Why the Automotive Sector Relies on Plasma Surface Processes

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Automotive Plasma Surface Treatment Evolution and Objectives

Plasma surface treatment in the automotive industry has evolved significantly over the past several decades, transforming from experimental applications to essential manufacturing processes. The journey began in the 1960s with rudimentary plasma cleaning techniques, primarily used for research purposes rather than mass production. By the 1980s, plasma technology had advanced sufficiently to be introduced into limited automotive manufacturing applications, mainly for specialized components requiring exceptional adhesion properties.

The 1990s marked a turning point as environmental regulations began restricting traditional solvent-based surface preparation methods due to their volatile organic compound (VOC) emissions. This regulatory pressure accelerated the adoption of plasma technologies as cleaner alternatives. Simultaneously, advances in plasma generation equipment, particularly atmospheric pressure plasma systems, made the technology more accessible and economically viable for automotive production lines.

The early 2000s witnessed widespread integration of plasma surface treatment in automotive manufacturing, coinciding with the industry's shift toward lightweight materials and multi-material assemblies. As vehicles incorporated more plastics, composites, and aluminum to reduce weight and improve fuel efficiency, plasma treatment became crucial for ensuring proper adhesion between these dissimilar materials.

Today's automotive plasma applications have expanded beyond simple surface cleaning to include functionalization, activation, coating, and etching processes. Modern vehicles contain numerous components that rely on plasma treatment, from painted exterior panels to bonded structural elements and electronic assemblies. The technology has become indispensable for meeting increasingly stringent quality, durability, and safety standards.

The primary objectives of plasma surface treatment in automotive applications center around four key areas: enhancing adhesion properties for paints, coatings, and adhesives; improving surface wettability for subsequent manufacturing processes; removing contaminants without environmentally harmful chemicals; and modifying surface properties to achieve specific functional characteristics.

Looking forward, the automotive industry aims to further refine plasma technologies to support emerging trends such as electrification, autonomous driving, and sustainable manufacturing. Specific technical objectives include developing plasma processes compatible with carbon fiber reinforced polymers and other advanced materials, creating selective treatment capabilities for complex geometries, reducing energy consumption of plasma systems, and establishing real-time monitoring and quality control protocols for plasma processes. These objectives align with the broader automotive industry goals of reducing environmental impact while enhancing vehicle performance, safety, and longevity.

The 1990s marked a turning point as environmental regulations began restricting traditional solvent-based surface preparation methods due to their volatile organic compound (VOC) emissions. This regulatory pressure accelerated the adoption of plasma technologies as cleaner alternatives. Simultaneously, advances in plasma generation equipment, particularly atmospheric pressure plasma systems, made the technology more accessible and economically viable for automotive production lines.

The early 2000s witnessed widespread integration of plasma surface treatment in automotive manufacturing, coinciding with the industry's shift toward lightweight materials and multi-material assemblies. As vehicles incorporated more plastics, composites, and aluminum to reduce weight and improve fuel efficiency, plasma treatment became crucial for ensuring proper adhesion between these dissimilar materials.

Today's automotive plasma applications have expanded beyond simple surface cleaning to include functionalization, activation, coating, and etching processes. Modern vehicles contain numerous components that rely on plasma treatment, from painted exterior panels to bonded structural elements and electronic assemblies. The technology has become indispensable for meeting increasingly stringent quality, durability, and safety standards.

The primary objectives of plasma surface treatment in automotive applications center around four key areas: enhancing adhesion properties for paints, coatings, and adhesives; improving surface wettability for subsequent manufacturing processes; removing contaminants without environmentally harmful chemicals; and modifying surface properties to achieve specific functional characteristics.

Looking forward, the automotive industry aims to further refine plasma technologies to support emerging trends such as electrification, autonomous driving, and sustainable manufacturing. Specific technical objectives include developing plasma processes compatible with carbon fiber reinforced polymers and other advanced materials, creating selective treatment capabilities for complex geometries, reducing energy consumption of plasma systems, and establishing real-time monitoring and quality control protocols for plasma processes. These objectives align with the broader automotive industry goals of reducing environmental impact while enhancing vehicle performance, safety, and longevity.

Market Demand Analysis for Plasma-Enhanced Automotive Components

The global market for plasma-enhanced automotive components has witnessed substantial growth in recent years, driven by increasing demand for high-performance vehicles with improved durability, aesthetics, and environmental sustainability. Current market analysis indicates that plasma surface treatment technologies are becoming essential in automotive manufacturing, with applications spanning from engine components to exterior body parts and interior trim elements.

Market research reveals that the automotive plasma surface treatment sector is projected to grow at a compound annual growth rate of approximately 6.5% through 2028, reflecting the industry's recognition of plasma technology's value proposition. This growth is particularly pronounced in regions with advanced automotive manufacturing capabilities, including Germany, Japan, the United States, and increasingly, China and South Korea.

Consumer preferences are shifting toward vehicles with longer lifespans, reduced maintenance requirements, and enhanced aesthetic appeal—all attributes that plasma-treated components can deliver. The demand for lightweight materials in automotive design to improve fuel efficiency and reduce emissions has further accelerated the adoption of plasma surface processes, as these treatments enable the use of previously incompatible materials by modifying their surface properties without altering bulk characteristics.

The electric vehicle (EV) segment represents a particularly promising market for plasma-enhanced components. As EV production scales up globally, manufacturers are seeking solutions to extend battery life, reduce weight, and enhance the performance of electrical components—areas where plasma surface treatments offer significant advantages. Market data suggests that plasma-treated components in the EV sector alone could represent a substantial portion of the overall market by 2025.

Regulatory pressures are also driving market demand. Stringent environmental regulations and safety standards across major automotive markets necessitate advanced manufacturing processes that can deliver components with superior performance characteristics. Plasma treatments, being environmentally friendly compared to many chemical alternatives, align well with these regulatory trends.

Tier 1 automotive suppliers are increasingly incorporating plasma treatment capabilities into their production lines, responding to OEM specifications that require enhanced surface properties. This vertical integration within the supply chain indicates the strategic importance these technologies have assumed in contemporary automotive manufacturing.

Market segmentation analysis shows that while premium vehicle manufacturers were early adopters of plasma-enhanced components, the technology is rapidly penetrating mid-range vehicle segments as processing costs decrease and production efficiencies improve. This democratization of plasma technology across vehicle price points suggests a broadening market base and increasing volumes in the coming years.

Market research reveals that the automotive plasma surface treatment sector is projected to grow at a compound annual growth rate of approximately 6.5% through 2028, reflecting the industry's recognition of plasma technology's value proposition. This growth is particularly pronounced in regions with advanced automotive manufacturing capabilities, including Germany, Japan, the United States, and increasingly, China and South Korea.

Consumer preferences are shifting toward vehicles with longer lifespans, reduced maintenance requirements, and enhanced aesthetic appeal—all attributes that plasma-treated components can deliver. The demand for lightweight materials in automotive design to improve fuel efficiency and reduce emissions has further accelerated the adoption of plasma surface processes, as these treatments enable the use of previously incompatible materials by modifying their surface properties without altering bulk characteristics.

The electric vehicle (EV) segment represents a particularly promising market for plasma-enhanced components. As EV production scales up globally, manufacturers are seeking solutions to extend battery life, reduce weight, and enhance the performance of electrical components—areas where plasma surface treatments offer significant advantages. Market data suggests that plasma-treated components in the EV sector alone could represent a substantial portion of the overall market by 2025.

Regulatory pressures are also driving market demand. Stringent environmental regulations and safety standards across major automotive markets necessitate advanced manufacturing processes that can deliver components with superior performance characteristics. Plasma treatments, being environmentally friendly compared to many chemical alternatives, align well with these regulatory trends.

Tier 1 automotive suppliers are increasingly incorporating plasma treatment capabilities into their production lines, responding to OEM specifications that require enhanced surface properties. This vertical integration within the supply chain indicates the strategic importance these technologies have assumed in contemporary automotive manufacturing.

Market segmentation analysis shows that while premium vehicle manufacturers were early adopters of plasma-enhanced components, the technology is rapidly penetrating mid-range vehicle segments as processing costs decrease and production efficiencies improve. This democratization of plasma technology across vehicle price points suggests a broadening market base and increasing volumes in the coming years.

Current Plasma Technology Landscape and Implementation Barriers

The plasma technology landscape in the automotive sector has evolved significantly over the past decade, with various plasma surface treatment processes becoming integral to manufacturing operations. Currently, atmospheric pressure plasma systems dominate the market due to their flexibility and lower operational costs compared to vacuum-based alternatives. These systems primarily utilize dielectric barrier discharge (DBD), corona discharge, and atmospheric pressure plasma jet (APPJ) technologies, each offering specific advantages for different automotive applications.

Low-pressure plasma systems, while less prevalent due to higher infrastructure requirements, remain essential for certain specialized treatments where superior uniformity and penetration depth are critical. These systems typically operate in the 0.1-100 Pa pressure range and are predominantly used for high-precision components in premium vehicle segments.

Despite technological advancements, several implementation barriers continue to challenge widespread adoption of plasma technologies in automotive manufacturing. The high initial capital investment represents a significant hurdle, particularly for smaller suppliers in the automotive value chain. A typical industrial-scale plasma treatment system requires investments ranging from $200,000 to over $1 million, depending on complexity and throughput requirements.

Technical integration challenges also persist, as plasma systems must be seamlessly incorporated into existing production lines without disrupting established workflows. This often necessitates custom engineering solutions and production line reconfiguration, adding to implementation costs and complexity.

Process control and quality assurance present another substantial barrier. The effectiveness of plasma treatments can be influenced by numerous variables including gas composition, power settings, exposure time, and substrate characteristics. Developing robust process monitoring systems that can ensure consistent treatment quality across high-volume production remains technically challenging.

Workforce expertise limitations further complicate implementation. The specialized knowledge required for plasma system operation, maintenance, and troubleshooting is not widely available in the traditional automotive manufacturing workforce, necessitating significant training investments or specialized hiring.

Regulatory compliance adds another layer of complexity, particularly regarding environmental and worker safety considerations. Plasma processes may generate ozone, NOx, and other potentially hazardous byproducts that must be properly managed to meet increasingly stringent regulations.

Energy consumption concerns also impact adoption decisions, as some plasma technologies require substantial power inputs, potentially conflicting with automotive manufacturers' sustainability goals and energy reduction targets.

Low-pressure plasma systems, while less prevalent due to higher infrastructure requirements, remain essential for certain specialized treatments where superior uniformity and penetration depth are critical. These systems typically operate in the 0.1-100 Pa pressure range and are predominantly used for high-precision components in premium vehicle segments.

Despite technological advancements, several implementation barriers continue to challenge widespread adoption of plasma technologies in automotive manufacturing. The high initial capital investment represents a significant hurdle, particularly for smaller suppliers in the automotive value chain. A typical industrial-scale plasma treatment system requires investments ranging from $200,000 to over $1 million, depending on complexity and throughput requirements.

Technical integration challenges also persist, as plasma systems must be seamlessly incorporated into existing production lines without disrupting established workflows. This often necessitates custom engineering solutions and production line reconfiguration, adding to implementation costs and complexity.

Process control and quality assurance present another substantial barrier. The effectiveness of plasma treatments can be influenced by numerous variables including gas composition, power settings, exposure time, and substrate characteristics. Developing robust process monitoring systems that can ensure consistent treatment quality across high-volume production remains technically challenging.

Workforce expertise limitations further complicate implementation. The specialized knowledge required for plasma system operation, maintenance, and troubleshooting is not widely available in the traditional automotive manufacturing workforce, necessitating significant training investments or specialized hiring.

Regulatory compliance adds another layer of complexity, particularly regarding environmental and worker safety considerations. Plasma processes may generate ozone, NOx, and other potentially hazardous byproducts that must be properly managed to meet increasingly stringent regulations.

Energy consumption concerns also impact adoption decisions, as some plasma technologies require substantial power inputs, potentially conflicting with automotive manufacturers' sustainability goals and energy reduction targets.

Mainstream Plasma Surface Processing Solutions

01 Plasma surface treatment for semiconductor manufacturing

Plasma processes are widely used in semiconductor manufacturing for surface modification, etching, and deposition. These processes involve using ionized gases to modify the surface properties of semiconductor materials, creating precise microstructures and improving device performance. The plasma treatments can be controlled to achieve specific surface characteristics, such as increased adhesion, altered wettability, or selective etching of materials.- Plasma surface treatment for semiconductor manufacturing: Plasma processes are widely used in semiconductor manufacturing for surface modification, etching, and deposition. These processes involve the use of ionized gases to modify the surface properties of semiconductor materials, enabling precise control over feature dimensions and surface characteristics. Plasma treatments can be used for cleaning, activating surfaces, and creating specific surface functionalities that are essential for semiconductor device fabrication.

- Plasma-enhanced chemical vapor deposition techniques: Plasma-enhanced chemical vapor deposition (PECVD) is a technique that uses plasma to enhance chemical reaction rates of precursors, allowing deposition of thin films at lower temperatures than conventional thermal CVD processes. This technique is particularly valuable for depositing films on temperature-sensitive substrates and creating unique material compositions. The plasma activation enables better control over film properties such as density, adhesion, and conformality.

- Plasma surface modification for improved adhesion and wettability: Plasma treatment can significantly alter the surface energy of materials, improving adhesion properties and wettability without affecting bulk material properties. This process is commonly used in manufacturing to prepare surfaces for bonding, coating, or printing. The plasma creates reactive species that can form new chemical groups on the surface, increasing surface energy and promoting better interaction with adhesives, coatings, or inks.

- Plasma cleaning and etching processes: Plasma cleaning and etching processes use reactive plasma species to remove contaminants or selectively remove material from surfaces. These processes are highly controlled and can be used for precision cleaning of sensitive components, removal of organic contaminants, or creating specific surface patterns through selective etching. The non-mechanical nature of plasma cleaning makes it suitable for delicate structures where traditional cleaning methods might cause damage.

- Plasma process control and monitoring systems: Advanced control and monitoring systems are essential for maintaining consistency and quality in plasma surface processes. These systems typically include real-time monitoring of plasma parameters, automated feedback control mechanisms, and process optimization algorithms. Sophisticated sensors and diagnostic tools enable precise control over plasma characteristics such as density, temperature, and composition, ensuring reproducible results and high yield in manufacturing environments.

02 Plasma cleaning and activation processes

Plasma technology is utilized for cleaning and activating surfaces prior to subsequent processing steps. The plasma treatment removes organic contaminants, oxides, and other unwanted materials from surfaces while simultaneously activating the surface by creating reactive sites. This dual cleaning and activation process improves adhesion properties for coatings, bonding, and printing applications across various industries including electronics, automotive, and medical device manufacturing.Expand Specific Solutions03 Plasma deposition techniques

Plasma-enhanced chemical vapor deposition (PECVD) and other plasma deposition techniques enable the creation of thin films and coatings with precisely controlled properties. These processes use plasma to activate precursor gases, allowing deposition to occur at lower temperatures than conventional methods. The resulting films can have tailored characteristics such as specific optical properties, electrical conductivity, or barrier performance, making them valuable for applications in optoelectronics, protective coatings, and functional surfaces.Expand Specific Solutions04 Plasma equipment and chamber design

Specialized equipment and chamber designs are critical for effective plasma surface processes. These systems include various plasma generation mechanisms such as radio frequency (RF), microwave, or direct current (DC) power sources, along with carefully engineered gas delivery systems and substrate holders. Chamber configurations are optimized for specific applications, with considerations for plasma uniformity, temperature control, and process stability to ensure consistent and repeatable surface treatments across large areas or complex geometries.Expand Specific Solutions05 Atmospheric pressure plasma processing

Atmospheric pressure plasma technologies enable surface treatment without the need for vacuum systems, offering advantages in terms of process simplicity, throughput, and the ability to treat larger or continuous substrates. These systems generate non-equilibrium plasmas at ambient pressure conditions, allowing for surface modification of heat-sensitive materials, roll-to-roll processing, and in-line manufacturing integration. Applications include surface activation of polymers, sterilization of medical devices, and functional coating of textiles and packaging materials.Expand Specific Solutions

Leading Automotive and Plasma Technology Providers

The automotive sector's reliance on plasma surface processes is evolving within a maturing market estimated at several billion dollars annually. This technology has reached moderate maturity, with established players like Tokyo Electron, Nordson, and BASF leading industrial applications, while automotive giants including Toyota, Hyundai, and Mercedes-Benz integrate these processes into manufacturing. Research institutions such as Fraunhofer USA and Nanyang Technological University continue advancing the technology. The competitive landscape features specialized equipment manufacturers, chemical companies providing treatment solutions, and automotive OEMs implementing plasma treatments for improved adhesion, corrosion resistance, and surface functionalization, driving innovation as environmental regulations and performance requirements increase.

Tokyo Electron Ltd.

Technical Solution: Tokyo Electron Ltd. has developed advanced plasma processing technologies that have found significant applications in the automotive sector. Their plasma surface treatment solutions utilize low-pressure plasma systems with precise control over plasma parameters, enabling nanoscale surface modifications of various automotive components. Tokyo Electron's plasma technology focuses on creating highly activated surfaces for improved adhesion, wettability, and surface energy control. Their systems employ a combination of reactive gases that can be tailored to specific material requirements, allowing for customized surface functionalization. Tokyo Electron has pioneered plasma-enhanced chemical vapor deposition (PECVD) techniques for applying functional coatings to automotive parts, including hydrophobic, oleophobic, and anti-corrosion layers. Their plasma technology has been particularly valuable for treating electronic components used in modern vehicles, where cleanliness and precise surface properties are critical for reliability. The company has developed specialized plasma chambers capable of treating large batches of automotive components with exceptional uniformity, ensuring consistent quality across high-volume production. Tokyo Electron's plasma systems incorporate advanced process monitoring and control capabilities, allowing for real-time adjustments and quality verification during treatment.

Strengths: Tokyo Electron's plasma technology offers exceptional precision and reproducibility for critical automotive applications requiring nanoscale surface control. Their systems provide excellent batch processing capabilities with high throughput for volume manufacturing. Weaknesses: The vacuum-based systems require significant capital investment and specialized infrastructure, potentially limiting implementation in some automotive manufacturing environments.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai Motor Company has developed comprehensive plasma surface treatment technologies specifically optimized for high-volume automotive manufacturing. Their approach focuses on atmospheric pressure plasma systems that can be seamlessly integrated into existing production lines. Hyundai's plasma technology targets improved adhesion for painting, coating, and bonding applications across their diverse vehicle lineup. Their plasma treatment process creates micro-level surface modifications that significantly enhance surface energy and chemical reactivity without affecting material bulk properties. Hyundai has implemented large-scale plasma treatment systems for both metallic and polymer components, achieving consistent surface activation across complex geometries. Their technology has been particularly effective for treating modern automotive plastics and composites that traditionally present adhesion challenges. Hyundai's plasma systems operate at atmospheric pressure using air as the process gas, minimizing operational costs while maintaining environmental sustainability. The company has documented significant improvements in paint adhesion and durability, with test results showing up to 40% better adhesion strength and substantially improved resistance to environmental degradation. Hyundai has also pioneered the use of plasma technology for treating interior components, improving bonding of fabrics, leathers, and trim elements while reducing or eliminating solvent-based adhesion promoters.

Strengths: Hyundai's plasma technology offers exceptional scalability for high-volume production environments while maintaining consistent treatment quality. Their systems are designed for operational efficiency with minimal maintenance requirements and low operating costs. Weaknesses: The technology may have limitations when treating extremely complex geometries or very small components, and requires careful process parameter optimization for each specific material and application.

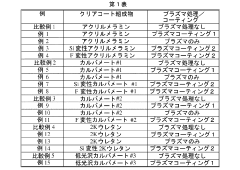

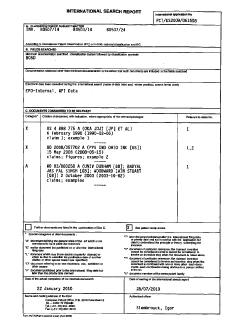

Critical Patents and Innovations in Automotive Plasma Applications

Automotive coating surface enhancement using a plasma treatment technique

PatentInactiveEP2349592A2

Innovation

- A plasma treatment technique is employed to modify the surface of automotive coatings by either depositing a thin film using a precursor material or destroying weak bonds on the surface, thereby enhancing surface-specific properties without compromising bulk properties.

Surface enhancement of automotive coatings using plasma treatment technology

PatentInactiveJP2012506768A

Innovation

- The use of plasma treatment techniques, including atmospheric pressure plasma discharges, to modify automotive coatings by forming thin films with precursor materials or breaking weak bonds on the surface, thereby enhancing surface-specific properties without adversely affecting the bulk properties.

Environmental Impact and Sustainability of Plasma Surface Treatments

Plasma surface treatments in the automotive industry have evolved significantly in their environmental profile over the past decade. Traditional surface preparation methods often involved solvent-based cleaning processes that released volatile organic compounds (VOCs) and hazardous air pollutants. In contrast, plasma technology operates primarily through electrical energy and process gases, substantially reducing chemical waste and emissions.

The sustainability advantages of plasma treatments are particularly evident in their resource efficiency. These processes typically consume less energy compared to conventional chemical treatments or thermal processes. Modern plasma systems have achieved energy reductions of 30-45% compared to their predecessors from the early 2000s, contributing to the automotive industry's carbon footprint reduction goals.

Water conservation represents another critical environmental benefit. Unlike wet chemical processes that may require thousands of gallons of water for rinsing and cleaning operations, plasma treatments operate in dry conditions. This characteristic eliminates wastewater treatment requirements and reduces the industry's overall water consumption—a significant advantage as water scarcity becomes an increasing global concern.

Regarding waste generation, plasma processes produce minimal direct waste streams. The absence of sludge, spent chemicals, and contaminated rinse water dramatically reduces disposal requirements and associated environmental impacts. Several automotive manufacturers have reported waste reduction exceeding 70% after transitioning from conventional surface preparation methods to plasma-based alternatives.

The longevity enhancement of automotive components through plasma treatment further contributes to sustainability. By improving adhesion properties and corrosion resistance, these treatments extend product lifecycles and reduce the frequency of replacements. This aspect aligns with circular economy principles increasingly adopted throughout the automotive supply chain.

Recent innovations in plasma technology have focused on further improving environmental performance. Low-temperature atmospheric plasma systems now operate at near-ambient temperatures, reducing energy requirements. Additionally, closed-loop gas recycling systems have been developed to minimize process gas consumption and emissions, with recovery rates reaching up to 85% in advanced installations.

As environmental regulations become increasingly stringent worldwide, plasma surface treatments position the automotive industry favorably for compliance. These processes align with major environmental frameworks including the European Union's Restriction of Hazardous Substances (RoHS) directive and various global initiatives targeting industrial emissions reduction and sustainable manufacturing practices.

The sustainability advantages of plasma treatments are particularly evident in their resource efficiency. These processes typically consume less energy compared to conventional chemical treatments or thermal processes. Modern plasma systems have achieved energy reductions of 30-45% compared to their predecessors from the early 2000s, contributing to the automotive industry's carbon footprint reduction goals.

Water conservation represents another critical environmental benefit. Unlike wet chemical processes that may require thousands of gallons of water for rinsing and cleaning operations, plasma treatments operate in dry conditions. This characteristic eliminates wastewater treatment requirements and reduces the industry's overall water consumption—a significant advantage as water scarcity becomes an increasing global concern.

Regarding waste generation, plasma processes produce minimal direct waste streams. The absence of sludge, spent chemicals, and contaminated rinse water dramatically reduces disposal requirements and associated environmental impacts. Several automotive manufacturers have reported waste reduction exceeding 70% after transitioning from conventional surface preparation methods to plasma-based alternatives.

The longevity enhancement of automotive components through plasma treatment further contributes to sustainability. By improving adhesion properties and corrosion resistance, these treatments extend product lifecycles and reduce the frequency of replacements. This aspect aligns with circular economy principles increasingly adopted throughout the automotive supply chain.

Recent innovations in plasma technology have focused on further improving environmental performance. Low-temperature atmospheric plasma systems now operate at near-ambient temperatures, reducing energy requirements. Additionally, closed-loop gas recycling systems have been developed to minimize process gas consumption and emissions, with recovery rates reaching up to 85% in advanced installations.

As environmental regulations become increasingly stringent worldwide, plasma surface treatments position the automotive industry favorably for compliance. These processes align with major environmental frameworks including the European Union's Restriction of Hazardous Substances (RoHS) directive and various global initiatives targeting industrial emissions reduction and sustainable manufacturing practices.

Cost-Benefit Analysis of Plasma vs. Traditional Surface Treatments

When evaluating plasma surface treatments against traditional methods in automotive manufacturing, the cost-benefit analysis reveals significant advantages that justify the industry's increasing adoption of plasma technology. Initial investment costs for plasma equipment are substantially higher, with systems ranging from $100,000 to over $1 million depending on scale and capabilities, compared to conventional chemical treatment setups typically costing $30,000-$200,000.

However, the operational cost structure heavily favors plasma processes. Chemical treatments require ongoing expenses for solvents, acids, and other consumables that can exceed $50,000 annually for medium-scale operations. These materials also incur additional costs for proper storage, handling, and disposal due to environmental regulations. Plasma systems, conversely, primarily consume electricity and process gases, with annual operational costs often 40-60% lower than chemical alternatives.

The efficiency metrics further strengthen plasma's economic case. Production cycle times are reduced by up to 70% with plasma treatments, as they eliminate multiple wet processing steps, drying times, and intermediate handling. This acceleration translates directly to increased throughput and better utilization of manufacturing facilities.

Quality improvements deliver additional financial benefits through reduced rejection rates. Automotive components treated with plasma show defect reductions of 15-25% compared to traditional methods, particularly in critical applications like electronic control units and safety systems. This quality advantage compounds when considering warranty costs and brand reputation protection.

Environmental compliance represents another significant cost factor. Traditional surface treatments face increasingly stringent regulations requiring expensive filtration systems, wastewater treatment facilities, and hazardous waste management protocols. These compliance costs are rising at approximately 8-12% annually in major automotive manufacturing regions. Plasma processes, being inherently cleaner, require minimal environmental management infrastructure.

The total cost of ownership analysis typically shows plasma systems reaching break-even points within 18-36 months compared to traditional methods, depending on production volume and application specifics. For high-volume automotive manufacturing, this payback period can be even shorter, often under 18 months, making plasma technology an economically sound investment despite higher initial capital requirements.

However, the operational cost structure heavily favors plasma processes. Chemical treatments require ongoing expenses for solvents, acids, and other consumables that can exceed $50,000 annually for medium-scale operations. These materials also incur additional costs for proper storage, handling, and disposal due to environmental regulations. Plasma systems, conversely, primarily consume electricity and process gases, with annual operational costs often 40-60% lower than chemical alternatives.

The efficiency metrics further strengthen plasma's economic case. Production cycle times are reduced by up to 70% with plasma treatments, as they eliminate multiple wet processing steps, drying times, and intermediate handling. This acceleration translates directly to increased throughput and better utilization of manufacturing facilities.

Quality improvements deliver additional financial benefits through reduced rejection rates. Automotive components treated with plasma show defect reductions of 15-25% compared to traditional methods, particularly in critical applications like electronic control units and safety systems. This quality advantage compounds when considering warranty costs and brand reputation protection.

Environmental compliance represents another significant cost factor. Traditional surface treatments face increasingly stringent regulations requiring expensive filtration systems, wastewater treatment facilities, and hazardous waste management protocols. These compliance costs are rising at approximately 8-12% annually in major automotive manufacturing regions. Plasma processes, being inherently cleaner, require minimal environmental management infrastructure.

The total cost of ownership analysis typically shows plasma systems reaching break-even points within 18-36 months compared to traditional methods, depending on production volume and application specifics. For high-volume automotive manufacturing, this payback period can be even shorter, often under 18 months, making plasma technology an economically sound investment despite higher initial capital requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!