Navigating Patent Constraints in Plasma Surface Treatment

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma Surface Treatment Technology Evolution and Objectives

Plasma surface treatment technology has evolved significantly over the past seven decades since its initial development in the 1960s. The fundamental principle involves modifying surface properties of materials through exposure to ionized gas (plasma) without altering their bulk characteristics. This technology emerged from vacuum science and gas discharge physics, gradually transitioning from laboratory curiosity to industrial application as manufacturing sectors recognized its potential for enhancing material performance.

The evolution of plasma treatment technology can be traced through several distinct phases. Early applications focused primarily on simple surface cleaning and activation processes using basic DC glow discharge systems. The 1980s witnessed significant advancement with the introduction of radio frequency (RF) plasma systems, enabling more controlled and uniform treatment of non-conductive materials. By the 1990s, atmospheric pressure plasma technologies emerged, eliminating the need for vacuum chambers and expanding industrial applicability.

Recent decades have seen remarkable innovation in plasma source designs, process control mechanisms, and application-specific optimizations. Modern systems incorporate sophisticated real-time monitoring capabilities, automated process controls, and specialized electrode configurations tailored to specific material requirements. The integration of computational modeling has further accelerated development by enabling prediction of plasma-surface interactions at molecular levels.

Patent landscapes in plasma surface treatment have become increasingly complex, with over 5,000 active patents worldwide. Major patent clusters focus on equipment design, process parameters, and application-specific methodologies. This creates significant navigation challenges for technology developers seeking to implement novel solutions while avoiding infringement risks.

The primary objectives of current plasma treatment technology development include enhancing process efficiency, reducing energy consumption, and expanding applicability to new materials including advanced composites and nanomaterials. Particular emphasis is placed on developing selective treatment capabilities that can modify specific surface properties while preserving others, a critical requirement for advanced electronic and biomedical applications.

Additional technical goals include improving process stability for industrial-scale implementation, developing in-line quality control methodologies, and creating environmentally sustainable plasma treatment solutions that minimize hazardous byproducts. The industry also aims to standardize characterization methods for treated surfaces to facilitate broader adoption across manufacturing sectors.

The evolution of plasma treatment technology can be traced through several distinct phases. Early applications focused primarily on simple surface cleaning and activation processes using basic DC glow discharge systems. The 1980s witnessed significant advancement with the introduction of radio frequency (RF) plasma systems, enabling more controlled and uniform treatment of non-conductive materials. By the 1990s, atmospheric pressure plasma technologies emerged, eliminating the need for vacuum chambers and expanding industrial applicability.

Recent decades have seen remarkable innovation in plasma source designs, process control mechanisms, and application-specific optimizations. Modern systems incorporate sophisticated real-time monitoring capabilities, automated process controls, and specialized electrode configurations tailored to specific material requirements. The integration of computational modeling has further accelerated development by enabling prediction of plasma-surface interactions at molecular levels.

Patent landscapes in plasma surface treatment have become increasingly complex, with over 5,000 active patents worldwide. Major patent clusters focus on equipment design, process parameters, and application-specific methodologies. This creates significant navigation challenges for technology developers seeking to implement novel solutions while avoiding infringement risks.

The primary objectives of current plasma treatment technology development include enhancing process efficiency, reducing energy consumption, and expanding applicability to new materials including advanced composites and nanomaterials. Particular emphasis is placed on developing selective treatment capabilities that can modify specific surface properties while preserving others, a critical requirement for advanced electronic and biomedical applications.

Additional technical goals include improving process stability for industrial-scale implementation, developing in-line quality control methodologies, and creating environmentally sustainable plasma treatment solutions that minimize hazardous byproducts. The industry also aims to standardize characterization methods for treated surfaces to facilitate broader adoption across manufacturing sectors.

Market Analysis for Plasma Surface Modification Solutions

The global market for plasma surface modification solutions continues to expand rapidly, driven by increasing demands across multiple industries for enhanced material properties and performance. Current market valuations place this sector at approximately $2.3 billion, with projections indicating a compound annual growth rate of 5.8% through 2028. This growth trajectory is particularly pronounced in semiconductor manufacturing, medical device production, automotive components, and advanced packaging applications.

Consumer electronics represents the largest market segment, accounting for nearly 32% of the total market share. The persistent miniaturization trend in electronic devices necessitates increasingly sophisticated surface treatment solutions to maintain functionality at reduced scales. Medical device manufacturing follows closely at 24% market share, where plasma treatments enable critical biocompatibility and sterilization capabilities.

Regional analysis reveals Asia-Pacific as the dominant market, controlling 45% of global demand, primarily led by China, South Korea, and Taiwan's robust electronics manufacturing ecosystems. North America and Europe collectively represent 48% of the market, with particularly strong growth in specialized applications for aerospace and medical technologies.

Market dynamics are increasingly influenced by patent constraints, creating distinct competitive landscapes. Companies with robust patent portfolios command premium pricing, while others must navigate complex licensing arrangements or develop alternative technical approaches. This patent-constrained environment has created market segmentation between premium solutions providers and value-oriented alternatives.

Customer demand patterns show increasing preference for integrated systems that combine plasma treatment with in-line quality control and process monitoring capabilities. This trend reflects the growing importance of consistent quality and process validation, particularly in regulated industries such as medical device manufacturing and aerospace applications.

Emerging market opportunities are developing around environmentally sustainable plasma treatment solutions that reduce energy consumption and eliminate hazardous chemicals. This segment is growing at nearly twice the overall market rate, driven by both regulatory pressures and corporate sustainability initiatives.

The competitive landscape features both established industrial equipment manufacturers and specialized plasma technology providers. Recent market consolidation has resulted in five companies controlling approximately 62% of global market share, with numerous smaller players competing in specialized application niches or regional markets.

Consumer electronics represents the largest market segment, accounting for nearly 32% of the total market share. The persistent miniaturization trend in electronic devices necessitates increasingly sophisticated surface treatment solutions to maintain functionality at reduced scales. Medical device manufacturing follows closely at 24% market share, where plasma treatments enable critical biocompatibility and sterilization capabilities.

Regional analysis reveals Asia-Pacific as the dominant market, controlling 45% of global demand, primarily led by China, South Korea, and Taiwan's robust electronics manufacturing ecosystems. North America and Europe collectively represent 48% of the market, with particularly strong growth in specialized applications for aerospace and medical technologies.

Market dynamics are increasingly influenced by patent constraints, creating distinct competitive landscapes. Companies with robust patent portfolios command premium pricing, while others must navigate complex licensing arrangements or develop alternative technical approaches. This patent-constrained environment has created market segmentation between premium solutions providers and value-oriented alternatives.

Customer demand patterns show increasing preference for integrated systems that combine plasma treatment with in-line quality control and process monitoring capabilities. This trend reflects the growing importance of consistent quality and process validation, particularly in regulated industries such as medical device manufacturing and aerospace applications.

Emerging market opportunities are developing around environmentally sustainable plasma treatment solutions that reduce energy consumption and eliminate hazardous chemicals. This segment is growing at nearly twice the overall market rate, driven by both regulatory pressures and corporate sustainability initiatives.

The competitive landscape features both established industrial equipment manufacturers and specialized plasma technology providers. Recent market consolidation has resulted in five companies controlling approximately 62% of global market share, with numerous smaller players competing in specialized application niches or regional markets.

Global Landscape and Technical Barriers in Plasma Technology

Plasma surface treatment technology has evolved significantly over the past three decades, with major advancements occurring in both developed and emerging economies. The global landscape reveals a concentration of plasma technology expertise in North America, Europe, and East Asia, with the United States, Germany, Japan, and increasingly China leading research and commercial applications. This geographical distribution creates distinct regional approaches to plasma technology development and implementation.

The technical barriers in plasma surface treatment are multifaceted and challenging. One primary constraint involves achieving precise control over plasma parameters across large surface areas, particularly for industrial-scale applications. Uniformity in treatment remains difficult when scaling from laboratory to production environments, creating a significant hurdle for manufacturers seeking consistent results across large components or high-volume production runs.

Patent constraints present another layer of complexity in the global plasma technology landscape. Key process technologies are protected by extensive patent portfolios held by major industrial players and research institutions. These patents often cover fundamental aspects of plasma generation, control systems, and specific application methodologies, creating a complex web of intellectual property that new entrants must carefully navigate.

Material compatibility issues constitute another significant technical barrier. While plasma treatment offers advantages for many substrates, certain materials exhibit degradation or undesirable side effects when exposed to plasma environments. Polymers with low thermal stability, for instance, may experience structural changes that compromise their mechanical properties during treatment.

Energy efficiency remains a persistent challenge, as conventional plasma systems require substantial power input. The conversion efficiency from electrical energy to useful surface modification effects is often suboptimal, leading to higher operational costs and environmental impact. This inefficiency becomes particularly problematic for continuous production environments where treatment must occur at high throughput rates.

Reproducibility and process validation present additional technical barriers, especially in highly regulated industries such as medical device manufacturing and aerospace. Establishing reliable quality control parameters and in-line monitoring systems for plasma processes has proven difficult due to the complex physicochemical interactions occurring at the plasma-surface interface.

The integration of plasma treatment into existing production lines presents logistical and engineering challenges, often requiring significant modifications to accommodate vacuum systems or atmospheric plasma equipment. This integration complexity increases implementation costs and may discourage adoption despite the potential benefits of plasma surface treatment technologies.

The technical barriers in plasma surface treatment are multifaceted and challenging. One primary constraint involves achieving precise control over plasma parameters across large surface areas, particularly for industrial-scale applications. Uniformity in treatment remains difficult when scaling from laboratory to production environments, creating a significant hurdle for manufacturers seeking consistent results across large components or high-volume production runs.

Patent constraints present another layer of complexity in the global plasma technology landscape. Key process technologies are protected by extensive patent portfolios held by major industrial players and research institutions. These patents often cover fundamental aspects of plasma generation, control systems, and specific application methodologies, creating a complex web of intellectual property that new entrants must carefully navigate.

Material compatibility issues constitute another significant technical barrier. While plasma treatment offers advantages for many substrates, certain materials exhibit degradation or undesirable side effects when exposed to plasma environments. Polymers with low thermal stability, for instance, may experience structural changes that compromise their mechanical properties during treatment.

Energy efficiency remains a persistent challenge, as conventional plasma systems require substantial power input. The conversion efficiency from electrical energy to useful surface modification effects is often suboptimal, leading to higher operational costs and environmental impact. This inefficiency becomes particularly problematic for continuous production environments where treatment must occur at high throughput rates.

Reproducibility and process validation present additional technical barriers, especially in highly regulated industries such as medical device manufacturing and aerospace. Establishing reliable quality control parameters and in-line monitoring systems for plasma processes has proven difficult due to the complex physicochemical interactions occurring at the plasma-surface interface.

The integration of plasma treatment into existing production lines presents logistical and engineering challenges, often requiring significant modifications to accommodate vacuum systems or atmospheric plasma equipment. This integration complexity increases implementation costs and may discourage adoption despite the potential benefits of plasma surface treatment technologies.

Current Patent-Compliant Plasma Treatment Methodologies

01 Plasma treatment apparatus design constraints

Plasma treatment apparatus design faces several constraints including chamber configuration, electrode placement, and power supply limitations. These constraints affect the uniformity of plasma distribution and treatment effectiveness. Innovations in apparatus design focus on overcoming these limitations through specialized chamber geometries, adjustable electrode systems, and advanced power delivery mechanisms that can maintain stable plasma conditions across various substrate types and sizes.- Plasma chamber design constraints: Plasma treatment chambers must be designed with specific constraints to ensure effective surface treatment. These constraints include proper electrode configurations, gas flow management systems, and pressure control mechanisms. The chamber design must accommodate various substrate sizes and shapes while maintaining uniform plasma distribution. Advanced designs incorporate features to minimize contamination and enhance treatment efficiency.

- Process parameter limitations for plasma surface modification: Plasma surface treatment processes are subject to various parameter constraints that must be carefully controlled. These include power density limitations, treatment duration restrictions, gas composition ratios, and temperature thresholds. Exceeding these constraints can lead to substrate damage, non-uniform treatment, or ineffective surface modification. Optimal process windows must be established for different substrate materials to achieve desired surface properties.

- Material compatibility constraints in plasma treatment: Not all materials are suitable for plasma surface treatment, creating significant constraints in application. Temperature-sensitive materials may degrade under plasma conditions, while certain polymers can experience unwanted cross-linking or chain scission. Material thickness, composition, and pre-existing surface conditions also limit treatment effectiveness. Specialized plasma chemistries and process parameters must be developed for different material classes to overcome these constraints.

- Equipment and technology limitations: Plasma surface treatment technologies face equipment-related constraints including power supply limitations, vacuum system capabilities, and control system precision. These constraints affect the scalability, reproducibility, and industrial applicability of plasma treatments. Advanced equipment incorporates real-time monitoring and feedback systems to maintain process stability within operational constraints. Emerging technologies aim to overcome traditional limitations through innovative power delivery methods and chamber designs.

- Regulatory and environmental constraints: Plasma surface treatment processes face regulatory and environmental constraints related to gas emissions, energy consumption, and workplace safety. Treatment processes must comply with environmental regulations regarding the use of certain gases and the management of byproducts. Safety constraints include radiation shielding, electrical isolation, and exhaust gas management. These constraints influence equipment design, process development, and industrial implementation of plasma surface treatment technologies.

02 Process parameter control limitations

Controlling plasma process parameters presents significant challenges in surface treatment applications. These include maintaining precise gas flow rates, pressure levels, power input, and treatment duration. The constraints involve balancing these parameters to achieve desired surface modifications without damaging substrates. Advanced control systems have been developed to monitor and adjust these parameters in real-time, addressing the narrow processing windows that many materials require for optimal treatment.Expand Specific Solutions03 Material compatibility restrictions

Plasma surface treatment faces significant constraints regarding material compatibility. Not all materials respond favorably to plasma exposure, with some experiencing degradation, unwanted chemical modifications, or thermal damage. These limitations necessitate careful selection of plasma gases, energy levels, and exposure times based on substrate properties. Innovations focus on developing gentler plasma processes for heat-sensitive materials and methods to treat complex multi-material components without compromising any constituent materials.Expand Specific Solutions04 Surface modification depth limitations

Plasma treatment typically affects only the outermost layers of a material, with penetration depth being a significant constraint. This limitation restricts the ability to modify bulk properties or treat complex three-dimensional structures uniformly. Techniques to overcome this constraint include multi-step treatments, specialized gas mixtures, and pressure modulation approaches that can enhance penetration while maintaining surface quality. The challenge remains in achieving consistent modification depth across irregular geometries and porous materials.Expand Specific Solutions05 Scale-up and industrial implementation challenges

Transitioning plasma treatment processes from laboratory to industrial scale presents numerous constraints. These include maintaining treatment uniformity across large surface areas, ensuring process repeatability, managing increased power requirements, and addressing throughput limitations. Solutions involve developing specialized large-scale plasma systems with multiple treatment zones, continuous processing capabilities, and robust process control mechanisms. Economic considerations also constrain implementation, requiring balance between treatment effectiveness and operational costs.Expand Specific Solutions

Competitive Analysis of Plasma Technology Patent Holders

The plasma surface treatment market is currently in a growth phase, characterized by increasing adoption across semiconductor, medical, and electronics industries. The market size is expanding steadily, projected to reach significant value due to rising applications in advanced manufacturing processes. Technologically, the field shows varying maturity levels, with established players like Tokyo Electron, Lam Research, and Applied Materials dominating the semiconductor segment with sophisticated plasma treatment solutions. Medical applications are being advanced by Becton Dickinson and DePuy Synthes, while research institutions like Beihang University and Wisconsin Alumni Research Foundation are driving innovation in novel plasma applications. The competitive landscape features both specialized equipment manufacturers like ULVAC and Canon Anelva alongside diversified technology corporations, creating a dynamic environment where patent constraints necessitate strategic collaboration and licensing arrangements.

Tokyo Electron Ltd.

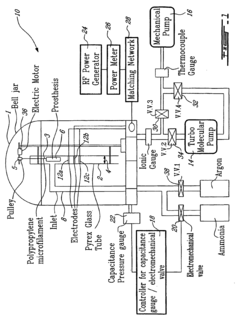

Technical Solution: Tokyo Electron has developed advanced plasma surface treatment technologies that navigate patent constraints through innovative approaches. Their RLSA (Radial Line Slot Antenna) plasma technology enables uniform plasma distribution across large surfaces while operating at lower temperatures than conventional systems. This technology utilizes microwave energy to generate high-density plasma with minimal damage to sensitive substrates. Tokyo Electron's systems incorporate multi-step plasma treatment processes that combine different gas chemistries to achieve specific surface modifications while avoiding patent-protected methodologies. Their equipment features real-time plasma monitoring systems that adjust treatment parameters dynamically, ensuring consistent results while operating within patent boundaries. The company has also pioneered pulsed plasma techniques that create intermittent plasma exposure, reducing thermal loading and allowing for precise control of surface modification depth.

Strengths: Exceptional plasma uniformity across large substrates, reduced thermal impact on sensitive materials, and sophisticated process control systems. Weaknesses: Higher equipment costs compared to simpler plasma systems, complexity requiring specialized operator training, and potential limitations in treating highly complex 3D structures.

Lam Research Corp.

Technical Solution: Lam Research has developed proprietary plasma surface treatment solutions that navigate patent constraints through their Vector platform technology. This system employs a unique combination of capacitively coupled plasma (CCP) and inductively coupled plasma (ICP) sources to create customizable plasma characteristics for different surface treatment requirements. Their technology incorporates multi-zone gas delivery systems that enable precise control over plasma chemistry across the substrate surface, allowing for tailored treatments that avoid patent-protected methodologies. Lam's systems feature advanced RF matching networks that optimize power transfer efficiency while maintaining plasma stability across varying process conditions. The company has also developed specialized plasma confinement techniques that enhance treatment uniformity while reducing unwanted interactions with chamber components. Their equipment includes sophisticated endpoint detection systems that monitor plasma-surface interactions in real-time, enabling precise process control while operating within patent boundaries.

Strengths: Exceptional process control capabilities, high throughput for industrial applications, and ability to handle diverse substrate materials. Weaknesses: Significant capital investment required, complex integration with existing manufacturing lines, and higher operational costs compared to simpler plasma treatment methods.

Critical Patent Analysis in Plasma Surface Engineering

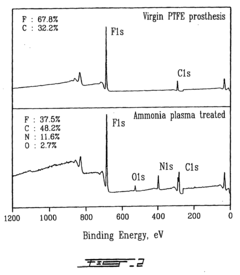

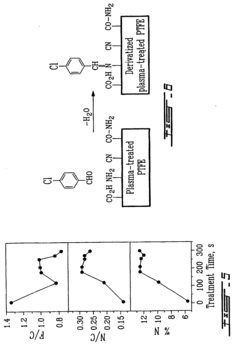

Plasma surface graft process for reducing thrombogenicity

PatentInactiveEP1368075B1

Innovation

- A novel process involving plasma treatment to create reactive groups on the surface of materials, followed by activation of molecules to form strong covalent bonds with these groups, specifically using ammonia RF plasma to introduce amine groups and react with phosphorylcholine derivatives to enhance biocompatibility and prevent thrombosis.

Plasma treatment apparatus and method for treatment of a substrate with atmospheric pressure glow discharge electrode configuration

PatentInactiveEP2245647A1

Innovation

- A plasma treatment apparatus with a dielectric barrier configuration that controls the product of gap distance and total dielectric distance to less than 1.0 mm², using a combination of opposing electrodes and a plasma control unit to generate a stable atmospheric pressure glow discharge, and incorporating nitrogen in the gas composition to suppress dust formation, allowing for efficient deposition of inorganic barrier layers with low carbon concentration and improved surface roughness.

Intellectual Property Strategy for Plasma Technology Development

Developing a comprehensive intellectual property strategy is crucial for companies operating in the plasma surface treatment sector, where patent constraints can significantly impact innovation and market positioning. The landscape of plasma technology patents is characterized by a complex web of overlapping claims, with major industry players holding extensive portfolios that create potential barriers to entry and development.

To navigate these constraints effectively, companies must first conduct thorough patent mapping exercises to identify the existing IP landscape. This involves analyzing not only direct competitors but also adjacent technology domains that might influence plasma surface treatment applications. Understanding the geographical distribution of patents is equally important, as protection strategies vary significantly across different markets, with particularly dense patent coverage in the United States, Japan, Germany, and increasingly, China.

Patent clustering analysis reveals several strategic approaches for technology development within constrained environments. These include designing around existing patents by developing alternative technical solutions, focusing on underexplored application areas, or pursuing incremental innovations that build upon but do not infringe existing protected technologies. The identification of white space opportunities—areas with minimal patent coverage—can provide valuable development pathways.

For companies with limited patent portfolios, strategic licensing and partnership arrangements offer viable pathways to market access. Cross-licensing agreements with established players can provide mutual benefits, while targeted acquisitions of smaller companies with complementary IP assets can rapidly strengthen a company's position. Defensive publication strategies may also be employed to prevent competitors from obtaining patents in areas critical to future development plans.

Patent expiration timelines present significant opportunities for technology advancement. Many fundamental plasma treatment patents filed in the early 2000s are approaching their expiration dates, potentially opening new avenues for innovation without infringement concerns. Companies should maintain comprehensive databases of these expiration dates to inform R&D planning and market entry strategies.

Risk management must be integrated into the IP strategy, including regular freedom-to-operate analyses and the establishment of patent challenge funds for potential litigation. Additionally, companies should consider jurisdictional strategies, focusing initial product launches in regions with favorable patent environments while building defensive positions in more challenging markets.

To navigate these constraints effectively, companies must first conduct thorough patent mapping exercises to identify the existing IP landscape. This involves analyzing not only direct competitors but also adjacent technology domains that might influence plasma surface treatment applications. Understanding the geographical distribution of patents is equally important, as protection strategies vary significantly across different markets, with particularly dense patent coverage in the United States, Japan, Germany, and increasingly, China.

Patent clustering analysis reveals several strategic approaches for technology development within constrained environments. These include designing around existing patents by developing alternative technical solutions, focusing on underexplored application areas, or pursuing incremental innovations that build upon but do not infringe existing protected technologies. The identification of white space opportunities—areas with minimal patent coverage—can provide valuable development pathways.

For companies with limited patent portfolios, strategic licensing and partnership arrangements offer viable pathways to market access. Cross-licensing agreements with established players can provide mutual benefits, while targeted acquisitions of smaller companies with complementary IP assets can rapidly strengthen a company's position. Defensive publication strategies may also be employed to prevent competitors from obtaining patents in areas critical to future development plans.

Patent expiration timelines present significant opportunities for technology advancement. Many fundamental plasma treatment patents filed in the early 2000s are approaching their expiration dates, potentially opening new avenues for innovation without infringement concerns. Companies should maintain comprehensive databases of these expiration dates to inform R&D planning and market entry strategies.

Risk management must be integrated into the IP strategy, including regular freedom-to-operate analyses and the establishment of patent challenge funds for potential litigation. Additionally, companies should consider jurisdictional strategies, focusing initial product launches in regions with favorable patent environments while building defensive positions in more challenging markets.

Legal Framework and Compliance in Plasma Surface Treatment

The plasma surface treatment industry operates within a complex legal framework that requires careful navigation to avoid patent infringement while maintaining competitive advantage. Current patent landscapes reveal concentrated ownership among major corporations like Applied Materials, Lam Research, and Tokyo Electron, who collectively hold significant intellectual property rights governing fundamental plasma treatment processes and equipment designs.

Regulatory compliance in plasma surface treatment spans multiple domains, including environmental regulations, worker safety standards, and industry-specific certifications. Companies must adhere to emissions standards established by agencies such as the EPA in the United States and equivalent bodies internationally, as these treatments often generate volatile organic compounds and other potentially harmful byproducts.

Freedom-to-operate (FTO) analysis has become an essential strategic tool for companies entering or expanding in the plasma treatment market. This process involves comprehensive patent searches and legal assessments to identify potential infringement risks before committing to specific technological approaches. Successful FTO strategies often include designing around existing patents, focusing on novel applications, or targeting geographical regions with different patent coverage.

Patent pooling and cross-licensing agreements have emerged as effective mechanisms for navigating the dense patent landscape. These collaborative approaches allow companies to access necessary technologies while reducing litigation risks. Notable examples include industry consortia formed around specific plasma treatment applications in semiconductor manufacturing, where multiple patent holders contribute their intellectual property to a common pool.

International patent harmonization efforts have simplified compliance for global operators, though significant regional differences persist. The Patent Cooperation Treaty (PCT) facilitates multi-jurisdictional patent filings, but enforcement mechanisms and interpretations vary substantially across major markets including the United States, European Union, Japan, and China.

Recent legal precedents have shaped the enforcement landscape for plasma treatment patents. Key court decisions have addressed issues such as the patentability of specific plasma process parameters, equipment configurations, and treatment outcomes. These rulings provide guidance for companies seeking to develop non-infringing alternatives while maintaining technical effectiveness.

Proactive compliance strategies typically involve continuous patent monitoring, maintaining robust internal documentation of independent development, and establishing clear supplier agreements regarding intellectual property indemnification. Companies that implement these practices effectively can navigate patent constraints while continuing to innovate in plasma surface treatment technologies.

Regulatory compliance in plasma surface treatment spans multiple domains, including environmental regulations, worker safety standards, and industry-specific certifications. Companies must adhere to emissions standards established by agencies such as the EPA in the United States and equivalent bodies internationally, as these treatments often generate volatile organic compounds and other potentially harmful byproducts.

Freedom-to-operate (FTO) analysis has become an essential strategic tool for companies entering or expanding in the plasma treatment market. This process involves comprehensive patent searches and legal assessments to identify potential infringement risks before committing to specific technological approaches. Successful FTO strategies often include designing around existing patents, focusing on novel applications, or targeting geographical regions with different patent coverage.

Patent pooling and cross-licensing agreements have emerged as effective mechanisms for navigating the dense patent landscape. These collaborative approaches allow companies to access necessary technologies while reducing litigation risks. Notable examples include industry consortia formed around specific plasma treatment applications in semiconductor manufacturing, where multiple patent holders contribute their intellectual property to a common pool.

International patent harmonization efforts have simplified compliance for global operators, though significant regional differences persist. The Patent Cooperation Treaty (PCT) facilitates multi-jurisdictional patent filings, but enforcement mechanisms and interpretations vary substantially across major markets including the United States, European Union, Japan, and China.

Recent legal precedents have shaped the enforcement landscape for plasma treatment patents. Key court decisions have addressed issues such as the patentability of specific plasma process parameters, equipment configurations, and treatment outcomes. These rulings provide guidance for companies seeking to develop non-infringing alternatives while maintaining technical effectiveness.

Proactive compliance strategies typically involve continuous patent monitoring, maintaining robust internal documentation of independent development, and establishing clear supplier agreements regarding intellectual property indemnification. Companies that implement these practices effectively can navigate patent constraints while continuing to innovate in plasma surface treatment technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!