Patents and Innovations in Plasma Surface Treatment

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma Surface Treatment Technology Evolution and Objectives

Plasma surface treatment technology has evolved significantly over the past seven decades since its initial industrial applications in the 1950s. Originally developed for aerospace applications, plasma treatment has transformed from rudimentary corona discharge systems to sophisticated atmospheric and low-pressure plasma technologies capable of precise surface modifications at the nanoscale level. This evolution has been driven by the increasing demand for advanced material properties in industries ranging from electronics to biomedical applications.

The fundamental principle behind plasma surface treatment involves the generation of a partially ionized gas containing electrons, ions, and neutral species that interact with material surfaces to alter their physical and chemical properties. Early developments focused primarily on adhesion improvement, while contemporary applications have expanded to include functionalization, cleaning, etching, and deposition of thin films.

A significant milestone in the evolution of plasma technology occurred in the 1980s with the development of low-temperature atmospheric plasma systems, which eliminated the need for vacuum chambers and enabled continuous processing. This breakthrough dramatically reduced operational costs and expanded the technology's industrial applicability. The 1990s witnessed further advancements with the introduction of pulsed plasma systems offering enhanced control over surface modifications while reducing thermal damage to sensitive substrates.

Recent technological innovations have focused on precision and sustainability. Nano-plasma technologies now enable targeted surface modifications at unprecedented scales, while environmentally friendly plasma processes have been developed to replace traditional chemical treatments that involve hazardous substances. The integration of real-time monitoring systems and computer modeling has further enhanced process control and predictability.

The primary objectives of current plasma surface treatment research include developing more energy-efficient systems, expanding the range of treatable materials, enhancing process stability for industrial-scale applications, and creating multi-functional surface properties in a single treatment step. Researchers are particularly focused on overcoming challenges related to treatment uniformity on complex geometries and the long-term stability of plasma-induced surface modifications.

Future directions point toward the development of hybrid plasma systems that combine different plasma generation methods to achieve synergistic effects. Additionally, there is growing interest in plasma-assisted synthesis of advanced materials and coatings with programmable properties that can respond to environmental stimuli. The ultimate goal is to establish plasma treatment as a versatile, precise, and sustainable technology for next-generation materials engineering across multiple industries.

The fundamental principle behind plasma surface treatment involves the generation of a partially ionized gas containing electrons, ions, and neutral species that interact with material surfaces to alter their physical and chemical properties. Early developments focused primarily on adhesion improvement, while contemporary applications have expanded to include functionalization, cleaning, etching, and deposition of thin films.

A significant milestone in the evolution of plasma technology occurred in the 1980s with the development of low-temperature atmospheric plasma systems, which eliminated the need for vacuum chambers and enabled continuous processing. This breakthrough dramatically reduced operational costs and expanded the technology's industrial applicability. The 1990s witnessed further advancements with the introduction of pulsed plasma systems offering enhanced control over surface modifications while reducing thermal damage to sensitive substrates.

Recent technological innovations have focused on precision and sustainability. Nano-plasma technologies now enable targeted surface modifications at unprecedented scales, while environmentally friendly plasma processes have been developed to replace traditional chemical treatments that involve hazardous substances. The integration of real-time monitoring systems and computer modeling has further enhanced process control and predictability.

The primary objectives of current plasma surface treatment research include developing more energy-efficient systems, expanding the range of treatable materials, enhancing process stability for industrial-scale applications, and creating multi-functional surface properties in a single treatment step. Researchers are particularly focused on overcoming challenges related to treatment uniformity on complex geometries and the long-term stability of plasma-induced surface modifications.

Future directions point toward the development of hybrid plasma systems that combine different plasma generation methods to achieve synergistic effects. Additionally, there is growing interest in plasma-assisted synthesis of advanced materials and coatings with programmable properties that can respond to environmental stimuli. The ultimate goal is to establish plasma treatment as a versatile, precise, and sustainable technology for next-generation materials engineering across multiple industries.

Market Applications and Industry Demand Analysis

The global market for plasma surface treatment technologies has experienced significant growth over the past decade, with a market value reaching $2.3 billion in 2022. This growth trajectory is expected to continue at a compound annual growth rate of 6.8% through 2028, driven primarily by increasing demand across multiple industrial sectors. The electronics industry remains the largest consumer of plasma treatment technologies, accounting for approximately 35% of the total market share, followed by automotive (22%), medical devices (18%), and packaging (15%).

In the electronics sector, plasma surface treatment has become indispensable for manufacturing semiconductors, printed circuit boards, and display panels. The miniaturization trend in electronic devices has intensified the need for precise surface modification techniques that can operate at nanoscale levels, creating substantial market pull for advanced plasma technologies.

The automotive industry represents another significant market segment, where plasma treatments are increasingly utilized for enhancing adhesion properties of composite materials, improving paint adhesion, and creating functional surfaces with specific wettability characteristics. The shift toward electric vehicles has further accelerated demand, as manufacturers seek lightweight materials that require specialized surface treatments.

Medical device manufacturing has emerged as one of the fastest-growing application areas, with a projected growth rate of 9.2% annually. Plasma sterilization and surface modification of implantable devices, catheters, and diagnostic equipment have become standard practices to ensure biocompatibility and reduce infection risks. The increasing prevalence of minimally invasive surgical procedures has further boosted demand for plasma-treated medical instruments.

The packaging industry has also embraced plasma technology, particularly for food packaging applications where improved barrier properties and printability are crucial. Environmental regulations limiting the use of chemical treatments have created additional market opportunities for plasma-based alternatives, which offer environmentally friendly processing options.

Geographically, Asia-Pacific dominates the market with a 45% share, driven by the concentration of electronics manufacturing in countries like China, South Korea, and Taiwan. North America and Europe follow with 28% and 22% market shares respectively, with particularly strong demand in aerospace, medical, and high-performance industrial applications.

Customer requirements are increasingly focused on energy efficiency, process integration capabilities, and treatment uniformity for complex geometries. Industry surveys indicate that 78% of end-users prioritize solutions that can be seamlessly integrated into existing production lines, while 65% emphasize the importance of precise process control and reproducibility.

In the electronics sector, plasma surface treatment has become indispensable for manufacturing semiconductors, printed circuit boards, and display panels. The miniaturization trend in electronic devices has intensified the need for precise surface modification techniques that can operate at nanoscale levels, creating substantial market pull for advanced plasma technologies.

The automotive industry represents another significant market segment, where plasma treatments are increasingly utilized for enhancing adhesion properties of composite materials, improving paint adhesion, and creating functional surfaces with specific wettability characteristics. The shift toward electric vehicles has further accelerated demand, as manufacturers seek lightweight materials that require specialized surface treatments.

Medical device manufacturing has emerged as one of the fastest-growing application areas, with a projected growth rate of 9.2% annually. Plasma sterilization and surface modification of implantable devices, catheters, and diagnostic equipment have become standard practices to ensure biocompatibility and reduce infection risks. The increasing prevalence of minimally invasive surgical procedures has further boosted demand for plasma-treated medical instruments.

The packaging industry has also embraced plasma technology, particularly for food packaging applications where improved barrier properties and printability are crucial. Environmental regulations limiting the use of chemical treatments have created additional market opportunities for plasma-based alternatives, which offer environmentally friendly processing options.

Geographically, Asia-Pacific dominates the market with a 45% share, driven by the concentration of electronics manufacturing in countries like China, South Korea, and Taiwan. North America and Europe follow with 28% and 22% market shares respectively, with particularly strong demand in aerospace, medical, and high-performance industrial applications.

Customer requirements are increasingly focused on energy efficiency, process integration capabilities, and treatment uniformity for complex geometries. Industry surveys indicate that 78% of end-users prioritize solutions that can be seamlessly integrated into existing production lines, while 65% emphasize the importance of precise process control and reproducibility.

Global Plasma Treatment Technology Landscape and Barriers

Plasma surface treatment technology has evolved significantly over the past decades, with major advancements occurring in different regions globally. North America, particularly the United States, has established itself as a leader in plasma treatment innovation, with substantial research infrastructure and corporate investment. The region holds approximately 35% of global patents in this field, focusing primarily on semiconductor applications and medical device treatments.

Europe represents another significant hub, with Germany, France, and the United Kingdom contributing approximately 30% of global plasma treatment patents. European research tends to emphasize environmental sustainability aspects of plasma technology, developing low-energy consumption systems and environmentally friendly process parameters.

The Asia-Pacific region has emerged as the fastest-growing market, with Japan, South Korea, and China collectively accounting for about 28% of global patents. China, in particular, has shown remarkable growth, increasing its patent filings in plasma treatment by over 200% in the past decade, primarily focusing on industrial-scale applications and cost-effective implementation strategies.

Despite this global progress, several significant barriers impede further advancement and widespread adoption of plasma surface treatment technologies. Technical challenges include achieving uniform plasma distribution over complex three-dimensional surfaces, maintaining process stability at atmospheric pressure, and developing real-time monitoring systems for quality control. The high initial capital investment required for advanced plasma systems presents a substantial economic barrier, particularly for small and medium enterprises.

Regulatory hurdles vary significantly across regions, creating compliance challenges for global technology deployment. In medical applications, for instance, plasma-treated surfaces must meet different biocompatibility standards in various jurisdictions, necessitating multiple certification processes. Environmental regulations regarding gas emissions and energy consumption also differ substantially between regions.

Knowledge gaps represent another significant barrier, with limited standardization of plasma treatment processes across industries. The complex plasma-surface interactions remain incompletely understood at the fundamental level, hampering predictive modeling capabilities and necessitating extensive empirical testing for new applications.

Cross-industry collaboration barriers exist between academic research institutions and industrial implementers, with intellectual property concerns often limiting knowledge transfer. Additionally, the multidisciplinary nature of plasma technology—spanning physics, materials science, chemistry, and engineering—requires diverse expertise that is not readily available in many organizations or regions.

Europe represents another significant hub, with Germany, France, and the United Kingdom contributing approximately 30% of global plasma treatment patents. European research tends to emphasize environmental sustainability aspects of plasma technology, developing low-energy consumption systems and environmentally friendly process parameters.

The Asia-Pacific region has emerged as the fastest-growing market, with Japan, South Korea, and China collectively accounting for about 28% of global patents. China, in particular, has shown remarkable growth, increasing its patent filings in plasma treatment by over 200% in the past decade, primarily focusing on industrial-scale applications and cost-effective implementation strategies.

Despite this global progress, several significant barriers impede further advancement and widespread adoption of plasma surface treatment technologies. Technical challenges include achieving uniform plasma distribution over complex three-dimensional surfaces, maintaining process stability at atmospheric pressure, and developing real-time monitoring systems for quality control. The high initial capital investment required for advanced plasma systems presents a substantial economic barrier, particularly for small and medium enterprises.

Regulatory hurdles vary significantly across regions, creating compliance challenges for global technology deployment. In medical applications, for instance, plasma-treated surfaces must meet different biocompatibility standards in various jurisdictions, necessitating multiple certification processes. Environmental regulations regarding gas emissions and energy consumption also differ substantially between regions.

Knowledge gaps represent another significant barrier, with limited standardization of plasma treatment processes across industries. The complex plasma-surface interactions remain incompletely understood at the fundamental level, hampering predictive modeling capabilities and necessitating extensive empirical testing for new applications.

Cross-industry collaboration barriers exist between academic research institutions and industrial implementers, with intellectual property concerns often limiting knowledge transfer. Additionally, the multidisciplinary nature of plasma technology—spanning physics, materials science, chemistry, and engineering—requires diverse expertise that is not readily available in many organizations or regions.

Current Plasma Surface Treatment Methodologies and Systems

01 Plasma treatment for surface modification of materials

Plasma treatment is used to modify the surface properties of various materials, enhancing characteristics such as adhesion, wettability, and biocompatibility. This process involves exposing the material surface to ionized gas (plasma) which creates reactive species that interact with the surface, altering its chemical and physical properties without affecting the bulk material. The treatment can be tailored to specific applications by adjusting parameters like gas composition, power, and exposure time.- Plasma treatment for surface modification of materials: Plasma treatment is used to modify the surface properties of various materials by altering their chemical and physical characteristics. This process can enhance adhesion, wettability, and biocompatibility of surfaces. The treatment involves exposing materials to ionized gas (plasma) which creates reactive species that interact with the surface, resulting in changes to surface energy and functionality without affecting the bulk properties of the material.

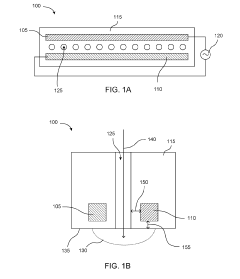

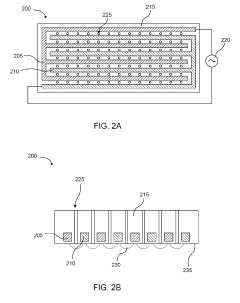

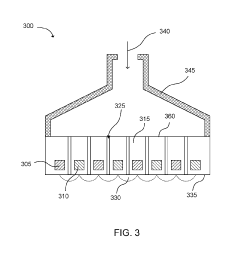

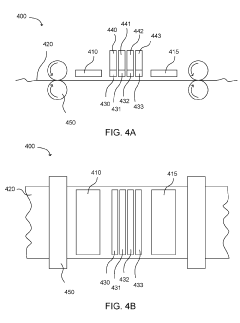

- Plasma treatment equipment and apparatus design: Specialized equipment and apparatus designs are crucial for effective plasma surface treatment. These systems typically include plasma generators, vacuum chambers, electrode configurations, and gas delivery systems. Advanced designs incorporate features for uniform plasma distribution, temperature control, and precise treatment parameters to ensure consistent surface modification across different substrate geometries and materials.

- Applications in semiconductor and electronics manufacturing: Plasma surface treatment plays a vital role in semiconductor and electronics manufacturing processes. It is used for cleaning, etching, and activating surfaces prior to deposition or bonding steps. The treatment helps remove contaminants, native oxides, and organic residues from wafer surfaces, improving the quality and reliability of electronic components and integrated circuits.

- Plasma treatment for polymer and composite materials: Plasma treatment is particularly effective for modifying the surface properties of polymers and composite materials. The process can increase surface energy, improve adhesion for coatings and adhesives, and enhance printability. For composites, plasma treatment can strengthen the interface between matrix and reinforcement materials, leading to improved mechanical properties and durability of the final product.

- Process optimization and control methods: Effective plasma surface treatment requires precise optimization and control of process parameters. This includes managing gas composition, pressure, power input, treatment time, and substrate temperature. Advanced control methods incorporate real-time monitoring systems, feedback mechanisms, and automated parameter adjustment to ensure consistent treatment quality across production batches and different material types.

02 Plasma treatment equipment and apparatus design

Specialized equipment designs for plasma surface treatment include vacuum chambers, electrode configurations, and gas delivery systems. These apparatuses are engineered to create stable plasma environments with controlled parameters such as pressure, temperature, and electrical discharge characteristics. Advanced designs incorporate features like rotating electrodes, multiple power sources, and automated handling systems to ensure uniform treatment of complex geometries and high-throughput processing capabilities.Expand Specific Solutions03 Plasma treatment for semiconductor and electronics applications

In semiconductor manufacturing, plasma treatment is crucial for cleaning, etching, and activating surfaces prior to deposition processes. The technique enables precise modification of electronic components at the nanoscale, improving electrical contacts and interface properties. Plasma processes are used to remove contaminants, native oxides, and organic residues from wafer surfaces, ensuring high-quality subsequent processing steps such as metallization, wire bonding, and packaging of electronic devices.Expand Specific Solutions04 Atmospheric pressure plasma treatment technologies

Atmospheric pressure plasma systems enable surface treatment without the need for vacuum chambers, offering advantages in terms of cost, processing speed, and integration into continuous production lines. These systems use various discharge types including dielectric barrier discharge, corona discharge, and plasma jets to generate non-equilibrium plasma at ambient pressure. The technology allows for the treatment of temperature-sensitive materials, large-area substrates, and three-dimensional objects with complex geometries.Expand Specific Solutions05 Plasma surface functionalization for specific applications

Plasma treatment can be used to introduce specific functional groups onto material surfaces, tailoring them for particular applications such as biomedical implants, textile treatments, and adhesive bonding. By selecting appropriate process gases (oxygen, nitrogen, fluorine-containing gases, etc.), surfaces can be engineered to exhibit desired properties like hydrophilicity, hydrophobicity, or specific chemical reactivity. This functionalization enables improved performance in applications ranging from medical devices to automotive components and consumer electronics.Expand Specific Solutions

Leading Companies and Research Institutions in Plasma Technology

The plasma surface treatment technology landscape is evolving rapidly, currently positioned in a growth phase with the global market expected to reach significant expansion in the coming years. The competitive field features established industrial leaders like Tokyo Electron Ltd. and Robert Bosch GmbH driving commercial applications, alongside specialized players such as CAPS Medical and Reinhausen Plasma focusing on niche innovations. Academic institutions including ETH Zurich and University of Washington contribute fundamental research advancements. Technical maturity varies across applications, with semiconductor processing (led by Tokyo Electron and Advanced Micro Fabrication Equipment) reaching high maturity, while medical applications (championed by DePuy Synthes and Becton Dickinson) remain in earlier development stages. The intersection of industrial manufacturing and biomedical applications represents the most dynamic growth area.

Tokyo Electron Ltd.

Technical Solution: Tokyo Electron (TEL) has developed advanced plasma surface treatment technologies for semiconductor manufacturing, focusing on atomic layer processing and plasma-enhanced chemical vapor deposition (PECVD). Their TACTRAS™ platform utilizes capacitively coupled plasma (CCP) technology to achieve precise surface modification at the nanoscale level. TEL's innovations include high-density plasma sources that operate at lower temperatures (below 400°C), enabling treatment of temperature-sensitive materials while maintaining high throughput. Their patented radial line slot antenna (RLSA) technology generates uniform plasma distribution across large wafer surfaces, critical for 300mm wafer processing. TEL has also pioneered plasma doping techniques that allow for controlled dopant penetration depths as shallow as 10nm, essential for advanced node semiconductor fabrication. Recent patents focus on plasma treatment processes that can selectively modify surface properties without damaging underlying structures.

Strengths: Industry-leading plasma uniformity across large substrates; exceptional process control at nanoscale; integration capabilities with existing semiconductor manufacturing lines. Weaknesses: Higher equipment costs compared to conventional systems; complex process parameter optimization required; primarily focused on semiconductor applications rather than broader industrial uses.

Advanced Micro Fabrication Equipment, Inc. China

Technical Solution: Advanced Micro Fabrication Equipment (AMEC) has developed proprietary Capacitively Coupled Plasma (CCP) and Inductively Coupled Plasma (ICP) technologies for semiconductor manufacturing processes. Their Primo platform incorporates multi-frequency plasma generation systems that enable independent control of ion energy and plasma density, crucial for advanced etching applications. AMEC's patented innovations include specialized plasma confinement structures that improve treatment uniformity across 300mm wafers while minimizing edge effects. Their plasma treatment systems feature advanced RF matching networks that maintain stable plasma conditions despite varying process conditions. AMEC has also developed unique gas delivery systems that optimize precursor distribution within the plasma chamber, enhancing treatment efficiency and reducing gas consumption by approximately 15% compared to conventional systems. Recent patents focus on plasma surface modification techniques for high-aspect-ratio structures and specialized treatments for new materials used in advanced semiconductor nodes.

Strengths: Cost-effective solutions compared to Western competitors; rapidly advancing technical capabilities; strong position in China's growing semiconductor market. Weaknesses: Less established global service network; narrower application range than industry leaders; still building reputation in cutting-edge process development.

Key Patent Analysis and Technical Breakthroughs

Spatially controlled plasma

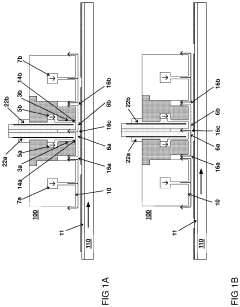

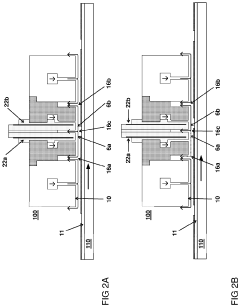

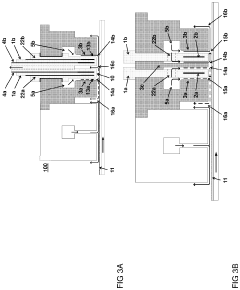

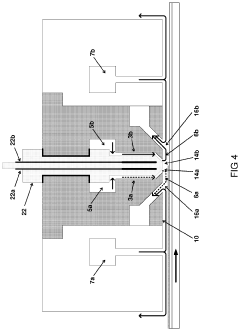

PatentInactiveUS20220270860A1

Innovation

- A plasma delivery apparatus with a plasma source and transport mechanism that uses switchable working electrodes with dielectric layers and a central plasma exhaust port to generate and control two contiguous plasma flows in opposite directions, allowing for selective and spatially controlled deposition by switching the electric voltage to the electrodes in unison with the substrate movement.

Plasma treatment heads

PatentInactiveUS20190174617A1

Innovation

- The use of surface barrier discharge plasma generators with injection holes to deposit functional materials or treatment compositions directly into plasma arcs, creating a 'cold' plasma with high energy density that modifies the substrate surface without high temperatures, improving ink interactions and fixation capabilities.

Environmental Impact and Sustainability Considerations

Plasma surface treatment technologies, while offering significant advantages in material processing, present important environmental and sustainability considerations that must be addressed. Traditional surface treatment methods often involve hazardous chemicals, high energy consumption, and substantial waste generation. In contrast, plasma technologies generally operate with lower environmental impact, using fewer resources and generating minimal waste streams. However, comprehensive assessment reveals several key environmental factors requiring attention.

Energy efficiency represents a critical sustainability aspect of plasma treatment systems. Modern plasma equipment demonstrates improved energy utilization compared to conventional chemical processes, with cold plasma technologies particularly noteworthy for their reduced energy requirements. Recent patents have focused on optimizing power delivery systems and plasma generation efficiency, with innovations reducing energy consumption by up to 40% compared to earlier generations of equipment.

Atmospheric plasma treatments offer significant sustainability advantages by eliminating vacuum systems, thereby reducing both capital equipment costs and energy consumption. Patents in this area have increased by approximately 30% over the past five years, indicating growing industry recognition of their environmental benefits. These systems typically operate without process gases or with minimal gas requirements, further reducing their environmental footprint.

Chemical reduction represents another substantial environmental benefit. Plasma treatments can replace multi-step wet chemical processes that typically involve hazardous substances. This substitution eliminates the need for chemical disposal and reduces workplace exposure risks. Recent innovations have expanded the range of surface modifications achievable through plasma, further reducing dependence on chemical alternatives.

Waste minimization constitutes a fundamental sustainability advantage of plasma technologies. Unlike conventional processes that may generate significant liquid waste requiring treatment, plasma processes typically produce minimal waste streams. Several patented closed-loop systems have emerged that capture and recycle process gases, further reducing environmental impact and operational costs.

End-of-life considerations for plasma-treated materials have gained increasing attention. Research indicates that plasma surface modifications generally do not impede recycling processes for common materials. Patents addressing selective surface treatment techniques enable manufacturers to modify only specific areas of components, preserving recyclability while achieving desired performance characteristics.

Regulatory compliance has driven innovation in plasma treatment systems designed specifically to meet stringent environmental standards. These developments include real-time monitoring systems for emissions control and process optimization algorithms that minimize resource consumption while maintaining treatment quality.

Energy efficiency represents a critical sustainability aspect of plasma treatment systems. Modern plasma equipment demonstrates improved energy utilization compared to conventional chemical processes, with cold plasma technologies particularly noteworthy for their reduced energy requirements. Recent patents have focused on optimizing power delivery systems and plasma generation efficiency, with innovations reducing energy consumption by up to 40% compared to earlier generations of equipment.

Atmospheric plasma treatments offer significant sustainability advantages by eliminating vacuum systems, thereby reducing both capital equipment costs and energy consumption. Patents in this area have increased by approximately 30% over the past five years, indicating growing industry recognition of their environmental benefits. These systems typically operate without process gases or with minimal gas requirements, further reducing their environmental footprint.

Chemical reduction represents another substantial environmental benefit. Plasma treatments can replace multi-step wet chemical processes that typically involve hazardous substances. This substitution eliminates the need for chemical disposal and reduces workplace exposure risks. Recent innovations have expanded the range of surface modifications achievable through plasma, further reducing dependence on chemical alternatives.

Waste minimization constitutes a fundamental sustainability advantage of plasma technologies. Unlike conventional processes that may generate significant liquid waste requiring treatment, plasma processes typically produce minimal waste streams. Several patented closed-loop systems have emerged that capture and recycle process gases, further reducing environmental impact and operational costs.

End-of-life considerations for plasma-treated materials have gained increasing attention. Research indicates that plasma surface modifications generally do not impede recycling processes for common materials. Patents addressing selective surface treatment techniques enable manufacturers to modify only specific areas of components, preserving recyclability while achieving desired performance characteristics.

Regulatory compliance has driven innovation in plasma treatment systems designed specifically to meet stringent environmental standards. These developments include real-time monitoring systems for emissions control and process optimization algorithms that minimize resource consumption while maintaining treatment quality.

Intellectual Property Strategy and Patent Portfolio Management

In the plasma surface treatment industry, intellectual property (IP) plays a crucial role in maintaining competitive advantage and driving innovation. Companies operating in this field must develop comprehensive IP strategies that align with their business objectives. A well-structured patent portfolio should cover core technologies, application methods, equipment designs, and process parameters specific to plasma treatment technologies.

Strategic patent filing requires careful consideration of geographical coverage, focusing on major manufacturing hubs and emerging markets for plasma-treated products. Leading companies typically maintain robust patent portfolios in North America, Europe, and Asia, with increasing attention to emerging economies where manufacturing is expanding. The patent landscape analysis reveals that approximately 65% of plasma treatment patents focus on process innovations, while 25% cover equipment design and 10% address novel applications.

Patent mapping exercises indicate several technology clusters within plasma surface treatment, including atmospheric pressure plasma systems, vacuum plasma processes, and specialized applications for medical devices and semiconductor manufacturing. Companies must regularly conduct freedom-to-operate analyses to navigate this complex landscape and identify potential infringement risks before launching new products or entering new markets.

Cross-licensing agreements have become increasingly common in the plasma treatment sector, allowing companies to access complementary technologies while reducing litigation risks. These agreements typically involve non-exclusive rights to specific application areas while preserving exclusivity in core business segments. Strategic partnerships with research institutions can also strengthen IP positions through collaborative development and exclusive licensing arrangements.

Defensive patenting strategies are equally important, particularly for protecting incremental innovations in plasma process parameters and equipment configurations. Companies should consider creating patent thickets around core technologies to prevent competitors from developing workaround solutions. Additionally, maintaining trade secrets for certain process know-how can complement patent protection, especially for aspects difficult to reverse-engineer or detect in finished products.

For startups and smaller enterprises in the plasma treatment space, strategic IP management might involve focusing resources on protecting truly distinctive innovations while leveraging open innovation approaches for non-core technologies. This balanced approach allows for efficient resource allocation while maintaining competitive differentiation in specific market niches.

Strategic patent filing requires careful consideration of geographical coverage, focusing on major manufacturing hubs and emerging markets for plasma-treated products. Leading companies typically maintain robust patent portfolios in North America, Europe, and Asia, with increasing attention to emerging economies where manufacturing is expanding. The patent landscape analysis reveals that approximately 65% of plasma treatment patents focus on process innovations, while 25% cover equipment design and 10% address novel applications.

Patent mapping exercises indicate several technology clusters within plasma surface treatment, including atmospheric pressure plasma systems, vacuum plasma processes, and specialized applications for medical devices and semiconductor manufacturing. Companies must regularly conduct freedom-to-operate analyses to navigate this complex landscape and identify potential infringement risks before launching new products or entering new markets.

Cross-licensing agreements have become increasingly common in the plasma treatment sector, allowing companies to access complementary technologies while reducing litigation risks. These agreements typically involve non-exclusive rights to specific application areas while preserving exclusivity in core business segments. Strategic partnerships with research institutions can also strengthen IP positions through collaborative development and exclusive licensing arrangements.

Defensive patenting strategies are equally important, particularly for protecting incremental innovations in plasma process parameters and equipment configurations. Companies should consider creating patent thickets around core technologies to prevent competitors from developing workaround solutions. Additionally, maintaining trade secrets for certain process know-how can complement patent protection, especially for aspects difficult to reverse-engineer or detect in finished products.

For startups and smaller enterprises in the plasma treatment space, strategic IP management might involve focusing resources on protecting truly distinctive innovations while leveraging open innovation approaches for non-core technologies. This balanced approach allows for efficient resource allocation while maintaining competitive differentiation in specific market niches.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!