Why Plasma Treatment is Pivotal in Automotive Manufacturing

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma Treatment Evolution and Objectives in Automotive Industry

Plasma treatment technology in the automotive industry has evolved significantly over the past several decades, transforming from an experimental process to a critical manufacturing technique. Initially developed in the 1960s for aerospace applications, plasma treatment found its way into automotive manufacturing during the late 1970s as manufacturers sought more efficient bonding solutions for increasingly diverse material combinations. The technology has progressed from simple corona discharge systems to sophisticated atmospheric plasma treatments capable of precise surface modifications at molecular levels.

The evolution of plasma treatment closely parallels the automotive industry's shift toward lightweight materials and complex composite structures. As vehicle manufacturers began incorporating plastics, carbon fiber composites, and advanced alloys to reduce weight and improve fuel efficiency, traditional mechanical fastening and chemical bonding methods proved inadequate. This technological gap accelerated plasma treatment development, particularly in the 1990s when environmental regulations began restricting solvent-based surface preparation methods.

Modern plasma treatment systems in automotive manufacturing have evolved to address specific industry challenges, including high-volume production requirements, diverse substrate materials, and stringent quality standards. Contemporary systems feature computer-controlled precision, in-line integration capabilities, and significantly reduced energy consumption compared to early generations. The technology now encompasses various specialized processes including atmospheric pressure plasma, vacuum plasma, and plasma-enhanced chemical vapor deposition (PECVD), each serving specific automotive applications.

The primary objective of plasma treatment in today's automotive manufacturing is to enhance surface properties without altering bulk material characteristics. Specifically, manufacturers aim to improve adhesion properties for paints, coatings, and adhesives while maintaining material integrity. Secondary objectives include increasing production efficiency by reducing process steps, eliminating environmentally harmful chemical pretreatments, and enabling the joining of previously incompatible materials.

Looking forward, the automotive industry's plasma treatment objectives are increasingly focused on supporting electrification and sustainability initiatives. As electric vehicles gain market share, plasma technologies are being developed to address unique manufacturing challenges such as battery component bonding, thermal management systems, and lightweight structural elements. Additionally, research is targeting plasma processes that can facilitate recycling and disassembly at end-of-life, aligning with circular economy principles.

The convergence of digitalization with plasma technology represents another evolutionary frontier, with objectives centered on developing smart plasma systems capable of real-time process monitoring, self-adjustment, and integration with Industry 4.0 manufacturing environments. These advanced systems aim to optimize energy usage, reduce waste, and ensure consistent quality across global production facilities.

The evolution of plasma treatment closely parallels the automotive industry's shift toward lightweight materials and complex composite structures. As vehicle manufacturers began incorporating plastics, carbon fiber composites, and advanced alloys to reduce weight and improve fuel efficiency, traditional mechanical fastening and chemical bonding methods proved inadequate. This technological gap accelerated plasma treatment development, particularly in the 1990s when environmental regulations began restricting solvent-based surface preparation methods.

Modern plasma treatment systems in automotive manufacturing have evolved to address specific industry challenges, including high-volume production requirements, diverse substrate materials, and stringent quality standards. Contemporary systems feature computer-controlled precision, in-line integration capabilities, and significantly reduced energy consumption compared to early generations. The technology now encompasses various specialized processes including atmospheric pressure plasma, vacuum plasma, and plasma-enhanced chemical vapor deposition (PECVD), each serving specific automotive applications.

The primary objective of plasma treatment in today's automotive manufacturing is to enhance surface properties without altering bulk material characteristics. Specifically, manufacturers aim to improve adhesion properties for paints, coatings, and adhesives while maintaining material integrity. Secondary objectives include increasing production efficiency by reducing process steps, eliminating environmentally harmful chemical pretreatments, and enabling the joining of previously incompatible materials.

Looking forward, the automotive industry's plasma treatment objectives are increasingly focused on supporting electrification and sustainability initiatives. As electric vehicles gain market share, plasma technologies are being developed to address unique manufacturing challenges such as battery component bonding, thermal management systems, and lightweight structural elements. Additionally, research is targeting plasma processes that can facilitate recycling and disassembly at end-of-life, aligning with circular economy principles.

The convergence of digitalization with plasma technology represents another evolutionary frontier, with objectives centered on developing smart plasma systems capable of real-time process monitoring, self-adjustment, and integration with Industry 4.0 manufacturing environments. These advanced systems aim to optimize energy usage, reduce waste, and ensure consistent quality across global production facilities.

Market Demand Analysis for Plasma-Enhanced Manufacturing

The global market for plasma treatment technologies in automotive manufacturing has experienced significant growth over the past decade, with a compound annual growth rate exceeding 8% between 2018 and 2023. This growth trajectory is primarily driven by increasing demands for higher quality surface finishes, enhanced adhesion properties, and more environmentally sustainable manufacturing processes across the automotive value chain.

Automotive manufacturers are increasingly adopting plasma treatment solutions to address critical challenges in material bonding and surface preparation. The market demand is particularly strong in premium vehicle segments where high-quality finishes and durability expectations are paramount. As vehicle designs incorporate more diverse material combinations—including advanced composites, lightweight metals, and specialized polymers—the need for effective surface treatment technologies has intensified.

Consumer expectations for vehicle longevity and aesthetic quality continue to rise, creating downstream pressure on manufacturers to implement more sophisticated surface preparation techniques. Market research indicates that vehicles with properly treated surfaces demonstrate significantly lower warranty claim rates related to paint adhesion failures, interior trim detachment, and weathering degradation.

The electric vehicle (EV) segment represents the fastest-growing market opportunity for plasma treatment technologies. As EV production volumes increase globally, manufacturers require specialized surface preparation solutions for battery components, lightweight structural elements, and novel interior materials. This segment is projected to generate substantial demand growth over the next five years as EV production scales up across major automotive markets.

Regional analysis reveals varying adoption rates, with European automotive manufacturers leading implementation of advanced plasma treatment systems, followed closely by North American and Japanese producers. Emerging automotive manufacturing hubs in China, India, and Southeast Asia represent significant growth opportunities as these regions upgrade production capabilities to meet international quality standards and environmental regulations.

Market demand is further bolstered by increasingly stringent environmental regulations worldwide that restrict traditional chemical surface preparation methods. Plasma treatment offers a compelling alternative with minimal waste generation and reduced chemical usage, aligning with automotive industry sustainability initiatives and corporate environmental responsibility commitments.

Supply chain considerations are also driving market growth, as tier-one and tier-two automotive suppliers increasingly integrate plasma treatment capabilities to meet OEM specifications. This vertical integration trend is creating new market entry points for plasma technology providers and expanding the overall addressable market beyond assembly plants to include component manufacturing facilities.

Automotive manufacturers are increasingly adopting plasma treatment solutions to address critical challenges in material bonding and surface preparation. The market demand is particularly strong in premium vehicle segments where high-quality finishes and durability expectations are paramount. As vehicle designs incorporate more diverse material combinations—including advanced composites, lightweight metals, and specialized polymers—the need for effective surface treatment technologies has intensified.

Consumer expectations for vehicle longevity and aesthetic quality continue to rise, creating downstream pressure on manufacturers to implement more sophisticated surface preparation techniques. Market research indicates that vehicles with properly treated surfaces demonstrate significantly lower warranty claim rates related to paint adhesion failures, interior trim detachment, and weathering degradation.

The electric vehicle (EV) segment represents the fastest-growing market opportunity for plasma treatment technologies. As EV production volumes increase globally, manufacturers require specialized surface preparation solutions for battery components, lightweight structural elements, and novel interior materials. This segment is projected to generate substantial demand growth over the next five years as EV production scales up across major automotive markets.

Regional analysis reveals varying adoption rates, with European automotive manufacturers leading implementation of advanced plasma treatment systems, followed closely by North American and Japanese producers. Emerging automotive manufacturing hubs in China, India, and Southeast Asia represent significant growth opportunities as these regions upgrade production capabilities to meet international quality standards and environmental regulations.

Market demand is further bolstered by increasingly stringent environmental regulations worldwide that restrict traditional chemical surface preparation methods. Plasma treatment offers a compelling alternative with minimal waste generation and reduced chemical usage, aligning with automotive industry sustainability initiatives and corporate environmental responsibility commitments.

Supply chain considerations are also driving market growth, as tier-one and tier-two automotive suppliers increasingly integrate plasma treatment capabilities to meet OEM specifications. This vertical integration trend is creating new market entry points for plasma technology providers and expanding the overall addressable market beyond assembly plants to include component manufacturing facilities.

Current Plasma Technology Landscape and Implementation Challenges

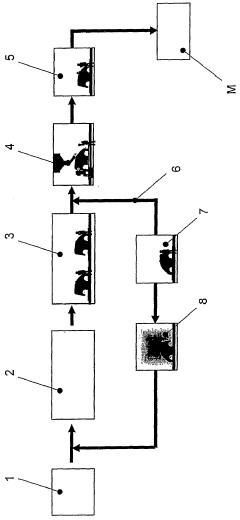

The global plasma treatment technology landscape in automotive manufacturing has evolved significantly over the past decade, with several distinct technologies now dominating the market. Atmospheric pressure plasma systems have gained prominence due to their operational flexibility and lower implementation costs compared to vacuum-based alternatives. These systems utilize various gas compositions including air, nitrogen, oxygen, and argon to achieve specific surface modification properties required in automotive applications.

Low-pressure plasma systems, while requiring more complex infrastructure, continue to maintain relevance in specialized applications where deeper surface modification and higher precision are required, particularly for critical automotive components with complex geometries. Corona discharge systems represent a cost-effective solution for high-volume production lines, though they offer less control over treatment parameters.

Plasma jet technologies have emerged as a versatile option allowing for targeted treatment of specific areas, making them particularly valuable for complex automotive assemblies where selective surface modification is necessary. The integration of these technologies with robotic systems has significantly enhanced precision and repeatability in automotive manufacturing environments.

Despite technological advancements, significant implementation challenges persist across the automotive manufacturing sector. The integration of plasma treatment systems into existing production lines presents considerable difficulties, often requiring substantial reconfiguration of manufacturing processes and equipment layouts. This integration challenge is particularly acute in older manufacturing facilities not designed with plasma treatment considerations in mind.

Quality control and process validation remain persistent challenges, as plasma treatment effects can be difficult to measure in real-time during high-volume production. The industry continues to seek more robust in-line monitoring solutions to ensure consistent treatment quality across thousands of components.

Cost considerations represent another significant barrier, particularly for smaller automotive suppliers. The initial capital investment for advanced plasma systems, especially those with vacuum capabilities or sophisticated control systems, can be prohibitive. Additionally, ongoing operational costs including energy consumption, specialized gas supplies, and maintenance requirements impact the total cost of ownership.

Technical expertise requirements pose another implementation hurdle, as effective plasma treatment operation demands specialized knowledge in plasma physics, surface chemistry, and process control. The shortage of qualified personnel with this multidisciplinary expertise has slowed adoption rates in some regions and manufacturing facilities.

Environmental and regulatory compliance adds another layer of complexity, with increasing scrutiny on chemical emissions, energy efficiency, and waste management associated with plasma treatment processes. Manufacturers must navigate evolving regulatory frameworks while maintaining production efficiency and quality standards.

Low-pressure plasma systems, while requiring more complex infrastructure, continue to maintain relevance in specialized applications where deeper surface modification and higher precision are required, particularly for critical automotive components with complex geometries. Corona discharge systems represent a cost-effective solution for high-volume production lines, though they offer less control over treatment parameters.

Plasma jet technologies have emerged as a versatile option allowing for targeted treatment of specific areas, making them particularly valuable for complex automotive assemblies where selective surface modification is necessary. The integration of these technologies with robotic systems has significantly enhanced precision and repeatability in automotive manufacturing environments.

Despite technological advancements, significant implementation challenges persist across the automotive manufacturing sector. The integration of plasma treatment systems into existing production lines presents considerable difficulties, often requiring substantial reconfiguration of manufacturing processes and equipment layouts. This integration challenge is particularly acute in older manufacturing facilities not designed with plasma treatment considerations in mind.

Quality control and process validation remain persistent challenges, as plasma treatment effects can be difficult to measure in real-time during high-volume production. The industry continues to seek more robust in-line monitoring solutions to ensure consistent treatment quality across thousands of components.

Cost considerations represent another significant barrier, particularly for smaller automotive suppliers. The initial capital investment for advanced plasma systems, especially those with vacuum capabilities or sophisticated control systems, can be prohibitive. Additionally, ongoing operational costs including energy consumption, specialized gas supplies, and maintenance requirements impact the total cost of ownership.

Technical expertise requirements pose another implementation hurdle, as effective plasma treatment operation demands specialized knowledge in plasma physics, surface chemistry, and process control. The shortage of qualified personnel with this multidisciplinary expertise has slowed adoption rates in some regions and manufacturing facilities.

Environmental and regulatory compliance adds another layer of complexity, with increasing scrutiny on chemical emissions, energy efficiency, and waste management associated with plasma treatment processes. Manufacturers must navigate evolving regulatory frameworks while maintaining production efficiency and quality standards.

Current Plasma Treatment Applications in Automotive Manufacturing

01 Plasma treatment systems for semiconductor processing

Plasma treatment systems are widely used in semiconductor manufacturing for etching, deposition, and surface modification. These systems typically include plasma chambers with specialized electrodes, RF power sources, and gas delivery systems designed to create controlled plasma environments. Advanced control mechanisms regulate plasma parameters such as density, temperature, and uniformity to achieve precise processing results on semiconductor wafers.- Plasma processing chambers and apparatus design: Various designs of plasma processing chambers and apparatus are used for efficient plasma treatment. These include specialized chamber configurations, electrode arrangements, and gas distribution systems that optimize plasma generation and uniformity. The chambers are designed to control plasma parameters such as density, temperature, and ion energy for specific applications in semiconductor manufacturing and materials processing.

- Plasma generation and control methods: Different methods for generating and controlling plasma are employed in industrial applications. These include radio frequency (RF) power delivery systems, pulsed plasma techniques, and magnetic field confinement approaches. Advanced control systems regulate plasma parameters to achieve precise processing conditions, enabling selective etching, deposition, or surface modification with high reproducibility and minimal damage to treated materials.

- Semiconductor processing applications: Plasma treatment is extensively used in semiconductor manufacturing for etching, deposition, and surface modification processes. These applications include plasma-enhanced chemical vapor deposition (PECVD), reactive ion etching (RIE), and plasma ashing for photoresist removal. The technology enables the creation of nanoscale features with high precision, which is critical for advanced integrated circuit fabrication and microelectronic device manufacturing.

- Surface modification and material treatment: Plasma treatment is used for modifying surface properties of various materials including polymers, metals, and ceramics. The process can alter surface energy, wettability, adhesion properties, and biocompatibility without affecting bulk material properties. Applications include improving adhesion for coatings, creating hydrophilic or hydrophobic surfaces, sterilization of medical devices, and enhancing material performance in various industrial products.

- Advanced plasma technologies and innovations: Recent innovations in plasma treatment include atmospheric pressure plasma systems, cold plasma technologies, and specialized plasma sources for unique applications. These advancements enable plasma processing under ambient conditions, reduce energy consumption, and allow treatment of temperature-sensitive materials. Emerging applications include plasma medicine, food preservation, environmental remediation, and nanomaterial synthesis, expanding the utility of plasma technologies beyond traditional industrial processes.

02 Plasma chamber design and components

Specialized plasma chamber designs incorporate various components to optimize plasma generation and control. These chambers feature electrode configurations, gas distribution systems, and thermal management solutions that enhance process efficiency. Key innovations include chamber materials resistant to plasma erosion, improved substrate holders, and advanced sealing mechanisms that maintain vacuum integrity while allowing for precise control of the plasma environment.Expand Specific Solutions03 Plasma power supply and control systems

Advanced power supply and control systems are essential for effective plasma treatment processes. These systems include RF generators, impedance matching networks, and sophisticated feedback control mechanisms that maintain stable plasma conditions. Modern plasma control systems incorporate real-time monitoring of process parameters, automated adjustment capabilities, and safety interlocks to ensure consistent treatment results and equipment protection.Expand Specific Solutions04 Surface modification using plasma treatment

Plasma treatment is effective for modifying surface properties of various materials including polymers, metals, and ceramics. The process can enhance adhesion, wettability, biocompatibility, and other surface characteristics without altering bulk properties. Applications include preparing surfaces for coating, printing, bonding, and improving material compatibility in medical devices, textiles, and electronic components.Expand Specific Solutions05 Plasma etching and deposition techniques

Plasma-based etching and deposition techniques enable precise material removal and thin film formation in microelectronics manufacturing. These processes utilize reactive species generated in plasma to selectively etch materials or deposit thin films with controlled composition and structure. Advanced techniques include reactive ion etching, plasma-enhanced chemical vapor deposition, and atomic layer processing that achieve nanoscale feature definition and high-quality film properties for advanced device fabrication.Expand Specific Solutions

Key Industry Players and Plasma Technology Providers

Plasma treatment has emerged as a critical technology in automotive manufacturing, currently in a growth phase with the market expected to expand significantly due to increasing demand for high-performance surface treatments. The global automotive plasma treatment market is projected to reach substantial value as manufacturers seek improved adhesion, coating performance, and environmental compliance. Technologically, the field is maturing rapidly with companies like Nordson Corp., Tokyo Electron, and Lam Research leading innovation in plasma application systems. Mercedes-Benz Group AG represents key end-users implementing these solutions for enhanced material bonding and surface preparation. Plasma technology adoption is accelerating as automotive manufacturers pursue lightweight materials and advanced manufacturing processes, with specialized providers like Plasmapp developing custom solutions for industry-specific challenges.

Nordson Corp.

Technical Solution: Nordson has developed advanced plasma treatment systems specifically for automotive manufacturing applications. Their Plasma-Treat technology employs atmospheric pressure plasma to modify surface properties of automotive components, enhancing adhesion properties prior to painting, coating, or bonding processes. The company's systems utilize a controlled plasma jet that can be precisely directed at specific areas of components, allowing for targeted surface activation without affecting surrounding materials. Their technology operates at atmospheric pressure, eliminating the need for vacuum chambers and enabling integration directly into production lines. Nordson's plasma systems are designed to improve paint adhesion on plastic components, increase bonding strength for composite materials, and ensure proper sealing of automotive electronics. The technology has been proven to increase bond strength by up to 50% while reducing chemical usage compared to traditional surface preparation methods.

Strengths: Atmospheric pressure operation eliminates need for vacuum chambers, enabling in-line integration; precise control over treatment areas; environmentally friendly alternative to chemical primers. Weaknesses: Higher initial capital investment compared to traditional chemical treatments; requires technical expertise for optimal parameter settings; treatment effectiveness can diminish over time requiring retreatment.

Mercedes-Benz Group AG

Technical Solution: Mercedes-Benz has implemented comprehensive plasma treatment processes across its manufacturing facilities to enhance surface properties of various automotive components. Their approach integrates plasma technology into multiple stages of vehicle production, particularly focusing on interior and exterior plastic components. The company utilizes low-pressure plasma chambers for treating complex three-dimensional parts and atmospheric plasma systems for in-line treatment of larger components. Mercedes-Benz has developed proprietary plasma treatment protocols that optimize adhesion for their specific paint formulations and bonding applications. Their implementation includes real-time monitoring systems that adjust plasma parameters based on material variations and environmental conditions, ensuring consistent quality. The company has reported significant improvements in paint adhesion and durability on plastic components, with a notable reduction in defect rates of approximately 30% compared to conventional chemical primers. Mercedes-Benz has also pioneered the use of plasma treatment for preparing surfaces for advanced driver assistance system (ADAS) sensor mounting, where exceptional bond reliability is critical for safety systems.

Strengths: Comprehensive integration across multiple manufacturing processes; proprietary treatment protocols optimized for specific materials and applications; significant reduction in environmental impact by eliminating solvent-based primers. Weaknesses: Requires substantial initial investment in equipment and training; process optimization is complex and material-specific; treatment effectiveness can be affected by ambient humidity and temperature variations.

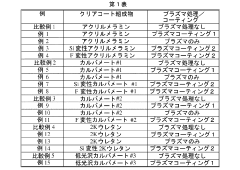

Critical Patents and Innovations in Automotive Plasma Processing

Surface enhancement of automotive coatings using plasma treatment technology

PatentInactiveJP2012506768A

Innovation

- The use of plasma treatment techniques, including atmospheric pressure plasma discharges, to modify automotive coatings by forming thin films with precursor materials or breaking weak bonds on the surface, thereby enhancing surface-specific properties without adversely affecting the bulk properties.

Complete repair process using a plasma method

PatentWO2005061128A1

Innovation

- The method involves selective sanding of defective areas with automated low-pressure plasma treatment of the entire vehicle body surface in a closed chamber to ensure paint adhesion, using oxygen as the process gas, allowing for automated and reliable complete repair without re-exposing the body to the entire painting line until defects are addressed.

Environmental Impact and Sustainability Considerations

Plasma treatment in automotive manufacturing presents significant environmental advantages compared to traditional chemical processes. By utilizing electrically charged gases instead of solvent-based chemicals, manufacturers can substantially reduce hazardous waste generation and volatile organic compound (VOC) emissions. This transition aligns with increasingly stringent environmental regulations worldwide, particularly in regions like the European Union where the End-of-Life Vehicle Directive mandates higher recycling rates and reduced hazardous substance usage.

Energy efficiency represents another critical sustainability aspect of plasma technology. Modern plasma systems consume significantly less energy than conventional thermal treatment processes, with advanced systems achieving up to 40% reduction in energy consumption. This efficiency translates directly to reduced carbon footprints across manufacturing operations, supporting automotive industry commitments to carbon neutrality targets.

Water conservation benefits further enhance plasma treatment's sustainability profile. Unlike wet chemical processes that may require thousands of gallons of water daily for cleaning and rinsing operations, plasma treatments operate as dry processes. This characteristic eliminates wastewater treatment requirements and associated chemical disposal challenges, addressing growing concerns about industrial water usage in manufacturing regions facing water scarcity.

The longevity impact of plasma-treated components also contributes to sustainability through extended product lifecycles. Enhanced adhesion properties and superior corrosion resistance in plasma-treated automotive parts reduce replacement frequency and warranty claims. Studies indicate plasma-treated components can demonstrate up to 35% longer functional lifespans compared to conventionally treated counterparts, reducing raw material consumption and manufacturing energy requirements over vehicle lifetimes.

Circular economy considerations further strengthen plasma treatment's environmental case. The technology enables better material compatibility for recycling processes at vehicle end-of-life stages. By eliminating chemical contaminants that might otherwise compromise recycling streams, plasma-treated components support higher-quality material recovery and closed-loop manufacturing systems, essential for sustainable automotive production.

As automotive manufacturers face mounting pressure to reduce environmental footprints, plasma treatment technologies offer a compelling pathway toward greener manufacturing processes while maintaining or improving product performance characteristics. The technology's alignment with sustainability objectives represents a significant factor driving its increasing adoption across global automotive manufacturing operations.

Energy efficiency represents another critical sustainability aspect of plasma technology. Modern plasma systems consume significantly less energy than conventional thermal treatment processes, with advanced systems achieving up to 40% reduction in energy consumption. This efficiency translates directly to reduced carbon footprints across manufacturing operations, supporting automotive industry commitments to carbon neutrality targets.

Water conservation benefits further enhance plasma treatment's sustainability profile. Unlike wet chemical processes that may require thousands of gallons of water daily for cleaning and rinsing operations, plasma treatments operate as dry processes. This characteristic eliminates wastewater treatment requirements and associated chemical disposal challenges, addressing growing concerns about industrial water usage in manufacturing regions facing water scarcity.

The longevity impact of plasma-treated components also contributes to sustainability through extended product lifecycles. Enhanced adhesion properties and superior corrosion resistance in plasma-treated automotive parts reduce replacement frequency and warranty claims. Studies indicate plasma-treated components can demonstrate up to 35% longer functional lifespans compared to conventionally treated counterparts, reducing raw material consumption and manufacturing energy requirements over vehicle lifetimes.

Circular economy considerations further strengthen plasma treatment's environmental case. The technology enables better material compatibility for recycling processes at vehicle end-of-life stages. By eliminating chemical contaminants that might otherwise compromise recycling streams, plasma-treated components support higher-quality material recovery and closed-loop manufacturing systems, essential for sustainable automotive production.

As automotive manufacturers face mounting pressure to reduce environmental footprints, plasma treatment technologies offer a compelling pathway toward greener manufacturing processes while maintaining or improving product performance characteristics. The technology's alignment with sustainability objectives represents a significant factor driving its increasing adoption across global automotive manufacturing operations.

Cost-Benefit Analysis of Plasma Treatment Implementation

Implementing plasma treatment technology in automotive manufacturing requires thorough financial analysis to justify the substantial initial investment. The capital expenditure for plasma treatment equipment typically ranges from $100,000 to $500,000 per production line, depending on treatment area size, automation level, and integration complexity with existing manufacturing systems. Additional costs include facility modifications ($20,000-$50,000), staff training ($5,000-$15,000 annually), and ongoing maintenance (approximately 5-8% of equipment cost annually).

Despite these significant upfront costs, plasma treatment delivers compelling long-term financial benefits. Material waste reduction of 15-25% translates to annual savings of $50,000-$150,000 for mid-sized operations. Enhanced adhesion quality reduces rework and warranty claims by 30-40%, saving an estimated $75,000-$200,000 annually. Production efficiency improvements of 10-15% further contribute to cost reduction through decreased cycle times and increased throughput.

Energy consumption presents a mixed financial picture. While plasma systems require 20-40 kW during operation, they eliminate energy-intensive mechanical surface preparation methods and reduce curing times, resulting in net energy savings of 5-15% across the entire production process.

The return on investment timeline varies by implementation scale and specific application. Small-scale implementations typically achieve ROI within 18-24 months, while comprehensive, facility-wide plasma treatment systems may require 24-36 months to reach the break-even point. However, these calculations often underestimate secondary benefits such as improved brand reputation from higher quality products and reduced environmental impact.

Comparative analysis with alternative surface treatment technologies reveals plasma treatment's superior long-term value proposition. Chemical primers cost less initially but incur higher ongoing expenses through material costs, waste disposal, and regulatory compliance. Mechanical abrasion methods have lower equipment costs but higher labor requirements and inconsistent results, leading to quality-related expenses.

Risk mitigation factors must also be considered in the cost-benefit equation. Plasma treatment significantly reduces the financial exposure associated with adhesion failures in safety-critical components, potentially avoiding costly recalls and liability claims that could exceed millions of dollars per incident.

Despite these significant upfront costs, plasma treatment delivers compelling long-term financial benefits. Material waste reduction of 15-25% translates to annual savings of $50,000-$150,000 for mid-sized operations. Enhanced adhesion quality reduces rework and warranty claims by 30-40%, saving an estimated $75,000-$200,000 annually. Production efficiency improvements of 10-15% further contribute to cost reduction through decreased cycle times and increased throughput.

Energy consumption presents a mixed financial picture. While plasma systems require 20-40 kW during operation, they eliminate energy-intensive mechanical surface preparation methods and reduce curing times, resulting in net energy savings of 5-15% across the entire production process.

The return on investment timeline varies by implementation scale and specific application. Small-scale implementations typically achieve ROI within 18-24 months, while comprehensive, facility-wide plasma treatment systems may require 24-36 months to reach the break-even point. However, these calculations often underestimate secondary benefits such as improved brand reputation from higher quality products and reduced environmental impact.

Comparative analysis with alternative surface treatment technologies reveals plasma treatment's superior long-term value proposition. Chemical primers cost less initially but incur higher ongoing expenses through material costs, waste disposal, and regulatory compliance. Mechanical abrasion methods have lower equipment costs but higher labor requirements and inconsistent results, leading to quality-related expenses.

Risk mitigation factors must also be considered in the cost-benefit equation. Plasma treatment significantly reduces the financial exposure associated with adhesion failures in safety-critical components, potentially avoiding costly recalls and liability claims that could exceed millions of dollars per incident.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!