potential licensing partners early and develop patents with licensing value in mind, focusing on technologies that complement rather than directly compete with potential partners' offerings.

Geographic filing strategies should be tailored to market opportunities, with consideration for both manufacturing locations and end-user markets. For plasma technologies with environmental applications, emerging markets with growing environmental regulations present valuable patent protection opportunities.

Regular portfolio reviews are essential to maintain alignment with business objectives. This includes pruning low-value patents to reduce maintenance costs and identifying gaps that require additional R&D investment. Companies should establish clear metrics for evaluating patent value, including technical relevance, market applicability, and legal strength.

Finally, organizations should develop internal processes to capture innovations effectively, including inventor incentive programs and IP awareness training. For plasma technology specifically, cross-functional collaboration between physicists, engineers, and application specialists often yields the most valuable patentable innovations at the intersection of fundamental science and practical implementation.

Organizations should adopt a strategic approach to patent portfolio development by focusing on both defensive and offensive patent strategies. Defensively, companies need to secure core technology patents that protect fundamental plasma generation methods, control systems, and application-specific implementations. Offensively, strategic patenting around competitors' technologies can create freedom to operate and potential licensing opportunities.

Patent quality should be prioritized over quantity, with emphasis on claims that cover commercially viable applications and future technology directions. For plasma technology specifically, patents that address energy efficiency improvements, novel electrode designs, and specialized plasma chemistry formulations tend to provide stronger competitive advantages and licensing potential.

Cross-licensing agreements have become increasingly important in the plasma technology sector, particularly at the intersection with semiconductor manufacturing and medical applications. Companies should identify potential licensing partners early and develop patents with licensing value in mind, focusing on technologies that complement rather than directly compete with potential partners' offerings.

Geographic filing strategies should be tailored to market opportunities, with consideration for both manufacturing locations and end-user markets. For plasma technologies with environmental applications, emerging markets with growing environmental regulations present valuable patent protection opportunities.

Regular portfolio reviews are essential to maintain alignment with business objectives. This includes pruning low-value patents to reduce maintenance costs and identifying gaps that require additional R&D investment. Companies should establish clear metrics for evaluating patent value, including technical relevance, market applicability, and legal strength.

Finally, organizations should develop internal processes to capture innovations effectively, including inventor incentive programs and IP awareness training. For plasma technology specifically, cross-functional collaboration between physicists, engineers, and application specialists often yields the most valuable patentable innovations at the intersection of fundamental science and practical implementation.

Environmental Impact and Sustainability of Plasma Technologies

Plasma technologies have demonstrated significant potential for addressing environmental challenges while promoting sustainability across various industrial sectors. The environmental impact assessment of plasma-based solutions reveals a dual nature: while offering substantial benefits in pollution reduction and waste treatment, these technologies also present certain environmental considerations that warrant careful evaluation.

The application of plasma technologies in waste management has shown remarkable efficiency in breaking down hazardous compounds into less harmful substances. Thermal plasma systems can reach temperatures exceeding 10,000°C, effectively destroying persistent organic pollutants (POPs) with destruction efficiencies often above 99.99%. This capability significantly reduces the environmental burden compared to conventional incineration methods, which typically generate secondary pollutants requiring additional treatment.

Air pollution control represents another critical environmental application where plasma technologies excel. Non-thermal plasma systems have demonstrated effectiveness in removing nitrogen oxides (NOx), sulfur oxides (SOx), volatile organic compounds (VOCs), and particulate matter from industrial emissions. Patent analysis indicates a growing trend toward hybrid systems that combine plasma with catalytic processes, achieving higher removal efficiencies while consuming less energy.

From a sustainability perspective, plasma technologies contribute to circular economy principles through resource recovery applications. Plasma gasification of waste materials generates synthesis gas (syngas) that can be utilized as a renewable energy source or chemical feedstock. Additionally, the vitrified slag byproduct from plasma treatment processes can be repurposed as construction material, further reducing landfill requirements and promoting resource efficiency.

Energy consumption remains a significant consideration in the environmental assessment of plasma technologies. While high-temperature plasma processes require substantial energy inputs, recent patent innovations focus on improving energy efficiency through optimized reactor designs, pulsed power systems, and energy recovery mechanisms. The sustainability profile improves considerably when renewable energy sources power these systems, creating potential carbon-neutral waste treatment pathways.

Water treatment applications of plasma technologies demonstrate promising environmental benefits through the generation of reactive oxygen species that effectively degrade pharmaceutical residues, pesticides, and other micropollutants resistant to conventional treatment methods. Recent patents highlight innovations in plasma-liquid interactions that enhance treatment efficiency while minimizing energy requirements.

The life cycle assessment of plasma technologies indicates that their environmental benefits generally outweigh impacts when implemented appropriately. However, the sustainability equation depends heavily on system-specific factors including energy source, operational parameters, and integration with existing industrial processes. Future development should prioritize reducing energy intensity while maintaining or improving treatment effectiveness.

The application of plasma technologies in waste management has shown remarkable efficiency in breaking down hazardous compounds into less harmful substances. Thermal plasma systems can reach temperatures exceeding 10,000°C, effectively destroying persistent organic pollutants (POPs) with destruction efficiencies often above 99.99%. This capability significantly reduces the environmental burden compared to conventional incineration methods, which typically generate secondary pollutants requiring additional treatment.

Air pollution control represents another critical environmental application where plasma technologies excel. Non-thermal plasma systems have demonstrated effectiveness in removing nitrogen oxides (NOx), sulfur oxides (SOx), volatile organic compounds (VOCs), and particulate matter from industrial emissions. Patent analysis indicates a growing trend toward hybrid systems that combine plasma with catalytic processes, achieving higher removal efficiencies while consuming less energy.

From a sustainability perspective, plasma technologies contribute to circular economy principles through resource recovery applications. Plasma gasification of waste materials generates synthesis gas (syngas) that can be utilized as a renewable energy source or chemical feedstock. Additionally, the vitrified slag byproduct from plasma treatment processes can be repurposed as construction material, further reducing landfill requirements and promoting resource efficiency.

Energy consumption remains a significant consideration in the environmental assessment of plasma technologies. While high-temperature plasma processes require substantial energy inputs, recent patent innovations focus on improving energy efficiency through optimized reactor designs, pulsed power systems, and energy recovery mechanisms. The sustainability profile improves considerably when renewable energy sources power these systems, creating potential carbon-neutral waste treatment pathways.

Water treatment applications of plasma technologies demonstrate promising environmental benefits through the generation of reactive oxygen species that effectively degrade pharmaceutical residues, pesticides, and other micropollutants resistant to conventional treatment methods. Recent patents highlight innovations in plasma-liquid interactions that enhance treatment efficiency while minimizing energy requirements.

The life cycle assessment of plasma technologies indicates that their environmental benefits generally outweigh impacts when implemented appropriately. However, the sustainability equation depends heavily on system-specific factors including energy source, operational parameters, and integration with existing industrial processes. Future development should prioritize reducing energy intensity while maintaining or improving treatment effectiveness.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!