Exploring the Patents in Plasma Surface Treatment Technology

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma Surface Treatment Technology Background and Objectives

Plasma surface treatment technology has evolved significantly over the past several decades, transforming from a niche scientific application to a widely adopted industrial process. The technology originated in the 1960s with basic plasma etching techniques used in semiconductor manufacturing. By the 1980s, plasma treatment expanded into broader applications including surface activation, cleaning, and coating deposition across multiple industries. This evolution represents a fundamental shift in how manufacturers approach surface modification challenges.

The core principle of plasma surface treatment involves exposing materials to ionized gas (plasma) that modifies surface properties without affecting bulk characteristics. This selective modification capability has driven adoption across diverse sectors including electronics, automotive, medical devices, packaging, and textiles. The technology enables critical surface functionalities such as improved adhesion, wettability, biocompatibility, and antimicrobial properties.

Current technological development focuses on several key areas: atmospheric pressure plasma systems that eliminate vacuum requirements, precision control mechanisms for nanoscale applications, environmentally sustainable processes with reduced energy consumption, and specialized plasma chemistries for novel material applications. These advancements aim to overcome traditional limitations while expanding the technology's application scope.

The global market for plasma surface treatment equipment has demonstrated consistent growth, with projections indicating a compound annual growth rate of approximately 5-7% through 2027. This growth is primarily driven by increasing demands in electronics manufacturing, medical device production, and advanced packaging applications. Regional adoption patterns show particular strength in East Asia, North America, and Western Europe, with emerging markets showing accelerated adoption rates.

The primary objectives of current plasma treatment technology development include enhancing process efficiency through reduced cycle times and energy consumption, improving treatment uniformity for complex geometries, developing specialized solutions for new materials including composites and biodegradable polymers, and creating integrated systems that combine plasma treatment with complementary manufacturing processes. These objectives align with broader industrial trends toward sustainability, miniaturization, and advanced materials integration.

Patent activity in this field has increased substantially over the past decade, with particular concentration in process optimization, equipment design, and application-specific methodologies. Key patent holders include both established equipment manufacturers and specialized technology developers, with notable geographic distribution across Japan, Germany, the United States, and increasingly, China. These patents reveal the technology's maturation and diversification into specialized applications.

The core principle of plasma surface treatment involves exposing materials to ionized gas (plasma) that modifies surface properties without affecting bulk characteristics. This selective modification capability has driven adoption across diverse sectors including electronics, automotive, medical devices, packaging, and textiles. The technology enables critical surface functionalities such as improved adhesion, wettability, biocompatibility, and antimicrobial properties.

Current technological development focuses on several key areas: atmospheric pressure plasma systems that eliminate vacuum requirements, precision control mechanisms for nanoscale applications, environmentally sustainable processes with reduced energy consumption, and specialized plasma chemistries for novel material applications. These advancements aim to overcome traditional limitations while expanding the technology's application scope.

The global market for plasma surface treatment equipment has demonstrated consistent growth, with projections indicating a compound annual growth rate of approximately 5-7% through 2027. This growth is primarily driven by increasing demands in electronics manufacturing, medical device production, and advanced packaging applications. Regional adoption patterns show particular strength in East Asia, North America, and Western Europe, with emerging markets showing accelerated adoption rates.

The primary objectives of current plasma treatment technology development include enhancing process efficiency through reduced cycle times and energy consumption, improving treatment uniformity for complex geometries, developing specialized solutions for new materials including composites and biodegradable polymers, and creating integrated systems that combine plasma treatment with complementary manufacturing processes. These objectives align with broader industrial trends toward sustainability, miniaturization, and advanced materials integration.

Patent activity in this field has increased substantially over the past decade, with particular concentration in process optimization, equipment design, and application-specific methodologies. Key patent holders include both established equipment manufacturers and specialized technology developers, with notable geographic distribution across Japan, Germany, the United States, and increasingly, China. These patents reveal the technology's maturation and diversification into specialized applications.

Market Demand Analysis for Plasma Surface Treatment

The global market for plasma surface treatment technology has witnessed substantial growth in recent years, driven by increasing demand across multiple industries. The market size was valued at approximately 2.1 billion USD in 2022 and is projected to reach 3.4 billion USD by 2028, representing a compound annual growth rate of 8.3%. This growth trajectory is primarily fueled by the expanding applications of plasma treatment in electronics, automotive, medical devices, and packaging industries.

In the electronics sector, the miniaturization trend and increasing complexity of components have created a significant demand for precise surface modification techniques. Plasma treatment enables improved adhesion properties, enhanced wettability, and superior bonding capabilities for microelectronic components, printed circuit boards, and semiconductor devices. The rapid expansion of consumer electronics and the emergence of IoT devices have further accelerated this demand.

The automotive industry represents another major market segment, where plasma surface treatment is increasingly utilized for improving paint adhesion, enhancing durability of plastic components, and developing advanced composite materials. With the automotive sector's shift toward lightweight materials and electric vehicles, the demand for specialized surface treatments has grown substantially to address new material integration challenges.

Medical device manufacturing has emerged as a high-growth application area, where plasma technology enables sterilization, biocompatibility enhancement, and precise surface functionalization of implantable devices and diagnostic equipment. The stringent regulatory requirements in healthcare have positioned plasma treatment as a preferred method due to its effectiveness and environmental advantages over chemical treatments.

The packaging industry has also contributed significantly to market growth, with plasma treatment being employed to improve printability, adhesion, and barrier properties of packaging materials. The increasing consumer preference for sustainable packaging solutions has further boosted the adoption of plasma technology as an environmentally friendly alternative to chemical primers and adhesion promoters.

Geographically, Asia-Pacific represents the largest and fastest-growing market for plasma surface treatment technology, driven by the region's robust electronics manufacturing sector and expanding automotive production. North America and Europe follow closely, with strong demand from medical device manufacturers and research institutions developing advanced materials and applications.

The market is also being shaped by evolving customer requirements for more energy-efficient, versatile, and automated plasma treatment systems. End-users increasingly demand solutions that can be integrated into existing production lines, offer precise process control, and accommodate a wider range of substrate materials and geometries.

In the electronics sector, the miniaturization trend and increasing complexity of components have created a significant demand for precise surface modification techniques. Plasma treatment enables improved adhesion properties, enhanced wettability, and superior bonding capabilities for microelectronic components, printed circuit boards, and semiconductor devices. The rapid expansion of consumer electronics and the emergence of IoT devices have further accelerated this demand.

The automotive industry represents another major market segment, where plasma surface treatment is increasingly utilized for improving paint adhesion, enhancing durability of plastic components, and developing advanced composite materials. With the automotive sector's shift toward lightweight materials and electric vehicles, the demand for specialized surface treatments has grown substantially to address new material integration challenges.

Medical device manufacturing has emerged as a high-growth application area, where plasma technology enables sterilization, biocompatibility enhancement, and precise surface functionalization of implantable devices and diagnostic equipment. The stringent regulatory requirements in healthcare have positioned plasma treatment as a preferred method due to its effectiveness and environmental advantages over chemical treatments.

The packaging industry has also contributed significantly to market growth, with plasma treatment being employed to improve printability, adhesion, and barrier properties of packaging materials. The increasing consumer preference for sustainable packaging solutions has further boosted the adoption of plasma technology as an environmentally friendly alternative to chemical primers and adhesion promoters.

Geographically, Asia-Pacific represents the largest and fastest-growing market for plasma surface treatment technology, driven by the region's robust electronics manufacturing sector and expanding automotive production. North America and Europe follow closely, with strong demand from medical device manufacturers and research institutions developing advanced materials and applications.

The market is also being shaped by evolving customer requirements for more energy-efficient, versatile, and automated plasma treatment systems. End-users increasingly demand solutions that can be integrated into existing production lines, offer precise process control, and accommodate a wider range of substrate materials and geometries.

Current Status and Challenges in Plasma Surface Treatment

Plasma surface treatment technology has evolved significantly over the past few decades, establishing itself as a critical process in various industries including electronics, automotive, medical devices, and aerospace. Currently, the global market for plasma surface treatment equipment is estimated at approximately $2.1 billion, with a compound annual growth rate of 5.8% projected through 2027. The technology has reached maturity in certain applications while still experiencing rapid innovation in others.

The current technological landscape is characterized by several distinct approaches, including atmospheric pressure plasma, vacuum plasma, and corona discharge systems. Low-pressure plasma treatments dominate high-precision applications in semiconductor and medical device manufacturing, while atmospheric plasma systems have gained traction in industrial settings due to their integration capabilities with production lines. Recent advancements in plasma source designs have improved energy efficiency by 30-40% compared to systems from a decade ago.

Despite significant progress, plasma surface treatment faces several critical challenges. Energy consumption remains a major concern, with most industrial systems operating at efficiency levels below 60%. The technology also struggles with treatment uniformity across complex three-dimensional geometries, limiting applications in advanced manufacturing. Process control and reproducibility present ongoing difficulties, particularly in atmospheric plasma systems where environmental factors can significantly impact treatment outcomes.

Patent analysis reveals geographical disparities in technology development, with approximately 45% of plasma treatment patents originating from East Asia, 30% from North America, and 20% from Europe. China has emerged as a rapidly growing contributor, with patent filings increasing by 180% over the past five years, primarily focusing on cost-effective atmospheric plasma systems.

Technical standardization represents another significant challenge, with inconsistent parameters and measurement protocols across different industries and regions. This hampers technology transfer and comparative performance evaluation. Additionally, environmental and safety concerns persist, particularly regarding ozone generation in atmospheric plasma systems and the use of fluorinated gases in certain applications.

The integration of real-time monitoring and control systems remains underdeveloped, with most current implementations relying on pre-process testing rather than in-situ adjustments. This limitation restricts the technology's application in high-precision manufacturing environments where adaptive processing is increasingly required. Recent research indicates that only about 25% of commercial plasma treatment systems incorporate advanced feedback control mechanisms.

The current technological landscape is characterized by several distinct approaches, including atmospheric pressure plasma, vacuum plasma, and corona discharge systems. Low-pressure plasma treatments dominate high-precision applications in semiconductor and medical device manufacturing, while atmospheric plasma systems have gained traction in industrial settings due to their integration capabilities with production lines. Recent advancements in plasma source designs have improved energy efficiency by 30-40% compared to systems from a decade ago.

Despite significant progress, plasma surface treatment faces several critical challenges. Energy consumption remains a major concern, with most industrial systems operating at efficiency levels below 60%. The technology also struggles with treatment uniformity across complex three-dimensional geometries, limiting applications in advanced manufacturing. Process control and reproducibility present ongoing difficulties, particularly in atmospheric plasma systems where environmental factors can significantly impact treatment outcomes.

Patent analysis reveals geographical disparities in technology development, with approximately 45% of plasma treatment patents originating from East Asia, 30% from North America, and 20% from Europe. China has emerged as a rapidly growing contributor, with patent filings increasing by 180% over the past five years, primarily focusing on cost-effective atmospheric plasma systems.

Technical standardization represents another significant challenge, with inconsistent parameters and measurement protocols across different industries and regions. This hampers technology transfer and comparative performance evaluation. Additionally, environmental and safety concerns persist, particularly regarding ozone generation in atmospheric plasma systems and the use of fluorinated gases in certain applications.

The integration of real-time monitoring and control systems remains underdeveloped, with most current implementations relying on pre-process testing rather than in-situ adjustments. This limitation restricts the technology's application in high-precision manufacturing environments where adaptive processing is increasingly required. Recent research indicates that only about 25% of commercial plasma treatment systems incorporate advanced feedback control mechanisms.

Current Patent Landscape and Technical Solutions

01 Plasma treatment for semiconductor manufacturing

Plasma surface treatment technology is widely used in semiconductor manufacturing processes for surface modification, cleaning, and etching. This technology enables precise control of surface properties at the nanoscale level, improving adhesion, wettability, and electrical characteristics of semiconductor materials. The plasma treatment creates reactive species that can remove contaminants, modify surface chemistry, and enhance the performance of semiconductor devices.- Plasma treatment for semiconductor manufacturing: Plasma surface treatment technology is widely used in semiconductor manufacturing processes for etching, cleaning, and modifying surface properties of semiconductor materials. This technology enables precise control of surface characteristics at the nanoscale level, improving adhesion properties and removing contaminants. The plasma treatment creates reactive species that interact with the semiconductor surface, allowing for controlled modification of surface chemistry and topography essential for advanced semiconductor device fabrication.

- Atmospheric pressure plasma treatment systems: Atmospheric pressure plasma treatment systems provide advantages over vacuum-based systems by enabling continuous processing and reducing equipment costs. These systems operate at normal atmospheric pressure and can treat various materials including polymers, metals, and ceramics. The technology allows for surface activation, cleaning, and functionalization without the need for vacuum chambers, making it suitable for in-line manufacturing processes and large-scale industrial applications.

- Plasma surface modification for improved adhesion: Plasma treatment can significantly enhance the adhesion properties of various materials by modifying their surface energy and creating functional groups. This process is particularly valuable for materials that are inherently difficult to bond, such as certain polymers and metals. The plasma treatment introduces polar groups on the surface, increasing wettability and providing anchor points for subsequent coatings, adhesives, or printing inks, resulting in stronger and more durable bonds between different materials.

- Plasma treatment for textile and polymer applications: Plasma surface treatment offers environmentally friendly alternatives to conventional chemical processes in textile and polymer industries. The technology can impart water repellency, oil resistance, antimicrobial properties, and improved dyeability to textiles without using large quantities of water or hazardous chemicals. For polymers, plasma treatment can enhance printability, paintability, and compatibility with other materials while maintaining the bulk properties of the substrate, leading to improved product performance and durability.

- Advanced plasma equipment and control systems: Recent developments in plasma treatment technology focus on advanced equipment design and precise control systems that optimize treatment efficiency and consistency. These innovations include real-time monitoring of plasma parameters, automated adjustment of process conditions, and specialized electrode configurations for different applications. The advanced systems enable more uniform treatment across complex geometries, reduced processing times, and improved energy efficiency, making plasma surface treatment more accessible and effective for various industrial applications.

02 Atmospheric pressure plasma treatment systems

Atmospheric pressure plasma treatment systems allow for surface modification without the need for vacuum chambers, making the process more cost-effective and suitable for continuous production lines. These systems generate plasma at normal atmospheric pressure using various gas compositions to achieve specific surface properties. The technology enables efficient treatment of materials that cannot withstand vacuum conditions and provides flexibility for treating large or irregularly shaped objects.Expand Specific Solutions03 Plasma surface functionalization for improved adhesion

Plasma treatment can introduce functional groups onto material surfaces to enhance adhesion properties. By exposing surfaces to specific plasma compositions, reactive functional groups such as hydroxyl, carboxyl, or amine groups can be incorporated, creating stronger bonds between different materials. This functionalization is particularly valuable for improving adhesion between dissimilar materials, such as polymers and metals, or for enhancing coating adhesion on various substrates.Expand Specific Solutions04 Plasma treatment for polymer surface modification

Plasma technology is extensively used for modifying polymer surfaces to improve their wettability, printability, and biocompatibility. The treatment can alter the surface energy of polymers without affecting their bulk properties, making them suitable for applications in medical devices, packaging, and advanced composites. By controlling plasma parameters such as power, treatment time, and gas composition, specific surface properties can be achieved to meet various application requirements.Expand Specific Solutions05 Plasma cleaning and activation processes

Plasma cleaning and activation processes are used to remove organic contaminants and prepare surfaces for subsequent processing steps. The energetic species in plasma can break down and remove organic compounds, oxides, and other contaminants without damaging the underlying material. This non-abrasive cleaning method is particularly valuable for sensitive electronic components, optical devices, and precision parts where traditional cleaning methods might cause damage or leave residues.Expand Specific Solutions

Major Players in Plasma Surface Treatment Industry

The plasma surface treatment technology market is currently in a growth phase, characterized by increasing applications across semiconductor manufacturing, medical devices, and industrial coatings. The global market size is expanding rapidly, driven by demand for advanced surface modification solutions in electronics and healthcare sectors. Technologically, the field shows varying maturity levels, with companies like Tokyo Electron, Lam Research, and Mattson Technology leading semiconductor applications through established plasma etching and deposition systems. Medical applications are advancing through innovations from Becton Dickinson and DePuy Synthes, while industrial applications see contributions from Nordson and Air Products & Chemicals. The competitive landscape features both specialized equipment manufacturers and diversified technology corporations, with Asian companies increasingly challenging traditional Western market leaders in patent development and technological innovation.

Tokyo Electron Ltd.

Technical Solution: Tokyo Electron has developed advanced plasma surface treatment technologies focusing on semiconductor manufacturing. Their TELINDY® plasma system utilizes inductively coupled plasma (ICP) technology to achieve high-density plasma at low pressures, enabling precise surface modification without thermal damage. The company has pioneered remote plasma source (RPS) technology that separates plasma generation from the process chamber, allowing for gentler surface treatments while maintaining effectiveness. Their systems incorporate multi-frequency capacitively coupled plasma (CCP) technology that enables independent control of ion energy and plasma density, crucial for nanoscale surface modifications. Tokyo Electron's plasma treatment solutions also feature advanced endpoint detection systems that precisely determine when the desired surface modification has been achieved, optimizing process efficiency and consistency across wafers.

Strengths: Industry-leading plasma density control allowing for treatment of complex geometries and temperature-sensitive materials; exceptional process uniformity across large substrates; advanced automation capabilities for high-volume manufacturing. Weaknesses: Higher capital equipment costs compared to competitors; systems typically require specialized infrastructure and utilities; relatively complex operation requiring skilled technicians.

Mattson Technology, Inc.

Technical Solution: Mattson Technology has developed innovative plasma surface treatment solutions based on their Helios® platform, which utilizes a unique rapid thermal processing (RTP) approach combined with plasma enhancement. Their technology employs a patented dual-sided heating system that enables precise temperature control during plasma treatment, critical for temperature-sensitive surface modification processes. Mattson's plasma systems incorporate advanced RF power delivery architectures that provide exceptional plasma stability across varying process conditions. The company has pioneered pulsed plasma technology that allows for surface treatment with minimal substrate heating, enabling applications for temperature-sensitive materials. Their systems feature sophisticated vacuum and pressure control mechanisms that maintain precise process conditions throughout the treatment cycle. Mattson's plasma treatment technology includes proprietary chamber designs that minimize contamination through innovative gas flow patterns and materials selection. The company has developed specialized plasma chemistries for specific surface functionalization requirements in semiconductor manufacturing.

Strengths: Superior temperature control during plasma processing allowing for treatment of highly temperature-sensitive materials; excellent process repeatability; advanced automation capabilities for high-volume manufacturing integration. Weaknesses: Higher initial capital investment compared to some competitors; systems typically require specialized infrastructure; technology primarily optimized for semiconductor applications with less flexibility for other industries.

Key Patent Analysis and Technical Innovations

Plasma treatment of substrates

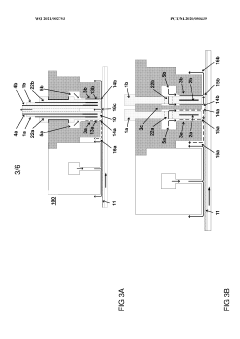

PatentWO2012010299A1

Innovation

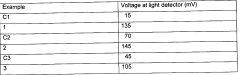

- Creating a turbulent gas flow regime within the plasma tube by controlling the gap between the outlet of the dielectric housing and the substrate, using a radio frequency high voltage to generate a non-equilibrium atmospheric pressure plasma with an atomized surface treatment agent, which promotes uniform deposition of a film derived from the surface treatment agent.

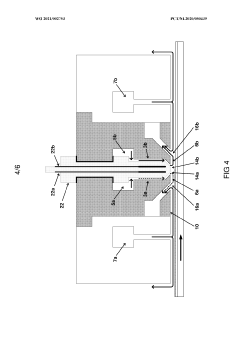

Spatially controlled plasma

PatentWO2021002753A1

Innovation

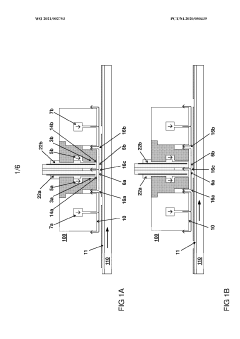

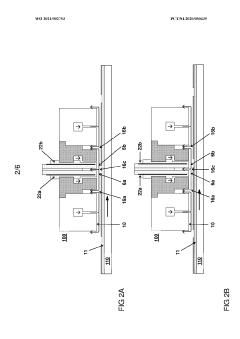

- A plasma delivery apparatus with a plasma source and transport mechanism that uses switchable working electrodes and a dielectric layer to generate and control two contiguous plasma flows in opposite directions, allowing for precise spatial control of plasma deposition and etching by selectively activating or deactivating plasma sources in unison with substrate movement.

Patent Strategy and Intellectual Property Protection

In the competitive landscape of plasma surface treatment technology, a robust patent strategy is essential for companies seeking to protect their innovations and maintain market advantage. The global patent landscape in this field reveals concentrated activity in major industrial nations, with the United States, Japan, Germany, and China leading in patent filings. These jurisdictions represent critical markets for technology commercialization and should be prioritized in any comprehensive intellectual property protection plan.

Patent analysis indicates several strategic approaches employed by industry leaders. Many companies pursue a "patent thicket" strategy, filing multiple overlapping patents around core technologies to create defensive barriers against competitors. This approach is particularly evident in specialized plasma treatment applications for semiconductors and medical devices, where high-value innovations justify extensive protection.

Cross-licensing agreements have emerged as a common practice among major players, allowing for technology exchange while maintaining competitive boundaries. These agreements often involve complementary technologies, enabling companies to expand their application portfolios without infringing on competitors' core patents.

For emerging companies in the plasma treatment sector, a focused patent strategy is recommended. Rather than attempting broad coverage, strategic protection of specific innovations in application methods, equipment design, or process parameters offers more effective protection with limited resources. Particular attention should be paid to novel plasma generation methods, control systems, and application-specific treatment protocols.

Patent monitoring systems represent a critical component of intellectual property management in this rapidly evolving field. Regular landscape analyses help identify emerging competitors, technology trends, and potential infringement issues before they impact business operations. Several specialized patent analytics platforms now offer plasma technology-specific monitoring services.

Freedom-to-operate analyses should be conducted before significant R&D investments, particularly in crowded technical areas like atmospheric pressure plasma treatments and nanostructure modification processes. These analyses help identify potential blocking patents and guide development efforts toward less constrained technical approaches.

For international protection, the Patent Cooperation Treaty (PCT) pathway offers cost-effective initial coverage, allowing companies to delay country-specific filing decisions while maintaining priority dates. Given the global nature of manufacturing utilizing plasma technologies, strategic selection of protection territories based on manufacturing locations and market potential is essential.

Patent analysis indicates several strategic approaches employed by industry leaders. Many companies pursue a "patent thicket" strategy, filing multiple overlapping patents around core technologies to create defensive barriers against competitors. This approach is particularly evident in specialized plasma treatment applications for semiconductors and medical devices, where high-value innovations justify extensive protection.

Cross-licensing agreements have emerged as a common practice among major players, allowing for technology exchange while maintaining competitive boundaries. These agreements often involve complementary technologies, enabling companies to expand their application portfolios without infringing on competitors' core patents.

For emerging companies in the plasma treatment sector, a focused patent strategy is recommended. Rather than attempting broad coverage, strategic protection of specific innovations in application methods, equipment design, or process parameters offers more effective protection with limited resources. Particular attention should be paid to novel plasma generation methods, control systems, and application-specific treatment protocols.

Patent monitoring systems represent a critical component of intellectual property management in this rapidly evolving field. Regular landscape analyses help identify emerging competitors, technology trends, and potential infringement issues before they impact business operations. Several specialized patent analytics platforms now offer plasma technology-specific monitoring services.

Freedom-to-operate analyses should be conducted before significant R&D investments, particularly in crowded technical areas like atmospheric pressure plasma treatments and nanostructure modification processes. These analyses help identify potential blocking patents and guide development efforts toward less constrained technical approaches.

For international protection, the Patent Cooperation Treaty (PCT) pathway offers cost-effective initial coverage, allowing companies to delay country-specific filing decisions while maintaining priority dates. Given the global nature of manufacturing utilizing plasma technologies, strategic selection of protection territories based on manufacturing locations and market potential is essential.

Environmental Impact and Sustainability Considerations

Plasma surface treatment technologies have gained significant attention due to their efficiency and effectiveness, but their environmental impact and sustainability aspects require careful consideration. Traditional surface treatment methods often involve hazardous chemicals and generate substantial waste, whereas plasma technologies offer potential advantages in reducing environmental footprint. The dry nature of plasma processes eliminates the need for large volumes of water and chemical solutions typically required in wet chemical treatments, significantly reducing wastewater generation and associated treatment costs.

Energy consumption remains a critical environmental factor in plasma surface treatment. While plasma processes can operate at lower temperatures than conventional thermal treatments, they still require substantial electrical power. Recent patents have focused on improving energy efficiency through optimized power supply designs, pulsed plasma systems, and more efficient electrode configurations. These innovations have demonstrated potential energy savings of 20-40% compared to earlier generation plasma systems.

Atmospheric pressure plasma technologies represent a particularly promising direction for sustainability improvement. By eliminating the need for vacuum systems, these technologies reduce both capital equipment costs and energy consumption associated with vacuum pumping. Patents in this area have shown increasing focus on room-temperature atmospheric plasma treatments that maintain effectiveness while minimizing energy requirements.

The chemical inputs and emissions from plasma processes also warrant attention from a sustainability perspective. Many plasma systems utilize inert gases like argon or helium, which have minimal direct environmental impact but represent non-renewable resources. Recent patent activity shows growing interest in nitrogen-based or air-based plasma systems that reduce dependence on these specialty gases. Additionally, patents addressing the capture and treatment of process emissions, particularly volatile organic compounds (VOCs) that may form during treatment of polymer surfaces, demonstrate industry awareness of potential air quality concerns.

Lifecycle assessment studies referenced in patent literature indicate that plasma treatments can extend product lifespans through improved surface properties, potentially offsetting the environmental impact of the treatment process itself. For instance, plasma-treated medical devices show enhanced durability and reduced replacement frequency, while plasma-modified packaging materials can improve product shelf life and reduce food waste.

Regulatory considerations are increasingly reflected in plasma technology patents, with explicit attention to compliance with environmental regulations such as REACH in Europe and similar frameworks globally. This trend indicates growing industry recognition that environmental performance is becoming a competitive factor in technology development and commercialization.

Energy consumption remains a critical environmental factor in plasma surface treatment. While plasma processes can operate at lower temperatures than conventional thermal treatments, they still require substantial electrical power. Recent patents have focused on improving energy efficiency through optimized power supply designs, pulsed plasma systems, and more efficient electrode configurations. These innovations have demonstrated potential energy savings of 20-40% compared to earlier generation plasma systems.

Atmospheric pressure plasma technologies represent a particularly promising direction for sustainability improvement. By eliminating the need for vacuum systems, these technologies reduce both capital equipment costs and energy consumption associated with vacuum pumping. Patents in this area have shown increasing focus on room-temperature atmospheric plasma treatments that maintain effectiveness while minimizing energy requirements.

The chemical inputs and emissions from plasma processes also warrant attention from a sustainability perspective. Many plasma systems utilize inert gases like argon or helium, which have minimal direct environmental impact but represent non-renewable resources. Recent patent activity shows growing interest in nitrogen-based or air-based plasma systems that reduce dependence on these specialty gases. Additionally, patents addressing the capture and treatment of process emissions, particularly volatile organic compounds (VOCs) that may form during treatment of polymer surfaces, demonstrate industry awareness of potential air quality concerns.

Lifecycle assessment studies referenced in patent literature indicate that plasma treatments can extend product lifespans through improved surface properties, potentially offsetting the environmental impact of the treatment process itself. For instance, plasma-treated medical devices show enhanced durability and reduced replacement frequency, while plasma-modified packaging materials can improve product shelf life and reduce food waste.

Regulatory considerations are increasingly reflected in plasma technology patents, with explicit attention to compliance with environmental regulations such as REACH in Europe and similar frameworks globally. This trend indicates growing industry recognition that environmental performance is becoming a competitive factor in technology development and commercialization.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!