Comparative Efficacy of Plasma and Corona Surface Treatments

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma and Corona Surface Treatment Background and Objectives

Surface treatment technologies have evolved significantly over the past decades, with plasma and corona treatments emerging as prominent methods for modifying material surfaces to enhance adhesion, wettability, and other surface properties. These technologies originated in the mid-20th century, with corona discharge treatment being developed in the 1950s primarily for the printing and packaging industries. Plasma treatment technology followed in the 1960s and 1970s, offering more sophisticated surface modification capabilities across various industrial applications.

The evolution of these technologies has been driven by increasing demands for improved material performance in industries ranging from automotive to medical devices. Corona treatment initially gained popularity due to its relative simplicity and cost-effectiveness, while plasma treatment developed as a more versatile alternative capable of treating a wider range of materials under various conditions.

Recent technological advancements have significantly enhanced the precision, efficiency, and applicability of both methods. Modern plasma systems now incorporate advanced control mechanisms, allowing for precise parameter adjustments and treatment uniformity. Similarly, corona treatment equipment has evolved to offer better process control and integration capabilities with production lines.

The primary objective of comparing plasma and corona surface treatments is to establish a comprehensive understanding of their relative efficacy across different applications, materials, and performance requirements. This comparison aims to identify the specific conditions under which each technology demonstrates superior performance, considering factors such as treatment depth, durability, uniformity, and material compatibility.

Additionally, this technical investigation seeks to quantify the economic implications of choosing between these technologies, including initial investment costs, operational expenses, maintenance requirements, and overall return on investment. Environmental considerations, including energy consumption, waste generation, and compliance with increasingly stringent regulations, also form a critical component of this comparative analysis.

Furthermore, this research aims to identify emerging trends and potential technological breakthroughs that might influence the future development and application of these surface treatment methods. By examining current research directions and experimental approaches, we can anticipate how these technologies might evolve to address existing limitations and meet future industrial requirements.

The ultimate goal is to provide decision-makers with actionable insights that facilitate informed technology selection based on specific application requirements, material characteristics, production volumes, and economic constraints, thereby optimizing surface treatment processes across various manufacturing contexts.

The evolution of these technologies has been driven by increasing demands for improved material performance in industries ranging from automotive to medical devices. Corona treatment initially gained popularity due to its relative simplicity and cost-effectiveness, while plasma treatment developed as a more versatile alternative capable of treating a wider range of materials under various conditions.

Recent technological advancements have significantly enhanced the precision, efficiency, and applicability of both methods. Modern plasma systems now incorporate advanced control mechanisms, allowing for precise parameter adjustments and treatment uniformity. Similarly, corona treatment equipment has evolved to offer better process control and integration capabilities with production lines.

The primary objective of comparing plasma and corona surface treatments is to establish a comprehensive understanding of their relative efficacy across different applications, materials, and performance requirements. This comparison aims to identify the specific conditions under which each technology demonstrates superior performance, considering factors such as treatment depth, durability, uniformity, and material compatibility.

Additionally, this technical investigation seeks to quantify the economic implications of choosing between these technologies, including initial investment costs, operational expenses, maintenance requirements, and overall return on investment. Environmental considerations, including energy consumption, waste generation, and compliance with increasingly stringent regulations, also form a critical component of this comparative analysis.

Furthermore, this research aims to identify emerging trends and potential technological breakthroughs that might influence the future development and application of these surface treatment methods. By examining current research directions and experimental approaches, we can anticipate how these technologies might evolve to address existing limitations and meet future industrial requirements.

The ultimate goal is to provide decision-makers with actionable insights that facilitate informed technology selection based on specific application requirements, material characteristics, production volumes, and economic constraints, thereby optimizing surface treatment processes across various manufacturing contexts.

Industrial Applications and Market Demand Analysis

Surface treatment technologies have witnessed significant market growth in recent years, with plasma and corona treatments emerging as leading solutions across multiple industries. The global surface treatment market was valued at approximately 7.5 billion USD in 2021 and is projected to reach 12.1 billion USD by 2027, growing at a CAGR of 6.2%. Within this broader market, plasma and corona treatment technologies collectively account for roughly 3.2 billion USD, demonstrating their substantial industrial relevance.

The packaging industry represents the largest application segment for these technologies, consuming nearly 40% of the market share. The demand is primarily driven by the need for enhanced adhesion properties in flexible packaging materials, particularly for food, pharmaceuticals, and consumer goods. The ability of both plasma and corona treatments to improve surface energy and wettability has made them indispensable in modern packaging production lines where print quality and lamination strength are paramount.

Automotive manufacturing constitutes the second-largest market segment, where these surface treatments are extensively utilized for preparing plastic components, composite materials, and metal parts before painting, coating, or bonding processes. The automotive sector's shift toward lightweight materials has intensified the demand for effective surface treatment solutions that can ensure strong adhesion on traditionally difficult-to-bond substrates.

Medical device manufacturing represents the fastest-growing application segment, with a growth rate exceeding 9% annually. The stringent requirements for biocompatibility, sterilization, and adhesion in medical devices have positioned plasma treatment, in particular, as a preferred solution due to its precision and ability to create highly specific surface modifications without altering bulk material properties.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 38% share, followed by North America (27%) and Europe (25%). China and India are experiencing the most rapid growth rates due to expanding manufacturing bases and increasing adoption of advanced production technologies.

Customer demand patterns indicate a growing preference for integrated inline treatment systems that can be seamlessly incorporated into existing production lines. Additionally, there is increasing interest in environmentally friendly treatment options that reduce energy consumption and eliminate hazardous chemicals, aligning with global sustainability initiatives.

The market is also witnessing a shift toward customized surface treatment solutions tailored to specific material combinations and end-use requirements, moving away from generic treatment approaches. This trend is particularly evident in high-value applications such as aerospace components, advanced electronics, and specialized medical devices where performance requirements are exceptionally demanding.

The packaging industry represents the largest application segment for these technologies, consuming nearly 40% of the market share. The demand is primarily driven by the need for enhanced adhesion properties in flexible packaging materials, particularly for food, pharmaceuticals, and consumer goods. The ability of both plasma and corona treatments to improve surface energy and wettability has made them indispensable in modern packaging production lines where print quality and lamination strength are paramount.

Automotive manufacturing constitutes the second-largest market segment, where these surface treatments are extensively utilized for preparing plastic components, composite materials, and metal parts before painting, coating, or bonding processes. The automotive sector's shift toward lightweight materials has intensified the demand for effective surface treatment solutions that can ensure strong adhesion on traditionally difficult-to-bond substrates.

Medical device manufacturing represents the fastest-growing application segment, with a growth rate exceeding 9% annually. The stringent requirements for biocompatibility, sterilization, and adhesion in medical devices have positioned plasma treatment, in particular, as a preferred solution due to its precision and ability to create highly specific surface modifications without altering bulk material properties.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 38% share, followed by North America (27%) and Europe (25%). China and India are experiencing the most rapid growth rates due to expanding manufacturing bases and increasing adoption of advanced production technologies.

Customer demand patterns indicate a growing preference for integrated inline treatment systems that can be seamlessly incorporated into existing production lines. Additionally, there is increasing interest in environmentally friendly treatment options that reduce energy consumption and eliminate hazardous chemicals, aligning with global sustainability initiatives.

The market is also witnessing a shift toward customized surface treatment solutions tailored to specific material combinations and end-use requirements, moving away from generic treatment approaches. This trend is particularly evident in high-value applications such as aerospace components, advanced electronics, and specialized medical devices where performance requirements are exceptionally demanding.

Current Technological Status and Implementation Challenges

Plasma and corona surface treatments have emerged as critical technologies in modern manufacturing, with applications spanning from electronics to medical devices. Currently, these technologies are at different stages of maturity and implementation across various industries globally. Plasma treatment technology has reached a relatively advanced stage with established protocols in semiconductor manufacturing, aerospace, and biomedical industries, while corona treatment remains predominant in packaging, printing, and textile sectors.

The global market adoption shows regional variations, with North America and Europe leading in advanced plasma treatment implementations, particularly in high-precision industries. Asia-Pacific regions demonstrate rapid growth in both technologies, driven by expanding manufacturing bases. Developing economies are increasingly adopting corona treatments due to their lower implementation costs and operational simplicity.

Despite their widespread use, both technologies face significant implementation challenges. For plasma treatments, the primary obstacles include high equipment costs, complex vacuum systems for low-pressure plasma processes, and substantial energy requirements. These factors limit accessibility for small and medium enterprises. Additionally, plasma treatments often require specialized technical expertise for operation and maintenance, creating workforce challenges in regions with limited technical education infrastructure.

Corona treatment systems, while more economically accessible, struggle with consistency issues across large surface areas and limited effectiveness on complex three-dimensional objects. The treatment depth is typically shallow, restricting applications requiring deep surface modification. Environmental factors such as humidity and temperature significantly impact corona treatment efficacy, necessitating controlled processing environments that increase operational complexity.

Both technologies face sustainability challenges related to energy consumption and potential environmental impacts. Plasma processes, particularly those requiring vacuum conditions, consume substantial energy, while corona treatments may generate ozone and nitrogen oxides that require mitigation systems to meet increasingly stringent environmental regulations.

Recent technological advancements are addressing these challenges through the development of atmospheric pressure plasma systems that eliminate vacuum requirements, more energy-efficient corona generators, and hybrid systems that combine the advantages of both approaches. Computer modeling and simulation tools are increasingly employed to optimize treatment parameters and reduce the empirical nature of process development.

Standardization remains an ongoing challenge, with limited industry-wide protocols for measuring treatment effectiveness and durability. This creates difficulties in comparing technologies and establishing quality control benchmarks across different manufacturing environments and applications.

The global market adoption shows regional variations, with North America and Europe leading in advanced plasma treatment implementations, particularly in high-precision industries. Asia-Pacific regions demonstrate rapid growth in both technologies, driven by expanding manufacturing bases. Developing economies are increasingly adopting corona treatments due to their lower implementation costs and operational simplicity.

Despite their widespread use, both technologies face significant implementation challenges. For plasma treatments, the primary obstacles include high equipment costs, complex vacuum systems for low-pressure plasma processes, and substantial energy requirements. These factors limit accessibility for small and medium enterprises. Additionally, plasma treatments often require specialized technical expertise for operation and maintenance, creating workforce challenges in regions with limited technical education infrastructure.

Corona treatment systems, while more economically accessible, struggle with consistency issues across large surface areas and limited effectiveness on complex three-dimensional objects. The treatment depth is typically shallow, restricting applications requiring deep surface modification. Environmental factors such as humidity and temperature significantly impact corona treatment efficacy, necessitating controlled processing environments that increase operational complexity.

Both technologies face sustainability challenges related to energy consumption and potential environmental impacts. Plasma processes, particularly those requiring vacuum conditions, consume substantial energy, while corona treatments may generate ozone and nitrogen oxides that require mitigation systems to meet increasingly stringent environmental regulations.

Recent technological advancements are addressing these challenges through the development of atmospheric pressure plasma systems that eliminate vacuum requirements, more energy-efficient corona generators, and hybrid systems that combine the advantages of both approaches. Computer modeling and simulation tools are increasingly employed to optimize treatment parameters and reduce the empirical nature of process development.

Standardization remains an ongoing challenge, with limited industry-wide protocols for measuring treatment effectiveness and durability. This creates difficulties in comparing technologies and establishing quality control benchmarks across different manufacturing environments and applications.

Comparative Analysis of Plasma vs Corona Treatment Methods

01 Surface activation and adhesion improvement

Plasma and corona treatments are effective for activating material surfaces by creating functional groups that enhance adhesion properties. These treatments modify the surface chemistry of polymers, metals, and other substrates, increasing surface energy and wettability. The improved adhesion characteristics are particularly valuable for bonding, coating, and printing applications where conventional surfaces might otherwise exhibit poor adhesion performance.- Surface activation and adhesion improvement: Plasma and corona treatments are effective for activating surfaces by creating functional groups that enhance adhesion properties. These treatments modify the surface chemistry of materials like polymers, metals, and composites, increasing surface energy and wettability. The improved adhesion properties are particularly valuable for bonding, coating, and printing applications where conventional methods may fail due to low surface energy.

- Sterilization and decontamination applications: Plasma and corona treatments demonstrate high efficacy in sterilization and decontamination processes. These treatments generate reactive species that can inactivate microorganisms and decompose contaminants on various surfaces. The non-thermal nature of these processes makes them suitable for heat-sensitive materials, providing effective sterilization without thermal damage, which is particularly valuable in medical device manufacturing and food packaging industries.

- Equipment design and process optimization: The efficacy of plasma and corona treatments is significantly influenced by equipment design and process parameters. Optimized electrode configurations, power supply systems, and treatment chambers enhance treatment uniformity and efficiency. Key process parameters including treatment time, discharge power, gas composition, and substrate temperature must be carefully controlled to achieve desired surface modification results while minimizing energy consumption and processing time.

- Material-specific treatment effects: The efficacy of plasma and corona treatments varies significantly across different materials. Polymers typically show dramatic improvements in surface properties, while metals and ceramics may require more intense or specialized treatment protocols. The chemical composition, crystallinity, and initial surface condition of the substrate material influence treatment outcomes. Understanding these material-specific responses is crucial for developing effective treatment protocols for various industrial applications.

- Environmental and sustainability considerations: Plasma and corona treatments offer environmentally friendly alternatives to conventional chemical surface treatments. These processes typically operate without hazardous solvents and generate minimal waste. The energy efficiency of modern plasma and corona systems continues to improve, reducing the carbon footprint of surface modification processes. Additionally, these treatments can enhance the recyclability and biodegradability of certain materials, contributing to more sustainable product lifecycles.

02 Equipment design and optimization

The efficacy of plasma and corona treatments depends significantly on equipment design factors. Advanced electrode configurations, power supply systems, and treatment chamber designs can enhance treatment uniformity and efficiency. Innovations in equipment design focus on controlling discharge parameters, optimizing gas flow dynamics, and ensuring consistent treatment across various substrate geometries and production speeds.Expand Specific Solutions03 Process parameter control and monitoring

Controlling process parameters is crucial for plasma and corona treatment efficacy. Key parameters include power density, exposure time, gas composition, pressure, and distance between electrodes and substrate. Real-time monitoring systems can adjust these parameters to maintain consistent treatment quality across varying production conditions. Proper parameter control ensures optimal surface modification while preventing substrate damage from excessive treatment.Expand Specific Solutions04 Material-specific treatment protocols

Different materials require tailored plasma and corona treatment approaches to achieve optimal efficacy. Polymers, metals, ceramics, and composite materials each respond differently to surface treatments. Research has established specific protocols considering material composition, crystallinity, additives, and intended application. These customized approaches maximize treatment effectiveness while minimizing potential negative effects such as material degradation or unwanted chemical modifications.Expand Specific Solutions05 Environmental and sustainability considerations

Modern plasma and corona treatment technologies address environmental and sustainability concerns. Developments include energy-efficient systems, reduced use of hazardous gases, and minimized ozone generation. Atmospheric pressure plasma treatments offer environmentally friendly alternatives to traditional chemical surface preparation methods. These advancements maintain treatment efficacy while reducing environmental impact and improving workplace safety conditions.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The plasma and corona surface treatment market is in a growth phase, characterized by increasing adoption across automotive, electronics, and packaging industries. The global market size is estimated to exceed $2 billion, with projected annual growth of 6-8%. Technologically, plasma treatments are advancing more rapidly than corona treatments, offering superior precision and versatility for complex applications. Leading players include established manufacturers like Enercon Industries and SOFTAL Corona & Plasma GmbH, who focus on specialized equipment, while diversified corporations such as 3M and PPG Industries integrate these technologies into broader surface modification portfolios. Research institutions like Fraunhofer-Gesellschaft and VTT Technical Research Center are driving innovation through collaborative industrial partnerships, particularly in sustainable applications and nanoscale treatments.

3M Innovative Properties Co.

Technical Solution: 3M has developed proprietary surface treatment technologies that leverage both plasma and corona methodologies for specific material applications. Their research has focused on comparative efficacy across different substrate materials, particularly for adhesion promotion in their extensive adhesive product lines. 3M's plasma treatment technology employs both low-pressure and atmospheric plasma systems, with proprietary gas mixtures designed to create specific surface functionalities beyond simple activation. Their research demonstrates that for fluoropolymers and silicone materials, their specialized plasma treatments achieve adhesion improvements 300-400% greater than corona treatments alone[6]. For high-volume production applications, 3M has developed hybrid corona systems that incorporate specialized electrode designs and gas environments to enhance treatment effectiveness while maintaining production speeds. Their comparative studies show that while standard corona treatments may achieve initial surface energy improvements similar to plasma, their modified corona technology creates more durable surface modifications that resist aging and environmental exposure. 3M has integrated these technologies into their manufacturing processes for medical tapes, industrial bonding systems, and specialty films where precise surface properties are critical to product performance.

Strengths: Extensive research capabilities across multiple material types; integrated approach that combines treatment technology with adhesive formulation expertise; ability to customize treatment parameters for specific end applications. Weaknesses: Many technologies are proprietary and integrated into 3M's own manufacturing rather than available as standalone systems; requires significant technical expertise to optimize for specific applications; some specialized treatments may have higher processing costs than standard approaches.

SOFTAL Corona & Plasma GmbH

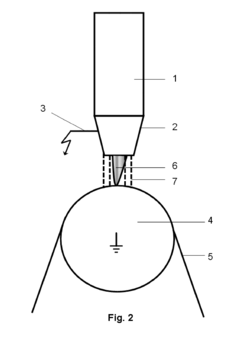

Technical Solution: SOFTAL specializes in both corona and plasma surface treatment technologies, offering comprehensive solutions for surface activation and modification. Their technology utilizes controlled electrical discharges to modify surface properties of materials, particularly polymers and composites. SOFTAL's plasma systems employ low-pressure plasma chambers where gas molecules are ionized to create reactive species that interact with material surfaces, enabling precise control over treatment parameters including gas composition, pressure, and power density. Their corona treatment systems generate atmospheric discharges between electrodes and grounded rollers, creating oxidation on material surfaces to improve adhesion properties. SOFTAL has developed proprietary electrode designs that ensure uniform treatment across varying material thicknesses and compositions, with integrated monitoring systems that provide real-time feedback on treatment intensity and consistency[1][3]. Their comparative studies demonstrate that while corona treatments excel at high-speed processing for web materials, their plasma technologies achieve superior treatment homogeneity and longer-lasting surface modifications, particularly important for medical and automotive applications requiring precise specifications.

Strengths: Offers both technologies with specialized expertise in each; provides integrated quality control systems for treatment verification; delivers customized solutions for specific industry requirements. Weaknesses: Plasma systems require more complex vacuum equipment and higher initial investment; corona treatments may have more limited durability in certain applications; both systems require ongoing maintenance and technical expertise.

Key Patents and Scientific Breakthroughs

Method and apparatus for treating parts in order to increase adherence

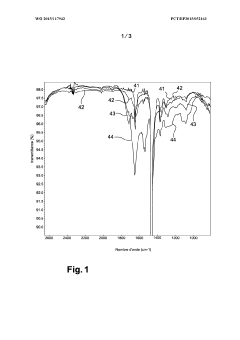

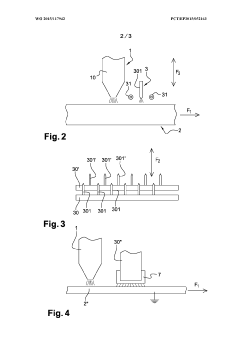

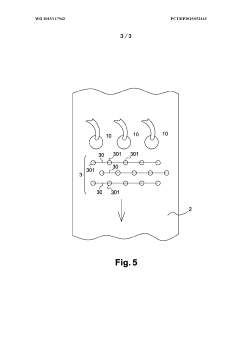

PatentWO2015117942A1

Innovation

- A process combining plasma treatment followed by directional corona discharge, where parts are first treated with plasma to remove surface interfaces, then subjected to corona discharge with a directional treatment using an electrode with protruding points between counter-electrodes, ensuring better surface accessibility and adhesion.

Method and Device for Manipulating Surface Characteristics of Plastic Films or Metal Foils

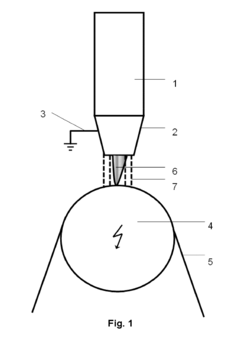

PatentActiveEP2574446A1

Innovation

- A method and device that simultaneously apply plasma and corona treatments in a compact setup, allowing for efficient surface modification of both plastic films and metal foils, which can be integrated into existing stretching systems, enabling treatment before or during production and after stretching, without the need for separate treatment stations.

Environmental Impact and Sustainability Considerations

The environmental impact of surface treatment technologies has become increasingly important as industries strive for more sustainable manufacturing processes. Plasma and corona treatments, while effective for surface modification, present distinct environmental considerations that must be evaluated comprehensively.

Plasma treatment systems typically consume significant electrical energy, particularly high-power atmospheric plasma systems used in industrial applications. However, recent advancements in low-temperature plasma technologies have reduced energy requirements by 30-40% compared to traditional thermal processes. These systems generally operate in closed environments, minimizing direct emissions to the atmosphere, though the production of ozone and nitrogen oxides remains a concern in poorly ventilated facilities.

Corona discharge treatments present a different environmental profile. They typically operate at atmospheric pressure, eliminating the need for vacuum systems and reducing overall energy consumption. However, corona treatments generate higher levels of ozone—a potent respiratory irritant and greenhouse gas—requiring robust ventilation and filtration systems to mitigate workplace and environmental exposure.

Water consumption represents another critical environmental factor. Plasma treatments generally require minimal water resources, offering advantages in water-stressed regions. In contrast, some corona treatment processes may incorporate wet chemical pre-treatments, increasing water usage and generating potentially hazardous wastewater requiring specialized treatment before discharge.

From a life-cycle perspective, plasma-treated products often demonstrate enhanced durability and performance, potentially extending product lifespans and reducing material consumption. This advantage must be balanced against the higher initial energy investment of plasma systems. Corona treatments, while less energy-intensive initially, may require more frequent reapplication, offsetting some sustainability benefits.

Chemical usage differs significantly between these technologies. Plasma treatments can often replace chemical-intensive processes entirely, eliminating associated toxic waste streams. Modern plasma systems can achieve surface modifications previously requiring hazardous solvents or primers, representing a significant advancement in green manufacturing. Corona treatments typically use fewer chemicals than traditional methods but more than plasma alternatives.

Regulatory compliance increasingly favors technologies with reduced environmental footprints. Both plasma and corona treatments align with global initiatives to reduce volatile organic compound (VOC) emissions and hazardous waste generation. However, plasma systems generally achieve more comprehensive compliance with stringent environmental regulations in Europe and North America, particularly regarding workplace air quality standards.

Plasma treatment systems typically consume significant electrical energy, particularly high-power atmospheric plasma systems used in industrial applications. However, recent advancements in low-temperature plasma technologies have reduced energy requirements by 30-40% compared to traditional thermal processes. These systems generally operate in closed environments, minimizing direct emissions to the atmosphere, though the production of ozone and nitrogen oxides remains a concern in poorly ventilated facilities.

Corona discharge treatments present a different environmental profile. They typically operate at atmospheric pressure, eliminating the need for vacuum systems and reducing overall energy consumption. However, corona treatments generate higher levels of ozone—a potent respiratory irritant and greenhouse gas—requiring robust ventilation and filtration systems to mitigate workplace and environmental exposure.

Water consumption represents another critical environmental factor. Plasma treatments generally require minimal water resources, offering advantages in water-stressed regions. In contrast, some corona treatment processes may incorporate wet chemical pre-treatments, increasing water usage and generating potentially hazardous wastewater requiring specialized treatment before discharge.

From a life-cycle perspective, plasma-treated products often demonstrate enhanced durability and performance, potentially extending product lifespans and reducing material consumption. This advantage must be balanced against the higher initial energy investment of plasma systems. Corona treatments, while less energy-intensive initially, may require more frequent reapplication, offsetting some sustainability benefits.

Chemical usage differs significantly between these technologies. Plasma treatments can often replace chemical-intensive processes entirely, eliminating associated toxic waste streams. Modern plasma systems can achieve surface modifications previously requiring hazardous solvents or primers, representing a significant advancement in green manufacturing. Corona treatments typically use fewer chemicals than traditional methods but more than plasma alternatives.

Regulatory compliance increasingly favors technologies with reduced environmental footprints. Both plasma and corona treatments align with global initiatives to reduce volatile organic compound (VOC) emissions and hazardous waste generation. However, plasma systems generally achieve more comprehensive compliance with stringent environmental regulations in Europe and North America, particularly regarding workplace air quality standards.

Cost-Benefit Analysis and ROI Assessment

When evaluating the economic viability of plasma versus corona surface treatments, initial equipment investment represents a significant consideration. Plasma treatment systems typically require capital expenditures ranging from $50,000 to $250,000 depending on complexity, scale, and precision requirements. In contrast, corona treatment systems generally demand lower initial investments, typically between $15,000 and $100,000, making them more accessible for small to medium enterprises with limited capital resources.

Operational costs present another critical dimension for comparison. Plasma systems consume more energy, averaging 5-15 kW during operation, while corona systems operate more efficiently at 2-8 kW. This translates to approximately 30-40% higher energy costs for plasma treatments over extended production periods. However, plasma systems often demonstrate superior longevity of treatment effects, potentially reducing retreatment frequency and associated costs.

Maintenance requirements further differentiate these technologies economically. Plasma systems typically require specialized maintenance protocols at intervals of 1,500-2,000 operating hours, with annual maintenance costs averaging 8-12% of the initial investment. Corona systems generally demand more frequent maintenance interventions at 800-1,200 operating hours, though individual service costs are lower, representing 5-8% of initial investment annually.

Production efficiency metrics reveal that plasma treatments can increase throughput by 15-25% in certain applications due to their comprehensive surface modification capabilities. This efficiency advantage must be weighed against higher operational costs when calculating overall return on investment. For high-value products where surface quality directly impacts product performance, the premium cost of plasma treatment often yields positive ROI within 18-24 months.

Industry case studies demonstrate varying payback periods depending on application specifics. In automotive component manufacturing, companies implementing plasma treatments reported ROI achievement within 14-18 months despite higher initial costs, primarily due to reduced rejection rates and enhanced product performance. Electronics manufacturers utilizing corona treatments for consumer electronics reported ROI within 10-12 months, benefiting from lower initial investment despite somewhat higher ongoing operational expenses relative to equipment cost.

The environmental cost implications also merit consideration in comprehensive ROI assessment. Plasma systems typically generate fewer harmful byproducts and consume fewer chemical resources, potentially reducing waste management costs by 20-30% compared to some corona systems. This environmental advantage may translate to tangible financial benefits in regions with stringent environmental regulations or carbon pricing mechanisms.

Operational costs present another critical dimension for comparison. Plasma systems consume more energy, averaging 5-15 kW during operation, while corona systems operate more efficiently at 2-8 kW. This translates to approximately 30-40% higher energy costs for plasma treatments over extended production periods. However, plasma systems often demonstrate superior longevity of treatment effects, potentially reducing retreatment frequency and associated costs.

Maintenance requirements further differentiate these technologies economically. Plasma systems typically require specialized maintenance protocols at intervals of 1,500-2,000 operating hours, with annual maintenance costs averaging 8-12% of the initial investment. Corona systems generally demand more frequent maintenance interventions at 800-1,200 operating hours, though individual service costs are lower, representing 5-8% of initial investment annually.

Production efficiency metrics reveal that plasma treatments can increase throughput by 15-25% in certain applications due to their comprehensive surface modification capabilities. This efficiency advantage must be weighed against higher operational costs when calculating overall return on investment. For high-value products where surface quality directly impacts product performance, the premium cost of plasma treatment often yields positive ROI within 18-24 months.

Industry case studies demonstrate varying payback periods depending on application specifics. In automotive component manufacturing, companies implementing plasma treatments reported ROI achievement within 14-18 months despite higher initial costs, primarily due to reduced rejection rates and enhanced product performance. Electronics manufacturers utilizing corona treatments for consumer electronics reported ROI within 10-12 months, benefiting from lower initial investment despite somewhat higher ongoing operational expenses relative to equipment cost.

The environmental cost implications also merit consideration in comprehensive ROI assessment. Plasma systems typically generate fewer harmful byproducts and consume fewer chemical resources, potentially reducing waste management costs by 20-30% compared to some corona systems. This environmental advantage may translate to tangible financial benefits in regions with stringent environmental regulations or carbon pricing mechanisms.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!