Innovations Uncovered in Plasma Surface Treatment Research

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma Surface Treatment Evolution and Objectives

Plasma surface treatment technology has evolved significantly over the past several decades, transforming from rudimentary applications to sophisticated industrial processes. The journey began in the 1960s with basic corona discharge treatments, primarily used for simple surface activation of polymers. By the 1970s and 1980s, low-pressure plasma systems emerged, offering more controlled and uniform treatment capabilities for specialized applications in aerospace and electronics industries.

The 1990s witnessed a paradigm shift with the development of atmospheric pressure plasma technologies, eliminating the need for vacuum systems and enabling continuous processing. This breakthrough dramatically expanded the accessibility and applicability of plasma treatments across various industrial sectors. The early 2000s brought further refinements with the introduction of precision-controlled plasma jets and specialized electrode designs, allowing for targeted treatments of complex geometries and temperature-sensitive materials.

Recent advancements have focused on enhancing energy efficiency, process control, and environmental sustainability. Modern plasma systems incorporate sophisticated diagnostics and real-time monitoring capabilities, ensuring consistent treatment quality and reproducibility. The integration of computational modeling has also accelerated development cycles, enabling rapid optimization of process parameters for specific applications.

The primary objective of current plasma surface treatment research is to develop more versatile, energy-efficient, and environmentally friendly processes that can be seamlessly integrated into existing manufacturing lines. Researchers aim to expand the range of treatable materials, particularly challenging substrates such as high-performance polymers, composites, and biodegradable materials that are increasingly important in sustainable manufacturing.

Another critical goal is to enhance process precision and control, enabling selective surface functionalization at micro and nanoscales. This capability is particularly valuable for emerging applications in biomedical devices, flexible electronics, and advanced packaging. Researchers are also exploring hybrid approaches that combine plasma treatment with other surface modification techniques to achieve unique surface properties not attainable through conventional methods.

Looking forward, the field is moving toward intelligent plasma systems with adaptive control algorithms that can automatically optimize treatment parameters based on real-time feedback. This development aligns with Industry 4.0 principles and promises to reduce setup times, minimize material waste, and improve overall process robustness. The ultimate vision is to establish plasma surface treatment as an indispensable enabling technology for next-generation materials and products across diverse industries.

The 1990s witnessed a paradigm shift with the development of atmospheric pressure plasma technologies, eliminating the need for vacuum systems and enabling continuous processing. This breakthrough dramatically expanded the accessibility and applicability of plasma treatments across various industrial sectors. The early 2000s brought further refinements with the introduction of precision-controlled plasma jets and specialized electrode designs, allowing for targeted treatments of complex geometries and temperature-sensitive materials.

Recent advancements have focused on enhancing energy efficiency, process control, and environmental sustainability. Modern plasma systems incorporate sophisticated diagnostics and real-time monitoring capabilities, ensuring consistent treatment quality and reproducibility. The integration of computational modeling has also accelerated development cycles, enabling rapid optimization of process parameters for specific applications.

The primary objective of current plasma surface treatment research is to develop more versatile, energy-efficient, and environmentally friendly processes that can be seamlessly integrated into existing manufacturing lines. Researchers aim to expand the range of treatable materials, particularly challenging substrates such as high-performance polymers, composites, and biodegradable materials that are increasingly important in sustainable manufacturing.

Another critical goal is to enhance process precision and control, enabling selective surface functionalization at micro and nanoscales. This capability is particularly valuable for emerging applications in biomedical devices, flexible electronics, and advanced packaging. Researchers are also exploring hybrid approaches that combine plasma treatment with other surface modification techniques to achieve unique surface properties not attainable through conventional methods.

Looking forward, the field is moving toward intelligent plasma systems with adaptive control algorithms that can automatically optimize treatment parameters based on real-time feedback. This development aligns with Industry 4.0 principles and promises to reduce setup times, minimize material waste, and improve overall process robustness. The ultimate vision is to establish plasma surface treatment as an indispensable enabling technology for next-generation materials and products across diverse industries.

Market Applications and Industry Demand Analysis

The global market for plasma surface treatment technologies has experienced significant growth in recent years, driven by increasing demand across multiple industries for enhanced material properties and performance. The market size for plasma surface treatment equipment reached approximately $2.1 billion in 2022, with projections indicating a compound annual growth rate of 6.8% through 2028.

Manufacturing sectors, particularly automotive and aerospace, represent the largest application segments, accounting for nearly 40% of the total market share. These industries utilize plasma treatment to improve adhesion properties, coating durability, and surface cleanliness of components, resulting in enhanced product performance and extended service life. The automotive industry specifically has increased adoption of plasma technologies to meet stringent quality requirements for interior and exterior plastic components.

Electronics manufacturing has emerged as the fastest-growing application segment, with demand increasing at approximately 8.5% annually. This growth is primarily driven by the miniaturization trend in consumer electronics and the need for precise surface modification of semiconductor materials and printed circuit boards. Plasma treatment enables manufacturers to achieve the necessary surface properties for reliable bonding and coating at micro and nano scales.

Medical device manufacturing represents another high-value application area, where plasma treatment technologies are essential for creating biocompatible surfaces and ensuring proper adhesion of coatings on implantable devices. The market in this segment is expected to grow substantially as aging populations drive increased demand for medical implants and devices.

Regionally, Asia-Pacific dominates the market with approximately 45% share, led by manufacturing powerhouses like China, Japan, and South Korea. North America and Europe follow with roughly 25% and 20% market shares respectively, with particular strength in high-precision applications for aerospace and medical industries.

Consumer demand for environmentally friendly manufacturing processes has also boosted the adoption of plasma treatment technologies. As a dry process that typically requires no hazardous chemicals, plasma treatment aligns with sustainability initiatives being implemented across various industries. This environmental advantage has become a significant market driver, particularly in regions with strict environmental regulations.

The textile industry has also begun adopting plasma treatment technologies at an accelerating rate, primarily for creating functional fabrics with properties such as water repellency, antimicrobial characteristics, and improved dyeability. This represents an emerging market segment with substantial growth potential as consumer demand for high-performance textiles continues to increase.

Manufacturing sectors, particularly automotive and aerospace, represent the largest application segments, accounting for nearly 40% of the total market share. These industries utilize plasma treatment to improve adhesion properties, coating durability, and surface cleanliness of components, resulting in enhanced product performance and extended service life. The automotive industry specifically has increased adoption of plasma technologies to meet stringent quality requirements for interior and exterior plastic components.

Electronics manufacturing has emerged as the fastest-growing application segment, with demand increasing at approximately 8.5% annually. This growth is primarily driven by the miniaturization trend in consumer electronics and the need for precise surface modification of semiconductor materials and printed circuit boards. Plasma treatment enables manufacturers to achieve the necessary surface properties for reliable bonding and coating at micro and nano scales.

Medical device manufacturing represents another high-value application area, where plasma treatment technologies are essential for creating biocompatible surfaces and ensuring proper adhesion of coatings on implantable devices. The market in this segment is expected to grow substantially as aging populations drive increased demand for medical implants and devices.

Regionally, Asia-Pacific dominates the market with approximately 45% share, led by manufacturing powerhouses like China, Japan, and South Korea. North America and Europe follow with roughly 25% and 20% market shares respectively, with particular strength in high-precision applications for aerospace and medical industries.

Consumer demand for environmentally friendly manufacturing processes has also boosted the adoption of plasma treatment technologies. As a dry process that typically requires no hazardous chemicals, plasma treatment aligns with sustainability initiatives being implemented across various industries. This environmental advantage has become a significant market driver, particularly in regions with strict environmental regulations.

The textile industry has also begun adopting plasma treatment technologies at an accelerating rate, primarily for creating functional fabrics with properties such as water repellency, antimicrobial characteristics, and improved dyeability. This represents an emerging market segment with substantial growth potential as consumer demand for high-performance textiles continues to increase.

Global Plasma Technology Landscape and Barriers

Plasma surface treatment technology has witnessed significant global advancement in recent years, with research centers across North America, Europe, and Asia contributing to its evolution. The United States leads in industrial applications, particularly in semiconductor manufacturing and medical device sterilization, while European countries like Germany and France excel in automotive and aerospace implementations. Asian markets, especially Japan, South Korea, and China, have rapidly expanded their plasma technology capabilities, focusing on electronics manufacturing and emerging applications.

Despite this progress, the plasma surface treatment field faces several critical barriers. Technical challenges include achieving uniform plasma distribution across complex geometries, maintaining process stability at atmospheric pressure, and developing real-time monitoring systems for quality control. The energy-intensive nature of plasma generation presents sustainability concerns, with many systems requiring significant power input and specialized cooling mechanisms.

Regulatory hurdles vary significantly across regions, creating compliance complexities for global manufacturers. The European Union's REACH regulations impose strict requirements on chemical processes including plasma treatments, while the FDA in the United States maintains rigorous standards for medical applications. This regulatory fragmentation necessitates customized approaches for different markets, increasing development costs.

Economic barriers further complicate adoption, particularly for small and medium enterprises. High initial equipment investment, specialized maintenance requirements, and the need for technical expertise create significant entry barriers. The return on investment timeline often extends beyond three years, deterring companies with limited capital resources from implementation.

Knowledge gaps represent another significant challenge, with plasma physics fundamentals still not fully understood in certain application contexts. The complex interactions between plasma species and various substrate materials require extensive empirical testing, as theoretical models often fail to accurately predict outcomes in industrial settings. This necessitates substantial R&D investment before commercialization.

Infrastructure limitations also impede advancement in developing regions, where unstable power supplies and lack of technical support networks make implementation challenging. Additionally, the shortage of specialized personnel with cross-disciplinary expertise in plasma physics, materials science, and process engineering creates operational bottlenecks globally.

These barriers collectively slow the broader adoption of plasma surface treatment technologies, despite their proven benefits in enhancing material properties, reducing environmental impact compared to wet chemical processes, and enabling novel product functionalities across industries.

Despite this progress, the plasma surface treatment field faces several critical barriers. Technical challenges include achieving uniform plasma distribution across complex geometries, maintaining process stability at atmospheric pressure, and developing real-time monitoring systems for quality control. The energy-intensive nature of plasma generation presents sustainability concerns, with many systems requiring significant power input and specialized cooling mechanisms.

Regulatory hurdles vary significantly across regions, creating compliance complexities for global manufacturers. The European Union's REACH regulations impose strict requirements on chemical processes including plasma treatments, while the FDA in the United States maintains rigorous standards for medical applications. This regulatory fragmentation necessitates customized approaches for different markets, increasing development costs.

Economic barriers further complicate adoption, particularly for small and medium enterprises. High initial equipment investment, specialized maintenance requirements, and the need for technical expertise create significant entry barriers. The return on investment timeline often extends beyond three years, deterring companies with limited capital resources from implementation.

Knowledge gaps represent another significant challenge, with plasma physics fundamentals still not fully understood in certain application contexts. The complex interactions between plasma species and various substrate materials require extensive empirical testing, as theoretical models often fail to accurately predict outcomes in industrial settings. This necessitates substantial R&D investment before commercialization.

Infrastructure limitations also impede advancement in developing regions, where unstable power supplies and lack of technical support networks make implementation challenging. Additionally, the shortage of specialized personnel with cross-disciplinary expertise in plasma physics, materials science, and process engineering creates operational bottlenecks globally.

These barriers collectively slow the broader adoption of plasma surface treatment technologies, despite their proven benefits in enhancing material properties, reducing environmental impact compared to wet chemical processes, and enabling novel product functionalities across industries.

Current Plasma Surface Modification Methodologies

01 Plasma treatment for surface modification of materials

Plasma treatment is used to modify the surface properties of various materials, enhancing characteristics such as adhesion, wettability, and biocompatibility. The process involves exposing the material surface to ionized gas (plasma), which creates reactive species that interact with the surface, altering its chemical and physical properties without affecting the bulk material. This technique is particularly valuable for materials that are otherwise difficult to bond or coat.- Plasma treatment for surface modification of materials: Plasma treatment is used to modify the surface properties of various materials, enhancing characteristics such as adhesion, wettability, and biocompatibility. The process involves exposing materials to ionized gas (plasma) which creates reactive species that interact with the surface, altering its chemical and physical properties without affecting the bulk material. This technique is particularly valuable for polymers, metals, and ceramics where specific surface characteristics are required for subsequent processing or end-use applications.

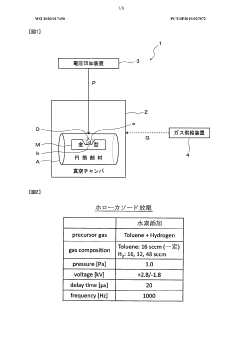

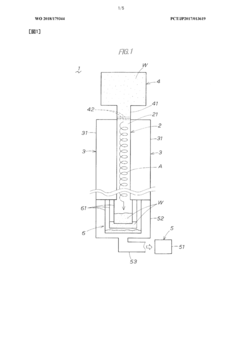

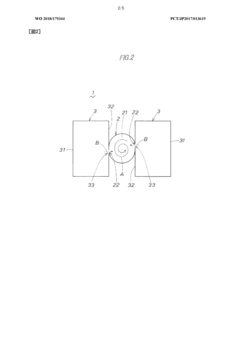

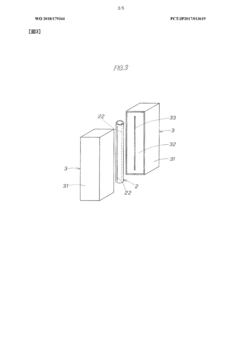

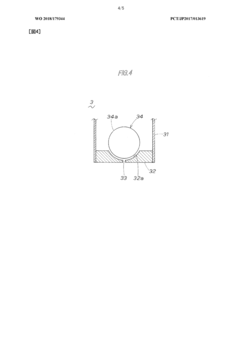

- Plasma treatment equipment and apparatus design: Specialized equipment designs for plasma surface treatment include various chamber configurations, electrode arrangements, and power supply systems. These apparatus are engineered to create stable plasma environments with controlled parameters such as gas composition, pressure, and power density. Advanced designs incorporate features like rotating electrodes, multiple gas inlets, and precise temperature control systems to ensure uniform treatment across complex geometries and different substrate materials.

- Plasma treatment for semiconductor manufacturing: In semiconductor manufacturing, plasma treatment plays a crucial role in processes such as etching, deposition, and surface cleaning. The technique enables precise modification of semiconductor surfaces at the nanoscale, facilitating better electrical contacts, improved layer adhesion, and removal of contaminants. Specialized plasma processes have been developed for different semiconductor materials and device structures, allowing for enhanced performance and reliability of electronic components.

- Atmospheric pressure plasma treatment technologies: Atmospheric pressure plasma treatment eliminates the need for vacuum systems, making the process more cost-effective and suitable for continuous production lines. These systems operate at normal atmospheric pressure while still generating effective plasma for surface modification. The technology enables in-line processing of materials with high throughput and can be integrated into existing manufacturing processes. Various gas compositions can be used to achieve specific surface functionalities without the complexity of vacuum equipment.

- Plasma surface treatment for advanced materials and applications: Plasma treatment is increasingly applied to advanced materials and emerging applications, including biomedical devices, flexible electronics, and composite materials. The process can impart antimicrobial properties, enhance cell adhesion for tissue engineering, improve barrier properties for packaging, and create functional surfaces for sensors. By carefully controlling plasma parameters, specific functional groups can be introduced to material surfaces, enabling tailored surface properties for specialized applications while maintaining the bulk material characteristics.

02 Plasma treatment equipment and apparatus design

Specialized equipment designs for plasma surface treatment include vacuum chambers, electrode configurations, and gas delivery systems. These apparatuses are engineered to generate stable plasma under controlled conditions, with features such as adjustable power supplies, temperature control systems, and automated processing capabilities. Advanced designs incorporate multiple treatment zones, in-line processing capabilities, and real-time monitoring systems to ensure consistent treatment quality across various substrate geometries.Expand Specific Solutions03 Plasma treatment for semiconductor and electronics manufacturing

In semiconductor and electronics manufacturing, plasma treatment is crucial for cleaning, etching, and activating surfaces prior to subsequent processing steps. The technique enables precise modification of electronic components at the nanoscale level, improving electrical connections and device performance. Plasma processes are used for removing contaminants, creating specific surface textures, and preparing substrates for thin film deposition in integrated circuit fabrication.Expand Specific Solutions04 Atmospheric pressure plasma treatment technologies

Atmospheric pressure plasma treatment eliminates the need for vacuum systems, making the process more cost-effective and suitable for continuous production lines. These systems operate at normal atmospheric conditions while still delivering effective surface modification. The technology includes various approaches such as dielectric barrier discharge, plasma jets, and corona treatments, each offering specific advantages for different applications and material types.Expand Specific Solutions05 Plasma surface treatment for polymers and textiles

Plasma treatment is particularly effective for modifying polymer and textile surfaces, enhancing properties such as printability, dyeability, and adhesion. The process can introduce functional groups onto polymer surfaces, increase surface energy, and create micro-roughness without using wet chemical processes. For textiles, plasma treatment can improve water repellency, flame resistance, and antimicrobial properties while maintaining the bulk properties and feel of the fabric.Expand Specific Solutions

Leading Companies and Research Institutions in Plasma Technology

Plasma surface treatment technology is currently in a growth phase, with an estimated market size of $2-3 billion and projected annual growth of 6-8%. The competitive landscape features established equipment manufacturers like Tokyo Electron and Nordson alongside specialized research-focused entities such as Leibniz Institut für Plasmaforschung and CINOGY GmbH. Academic institutions including Swiss Federal Institute of Technology, University of Washington, and Osaka University are driving fundamental innovations, while medical applications are being advanced by DePuy Synthes, Becton Dickinson, and Cedars-Sinai Medical Center. The technology demonstrates varying maturity levels across sectors, with semiconductor applications being most advanced, while biomedical applications remain in earlier development stages. Industry-academic collaborations are increasingly shaping the innovation trajectory, with companies like US Patent Innovations and FUJIFILM Manufacturing Europe commercializing research breakthroughs.

Tokyo Electron Ltd.

Technical Solution: Tokyo Electron has developed innovative plasma surface treatment technologies for semiconductor manufacturing. Their Tactras™ platform utilizes a proprietary inductively coupled plasma (ICP) source that achieves high-density plasma at low pressures, enabling precise surface modification without substrate damage. The company has pioneered multi-step plasma treatment processes that combine cleaning, activation, and deposition in a single tool, significantly improving throughput and reducing contamination risks. Their plasma doping technology incorporates pulsed plasma with optimized gas chemistry to achieve ultra-shallow junction formation critical for advanced node semiconductor devices. Tokyo Electron has also developed specialized plasma treatment solutions for 3D structures and high-aspect-ratio features, addressing key challenges in advanced packaging and memory manufacturing.

Strengths: Industry-leading plasma equipment design with exceptional process control; comprehensive intellectual property portfolio; strong integration capabilities with other semiconductor manufacturing steps. Weaknesses: Technologies primarily focused on semiconductor applications; high capital equipment costs; some processes require specialized gases with environmental considerations.

Leibniz Institut fr Plasmaforschung und Technologie e.V. (INP)

Technical Solution: Leibniz Institute for Plasma Science and Technology (INP) has developed advanced atmospheric pressure plasma sources for surface modification applications. Their proprietary PlasmaDerm® technology utilizes cold atmospheric plasma for biomedical applications, particularly in wound healing and dermatology. The institute has pioneered microplasma jet arrays that allow precise treatment of complex three-dimensional surfaces with controlled plasma parameters. INP has also developed plasma-based coating processes that enable functional nanocomposite layers with antimicrobial properties to be deposited at atmospheric pressure. Their research extends to plasma polymerization techniques that create highly adherent, chemically stable coatings with tailored surface properties for industrial and medical applications.

Strengths: World-leading expertise in atmospheric plasma technology; strong interdisciplinary approach combining physics, chemistry, and biology; excellent technology transfer capabilities with multiple commercial products. Weaknesses: Some technologies require specialized knowledge for implementation; scaling up certain plasma processes from laboratory to industrial scale remains challenging.

Breakthrough Patents and Scientific Literature Review

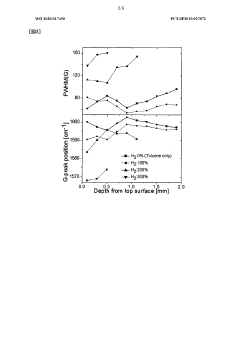

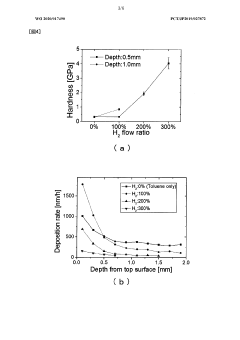

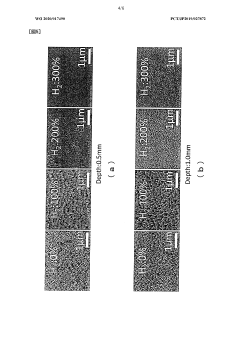

Plasma surface treatment device and plasma surface treatment method

PatentWO2020017490A1

Innovation

- Incorporating hydrogen into the surface treatment gas alongside hydrocarbons during plasma surface treatment, allowing hydrocarbon and hydrogen ions to form an amorphous hard carbon film with reduced graphite structure content, thereby increasing the film's hardness and achieving properties similar to diamond-like carbon (DLC).

Plasma surface treatment method and plasma surface treatment apparatus

PatentWO2018179344A1

Innovation

- A plasma surface treatment method using a tubular passage where plasma processing gas is injected perpendicular to the object's fall, ensuring consistent contact and reducing the risk of scattering, with a plasma surface treatment apparatus featuring a tubular body, plasma generators, and a suction device to manage the object's flow and recovery.

Environmental Impact and Sustainability Considerations

Plasma surface treatment technologies have evolved significantly with a growing emphasis on environmental sustainability. Traditional surface treatment methods often involve hazardous chemicals, high energy consumption, and substantial waste generation. In contrast, plasma-based processes offer considerable environmental advantages, operating at ambient temperatures with minimal chemical usage and reduced water consumption. Recent innovations have further enhanced these benefits through the development of atmospheric pressure plasma systems that eliminate the need for vacuum equipment, thereby reducing energy requirements by up to 40% compared to conventional vacuum-based plasma treatments.

The environmental footprint of plasma surface treatment is markedly lower than chemical alternatives. Studies indicate that plasma processes can reduce chemical waste by 70-85% and wastewater by 60-75% in industrial applications. Additionally, modern plasma systems have demonstrated a 30-50% reduction in greenhouse gas emissions compared to traditional wet chemical processes, contributing significantly to corporate carbon reduction initiatives across manufacturing sectors.

Sustainability advancements in plasma technology include the integration of renewable energy sources to power plasma generators. Research at several European institutions has successfully demonstrated plasma systems operating on solar and wind energy, creating pathways for carbon-neutral surface modification processes. These developments align with circular economy principles and increasingly stringent environmental regulations worldwide.

Material conservation represents another sustainability dimension of plasma innovation. By enabling precise surface modifications without altering bulk material properties, plasma treatments extend product lifecycles and reduce material consumption. In textile industries, plasma-treated fabrics demonstrate 25-40% longer useful life than conventionally treated alternatives, while in polymer processing, plasma-modified components show enhanced durability with 15-30% improvement in wear resistance.

Toxicity reduction has been a focal point in recent plasma research. Next-generation plasma systems utilize non-toxic working gases like argon, helium, and air, eliminating the need for environmentally harmful chemicals common in conventional surface treatments. This transition addresses growing regulatory pressures and consumer demand for environmentally responsible manufacturing processes.

The life cycle assessment of plasma surface treatment technologies reveals significant sustainability advantages. A comprehensive analysis conducted across multiple industrial applications indicates that plasma processes reduce the overall environmental impact by 40-60% compared to conventional alternatives when considering resource extraction, manufacturing, use phase, and end-of-life disposal. These findings have accelerated adoption in environmentally sensitive industries including medical device manufacturing, automotive components, and consumer electronics.

The environmental footprint of plasma surface treatment is markedly lower than chemical alternatives. Studies indicate that plasma processes can reduce chemical waste by 70-85% and wastewater by 60-75% in industrial applications. Additionally, modern plasma systems have demonstrated a 30-50% reduction in greenhouse gas emissions compared to traditional wet chemical processes, contributing significantly to corporate carbon reduction initiatives across manufacturing sectors.

Sustainability advancements in plasma technology include the integration of renewable energy sources to power plasma generators. Research at several European institutions has successfully demonstrated plasma systems operating on solar and wind energy, creating pathways for carbon-neutral surface modification processes. These developments align with circular economy principles and increasingly stringent environmental regulations worldwide.

Material conservation represents another sustainability dimension of plasma innovation. By enabling precise surface modifications without altering bulk material properties, plasma treatments extend product lifecycles and reduce material consumption. In textile industries, plasma-treated fabrics demonstrate 25-40% longer useful life than conventionally treated alternatives, while in polymer processing, plasma-modified components show enhanced durability with 15-30% improvement in wear resistance.

Toxicity reduction has been a focal point in recent plasma research. Next-generation plasma systems utilize non-toxic working gases like argon, helium, and air, eliminating the need for environmentally harmful chemicals common in conventional surface treatments. This transition addresses growing regulatory pressures and consumer demand for environmentally responsible manufacturing processes.

The life cycle assessment of plasma surface treatment technologies reveals significant sustainability advantages. A comprehensive analysis conducted across multiple industrial applications indicates that plasma processes reduce the overall environmental impact by 40-60% compared to conventional alternatives when considering resource extraction, manufacturing, use phase, and end-of-life disposal. These findings have accelerated adoption in environmentally sensitive industries including medical device manufacturing, automotive components, and consumer electronics.

Cost-Benefit Analysis of Industrial Implementation

The implementation of plasma surface treatment technology in industrial settings requires a thorough cost-benefit analysis to determine its economic viability. Initial capital expenditure for plasma treatment systems ranges from $50,000 to $500,000 depending on scale, complexity, and customization requirements. This investment includes equipment acquisition, installation infrastructure, and staff training programs. However, these upfront costs must be evaluated against long-term operational benefits.

Operational expenses for plasma treatment facilities typically include electricity consumption (3-7 kWh per treatment hour), process gases (argon, oxygen, nitrogen), maintenance requirements, and specialized personnel. These recurring costs generally represent 5-15% of the initial investment annually, which is significantly lower than traditional chemical treatment methods that often require 20-30% of initial investment for ongoing operations.

The economic benefits manifest in multiple dimensions. Production efficiency improvements of 15-40% have been documented across various industries, primarily due to faster processing times and reduced material handling steps. Quality enhancement leads to defect reduction rates of 10-25%, substantially decreasing rework and warranty costs. Environmental compliance costs are minimized through the elimination of hazardous chemical waste disposal, which can save manufacturers $10,000-$100,000 annually depending on production volume.

Return on investment calculations indicate that most industrial plasma treatment implementations achieve breakeven within 12-36 months. Industries with high-value products or stringent quality requirements, such as medical device manufacturing and aerospace, typically realize ROI in the shorter end of this spectrum. Companies producing consumer electronics or automotive components generally experience medium-term returns.

Sensitivity analysis reveals that the most significant factors affecting economic outcomes include production volume, product value, and quality requirements. For high-volume operations processing over 100,000 units monthly, even small improvements in adhesion quality or processing speed translate to substantial financial benefits. Conversely, low-volume specialty manufacturers may find justification in premium pricing opportunities that plasma-enhanced products command.

Risk factors that may impact the cost-benefit equation include potential technology obsolescence, changing regulatory requirements, and market demand fluctuations. However, the versatility of modern plasma systems allows for adaptation to various materials and processes, mitigating some of these concerns and extending the useful economic life of the equipment beyond initial projections.

Operational expenses for plasma treatment facilities typically include electricity consumption (3-7 kWh per treatment hour), process gases (argon, oxygen, nitrogen), maintenance requirements, and specialized personnel. These recurring costs generally represent 5-15% of the initial investment annually, which is significantly lower than traditional chemical treatment methods that often require 20-30% of initial investment for ongoing operations.

The economic benefits manifest in multiple dimensions. Production efficiency improvements of 15-40% have been documented across various industries, primarily due to faster processing times and reduced material handling steps. Quality enhancement leads to defect reduction rates of 10-25%, substantially decreasing rework and warranty costs. Environmental compliance costs are minimized through the elimination of hazardous chemical waste disposal, which can save manufacturers $10,000-$100,000 annually depending on production volume.

Return on investment calculations indicate that most industrial plasma treatment implementations achieve breakeven within 12-36 months. Industries with high-value products or stringent quality requirements, such as medical device manufacturing and aerospace, typically realize ROI in the shorter end of this spectrum. Companies producing consumer electronics or automotive components generally experience medium-term returns.

Sensitivity analysis reveals that the most significant factors affecting economic outcomes include production volume, product value, and quality requirements. For high-volume operations processing over 100,000 units monthly, even small improvements in adhesion quality or processing speed translate to substantial financial benefits. Conversely, low-volume specialty manufacturers may find justification in premium pricing opportunities that plasma-enhanced products command.

Risk factors that may impact the cost-benefit equation include potential technology obsolescence, changing regulatory requirements, and market demand fluctuations. However, the versatility of modern plasma systems allows for adaptation to various materials and processes, mitigating some of these concerns and extending the useful economic life of the equipment beyond initial projections.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!